White Rock Aims to Fast Track its NSW Gold-Silver Project: Progresses High-Grade Zinc-Silver Alaskan Project

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

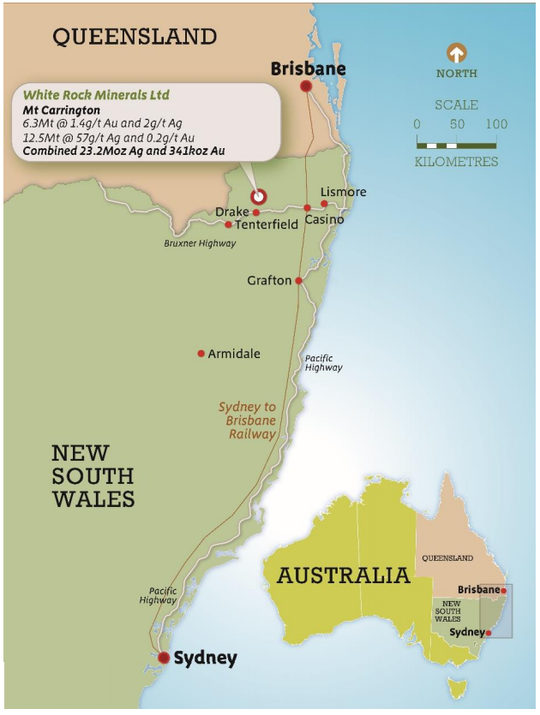

Record high gold prices have provided the incentive needed for White Rock Minerals (ASX:WRM) to fast-track its Mt Carrington Gold-Silver Project in northern NSW.

The move sees the advanced gold-silver epithermal project deliver a reduced timeline to gold and silver production.

WRM has an advanced Pre-Feasibility Study (PFS) that confirmed Mt Carrington as a viable gold first project, with significant potential upside in silver production and further gold and silver exploration success in the future. The project has a maiden JORC Reserve and is now being taken through the approvals process.

The strong Australian dollar gold price, along with the recent strength in silver, also encouraged White Rock to continue exploring avenues to advance Mt Carrington with interested parties and corporate advisory groups.

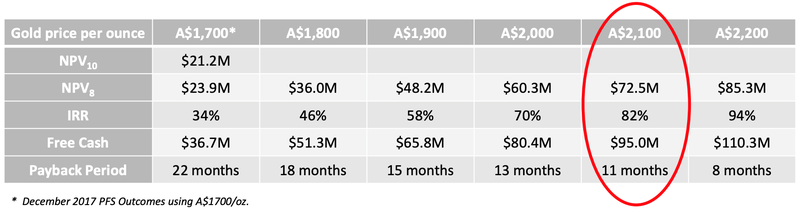

It determined that with the AUD gold price now exceeding A$2,000/oz, there’s potential for Mt Carrington to generate a significant return on investment with an NPV8 of A$60M, A$80M in free cash flow generated during its initial four years, an IRR of 70% and a capital payback of just 13 months.

In order to fund this fast-tracked schedule, White Rock launched a non-renounceable entitlement offer to raise A$5.4M to advance the permitting and DFS for its gold and silver project at Mt Carrington.

The intent is for gold to be mined first with an initial focus on the Strauss and Kylo gold deposits, and silver to be mined at a later stage.

Yet Mt Carrington isn’t the only reason to take a closer look at White Rock.

Having partnered with billion dollar Australian resources leader Sandfire Resources (ASX:SFR), White Rock is also delivering some impressive early stage findings from its exploration program at the Red Mountain high-grade zinc and precious metals (silver and gold) VMS project in central Alaska.

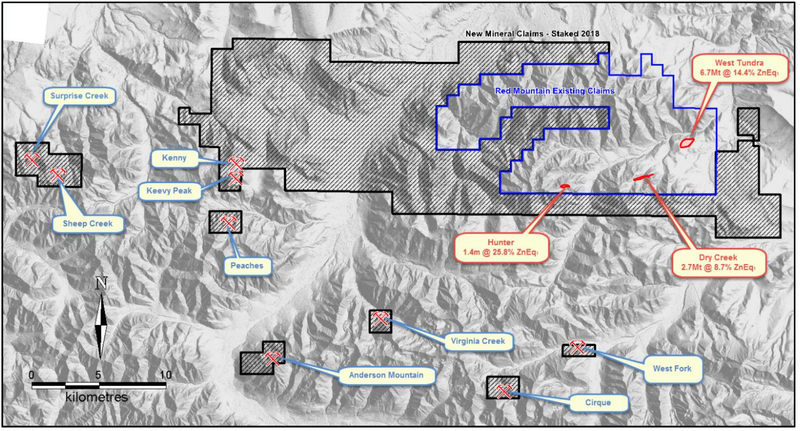

The Red Mountain project sits in the top quartile of undeveloped high-grade zinc VMS deposits globally, and has the potential for multiple VMS deposits throughout the company’s large strategic tenement package, that was expanded to 475km2 last year, only now beginning to be understood.

This globally significant project is said to hold a substantial Resource, with two high-grade deposits containing an existing Inferred Mineral Resource of 9.1Mt at 5.8% zinc, 2.6% lead, 157 g/t silver and 0.9g/t gold for 12.9% zinc equivalent (ZnEq) for 1.1Mt of contained ZnEq.

However, that’s far from the extent of what’s on offer at Red Mountain — a fact that hasn’t gone unnoticed by Sandfire Resources, which is not only a JV partner, but also WRM’s largest shareholder.

Having agreed to farm-in to the Red Mountain Project earlier this year, Sandfire is pouring $8 million into the project’s exploration in 2019 — with a total of $20 million required to be spent under the earn-in Joint Venture Agreement over the coming four years to earn a 51% share of the Red Mountain asset.

The billion-dollar company continues to commit funds for the exploration and advancement of the project — not surprising given that the project is one of the highest grade and more significant deposits of any zinc company that’s listed on the ASX.

Joining forces with Sandfire provides WRM with significant leverage to exploration success upside, all with low capital commitment.

The pair has undertaken on-ground exploration activities and assay results have now been received for the final drill hole of the 2019 season at Dry Creek. Stand-out successes from the 2019 field program include flying modern airborne geophysics over the entire land holding for the first time, a compelling target identified at the Cirque prospect, along with other already known prospects that remain to be tested, and the last drill hole delivering grades of 13.9% zinc, 4.4% lead, 115g/t silver, 0.8g/t gold and 0.3% copper for 21.6% ZnEq, over 1.4m.

All the latest from,

Share Price: 0.4 cents (as at 6 November 2019)

Market Capitalisation: $6.55 million

Here’s why I like WRM:

Mt Carrington Gold-Silver Project

White Rock is fast tracking its 100%-owned Mt Carrington advanced gold-silver epithermal project in northern NSW.

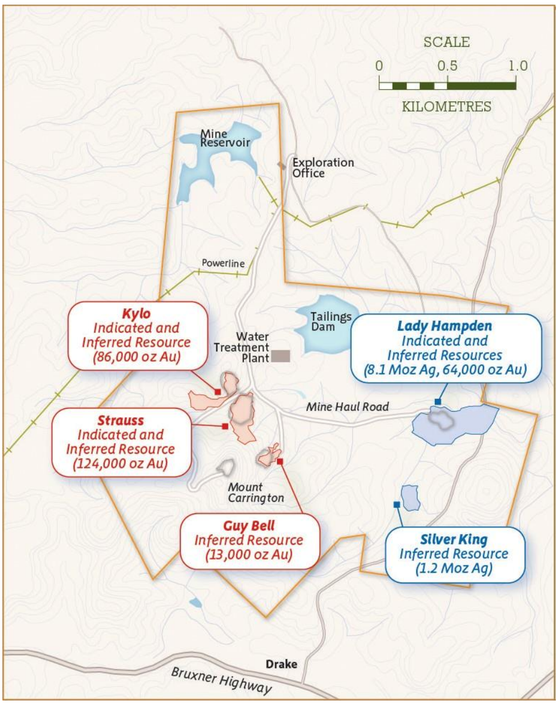

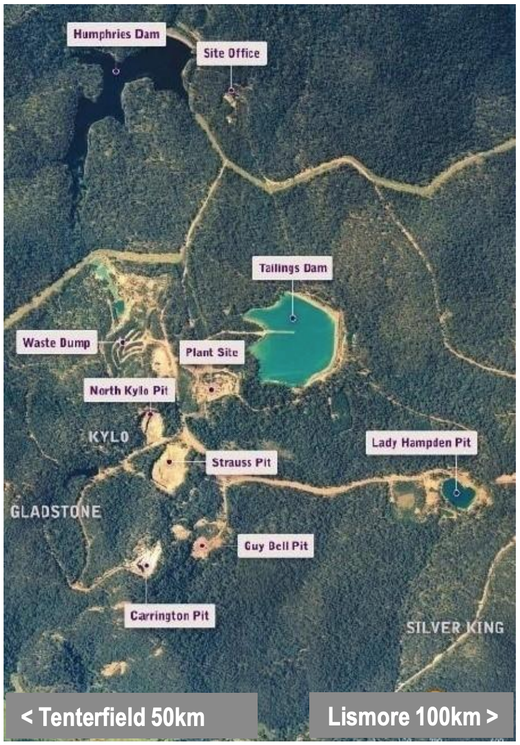

The project has over 180km2 of tenements that are highly prospective for epithermal and intrusion-related gold, silver and copper mineralisation. It has an advanced Pre-Feasibility Study (PFS) and a maiden JORC Reserve and offers a reduced timeline to both gold and silver production.

This reduced timeline also comes about thanks to the fact that the project is already on a granted mining lease. Past mining has left the first two gold deposits pre-stripped for mining, plus there’s a tailings storage facility and fresh water dam in place, with the plant site cleared and power to site. The fact that these are already complete save White Rock some $20M in capital costs.

The Stage One PFS in 2017, confirmed Mt Carrington as a viable gold first project with significant potential upside in subsequent silver production and future gold and silver exploration.

This PFS into the “Gold First” development stage declared a Maiden Ore Reserve of 3.47 million tonnes at 1.4g/t gold for 159,000 ounces gold within a resource of 341,000 ounces of gold and 23.2 million ounces of silver.

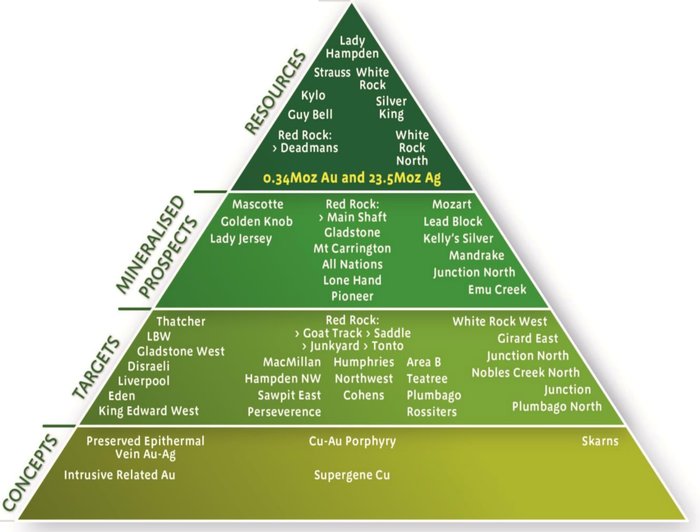

White Rock’s priority near-term exploration targets to build its resource inventory and extend its mine life are firstly on its mining leases, as well as its exploration licences, and finally — exploring the project’s copper porphyry potential.

Mining Leases

WRM is exploring the potential for resource additions with there being multiple shallow targets, historic drill intercepts for follow-up and the high-grade underground potential having been poorly tested.

Exploration Licences

The company’s exploration licences have a pipeline of prospects, there being a number of silver-gold-copper drill ready targets based on mapping, geochemical anomalies, and geophysical IP/resistivity anomalies.

Porphyry Potential

White Rock is also considering the copper porphyry potential at Mt Carrington. There is a robust intrusion related copper model at the project, strong secondary copper in shallow drilling, and a large open geophysical IP anomaly with confirmed alteration source. The project is under-drilled, while there are similar zoned copper-gold-silver systems recognised at White Rock and Red Rock.

Nearby Gold Targets

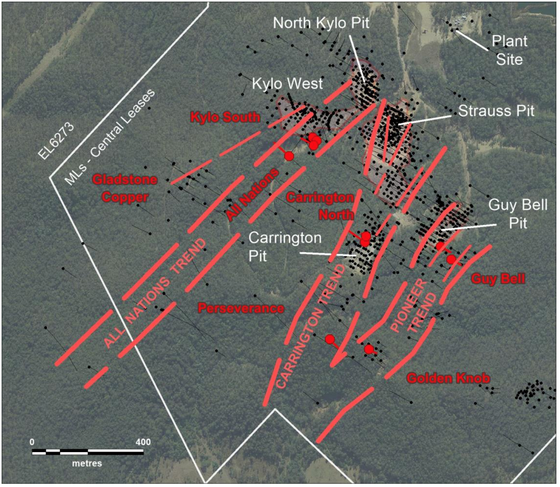

Multiple zones of gold mineralisation with high-grade gold potential analogous to classic epithermal vein targets exist within White Rock’s extensive exploration tenement package. WRM intends to focus on exploration for high-grade vein structures that feed known stock work Mineral Resources (Kylo / Strauss / Guy Bell / Carrington).

The All Nations Zone is a standout target having 400m strike potential not properly drilled, including:

- 0.85m @ 18.2g/t Au from 76.5m (ANDD003)

- 0.4m @ 17.2g/t Au from 96.6m (ANDD003)

Other target / zones with high-grade drillhole intersections for follow up are known at Kylo South, Perseverance, Golden Knob, Carrington North, and Guy Bell. Significant copper potential also remains to be tested beneath shallow mineralisation at Gladstone – zoned intrusion related mineralisation.

WRM has key Infrastructure in place at Mt Carrington valued at ~A$20 million and includes granted mining leases, a 1.5Mt tailings dam, a 750ML freshwater dam, site office, RO water treatment plant, access to state grid power, much of which can be seen on the image below.

The current gold price in excess of A$2,100 per ounce highlights the potential for Mt Carrington to generate a significant return on investment with an NPV8 of A$72M (being at two times Capex), A$95M in free cash flow generated, an IRR of 82% and a capital payback of just 11 months:

GOLD / AUSTRALIAN DOLLAR – 5 Year Chart

Potential and significant upside exists in further improving these strong financial metrics, while the initial mine life includes some of the JORC silver resources that could add another two to three years of mine life. There is also drilling out the two remaining JORC inferred gold resources and the six near-mine identified gold prospects to consider.

Entitlement Offer

The company is currently undertaking an equity raising of up to $5.4 million (before costs) through a 2 for 3 pro-rata non-renounceable entitlement offer of fully paid ordinary shares together with 1 option for every 3 new shares to existing eligible shareholders.

The offer price of $0.005 per share represents a 28% discount to the last traded price of WRM shares before the raising was announced, and a 30% discount to the 15 day and a 34% discount to the one-month VWAP share price.

The entitlement offer closes at 5.00 pm (Melbourne time) Wednesday, 13 November 2019.

Funds raised will be used to take the advanced Mt Carrington gold and silver project forward from the current PFS to DFS and through the approvals process.

Mt Carrington ‘valued’ at 1.7 cents per share

As explored in the following article from Finfeed, Breakaway Research recently valued White Rock at 2.5 cents per share — well above both the share price at the time that report was published last month and the current price.

One point to note is that with cash of 0.2 cents per share, based on the current share price investors are getting a relatively high value project in Mt Carrington, as well as the Red Mountain Project for 0.3 cents.

At the time of the article, the WRM share price was 0.4cps.

This recent research report assigned a $47.3 million valuation to the Mt Carrington project alone.

Red Mountain high-grade VMS project

The Red Mountain high-grade VMS project in central Alaska also has a number of factors that should encourage investors to take a closer look.

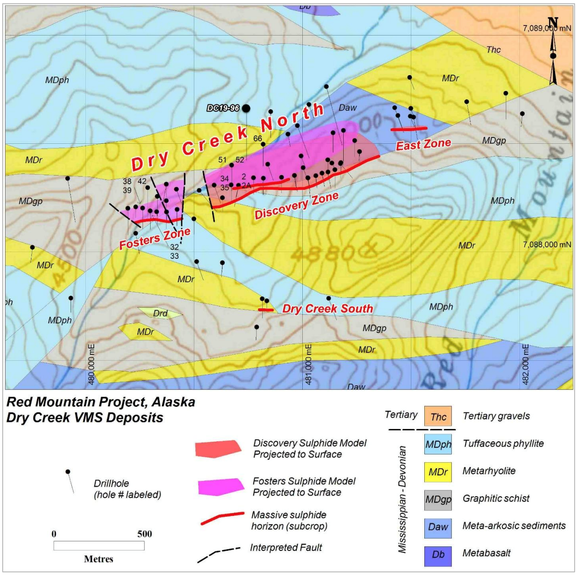

With its JV partner Sandfire Resources, White Rock has been undertaking a comprehensive program exploring for high-grade zinc and precious metals volcanogenic massive sulphide (VMS) deposits at Red Mountain.

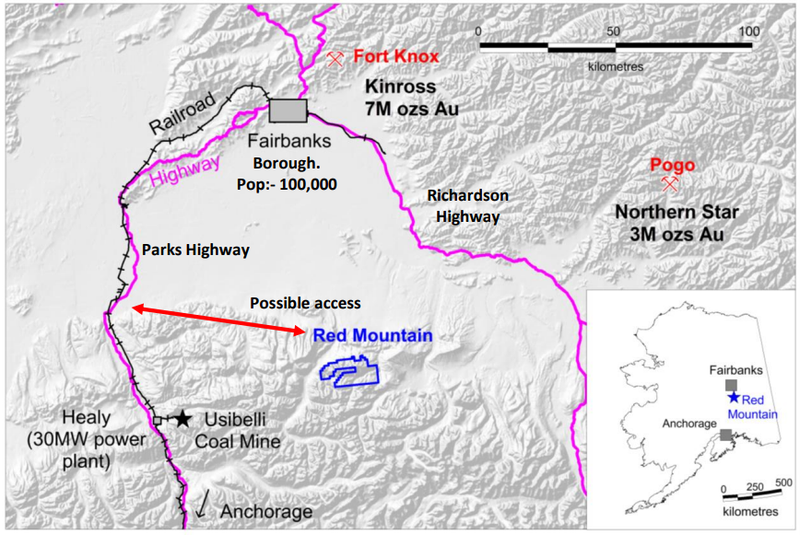

Its highly prospective 475km2 land position with high-grade mineralisation from surface and historic exploration that was undertaken from 1975-1999 leaves significant upside — assuming the use of modern exploration techniques. Plus, the project is well supported with surrounding infrastructure in Alaska.

The project is well located, not far from the established mining hub at Fairbanks, and in respect to infrastructure and logistics it has all-weather major road and rail access to the port of Anchorage.

Earlier this year the $1.03 billion ASX-listed Sandfire Resources signed an earn-in joint venture with White Rock that would see funding for the project of A$20 million over four years (A$6 million in 2019) to earn a 51% interest.

Upon the delivery of a further $10 million along with a PFS, SFR can increase its interest to 70%. This investment immediately puts a healthy valuation on this Alaskan asset that is currently 100% owned by White Rock.

In July, Sandfire followed up with a further commitment of US$1.5 million (~A$2M) on top of the minimum for Year One of A$6 million for 2019, taking total exploration budget for this year to ~A$8 million.

In summary, this all adds up to significant leverage to exploration success upside for WRM with low capital commitment.

2019 field exploration project

The aim of the 2019 field exploration program, developed in conjunction with Sandfire, was to drill test the maximum number of new targets possible within the strategic 475km2 belt-scale regional tenement package.

Funded by this A$8 million+ budget 2019, exploration activities included:

- 4,000 metres of diamond drilling over a 15-week field season;

- A 3,000 line kilometre airborne electromagnetic survey covering 500km2;

- On ground mapping reconnaissance, surface geochemical sampling and ground electrical geophysics;

- Downhole electromagnetics; and

- Lithogeochemical and spectral studies to assist new drill target generation.

The summer field exploration activities at Red Mountain focused on defining and drill testing new targets, away from the two known high-grade deposits that have the potential to yield a significant discovery to support a greenfield development scenario.

Earlier this week, White Rock provided an update on the exploration program at Red Mountain after assay results for the final drill hole of the 2019 season at the Dry Creek deposit were received.

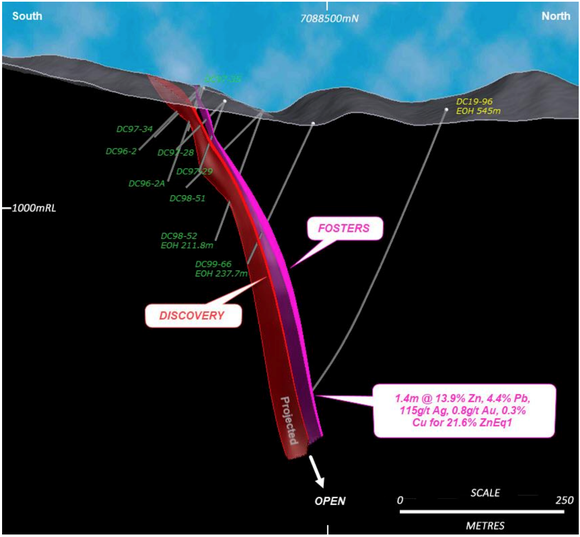

At Dry Creek, drillhole DC19-96 tested an aggressive 200 metre plus down-dip step out from the known high-grade zinc-silver-lead-gold mineralisation of both the Fosters and Discovery lenses. Mineralisation was successfully intersected with 1.4 metres including massive sulphide containing abundant sphalerite (zinc sulphide) located within stratigraphy equivalent to the Fosters lens.

Assay results for this intersection returned 1.4m @ 13.9% zinc, 4.4% lead, 115g/t silver, 0.8g/t gold & 0.3% copper for 21.6% ZnEq.

This aggressive step-out drill hole at Dry Creek showed that the deposit is wide open with high-grade zinc and silver persisting over 200m deeper than previously drilled.

While this particular intersection is narrow, typical VMS lenses pinch and swell along strike and down dip, as evidenced by previous drilling where true width intersections of up to 40 metres at the Fosters lens have been recorded.

There are already two high grade deposits at the Red Mountain Project, with an Inferred Mineral Resource of 9.1Mt @ 12.9% ZnEq for 1.1Mt of contained zinc equivalent at Dry Creek and West Tundra Flats.

The majority of the current Inferred Resource is drilled to a depth of just 200 metres, so a further step out of over 200 metres suggests considerable upside is possible in expanding the size of the deposit. This leaves considerable additional potential to this down dip position in the deposit, especially as the Resource footprint extends for 1,200 metres of strike.

Prior to this, in September, the company reported that reconnaissance of historic VMS prospects has been completed at Red Mountain with the Cirque prospect identified as the highest priority area for follow-up.

The company intend to undertake a targeted drill program early in the 2020 field season to determine just how significant the Resource expansion potential could be.

Here’s WRM CEO Matthew Gill speaking in August on the company’s exploration projects and operations:

A Final Word

White Rock is a diversified explorer, operating in two geographically friendly and stable environments.

It has a near development gold-silver asset in Mt Carrington that’s being fast tracked to strategically capitalise on the historically high AUD gold prices and rising silver prices.

While in Alaska, it has a billion-dollar partner and a project in Red Mountain that is in the top quartile of undeveloped high-grade zinc VMS deposits globally.

With further near term newsflow on the way, combined with a beaten down share price, now is a good time to take a closer look.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.