GPP Smashing the Costs of Fertilizer: 1/10th the Cost of Traditional Producers

Published 30-MAY-2017 10:40 A.M.

|

17 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Agriculture holds plenty of upside for savvy innovators who can improve the sector’s output.

Australia’s agricultural sector is a major contributor to the country’s GDP, and its value is tipped to break another record this year, peaking at $63.8 billion.

While the Australian agriculture industry is seemingly going from strength to strength and the total value of Australia’s farm exports is expected to hit a new record of $48.7 billion in 2016-17, $1 billion higher than the previous year , a market facing almost a polar opposite sentiment is Australia’s thermal coal industry.

If you don’t read the papers you may not be aware that it’s on the decline...to say the least.

Many of our thermal coal plants and their supporting infrastructure are well past their used by date, plus there’s a growing demand for more environmentally friendly methods of power generation.

All this has led to the closure of many of Australia’s major coal fired power plants.

But change brings opportunity... and no more so than for one innovative Aussie small-cap.

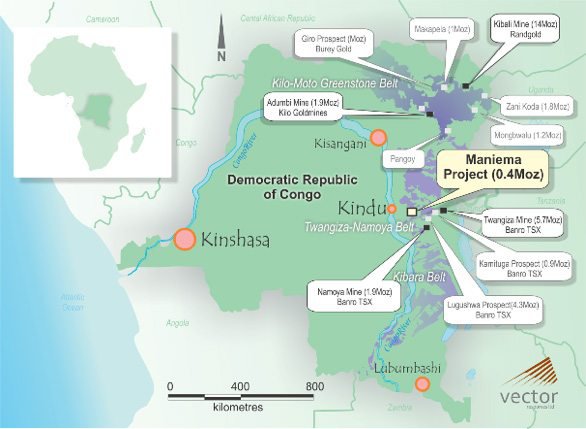

Greenpower Energy Limited (ASX: GPP) is set on disrupting the $8 billion fertiliser market by converting coal into fertiliser.

Whilst that may sound a bit far fetched – stay with us as we take you through how this company does it.

The company’s Oxidative Hydrothermal Dissolution (OHD) bio-stimulant fertiliser ( biological or biologically derived fertilizer additives and similar products that are used in crop production to enhance plant growth, health and productivity ) has the potential to shake up the market, supported by significant cost advantages over its competition — GPP can produce fertilisers at one-tenth of the cost of manufacturing traditional fertilisers.

We’ve mentioned the fertiliser market is worth $8 billion, but it is also worth pointing out that the biostimulant segment is expected to reach $2.2BN by 2018, an increase of 12% per year.

Suffice to say the overall market and the elements within are substantial.

GPP has three major projects on the go. One is this potentially game changing bio stimulant business in Victoria — supported by the changing dynamics in Australia’s agriculture and coal sectors.

Another is focused on potash for fertiliser and lithium brines in the Northern Territory, while the third is a South American hard rock lithium exploration play that’s underway, yet still in its early days.

This company is in the early stages of its development on all fronts and investors should therefore take a cautious approach to any investment decision made and seek professional financial advice with regard to this stock.

When we last updated you on GPP back in February, the company had just completed OHD bio-stimulant fertiliser cereal crop trials on wheat in Victoria. The results from the trials were impressive with significantly more heads of wheat on OHD treated wheat per plant compared to the untreated control wheat.

Moving on, further trials with OHD bio-stimulant fertiliser to cover oil cereals will be conducted with Monash University, with a focus on canola and palm oil. There are high hopes for these trials as studies found the OHD bio-stimulant fertiliser to enhance reproductive activity in plants that produce flowers and seeds – news expected on this front in the coming weeks.

On top of that, the PFS for the OHD project is well underway and expected to be released in the third quarter.

GPP has the exclusive OHD bio-stimulant rights to the Australian and New Zealand market for the next 15 years.

Another factor that has the potential to be highly lucrative with substantially more financial upside is the fact that GPP holds the global distribution rights for all bio-stimulant fertilisers manufactured in Australia.

The company is currently in discussions with international firms and national grower groups regarding offtake and partnering opportunities. Any long-term offtake contracts could be used as an instrument to fund the construction of an OHD plant.

As for GPP’s South American exploration project, first assay results have been received from its highly prospective Morabisi Lithium and Tantalum Project, located within central Guyana’s mineral-rich greenstone belt.

The assays confirmed encouraging lithium in surface rocks, while extensive sampling at the project has already high levels of Tantalum and geochemistry results confirm accessary minerals consistent with LCT type Pegmatites.

The project’s Phase I field work exploration activities have now been completed and the final assay results are imminent. On top of that, a market update on Phase II exploration is expected soon.

GPP’s third focus is in the Northern Territory. Here the company is busy exploring for Sulphate of Potash – a premium fertiliser product that is highly valued by farmers worldwide, plus GPP is exploring the potential to extract lithium from brines in the region.

So with plenty of potential share price catalysts on the horizon let’s catch up with...

Greenpower Energy Limited (ASX: GPP), currently capped at $30 million, has three major projects which are each highly promising in their own right.

GPP updated the market with its latest news across its three major projects on May 25 with the major takeaway being that a significant amount of news flow is anticipated in the near-term – which is good news for existing investors, and those considering making an investment in this stock.

Before we get into the details of GPP’s Morabisi Lithium and Tantalum project in Guyana and its Northern Territory Brine and Potash Project, let’s review the latest from the company’s headline fertiliser play.

Oxidative hydrothermal dissolution (OHD) is a brand new process for making good on the global slowdown of coal by turning it not into an energy source, but a fertiliser.

Here’s a look at how the process works:

Essentially, the OHD process works by crushing the coal to powder, slurrying it with water, feeding the slurry into a reactor, applying heat and pressure and introducing liquefied oxygen.

It is a quick, cost effective process at 1/10 th the cost of traditional products and is environmentally friendly.

In a nutshell the OHD process which is exclusively licensed to GPP for use in NZ and Australia could shake up the global agricultural sector by significantly increasing crop yields, without increasing input costs.

GPP has an agreement with Thermaquatica to jointly test and develop the OHD process for the conversion of coal into liquid fertilisers.

Cereal crop trials in conjunction with Monash University were completed with positive results, as announced in February . This followed on from initial trials in October, the results of which suggested that OHD significantly increases crop yields .

The bio-stimulant fertiliser liquid was applied to test crops at application rates of 5L/ha through to 70 L/ha in addition to control plants. The results from the trials on wheat were impressive with confirmation of OHD boosting wheat yields by around 300%, when OHD application rates of between 5L/ha and 35 L/ha were used.

The next round of trials will look at results of OHD bio-stimulant fertiliser on oil cereals, with a focus on canola and palm oil.

While we won’t make lofty predictions about what impact the next round of trials could have on the share price, the results are overwhelmingly expected to be positive.

A big reason for that is because studies have found fertiliser to enhance reproductive activity in plants that produce flowers and seeds — like canola and palms.

The next big news will be the PFS for the OHD project, which is due to be released to the market in the third quarter.

As you can see, there is a large amount of anticipated news flow from the OHD project, which has the potential to attract significant investor interest.

Although any interest is speculative at this stage and not guaranteed to occur, so seek professional financial advice for further information with regard to this stock.

GPP, along with its consultants, has been busy progressing the OHD PFS all the while finalising the site location for the proposed construction of the bio-stimulant fertiliser plant.

Once GPP has completed the additional trials over the course of the 2017 growing season, it will move to the planned construction phase of a 20 tonne/day OHD manufacturing plant.

Discussions with the preferred infrastructure provider in the region regarding the supply of coal, electricity and water at one site where the OHD plant is proposed to be constructed are progressing well with a final decision to be made soon.

We are also anticipating costs and feedstock economics to be released to the market very shortly...

So there is plenty in the pipeline from GPP, as it goes about commercialising this technology.

A major benefit of OHD bio-stimulant fertiliser is that the costs involved in production are just one-tenth of that of traditional bio-stimulant fertiliser.

Existing bio-stimulant fertiliser (Fulvic acid) products for agriculture are effective, yet are expensive to produce. So despite improving plant growth and nutrient uptake benefits, these products are generally reserved for high value crops.

The OHD process allows for the production of bio-stimulant fertiliser at a significant cost saving using coal as feedstock, as opposed to seaweed and other decaying plant matter, with a production cost of circa $350 to $700 per 1,000 litres wholesale.

That’s significantly lower than the retail price of existing bio-stimulant fertiliser at $3,500 to $7,000 per 1,000 litres – this is the typical production cost of products in the residential market such as Seasol, Powerfeed, MegaKelp and SuperKelp, which you may have come across when doing the rounds at Bunnings.

The relatively lower cost of OHD production will be supported as demand for coal to produce electricity falls, opening the way for more coal supply for GPP.

You might be wondering what exactly is OHD?

Let’s take a step back for a moment and consider what exactly OHD is and why it has such a bright future.

Oxidative Hydrothermal Dissolution (or OHD for short) is the descriptive name for converting carbonaceous material — that includes coal — into a range of low molecular weight organic compounds.

GPP’s Coal to Liquid process converts Latrobe Valley lignite (brown coal) into a bio-stimulant in an environmentally acceptable way having no — or at the least, very low — carbon dioxide emissions.

LaTrobe Valley coal is young and has a low ‘ash’ content (3% to be precise). If you don’t know much about coal, low ash content is quite rare — ash being the informal term for the waste material leftover once the carbon has been burned, some of which can be toxic.

Using coal in this way avoids burning coal for energy, meaning the manufacturing process is environmentally friendly and less damaging than the traditional use of coal as an energy source.

Yallourn power station in Victoria is one possible location for GPP to establish a larger commercial demonstration plant. It has all the necessary infrastructure to supply coal, water and electricity. The plant is not facing imminent closure and is expected to remain in operation until at least 2030.

Yallourn coal fired power plant in the Latrobe Valley

Power companies are all power suppliers so they will want to find a (green) buyer as pressure builds for energy supply to become more environmentally friendly – initially moving from coal power to gas.

With the move away from coal-fired power generation it will work in GPP’s favour if it can use coal in an environmentally friendly way and pick up some of the slack as demand for coal for energy production continues to decline.

GPP could also be helped along by Federal Government innovation incentives to the tune of a 40% tax recovery, if it can convince the Federal Government that it is building a pilot plant (this will in fact be the first OHD plant in the world).

So, it is all go on the OHD front, but for those interested in GPP there is also a lithium play to consider.

The Morabisi Lithium and Tantalum Project in Guyana

GPP’s lithium and tantalum play is in the South American nation of Guyana, an underexplored, yet mining-friendly, country north of Brazil.

The project area covers over 950,000 acres and is conveniently serviced by existing road and future planned power facilities and close to local service towns.

GPP is currently investigating how prospective the project is for lithium-bearing pegmatites – and results thus far are looking promising.

Extensive sampling from the project has already confirmed high levels of Tantalum, plus geochemistry results confirm accessary minerals consistent with LCT type Pegmatites with strong Rb, Cs, Be and Ta anomalies.

Another reason to be optimistic is that the project appears to be very geologically similar to the Pilgangoora ‘Hotzone’ in Western Australia — home to multiple ASX-listed lithium explorers and developers with a combined value of more than $2 billion.

GPP has executed a binding Heads of Agreement with Guyana Strategic Metals (GSM) to acquire up to a 74% interest in the Morabisi Project. GSM is a private Canadian company which adds another layer of expertise to the venture, having been established by a group of mining professionals with significant Guyanese experience and in-country expertise.

Over the past two and a half years, GSM has undertaken a substantial amount of work to identify areas in Guyana that are prospective for lithium and tantalum. This has included compiling, interpreting and undertaking desktop work in relation to historical information.

The project’s initial Phase I field program, which is now complete — coming in on time and under budget — was focused on mapping and sampling historically reported spodumene occurrences in the southern margin of the Morabisi Batholith. The first Phase also revisited historical mining camps in the Robello and Rumong-Rumong rivers, where Coltan (Niobium and Tantalum) production has been undertaken in the past from alluvial deposits.

The samples collected at Morabisi to date are as follows:

Now as the initial ‘Boots on the Ground’ Phase I program is complete, GPP along with GSM, are assessing the early results received from MS Analytical.

The final assay results from the 20km Ridge, Robello, and Rumong-Rumong from Phase I are imminent and the pair is busy planning the Phase II program that is aimed at delivering early drilling results as the Guyana wet season comes to a close.

A market update is due shortly outlining the next steps involved in Phase II of the project.

Add to that the fact that GPP has been approached by the Guyana Government regarding two additional license areas in-country, which are each regarded as being highly prospective for Lithium-Tantalum and the Nickel-Cobalt.

This project alone offers significant opportunity for the company to be revalued.

GPP is currently valued at just $30 million on the market, and that looks quite small when compared to its lithium exploring peers with market caps of more than $50 million.

And that’s not even taking into consideration the company’s main OHD bio-stimulant fertiliser business...

All it will take is one major bit of positive news and GPP could be rapidly catching up in the valuation stakes.

Northern Territory Pretoria Potash and Brines Project

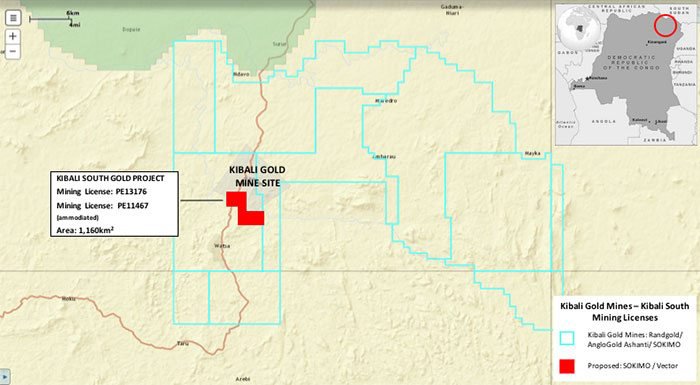

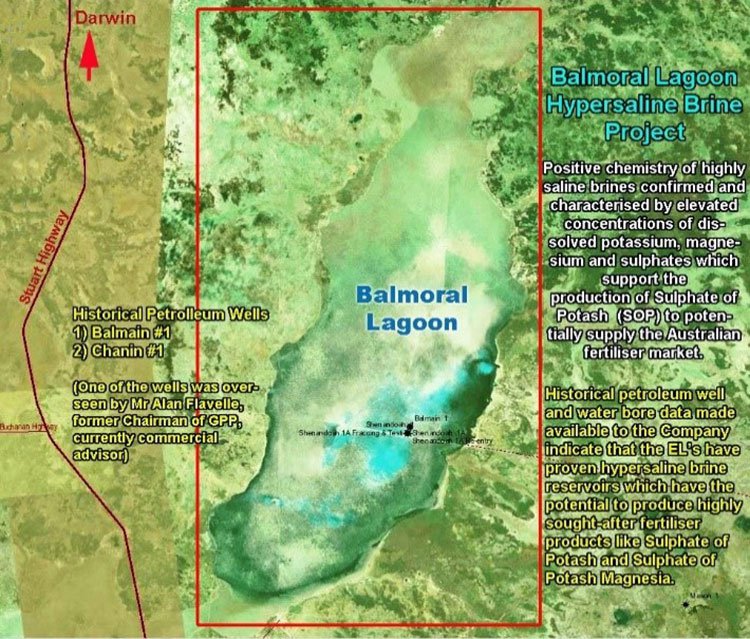

GPP’s third play is its Pretoria Project in the Northern Territory. The 100% GPP-owned hypersaline brine holding covers 7,000 square kilometres and nine exploration licences in the NT’s Macarthur Basin.

Exploration so far has covered the Hayfield and Shenandoah Stations over an area of 270 square kilometres, testing the soil for its Sulphate of Potash (SOP) potential. In a promising sign, the clay tested so far has a very high percentage potassium.

This area has a distinctively high Potassium radiometric signature where the potassium radiometric signature coincides with a flat claypan, the product of internal drainage.

Positive chemistry of highly saline brines confirmed and characterised by elevated concentrations of dissolved potassium, magnesium and sulphates supports the production of Sulphate of Potash to potentially supply the Australian fertiliser market.

SOP is a fertiliser that offers a host of benefits to farmers worldwide, ultimately improving the quality and yield of high value crops – fruits, vegetables, coffee beans, nuts, potatoes, and tobacco.

GPP is pursuing SOP production for the simple reason that it is a premium-priced product that is in short supply. Prices are around $700/tonne, and with the costs involved in developing a mine and mill coming in well below what it would cost to build a competing Muriate of Potash (MOP) mine —MOP being the other main type of potassium fertiliser.

SOP is the premium potassium source that helps plants reach their full yield potential and is less harmful to plant roots and soil bacteria than muriate. And as with GPP’s OHD project, SOP is also a more environmentally friendly fertiliser, when compared to other potassium alternatives. The value of this attribute will only be more highly regarded as we move towards a more environmentally conscious world.

Being a premium product, demand for SOP is quite inelastic, that means that it will continue to sell even when the price rise. However, the same cannot be said for MOP where buyers are much more sensitive to price.

This article outlines the potential on offer for any Australian company than can get produce and commercialise SOP:

In addition to its SOP fertiliser aspirations, GPP is also exploring for lithium in the Northern Territory.

The Northern Territory is home to some large salt water reservoirs, with plenty of testing having already been done by oil and gas producers in the region.

Brines were tested and were found to be saltier than those found in Nevada, but are yet to be tested specifically for lithium...

Seasoned lithium investors would know that Nevada is home to the multi billion capped Albemarle (NYSE: ALB)’s Clayton Valley lithium mine – the only one in North America. GPP is hoping that the salt flats of the Northern Territory can serve up something as equally lithium abundant.

A review of the regional geology covered by GPP’s exploration licences confirm the presence of localised and regional faulting which, when combined with volcanics intersected by previous petroleum wells drilled within the licence area, provides several technical attributes for the potential for Lithium salts to be present. Analysis of brines in the past didn’t test for lithium as it wasn’t a sought after commodity at the time.

If lithium is confirmed, this has the potential to be Australia’s first lithium brine resource.

Brines could be easily obtained from existing oil and gas operators in the region that need to dispose of the water — it would be a win-win for all involved.

However, like its agricultural tech play, this brine play is also in its early stages and there is much more ground to cover. Investors should seek professional financial advice if considering his stock for their portfolio.

Looking ahead

GPP remains well positioned to advance towards commercialisation of OHD bio-stimulant fertiliser and continue its exploration in the Northern Territory and in Guyana.

And with the support of Monash University and from state governments in Victoria and the Northern Territory, plus the Guyana Government, GPP is looking like it could shore up success on all fronts.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.