WRM’s Deposits Now Rank in the Top Quartile of Undeveloped VMS Zinc – Silver Projects Globally

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

If you’ve been tuned into White Rock Minerals (ASX:WRM), you’ll know the company has laid some solid foundations over the past few months: assembling a top team, and announcing a very promising JORC Estimate at its highly prospective Red Mountain Project in Alaska.

The Red Mountain Project, located 100km south of Fairbanks, is a quality advanced VMS project with high grade zinc and silver deposits. It, along with WRM’s cornerstone asset, the Mt Carrington epithermal gold-silver project in New South Wales, offers an excellent exposure to the AUD gold price, with upside to silver and zinc.

However it is an early stage of this company’s development and if considering this stock for your portfolio you should take all public information into account and seek professional financial advice.

Today we are going to take a closer look at Red Mountain as WRM has just released its Maiden JORC Resource for the zinc-silver project in the very mining friendly jurisdiction of Alaska.

WRM’s Red Mountain Project is now in the top quartile of undeveloped high-grade VMS (zinc, silver, gold) deposits globally.

As such, with a market cap of just $13 million, it could be argued that WRM is undervalued when compared to its peers. This is especially true when you consider that it has one of the highest-grade VMS zinc – silver – lead – gold deposits of any of its peers, and there are still 30 lookalike targets to be tested.

Establishing a Resource estimate at Red Mountain has been top of mind for WRM as its broader plans for the zinc-silver-gold project start to unfurl and it looks to improve its valuation.

Yet, this maiden JORC Mineral Resource at Red Mountain is not the only news the company is moving forward with.

Results from WRM’s, now completed, most recent round of drilling at its Mt Carrington Project are due shortly.

It seems the company has all its ducks in a row for Mt Carrington, with a fully funded construction financing package agreed upon, around $20 million worth of infrastructure in place, and now, this recent round of targeted drilling completed.

Adding to the overall impression that WRM is really on a roll, the company has raised $5.7 million to advance the DFS and Environmental Impact Statement at Mt Carrington.

It’s clear WRM is shooting for the basket — and the company has two shots at it with a pair of very promising projects.

Holding $4.4 million in cash at 31 March, WRM is well-funded and raring to go.

On that note, let’s check back in with:

We last covered White Rock Minerals (ASX:WRM) in January, with the article: WRM’s Path to Gold Production Continues: DFS Now Underway .

In that article we discussed how WRM was advancing its Scoping Study and would unlock a financing package of US$19 million, putting it well on its pathway to production at its Mt Carrington gold and silver Project.

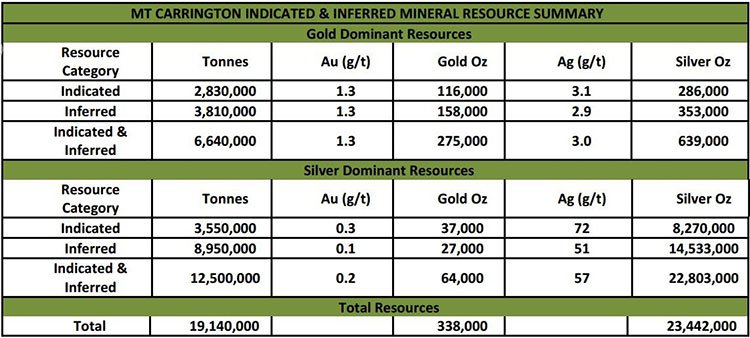

While Mt Carrington is progressing nicely, with an existing JORC Resource (JORC 2004) of 338,000 ounces of gold and 23.4 ounces of silver — and the potential for those numbers to be expanded, it is the maiden JORC 2012 Mineral Resource estimate at Red Mountain that has raised the bar for this stock.

In brief, the Dry Creek and West Tundra Flats deposits at Red Mountain have a high grade Inferred Mineral Resource totalling 9.1 million tonnes at 12.9% zinc equivalent, for 1.2 million tonnes of contained zinc equivalent at a 3% zinc cut off.

So before we get up to date on the latest at Mt Carrington, let’s dig deeper into why Red Mountain looks so impressive.

Maiden JORC Resource released for Red Mountain

The release of this maiden JORC 2012 Mineral Resource estimate at its Red Mountain zinc-silver project in Alaska is big news for WRM.

The company has long-believed Red Mountain hosts significant high-grade deposits, so validation of those claims in the form of a JORC estimate is very welcome.

The latest JORC estimate only encompasses a portion of WRM’s deposits at Red Mountain — leaving a lot of room to add on new discoveries as they come to light.

Considering the level of prospectivity at Red Mountain, the news is timely validation of its unlocked value just as WRM is starting to attract more investor attention.

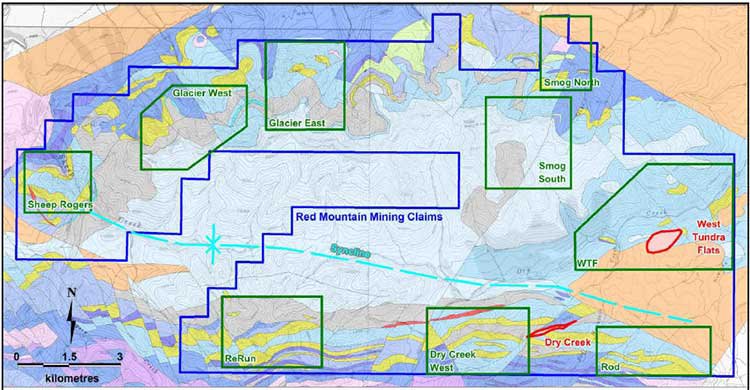

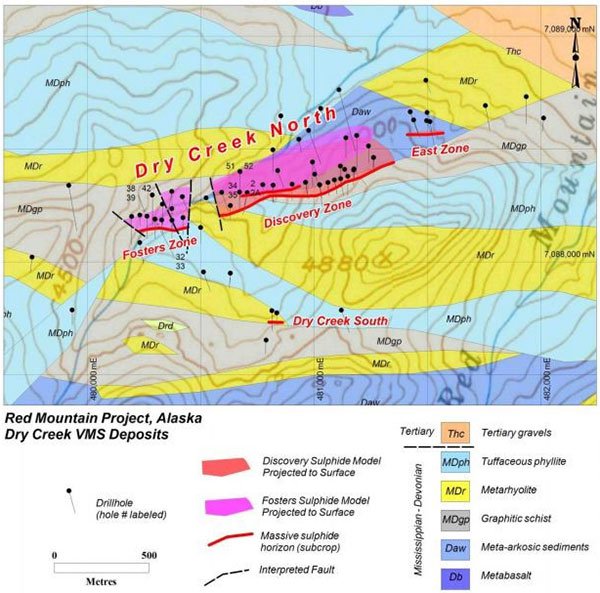

The Maiden Resource estimate pertains to the core deposits of Dry Creek and West Tundra Flats, which are the focus of WRM’s exploration at Red Mountain, highlighted in red below:

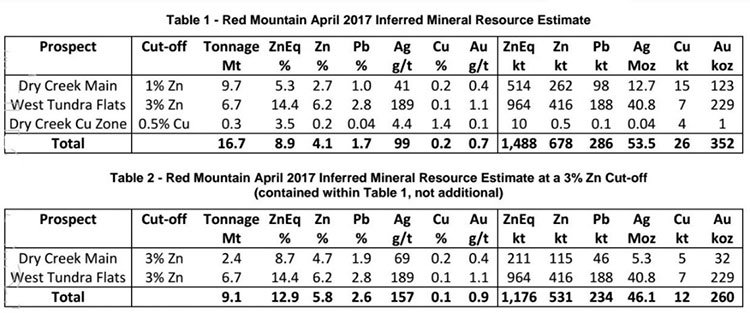

The focus on these two deposits is due to the promise they both hold... as evidenced by the JORC numbers, which brought the total Inferred Mineral Resource to a massive 16.7 million tonnes @ 8.9% ZnEq 4 for 1.5Mt of contained zinc equivalent (as shown in the first table below).

And with a 3% zinc cut-off, the Inferred Mineral Resource estimate comes in at 9.1 million tonnes @ 12.9% ZnEq 4 for 1.2Mt of contained zinc equivalent (see second table).

Below is a copy of the full summary:

The data also shows that mineralisation commences at surface and is open down dip and in places along strike — always music to the ears of enthusiastic, cashed-up explorers like WRM...

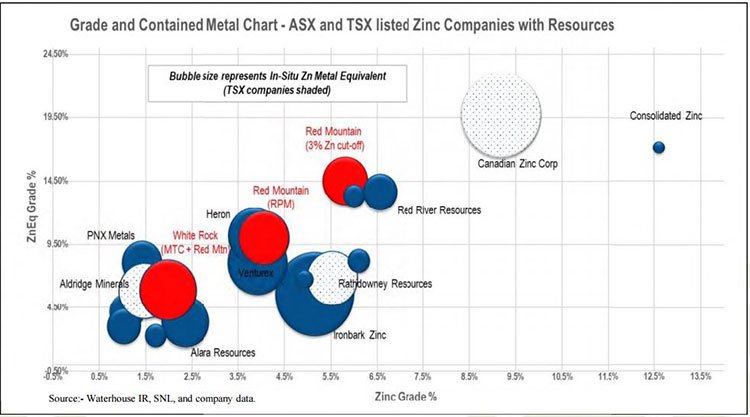

The JORC Resource places the Red Mountain Project in the top quartile of undeveloped high-grade VMS (zinc, silver, gold) deposits globally.

And that’s exactly where WRM wants to be, and where it suspected Red Mountain could take it.

It is a globally significant project, as the table below attests:

The above table is a great indication of just where WRM sits amongst its peers in terms of grade and size — it is certainly mixing it with some of the biggest and best, and is operating in a mining friendly jurisdiction with all the necessary infrastructure at its fingertips.

It is worth reiterating again that there are still 30 targets yet to be tested, and with a market cap of just $13 million there is plenty of upside for WRM and its shareholders if the company is revalued in line with its (thus far) more fancied peers.

Of course any talk of revaluation is speculation on our part at this stage, so investors should not only look at the information within this article, but all publicly available information before making an investment decision.

The company has more field work planned at Red Mountain following these encouraging results, including surface geochemical sampling and ground geophysics, at zones exhibiting the same signatures as the two zones already drilled, to define drill targets for follow-up.

The high priority VMS targets are conductors located within zones of anomalous surface geochemistry that are indicative of proximal VMS mineralisation as illustrated below.

WRM has only just scratched the surface at Red Mountain, as it encompasses only a small portion (15km 2 ) of the company’s total tenement holding (143km 2 ). It is now looking forward to adding considerable additional discoveries in the near future.

The outstanding maiden Mineral Resource estimate at Red Mountain validates WRM’s view of the potential of the district to yield further high-grade VMS zinc – silver – lead – gold – copper deposits. That said, we shouldn’t ignore the company’s cornerstone asset — the Mt Carrington gold-silver project in NSW.

Making headway at Mt Carrington

Even before the latest news of the now completed drilling program at Mt Carrington came down the wire, WRM was garnering publicity.

The Resource estimate for all deposits at the Mt Carrington Project totals 0.34Moz gold and 23.5Moz silver.

WRM has expanded the Resource base over 230% for both gold and silver with the majority of ore considered in scoping studies now classified as Indicated.

So far the ongoing Scoping Study forecasts the following, assuming prices of AU$1,600/oz gold and AU$22/oz silver:

- production of 111,000 oz gold and 6.7Moz silver over an initial mine life of seven years

- a low capital cost of A$24.2M

- an NPV 10 of A$60.6M and an IRR of 103%

- free cash flow of A$100 million (undiscounted and before financing)

- a quick payback of 10 months, and

- a C1 cash cost of A$754/oz gold and $A10/oz silver

WRM is now in the process of completing a JORC 2012 Resource Estimate for the project, providing clearer data on the 5 main gold-silver deposits it has its eye on.

Mt Carrington has a JORC 2004 Resource containing 338,000 ounces of gold and 23.4M ounces of silver.

Here’s a refresher of the Mt Carrington 2004 JORC Resource Estimate:

Earlier this year, WRM assembled a study team to progress its Definitive Feasibility Study (DFS) and Environmental Impact Statement studies (EIS) at Mt Carrington.

The company went to pains to choose the most strategic team to work on the DFS and EIS, and now that it’s underway WRM can dig deeper (in every sense) into mine planning, sequencing, budgets and forecasted profits for this NSW-based gold-silver asset.

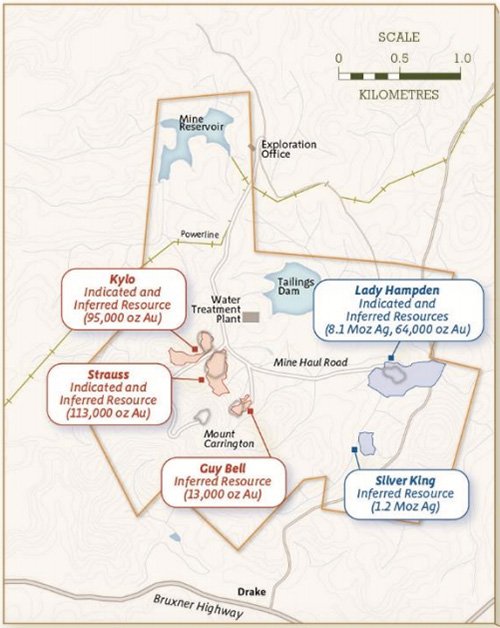

Results from the recently completed program should help decide the best processing route for the ore to be mined at the key open pits, Strauss, Kylo and Lady Hampden, taking into account both technical aspects as well as community consultations and environmental permits.

The drilling program focused on the Lady Hampden open pit as it forms a key part of the Mine Plan in the DFS for the project. Below gives a snapshot of the Mt Carrington project site and shows the location of Lady Hampden:

The silver-rich Lady Hampden is important, considering the deposit currently has an Indicated and Inferred Resource Estimate of 4.3M tonnes at 58 g/t silver and 0.5 g/t gold for 8.1M ounces of silver and 64,000 ounces of gold.

Some of the previous drilling results for the pit were 58 metres @ 83 g/t Ag and 1.6g/t Au (hole LHDD005); 26 metres @ 65 g/t Ag and 3.4 g/t Au (hole LHDD 031); and 31 metres @ 50 g/t Ag and 1.1 g/t Au (hole LHDD 030).

All of these steps are going to be formative in terms of WRM’s ability to actually mine the site and process the ore.

The company is making use of multi-disciplinary experts across geology, mining, metallurgy, and engineering to put together a final works plan.

If it gets to its goldmine destination as planned, the projected free cash flow is expected to come in at over $100 million over its first 7 years.

As findings from the drilling program, progress towards a DFS and even an updated JORC Estimate come through, there is scope for WRM to see some significant growth in the near-term.

News flow ahead and a friendly forecast on commodities

We are looking at a global recovery in base and precious metals, and it looks like it could be long-lasting. The recovery kicked off last year, when commodity prices rose for the first time in five years.

However at the same time, we should point out that commodity prices can also fluctuate down, so caution should be applied to any investment decision and not be based on historical spot prices alone.

Bloomberg’s broad index of commodity prices ended the year 11.4% higher — after 5 years in the red:

While the gold price continues to fluctuate, the internal financial metrics for WRM look promising: not just in terms of its current balance sheet, but in the details of the company’s individual projects and in its current activity timeline through to 2020, by which time it expects to be in production:

WRM’s prospects are looking rosy as it aims to be in gold production before 2020.

Elsewhere, like Alaska, WRM is looking Red (Mountain) hot: the company’s Red Mountain zinc-silver project could underpin the share price with the recent JORC Estimate broadcasting some big numbers.

We are starting to see pieces of a larger treasure map coming together for WRM – and with it, promises of hidden gold and silver to be found.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.