BGS Has One of the Highest Grade Hard Rock Lithium Deposits in the World

Published 14-NOV-2016 10:30 A.M.

|

13 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

The Next Mining Boom presents this information for the use of readers in their decision to engage with this product. Please be aware that this is a very high risk product. We stress that this article should only be used as one part of this decision making process. You need to fully inform yourself of all factors and information relating to this product before engaging with it.

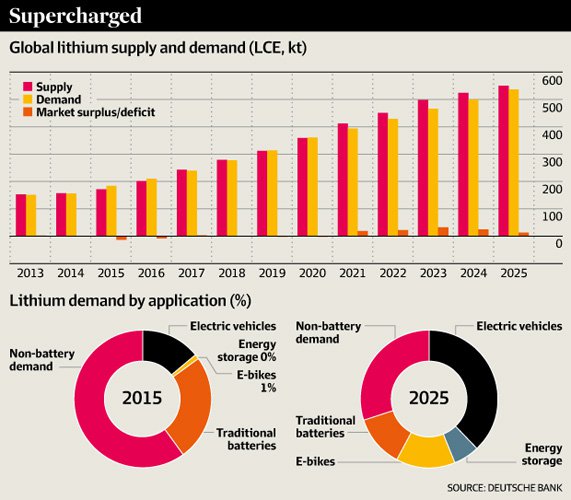

In the last 12 months, lithium and gold seem to have taken the mantle as the dynamic duo – the Batman and Robin – of the commodity sector.

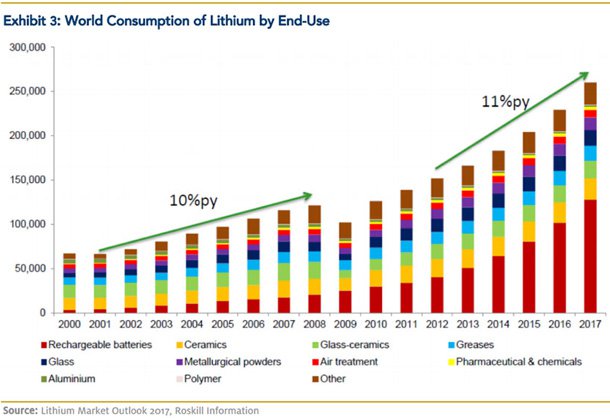

While demand continues to surge for lithium on the back of the new energy storage boom led by Tesla, Samsung and many other major battery manufacturers who are desperate to shore up lithium supply, gold has also been an investor favourite of late.

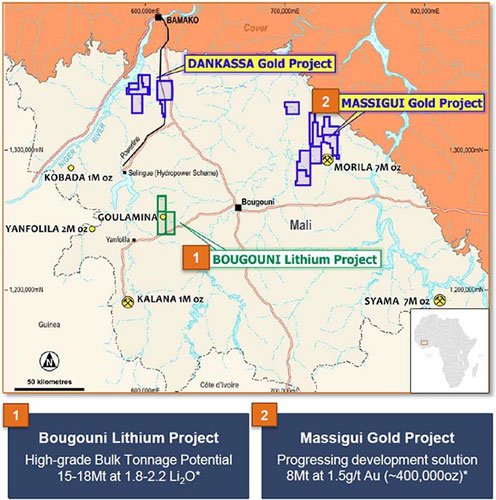

One cashed-up ASX explorer with stakes in both these commodities is Birimian Limited (ASX: BGS), which has its interests in the west African nation of Mali, with a particular focus on lithium.

It has been some time since we caught up with BGS. In July we notified readers that the company was well on its way to defining its Maiden Resource at its 100% owned Bougouni Lithium Project and publishing a Scoping Study by the end of 2016.

Since then, BGS has delivered on its first promise and in late October reported a Maiden JORC-compliant mineral resource estimate for the Goulamina deposit at Bougouni.

Without going into figures just yet, the results position the deposit as one of the highest grade, hard rock lithium deposits held by an ASX listed company in the world today.

Now, before we go too far, it should be noted that for political and social reasons, this is a very high-risk stock. Getting mining projects up and running in countries such as Mali is no simple feat, and there may be challenges ahead.

Recent results also put BGS in a strong position to advance its Scoping Study to define the key parameters that will underpin the project Feasibility Study and first Ore Reserve Estimate, and this is expected to be completed by year’s end.

BGS is confident it can expand its maiden resource and is set for additional drilling which will commence in late November, just weeks from now.

These strong results feed nicely into the current lithium zeitgeist. Indeed BGS has a big ambition: to be a major player in lithium-led energy reform.

So not only is it drilling to meet its on-field milestones, it is also working out potential sales deals in the background.

The recent Memorandum of Understanding BGS has signed with the multi-billion dollar Chinese company Tongdow Group provides scope for off-take agreements, mine development and spot market pricing of BGS’ lithium products.

Tongdow Group, along with Shanghai Metal Market, are the two largest commodity trading platforms in China, with Tongdow working to create a global lithium spot price index.

China is an important market for BGS as ongoing lithium carbonate shortages are driving up demand. Tongdow’s clients in particular have immediate demand for spodumene.

So this is a big agreement for BGS, but from what we can gather, there has been several other interested partners keen on helping BGS define its path to commercialisation.

BGS is also marching towards commercialisation of its gold resource having just signed an option agreement with Morilla mine operator Randgold , a $6.4BN capped company to provide a potential low risk and low cost processing solution for its Massigui gold deposits, also situated in Mali.

The agreement could lead to the commercialisation of several of its gold deposits in the region. Under the terms of the agreement Morilla has been granted a six month option to acquire an Area of Interest within the project and upon exercise would pay BGS $1M, with BGS retaining a royalty of up to 4% of gold produced from that Area.

That’s a pretty good deal in anyone’s estimation.

So as it moves towards commercialisation in both its lithium and gold interests, BGS is putting itself in a serious position to make a substantial contribution in two leading markets.

With that in mind, let’s catch up with...

It has been some months since we last turned our attention to Birimian Limited (ASX: BGS).

We first covered BGS back in April 2016 in the article Lithium Race Expands to Africa: ASX Explorer Secures High Grade Lithium Asset . Between that article and our coverage in July in the article Lithium Drilling Continues for BGS: Exceeding Expectations , BGS was up as high as 98% having raised raise its valuation by as much as 670% since the start of 2016. Overall, since we initiated coverage, BGS has been up over 120%:

The past performance of this product is not and should not be taken as an indication of future performance. Caution should be exercised in assessing past performance. This product, like all other financial products, is subject to market forces and unpredictable events that may adversely affect future performance.

Although the stock has come back slightly, you get a sense that if positive news flow continues BGS could prolong its revaluation.

Certainly research analyst Trent Barnett of Hartleys is of this opinion. Barnett has put a preliminary valuation of $0.68 on the stock, which is a 115% premium from today’s price:

At the same time, it is worth reminding that analyst predictions are no guarantee to come to fruition. Don’t invest on the basis of an analyst price target alone, make a decision based on a range of factors and sources.

With a current market cap of $57M, BGS is intent on catching its larger peers including the $655M Galaxy Resources (ASX:GXY), $692M Pilbara Minerals (ASX:PLS) and the $184M Altura Mining (ASX:AJM).

This may not be beyond the realms of possibility, given the JORC resource results recently announced by BGS.

This JORC is no joke

BGS has 100% ownership of the highest grade lithium resource of significant size held by an ASX listed company today – the Goulamina deposit at its Bougouni Lithium Project.

That in itself is a milestone. However, this could be just the beginning, here as there is potential for expansion.

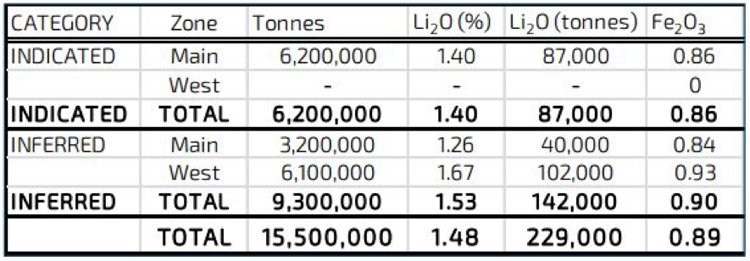

BGS’ maiden JORC resource is 15.5MT @ 1.48% Li 2 0 for 229,000 tonnes of contained Li 2 0.

The results position BGS to now rapidly advance its scoping study and define the parameters that underpin the project Feasibility Study and first Ore Reserve Estimate.

There is potential for this resource to grow over time, as the deposit is open along strike and at depth – and that is what BGS will be intent on making happen.

BGS will now commence further drilling later this month at the highly prospective, recently discovered West Zone of Goulamina, where high grade mineralisation remains open along strike, near surface and at depth.

The resource grade of 1.67% Li 2 0 in this zone has enthused BGS, which is in a strong financial position and cash in the bank to fund its development activities.

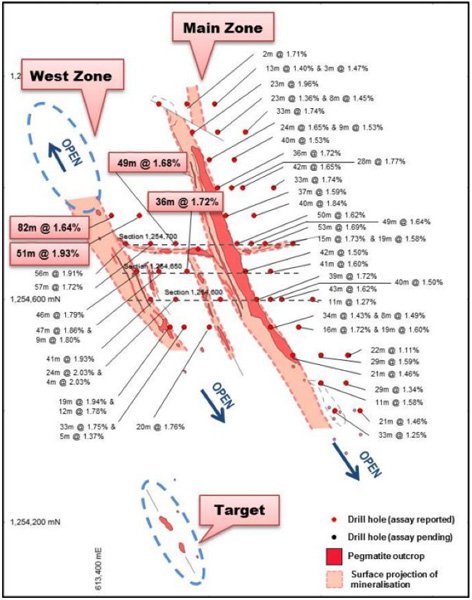

In total 50 holes for 5,179m of drilling informed the resource model, with the majority of drilling taking place at a 50m x 50m and 50m x 25m spacing on the main pegmatite zone, which you can see on the Goulamina Deposit map below, which also indicates lithium pegmatite with drill hole locations and reported drill intersections.

The Resource estimate was carried out by Cube Consulting, with Resources estimated to Indicated and Inferred confidence levels as you can see below.

Interestingly, 40% of the Mineral Resource already lies in the Indicated category.

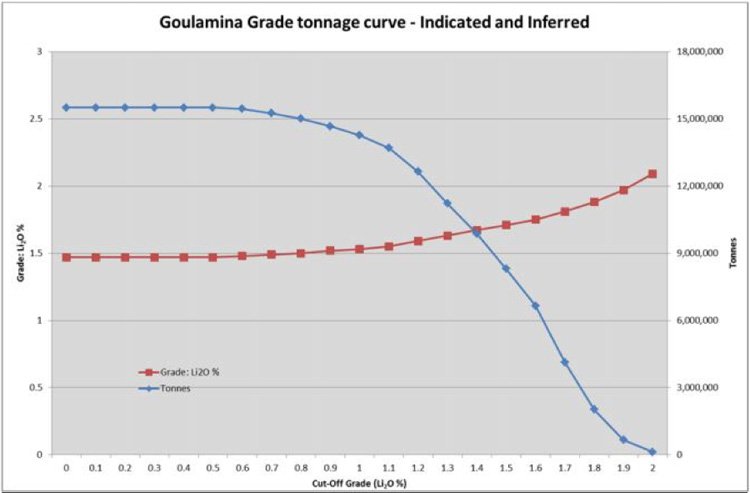

Have a look at this graph and you’ll gain a better understanding of Indicated and Inferred Grade Tonnage:

What this indicates is that the tonnages of mineralisation do not vary substantially, confirming the robust grade and good continuity of the modelled mineralisation. It also shows that substantial tonnages of high grade (<1.5%Li 2 0) mineralisation have been modelled within the resource.

Of further importance is that the very high grade material occurs in outcrop and near surface which could enable BGS to exploit ore early in the life of the project. This is significant because it would give BGS rapid payback and enhanced cash flow.

However, this is still an early stage play and caution is advised if considering an investment in this stock. The company is some time away from first revenues.

With its project in close proximity to vital infrastructure, high grade lithium exceeding early expectations and the scope to expand, BGS well may be onto something substantial.

Time will tell, but with upcoming catalysts including scoping study finalisation and further drilling to be commenced in the near term, we are expecting to see plenty of newsflow coming from BGS.

Looking forward at Bougouni

With results so pleasing for BGS and the existence of a resource extension, BGS is conducting further drilling to investigate the extensions to mineralisation during the next phase infill and step-out drilling program.

It is expected that approximately 10,000m of drilling will be undertaken to expand and upgrade resource classifications and facilitate eventual ore estimation.

Further, BGS is also rapidly advancing its Scoping Study to define inputs into the project Feasibility Study.

Como Engineers will help BGS determine key processing parameters and capital costs.

BGS is in good hands with Como recently taking care of the Definitive Feasibility Study for Pilbara Minerals’ Pilgangoora Lithium Project.

Finally BGS has engaged Digby Wells to determine and prepare the Terms of Reference for the Environmental and Social Impact Assessment (ESIA) which will be utilised to formulate an appropriate plan for completion of necessary base line studies and submission of the formal project ESIA for mine permitting.

It is all systems go now for BGS, but one further piece of the puzzle could really give it significant uplift.

Getting into China

Tongdow Group is a multibillion dollar Chinese company that is one of the top two largest commodity trading platforms and high tech logistics platforms in China, trading up to US$150M daily.

The company is also working to create a global lithium spot price index and intends to trade lithium products to meet growing domestic spot demand.

Which is where BGS come in to play.

A strategic Memorandum of Understanding (MoU) signed between BGS and Tongdow seems to have a lot of people interested, including major Australian media .

The agreement between the two companies is of mutual benefit.

For BGS, the most significant advantage is a potential offtake agreement. However, it doesn’t end there. Tongdow will also be able to help with mine development, while Tongdow could achieve spot market pricing for BGS’ lithium products.

BGS sees the agreement as validating its high grade bulk tonnage, whilst giving it the flexibility to operate and distribute its product under long term and spot market pricing.

BGS will be able to leverage Tongdow’s experience and broad resources to accelerate the date it could bring Bougouni into production.

Meanwhile both companies will work to establish commercial terms for offtake of spodumene concentrate from the Bougouni Project.

While the Tongdow deal is a milestone, it has also opened the door for discussions with other potential Chinese MoU partners.

There are several reasons China is interested, most notably because of ongoing shortages of lithium carbonate in China, which has been driven by a surge in sales volume of new energy vehicles in the country.

China’s electric car sales increased 223% in 2015 and are estimated to be larger this year.

According to CleanTechnica , altogether, 2015 saw ~188,700 NEVs sold in China — a roughly 223% year-on-year increase over sales in 2014. The market share held by NEVs for the full year was around 0.9%. In addition to these impressive numbers for the consumer NEV market, there were around 124,000 electric buses + commercial vehicles deployed in the country in 2015.

So it is understandable that BGS will be looking to firm up its deal with Tongdow, whilst seeking out other partnerships. The lithium market and how it feeds into the new energy paradigm, will be of enormous interest in the coming years and BGS wants to be at the forefront of production and subsequent distribution.

It’s not only lithium...

While it was in the mood to sign large agreements that could facilitate its commercial ambitions, BGS looked into what it could do with its gold deposit and found that the Societe de Mines de Morila, otherwise known as Morila would be a willing partner.

The Morila Gold Mine is managed by Societe de Mines De Morila is a joint venture between Randgold Resources, Anglogold Ashanti and the Republic of Mali.

As such, the two came together in an attempt to commercialise several of BGS’ gold deposits within its Massigui Gold Project in Southern Mali.

The agreement enables BGS to focus on lithium, whilst Morila takes a six month option to acquire an Area of Interest within the Project. If Morila takes up the option, it will make a payment of $1M and give BGS up to a 4% royalty of any gold produced.

However, as with any early stage resource stock, BGS’ mining success is not a sure thing, and we encourage you to do your own research and seek professional financial advice before investing.

The proximity of BGS Project to Morila’s is what is driving the deal, as Massigui surrounds the Morila mine lease on three sides and covers strike extensions of the highly prospective geological sequence that hosts 7Moz Morila Gold Deposit. The map below indicates just how intertwined these two companies are. The Randgold Morila Area of Interest is marked in red.

The Area of Interest comprises 11km 2 and covers the gold deposits at Nitola and Viper. The balance of the project area is controlled by BGS and the company is maintaining control of its highly prospective areas including its Koting Prospect.

While we’re mentioning Nitola and Viper, BGS’ targeted drilling program has already resulted in significant gold discoveries and based on current drilling an Exploration Target is estimated in the range of four million to six million tonnes grading approximately 1.2-1.8g/t Au.

Further drilling is required, but you can see why Morila is so interested and why it is willing to put cash in BGS’ bank account.

All in all, this is a win-win deal that could help BGS further facilitate its overall aims – most importantly its lithium ambitions.

The final word

With money in the bank and a potential gold deal that could further fill its coffers, BGS has really positioned itself well for a major crack at both the lithium and gold markets, which are currently seeing a lot of commercial interest.

As BGS is sitting on the highest grade lithium resource of significant size held by any company on the ASX, it was bound to attract attention and that has come in the form of a billion dollar Chinese partner, with whom it could potentially capture a significant amount of the Chinese lithium market.

Offtake and sales deals could be on the cards for BGS and it is now marching towards commercialisation in no uncertain terms.

It also has an eye on gold commercialisation, making this $57M company one to watch, particularly as it ramps up operations in the new year.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.