LIT is Looking for the ‘Holy Grail’ of Lithium Processing

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

There’s something about today’s Next Mining Boom stock which makes us think that it may not be a miner after all – but a disruptive tech company undercutting its competitors by at least 33%.

Stay with us here.

Lithium Australia (ASX:LIT) is playing in a market with massive future growth potential in clean energy applications, and is threatening to completely and utterly undercut its better funded competitors through the innovative use of technology.

We have seen it all before.

TV is being disrupted by online video channels such as YouTube and Facebook; the taxi industry is being disrupted by Uber; the hotel industry is being disrupted by Airbnb; and the newspaper industry is being disrupted by the Internet.

LIT may just disrupt the lithium industry in the same way, lithium being one of the literal building blocks of the clean energy revolution – owing to its use in lithium ion batteries used to store renewable energy.

LIT is using technology to open up a new resource that other hard-rock lithium miners simply don’t pursue for not being profitable enough – and then using low-carbon tech to bring it up to a saleable product, while also stripping out other products which can be on-sold to improve the economics of its operation.

Now, LIT is a speculative stock – and runaway success is no guarantee here, so professional advice should be sought before making an investment.

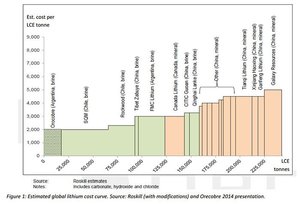

At the moment, lithium producers can be divided into hard-rock producers (conventional mining) shown in orange on the below chart; and brine producers (production from salt water) shown in green below.

Despite starting with minerals derived from conventional mining operations, LIT is aiming to produce lithium carbonate for under $2000 per tonne (including other credits), cheaper than any current producer.

This provides a significant margin with lithium carbonate usually selling for about $6000 per tonne.

Profit margins for the other players is somewhere between 16% and 50%, but for LIT it could be more than 66% , based on current prices.

Essentially LIT is consistently bringing the costs down to the point where it may able to undercut producers in lower-cost environments such as Chile or China to sell into a market which is tipped to treble in a few short years.

Better yet, LIT’s process produces very little greenhouse gas emissions.

Recently, LIT announced that trial runs of processing lithium from low-grade micas have gone swimmingly.

On the upstream side, LIT has built a position in Australia and Europe, ensuring that the company has plenty of feedstock for when it’s ready to go to full-scale production.

Regardless of whether any other operators decide to use this tech in the future, LIT has essentially built a first-mover advantage.

We think this sounds more like a buzz-worthy tech company than a miner...

Re-introducing:

To understand why we at The Next Mining Boom continue to watch LIT very closely, you have to understand a little bit (don’t worry, just a little bit) about the tech it’s using to achieve cost savings.

Traditionally, hard-rock lithium processing is somewhat of a brutal process.

Simply put, lithium ore is roasted at high temperatures in massive industrial-scale roasters before the metals are leached out of them.

Anybody with an electric heater running during winter will appreciate just how costly that can be – but industrial roasting is done on a vastly bigger scale.

It needs massive amounts of energy, which if the company can’t provide itself, means that processing costs can run into the millions of dollars, cutting into margins.

It usually means hard-rock lithium producers can only realistically produce lithium carbonate from high-grade concentrates grading at 5-6% Li 2 O.

To counter this the ‘L-Max’ method has been licenced to LIT by unlisted company Lepidico.

The way the L-Max method works (in a nutshell) is that LIT grinds its lithium mica into a fine powder and digests it in a sulphuric acid solution at 90 degrees centigrade.

It then strips out all the metals (which can be sold and can be thought of as ‘credits’ in the process), including lithium, and leaves them in the solution.

The reaction creates sulphur dioxide, which is then used to create more sulphuric acid, and on the process goes.

The upshot is that LIT doesn’t need to waste a whole tonne of money roasting ores before a leaching process.

This translates to large cost savings and means that LIT can go after lithium resources which would otherwise be simply uneconomical to mine.

At the moment, the company is tinkering away on mini-plant tests with an eye to go full-scale...

Of trials and demand

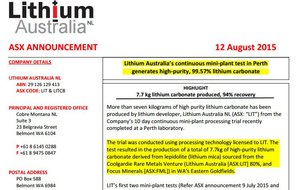

In July, LIT announced that it had performed a continuous mini-plant run , processing lithium from micas present at one of its upstream projects.

The mini-plant was run over 15 days, which included pre-fill, continuous operation, and de-commissioning.

A total of 229kg of mica ore was processed in that time, with 111 hours of continuous leaching. LIT was able to recover 8.7kg of lithium carbonate with an average grade of 99.53% and a recovery rate from leach liquor of 94%.

It was only in September that LIT got the full numbers back from its testing and was able to tell the market that it had managed to produce carbonate at the 99.6% grade.

LIT also said many of the small impurities left could easily be eliminated by “improved washing of the final carbonate product” – literally just giving the carbonate a bit more of a rinse at the end.

The company showed that the process could work, and the leach results emulated those achieved during batch testing.

This means that it is easier to predict future performance – a massive boon for LIT as it crunches the numbers on going full-scale.

It was also recently able to auction off forfeited partly-paid ordinary shares for a premium of 25%.

The average sale was 1.2c, but one parcel went as high as 1.5c per share – these have since traded up to 4c per partly paid share on good volume.

It managed to sell every single one of the almost 5.9 million shares it put up for auction, raising the company a nice little sum of $73,615.

The sum isn’t the most important thing here, but rather the sentiment from the market.

One can’t help but wonder what the premium would have been if they had known about the latest processing improvements released in the past month by the company.

LIT recently outlined that it can now recover even higher amounts of lithium from its lithium micas.

In fact, it said that by adjusting the process just a touch that it could improve recovery rates from leach liquor to more than 98%.

Remember before it had a recovery rate of 94% from leach liquor.

A figure of 4% may not seem huge, but when we’re talking potentially millions of tonnes of lithium mica to go through the process, there could be massive processing savings down the road.

It’s simply been going about its business in a methodical and scientific manner, and has been crunching the numbers to come up with greater efficiencies.

The best part is that the lithium mica it has put through the mini plant process has been sourced from its own project at Lepidolite Hill in Western Australia.

Swimming in the upstream

You see, the technology is only one part of the broader play from LIT.

It’s aiming to build a substantial upstream position by entering into joint ventures with more traditional lithium explorers.

It’s involved in six key projects in Australia and the Czech Republic.

Cinovec – Czech Republic

LIT has a non-binding Heads of Agreements for a 50:50 JV to produce lithium carbonate with European Metals Holdings (ASX:EMH), focused on the giant Cinovec deposit in the Czech Republic. We have covered EMH extensively over the past few months – you can read the latest with this company in this article: Lithium Project Fast Tracked by EMH: World’s Biggest Hard Rock Resource? In fact since we first brought EMH to our readers’ attention, the stock has been up as high as 250%:

The past performance of these products are not and should not be taken as an indication of future performance. Caution should be exercised in assessing past performance. These products, like all other financial products, are subject to market forces and unpredictable events that may adversely affect future performance.

At the moment, Cinovec has an inferred lithium resource of just under 515 million tonnes with 0.43% Li 2 O lithium grade at a 0.1% cutoff. All indications are that LIT will be teaming up with EMH and applying the L-Max technology to this resource, allowing a cheaper production method than traditional methods.

Cinovec also has an exploration target of 350-400Mt of lithium at 0.39-0.47% Li 2 O, but that’s yet to be confirmed.

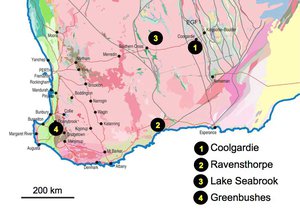

Coolgardie

Back in Australia, this eastern Goldfields project actually fed the mica lithium ore into the L-Max mini-plant trial.

To do a theoretical test is one thing, but using the rocks you eventually want to be digging up, selling and running it through the plant is a significant step forward.

At Coolgardie, it has an 80% stake in an area shared with Focus Minerals (ASX:FML), focusing on pegmatites 15km from the WA outback town.

Waste dumps from prior mining at Lepidolite Hill comprise around 400,000 tonnes of lepidolite-rich material.

Seabrook

It has a joint venture with Tungsten Mining (ASX:TGN), with LIT taking an 80% slice.

It has also recently been awarded a new exploration license, which effectively doubles the size of the project’s footprint.

The joint venture is hoping to feed that material through the L-Max method to make that waste market-viable lithium carbonate.

Ravensthorpe

Ravensthorpe, near Esperance, is often thought of as a nickel town thanks to BHP’s presence there, but LIT has taken up a position near General Mining’s (ASX:GMM) Mt Cattlin lithium project. This project was previously operated by Galaxy Resources Limited.

Ravensthorpe isn’t the main focus for LIT, but the project area has brought up mica samples which are being tested.

Again, if sample testing goes through to bulk testing, then it could get a whole lot more prospective.

Greenbushes

Greenbushes is within cooee of the world’s largest lithium mine , operated by Talison Lithium.

Talison produces approximately 38% of the world’s lithium, and accounts for 75% of Chinese demand.

The LIT project covers a 50km structural trend which is showing early signs of being similar to Talison’s project.

Pilgangoora Li-Tantalum project

Up in the Pilbara region, it has teamed up with Pilbara Minerals (ASX: PLS) to assess the lithium micas at PLS’s Pilgangoora project.

The spodumene project has indicated and inferred resources of 20.48 million tonnes @ 1.16% lithium oxide ore, so about 287,000 tonnes of lithium oxide.

Most of the resource is a more conventional spodumene mineralisation, but LIT has its eyes on a different game.

Historic records suggest most of the lithium mica (in this instance lepidolite) may be in areas not yet drilled .

Hence LIT’s interest in the project.

Lithium economics

The reason LIT has been quietly building up a position in lithium projects that the majors won’t touch (due to lower grades), is because of the long-term fundamentals of the lithium market.

If LIT can prove up lower-grade lithium mica ore into high-purity oxide, then it will be well and truly playing in an emerging space.

LIT Managing Director Adrian Griffin is talking a big game, saying that “we continue on our quest to become the greatest holder of lithium inventory in the world” .

That would make LIT a market leader in lithium – however this is no guarantee, and investors are encouraged to seek professional advice before investing in the company.

In fact, all producers around the world are scrambling to shore up their positions, and here’s why:

As you can see towards the back end of the table above, a huge amount of global lithium demand is being driven by its increasing use in batteries.

Specifically, the use of lithium-ion batteries, which are facing skyrocketing demand at the moment thanks to renewable energy advances such as Tesla’s electric car range.

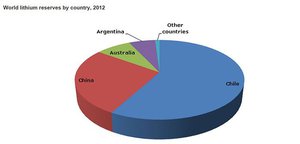

At the moment, Australia is the largest producer of lithium in the world – but it does not have the largest amount of reserves.

That title would go to Chile, which is also the second-largest producer of lithium, with China coming in at third.

From Merchant Research & Consulting report “Lithium: 2014 Market Review and Forecast”.

LIT is trying to redress that balance before demand starts to truly go up by focusing on lithium micas, which aren’t usually counted as part of lithium reserves reports.

China, will more than likely keep a fair chunk of lithium within its borders for domestic consumption while production in Chile is tightly controlled, with reserves taking a while to make it to market.

Outside of China and Chile, Australia stands as an attractive destination for those trying to source large volumes of lithium in short order. That’s exactly what’s going to happen in the next few years.

And then there is Europe also – with LIT’s ever closer involvement with the Cinovec project in the Czech Republic, the company may soon be supplying into powerhouse European battery markets like Germany...

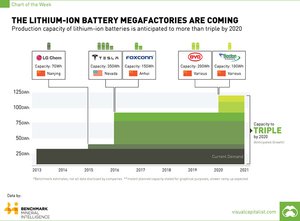

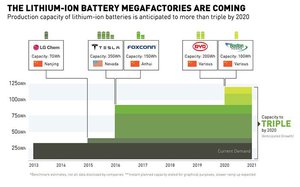

The megafactories are coming

Below is a chart we like here at The Next Mining Boom , because it so perfectly demonstrates just how much demand is forecast to go up:

In three short years, demand could more than treble .

The world currently consumes about 38,000 tonnes per year of lithium metal, and Tesla alone wants 38,000 tonnes to power its gigafactory in the desert of Nevada.

Goldman Sachs has estimated that the Tesla gigafactory alone could soak up 16% of world supply.

The final word

Lithium has been surrounded by a huge amount of buzz for a long time, and yet no single player has come in to dominate the market although plenty of companies have tried and failed to crack the ‘hard rock lithium processing’ code.

Can LIT be the company that manages to do it?

LIT stands a chance, however success is no guarantee here – and LIT remains a speculative, early stage investment.

In a piece written for Fortune Magazine by David Z Morris earlier this year , the CEO of lithium consultancy TRU was tapped for his opinion.

Morris’s theory was that hard rock miners were never going to be able to produce cheaply enough compared with their brine deposit counterparts.

However, LIT has now presented a third viable option.

By mining lithium micas which other companies usually won’t touch and applying market-leading technology in the processing of it, LIT is aiming to produce lithium carbonate for lower than $2000 per tonne.

This would put LIT on the threshold of being the cheapest producer in the world, and if all goes well, the company will start producing at scale just at the time when demand for lithium starts to really take off.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.