Uranium is Back - and GTR is Finally Coming Good

We have been holding our uranium exploration stock GTi Resources (ASX:GTR) since late-April 2020.

We added GTR to the Next Investors portfolio almost 18 months ago when the uranium price went on a run. However, the uranium price rise wasn’t sustained - it cooled off and traded sideways over the next year, as did GTR’s share price.

After patiently holding onto our GTR shares in the hope that the uranium price would continue its rise, it finally has, and the timing of GTR’s new uranium acquisition in the USA just before the uranium price run is spot on.

This is a good example of the importance of having patience when investing, to hold and wait for a sector to fire up. Another example of this is our investment in lithium (via Vulcan) back when the lithium price was in the doldrums and no one was interested in lithium stocks.

Patient holding has paid off with our early investment in GTR now. Of course, in hindsight, we wish we had been investing in more uranium stocks over the last 12 months but you can’t win them all. We do have positions providing exposure to a few other key investment themes, and will wait patiently for those markets to heat up too.

But for now, the market gods say it is the time for uranium and we see plenty of upside ahead for GTR if the uranium price keeps going up AND if they deliver some exploration success over the next few months of their campaign (for which they are already fully funded).

New readers should be aware that we have been invested in GTR for nearly 18 months and now that the uranium price is running hot, there could be increased volatility in the share price over the next few months. Also remember that exploration is a very risky investment.

GTR recently announced the acquisition of new uranium assets in Wyoming. We had originally invested in GTR as we liked its existing Utah uranium assets, which GTR still holds, but our expectations for the company are even better now.

The uranium price is surging, the new uranium assets are impressive, and GTR has multiple near term exploration and drilling catalysts lined up. For those reasons we recently increased our position in GTR and plan to invest further by participating in the upcoming rights issue next week.

The terms of the GTR rights issue are as follows: Anyone recorded as a GTR shareholder on WEDNESDAY 22ND SEPTEMBER can subscribe for 1 new GTR share at 1.5c for every 8 GTR shares they hold PLUS get 1 option for every 4 new shares subscribed, option exercisable at 3c expiring in 3 years - with the share price where it is we plan to take up our full allocation.

The prospectus is due to be lodged tomorrow, with a record date of 22nd September — meaning that investors need to be holding GTR shares on this day to participate.

ASX:GTR

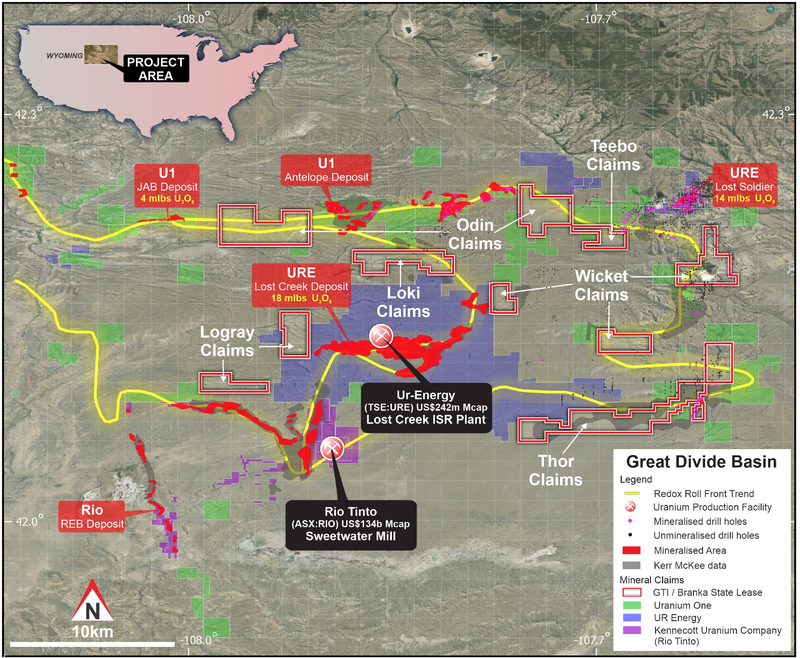

GTR is now finalising the acquisition of a set of uranium projects in the USA, including in Wyoming’s Great Divide Basin (GDB) — the uranium capital of America and home to Bill Gates’ and Warren Buffet’s latest uranium production project.

Our favourite thing about this new uranium deal is that it was entered into BEFORE the uranium price ran, and the acquisition terms were made on the basis of the lower project economics at the time. So the timing couldn’t have been better for GTR, which was finally due a bit of luck after its false start 12 months ago.

Given all of the above, we thought now is a good time to take a deeper look at GTR and its new projects.

Specifically, there are 8 reasons why we like GTR and its new uranium assets:

- Uranium projects located in Wyoming, the capital of uranium in the USA

- ISR uranium projects - the lowest cost uranium mining method in the world

- Uranium price at 9 year highs

- The USA is going to need a lot more uranium

- GTR gains a new highly experienced US uranium team in the acquisition

- Drilling by Christmas with funding in place

- Sector consolidation moves underway. Could GTR get taken over by a larger uranium player?

- Imminent rights issue looks attractive at current share price (the rights issue is priced at 1.5¢, current share price is 3.4¢. Record date is Sept 22nd).

Read on for further detail on these.

KEY RISKS: Of course, as an early stage small cap, this investment isn’t without risk. There are always risks when it comes to exploration investing, whether that be the risk of the quality of the assets, the team’s ability to capitalise on them, or simply adverse moves in commodity markets.

GTR is definitely an early stage exploration play and we are adopting our usual exploration investment strategy - to free carry and take some profit prior to the key drilling results in a few months time (this one is a bit easier as we have already been holding for over a year already)

In the case of GTR, its share price appears to be tied pretty strongly to the uranium price and sentiment. So while it's all looking good now, that could change pretty quickly.

ASX:GTR

Our Next Investors investment was made in April 2020, right as the uranium price jumped from around US$24/lb to US$34/lb in a matter of weeks... and the GTR share price followed it higher.

Since then, GTR (and the uranium price) hasn’t done a whole lot. Well that was the case at least until the last month. Since mid-August the uranium price has spiked back to nine year highs and continues to rise by the day.

And while GTR finally looks to have picked itself off the floor and made a move higher, we think that if the uranium price keeps running then GTR still has plenty of room to move higher. Of course the opposite is also true, with risk to the downside as GTR is highly leveraged to moves in the uranium price.

GTR’s share price responded sharply to the higher uranium price in April 2020, but it is still to catch up to the latest uranium price spike relative to its 2020 move (and many of its industry peers):

GTR is set to acquire ~22,000 acres (8,900Ha) across strategically located and underexplored mineral lode claims and two state leases. The properties are in Wyoming’s Great Divide Basin (959 claims of ~8,000 hectares), as well as the Uravan Belt in Colorado (~427 hectares over 51 claims).

The properties are prospective for sandstone hosted uranium that can be mined using the lowest cost mining methods.

We like the terms of the deal, with the vendors receiving a small amount of cash, and the majority of the vendors in GTR shares at 2¢. There are project milestones that will see the vendors getting more shares, which is good as they are aligned to the longer term success of these projects. The fact that the key team that owned the assets is coming to work with GTR is another good sign for us.

Readers should be aware that GTR has already more than doubled its price in the last month, (in line with most small cap uranium stocks) — GTR is trading at ~3.8¢ and has a $34M market cap. We certainly can’t predict what uranium sentiment will be like over the next few months, but right now it’s looking pretty good.

The 8 reasons why we like GTR:

1. The uranium projects are in Wyoming, the capital of uranium in the US

GTR’s new projects sit in the USA’s best uranium neighbourhood, Wyoming’s Great Divide Basin (GDB).

Wyoming has a long history when it comes to uranium. It first began commercially mining uranium in the 1950s and has since produced more than a quarter of a billion pounds of yellowcake.

While explored extensively in the 1970s and early 1980s by a number of major US mining companies, the GDB remains the most underexplored and underdeveloped of the major Wyoming uranium districts.

The type of uranium mineralisation here can be mined using the lowest cost uranium mining method, which wasn’t as common a way to recover uranium back then as it is now. Consequently, historical exploration was often focused only on shallow mineralisation.

While Wyoming is the USA’s top uranium-mining state, it is also its top coal mining state and a producer of oil and natural gas. But the switch to cheaper and cleaner-burning energy sources has caused a dramatic downturn in the coal industry over the past decade, so nuclear development is being strongly supported for both the local economy and in the switch to low emission energy production.

This comes as the Biden administration is seeking to cut carbon emissions by half of 2005 levels by 2030 — nuclear energy will play a big role in this.

Bill Gates and Warren Buffet chose Wyoming as the location to build a nuclear reactor project later this year, on the site of a retiring coal plant. The reactor would use uranium from in-situ mines that extract the heavy metal from networks of water wells on the high plains.

On completion of the acquisition, GTR will control the largest non-US, Russian or Canadian owned uranium exploration land holding in Wyoming’s Great Divide Basin with ~21,000 acres (85sq. kms). The Wyoming Properties come with historical drill maps, drill holes, adjacent deposits and known mineralised areas like Jab, Lost Creek, Antelope and Lost Soldier.

Its nearest neighbours include Rio Tinto, Uranium One, UR Energy (URE) and Anfield Energy who all have deposits and, in the case of URE and Rio, processing plants very close by. GTR already has a relationship with Anfield having acquired ground from them in Utah.

GTR selected the properties to include areas close to known mineralisation and prospective land between UR Energy (TSX: URE) and Uranium One (TSX: UUUS)’s (U1 in the map below) mineral holdings.

UR Energy’s Lost Creek ISR Production plant is believed to be the lowest cost uranium producer outside Kazakhstan. GTR’s properties will also be adjacent to Rio Tinto’s Kennecott Sweetwater Mill.

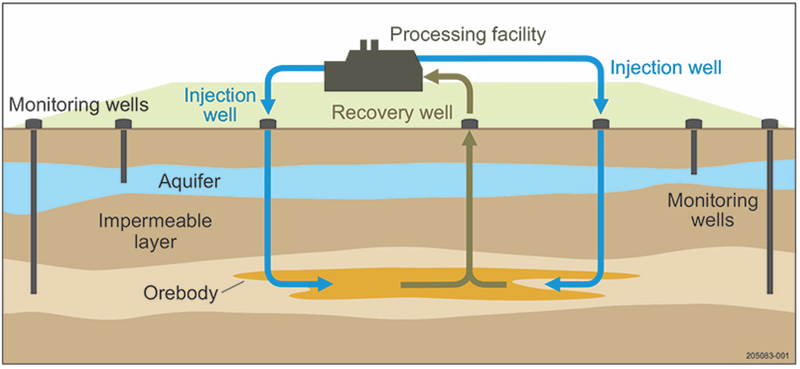

2. GTR is acquiring In Situ Recovery (ISR) uranium projects, the lowest cost uranium mining method in the world

The Wyoming Projects are highly prospective for “sandstone hosted roll front uranium mineralisation”, which is amenable to In Situ Recovery (ISR).

ISR mining — also called Insitu Leach (ISL) or Solution Mining — is the lowest cost uranium mining method and has lower environmental impact than hard rock mining.

The process accounts for ~90% of US uranium production and has been used in Wyoming since the 1960’s. The world’s lowest cost U3O8 mines in Kazakhstan also use ISR and more than half of all uranium mined worldwide is ISR methods.

But what actually is In-Situ Recovery (ISR) mining?

The process utilises an acid or alkaline “lixiviant“ solution (a liquid used to extract a desired metal from the ore or the mineral) injected and extracted using a series of wells drilled from surface to leach target ores.

The lixiviant is pumped down injection wells into the permeable mineralised zone to remobilise uranium from the ore body.

The uranium-bearing solution is pumped to the surface and recovered in a processing plant. It is then pumped to the treatment plant where the uranium is recovered.

Essentially, it is the reverse of the natural geologic processes that originally concentrated uranium in its host rock. Natural processes oxidize and leach uranium from its source rocks, then surface water and ultimately groundwater transport uranium in solution to a reducing environment in a porous host rock where the uranium is deposited.

3. Uranium price at 9 year highs

Ten years ago, the Fukushima nuclear disaster created a demand shock for uranium and a prolonged downturn as uranium mines shut or stopped production. And with the spot price dropping to $US20-$US30 per pound, there was little reason to restart production.

The disaster came amid a sustained fall in the uranium price since 2007, which saw a bubble push the price to $US137/pound.

However, a global supply squeeze beginning just weeks ago is driving up the uranium price, which is now at 9 year highs of ~US$49/lb.

Growing numbers of nuclear reactors and reactor life extensions, mine shutdowns, and pressure on spot market supply from producers, developers and financial buyers is pushing up prices.

Much of this has to do with the Sprott Physical Uranium Trust (SPUT), which is in a “buying frenzy” for physical uranium. The trust is attracting capital from investors who want to participate in the newly forming uranium bull market and in a sign of that strong demand, Sprott this week enlarged its at-the-market fund and now has funds to buy US$1.3BN in uranium over the coming months.

Traditionally a gold investor, Sprott now has the world’s largest listed physical uranium fund which began trading on the Toronto Stock Exchange in July. The sheer size of Sprott’s gold trusts points to the potential impact it could have on uranium. When traditional gold investors are betting big on a surge in uranium prices, we take notice.

4. The US is going to need a lot more uranium

There are three key drivers of uranium demand in the USA: a global supply squeeze (as above), climate change, and US national security.

Nuclear energy has been identified as having a large role to play in combating climate change.

Currently, half of all clean energy in the US comes from nuclear — it underpins the US achieving its emissions reduction targets. So preserving the existing fleet of nuclear plants, driving the development of advanced reactors, and investing in nuclear R&D are all essential to the USA's clean energy transition.

But while the US is the world’s largest uranium consumer, its domestic uranium mining and exploration have collapsed. After leading the world in uranium production from 1953 to1980, total US U3O8 production fell in 2019 to the lowest volume since 1948.

So as there is no meaningful uranium production in North America, the US relies on foreign supply and enrichment.

But US government policies do support nuclear power and uranium mining, with nuclear now identified as a key national security issue, and it has bi-partisan political support.

The US plans to rebuild its nuclear supply chain and at least preserve its existing nuclear reactor fleet and is building a strategic uranium reserve by purchasing US$150M of local U3O8 every year for 10 yrs.

This macro backdrop is all helpful for GTR and its uranium exploration ambitions in Wyoming USA.

5. GTR gains highly experienced US uranium team

Along with Wyoming assets, the acquisition saw GTR gain a highly experienced Wyoming-based execution team, adding decades of GDB uranium deposit discovery success and proven development and engineering expertise.

Guiding the exploration and development of the projects is Doug Beahm, a professional engineer and geologist with over 45 years’ experience in mineral exploration, mine development and project evaluation.

Doug is the Principal Engineer with BRS Engineering Inc. — a engineering and geology consulting corporation that specialises in uranium — and has worked in uranium exploration mining, and mine land reclamation in the western US since 1975. He has a proven track record in a variety of mining and mine reclamation projects, including surface and underground mining, heap leach recovery, ISR, and uranium mill tailings projects.

Throughout his career, Doug has worked for most of the GDB’s major companies and brings relevant experience to the style of mineralisation and type of deposit under consideration.

James Baughman is another Wyoming geologist with more than 30 years’ experience that will help guide GTR’s activities. Jim is former President and CEO of High Plains Uranium, which was sold to Uranium One for US$55M in 2006 and of Cyclone Uranium.

Now they are both helping GTR move its Wyoming uranium exploration forward.

6. GTR will be drilling by Christmas with funding in place

With the current capital raise, GTR will be well funded for drilling at its Wyoming Properties. It is seeking to raise up to ~$4M ($600k of this going to the project vendors) adding to the $2.37M it held at June 30.

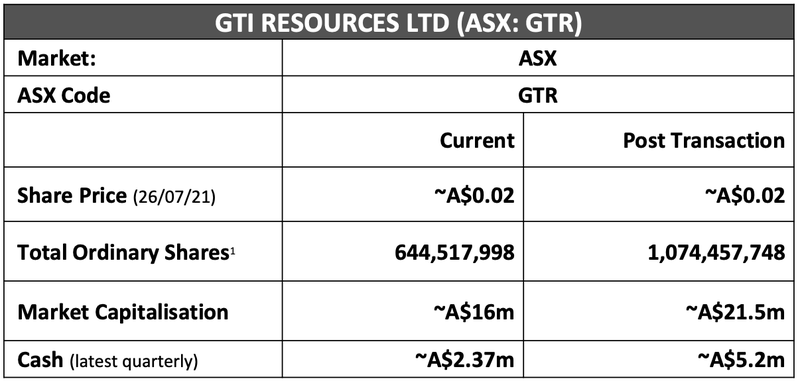

GTR expects to hold ~$5.2M post completion of the transaction:

GTR is aiming for resource definition with its first drill program due by end 2021. Permits are expected soon.

7. Sector consolidation moves underway already: is a takeover GTR’s destiny?

There’s a fair bit of corporate activity underway in the uranium sector right now.

This includes the deal between Encore Energy and Azarga Uranium.

Encore is a US domestic uranium developer focused on becoming a leading ISR uranium producer capped at C$343M, and has announced an all-stock merger with C$139.2M capped Azarga Uranium. By adding Azarga’s assets it will create a top-tier US uranium ISR mining company with multiple assets at various stages of development.

International-Consolidated-Uranium (CUR) is also acquiring the portfolio of uranium production assets of Energy Fuels in Utah and Colorado to create a strategic partnership.

GTR is capped at around A$34M right now, and given the location of its ISR projects, once it starts drilling and hopefully delivering some strong results, it may catch the attention of larger uranium companies in the region.

8. GTR’s imminent rights issue looks very attractive

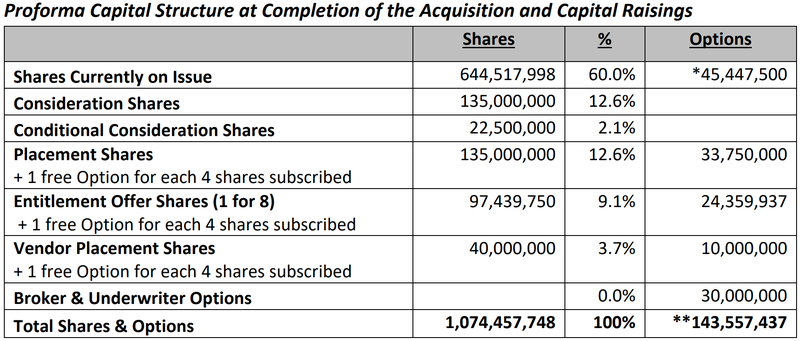

GTR is now completing a placement to raise $2.6M at 1.5¢ per share with 1 free attaching option for every 4 shares subscribed (exercisable at 3¢, expiring 3 years). Of this, the uranium project vendors, Branka, are subscribing for 40M shares for $600k, this is in addition to the 2¢ shares they will receive via the transaction.

As mentioned, GTR is also set to launch a rights issue to shareholders holding GTR shares on 22 September to raise up to an additional $1.461M.

Given the stock is currently trading at ~3.4¢ it makes the 1 for 8 rights entitlement offer at 1.5¢ look very attractive. The rights issue includes a 1-for-4 free attaching listed option with a 3¢ strike price and a three year term.

The prospectus is due to be lodged tomorrow, with a record date of 22 September, meaning that in order to participate investors must be holding shares on that day. The offer documents are due to be sent to eligible holders on 27 September.

Here is GTR’s Capital structure post acquisition and raisings:

GTR’s existing exploration assets

GTR has previously focused on uranium and vanadium exploration in Utah’s Henry Mountains and some interim gold exploration at the Niagara gold project in WA.

GTR continues to progress its Utah projects in anticipation of a continued recovery in uranium and vanadium prices. It is also evaluating all options to develop the Niagara gold project, including the possibility of a joint venture arrangement or the sale of the projects to deliver value to shareholders and allow the Company to focus its efforts on US uranium.

Company Milestones

✅ Next Investors Portfolio Launch

🌎 Support for Domestic Uranium Produces in the US

✅ $1.8M Cap Raise @ 3¢

🔄 $4M Cap Raise @1.5¢ ($2.6M Placement + up to $1.1461M Rights Issue)

🔲 Unexpected Announcement 1

🔲 Unexpected Announcement 2

🔲 Funding 1

🔲 Funding 2

Wyoming Projects: Uranium, U.S.A

✅ Project Acquisition Announced

🔲 Project Acquisition Complete

🔲 Drilling Permits Secured (Q4 2021)

🔲 Initial Drilling (Thor, Q4 2021)

🔲 Drilling Results (Thor, H1 2022)

🔲 Initial Drilling (Odin & Loki, H1 2022)

Utah Projects: Uranium / Vanadium, U.S.A

Drilling Program 1

✅ Down-hole geophysical logging (Jeffrey Project)

✅ Drill Targets Identified (Jeffrey Project)

✅ Drilling Complete (Jeffrey Project)

🟨 Assay Results (Jeffrey Project)

✅ Sampling Program (Rats Nest Project)

🟧 Assay Results (Rats Nest Project)

Drilling Program 2

✅ New Land Acquired (Section 36)

✅ Permits Secured (Section 36)

✅ Downhole Geophysical Logging & Field Mapping (Section 36)

✅ Drill Targets Identified (Section 36)

✅ Drilling Complete (Section 36)

🟧 Assay Results

Drilling Program 3

🔲 New Milestones Added

GTR Investment Milestones

✅ Initial Investment: @ 1.2¢

✅ Increase Investment: @ 3.3¢

✅ Increase Investment: @ 1.5¢

🔲 Price increases 500% from initial entry

🔲 Price increases 1000% from initial entry

🔲 Price increases 2000% from initial entry

✅ 12 Month Capital Gain Discount

🔲 Free Carry

🔲 Take Some Profit

🔲 Hold remaining Position for next 2+ years

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.