Experts Re-Analyse TMZ’s Historical Silver Assets

Today our silver investment Thomson Resources (ASX:TMZ) has announced a group of experts are re-analysing historical data from its multiple silver projects in order to re-model the silver resource size.

And early indications are that TMZ’s assets look bigger than they used to...

Meanwhile, the silver price continues its strong performance and appears to be tracking with inflation. The precious metal captured everyone's imagination during a “silver squeeze” that came and went back in early 2021.

The silver price has been creeping upwards ever since and is now trading steadily around the price it was at “peak-squeeze”.

The silver price is the highest it's ever been aside from peaks in 1980 and around 2011 and we expect it to keep rising.

Our only investment in silver is in Thomson Resources (ASX:TMZ).

TMZ was acquiring a bunch of historical silver mines and projects before the silver price started running.

TMZ is currently combining all of these nearby projects into one “global resource”, which it wants to be the largest silver resource base on the ASX.

TMZ is targeting a global resource of 100 million ounces of silver.

Today TMZ announced that a group of technical consultants have been engaged to re-analyse all the historical data that came with each acquisition.

The early indications are that new mine modelling, assumptions and a running silver price is going to result in larger silver resources than reported years ago by previous owners.

We first invested in TMZ in December 2020. We like the upside in TMZ compared to its bigger ASX silver peers as it grows its silver resource base.

We are hoping once its silver JORC resource estimates are rolled out, TMZ valuation will start to catch up to its peers.

TMZ’s share price has slowly crept up since an April low of 10c, and is now consolidating around the 13-14c mark.

Based on two recent ASX “change in substantial holder announcements”, Silver Mines Ltd (one of TMZ’s major shareholders) has been reducing its position in TMZ. Our opinion is that this selling is currently keeping a lid on the TMZ share price (despite company progress and positive macro factors). We expect the TMZ price to run up once this selling stops.

We are also waiting for TMZ’s tin drilling assay results, which should be due any week now. The tin price rose to 10 year highs a few weeks ago - read more about TMZ’s tin asset here. Any solid tin intercepts would be welcome, and complement TMZ’s main silver strategy.

TMZ’s Silver Strategy

TMZ has been busy working on its silver strategy over recent months by acquiring a bunch of silver projects in NSW and Queensland.

The next steps for TMZ are to pull them all into one global JORC resource, which will allow the market to easily compare its valuation to other ASX silver peers.

TMZ wants to produce new resource estimates or re-estimates that are JORC 2012 compliant, leveraging existing drilling combined with innovative geological models, metallurgical technologies, mining methodologies and current metal prices.

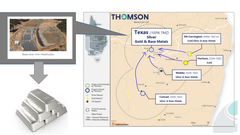

Beyond the new resource calculations, TMZ has devised a “Hub and Spoke” strategy - which involves a central processing facility that receives mined ore from its nearby projects.

Here you can see where TMZ’s projects sit on the map:

TMZ has 100% ownership of the Conrad, Silver Spur, Webbs and Texas projects plus TMZ is earning into the Mt Carrington project in a JV with White Rock Minerals.

TMZ’s first new JORC resource to be delivered by next quarter

TMZ has hired an external consultant to undertake systematic resource re-estimations for all of its newly acquired silver projects.

TMZ is going to deliver its first JORC resource estimate next quarter, starting with its Conrad Project.

TMZ’s Conrad silver project is historically the largest silver producer in the NSW section of the New England Fold Belt, producing 3.5 million ounces of silver at a grade of 600 g/tonne.

TMZ is running some 3D lode models that suggest that significantly more tonnes of mineralisation will be considered in the new resource estimate.

Together with its technical consultant, TMZ has identified significant exploration potential based on new modelling based on true lode width versus the previously artificially constrained mining widths.

[NEW] Here are TMZ’s Company Milestones as we see them

Here is our milestone summary and what TMZ has achieved since our last commentary .

This is a new feature we are working on and will soon be rolled out to all portfolio companies, please reply to this email with any feedback/suggestions.

[NEW] Here is our TMZ investment strategy

Here are our investment milestones for TMZ.

Our investment milestones are a new feature we are rolling out to all portfolio company pages. Again, please reply to this email with any feedback/suggestions.

Here is our past commentary on TMZ

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.