Major Cornerstone Investor in Place for Rafaella

Published 26-JUN-2019 12:40 P.M.

|

5 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

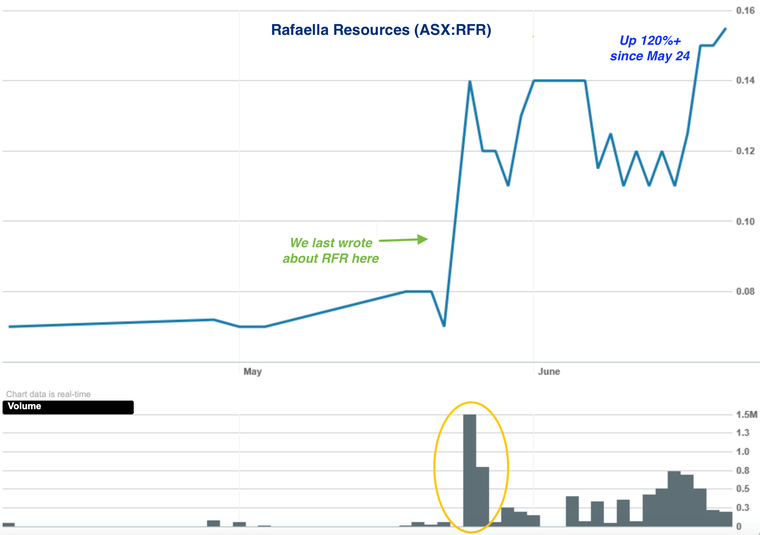

Rafaella Resources (ASX:RFR) has been a star in the ASX resources space over the last month.

The stock has gained more than 120% since we brought the company to your attention in the report, Previously Overlooked ASX Micro-Cap Confirms Transformative Tungsten Project.

At that time, Rafaella announced it is acquiring a 100% of the shares of the private Spanish company Galicia Tin & Tungsten (GTT), owner of the Santa Comba tin-tungsten project in Spain.

Backing up Rafaella’s strong performance over the last month comes further major news for shareholders today.

In a huge sign of confidence, the world's oldest independent and privately held commodities trading company is coming onboard as a cornerstone investor.

Transamine Trading S.A, headquartered in Geneva, Switzerland, specialises in all aspects of non-ferrous raw materials production and trade, and it has now conditionally agreed to provide both financial and operational support to the development of the Santa Comba Tungsten Project.

Transamine will provide strategic support through marketing services and offtake agreement and equity investment of up to $1.5 million.

The trading company has conditionally agreed to purchase 100% of the project’s tungsten and tin concentrate production, including managing logistics for tungsten concentrate delivery to HC Stark Tungsten GmbH.

The new project adds to RFR’s diversified project portfolio that includes the McCleery cobalt and copper project in the Yukon territory, Canada, and the Sandstone gold project in Western Australia.

But it’s this new deal that executive director Ashley Hood describes as a transformational one for RFR, saying the Santa Comba project “represents an attractive tungsten opportunity with low entry costs and the prospect of exceptional returns for shareholders”.

Hood said of the agreement, “Transamine’s support represents a significant vote of confidence for the Santa Comba Project and its potential and validates our acquisition of the Project.

“Transamine’s marketing and logistical support will be vital as the Santa Comba Project ramps up production during early stages and we look forward to working with Transmine to advance the Project.”

The acquisition comes at a perfect time as end users scramble to secure alternative, reliable sources of tungsten — a specialty metal that has been identified as a critical raw material having vast commercial, industrial and military applications.

Having now secured the financial and strategic endorsement of such a well-respected and venerable trading house as Transamine, I expect RFR to go from strength to strength.

Let's take a look at the latest deal with...

Market capitalisation: $6.5 million

Share price: $0.17

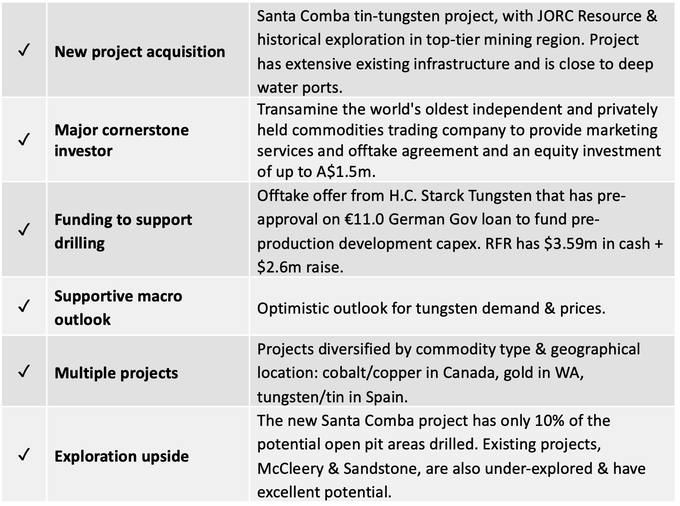

Here’s why I like RFR:

Securing the strategic support of Transamine is a major win for the junior exploration company, Rafaella Resources Limited (ASX:RFR) and its acquisition of the Santa Comba Tungsten Project in Spain.

Along with this newly announced support of Transamine, RFR has received an offtake offer from H.C. Stark Tungsten GmbH (HCS) with associated development funding from the German government.

In addition to the upside potential of the Santa Comba tin-tungsten project acquisition, I last month laid out why the company was a good buy at those levels.

At the time the stock was hugely unloved, capped at just $2.6 million with a 7 cents share price and only very lightly traded. Looking at its cash backing, its share price should have been around $0.13.

Here’s the stock’s performance since then:

And while the share price has since rallied to 17 cents, it still remains attractive when considering that the (proposed) acquisition involves issuing shares to the vendors at $0.20 per share. The scrip-based purchase will also involve a capital raising, targeting $2.6 million, via a share placement at $0.20 per share.

That raising has already gained support. Transamine Holdings and Investments, Hong Kong has agreed to support equity raising, committing $1 million to be followed by a further $500,000 once a positive feasibility study is complete and the execution of German government development funding.

Founded in 1953 and headquartered in Geneva, Switzerland, Transamine Trading S.A is the world’s longest established independent and privately held commodities trading company specialising in non-ferrous raw materials production and trade.

As a cornerstone investor, Transamine must believe the project stacks up and has agreed to provide marketing and logistics services to Galicia Tin & Tungsten S.L. (GTT), the current 100% owner of the project.

In terms of a heads of agreement negotiated in May, GTT is currently the subject of an agreed acquisition by Rafaella.

More detail on today’s announcement is available in the following Finfeed article:

Rafaella has recognised Santa Comba as a development project that’s capable of being fast-tracked to production.

A more detailed review of the project can be found in my last report of RFR in May, but here are the project’s strengths:

A final word

Today’s announcement is further verification that the project stacks up. As the world's oldest independent and privately held commodities trading company, Transamine has a proven track record of investing wisely.

It’s commitment to step in as a cornerstone investor on this project and taking the offtake production is significant affirmation of the quality of the project and Rafaella’s future.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.