New Assay Results for LCL’s Giant Porphyry System

Our investment Los Cerros Ltd (ASX:LCL) continues to deliver more outstanding drill results from its large near surface gold discovery in Colombia.

Yesterday LCL released assay results from two more holes, continuing to grow the size of the discovery, and demonstrating shallow, high grade gold is present.

We are looking forward to a resource estimate by Christmas, taking into account all the impressive drill results LCL has been posting.

Here’s why we continue to hold LCL:

LCL is hunting giant gold systems in Colombia, in a place called the ‘Mid Cauca Porphyry Belt’ - this region is dotted with many multi-million ounce gold deposits.

LCL has already identified a giant porphy discovery called Tesorito South that it is aggressively drilling now.

LCL has another EIGHT porphyry and epithermal targets that it is working on.

We first invested in LCL in April last year. When LCL first found evidence of a big porphyry gold system in September 2020, its share price tripled.

LCL then raised $10M (at 11.5c) to drill in all directions around it to see just how big it actually is.

LCL has had three drill rigs going in parallel in Colombia, across its gold discovery and testing new targets in recent months.

We maintain a significant position in LCL and closely follow new developments as the company continues to deliver excellent drill results.

Since the first discovery hole, LCL’s gold system has continued to get bigger and bigger.

What happened to LCL yesterday?

Yesterday LCL put out more impressive drill results from two more holes.

Here are the key takeaways:

- Both holes intersected high grade gold mineralisation at surface.

- Adds to ‘modelled volume’ to the high grade surface material first encountered in a previous drill hole.

- This is a good sign for the potential project economics - near surface high grade gold is critical in early production years.

- LCL is going to drill more holes radiating from the same region to further expand this “zone of interest”.

Drill Result #1:

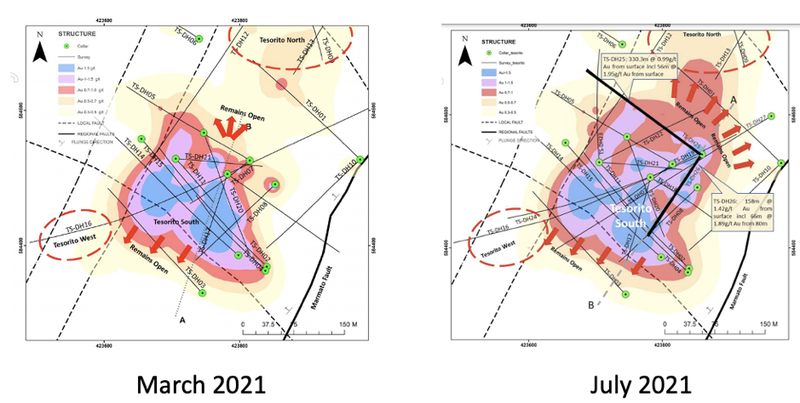

330 metres at 0.99 g/t gold, including 56 metres at 1.95 g/t gold from surface, including 24 metres at 2.7 g/t gold from surface.

These are outstanding results in terms of thicknesses and grades - 330m at ~ 1 g/t gold was far wider than LCL was anticipating.

That result was backed up by the second hole.

Drill Result #2

158.0m @ 1.42 g/t gold from surface, including 10.0m @ 2.13 g/t gold from 2m, 66.0m @ 1.89 g/t gold, including 30.0m @ 2.6 g/t gold from 80m.

LCL is still seeking to define the limits of Tesorito, as it is still open in all the directions drill tested so far - it's pretty excited by the north west extension that remains open.

Here you can see how the discovery has grown in recent months from one quarter to the next:

Once LCL comes to grips with the boundaries of the system, we would expect the company to start the resource estimation process - the first stage would be an indicated and inferred resource, perhaps that could be delivered by Christmas.

So why isn't the LCL share price going up?

LCL has a current market cap of $82M.

LCL had $6.12M in cash at the end of the March quarter, having spent ~ $1M on aggressive exploration and drilling in the three month period.

We will get a fresh look at the cash on hand at June 30th in the next quarterly report which should arrive in the coming weeks.

We can offer a couple of potential explanations as to why we think the share price might not be moving as rapidly as it did on the first discovery hole back in September 2020.

- Options overhang. LCL currently has 486.5 million shares on issue, and 50 million options expiring on 16th August at a strike price of $0.16. If all the options were exercised, it would bring in $8.4M to the company removing the need for a medium term funding alternative. Given LCL is trading at around 17c it’s hard to see this completely happening but we will have to see. Perhaps the market is waiting for these to be exercised or expire...there is now just 4 weeks to go.

- Combined with...market desensitised to good news from LCL. If any other company with no previous drill holes, was delivering the assay results LCL is, we would expect much more share price movement. LCL keeps posting some of the biggest and highest grades gold results anywhere in the world.

LCL discovery - comparison to AngloGold’s 30 million ounce beast

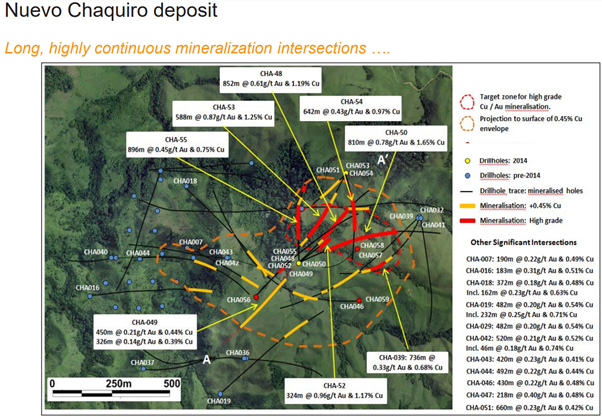

If LCL’s discovery was one of AngloGold’s Colombian projects, which aren’t too far away from Tesorito, and located in the same Mid-Cauca Porphyry Belt, market commentators might be hailing LCL’s results as the forerunner to another Nuevo Chaquiro’s 30 million ounce AuEq (gold plus copper).

Nuevo Chaquiro is an AngloGold project that delivered similar grades and thicknesses to those being delineated by LCL at pretty much the same stage of exploration and drilling.

LCL is hitting large thicknesses like Nuevo Chaquiro, but note the generally higher gold grades LCL is delivering, including 320 metres at 1.5 g/t gold, just 2 metres from surface and 330 metres at 0.99 g/t gold, including 56 metres at 1.95 g/t gold from surface as we saw yesterday.

Today, Nuevo Chaquiro is one of Anglo’s largest gold projects in South America.

Check out AngloGold’s full presentation on the Nuevo Chaquiro discovery here.

LCL continues to intercept strong gold mineralisation in every direction tested, delivering ‘spectacular’ result after ‘spectacular’ result.

What’s next for LCL?

- Pending assays results from TS-DH27 - sited ~100m north-east of TS-DH25: This has the potential to dramatically expand mineralised volumes to the north-east towards

- Maiden resource at Tesorito: With all these outstanding results, just how big can we expect Tesorito to grow? We anticipate a first indicated and inferred resource by Q4 2021, with a million+ ounce deposit very much on the cards.

- Ceibal: More drill results to come from LCL’s latest drill target.

- More targets: LCL is on the hunt for further drill targets to expand its ground.

- Scoping study at Tesorito: LCL will soon begin a Scoping Study.

Moving from exploration to production: Smart investors that look past the headline grades and reflect on other huge deposits in the region, will notice that some of the monster projects in the area have a combination of lower grade copper and gold mineralisation near surface – and lots of it. That sounds a lot like Tesorito.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.