HAR uranium project about to get bigger? XRF gun results are in

Disclosure: S3 Consortium Pty Ltd (the Company) and Associated Entities own 3,409,091 HAR shares at the time of publishing this article. The Company has been engaged by HAR to share our commentary on the progress of our Investment in HAR over time.

Haranga Resources (ASX:HAR)’s uranium assays from its RC drilling program are now on the way to the lab.

We expect in a few weeks we’ll find out the exact U grades from assay results.

Armed with this data, we will see if HAR can increase its existing JORC resource of 12.4 Mt @ 587 ppm for 16.1 Mlbs of uranium.

Hopefully a resource increase can be announced just as the U price runs even more from its current higher base where it has stopped for a bit of breath over the last few weeks.

BUT...

For now, we have a preview of what to expect.

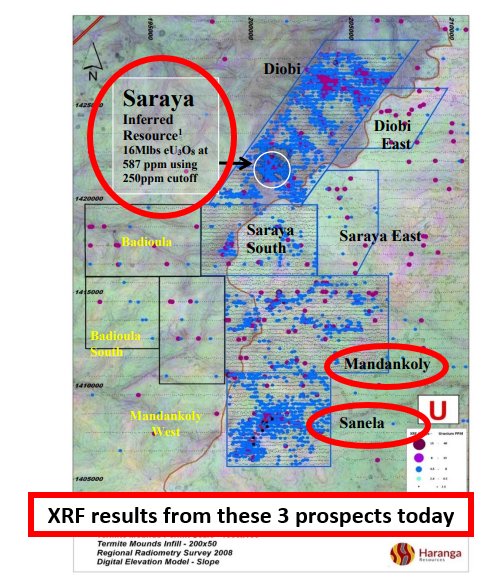

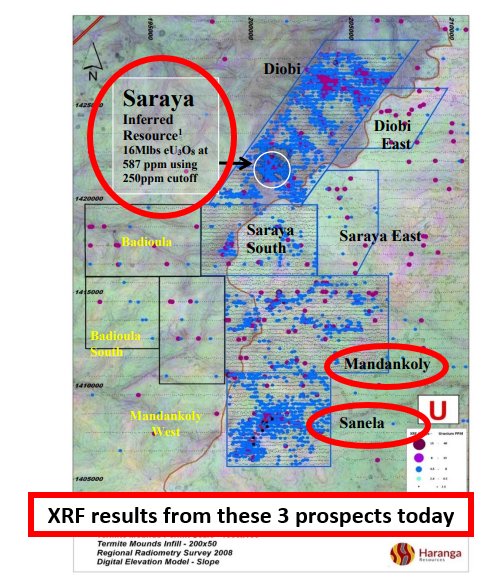

Today HAR put out XRF results from its first batch of RC drilling at three of its target areas - Saraya (where HAR’s JORC resource is), Mandankoly and Sanela.

HAR hit uranium grades as high as 4,647ppm and its best hit came from Saraya where HAR got a 36m intercept with uranium grades at 913 ppm from hole #10.

For context, HAR’s JORC is based on an average uranium grade of 587ppm, so that result is strong relative to what HAR has across its existing resources.

“XRF results” come from handheld XRF guns that geologists use on site - they can be good at giving a preview of what to expect from the final lab results but are ultimately just a “guide” on what to expect and can not and should not be relied upon.

We will need to wait for the assay results from the lab in a few weeks...

Whilst it's good to get an early preview of what the assay results may be able to deliver, we think the timing of today’s results are more important...

The XRF results set the scene for HAR delivering final U assay results and then a resource upgrade, hopefully just as the U price starts moving again after its current breather.

If the uranium price runs further and HAR’s results come back in line with or above the XRF results, then HAR should be able to deliver a resource upgrade into an even stronger uranium market.

Of course - this assumes the U price will be higher in the near term - and that is speculation on our part - no one can accurately predict future commodity prices.

If the U price holds at these current levels for many months, we think this will be enough to convince the market that this U price rally is the real deal.

HAR currently has a tiny market cap of ~ $10M, and its 11.5c share price is significantly less than its January highs of circa 25c while uranium price was very running hot.

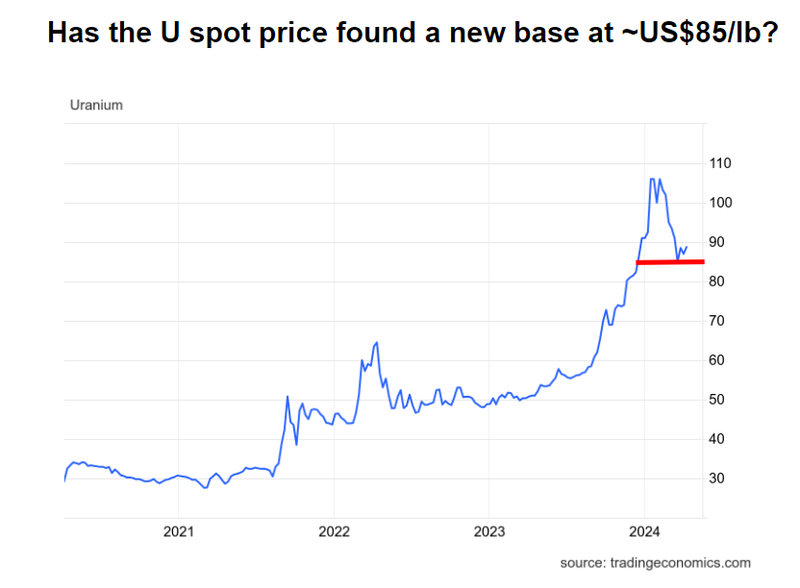

Whilst that has cooled a little from earlier in the year, the uranium price has spent the last few weeks forming a base around ~$85 USD /lb (almost three times the ~$30 where it has traded for the last decade).

We hope the next leg up in the U price happens (or at least starts to happen) before HAR’s final lab results and its upgraded resource estimate.

So, for the next few weeks, we will be watching for the HAR assay results and for any positive news on the metwork HAR is currently doing.

(Metwork is short for “metallurgical work” - a process to determine how to to extract the actual uranium from mined ore samples (and how much it might cost at scale) - its key to prove the project could be commercially viable)

We are also closely watching for the U price to jump off its new base of ~$US 85.

As we noted above, the next jump in the U price (IF another jump happens of course, that's certainly not guaranteed) is key for small U stocks like HAR to enjoy a share price rerate.

We use Numerco to follow the daily U spot price:

(Source)

HAR owns 70% of its uranium project which holds an existing JORC resource of 12.4 Mt @ 587 ppm for 16.1 Mlbs of uranium.

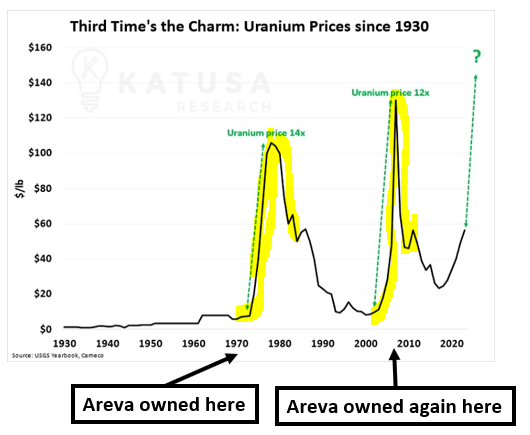

HAR’s project is located in Senegal - and was previously owned by Areva/Orano.

Areva/Orano is a huge French multinational nuclear power and uranium supplier that used to own HAR’s project - TWICE.

Both times that Areva owned HAR’s project was during huge uranium bull runs where the price shot up dramatically.

It seems every time a uranium bull run happens, the French are interested in HAR’s project.

As we mentioned before, with the uranium spot price holding up quite well at a sharply elevated level (~US$89/lb) - the top end of the market is buoyant.

The uranium spot price has bounced slightly at ~US$85/lb after a strong run up. It looks to have started consolidating over the last few weeks, if it shoots up again from the new base it is forming, we think that will be the signal for early stage U stocks to move,:

Again, if the U price holds at these current levels for many months, we think this will be enough to convince the market that this U price rally is the real deal.

And it’s worth noting that uranium spot prices are at levels not seen since the mid/late 2000s and $32BN capped uranium major Cameco is trading at or near all time highs...

But we’ve yet to see the enthusiasm fully trickle down to uranium micro caps like HAR.

Growing its defined resource is a great way for HAR to build its relevance in the uranium market. Which is exactly what it's aiming to do.

Today’s drill results

The best results from today’s announcement came from HAR’s Saraya deposit - where HAR’s existing 16.1m lb uranium JORC resource sits.

At the moment, HAR has a 16.1 Mlbs uranium JORC resource at average grades of ~587ppm at Saraya.

In the latest round of drilling, HAR’s best hit was hole #10 - 36 m @ 913 ppm, which is relatively strong considering the JORC resource’s current average grade.

Cautionary statement: These are XRF gun results and may not accurately reflect the results found in the assay lab - we’ll have to wait for those. These results will not be relied on in any resource estimation undertaken at HAR’s Senegalese projects.

We were expecting solid results from Saraya because we already knew the JORC resource is there, but it's always good to see some of the hits exceed the grades from the JORC resource.

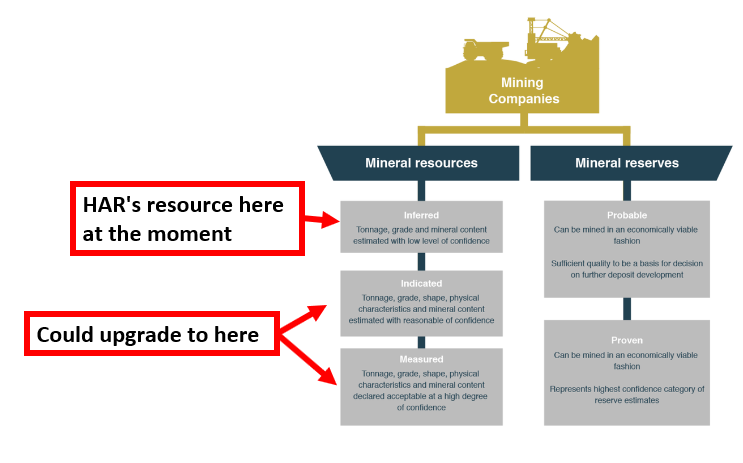

Higher grades could ultimately lead to an upgrade in the size of the resource AND/OR an upgrade in its classification.

(Source)

We also noticed HAR got a sniff of uranium mineralisation from its Sanela prospect.

The result wasn't strong enough to declare a new discovery but it's a good sign HAR’s exploration strategy is throwing up decent drill targets.

For us the small hit was more a sign that HAR has discovery potential across the many other targets at its project:

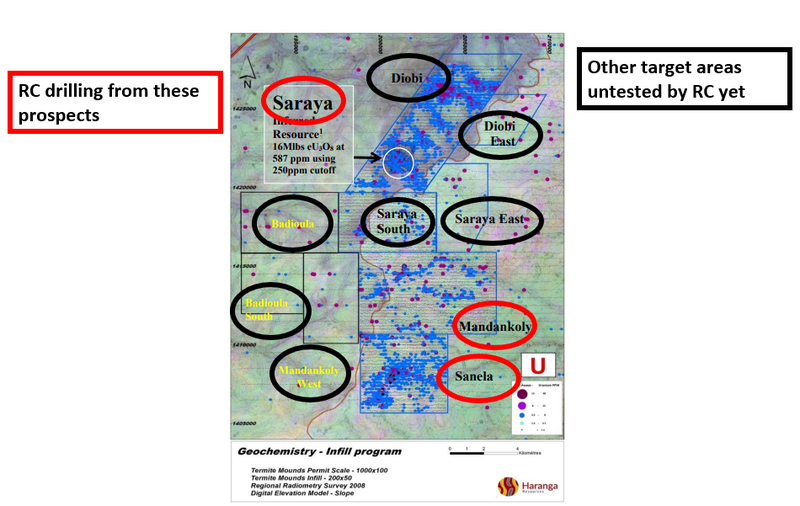

So far only three of the parts of HAR’s project area have been tested.

There is potential to deliver new discoveries and surprise the market in some of the other untested areas.

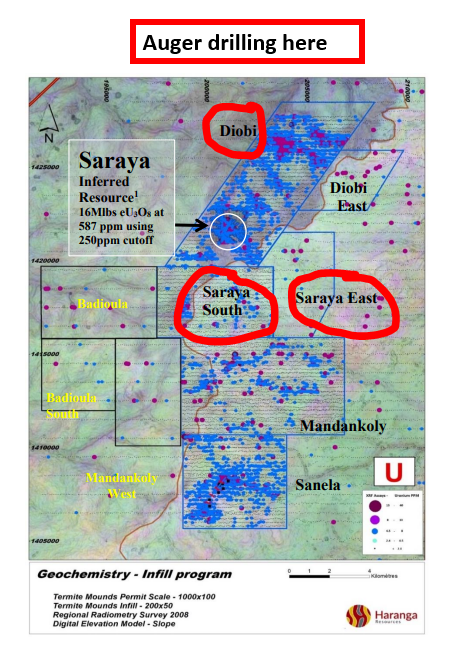

Auger drilling will continue on termite mound anomalies at Saraya East, Saraya South and Diobi.

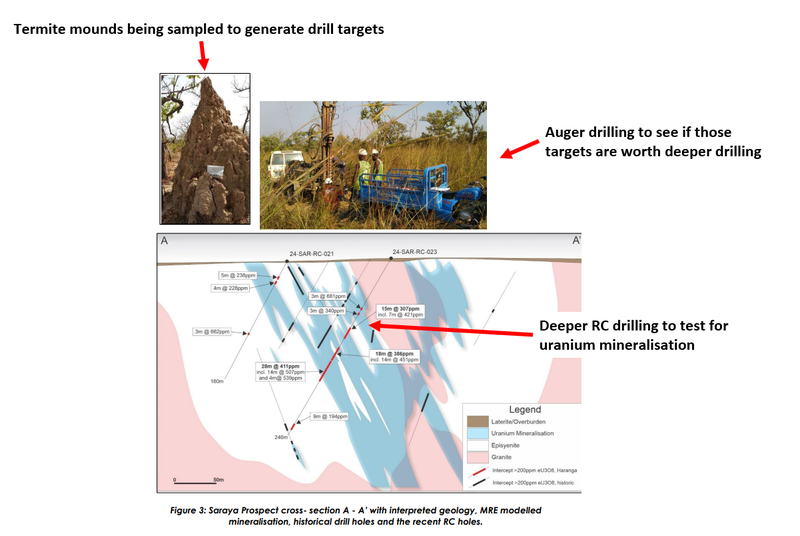

What is HAR’s exploration strategy?

HAR’s strategy is a little bit unusual when compared with the type of exploration methods we are used to on the ASX, and this is driven by the unique characteristics of its project.

Typically you see geochem/geophysics, large, colourful blobs (EM targets) which are then drilled to see what is actually underground.

HAR’s approach has a lot of the same principles, however is executed a little bit differently.

HAR is executing a four staged exploration program as follows:

- Regional termite mound sampling - this is a bit like doing the geochemical work explorers do. Except, HAR isn't sampling soil, it is sampling the termite mounds on its project area. Sampling the termite mounds allowed HAR to overcome a laterite hardcap barrier and get samples of the saprock below, which contains uranium. This is HAR’s first filter.

- Infill termite mound sampling - After seeing which of the termite mounds are returning the highest uranium grades, HAR goes in and tests more of them in those specific areas. The purpose of this is to work out where HAR should be drilling.

- Auger drilling - HAR then does some shallow drilling to see if there is the right type of geology underground to warrant deeper RC drilling.

- RC drilling - Only the best targets get the RC drilling treatment. This is when HAR is either looking to add to its existing resources or make new discoveries.

So the first three steps are to find drill targets (geochem) - and the final RC drilling step is to test them and see whether or not there is any uranium mineralisation of note.

What is HAR doing now?

For the past few months HAR has been doing all four of those steps at the same time.

HAR just finished its first round of RC drilling at Saraya (where its existing JORC resource is) and at the Mandankoly/Sanela prospects.

Right now HAR is auger drilling across anomalies at Saraya East, Saraya South and Diobi.

After that the plan is to go back to Sanela and Mandankoly and look for more drill targets.

We also expect to see some more newsflow from the termite mound sampling programs. In today’s announcement HAR said that would be completed in Q2 for the whole project.

The next major catalysts for HAR

Lab results for Saraya Assays

This is a catalyst, but it is also expected news. With the assays we want to see the XRF readings get confirmed and (hopefully improved on).

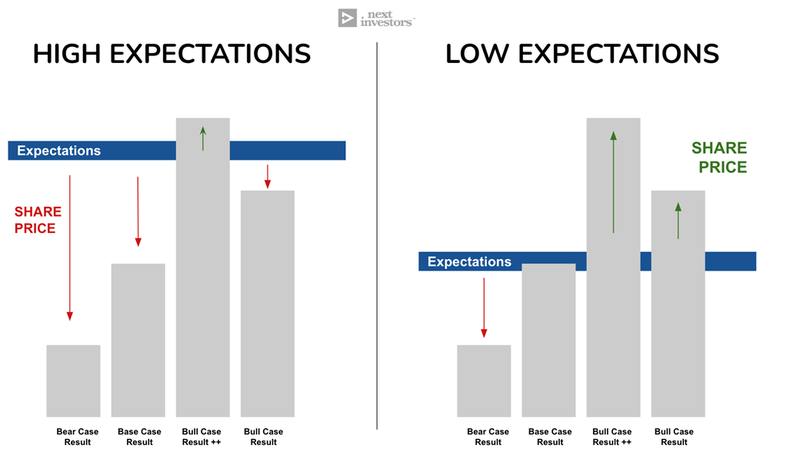

We don't expect this to move the share price much, primarily because its assays from HAR’s existing JORC and because the XRF news has already come out today and set expectations for the lab results.

Drilling across regional targets 🔄

This is the big one.

HAR still has plenty of target areas across its project that haven't been touched with an RC drill rig yet.

New discoveries across any of these could be game changers for the company.

We think this would have the biggest impact on HAR’s share price as it's a situation where expectations are low and the potential to surprise the market is high.

🎓Learn: What is a share price catalyst?

The XRF results from Sanela today were a decent start, and there are still plenty of targets to follow up.

HAR is currently doing auger across its other prospects so we will be watching to see if any targets come about with serious discovery potential.

JORC resource update/upgrade 🔄

This has always been one of the key reasons for our Investment in HAR.

We think a JORC resource upgrade could be a catalyst for HAR’s share price for two specific reasons:

- Classification upgrade - Most of HAR’s resources are inferred at the moment. Upgrading the classification would improve the confidence of the resource estimate. This is usually appreciated by the market because it derisks the project.

- Resource size increases - Could also see HAR increase the size of the resource. Again this would increase the value of the project from a fundamental perspective.

🎓Learn: What is a JORC resource? How does a company define a resource?

Metwork update 🔄

Metwork is always a key hurdle for projects.

Strong recoveries could mean the project gets de-risked and the fundamentals of the asset improve.

We are hoping that as HAR delivers the above catalysts and it is able to achieve our HAR Big Bet which is as follows:

Our long term HAR Big Bet:

“HAR re-rates to a +$100M market cap on significant resource growth and/or a transaction with a major player in the nuclear fuel supply chain”

NOTE: our “Big Bet” is what we HOPE the ultimate success scenario looks like for this particular Investment over the long term (3+ years). There is a lot of work to be done, many risks involved - just some of which we list in our HAR Investment Memo. Success will require a significant amount of luck. There is no guarantee that our Big Bet will ever come true.

What are the risks?

Country Risk

HAR’s project is in Africa, and all investments in Africa carry some geopolitical risk.

While Senegal is generally one of the most stable countries in West Africa, the broader region where HAR’s project is located, is considered a high-risk region of the world.

Most recently in the region there was a coup in Niger (2023), and coups in Mali (2021) and Burkina Faso (2022) also occurred in recent years.

Political instability in the region could disrupt HAR’s ability to operate or commercialise its project, or significantly slow progress down.

Senegal recently had an election and the new president, Bassirou Diomaye Faye, has promised to alter the country’s approach to resources - potentially the re-negotiation of oil, gas and mineral contracts with foreign operators.

Reforms made to the regulatory environment for resources could adversely affect HAR.

Exploration risk

HAR is planning to drill exploration targets to grow its uranium resource.

Exploration activities may or may not return any uranium mineralisation or low-grade uranium resource that is uneconomic.

Commodity risk

In recent decades, governments have shunned uranium because of the issues related waste removal and accidents like Chernobyl and Fukushima.

If the adoption of nuclear power is slower than expected then it may impact the future demand for uranium.

Uranium price risk

Share prices of junior explorers like HAR are dependent on strong spot prices for the commodity they are exploring for.

The uranium price currently remains strong, but any retracements or a return to a bear market in spot prices could lead to capital withdrawing from the sector and a fall in share prices.

Funding/Dilution risk

Like most micro cap resource exploration companies, HAR has no revenues to fund exploration and its ongoing costs.

This means the company is reliant on capital raises to fund exploration programs that aim to build significant shareholder value.

HAR had $2.4M as of 31 December 2023, which is a reasonable amount given its $10.7M market cap, however like all small caps, HAR will need to raise capital to continue its operations at some stage in the future which may incur dilution to current shareholders.

Capital may be hard to come by or cannot be secured at favourable prices, and this can be dependent on broader capital market conditions.

Market risk

If the broader market sells off, investors may shy away from high-risk investment opportunities like junior explorers. During market downturns, investors will look to pull capital away from the high risk investments. HAR is a junior explorer and may be impacted by these market wide sell offs.

Our HAR Investment Memo

In our HAR Investment Memo, you can find:

- HAR’s macro thematic

- Why we Invested in HAR

- Our HAR “Big Bet” - what we think the upside Investment case for HAR is

- The key objectives we want to see HAR achieve

- The key risks to our Investment thesis

- Our Investment Plan

🎓Learn: Click here to learn more about the difference between the different types of drilling

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.