News in From Our Favourite ASX Stock to Surf the Silver Squeeze

It’s now been a few weeks since the “silver squeeze”.

A crazy time when waves of people coordinated using chat rooms and social media to buy up physical silver - hoping to drive up the silver price and squeeze short sellers of the precious metal.

The dust has settled after the initial frenzy, and the silver price is still trending up...

We actually YOLO’d into some physical silver ourselves so we could say we were part of the silver squeeze - a couple of grand got us some little bricks to add to our portfolio, safely tucked away for the long term.

How do we add this into our portfolio?

We aren’t traditionally “physical metals” investors but got swept up in all the silver squeeze excitement. And we think millions of other people around the world did too...

The impact of all these people (including us) suddenly buying and holding physical silver is starting to ripple through the precious metals markets, with the silver price continuing to rise day after day.

Add to this Bitcoin’s breather overnight which might make people realise that good old physical precious metals have been a tried and true store of value for thousands of years.

This bodes well for physical silver - and we aren’t just trying to talk up our own silver bricks here.

Unlike gold, silver is actually used to make stuff - like solar panels (that are used to make green hydrogen which is about to take off), electronics, and is even contained in batteries.

Now while we don’t know much about holding physical silver, we DO know about investing in silver development companies on the ASX.

That brings us to the only silver stock we have chosen to invest in:

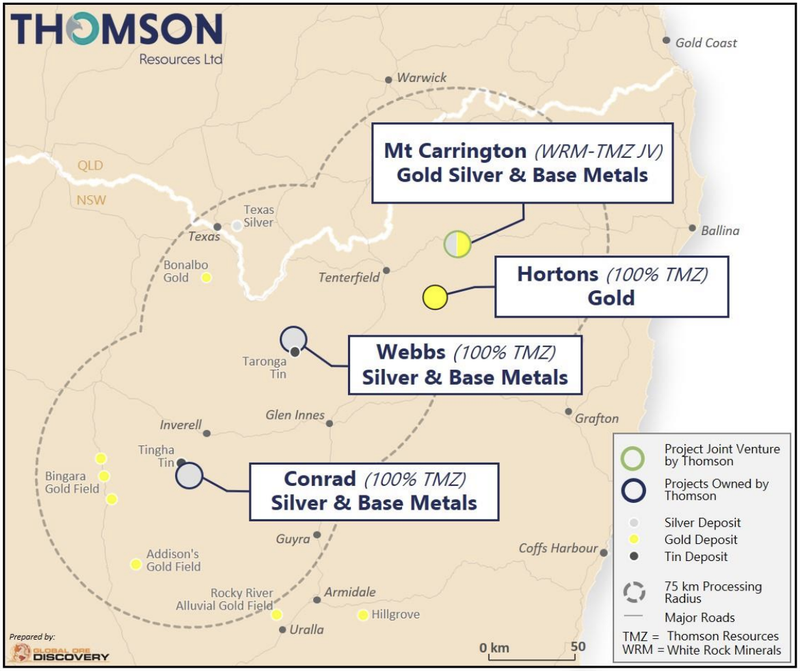

In recent months TMZ confirmed its acquisition of a combined 34 million ounces of silver at the Webbs and Conrad projects...

And yesterday TMZ signed a Term Sheet that will see it take a 70% stake in a 23 million ounce silver project - Mt Carrington.

There is also a fair amount of gold credits in these projects as well.

We invested in Thomson Resources (ASX:TMZ) in December last year, as we believe it offers the best exposure to silver on the ASX.

Aside from the silver squeeze mania of January, the share price has gradually crept up since then, which is good to see, rather than rapid share price spikes.

TMZ is steadily building a large silver resource base clustered in the northeast corner of NSW.

TMZ has a $50M market cap right now, which is a fraction of bigger silver peers.

Investigator Resources has a market cap of $139M and has a 42 million oz. silver resource.

Silver Mines Ltd has a market cap of $284M and a 87 million oz. silver resource.

It looks like TMZ has some catching up to do.

If the silver price continues on its merry way, and TMZ continues its ongoing consolidation efforts in New South Wales, TMZ could soon catch up to its more significantly sizeable silver siblings.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.