ASX Miner Snags Ultra High Grade Anthracite Project in South Africa

Published 08-MAY-2017 10:49 A.M.

|

14 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

If you have never heard of ‘anthracite’ before, fret not.

It’s just another name for the highest grade of coal possible – i.e. coal with carbon content in excess of 70%. Such coal is primarily used for high-end industrial purposes such as steelmaking and alloys.

The company we’ve reeled in for you on this occasion, just happens to have a 10Mt stockpile of anthracite already in its locker at its flagship Riversdale Anthracite Colliery Project in KwaZulu-Natal, South Africa, with more to come it would seem, when the next drilling campaign brings another seam into the equation.

This company has a mining right to commence mining operations –after the $3.7 million acquisition of the Project from mining giant Rio Tinto – and has just released a PFS ahead of schedule to the market, with a BFS slated for completion by year end. This should include maiden reserves and a likely increase in resources.

Today’s company is working up a geologically-rich ‘anthracite’ resource that could propel its AU$8 million micro-cap to the heights of its chrome-tinted market niche, currently saturated with opportunity.

This company’s management team is the same that founded Riversdale Mining – later acquired for $3.9BN by Rio Tinto.

And now it’s aiming to build some serious value into these South African anthracite assets.

However, the company is an early stage company and investors should seek professional financial advice if considering this stock for their portfolio.

The global market for anthracite is substantial. With the US and Ukraine no longer forces in the international seaborne market and Vietnam shifting from major exporter to major importer, it leaves the door open for the handful of producers in South Africa to find a global market although it is their domestic market that offers the rich prizes for the fortunate few.

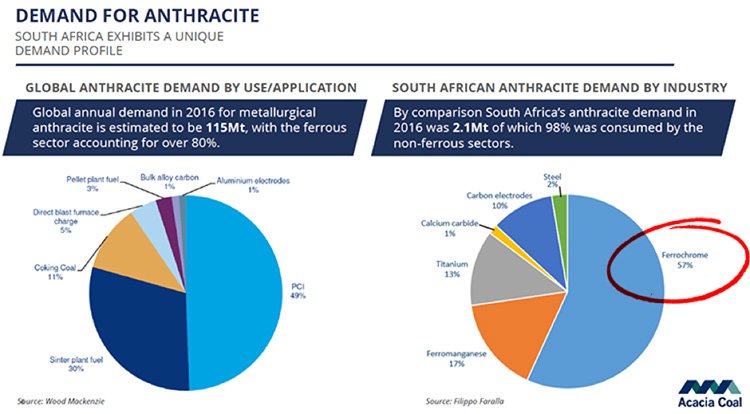

South Africa itself has a unique fundamental supply/demand profile, hosting the world leading local ferrochrome industry, the world leading local ferromanganese industry and the world leading local mineral sands industry which are all dependent on high quality anthracite.

Today’s company can supply this in spades, with a low CAPEX (an initial CAPEX of just $24M due to an outsourced operating model), high margin project that has an initial eight year mine life with room to extend.

The company expects annual sales of 438,000t of low impurity anthracite, and peaked annual sales of 540,000t at post tax and royalty margins of $34.4/t based on an average selling price of AU125.1/t and a nett 6% royalty rate.

Further good cheer with regards to this company’s prospects comes in the form of an existing non-binding off-take agreement already signed with the world’s largest producer of ferrochrome to buy all of the project’s output.

There are also discussions taking place with regards to binding offtake agreements and funding options.

As you’ll soon read, anthracite remains a key component in today’s uber-flexible energy mix that still requires high-grade coal, regardless of environmentally-conscious governments or lobbyists.

Coal may have left the energy-generation arena amongst investors, but it is very much alive and kicking in the field of industrial applications. In any case, this is a more lucrative end-user market, growing on the back of renewed demand from insatiably ambitious economies such as China, India, Brazil and Russia and South Africa, aptly named the ‘BRICS’.

With the world running full steam ahead into a new industrial cycle based on commodity consumption, we think now could be a good time to claim a stake in a company currently at the starter’s gate of developing a timely multi-million tonne project — and already on the cusp of regurgitating early sales revenues later this year.

Without further ado, we present a company with near-term production plans and long-term benchmark outperformance potential:

Acacia Coal (ASX: AJC) is not just another coal company with a high-grade pitch.

Coal is a rather divisive commodity in that its applications (and benefits) were never questioned — only its after-effects.

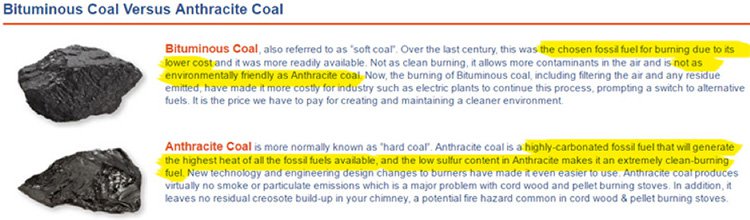

As the use of coal boomed, so too did the realisation that its consumption can have negative environmental impact. However that is only relevant for thermal coal .

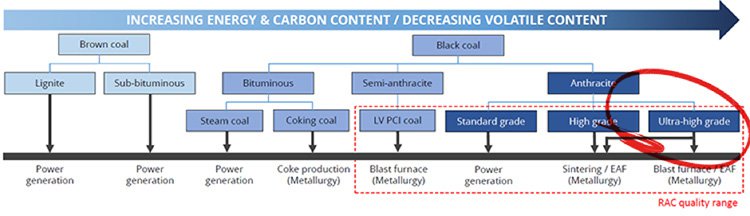

Anthracite , the product of AJC’s flagship project, is a clean, smokeless coal with low volatiles, high fixed carbon content and remains highly-valued within a number of industrial applications, primarily as a reductant in the metallurgical extraction process.

Here’s a look at the difference:

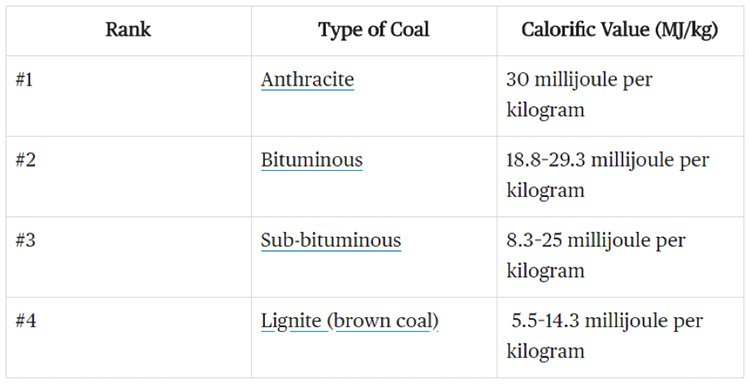

The international standards organization ASTM, has issued a ranking method for classifying grades of coal formed from biodegraded peat-based humic substances and organic material or vitrinite. The coal ranking is based on levels of geological metamorphosis, fixed carbon, and calorific value.

As a general rule, the harder the coal, the higher its energy value and rank. The following is a comparative ranking of various types of coal.

Natural gas, oil, solar, and nuclear, are all sources of energy that seem to be demonstrating far greater advantages in generating energy, compared to coal.

However, when it comes to applications such as steelmaking, coal remains an integral component which is growing in demand as steelmaking sets off on its cyclical resurgence.

And so, we come to AJC — an aspirational anthracite producer with an existing estimate of 10Mt in high-grade coal on its books.

AJC has a Mining Right already in place, which means there are relatively few other boxes to tick off, before the company gets into generating sales revenues.

Let’s go through AJC’s chances of improving upon its current market position, and deploying its high-grade potential

The Riversdale Anthracite Colliery (RAC) Project covers an area of 2,176 hectares and is located in southern South Africa.

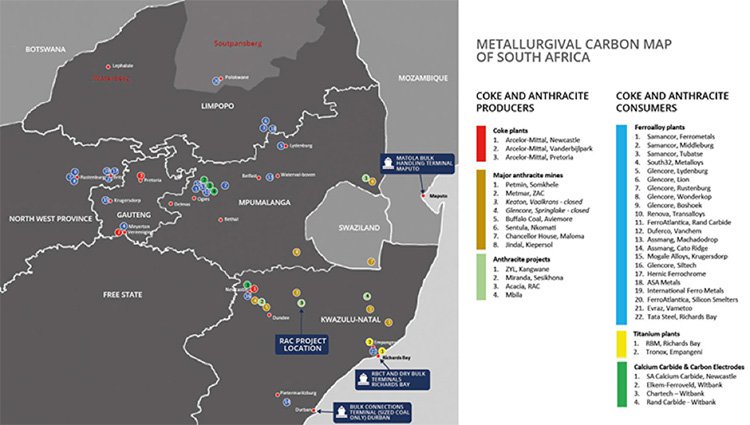

AJC’s location, as well as some of the existing projects neighbouring AJC, are mapped out below:

What the map tells us is that AJC is well positioned to attract inland markets and also has export infrastructure at its fingertips.

Also having the likes of ferrochrome giants such as Glencore and Samancor to whom it may be able to offload product, not to mention South32 and Assmang as the largest ferromanganese producers (all in a 500km radius of the mine), the vicinity is encouraging for a junior miner looking to take the next step on its production journey and potentially give its sub $10 million market cap a good shake.

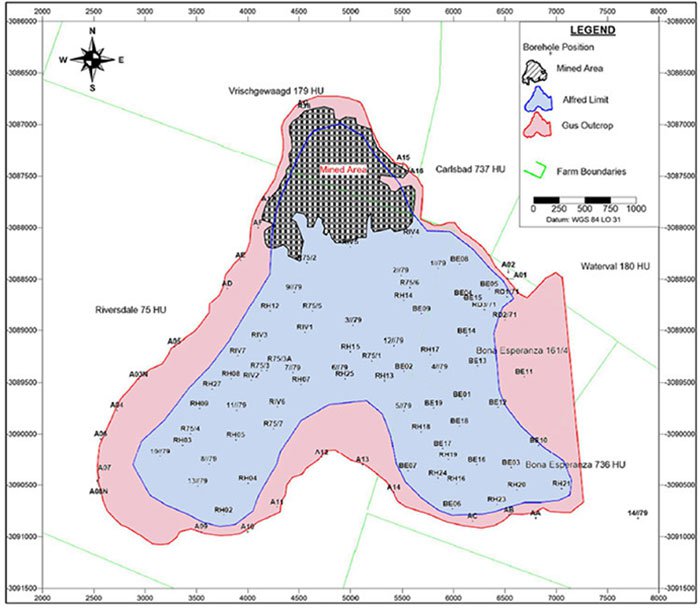

Thus far, a total of 84 boreholes have been drilled in 4 campaigns since 1968, and 32 adits cut for a bulk sample programme.

The most recent campaign of 10 cored boreholes was completed in March 2017 as part of a Feasibility Study that updates and refreshes an earlier Study completed by AJC’s current management in 2006.

In the most recent update published last month, AJC had collected 30 adit samples as part of a bulk sample testing programme. These results will be collated and integrated into a single assessment of RAC, including an updated Resource Statement to be published later this year.

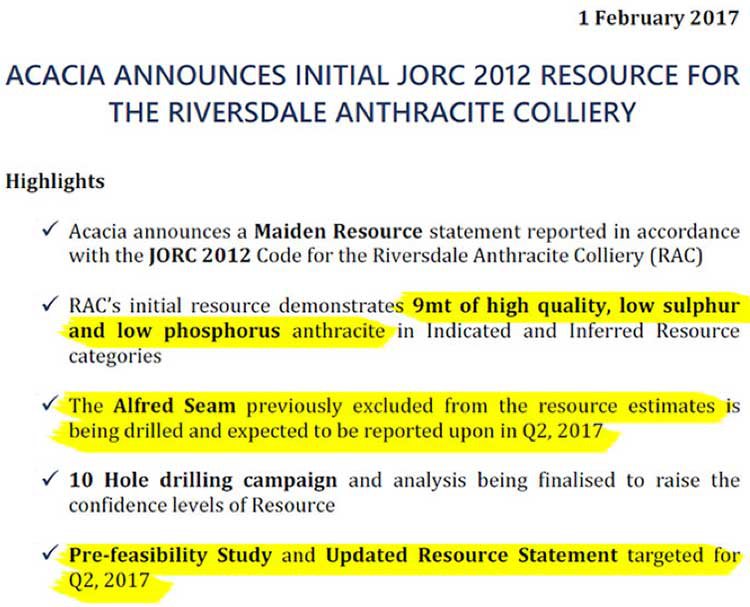

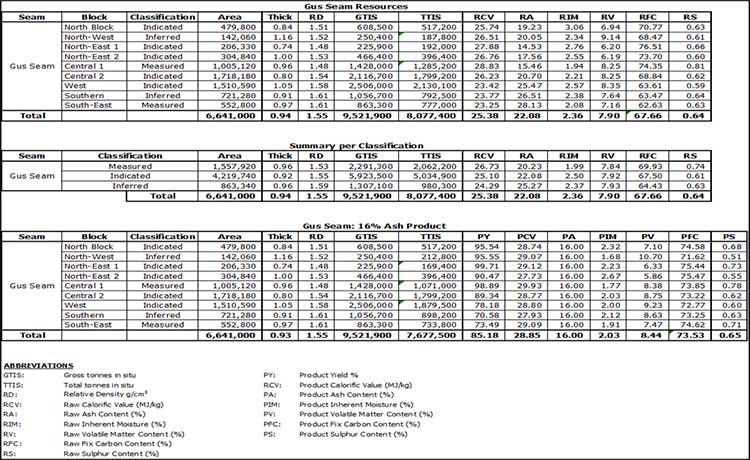

Here are the full JORC Resource figures which AJC has at its disposal:

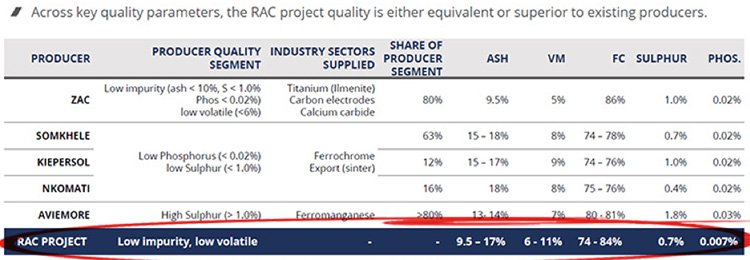

As you can see, AJC has access to approximately 10Mt of anthracite, with a high carbon-content in excess of 73% and very low phosphorus content at 0.007%, added to which low sulphur content at 0.65% could create a premium product.

Also, bear in mind that the above resource was reported from AJC’s Gus Seam only.

AJC has other prospects which have not yet been drill tested such as the Alfred Seam — these additional resources will be developed and summarily added to AJC’s overall asset portfolio over time.

The Alfred Seam has the potential to expand AJC’s footprint by several multiples. Here is a comparison of AJC’s existing mining work (shaded in black), in relation to the broader potential offered by the Alfred Seam (shaded in red).

If you want to know your future, remember your past

One aspect of AJC that really warmed our cockles, is the fact that the RAC Project is by no means a maiden project with an unknown amount of exploration to be done.

The RAC Project had already been spotted and rigged for commercialisation back in 2004, when AJC’s current Management team led by Hugh Callaghan first identified it and vended it into Riversdale Mining Ltd. (ASX: RIV).

It was owned by Rio Tinto’s world leading Richards Bay Mineral Sands Business unit 160km away as a hedge against dwindling local supplies of low impurity anthracite.

Then, in 2011, Riversdale Mining as a whole was swallowed by Rio Tinto (for $3.9 Billion...) who bought the company for its Mozambiquan coal projects, only to find that things didn’t turn out quite as planned and so the Riversdale project ended up back with Rio Tinto!

Now, in 2017, as broad commodity prices have started to head northwards, AJC has snuck into pick Rio Tinto’s pocket:

Since its was first discovered in 2004, and evaluated in 2011/2012, the RAC Project now has considerably different viability potential due to the many changes that have occurred over that time.

In effect, AJC is finishing what it started over a decade ago by its eagle-eyed management entourage, starting with updated feasibility studies and a commitment to commence mining.

One neat factor coming around in perfect synchronicity for AJC, is that prices in South Africa for low-impurity anthracite are now more than double what they were back in 2006.

Although it should be noted that commodity prices do fluctuate and caution should be applied to any investment decision here and not be based on spot prices alone. Seek professional financial advice before choosing to invest.

The recent rise has been attributed to bustling ferro-alloy and ferrochrome market segments that have experienced significant ramp-ups in demand over the past decade.

Chrome is used to provide temperature and corrosion resistance, as well as offering significant ‘bling-bling’ capabilities:

The fact that AJC is based in South Africa, while the majority of South African demand is coming from the ferrochrome sector — suggests that AJC is in the right place at the right time.

As you can see by the charts below global annual demand for metallurgical anthracite is estimated to be 115Mt, with the ferrous sector accounting for over 80%. Meanwhile South African demand last year was 2.1Mt.

In other words demand is high.

In the period since 2006, the anthracite market has changed significantly in RAC’s favour and the ferroalloy reductant market is compelled to accept significantly higher ash coal (16-19% ash vs. 13% ash) in return for low impurities.

What is really the clincher is that domestic prices paid for a low impurity, but higher ash anthracite today are more than double prices paid in 2006, and didn’t decline at all during recent years of tough times for coking and thermal coal suppliers.

That tells us something unusual is happening here.

AJC is expecting to offload all of its product to blue chip customers such as Glencore, Samancor and South 32 — giant global leaders in their respective industries, who are less susceptible to cyclical downturns compared to smaller rivals.

Also, the lion’s share of AJC’s production will be sold locally on an ex mine gate basis rather than exported overseas, which further helps to reduce costs and simplifies the path to AJC’s first whiff of sales revenues.

Let’s take a deeper gander at Anthracite, and the specialised industries revolving around it

Anthracite production is entering bottle-neck territory with viable anthracite projects dwindling in number.

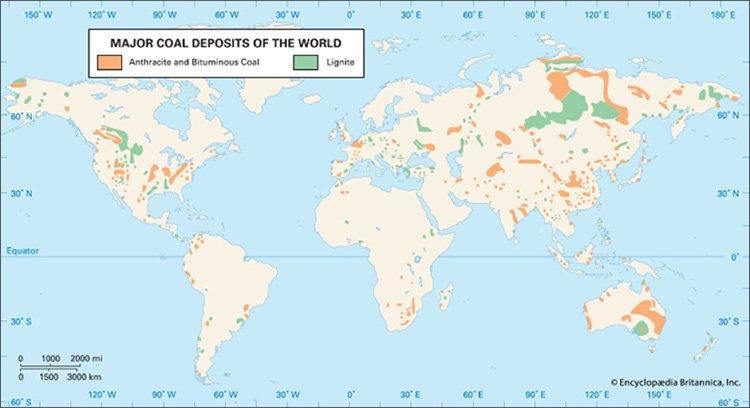

Here are the recognised anthracite deposits around the world, shaded in orange.

As you can see, AJC’s location (South Africa) currently has a smattering of anthracite deposits in the south-east, with other countries such as Australia, Russia and China being notable deposit-holders.

However, these countries have comparable higher capital expenditure estimates for various reasons including weather, geography, permitting or just plain old simple economics.

What’s most important for AJC however, is the local South African niche in particular.

Coal prices are not traded on exchange and do not have homogenised contracts like other commodities. Instead, coal is traded on the spot market via fixed-term contracts. Given the huge variability in coal quality and purity, there is no single price for each type of coal, although there are standard specifications.

This means there can be incredible differences between anthracite sold in South Africa, compared to anthracite sold in Australia.

It all comes down to end-use, grade, and the extent of ‘impurities’ in the extracted ore, which must eventually be processed before sale.

Add locational factors, transport costs, and the all too problematic degradation of product from multiple handling, and anthracite prices very much on a “willing buyer, willing seller” basis.

Given the strong increase in anthracite demand from chrome alloy manufacturers in South Africa, AJC has a growing market which is likely to suck up all of its production.

As we mentioned earlier, AJC has an offtake agreement already signed, albeit a non-binding one for the time being. However, as its exploration and quality-control programmes progress as expected, we could see AJC’s offtakes transforming into the binding variety later this year.

What’s also helping AJC’s momentum is the fact that South Africa’s current anthracite production is dwindling, on the back of a double-whammy of rising costs and deteriorating quality, putting existing producers at a noticeable disadvantage compared to AJC.

AJC’s RAC Project is the last known long-life, high quality anthracite project in South Africa

The declining production profile is attributable to the depletion of viable resources, growing geological complexity of established mines and challenging quality.

Let’s run through a conceptual peer comparison of AJC vs. the rest of the field in South Africa:

As you can see, AJC’s anthracite is well-positioned from a quality perspective and should therefore hold AJC in good stead when it comes to conducting Feasibility studies and kick-starting production later this year.

Money can’t buy you Love

After pencilling in their long-term plans for the Riversdale Anthracite Colliery (RAC) in 2006, AJC’s Management has returned to the scene of its ambition in 2017 — to finish what it started.

As with all the stocks we screen through, we always take a peek at current Management personnel to gauge whether our small-capped steeds have the pedigree to make it over the finish line of near-term production.

In AJC’s case, its Management team has anthracite development experience in abundance, in tandem with tender loving care for South African anthracite from the RAC.

Current Managing Director at AJC Hugh Callaghan, has over 20 years’ Resources experience, having held various portfolios around the world during his time at Rio Tinto and Xstrata Copper, before branching out into a world in juniors that has taken him from founding Riversdale Mining Ltd, to coal mines around the globe, copper mining in Chile, and potash developments in West Africa and the USA.

It is worth repeating here that the sale of Riversdale Mining assets to Rio Tinto netted $3.9BN.

So the big picture looks something like this: a $7.8 million market cap company, with a premium metallurgical coal deposit and a highly experienced team that was part of the foundation of Riversdale Mining, that managed to sell that company for a multi-billion dollar price tag.

As the tide in global commodity markets continues to turn (and rise), it is lifting up previously uneconomic projects such as the RAC back into economic viability.

However, AJC does remain a speculative stock and investors should seek professional financial advice if considering this stock for their portfolio.

The now-improved market ecosystem for high-grade coal means that AJC can conduct its anthracite market plans in earnest and confidently develop its flagship asset in South Africa.

Later this year, AJC will also explore the Alfred Seam — a potential fresh source of additional anthracite deposits, which AJC will be adding to its growing Resource at RAC, and very possibly, expanding its longevity.

The 2006 Feasibility Study is in the process of being updated and refreshed, while the Alfred Seam drilling programme should have a substantial update later this year.

AJC’s Pre-Feasibility Study has just been delivered two months ahead of schedule along with an updated Resource Statement, as part of a more thorough Bankable Feasibility Study (BFS) targeted for delivery by year end.

Sorting the wheat from the chaff in coal

Anthracite is a type of coal that is made almost entirely of carbon, and as a result, is much harder than other forms of coal. Its low pollutant content allows it to burn cleaner than other types of coal – an ability that makes it the preferred commodity in many industrial and manufacturing applications.

Given the higher-value end-uses it is compatible with, we think overlooked anthracite projects such as AJC’s close to final points of sale, are well worth considering.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.