Lithium Australia on Track to Develop Full Circle Lithium Solution

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

The emergence of lithium as one of the world’s latest (and possibly greatest) staple commodities, has caught many unawares. Who would have thought that the “next gasoline”, according to Goldman Sachs, would be such a quick hit with investors, so quickly out of the starting gate? Industry and government around the world — Europeans in particular but also the Americans — are voting with their wallets .

No one expected lithium batteries, energy storage and electric cars to put their stamp on global markets quite as quickly and efficiently as has occurred.

The good news is that as an industry, lithium is still at the incubation stage with many ambitious lithium explorers remaining undervalued.

With the lithium boom now truly underway, part of our attention here at The Next Mining Boom remains focused on how lithium as a commodity will fare in this climate.

We are also focused on several potentially undervalued lithium stocks, including the A$39.5 million capped Lithium Australia (ASX:LIT).

LIT is making all the right noises and taking the necessary steps to achieve its underlying goal: to become the preeminent hub for lithium exploration, extraction, and processing.

Overall this is an early stage play and as such any investment decision should be made with caution and professional financial advice should be sought.

The future of lithium production is via energy-efficient non-pollutive means

Over the past 12 months, LIT has been working diligently to commercialise its 100%-owned SiLeach® lithium extraction technology. Here is the timeline so far.

LIT’s blue-sky potential is rooted in the fact that this still-small ASX lithium developer, could have the keys to unlocking high-grade lithium for any manufacturer, or end-user, at a fraction of the current cost .

The company is making the most of its technological leadership position, as it not only looks to become the foremost developer of disruptive lithium technologies, but also create a circular energy economy in terms of the production and utilisation of lithium ion batteries.

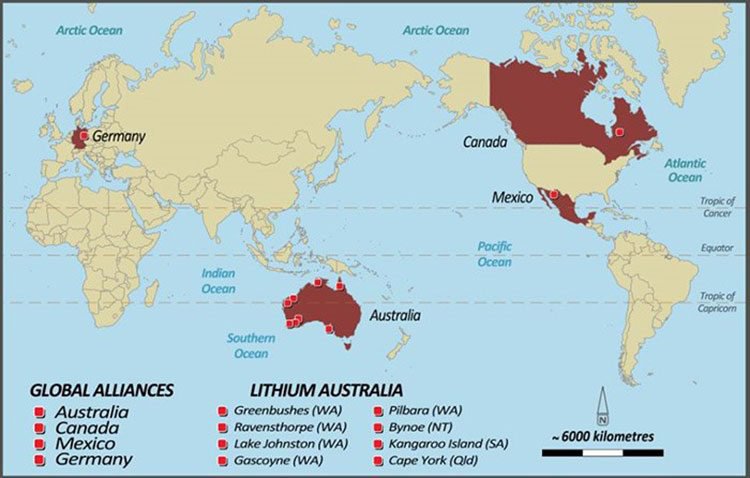

LIT’s SiLeach® technology has caught the eye of several partners, with LIT signing strategic partnerships and alliances across major lithium provinces globally. Its latest MoU is with Poseidon Nickel, with whom it will work to evaluate joint exploration and lithium processing opportunities at its Lake Johnston and Ravensthorpe Projects in southern Western Australia.

LIT is aiming to establish Lake Johnston as a central lithium processing hub.

We’ve been keeping pace with LIT the entire way, cognisant of the significant progress already made, and the forthcoming commercial spoils just around the corner.

It’s not just its SiLeach® technology that has been slowly sending Lithium Australia’s (ASX:LIT) value higher; a range of prospects, resources and exploration programmes in Australia and around the globe are also afoot.

As most of our readers already know, having access to large amounts of lithium-bearing ore is handy, yet without the ability to extract high-grade lithium at the right production costs, once the bigger players consolidate their positions and raise the drawbridge, a future in the lithium business will be difficult.

LIT is thinking ahead of the game here by targeting a plentiful but virtually unutilised mineral resource – lithium bearing micas – which are lower in grade than the more commonly mined mineral spodumene, however – and this is the key – processing micas using SiLeach® will also generate value from by-products as micas are more fertile minerals containing a greater range of elements, compared to spodumene.

Potential by-products include potassium sulphate (a fertiliser), sodium silicate (a widely used and easily marketable industrial chemical); rubidium and caesium compounds (niche market high-value chemicals). These by-products have potential to add as much value to LIT as lithium does and this should equate to a lower unit cost of production for LIT and LIT’s partners.

LIT is still a relatively small company, but with incredibly large aspirations to become Australia’s premiere source of high-grade lithium products as well as being active on the world stage.

LIT’s ambitions are nearing closer to realisation courtesy of pre-production viability testing, ongoing exploration, joint-venture agreements and cross-sector partnerships with aspirational battery-market operators.

LIT’s development path is clearly marked, signposted and paved for the taking.

Here is Managing Director Adrian Griffin speaking about LIT’s year of achievement and how it is attempting to build a sustainable future:

As far as LIT is concerned, it’s time to get down to the business of progressing its proprietary SiLeach® technology and moving towards becoming Australia’s premier lithium developer.

A quick peek at LIT’s share price, suggests there’s plenty of market action afoot and has risen considerably since the Next Mining Boom first called it in August 2016.

The past performance of this product is not and should not be taken as an indication of future performance. Caution should be exercised in assessing past performance. This product, like all other financial products, is subject to market forces and unpredictable events that may adversely affect future performance.

Here’s how some of LIT’s closest lithium-market peers are performing — in a nutshell, rather well:

The past performance of this product is not and should not be taken as an indication of future performance. Caution should be exercised in assessing past performance. This product, like all other financial products, is subject to market forces and unpredictable events that may adversely affect future performance.

With all that in mind, let’s wade through the latest goings on at LIT, to see if this aspiring lithium developer can deliver...

Despite a variety of challenges, obstacles (and roadblocks), LIT is now on the straight-and-narrow path towards Aussie-powered lithium dominance.

The reasons why LIT represents a good shot at the lithium space, is simply because of its array of lithium options — for one, LIT has amassed a cavalcade of land tenure, JV deals, exploration permits and exploration targets; these elements provide the ammunition for LIT’s exploration team to make progress.

The recent advances at LIT’s Western Australian projects are testament to that (more on that later) and if we then add LIT’s other Projects, it would seem LIT is truly on a path to becoming one of Australia’s most prominent lithium companies.

Beyond these traditional mineral resource exploration activity, LIT is also pursuing a ‘next level’ approach to a stake in the lithium market — proprietary technology that every spectator would love to get their mitts on. If LIT manages to commercialise its proprietary SiLeach® technology over the coming years, it could position LIT as the go-to processor for dozens of other lithium producers.

Of course, as with all minerals exploration, success is no guarantee – consider your own personal circumstances before investing, and seek professional financial advice.

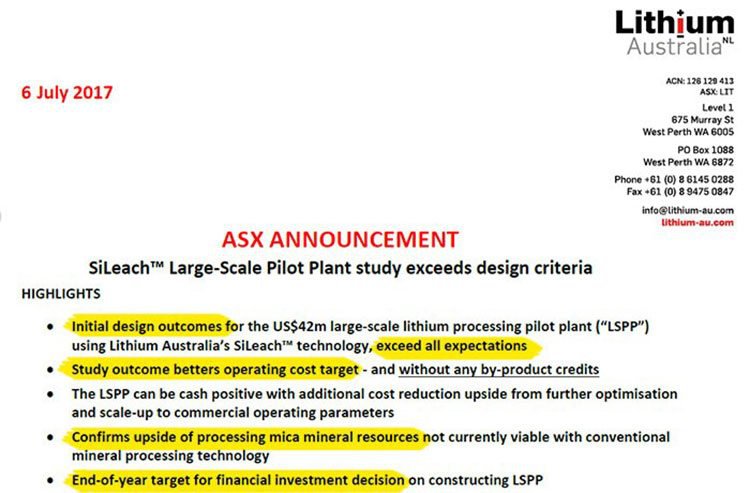

The good news is that SiLeach® is outperforming even the most optimistic technical expectations as highlighted in this ASX release by LIT on July 6 2017:

SiLeach® is a method of extracting lithium from surplus-to-requirements rocks, readily available at a global scale — which shows promise of a cheap, safe and efficient processing route in terms of energy consumption and final lithium carbonate grade.

According to the study, LIT’s proposed large-scale US$42 million lithium processing pilot plant (with 2,500t in annual production) can be cash positive and confirms LIT’s assertions that that mica material can be a competitive source of commercial lithium products.

On a Path to a LITer Future

As we have detailed in previous articles about LIT, SiLeach® is a breakthrough technology that makes it possible for huge amounts of discarded rock to be converted into high-grade lithium carbonate. It’s not just the ‘What’, that LIT is changing — it’s also changing the ‘How’.

In a nutshell, LIT plans to greatly improve the speed, efficiency and cost-effectiveness of lithium processing. And it looks something like this:

LIT’s SiLeach® technology is a completely new addition to the lithium market, which has meant a steady stream of pilot tests as LIT continues to tweak SiLeach® and how it will ultimately operate on a large commercial scale.

But that’s not all...

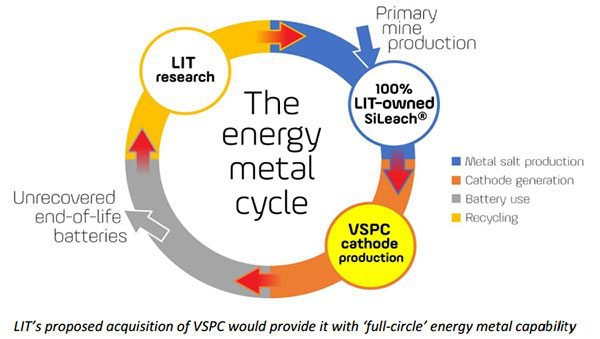

In addition to rolling out better lithium processing, LIT is also going for the jugular by developing a “full circle” solution in the lithium-ion battery space.

The name of the game is to recover lithium from ‘spent’ batteries and once again display its metallurgical nous, only this time from existing batteries rather than tonnes of lithium micas.

This game plan will be given a boost if a proposed acquisition to purchase Brisbane based battery cathode developer Very Small Particle Company (VSPC) is successful.

VSPC is a research and developer of some of the world’s most innovative and respected new era cathode materials for lithium-ion batteries and the acquisition would give LIT access to the technologies required to participate in all sectors of the energy metal cycle:

Under the terms of the proposed share based acquisition, LIT would acquire up to 100 per cent of the company with a minimum acceptance requirement of 75 per cent.

VSPC’s research and development work has resulted in it supplying high quality cathode material, including lithium-ion phosphate, widely used in hybrid electric vehicles, power tools and domestic storage batteries, into global test markets.

Here is LIT MD Adrian Griffith explaining the potential benefits of the acquisition.

Early results regarding how well LIT can process various lithium micas (currently at >95%), and whether LIT can get its foot in the door of battery optimisation, are not absolutely conclusive and do not offer any guarantees...

...but they do provide a hint as to whether LIT’s tech ambitions are feasible.

The answer on the feasibility front is: so far, so good.

Very crucial, is the growing likelihood that LIT will be able to avoid an over-reliance on by-product credits — an issue that tends to plague many small-cap metals explorers, still sifting through various types of mineralisation. LIT’s large scale pilot plant study shows that the project washes it face just based on lithium – even with operations on a very small-scale. Scaling up operations will clearly increase the potential for profitability and value from by-products and from large scale should be cream on top.

LIT has made great strides towards ensuring its tech-development and exploration drilling activities are complementary of each other, and reinforce LIT’s commercial chances.

Putting theory into practise at Agua Fria

As with any resources explorer, we’re always keen to see theories put in practise, before we commit our hard-earned money on a stock.

As well as its world-leading mineral technology LIT is doing work to obtain market traction, and prove its tech ambitions to the world can be seen at Agua Fria in Mexico.

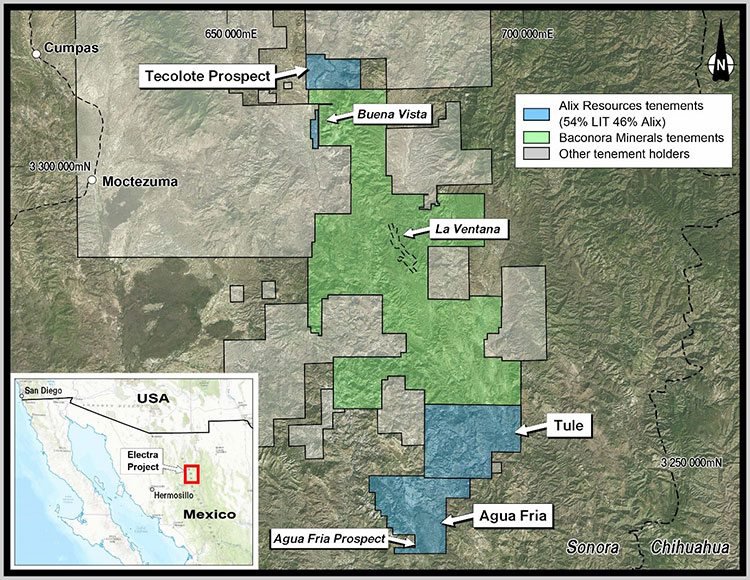

Located just a stone’s throw away from Nevada-dwelling Tesla, and its battery-stuffed Gigafactory, Agua Fria is a JV project LIT is progressing in tandem with Alix Resources.

LIT likes what it sees at Electra and likes it so much it has recently moved to increase its stake to a controlling interest of 54% as announced here.

Here’s a quick reminder of the location, and the lay of the land at Agua Fria. As you can see, LIT is rubbing shoulders with Bacanora Minerals, a Canadian Resources company worth around C$185 million.

LIT and Alix have completed extensive drilling campaigns at the Agua Fria deposit and indications are very promising with significant drill intervals having average values exceeding 1,000ppm lithium.

Following its most-recent tweaks, LIT’s SiLeach® process assuredly extracts 95%-99% of lithium from its source rock — and here’s the clincher — in under 4 hours at room temperature.

LIT’s technology-focused SiLeach® angle is a great long-term asset, and its gradual progress most definitely piques the interest for early investors.

Exploration Update

Most recently, LIT has signed a key MoU deal with Poseidon Nickel (ASX:POS).

This is a strategic move to jointly evaluate the lithium potential in the Lake Johnston region in southern WA. LIT plans on using Lake Johnston as a source for tailings, to be supplies to a local lithium processing plant.

From an exploration perspective, LIT wants a large Resource of its own, but more importantly, it wants access to copious amounts of ‘feedstock’ that will be used for lithium extraction via SiLeach® , and other modern technologies. Feedstock is another word for low-grade lithium-bearing rocks and they’ve previously been ignored because it was deemed uneconomic to extract the sought-after lithium locked within them.

But with LIT’s lithium-industry-busting SiLeach® technology now nearing the industrial commercialisation stage, LIT is growing evermore confident that it will ultimately have one of the largest Resources in the world, only not in the traditional JORC sense. Lake Johnston sports a 1.5 million tonne per annum processing facility which will mean POS and LIT can collaborate on both exploration and practical SiLeach® implementation at commercial quantities.

Ravensthorpe update

The latest geological work indicates Ravensthorpe is highly analogous to the nearby Mt Cattlin Project being progressed by the A$800 million-capped Galaxy Resources (ASX:GXY). With an 800 metre by 800 metre flat lying footprint containing both lepidolite and spodumene, the Horseshoe Pegmatite shows strong geological similarities to mineralisation at Mt Cattlin.

Also, Mt Cattlin is less than 20km away from Ravensthorpe which raises hopes of LIT scoring some decent hits here and summarily adding them to its own growing Resource base.

The Path to a Lithium-powered Future

Australia is a country more synonymous with metals such as iron ore, copper and gold as opposed to lithium. However, that could soon change as lithium comes to the fore as a new commodity likely to be used ubiquitously as part of the emerging energy storage revolution.

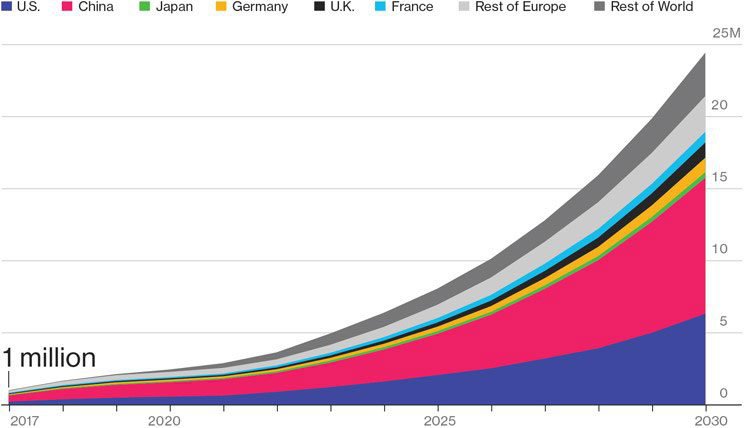

Estimates show that for the world to adopt new battery technology, it will need to produce millions of tonnes of lithium just to meet current projections. The problem is that existing lithium manufacturing techniques are rather expensive and time consuming which is putting the brakes on Tesla’s world domination plans for the time being.

What’s needed is some way of rapidly escalating the supply of lithium, without breaking the bank.

Take a look at the projected level of demand, just for electric cars (EVs) alone:

Meanwhile, this is how a basket of the most prominent lithium companies is faring:

As you can see; collectively, lithium companies are growing on the back of lithium batteries and the realisation that lithium has arrived to dethrone oil from its historical position of dominance.

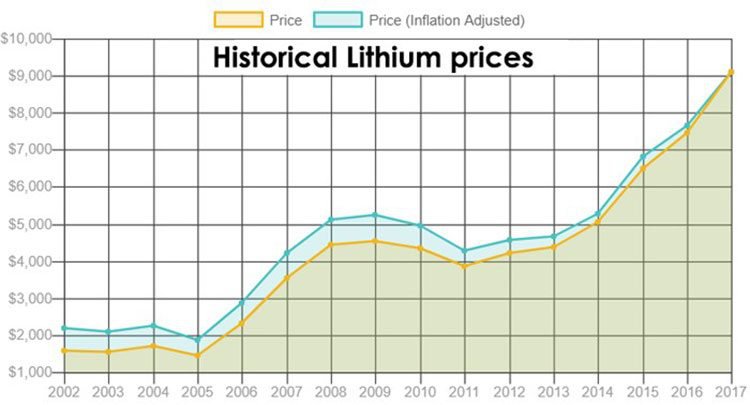

Take a look at lithium prices over the past few years:

It should be noted that commodity prices do fluctuate and caution should be applied to any investment decision here and not be based on spot prices alone. Seek professional financial advice before choosing to invest.

One of the most surprising things about LIT’s tech angle is that it aims to produce lithium at a discount to traditionally cheaper brine producers. That’s never been done before... and if it comes off as LIT hopes it will, it will be a major disruptive factor for the lithium industry.

LIT has demonstrated it can produce lithium carbonate to 99.57% purity – just the thing lithium-ion battery producers need as they look to ramp up production over the coming years, on the back of a surge in electric cars and home battery power storage.

Critically, LIT’s process is targeting production costs of around $2,000/tonne while market prices continue marching north, currently above $9,000/tonne. Given the current lay of the land in lithium, LIT has a good chance of seeing strong operating margins when it enters production sometime over the next 2 years.

What LIT has up its sleeve could not only elevate them to the top of the lithium pool in Australia...

...but also set LIT on a course towards grass roots lithium dominance on the back of its SiLeach® proprietary technology.

LIT is stone-cold serious about turning geological curiosities into defined ore bodies, without putting all its eggs into extensive exploration. This technology and peripheral exploration combo-strategy, is poised to reel in the spoils as the commercial tide of the lithium industry continues to rise.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.