HAR finds two large uranium anomalies, drilling and assays next

Disclosure: Disclosure: S3 Consortium Pty Ltd (the Company) and Associated Entities own 3,410,000 HAR shares at the time of publishing this article. The Company has been engaged by HAR to share our commentary on the progress of our Investment in HAR over time.

Uranium is the hot topic of this week.

Our uranium Investment, Haranga Resources (ASX:HAR) has just announced they have found another two large uranium “anomalies” on their project in Senegal.

An “anomaly” is something abnormal, something out of place - in this case - it's related to potential high grade uranium mineralisation, and it's a very good thing to find ahead of a drill campaign.

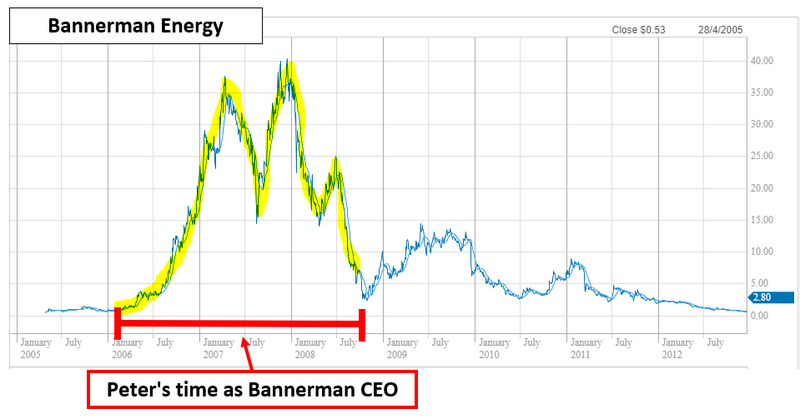

Captaining the good ship HAR is uranium buccaneer Peter Batten, who some may recall led literally the “best performing company on the ASX” in 2006 during the last uranium bull run.

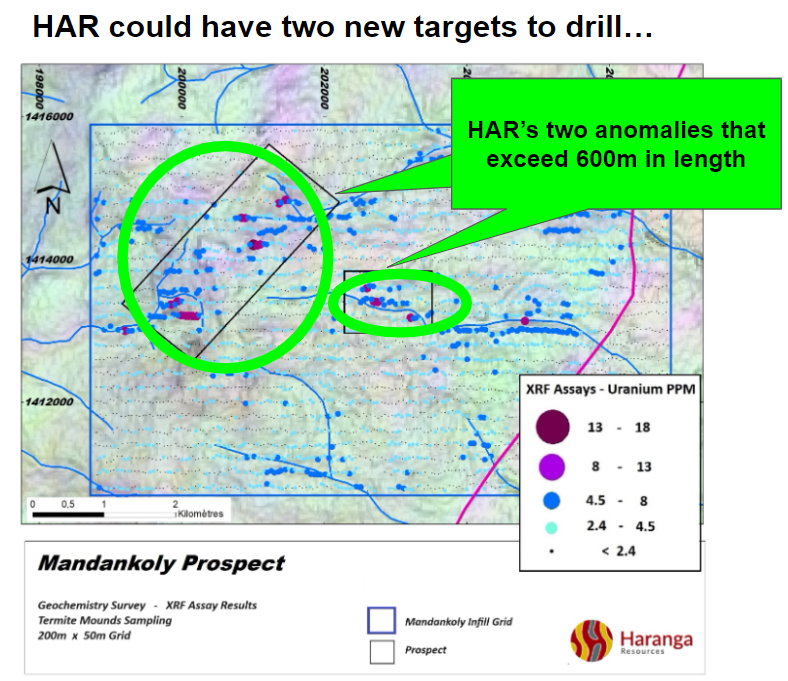

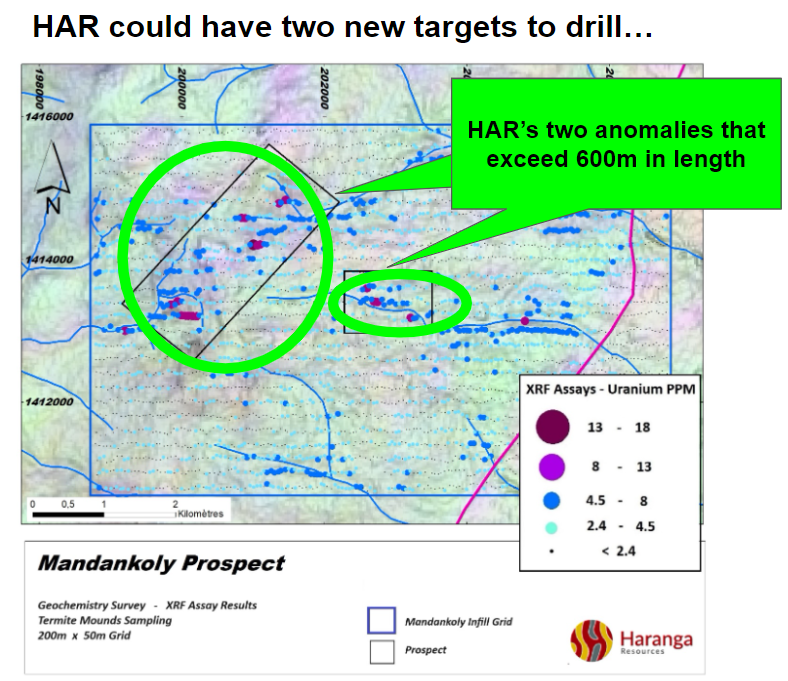

To find new drill targets HAR has been sampling soil and found two large areas where the uranium content is 7x normal levels.

HAR is currently drilling some shallow (auger) holes and will use this information to best target deeper RC drilling into the best uranium mineralisation.

(the RC rig is already on site)

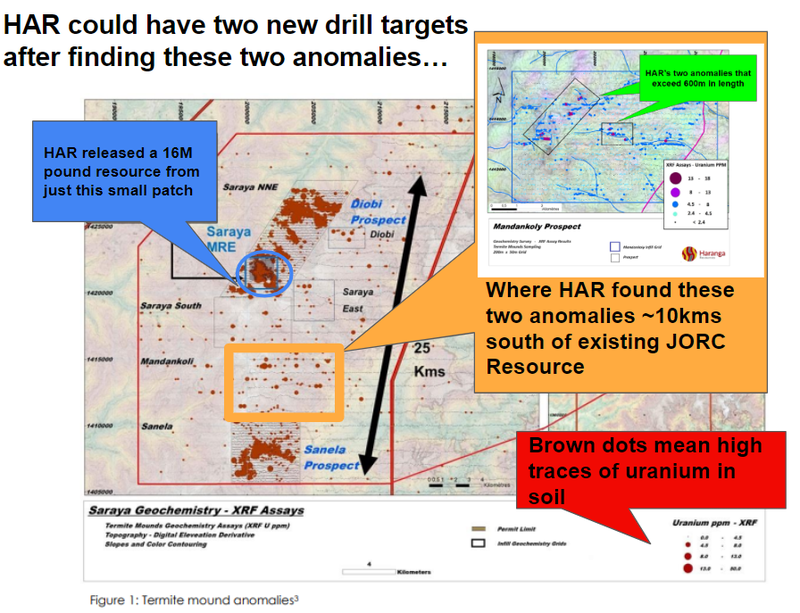

Both of HAR’s new uranium anomalies stretch more than 600m in length, and they sit 10kms to the south of where HAR has an existing 16.1mlbs JORC resource at 587ppm.

Now we wait for HAR to refine RC drill targets and kick off the bigger drill program.

And hopefully deliver some material new uranium mineralisation.

Which should help HAR add to the 16.1mlb JORC uranium resource it announced on 25 September 2023.

(and ideally, the U price keeps on running...)

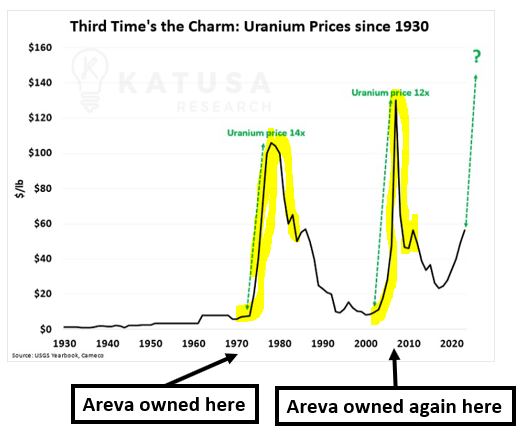

HAR’s two new anomalies were found in an area that former owner Areva (now Orano) never looked at.

Areva/Orano is a huge French multinational nuclear power and uranium supplier that used to own HAR’s project - TWICE.

Both times that Areva owned HAR’s project was in huge uranium bull runs where the price shot up dramatically:

We are hoping that when the EU needs to go out looking for uranium supply, HAR’s project will become of interest to them again...

Our long term HAR Big Bet:

“HAR re-rates to a +$100M market cap on significant resource growth and/or a transaction with a major player in the nuclear fuel supply chain”

NOTE: our “Big Bet” is what we HOPE the ultimate success scenario looks like for this particular Investment over the long term (3+ years). There is a lot of work to be done, many risks involved - just some of which we list in our HAR Investment Memo. Success will require a significant amount of luck. There is no guarantee that our Big Bet will ever come true.

We started looking at HAR last year in anticipation that uranium would continue its price run.

And then Peter Batten joined the good ship HAR as Managing Director in September 2023.

(back then the uranium spot price was $60/lb, it's now ~$104/lb).

Peter was the founding managing director of now ~$553M Uranium (developer) Bannerman Resources.

At Bannerman, Peter was responsible for pegging ground in Namibia where he eventually defined a JORC resource of over 100m lbs of uranium (remember HAR currently has a 16m lbs JORC resource of uranium, and is looking to grow it).

Under Peter’s leadership, Bannerman was the best-performing company on the ASX in 2006 (during the last uranium price run).

When Peter was leaving Bannerman, the company was in the feasibility study phase.

The past performance is not and should not be taken as an indication of future performance. Caution should be exercised in assessing past performance. This product, like all other financial products, is subject to market forces and unpredictable events that may adversely affect future performance.

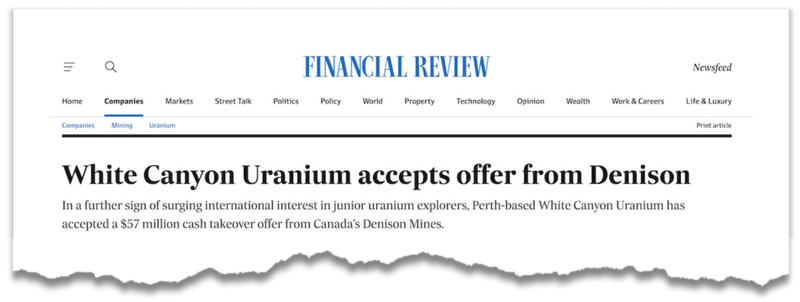

After Bannerman, Peter did a stint at White Canyon Uranium, where he helped commercialise the company’s Utah uranium project in the USA.

Peter led White Canyon to being the first company to get a uranium mining licence in Utah in over 30 years - eventually, White Canyon was taken over by a major Canadian miner in 2011 for $57M.

(Source)

Peter brings exactly what we think HAR needs at this moment in time, while the uranium price is kicking off.

We are hoping that under the highly experienced uranium MD Peter Batten that HAR can successfully deliver some new uranium discoveries at its historically significant U project, and materially increase its uranium JORC resource while the U price hopefully keeps running.

The 7 Reasons we Invested in HAR:

Back in September 2023 when we first added HAR to our portfolio, we listed the reasons why we invested (and the risks, which are further below).

Here are the original 7 reasons and a short update on any changes that have occurred:

- Uranium prices trading at decade highs - Uranium spot prices are recently trading at the highest level in over a decade. Uranium price runs don’t happen often (decades in between) and when they do happen they usually last a few years. The current Uranium run has just started.

***UPDATE: Uranium prices are now at 16 year highs, with the spot price up over 100% in the last 12 months.

- HAR has a giant 1,650km2 uranium exploration land holding - HAR’s project is in Senegal, West Africa. While Africa comes with risks, it is one of the rare places where massive new resources can be discovered and deliver multi-hundred million market caps uranium companies (like Paladin Energy, Lotus, Bannerman, Deep Yellow, Aura Energy).

- Nuclear giant and reactor builder Areva used to own HAR’s project... twice - The French Nuclear giant owned HAR’s project in the ‘70s and ’80s, then again in 2009 to 2011 - they relinquished the project after the uranium price crashed post the Fukushima disaster. Areva did ~62,000m of drilling on HAR’s project.

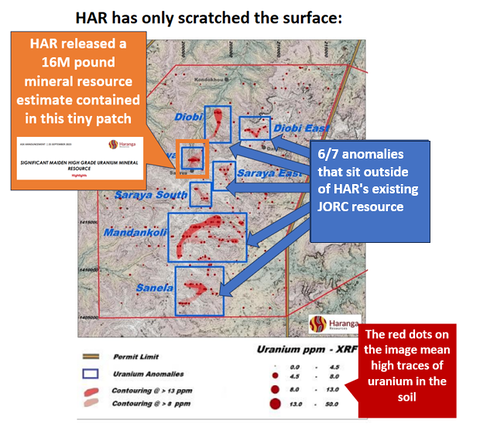

- Existing 16m lbs JORC uranium resource with plenty of exploration upside - HAR’s initial resource released last week is only scratching the surface on its project. Mostly using Areva’s historical 62,000m of drilling, HAR has a further 6 anomalies covering far more ground than the initial resource yet to be tested.

***UPDATE: HAR now has two additional anomalies to drill test.

- Peter Batten (Ex-Bannerman) just appointed as HAR Managing Director - Peter was one of the founding managing directors for Uranium company Bannerman Energy. In 2006, while Peter was MD, Bannerman was the best performing company on the ASX.

- Re-applying Bannerman’s African playbook, HAR to become Bannerman 2.0? - Peter was responsible for taking Bannerman’s African uranium projects from exploration into the feasibility stage. We are hoping he can do it all again with HAR.

- HAR has a tiny market cap - HAR seems to have been overlooked by the market at the start of this current uranium run, at ~15c HAR where it last traded, HAR has a ~$9M market cap.

***UPDATE: HAR now has a market cap of ~$21M, which we think could still be seen as small relative to exploration upside and recent uranium market moves.

More on today’s HAR announcement

HAR is using a three step process to try and multiply its existing resource of 16.1mlbs of uranium:

- Find an anomaly with soil sampling🪨

- Shallow auger drilling to refine targets for deeper RC drilling🎯

- RC drilling to hit larger intercepts of uranium ☢️

This is what the anomalies look like at this area the French never looked:

And this is how they fit into HAR’s overall project in Senegal:

The significance of today’s finding is this:

- The new anomalies have the same geology as existing resource - this points to the potential of drilling to replicate results seen in the existing JORC resource

- The new anomalies may now be targeted by deeper RC drill rig, - the RC rig arrived on site in mid December and could now be used on these two anomalies.

What’s next for HAR?

Drill results 🔄

HAR is currently running a ~20,000m auger (shallow) drill program across two of its seven uranium targets, this was to help define the best place to place a deeper drill hole with the RC rig now on site.

While HAR waits for the delays caused by the later wet season to end, auger drilling will continue at Diobi.

Assays for the 4,000 to 6,000m RC program are expected late February through to April.

Sampling results 🔄

HAR is continuing to run a tenement wide termite mound sampling program.

We think assays from the first phase of sampling should start coming back in later this month.

The ultimate aim for the sampling work will be to find more drill targets.

Resource upgrade 🔲

After the results come back from the soil sampling/drilling, we want to see HAR increase its JORC uranium resource.

We want to see HAR increase the confidence level of its resource (take it from inferred to indicated) AND at the same time increase the resource in terms of size.

Our HAR coverage so far:

Our newest Investment: Haranga Resources (ASX:HAR)

HAR is Hunting for Uranium - 7 Big Targets, Drill Rig arriving next week

🗣️Quick Takes:

HAR’s uranium exploration targets keep getting bigger

Haranga to probe Senegal uranium project anomalies

Haranga starts drilling for uranium in Senegal

What are the risks?

Country Risk

While Senegal is generally one of the most stable countries in West Africa, the region where HAR’s project is located, is considered a high-risk region of the world.

Most recently in the region there was a coup in Niger (2023), which coups in Mali (2021) and Burkina Faso (2022) in recent years.

Political instability in the region could disrupt HAR’s ability to operate or commercialise its project.

Exploration risk

HAR is planning to drill exploration targets to grow its uranium resource.

Exploration activities may or may not return any uranium mineralisation or low-grade uranium resource that is uneconomic.

Commodity risk

In recent decades, governments have shunned uranium because of the issues related waste removal and accidents like Chernobyl and Fukushima.

If the adoption of nuclear power is slower than expected then it may impact the future demand for uranium.

Uranium price risk

Share prices of junior explorers like HAR are dependent on strong spot prices for the commodity they are exploring for.

The uranium price has started running at the moment but any retracements in spot prices could lead to capital withdrawing from the sector and a fall in share prices.

Dilution risk

HAR is a junior explorer with no revenues to fund exploration and ongoing costs. This means the company is reliant on capital raises to fund exploration programs. Despite a recent capital raise, HAR will need to raise capital to continue its operations which may incur dilution to current shareholders.

Market risk

If the broader market sells off, investors may shy away from high-risk investment opportunities like junior explorers. During market downturns, investors will look to pull capital away from the high risk investments. HAR is a junior explorer and may be impacted by these market wide sell offs.

Our HAR Investment Memo

In our HAR Investment Memo, you can find:

- HAR’s macro thematic

- Why we Invested in HAR

- Our HAR “Big Bet” - what we think the upside Investment case for HAR is

- The key objectives we want to see HAR achieve

- The key risks to our Investment thesis

- Our Investment Plan

🎓Learn: Click here to learn more about the difference between the different types of drilling

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.