EUR is Drilling Right Now: Updated Resource Due in Coming Weeks

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

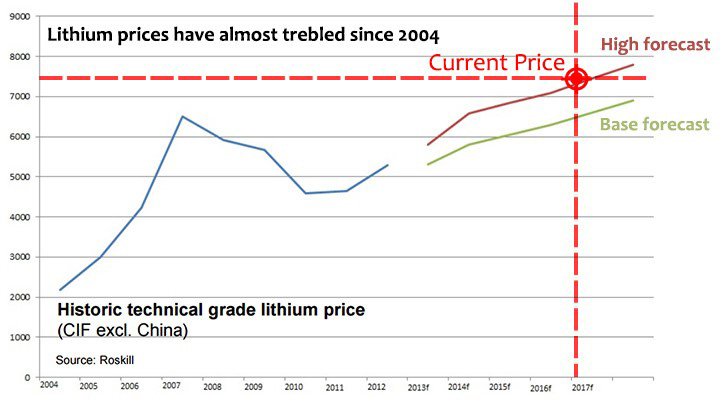

European Lithium (ASX:EUR) holds an advanced lithium resource in Europe – and is one stock for investors to consider who are looking for leverage to the lithium theme, with an already well advanced resource.

EUR’s JORC compliant resource in Austria currently stands at 3.7 mt inferred at 1.5% Li 2 O at a 0.75% Li 2 O cut off, and the company is looking to expand this considerably over the coming weeks.

EUR’s current aim is to increase this resource by drilling and extending its “Zone 1” resource via the drilling of four deep diamond holes, between 340m and 500m in depth, for a total of 1,760m.

From there it is also conducting exploration in “Zone 2” – by drilling nine holes between 150-250m in depth, for a total of 1,750m. This exploratory drilling gives plenty of blue sky appeal for EUR.

At the same time, like all speculative mining stocks, there is no guarantee an investment will turn out successful. Seek professional financial advice before investing.

Importantly, the short timelines between exploration activity and the imminent increase in resource should provide management with a strong guide regarding its decision to mine.

These will be vital catalysts for this stock, and with a healthy cash balance, EUR may be one to keep an eye on over the coming weeks as drilling results start coming through:

FWB: PF8

European Lithium Ltd (ASX:EUR; FWB: PF8) recently re-listed on the ASX via a reverse take over of Payne’s Find Gold.

Following a $6M capital raise, it remains well funded to progress with its exploration and fast track production over the near term, and likely get it all the way to a Pre-Feasibility Study by mid next year.

In order to garner more interest closer to where its resource lies, EUR has listed on the Frankfurt Stock Exchange, under the stock code “PF8”, which will no doubt raise its profile in Europe and assist with market liquidity.

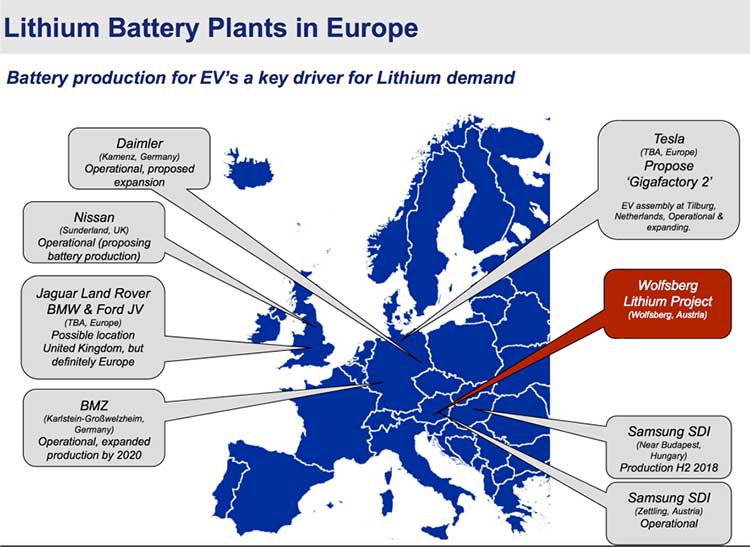

As can be seen below, mainland Europe is one of the hottest regions for large scale lithium projects, arguably driven by the size and quality of the resources, as well as close proximity to industrial markets where demand for lithium and associated by-products is particularly strong.

As highlighted towards the end of September in the Next Mining Boom ( The Surge in Euro Battery Plants Begins: ASX Stock in the Box Seat for Lithium Supply ), EUR is an advanced stage explorer/emerging producer of lithium, ideally located in Austria where it has the capacity to supply burgeoning industrial centres in Germany, as well as EV battery gigafactories which are being considered in nearby regions.

A series of new battery plants have been announced for production in Europe, and it is these kinds of lithium buyers that EUR will be talking to as it considers offtake partners.

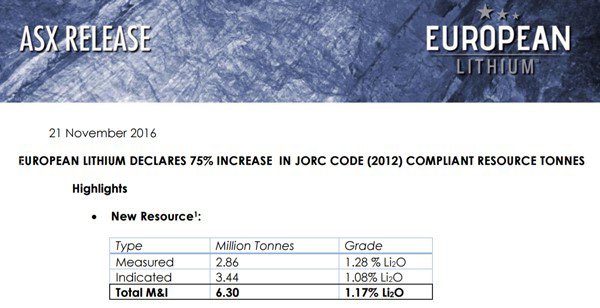

As we mentioned above, EUR’s Wolfsberg project isn’t a drill and hope greenfield operation, it has an established inferred resource of 3.7 million tonnes grading 1.5% lithium oxide which is in the process of being reclassified to meet JORC 2012 reporting standards.

EUR has made significant progress in terms of achieving an upgraded resource model, and we would expect this to be announced in the coming days given previous timelines given by the company.

EUR recently completed a program of twin hole drilling and repeat channel sampling to verify the original resource data provided by Minerex (the discoverer of the Wolfsberg project). Drill holes have been logged and core and channel samples are being assayed by ALS, and these results have the potential to drive further interest in the stock.

There is also the potential for further catalysts in the first quarter of 2017 given current drilling of the established resource at Zone 1 and the potential to uncover new mineralisation in Zone 2 where a drilling permit has been received to immediately commence exploration work.

The following outlines the company’s key objectives that underpin its surface exploration program with the map demonstrating the likelihood of adjacent mineralisation in zone.

Zone 2 holds blue sky appeal – how big could EUR’s resource get?

EUR has good reason to believe that drilling in Zone 2 will yield commercial quantities of lithium.

Not only is there a sound geological basis for postulating the presence of lithium bearing mineralisation, the chief geologist (Dr Richard God) from the engineering company, Minerex which discovered the Wolfsberg project holds that view and he is now EUR’s geological advisor.

It is his interpretation that the pegmatite veins extend down dip to unknown depths, noting one of Minerex’s boreholes extended to 450 metres down dip intersecting pegmatite veins. God is of the view that pegmatites were intruded into the host rocks and that the anticline was formed by a later folding event.

In such a situation, the presence of lithium bearing veins would be expected to continue into the southern limb of the anticline (Zone 2). Providing further support is the fact that in 2012 surface mapping identified many lithium bearing pegmatite boulders exposed on surface on the southern limb, and limited drilling intersected lithium bearing pegmatite veins and proved the geological interpretation.

However, this is still a relatively early stage mining project, with a number of hurdles to jump through before the company is generating revenue. Invest with caution and keep your own personal circumstances and risk profile in mind if considering an investment.

Watch this space

As can be seen from the following timeline, the all-important Pre-Feasibility Study will be finished as early as the first half of 2017 and by the first half of 2018 the company will be in a position to sign off on the project, potentially bringing production from this project to market quicker than many of its peers.

Consequently, EUR shapes up as a news driven story.

While the company is only in its infancy as a listed entity, it has an established asset with a proven resource and the potential for a relatively quick expansion of that resource, suggesting it could be valued more in line with relatively advanced players in the sector.

If considering an investment, it’s worth reminding again that this is a speculative mining stock, and success is no guarantee.

We will be watching EUR closely over the coming days and weeks, and with a bigger lithium resource to its name, it may be in line for a re-rate, thus catching up to its larger lithium peers...

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.