Fully-Funded ASX Explorer Following in Sandfire’s Footsteps

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Sandfire’s DeGrussa deposit was one of the biggest mineral discoveries of recent times.

As the market realised just how big this discovery was back in 2009, Sandfire’s share price leapt from $0.065 to $4, and then onwards to $8 through 2010:

The past performance of this product is not and should not be taken as an indication of future performance. Caution should be exercised in assessing past performance. This product, like all other financial products, is subject to market forces and unpredictable events that may adversely affect future performance.

With Sandfire now capped at close to a billion dollars, the DeGrussa deposit currently stands at 10.6 million tonnes @ 3.5% copper and 1.3 g/t gold (for contained copper of 376kt and 456koz Au).

It’s been a great result for early stage Sandfire investors who have held over the long term – but the high growth period in that company has now likely past.

Whilst discoveries like DeGrussa do not happen every day, at the Next Mining Boom we are always on the look out for a company that might be sitting on something with similar potential...

A company that presents an opportunity for significant and rapid share price gains as a large mineral resource is proven up and steered into production.

And we think we may have just found one...

With exploration ongoing, this ASX explorer is targeting an initial, economic resource of around 140,000 tonnes of contained copper this year, which will allow it to kick off production and start generating cash flow.

Best of all – Just days ago the company confirmed a $23M funding strategy that will see it through all the way through to maiden JORC resource definition and a Scoping Study.

$9M was committed at a premium to the current share price by deep pocketed funding partners who will end up with a combined 53.8% stake in the company.

These guys are determined to see this little ASX explorer blossom into a producer over the coming months.

A fully underwritten rights issue for eligible shareholders will complete the remaining $14M in funding, which will be issued at a discount to the cornerstone funders $9M commitment.

Once start up production is underway, the company expects to continue increasing its JORC resource and production volumes, via ongoing exploration drilling, backed up by strong geophysics work done to date.

Expanding the resource size shouldn’t be too much of a problem – Over 80% of drillholes to date have been mineralised.

This high level of correlation between the company’s geophysics surveys and actual drilling has made drill-targeting much easier, cheaper and most importantly, more accurate.

Further, this ASX company is anticipated to achieve higher recoveries of copper and gold than Sandfire, at a lower cost of production, with much lower capital expenditure required to take it in to production. Again making it a stand out compared to its peers...

Currently prodding dozens of fully funded diamond drill bits into its ground over the coming months, the company is accelerating its plans to define a maiden JORC resource – so there is plenty of news flow to look forward to.

With a strong management team in place that has operated 8 mines in 6 countries collectively, with 120 years of mining experience, this company has the know-how to find a resource and bring it into production and strong cash flow generation.

This crack mining team is now looking to repeat its past success with our ASX listed company, which, post the funding deal, will be capped at around just $44M, with over $23M cash in the bank...

With the company now fully funded to deliver a significant maiden resource and a finalised Scoping Study over the coming months, we expect it to start popping up on a lot more people’s radars...

One analyst has already ran the numbers on this company, and a preliminary economic assessment gives a glimpse of the potential here – read on to find out just how big this could be.

Introducing:

Geopacific Resources (ASX:GPR) is an emerging metals explorer focusing on its flagship Kou Sa copper/gold project in Cambodia.

Cambodia is one of the last truly unexplored countries in the world, and this company is one of a few first movers there. If all goes to plan, GPR will deliver the country’s very first metals mine, a milestone the Cambodian government is determined to achieve.

GPR’s Kou Sa Project sits to the north of the country, near the borders of Laos and Thailand:

The Kou Sa project is a joint venture between GPR (85%) and the Royal Group (15%) – a Cambodian conglomerate who have the local knowledge and connections to see this project through to production.

We will go into the copper and gold producing potential of GPR’s Kou Sa Project soon, but what’s really crucial to this story is the $23M funding strategy just announced by GPR:

$9M will be raised via two specialist resource funds – Resource Capital Funds (RCF) and Tembo Capital Mining Fund , who will be taking GPR shares at 6 cents a share – GPR is currently trading at just 5.7 cents a share, so it’s sitting cheaper than the current placement.

For its cash, RCF will end up taking a 35.9% stake in GPR, and Tembo will take a 17.9% stake in the company.

These guys are serious players – RCF makes investments exclusively in the mining sector globally with a view of delivering superior returns. Since inception in 1998, RCF has supported 135 mining companies in 44 counties, spanning 29 different commodities. Meanwhile Tembo has a strong technically oriented team of investment and mining finance professionals with a long association in emerging markets.

They are both backing GPR in a big way, and will obviously want to see a strong return on their investment.

Further to the $9M placement, a fully underwritten rights issue for eligible shareholders at an issue price of $0.055 per share will raise an additional $14M – at a discount to both GPR’s current share price and the initial $9M funding.

The offer to eligible shareholders will for 10 new shares for every 21 shares held at the record date. GPR will be announcing the Rights Issue timetable and provide offer documentation in the near future.

Both RCF and Tembo will participate in the rights issue to maintain their positions, as well as sub-underwriting the rights issue.

GPR’s exploration to date has been very encouraging, however it may just be the start – let’s see what the company can deliver with $23M in funding behind it.

In general, the cash will be used to fund the next 12 months of development at Kou Sa, allowing GPR to move the project from exploration to obtaining its maiden JORC resource and scoping study.

As part of that process, GPR will continue its aggressive, multi-rig drilling program and complete two payments to the project vendor.

This is great news for GPR, its shareholders – and Cambodia as well, with the country’s first commercial metals mine now firmly in sight.

Multiple high potential prospects at Kou Sa

So why are such deep pocketed funding partners so interested in GPR?

Well it all comes down the exploration work to date, and the high potential geology GPR seem to be uncovering. Zooming in on the Kou Sa project, it’s possible to see that its comprised of a number of different Prospects, all mapped out below:

Source: Geopacific Resources

GPR have been focussing most of their attention on Prospect 150 to date, sinking the most number of drill holes here. Prospect 150 is expected to be the key contributor to the upcoming maiden JORC resource, and alone may contain 53,000 tonnes of copper equivalent metal – based on a simple interpretation of drill results found to date.

Exploration work only began in late 2013, but already, drill testing has identified zones of high grade mineralisation with drill results including 5m at 128.64 g/t Gold and 4.01% Copper .

Some of the more impressive drill hits at Prospect 150 are marked against the geophysics chargeability map below – you can see the high chargeability zones in red and white:

Source: Geopacific Resources

But Prospect 150 is not all there is to GPR’s Kou Sa Project.

Significant drill results have also been encountered at other targets such as Prospects 100, 117 and 160.

The results and geophysics along the 4km zone between Prospects 128 and 160 are particularly strong and are expected to boost GPR’s maiden JORC resource beyond Prospect 150 alone.

Additional targets including Prospects 170, 180 and 190 have also shown strong preliminary results and could therefore be added to GPR’s total resource.

Now that GPR has a clear funding path going forward, we expect the company to rapidly progress with proving up the other prospects to the level Prospect 150 is at and beyond.

Over 80% of drill holes at Kou Sa have struck mineralisation

GPR is breaking new ground, not only by being one of the first Western explorers looking for metals in Cambodia and potentially THE first to open a commercial mine...

But also because of its supremely accurate geophysics work that has helped GPR drills to find mineralised, metal-rich rock almost every time.

A combination of IP geophysics and geochemistry has allowed GPR to consistently and accurately identify drill targets that yield impressive results, with over 80% of drill holes at Kou Sa finding mineralisation to date.

Source: Geopacific Resources

Having brought in a chargeability geophysics team, GPR is using dipole-dipole Induced Polarisation geophysics (IP) to detect the most likely places for high-grade metals resources including copper, gold and silver.

Below is a map indicating levels of ‘chargeability’ of the ore below the ground. Areas shaded in white/red indicate the highest chargeability, which tends to indicate that highly conductive metals such as gold, silver and copper are sitting close by.

The drill results achieved by GPR to date have proved the accuracy of this technique, consistently achieving significant mineral hits in these areas.

Source: Geopacific Resources

By using IP Geophysics to strategically locate the best exploration sites, GPR’s Prospect locations and areas of high chargeability line-up almost perfectly.

With IP surveying continuing on schedule, the map above gives a clear picture as to where the best drilling locations are based on mineralisation ‘sensed’ below the ground. By using this, GPR is able to select the best areas for both exploration and eventual mining activity. It is also important in predicting the potential upside of the project (size of resource) as well as increasing time and cost efficiencies to achieve a JORC resource.

Following this, it is easy to get a visual indication of the potential scale of the resource, especially by looking at the 4km red/white stretch between Prospect 160 and 128 alone in the above image.

GPR is keen to locate the most optimal areas to base its Scoping Study on and ultimately where to start production – with the help of IP geophysics that process is being made easier, faster and cheaper.

Preliminary economic modelling gives a clue for GPR’s future

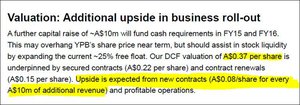

Given the high-potential resource GPR are unveiling, BBY analyst Johannes Faul ran some preliminary calculations on economic modelling for GPR. He arrived at an implied valuation of $0.35/ share for GPR, assuming:

- an estimated mine inventory of 140,000 t Cu equivalent, and;

- ‘starter’ production of 20,000 tonnes Cu equiv per annum, with $80M of capex required to achieve this.

If GPR opt for a potentially lower capex of US$40m for a 650kt plant, this only increases the valuation to $0.41/share . You can see it all laid out in the table below, and the full analyst report can be read here .

Now, these BBY price targets are in stark contrast to GPR’s currently share price of just $0.057/share .

If the BBY price target of $0.41/share is met, that would result in a gain of over 600% from current levels – indicating just how much upside is present in GPR right now.

On the other hand, analyst reports like these are simply one tool we use when making an investment decision – this is a preliminary evaluation and a number of assumptions were made – analysts can sometimes get things wrong.

In any case, we are hoping the company can make some inroads towards that BBY price target soon...

GPR to follow Sandfire’s lead?

GPR plans to kick start production as soon as possible and to do so, the company must obtain a Maiden JORC resource as priority number one. This will hopefully allow them to build up an initial mining inventory of 140,000 tonnes copper equivalent contained metal, with an estimated grade of 3%.

Inspired by Sandfire’s success in recent years, GPR is hoping to tred a similar path.

A market darling, Sandfire is one of the Australian mining industry’s most compelling success stories, making the transition from junior explorer to leading mid-tier producer in just over three years. The company is currently capped at $950M.

To GPR’s advantage is it’s low depth/high-grade discoveries which correspond with lower production costs and lower capital expenditure to get into production.

This certaintly caught our eye, and those of the new funding partners.

GPR has every chance for a substantial rise in valuation as target milestones are met, such as maiden JORC resource, feasbility studies and commencing production.

And it’s coming from a very low valuation base, just the thing we like at the Next Mining Boom .

Outstanding metallurgy points the way for GPR

In terms of recovery, metallurgical studies have only been conducted on GPR’s Prospect 150, and results are impressive with copper recoveries ranging from 96%-99%, gold 88%-94% and silver, 89%-92%:

Source: Geopacific Resources

That kind of high-grade recovery is significantly better than what Sandfire can get out of DeGrussa – again backing up the idea that GPR have a potentially globally significant project on their hands.

Low cost Kou Sa potential

One further aspect of GPR’s profile that interests us is the razor thin cost of production owing to the strong recoveries and low cost base operating out of Cambodia.

GPR are looking to launch an initial high-grade operation at US$0.85/lb of copper equivalent subject to a 650ktpa processing plant. That means that GPR are on track to produce copper equivalent at $2,000 – $3,000 per tonne.

Given current estimates such a plant would take 8 months to build, costing approximately US$40M.

To give some idea, with copper currently fetching over $6,000 per tonne, that equates to over $3,000 margin for GPR for each tonne it produces.

If GPR were to build a fully operational plant and launch a conservative operation of 20,000 tonnes annual production, that would roughly equate to over $60M EBITDA a year...

Sandfire is currently producing 65-68kt Cu and 35-38koz AU with a market cap of around $1bn.

Yet GPR are currently capped at around $44M post funding – with over $23M cash in the bank...

Team and Backers

The company’s recent progress and excellent exploration results are largely attributed to key personnel that joined GPR in 2013.

GPR’s Non-Executive Chairman Milan Jerkovic has over 25 years experience in the mining industry involving resource evaluation, operations, financing, acquisition, project development and general management. Mr. Jerkovic has worked with numerous metals explorers and still serves as Non-Execitive Chairman at Triton Resources Pty Ltd in addition to GPR.

GPR’s Managing Director, Ron Heeks is also a mining veteran with over 30 years experience. Mr. Heeks was a founder of Exploration and Mining Consultants and has had previous experience with WMC, Newcrest, Newmont (US) and many years with RSG Consulting. He was Technical Manager for Straits and then Straits Asia, responsible for the expansion of the Sebuku Coal Project and the restart of the Mt Muro Gold mine which were both in Indonesia. He was also Operations Manager of the Whim Creek SXEW copper mine and technical manager for the Adamus Resources Nzema Gold Mine in Ghana.

Mr Heeks came on board to lead GPR’s exploration in Cambodia since March 2013, following the takeover of Worldwide Mining Projects Ltd.

With a wealth of experience, and decades spent defining and getting resources into production, we believe they are well placed to repeat their formula for success at GPR – they don’t know any other way.

GPR’s Royal Connection

As we mentioned earlier, it’s not just the two wealthy mining funds who have an interest in seeing GPR’s Kou Sa Project move into production.

There is another major player determined to see the project succeed, and that’s the Royal Group – Cambodia’s largest conglomerate.

The Royal Group owns 15% of Kou Sa, and has a 20-year history in attracting international investors. Led by Chairman and CEO, Neak Oknha Kith Meng, the Royal Group is currently working with foreign companies in a number of industries with household names such as ANZ Royal Bank, Samsung, Motorola and Siemens.

Having the Royal Group as GPR’s joint-venture partner gives it priceless local experience and know-how to advance its Kou Sa Project.

By combining a new management team, commercial plan, exploration strategy and IP geophysics, GPR has made rapid and substantial progress towards achieving its Maiden JORC resource.

And with funding now secured and drilling results coming in thick and fast, it wont be long before that Maiden JORC resource is released.

Infrastructure & Operating Environment

As one of only a handful of Western explorers in Cambodia, combined with the country itself not having an established mining sector, the administrative path for GPR is looking rather smooth.

Cambodian government officials are just as keen as GPR to see the company obtain good drilling results, define a JORC resource, conclude scoping studies and move to production.

Cambodia is currently booming with a forecast 6.9% growth rate in 2015, making the country one of the fastest growing countries in the world. The political landscape has been stable for over 25 years with the current government extremely pro-development. In fact, GPR can expect a pro-business corporate tax rate of 30% which is very competitive in the global landscape.

Foreign property rights are now also assured with other explorers facing no entitlement issues regarding their respective exploration sites.

When looking at what other projects are ongoing in the local area close to GPR, its clear that bureaucratic hurdles are unlikely to be an issue for several reasons.

A huge Chinese-backed operation to build a sugar plantation close by, spanning in excess of 10,000 hectares, indicates that environmental permits are not an issue in the area.

In addition to GPR, there are a handful of bold explorers not deterred by the past absence of minerals exploration activity in Cambodia. To companies like GPR, this lack of exploration represents a big opportunity to make a globally significant discovery.

Several other explorers are showing the fruits of their labour via high-grade discoveries, at low-cost and in abundant quantities to sustain long-term mine operations in Cambodia.

Other than GPR, here’s a quick digest of who is doing what in Cambodia:

Renaissance Minerals (ASX:RNS)

Renaissance Minerals is exploring in Cambodia’s Okvau region, 100km to the East of GPR’s Project in Kou Sa, and is finding good grade at low depth, further corrobarating Cambodia’s untapped wealth of resources just below the surface.

In a recent announcement, Renaissance published geochemical and geological mapping test results indicating a resource of 19m @ 4.1g/t gold. The total resource in Okvau is 1.2 million ounces at 2.4g/t gold.

Southern Gold (ASX:SAU)

Southern Gold has prospects spanning 1,500 km 2 in northeast Cambodia where exploration is being done with a partner company, Mekong Minerals. Owing to deep exploration required one their project and the expenses assocaited, Southern Gold is concentrating on operations closer to home in Western Australia. Southern Gold recently annunced a JORC resource of 753,207 tonnes @ 3.75g/t Gold for 90,927 ounces.

Southern Gold is estimating a C1 operating cost of A$1,053 per ounce of gold based on operations in Western Australia.

Angkor Gold Corporation (TSX:ANK)

Last but not least, Canadian explorer Angkor Gold has been active in Cambodia for over 6 years. The company operates in the Ratanakiri Province, far eastern Cambodia. In 2012, Angkor announced the discovery of 16.67g/t gold over 4.05M at its Phum Syarung Prospect.

GPR’s peers in Cambodia show they are not alone in pushing to get mining projects into production in the country, and given the government’s pro mining attitude, it appears that Cambodia may soon be the latest country with a globally significant resource to its name.

A Future Garden of Eden?

Backed by local communtities and the Cambodian government, whilst seeking to establish its first commercial metals mine in the country, there appear to be no major roadblocks to stop GPR from achieving its initial aim of announcing a Maiden JORC Resource at the Kou Sa project over the coming months.

Summing up, all the required fators for a successful gold and copper mining operation in Cambodia are there for GPR:

– high-grade gold and copper deposits close to the surface;

– globally competitive cost of production;

– excellent infrastructure,

– likely absence of administrative delays due to a pro-mining government, and;

– a fully-funded exploration vehicle.

With an experienced management team in the drivers seat, and over 50% of the company to be owned by weathly specialist resource backers, a confluence of positive fators are dovetailing nicely and shaping up to make Cambodia a ‘Garden of Eden’ for GPR – and we will be following this story closely as it unfolds over the coming months.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.