Next Stop, PFS? GSC Completes Initial Drilling at Lithium-Boron Project

Published 06-FEB-2017 10:09 A.M.

|

12 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

There’s currently only one lithium mine in production in the US... leaving a pretty wide open market for a company that can compete on asking price.

Which is exactly what Global Geoscience (ASX: GSC) plan to do via its Rhyolite Ridge lithium-boron play – one of the largest lithium-boron deposits in the US and just 340km (of paved road) from Tesla’s gigafactory.

In what could be classified as a unique approach, GSC is looking to turn its searlesite mineralisation in Nevada into a major supply for the lithium and boron markets in the US and the world.

That’s not just a focus on Tesla, but manufacturers such as Samsung, Sony and other multi-national giants who need lithium-boron components for their products.

GSC is thinking big and is looking to ride the coattails of the lithium boom, while adding a little boron stability on its quest to hopefully produce 10% of lithium world supply.

GSC’s plans for world market penetration should be buoyed by the fact its Searlesite Zone hosts a high-grade Li-B Resource at its South Basin.

GSC already has a lithium JORC resource on its hands and looks to be in a very good position to meet any future demand, both geographically and on paper.

Now, it is relatively early days for mine development here, so there is no guarantee of how much of this demand this company will meet, so if considering this company for your portfolio seek further information and professional financial advice.

With its initial drilling program completed in January, GSC is churning out results from metallurgical testing to make sure it can extract lithium and boron effectively and inexpensively.

Interim results of the metallurgical test work demonstrate the potential for simple and low-cost processing to produce lithium carbonate and boric acid.

In fact that is exactly how GSC is positioning itself: as a low cost, easy to process, high margin project.

In the coming months we should find out how much of the total lithium-boron mineralisation will be able to be liberated from the searlesite rock and the cost to do so – which by all indications could be a further tipping point for the company.

With funding that should see it through to the completion of an imminent PFS in the September quarter of 2017, it’s all good news for GSC at the moment.

So without further ado, let’s catch up with this ASX-listed junior, rolling out a formidable game plan on the other side of the world:

When first alerted Next Mining Boom readers to Global Geoscience (ASX:GSC) in December in the article, This ASX Stock has One of the Largest Lithium Deposits in the USA: Just 340km from Tesla , the company had just commenced drilling at its Nevada ‘Rhyolite Ridge’ lithium-boron project.

Its market cap was $75M (it is now $122M) and it was freshly cashed up thanks to a $6M capital raising venture in August last year.

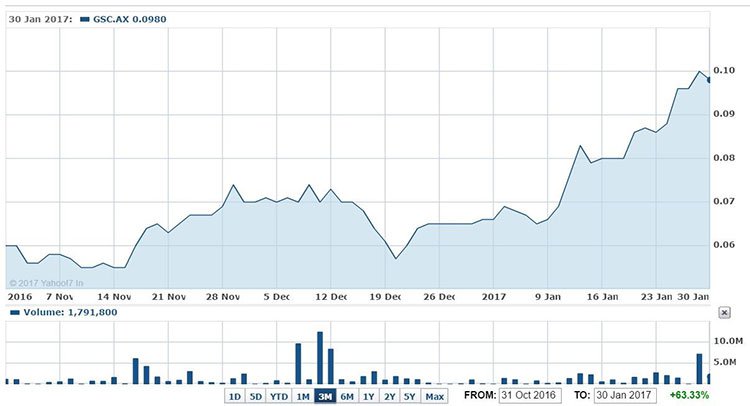

Since that article, and the release of metallurgical test work results, GSC has seen a 30% rise in its share price, indicating that plans for its primary Rhyolite Ridge project could be on the money. Literally. Here’s a look at what the share price has done since 31 October 2016.

Since our December article, GSC is up 64%:

The past performance of this product is not and should not be taken as an indication of future performance. Caution should be exercised in assessing past performance. This product, like all other financial products, is subject to market forces and unpredictable events that may adversely affect future performance.

The potential for it to head further north in the near future is definitely there. But read on to judge for yourself how well this growing junior explorer is progressing its dreams to become a global producer.

A quick look at Rhyolite

GSC’s flagship project – the Rhyolite Ridge lithium-boron project in Nevada, USA – is a rather valuable 22km2 land holding situated between Las Vegas and Reno, not far from a sealed highway, close to Nevada power and infrastructure, and with towns and a skilled workforce conveniently close by.

It’s also located just 25km from Albemarle’s Silver Peak lithium brine mine – which has produced lithium continuously since 1966. The only lithium mine in the USA.

GSC holds a JORC Resource containing 3.4 million tonnes of lithium carbonate and 11.3 million tonnes of boric acid, which fetches US$750 to $1250 per tonne on the market (for reference, 1% of boron converts to 5.7% boric acid – increasing the profit margin substantially).

Its recently discovered ‘Searlesite Zone’ at the South Basin on the Rhyolite Ridge project has a resource size of 65Mt –the known high grade lithium-boron from existing holes – at 1.0% Li 2 CO 3 and 9.1% H 3 BO 3 for a total of 650,000 tonnes of lithium carbonate and 5.9 million tonnes of boric acid. This is sufficient material to support a 3Mtpa mining operation over 20 years.

However, this is just the start and only takes into account existing drill holes. GSC could be on top of 10-times the amount across both basins with further step out and exploration drilling.

This searlesite zone occurs in the Upper Lens of the deposit, and constitutes 97% of the high-grade component of the South Basin Resource. It is shallow, and outcrops along the western margin of the basin; and it’s also open in three directions and likely to increase in size with step-out drilling.

In case you’re wondering, boron is a mineral commonly used in borosilicate glasses used in cookware, fibreglass, ceramics, fertilisers and detergents.

Shareholders have been waiting for results of metallurgical testwork to get an indication one way or another of the viability of GSC’s proposed method for lithium-boron extraction and as mentioned above, interim results have now been released.

Although, GSC is still in the early stages of its gameplan, so investors should seek professional financial advice for further information if considering this stock for their portfolio.

Metallurgical testwork – first round of results

The all-important metallurgical testing phase is now in process for GSC – with results flowing.

This stage all comes down to the fact that searlesite mineralisation holds plenty of lithium, boron and potassium, but there are a few question marks around the potential to ‘liberate’ the precious minerals from the waste materials they are couched in.

These latest results , released in the last few weeks show that the Li-B rich mineralisation is mainly composed of relatively coarse material (78% greater than 212 microns) and that the coarse material comprises 40-44% searlesite; specifically, the results are confirming the low clay content, as GSC had hoped, to make extraction easier and less expensive.

GSC’s proposed process of liberation involves crushing, screening and flotation followed up with dilute acid leaching.

These methods are not new, however the parameters need to be established, for example how much or little these steps are used for greatest efficiency and minimal loss of lithium, boron and potassium.

The flotation and other methods are being tested to see if lithium/boron-bearing minerals can be separated from gangue minerals including acid consuming minerals such as calcite.

The aim, obviously, is to arrive at a concentrate of the minerals that can be leached and then sold and used by companies like Tesla who need them... and the latest results mark the end of the first stage of the metallurgical test work being undertaken by the company through Hazen Research and SGS Minerals.

Further testing will go towards ascertaining the full extent, and limits, of the process at the testing laboratories in Denver, Colorado and Ontario, Canada.

The metallurgical program, once fully complete, will provide a full evaluation of a simple process route wherein crushing, screening and flotation are used to extract lithium and boron from searlesite rock, followed up by diluted acid leaching.

Basically, the results show that the lithium boron rich mineralisation is mainly composed of relatively coarse material, between 40-44% searlesite.

The team was expecting this method to impress, quality and cost wise, in comparison to other current sources of lithium like brine and spodumene deposits... and so far, they seem on track to do just that.

In the next month or two several things should click into place for GSC with some important questions answered. First, how much of the total lithium-boron mineralisation will be able to be liberated from the searlesite rock through these processes; and at what cost.

Keeping in mind that GSC are already a step ahead thanks to the amount of historic work that’s been done at the South Basin of Rhyolite Ridge – estimated by the company at about AU$3M worth of work...

It took a bit of optimism around unconventional extraction methods to get the Rhyolite Ridge project this far, but GSC has an advanced lithium JORC resource and we are now awaiting positive results from the maiden drill program.

Now the team is getting to the pointy end where they can start to crunch some numbers in real terms.

GSC: License to drill

Next on the list will be assay results of the initial drilling program which are expected to be released within weeks.

This maiden drill program which kicked off in December has been targeting high grade Li-B searlesite mineralisation, because it represents the high value material within the deposit and the lowest cost option to process and produce lithium carbonate and boric acid.

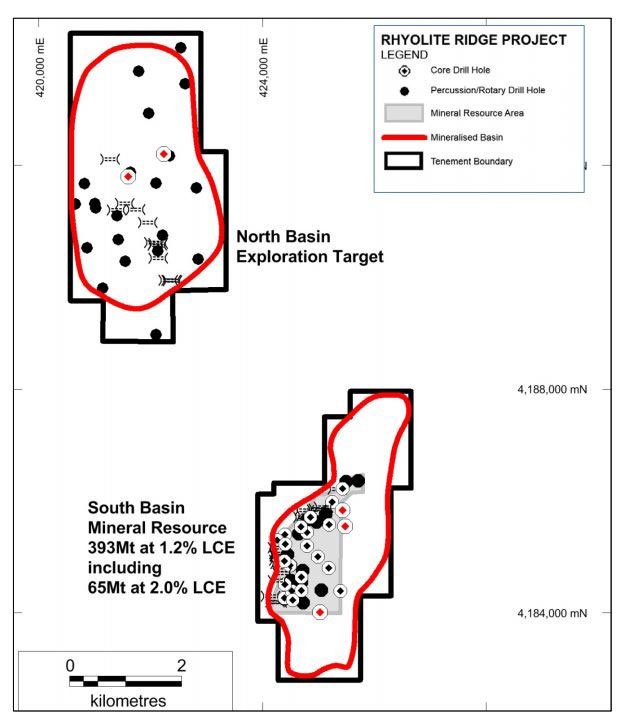

The drilling program involved two holes at North Basin and three holes at South Basin (as seen on the map below) and is now complete:

The same metallurgical test work will be completed on drill core samples with more results imminent...

Drilling was completed in mid-January, and the company has advised shareholders they can expect the release of assay results within the coming weeks...

In the end, the program included two holes drilled at North Basin and three at South Basin for a total of 1246m. All drill holes were outside the current Resource area. Core samples from the North Basin have been added to the metallurgical program to ensure all types of mineralisation are tested.

Testing now, Tesla later...

Being a lithium hopeful, Tesla – the electric vehicle giant primed for world domination – is never far from the thoughts of companies like GSC. In this case, they’re not far in a physical sense either.

GSC’s key Rhyolite Ridge project is only a few hours’ paved-road drive (340km) from Tesla’s gigafactory outside Reno.

Now, Tesla has a public objective to source materials for rechargeable lithium-ion batteries, like lithium and cobalt, from domestic sources to lower its transport carbon footprint...

... so being so closely located to such a large manufacturer destined to require ever-increasing amounts of lithium into the foreseeable future is an excellent starting point, to say the least.

Back to cost. GSC aren’t looking to produce lithium from brine, from spodumene or pegmatite, or extract it from clay... all more expensive options than what they have planned.

If GSC can extract lithium carbonate as cost-effectively as they hope, and liberate as much lithium and boron as in JORC Estimates, it’s hard to see what will stop them from entering and dominating what is a very hot market right now.

Lithium carbonate attracts quite a high value per tonne – in fact, more than 10 times the value of the spodumene concentrate extracted from lithium-bearing pegmatite.

The story so far...

Rhyolite Ridge was explored for lithium in 2010-11 by JOGMEC (a Japanese Government funded company), who completed 36 drill holes.

JOGMEC’s focus was on lithium, taking little notice of the boron mineralisation found in the same area. That’s where GSC differs, and why the company is going further than JOGMEC reached in its efforts to mine the area.

And perhaps that explains why GSC’s market cap has gone up nearly $30M in just a few months.

It should be noted that any there is no guarantee GSC will continue to grow at this pace and investors should take a cautious approach to any investment decision they make in this stock.

Now that it’s GSC’s Resource to play with, the team has created its own tight game plan that’s as simple as it is unique.

Here’s a rough idea of the path it hopes will get it to the level of lithium-boron Producer:

Now that we’re into 2017, the last two points in December have been ticked off, which means the next stop for GSC will be a Pre-Feasibility Study.

Committed and cash positive

As at the quarter ending December 2016, GSC held $4.3M in cash (a breakdown of cashflow for the quarter is found in the latest report released in January ).

The company raised $6M in a heavily oversubscribed share placement in August, giving it ample cash backing to see Rhyolite Ridge through a drilling program, and likely through to PFS if all goes to plan.

During the quarter to December, GSC spent only $436,000 on exploration and $374,000 on corporate/administration/salaries...

Which has left it sitting pretty from just about any angle; cashed up, Maiden JORC Resource in hand, first round drilling complete, ideally located, honing in on a uniquely inexpensive means of production, and the buffer of a two-pronged commodity play (leaving the potassium kicker out of it).

In the latest quarterly, GSC advised of its plans for the coming months, including releasing assay results for the drilling program and hopefully a Resource estimate for the site’s North Basin.

Once the metallurgical testwork is done and dusted, the company will aim to make a decision around the commencement of a crucial PFS...

A bright future, battery-powered

GSC is a strong lithium hopeful, looking to join the ranks of the top 4 lithium producers in the world that currently supply 10% of world supply. Its key project, Rhyolite Ridge, has the potential to become a mine with a lifespan of more than 20 years.

If current estimates eventuate, there’s the possibility of GSC producing 20,000 tonnes of lithium carbonate per year.

Currently, that would provide about 10% of world demand. An enormous addressable market.

There are still a few hills for GSC to climb, however. Metallurgical testing is in process, and a definitive idea of efficacy and numbers for extraction are yet to come. There’s also plenty of drilling to be done between now and the transformation of Rhyolite Ridge into a lithium-boron mine.

But there is an undeniable synergy happening at a foundational level for GSC, with a formidable Resource, a low production method, geographical proximity to a large potential offtaker with growing revenues and an even faster growing need for lithium... the orchestration of these strategic advantages could prove a major knock to GSC’s competitors.

When the time comes for its products to go to market, assuming current plans unfold in GSC’s favour, the company’s entry into the big leagues could disrupt the supply of lithium on a global scale. Look out for the new kid in town.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.