NSL Now Producing: Imminent Sale of Stockpiles

Published 10-SEP-2014 09:53 A.M.

|

12 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

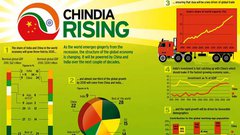

The NSL cash generating machine has turned on . Their dry beneficiation plant has re-started, and NSL are expecting free cash flow of $200k/month, ramping up to $530k/month shortly after. All this in an $8M market cap company. NSL are currently producing a 52% Fe finished product from a 28% Fe feed grade. By selling this iron ore into the local Indian market, they can generate immediate cash flow. NSL’s operating base in India is home to a surging domestic iron ore market, completely oblivious to the world seaborne market. This is just the start for NSL – soon they will start feeding 30-35% Fe feed grade, which will deliver a 55% Fe finished product, and higher cash flow... Plus, NSL also appears to have friends in high places – they have just won full support from India’s government for its AP14 Magnetite project. India’s leaders want more resource projects to get into production and NSL’s AP14 has been designated a critical asset for the country. Whatever bureaucratic problem or challenge NSL has to overcome it can phone a government friend who can help get it sorted. Everything seems to be coming together for NSL right now – iron-ore sales are imminent, production is ramping up, the Indian government is in its corner and it even had a legal win netting $250,000 – the momentum is building for NSL...

It was only a month ago when we first brought NSL to your attention and into our portfolio of long term investments with the article “Tiny Miner’s First Sales Days Away: Stockpiles Waiting to Be Processed, Delivering Instant Cash Flow.” NSL has climbed as high as 80% since its release:

The past performance of this product is not and should not be taken as an indication of future performance. Caution should be exercised in assessing past performance. This product, like all other financial products, is subject to market forces and unpredictable events that may adversely affect future performance. NSL does remain a speculative and high risk investment for now, and we have invested in NSL for the long term to follow the expansion of its Indian operations. NSL has been working hard for years in India, and now, first sales are weeks away. NSL’s production facility has just been restarted and all of the gear it needs to get those stockpiles fed into the machinery is now in place. You can get all the facts and figures from our original article but here’s a quick project summary: NSL has a mining lease called AP23 in the Kurnool district of Andhrah Pradesh in India, where low-grade iron ore is found in abundance. At a nearby stockyard owned by NSL a beneficiation plant has been set up that turns low-grade iron ore to 55% Fe material at low cost. Indian miners concentrate on high grade iron ore – they ignore the low grade stuff – so NSL is developing a niche within the Indian iron ore industry which sets its own prices independent of the global seaborne price. NSL is the only foreign owned iron ore company that owns and operates iron ore assets in India. And as you’re about to see, that niche is getting bigger and better every day as NSL ramps up its iron ore project in India...

Our Track Record

Regular readers of our sites will be familiar with our long-standing interest in high potential stocks. To note just a few:

- Since the Next Small Cap article on Segue Resources (ASX:SEG), Sirius went from 5c to $5... New Upstart Explorer Has More Land, More Drilling Targets , SEG has been up as high as 200%.

- After we released the Next Mining Boom article on NSL Consolidated (ASX:NSL), Tiny Miner’s First Sales Days Away: Stockpiles Waiting to Be Processed, Delivering Instant Cash Flow , NSL has risen as high as 80%.

- Following the Next Mining Boom article on Apollo Minerals (ASX:AON), Drilling Results in Days: Billionaire Backer Hunting Mammoth IOCG Deposits with Tiny Explorer , AON has risen as high as 90% since.

- Following the Next Oil Rush article on Austin Exploration (ASX:AKK), $20M to $5.6BN: Can He Do It Again? Multiple Catalysts In Weeks , AKK has risen as high as 130% since.

The past performance of these products are not and should not be taken as an indication of future performance. Caution should be exercised in assessing past performance. These products, like all other financial products, are subject to market forces and unpredictable events that may adversely affect future performance.

NSL production now in full swing

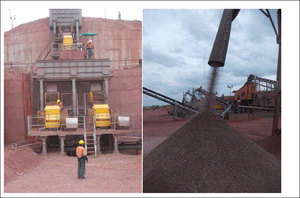

A picture is worth a thousand words so check these out from NSL’s operations:

NSL’s dry beneficiation plant is now producing 52% Fe grade material, and this will be sold to market in the coming weeks. While NSL awaits government issued royalty passes from the AP23 mining lease material (they have 200,000 tonnes of stockpile here), NSL is getting on with production and taking feed material from third party miners. Overall, this third party stream of material could increase NSL’s production rate and profitability further, on top of previously released sale forecasts.

The above image is the fleet of earthmoving equipment NSL has mobilised at its stockyard in the Kurnool district of Andhrah Pradesh where you’ll also find its Phase One Beneficiation Plant . As indicated earlier, the dry beneficiation plant has now been successfully restarted and the company is on track to complete its first sales in weeks – we expect a flow of more updates from NSL very soon. Beneficiation is a common process in iron-ore producing nations like Australia and Brazil but almost unheard of in India. It’s a game changer for the country and NSL is bringing it to town! Basically, beneficiation uses techniques like crushing, milling and magnetics to improve the concentration of ore and remove impurities. In the end you get a high-grade iron-ore product.

Now that the earthmoving equipment, workers, spare parts and everything else you need to run the plant is in place, the beneficiation plant can start making high grade iron ore product – and cash flow! NSL reckons it can move 25,000 tonnes of low grade iron ore material from AP23 to the stockyard every month, refine it to a 55% Fe product suitable for domestic sale in India for A$28 a tonne and sell it for more than A$56 a tonne ex mine gate:

NSL calculates it can earn approximately $200,000 a month free cash flow from the Phase One Beneficiation plant right now and then when it ramps up production and mining it reckons it can raise the bar to $530,000 a month. That’s not bad at all for an $8M small cap company. Quick cash flow is on the horizon for NSL and that money will help fuel the expansion of its mining and processing operations. The current production plant is all well and good, but to improve margins on the AP23 stockpiles, NSL plan on building a standalone dry separation plant on the AP23 site. This is expected to be complete in the next 6 months. This will be a low cost, mobile plant, of similar capacity to the current one in use. NSL’s next move is dubbed “Phase Two”, establishing a wet beneficiation plant that can extract even higher grade iron ore from the low-grade material at the AP23 and AP14 mining leases. This will increase the sale price and get NSL even more cash flow. But for now it’s all about Phase One – production has kicked off, sales are a few weeks away, and once the government ticks off NSL’s royalty passes it can turn its 200,000 tonnes of stockpile into immediate cash flow.

Just a month ago when we first wrote about NSL’s low-grade iron-ore projects in India it was on the cusp of making all of this happen. So far everything has gone to plan and the pipeline of catalysts is flowing nicely. Plus it’s all happening at a great time for the domestic iron ore sector in India...

Iron ore pricing immunity

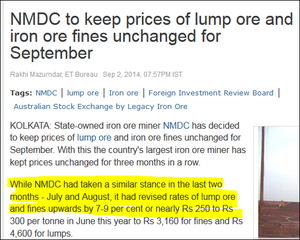

Iron ore in India is bought and sold in a totally different way to the rest of the world. The global seaborne trading price for iron ore may be in a slump but the domestic price for iron ore in India is actually surging – with 50% Fe hitting A$56 a tonne ex mine gate right now . Prices are set by the state-owned mining company NMDC and it has just decided to keep the prices for lump ore and iron ore unchanged for September – right as NSL starts producing its 55% Fe product from the low grade stockpiles at AP23.

That makes it three months in a row that the prices for domestic Indian iron ore have gone unchanged – try getting that from the seaborne trade... Plus, the price went up between 7 and 9% in June, and then NMDC increased its sales by 23% in August due to strong demand. This is all part of a major new effort by the Indian government to increase its iron ore production and NSL is perfectly placed to reap the benefits. Remember, NSL is targeting the niche of low-grade iron ore that Indian miners utterly ignore in favour of the high grade stuff. NSL is using advanced beneficiation technology to turn this ignored product into high-grade material that can be sold for profit. NSL is in a very rare position in the iron ore market – in the middle of a domestic up cycle when the rest of the world is still at the bottom of the curve. And a generous iron ore price isn’t the only benefit NSL is getting from the Indian state...

Friends in very high places for NSL

Another mining play NSL is developing in India is the AP14 Magnetite Project in Karimnagar Province where an exploration target of between 134M to 377M tonnes of magnetite is being targeted. The grades up for grabs range between 20% to 50% Fe and NSL also has a Direct Shipping Ore (DSO) target of between 5 and 10M tonnes. It’s a prospect that provides strong upside for NSL and the Government of India has just declared NSL’s AP14 project to be ‘critical to the national interest’ and placed it on a fast-track programme.

The AP14 project has been accepted into something called the Project Monitoring Group (PMG) that has been set up by the Prime Minister’s office to help push major infrastructure and resource projects through any bottlenecks to ensure they get finished. The PMG only looks at projects deemed critical to the national interest and that are worth more than 1,000 Indian Cores (A$180M) so the Indian Government is placing a lot of value in NSL’s AP14 project.

Getting this level of government support is a huge win for NSL, especially when they are the only foreign owned iron ore business owning and operating iron ore assets in India . The government of India is getting very serious about ramping up its domestic mining sector and projects like AP14 are going to benefit hugely from this push. Any bottleneck – from bureaucratic paperwork to supply difficulties to a missing paperclip – can be brought to the state’s attention and get sorted out. NSL has spent years sinking blood, sweat and toil into developing its iron ore and magnetite projects in India. It’s dealt with maddening bureaucracy, lease agreements, local agreements, anything you can name that can go wrong, it has had to overcome to get to this point. Now it’s all coming together for NSL, and we have made a long term investment. Now it has the government’s attention and support we are hoping progress can really speed up for NSL at AP14. The plan is to firm up the magnetite resource at AP14 through more testing and exploration, then set up a 10Mtpa mine with a 10Mtpa crushing, screening and beneficiation plant with 4Mtpa high grade concentrate production. Getting from the drawing board to the production line is going to be a heck of a lot easier now NSL has the government of India in its corner. It’s a big win for the company and comes as the team is welcoming a victory of a different kind...

NSL scores a legal victory – and $250K for its trouble

More NSL news that’s come to our attention is its recent arbitration win against a logistics supplier:

We don’t want to bog you down in the legal mumbo jumbo so here’s a quick snapshot... NSL paid advances totalling $250,000 to Mega Logistics and Solutions for work that wasn’t delivered. NSL has been trying to get its money back since 2011 and regularly updating its shareholders on the legal process. Now an arbitration process between the parties had ruled in NSL’s favour. The arbitrator says the claimant – NSL’s wholly owned subsidiary NSL Mining Resources India Private Limited – must be paid A$250,000 by Mega, relating to the unrecovered advances, and that the claimant is also entitled to 9% interest. It’s a clear win for NSL – the arbitrator even said Mega has ‘failed miserably’ to establish its case and counter claims. So an extra $250,000 in the bank for NSL, plus interest, – that’ll come in handy as it continues to ramp up its iron ore production in India. Every little bit helps!

Sales, production and exploration coming up

It’s been a busy month for NSL and the rest of year is going to be even busier for the team. It’s just successfully restarted the Phase One Dry Beneficiation Plant at its stockyard in Karnool and put a fleet of earthmoving equipment supported by a full workforce in place. 200,000 tonnes of low-grade iron ore material is going to be moved from NSL’s nearby AP23 mining lease at the rate of 25,000 tonnes a month and processed at the plant into 55% Fe product worth A$56 a tonne. The first sales are expected in weeks – cash flow is imminent for NSL. While the dry beneficiation plant crunches away at the stockpiles, we expect to see NSL making moves to set up the wet beneficiation plant so it can further refine the material it has, extracting higher grade iron-ore (and value) from the material. In addition, exploration and mining at AP23 should be getting underway to keep those beneficiation beasts well fed! Over at AP14 the Indian government is throwing its weight behind the project and we can’t wait to see the benefits those friends in high places bring. Exploration and planning for a 10Mtpa mining operation is in the works and having big government support will surely fast-track NSL’s journey from the drawing board to the bottom line. When The Next Mining Boom first invested in NSL as a long-term hold we were impressed by the company’s plans and the ready to go assets it had developed in India. At the same time, our investment in NSL is speculative and remains high risk. Right now, we’re seriously impressed by the speed at which NSL is turning things on and the benefits it’s getting from India – government support and a surging domestic iron ore price. There are catalysts galore on the horizon – imminent sales, production ramp ups and project fast tracking. NSL is accelerating its India iron ore plays and we can’t wait to see what’s next.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.