Australia’s Only Pure Play Bauxite Producer Capitalising on China Demand

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

It has been a mixed year for metals with those in the precious category claiming most of the limelight.

This has been particularly true of gold over the last three months as it surged from sub-US$1,400/oz to around US$1,560/oz — levels it hadn’t traded at since 2013. On the other hand, base metals and battery metals have taken a backseat.

So if gold, silver and the resurgent nickel are looking toppy and the hype has come out of lithium, cobalt and vanadium, where does one look for the next big thing?

One of the few commodities not to experience wild swings over the last decade is bauxite, and as the key component in the manufacturing of aluminium its outlook remains strong.

Granted, it hasn’t displayed the heady peaks of some other metals, but neither has it experienced the significant troughs incurred by precious, base, and what we refer today as battery metals.

Today’s company presents a unique opportunity for ASX investors as it is the only pure play bauxite producer of any size in Australia exposed to the China market. Its bauxite producing mine in Queensland’s Cape York is hitting its targets and is on track to meet its production and shipping guidance for 2019. The mine recently lifted its reserves and a stage 2 mine expansion DFS is due shortly that will set the mine up for next 15 years.

Introducing,

Share Price: $0.12 (as at 9 October)

Market Capitalisation: $159.3 million

Here’s why I like Metro:

Metro is a unique bauxite producer

Though Australia is a large producer of bauxite, there are only a few mines. For this reason, the commodity receives very little commentary compared with base and precious metals.

However, one Australian company is looking to give bauxite its own voice.

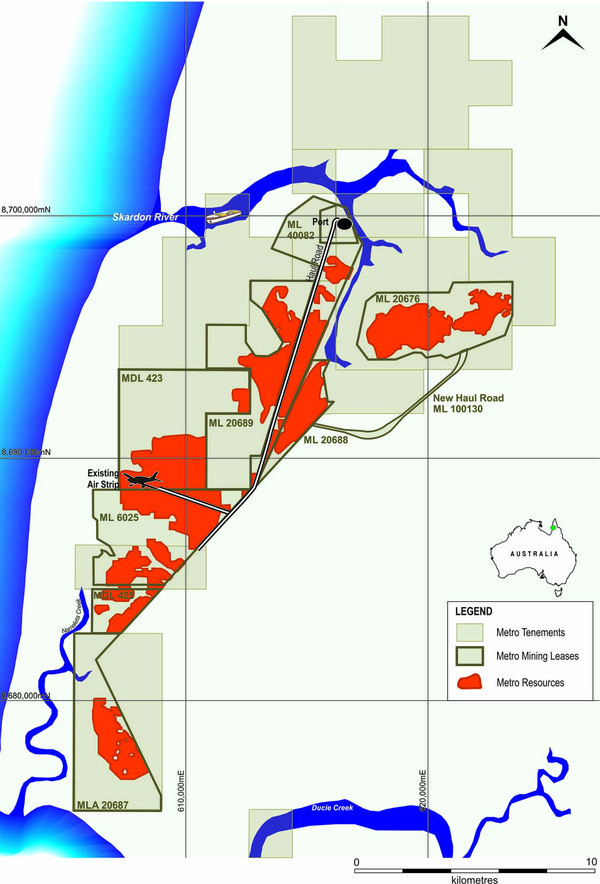

Metro Mining (ASX:MMI) is the only pure play bauxite producer in Australia with ties to China. The company’s 100% owned Bauxite Hills Mine is located in Cape York, Queensland, where it commenced mining in April 2018.

In the following video MMI managing director Simon Finnis speaks with Morgan Senior Analyst about the bauxite market and the work being done at the Bauxite Hills Mine.

The project has contained mineral reserves of 109.5Mt and resources of 138.2Mt and a 19 year mine life.

Metro tends to fly under the radar, arguably because its key commodity is bauxite, but also because it has a sub-$200 million market cap.

However, the company has everything investors are looking for in a mining group — a long life mine, established production, offtake agreements in place, robust margins, profitability and the scope to improve its already strong margins should the anticipated doubling in production occur over the next few years.

Also, this unique Australian company has and will continue to benefit from the depreciation in the Australian dollar.

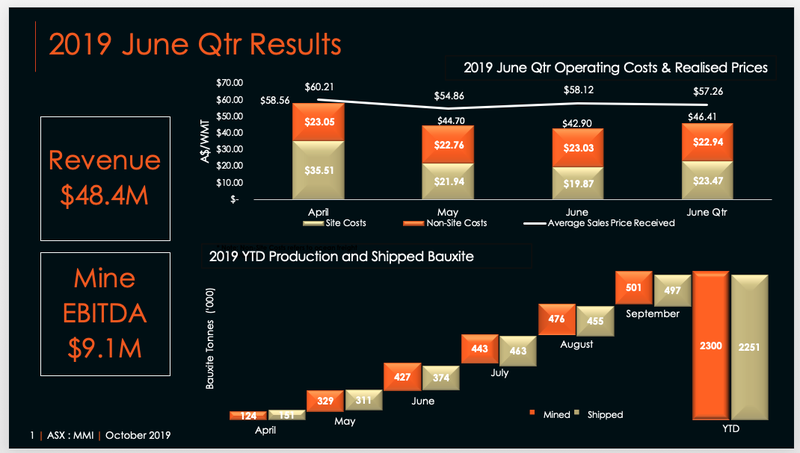

As indicated below, in the June quarter the average price it received for bauxite bound for China was $57.26 per wet metric tonne (WMT).

During this period the Australian dollar traded as high as US$0.71, but in the September quarter it has fallen dramatically, hitting a recent low of approximately US$0.67.

To illustrate the impact of currency fluctuations, if recent rates were applied to June quarter prices that would equate to an increase of approximately $3.00 per WMT.

While this may seem a fairly nominal difference, when you apply it on an annualised basis to Metro’s export volumes of around 3.5 million tonnes, it potentially adds more than $10 million to underlying earnings.

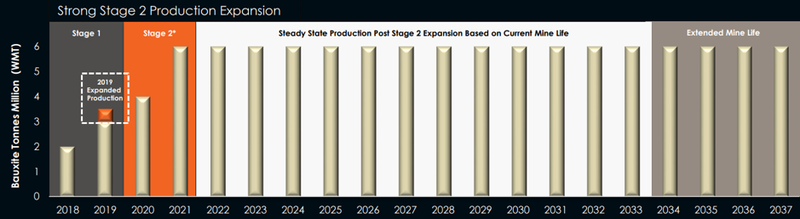

Potential to increase production to 6 million tonnes

Take a close look at Metro and you will see a company with both compelling financial investment metrics and a management team that has consistently met and/or exceeded key milestones and projections in developing a highly efficient production and export operation. It’s building a financially robust enterprise with strong earnings and the cash flow to self-fund near term growth.

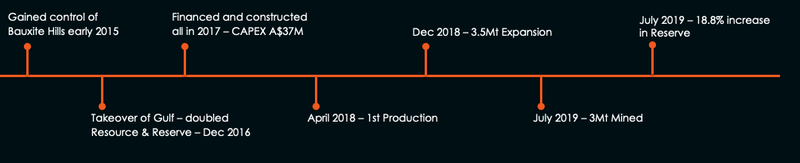

Firstly, let’s examine how quickly management transformed the Bauxite Hills project from acquisition in 2015 to first production in 2018.

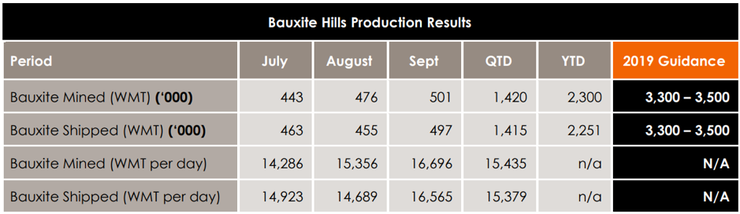

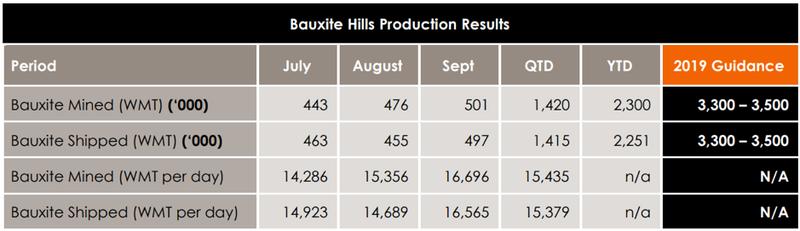

Building on its operating experience and the improved work systems which have enhanced productivity, Metro recorded another productive month in September, producing 501,000 WMT, taking year-to-date production to more than 2.3 million WMT.

This provides management with confidence that it will achieve its production and shipping targets for the year — in a range of between 3.3 and 3.5 million WMT.

With a definitive feasibility study (DFS) largely complete and due this month, Metro could well be primed to commence stage II of its expansion that could see production increase substantially to approximately 6 million tonnes per annum.

The company has sufficient reserves to support a mine life out to 2037.

DFS likely to restore oversold share price

While frustrating for Metro’s management and shareholders there was a sustained decline in the company’s share price over the last 18 months which could be attributed to three factors, one of which is particularly important to understand in terms of the group’s ongoing operating program.

However, dealing first with matters that are beyond management’s control, selling by one of the funds that had taken a position in the company created downward momentum.

The company then had to deal with tax-loss selling in the lead into June 30, 2018 and June 30, 2019, the culmination of which saw the company’s shares roughly halve since about April last year.

This was in a period when Metro was transitioning from development to production, reflected in the group’s increased costs and nominal revenues in 2018.

Further, it has taken some time for the market to absorb the fact that Metro generates 12 months of revenues over a nine-month period between March and December as the wet/monsoon season typically occurs between January and March. This normally results in a significant second half skew (6 months to December 31) in production, revenues and earnings.

So predictable is the wet season that both politicians and entrepreneurs have considered building dams in far North Queensland to harness the water that is dumped in the area every year.

Consequently, Metro shuts down its operations over this period. While the company is able to scale back operations and some overheads, it isn’t just a matter of walking away from the site and not incurring any costs.

This being the case, it could be argued that some investors examine the group’s results for the six months to June 30 in isolation rather than looking at the 12 month picture.

For example, 880,000 wet metric tonnes of bauxite was mined between April and June this year, generating revenues of $48.4 million and EBITDA of $9.1 million. This compared to zero production between January and March.

To illustrate how Metro is still growing and refining its operations, production for the September quarter was just over 1.4 million WMT, more than 500,000 WMT more production than in the three months to June 30.

September, in itself, has been an excellent month. Production levels across all areas are the strongest since operations commenced.

Here is a look at the September numbers again, as compared to the rest of the quarter:

Consequently, we can expect a cracking quarterly performance for the three months to September 30 2019, positioning the company to meet the aforementioned production and shipping guidance.

Metro Mining Managing Director and Chief Executive Officer, Simon Finnis, said of the results, “The mining and shipping results continue to improve as we build our operational knowledge and experience. Recent incremental changes to our haulage, loading and transhipping systems are yielding positive results and reflect the commitment and dedication of the entire team, particularly in identifying areas of process improvement. The mine is ideally placed to maintain current levels for the remainder of the operating year and is on track to meet the production and shipping guidance of 3.3-3.5M WMT for 2019.”

What the brokers are saying

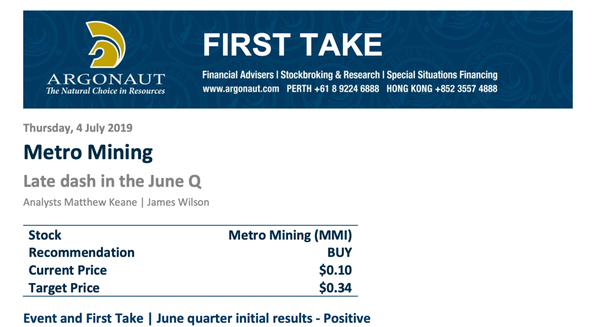

A July research note from Argonaut saw the broker assign a share price target of 34 cents to Metro, implying upside of more than 150% to the company’s recent trading range of 11 to 13 cents.

Predictions for 2020 by Argonaut analysts were based on production of 3.8 million tonnes at costs broadly in line with the company working at capacity for the full nine months and look to be a reasonable measure of Metro’s financial metrics.

Management recently indicated that June costs of $42.90/WMT should be fairly indicative of what can be achieved between July and December when the mine is operating at capacity.

While Argonaut’s price target of 34 cents is a substantial premium to the current share price, it appears easily justified on a price-earnings basis.

The group’s fiscal 2020 PE multiple of about 6 based on consensus forecasts doesn’t reflect the quality of its earnings, the strong likelihood of exponential growth due to a near doubling in capacity and management’s unerring ability to deliver on time/on budget for big projects such as the anticipated expansion.

Bauxite Hills ready for expansion

Importantly, increased production will result in improved margins, enhancing the bottom line as the company grows.

Much of the existing plant and infrastructure at Bauxite Hills has been designed to accommodate higher operating levels so the initiatives to incrementally increase production are easy to implement.

Many of these initiatives were part of the long-term Stage 2 expansion to steady state production of 6.0 million WMT per annum.

The company will see a significant uptick in operating cash flow, providing it with the balance sheet capacity to expand production should the DFS supports such an initiative.

It is worth noting that the company is already in a robust financial position, and with cash of approximately $11.35 million as at 30 June, 2019 it has a solid base to build on.

Robust Bauxite market for Aussie miners

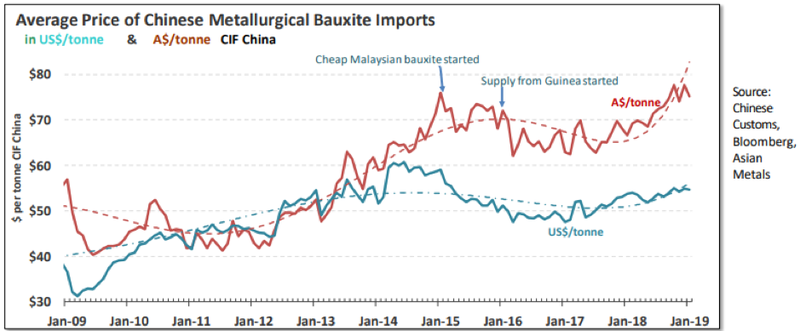

Just as Australian miners of other commodities are benefiting from the depreciation of the Australian dollar against the US dollar, the Australian dollar bauxite price for local miners is extremely robust.

Over the last 10 years, Australian bauxite has generally fetched prices in a range between US$45 per tonne (CIF China) and US$55 per tonne.

As you can see below, the upward trajectory in the Australian dollar bauxite price over the last two years is far steeper than the US denominated price per tonne.

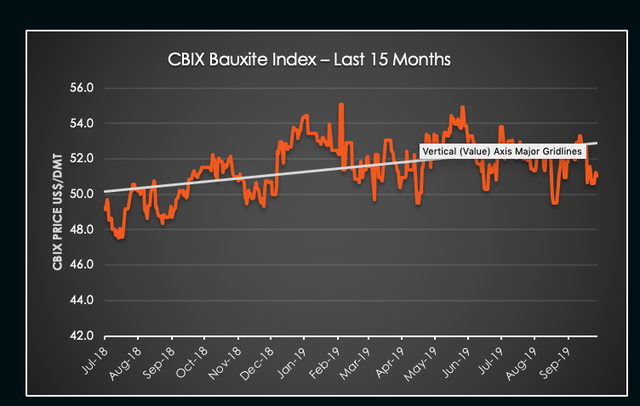

The following shows the more recent trend in the broader bauxite price since mid-2018.

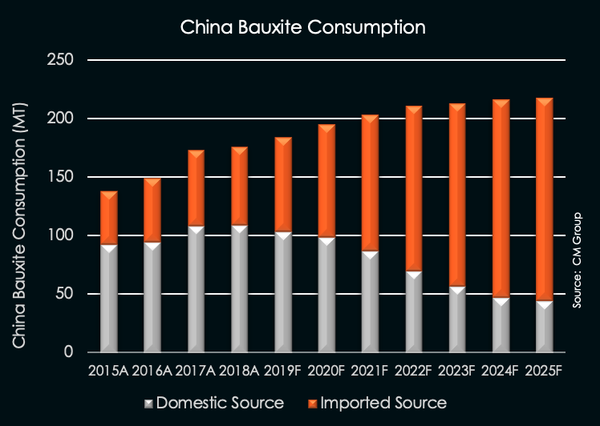

Also, note the bar graph that shows China’s forecast bauxite consumption, in particular its increasingly heavy reliance on imported bauxite due to a sharp decline in domestic supply.

There is strong demand for Metro’s bauxite from Chinese inland Refineries as domestic bauxite supply has been hindered by resource depletion, recent mine closures and environmental audits.

As well as many of the mines in China reaching the end of their life, a number have had to be shut down for environmental reasons leading to a significant decline in domestic production.

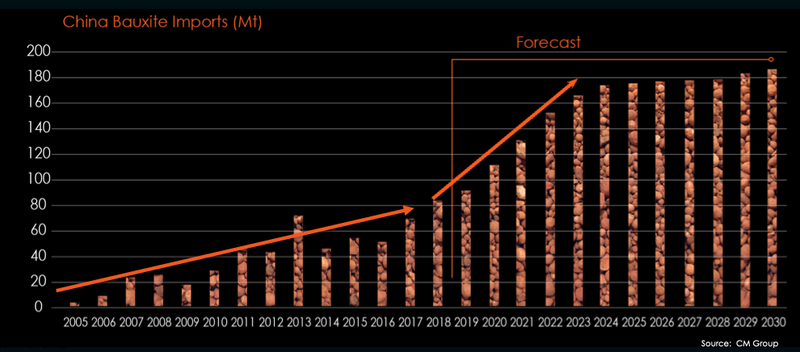

With regards to the industry outlook, the following indicates that Metro would be bringing its upgraded facilities into production at a time when bauxite demand from China is accelerating sharply.

While Metro continue to engage with potential new customers, the company has already shipped to six different Chinese refineries.

Importantly it also has China-based Xinfa as a major offtake partner.

Argonaut recently expressed its upbeat take on the seaborne bauxite market with analyst Matthew Keane saying, “Alumina prices in northern China recently reached multi-month highs as the environmental shutdowns of domestic bauxite mining in the Shanxi Province has led to a critical shortage of feedstock.

“Bauxite prices stand to benefit from increasing seaborne demand which is replacing domestic supply. This is lifting Metro’s average realised bauxite price.’’

Consequently, Metro’s positive operational position and production expansion prospects provide excellent leverage to a sweet spot in the bauxite industry.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.