South Africa Back on the Gold Map? ASX Goldie Hits Shallow Gold Reef at the Right Time

Published 17-JAN-2018 19:00 P.M.

|

15 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

With gold now back above $1300/oz., its allure is tempting more and more gold juniors back into the resources market.

The likes of Northern Star (ASX:NST), Metals X (ASX:MLX) and St. Barbara (ASX:SBM) have all experienced respective revaluations of 50%, 70% and 65% over the past 12 months.

With that in mind, several juniors are looking to follow suit as they ramp up their gold operations.

However, it should be noted here that today's junior is in its early stages and investors should seek professional financial advice if considering this stock for their portfolio.

Australia is the world’s largest net producer of gold, courtesy of large majors such as Newcrest and Evolution Mining, so it’s a good place to set up shop

But go back around 20 years and things were ever-so different.

The gold crown belonged to South Africa as the world’s omnipotent gold producer and those days seem to be coming back given the country’s immense mineral wealth.

Gold stopped pouring out of South Africa for socio-economic reasons, not geological ones.

However, South Africa’s political landscape has been terraformed beyond all recognition in recent years, so much so that South Africa is now re-discovering its heyday and ascending the Mining league tables once again.

With the stage set, the act of commercialising 5 million ounces JORC Resources and 100,000 ounces per year of gold begins

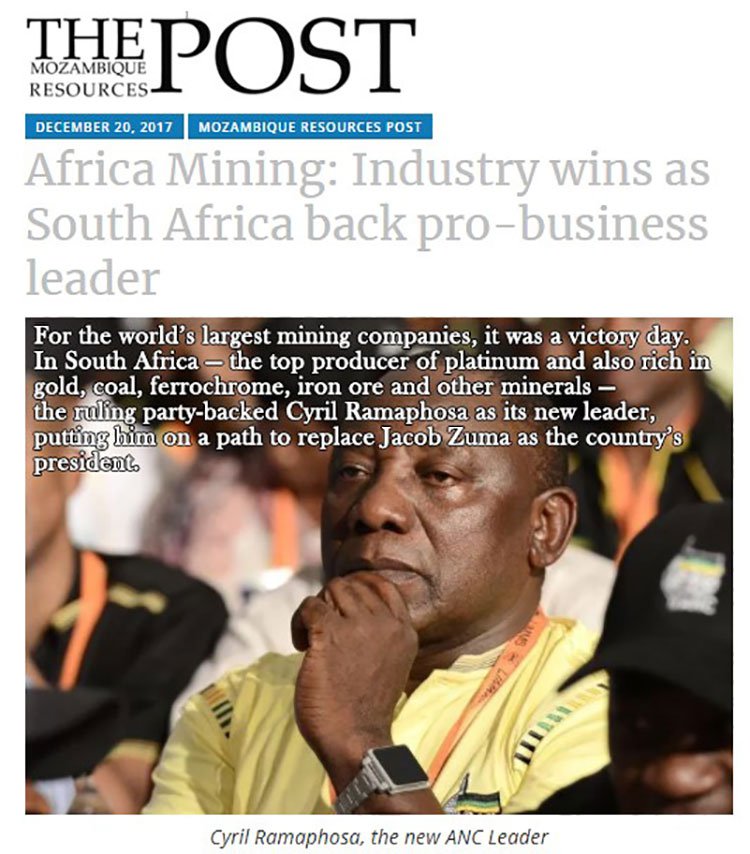

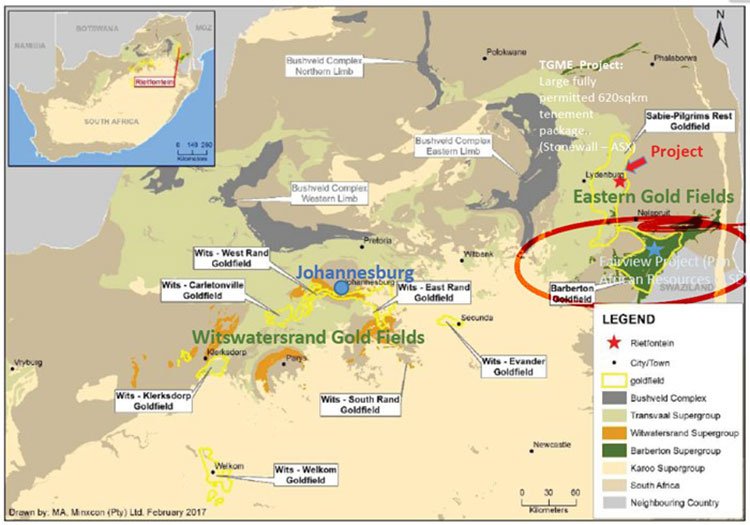

One ASX listed company has identified an advantageous location deep in South Africa’s Eastern Gold Fields, nestled close to all-important project features, but more importantly, at the epicentre of a modern South African renaissance led by corporate heavyweight Cyril Ramaphosa, the man who has just been elected as leader of the African National Congress – South Africa’s ruling political party.

Mr Ramaphosa was Chairman at one of this company’s peers — Pan African Resources (LSE: PAF), but more on them later — and is committed to helping Africa’s richest country regain its commodity-sponsored power-base in the region.

This emerging ASX gold stock is in with a strong chance of walking the narrow path to gold revenues, having just published high-grade results including the scope for an open-cut mine in South Africa.

If this company manages to conduct the necessary fieldwork and obtains the assay results it’s looking for, it will be well on its way to capitalising on its 28.7 million tonnes at 3.7 grams per tonne of gold for 3.42 million ounces that’s already been proved up from historic drilling.

Given South Africa’s former status of being the most prolific gold-producing country on Earth, we think this company could well be onto something at its Theta and Colombia prospects, located in the heart of former gold-producing territory that’s been overlooked by the larger majors.

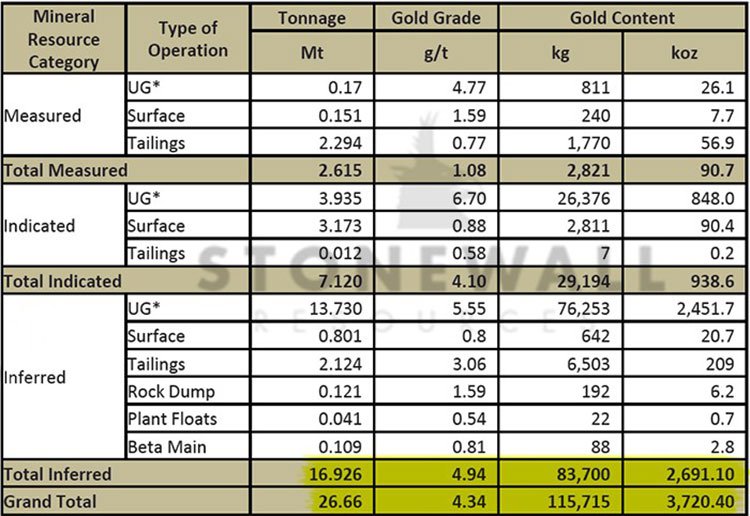

As it stands, our chosen gold explorer has total group resources of 26.6 million tonnes at 4.34 grams per tonne gold for 3.7 million ounces help predominantly underground and include the recently announced Rietfontein resource of 2.55 million tonnes at 11 grams per tonne for 905,000 ounces.

This company has access to more than 43 historical mines and 62,000 hectares of tenements.

With drilling already being conducted and this company standing on the doorstep of a PFS — we think it has the potential to increase its Resource base and enter commercially-viable production in the near future.

So, while the likes of Evolution and Newcrest gallivant into high capex projects in places like Australia and Canada, looking for that motherlode gold hit; this company is setting its targets on a smaller but much-more amenable set of projects in South Africa.

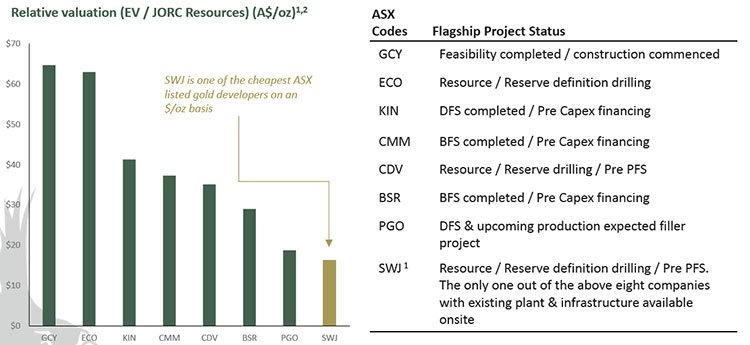

With a current Enterprise Value of A$44 million, this company represents the typical commodities-junior that may grow its valuation via diligent exploration and supportive demand-side factors that are supporting spot gold prices rather well.

Introducing:

Stonewall Resources (ASX: SWJ) is chasing the grade at shallow depth in South Africa. More precisely, SWJ is actively reawakening a giant goldfield in the country’s Eastern Goldfields, where its gold mining industry began almost 130 years ago.

Having recently raised $2.5 million, SWJ is aggressively exploring right now.

Over the next few weeks and months, we are expecting to see SWJ continue its exploration of its assortment of gold projects in what used to be the epicentre of global gold production.

As it stands, SWJ is already off to a decent start with a 26.6 million tonnes at 4.34 grams per tonne gold for 3.7 million ounces of gold JORC Resource . That’s a solid platform from which to springboard into more substantial gold reserves and ultimately, higher sales revenues.

Furthermore, SWJ has a processing plant in its possession as part of its activities and has a Pre-Feasibility Study in progress at the time of writing.

Let’s wade into SWJ’s company metrics in more detail, to see if early investors can’t follow this gold bug to a higher portfolio valuation later this year.

SWJ is aiming for a 100,000 ounces per year mining operation once fully developed and brought online

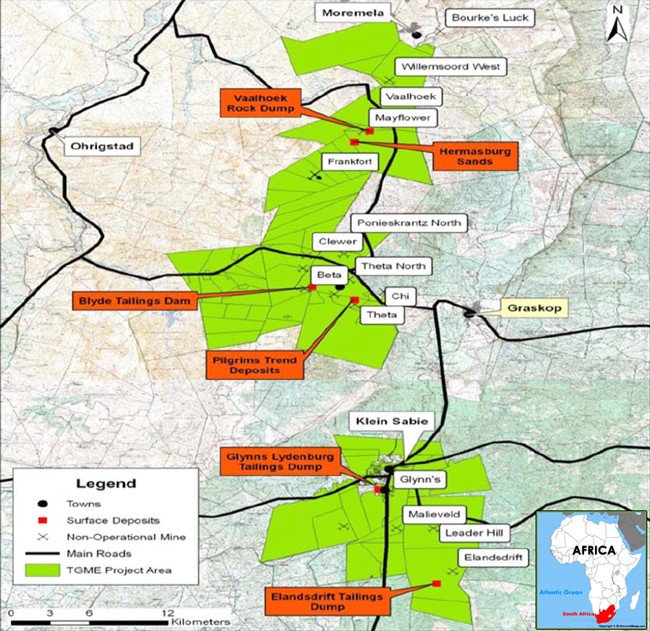

Here is an outline summary of SWJ’s asset portfolio in South Africa:

SWJ has rights to around 620 square kilometres of land tenure, and best of all, exclusive access to a high-grade gold belt that accounts for a large portion of the Pilgrim’s Rest/Sabie gold mineralisation.

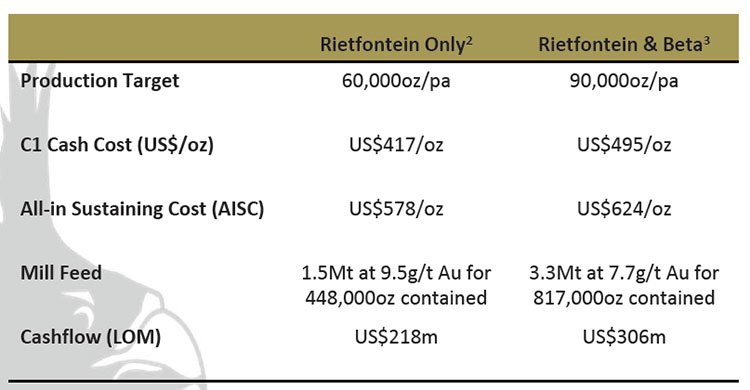

In total, SWJ has half a dozen high-grade prospects that it wants to fold into its ongoing PFS, with two project areas currently showing best commercial potential — Rietfontein and Beta.

Both Rietfontein and Beta are shallow underground mines that will likely provide SWJ with a long-term mining capability.

Currently, Rietfontein’s underground Mineral Resource stands at 2.55 million tonnes at 11 grams per tonne gold for 0.9 million ounces.

Combined, the two prospects are estimated to contain an underground mining inventory of 3.3 million tonnes at 7.7 grams per tonne gold.

If all goes well, SWJ will be able to initially chisel out a 9-year mine life averaging around 90,000 ounces per year with a fully-optimised production rate of 440,000 tonnes per annum.

This kind of output, at such an early juncture in SWJ’s development means that SWJ will need to consider processing facilities sooner rather than later.

On this front, SWJ can expect to offload all its output to a processing facility that’s 40 kilometres away from Rietfontein and two kilometres away from Beta.

Here’s the complete snapshot of SWJ’s JORC Resource:

As it stands, Rietfontein is fully permitted and ready for its finishing touches in order to commence a fully-fledged drilling program to establish Reserves. To further alleviate its capital expenditure burden, SWJ intends to develop Beta with funding obtained from gold sales and cashflow from Rietfontein. In many respects, SWJ is taking a pay-as-you-go approach and thereby mitigating capex risks as much as possible.

That’s the kind of thing we like to see from our stocks here at The Next Mining Boom . And if that wasn’t enough, here’s another indicator which gives us confidence in SWJ:

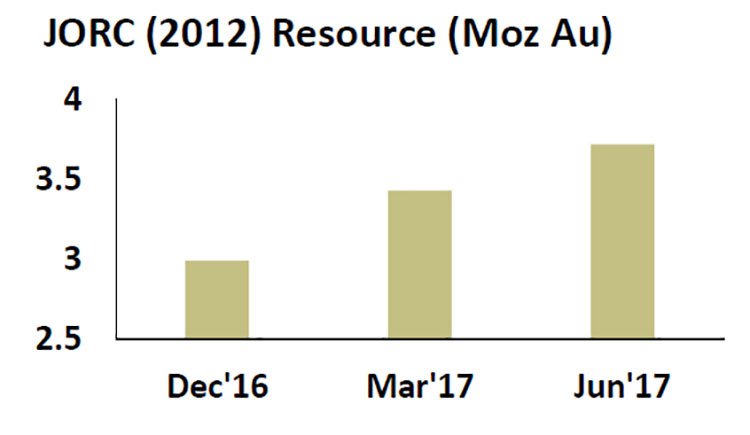

This little gold bug has consistently raised its JORC Resource since 2016, which is further indicative that it will manage to hit its ultimate aim of becoming a significant 5 million tonnes per year gold producer in South Africa.

However, this is speculative at this stage and would be investors should review all publicly available information and take a cautious approach to any investment decision made with regard to this stock.

South Africa — the sleeping giant of global mining

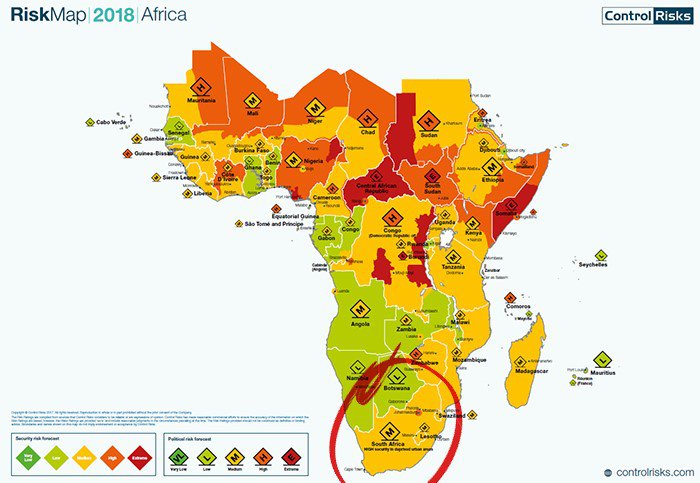

South Africa is rich in minerals and regularly found in the Top 5 producing nations for chrome, manganese, platinum, palladium and zircon.

It is also the world's third largest exporter of both coal and iron ore.

In gold, South Africa accounted for 15% of the world's gold production in 2002 and 12% in 2005, though the nation had produced as much as 30% of world output as recently as 1993.

Going from 30% to 12% of global gold output in the space of 20 years has served as a huge drain on the country’s resources, preventing much-needed commodity revenues from beefing up South Africa’s state coffers.

But all that is gradually changing courtesy of a former gold miner who may be on course to become South Africa’s incumbent Prime Minister later this year.

In some respects, South Africa is the Australia of Africa — with its commodity-heydays gradually returning.

To ensure South Africa basks in its commodity-powered glory days once more, the leader of the current governing party (ANC), Cyril Ramaphosa, is rapidly gaining popularity on a non-corruption manifesto based on reliable business practises, ownership rights and attracting Western capital.

Mr Ramaphosa is staunchly pro-business and pro-mining — two key factors that are likely to secure an undisturbed and productive operating environment for SWJ over the coming years.

Strong favourite to become the next South African President, Mr Ramaphosa’s imminent succession has already pushed the Rand up by over 20% on world markets — big business sure likes him.

Meanwhile, this macroeconomic geopolitical tectonic shift is already being felt, with SA gradually recovering its global share of gold output.

Assuming this trend continues, SWJ stands to benefit given its primetime location, strong assortment of projects, confirmed access to high-grade mineralisation and most importantly, its market-entry timing.

The ruling ANC party held its 2017 ANC Elective Conference, from December 16 through to December 20, in Jozi. It was a seminal moment for the ANC party and the nation as a whole, as Jacob Zuma’s successor was crowned. The victor (Cyril Ramaphosa) is effectively SA’s next president and will officially take-up his role later this year.

A solid emulation-target adjacent to SWJ is Pan African Resources, an LSE-listed company worth USD$500 million (and growing)

Anytime we consider a potential Next Mining Boom portfolio addition, we always like to scour the local habitat close to our chosen explorer/miner.

Why, I hear you ask...

...well, because ‘nearology’ is a marketable and valuable feature for any small-cap explorer looking to take the next step towards mid-cap status.

Take a look at how close SWJ is to Pan African Resources (LON: PAF):

Less than 100 kilometres away and exploring the same geology as PAF, SWJ’s location is ideal.

In terms of what SWJ can hope to achieve valuation-wise, here is how PAF has performed in recent times (it’s this kind of performance SWJ is working hand over fist to emulate):

The past performance of this product is not and should not be taken as an indication of future performance. Caution should be exercised in assessing past performance. This product, like all other financial products, is subject to market forces and unpredictable events that may adversely affect future performance.

As you can see, PAF shares have had a spring in their step since 2016 — a time when the fortunes of all gold miners improved on the back of a rebound in the gold industry.

SWJ is in many ways at the beginning of its journey, and are aspiring to reach PAF levels – which if did happen, would result in a rather decent multi-bagger for current investors.

Of course, that is no guarantee to eventuate, always proceed with caution when it comes to speculative stocks like this one.

The potential knockout factor for SWJ, is that South Africa’s president elect used to serve as Chairman at PAF and has already indicated that gold mining will makeup a significant portion of his new political regime.

South Africa’s banking sector was also a big winner from Ramaphosa’s election.

If SWJ can do the required exploration and get into production, its operating conditions have a chance of seeing improvement automatically on the back of pro-mining policies and pro-gold government initiatives.

In other words, as the new kid on the block, SWJ is likely to see the usually steep gradient of gold exploration, made just that little bit shallower.

Meanwhile, gold prices have remained stable for several years now and indicate a strong level of market viability.

So as gold prices continue playing into the hands of gold juniors like SWJ, the most important aspect for any miner is moving as many resources from the Indicated to the Measured category in order to bulk up the overall tonnage they are able to recover.

SWJ has a diversified portfolio in that it already has some of its Resource defined, but there is potential for a whole lot more.

SWJ has a strong chance of seeing its close-to-surface open-cut exploration add to its JORC Resource in South Africa, courtesy of Project Bentley.

Just before Christmas 2017 the company announced its successful Theta Hill drilling campaign which confirmed the shallow multiple levels of high grade gold reefs with results such as interception of 2 metres at 16.5 grams in RC hole RCBH14, 5 metres at 6 grams including 2 metres at 8.9 grams in hoe RCBH6.

Only days after the 2018 New Year celebration, SWJ received assays from the first two drill holes revealing high grade gold-bearing reef at the Columbia Hill area, hole CHRC9 intercepts of 1 metre at 9.61 grams per tonne from 11 metres, and 2 metres at 4.95 grams per tonne from 22 metres (Rho reef) and CHRC9B intercepts of 8 metres at 4.34 grams from 23 metres including 2 metres at 5.54 grams and 1 metre at 20.4 grams.

Following this news, SWJ informed the market on January 16 of a new high grade discovery , confirming shallow gold reef from the first drilling. Assays include 8 metres at 4.34 grams per tonne gold , including 1 metre at 20.4 grams per tonne gold from 27 metres (CHRC9b ), 1 metre at 9.61 grams per tonne from 11 metres and 2 metres at 4.95 grams per tonne from 22 metres (CHRC9) .

As the gold bearing reefs are usually under one metres in thickness, the above RC drilling doesn’t reflect the exact high reef grades, to be accurately measured by diamond drill during second round of drilling.

SWJ is employing an open-cut strategy at Project Bentley and recent drilling results from Theta Hill and Colombia Hill are trickling in.

One key next step for SWJ is to conduct processing plant engineering works in Q1/Q2 2018, thereby readying SWJ’s entire supply chain and bring that all-important first gold pour ever closer.

If we take a look at how SWJ stacks to its peers, it’s clear there is much catching up to do from a valuation standpoint:

SWJ is one of the cheapest ASX listed gold developers on a $/oz. basis.

Despite SWJ being at an early juncture of its development and cost assessments are still in the early stages, it is becoming clear that operating conditions in South Africa are low-cost compared to other regions.

SWJ has a Pre‐Feasibility Study underway, with drilling to commence shortly. The peak capex funding requirement for SWJ is around just US$29 million although development of the Beta prospect is expected to occur from existing cashflow from other prospects such as Rietfontein.

SWJ is working towards ample high-grade gold production alongside a socio-political renaissance in South Africa

Economic viability is assured in South Africa, but to what extent is unclear.

SWJ knows already that it is sitting on a potentially company-making Resource capable of spitting out more than 100,000 ounces in annual production, at lower cost compared to other global regions.

The initial focus is the Rietfontein mine, which contains a JORC Resource of 2.55 million tonnes at 11 grams per tonne for 905,000 ounces of gold. The Scoping Study indicates a potentially low cost, 60,000 ounces per year underground development with a C1 cash cost of US$417 per ounce.

As well as Rietfontein and its entire 3.72 million ounce resource, SWJ’s South African tenure has a total of 43 historical mines across a vast prospective area of 62,000 hectares that contain about 35 million tonnes of pre-explored, pre-developed, pre-drilled, pre-blasted gold-bearing ore left over from almost a century of mining... which leaves you pondering about just how much bigger this company could one day become.

For now, to facilitate production, SWJ intends to refurbish the existing TGME processing plant at Pilgrims Rest. The TGME plant has not produced commercial quantities of gold since 2015 and remains connected to the national electricity grid.

Many factors have now come into line, one of which is a geo-political morsel that could affect the global gold industry for decades.

After political infighting for several years, a virtuous circle is now being setup in South Africa.

A former Pan African Resources Chief Executive is leveraging his deep gold industry expertise to claim political power and resurrect South Africa’s once-glorious mining heritage.

For SWJ to snuggle itself so tightly into this web of political intrigue is incredibly opportunistic and that’s something one might consider worthy of investment, especially when you discover this gold bug has a current enterprise value below $50 million.

Clearly, SWJ is an overlooked company, developing undervalued projects, in a forgotten gold mining epicentre that’s going through a modern renaissance.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.