ASX-listed Early-Bloomer Sets up Basecamp in Tesla’s Backyard

Published 10-OCT-2017 10:55 A.M.

|

14 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

The stock we have for you today is launching itself into two rapidly evolving commodity markets with enviable growth estimates. And it comes with much of the exploration risk already mitigated and plenty of funding is available post its recent ASX-listing.

We’ve stumbled upon a company that is more advanced and deemed a development stage company as opposed to an exploration one, operating in the same region, searching for the same commodity, and trading on the same stock exchange as a well-known and much larger peer.

That peer is now worth over A$300 million, after rallying 250% over the past year, while our sprightly stock-pick is still flying under the radar at a paltry A$54 million.

The past performance of this product is not and should not be taken as an indication of future performance. Caution should be exercised in assessing past performance. This product, like all other financial products, is subject to market forces and unpredictable events that may adversely affect future performance.

Our overlooked commodity-gatherer is also emulating existing industry giants such as SQM, Rio Tinto and GSC. It’s rubbing shoulders with the key customers too — battery manufacturers who need lithium in Tesla’s backyard in Nevada, USA.

By all accounts this appears to be a value-packed peer emulation play, that’s ticking the right boxes, at just the right time.

However, this is an early stage play and as such any investment decision should be made with caution and professional financial advice should be sought.

Two commodities are at the centre of the ‘energy storage’ revolution, and seeing historic price highs as a result.

One commodity, that we’re sure you’ve heard of, is lithium.

The other led a sheltered existence until rampant urbanisation and consumerism ushered in demand for gadgets and gizmos, as well as glass. That commodity is borates, more specifically the refined product, boric acid.

Boric acid and lithium carbonate are — to a large extent — future-proofed, and currently experiencing supply shortages.

This is to do with how society is shifting its consumption preferences. Not only are people buying glitzy products that use lots of borates and lithium, there’s more people joining the middle-class at the fastest rate in history.

Modern living is built upon a slew of new commodities.

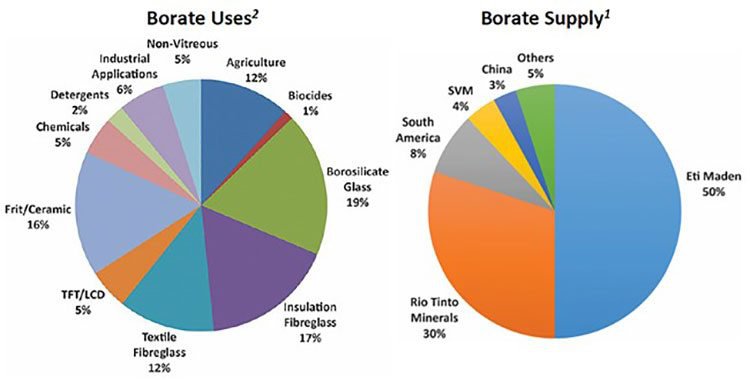

Borate supply is required to fulfil a demand spurt for new-age products from a burgeoning middle-class, including LCD screens, ceramics, glass, fertiliser, appliances and even fibre-glass wall insulation. It is also used in clean energy technologies like wind turbines and solar PV panels.

On a purely consumer level, lithium and boron are enabling a greater level of sophistication in electronic gadgets, with a greater number of features.

The combination of boric acid and lithium exploration sets the stage for this company to achieve ultra-low borate production costs...

By focusing on borates and using efficient processing, this company is looking to prove it can produce high-grade lithium carbonate as a by-product. This is similar to how SQM produce lithium from its potash production. SQM have a market capitalisation of US$14.5bn with much of the increase in value coming in the last 12 months and since production of its lithium.

This early-stage junior could have its foot in the door to produce two crucial commodities for the consumer-led demand explosion for electronic products, electric vehicles and lithium-ion batteries.

Introducing the latest ASX-listed go-getter:

American Pacific Borate & Lithium (ASX:ABR) is wholeheartedly set on joining the leading pack of the lithium peloton.

It also wants to rustle up a bulky borates Resource to the extent of 115Mt @ 7.4% B 2 O 3 .

That’s the current non-JORC compliant historical resource, which ABR is in the process of converting to a JORC compliant Resource and will hopefully be revising upwards over time as more exploration is done and substantiated.

ABR wants to go a step further, by not only possessing a borates Resource that lasts decades, but also manufacturing high-grade lithium carbonate as a by-product of processing its primary borates endowment.

It just so happens that extracting lithium from boric acid-laden brines and clays can be very cost effective. Plus, there’s the added bonus of having two distinctly different products available for sale.

The combination of lithium and borates is a fairly unique blend for aspiring explorers, but one that could deliver some extensive cost savings for ABR. The ultimate result could potentially be some gargantuan profit margins, if and when ABR gets to the production stage as a fully-fledged miner.

Let’s run through the caveats that will hold ABR in good stead.

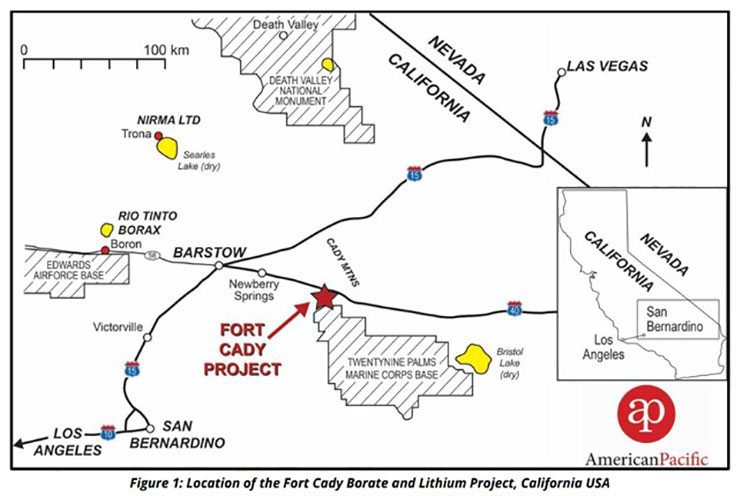

The scene of ABR’s ambitious plans is the Fort Cady Project on the California-Nevada border are mapped out below:

Notice the Rio Tinto Borax operation just up the road to the west, and the Searles Lake deposit to the north-west.

Nevada is the current springboard for several energy-storage-focused companies including the likes of Tesla. Rio Tinto’s boron mine is also in the area, just 120 kilometres from ABR’s Fort Cady Project.

As the first battery cells roll off the production line at Tesla’s 1.9 million square foot Gigafactory in Nevada, a scramble is already underway to supply Tesla with the ingredients it needs most, namely lithium, cobalt and graphite.

Electric vehicles (EVs) use almost 5,000 times the lithium of a smartphone and with vehicles such as the Tesla Model 3 and the Chevrolet Bolt set for mass production, there is considerable excitement about lithium’s future prospects.

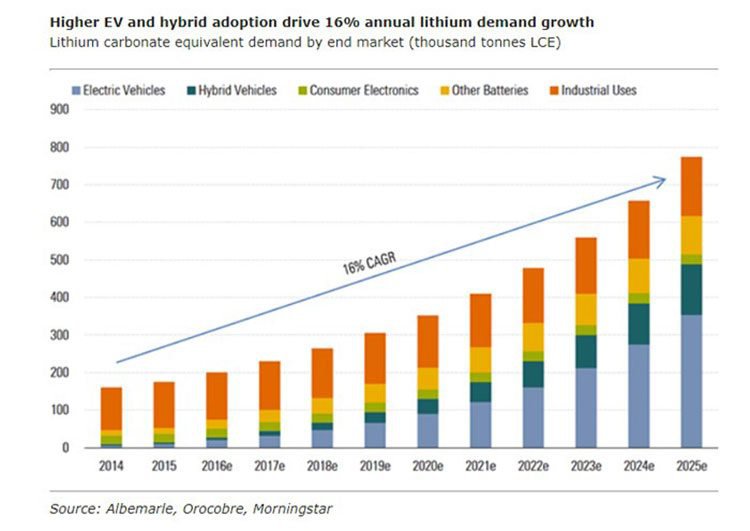

Lithium demand has been surging and is expected to continue that way. Analysts at MorningStar estimate lithium demand will rise at double-digit rates from the current 175,000 tonnes in 2015 to 775,000 tonnes by 2025 — an increase that they say would be the fastest of any significant commodity over the past century.

Alongside such rampant growth rates, the average price of lithium has jumped threefold since 2014 and was up 60% over the course of 2016.

Electric vehicles, phones and laptops all need one thing: lithium batteries. And the world’s foremost battery manufacturers are scrambling to secure lucrative futures in an industry set to be a blockbuster over the next decade, similar to how gasoline has developed since the advent of the car.

The important borates angle

With lithium supply and demand making headlines and helping lithium explorers, ABR has another trick up its sleeve.

Borates is what ABR will have as its primary commodity (with lithium produced as a by-product).

The most recent non-JORC compliant borate mineral estimates calculated for Fort Cady stands at 115Mt @7.4% B 2 O 3 (5% cut off).

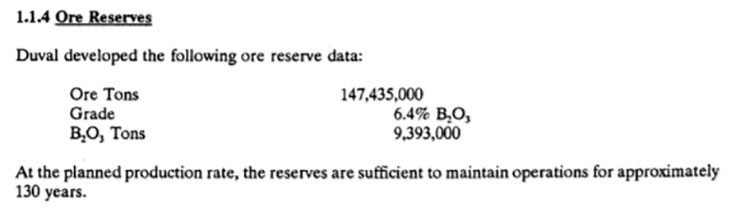

A previous report done in the late 1980s estimated the Ore Reserve at Fort Cady to be around 147Mt at 6.5% B 2 O 3 .

Of course, these are preliminary non-JORC compliant figures which will have to be substantiated. However, Fort Cady is already recognised as a world-class borates project. Given how quickly the commodity is coming to the fore of world markets, along with ABR’s low-cost and low capex strategy, it could unearth significant value for ABR.

Overall this is an early stage play and as such any investment decision should be made with caution and professional financial advice should be sought.

Borates have become a modern enabler and the catalyst for modern technology

Borates are a fairly rare commodity, but one that is rapidly growing in everyday applications.

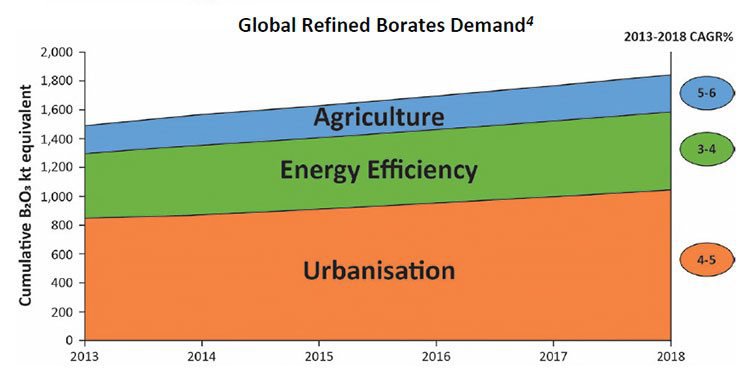

Currently, they are used in more than 300 applications with 75% going into glass, fibreglass, ceramics, agriculture and detergents. In many ways, boric acid is a market proxy for the themes of ‘urbanisation’ and ‘energy efficiency’ because of its applications in LCD screens, refrigerators, food cultivation and modern architecture.

As a result of such demand conditions, borates are growing in value. The supply of borates, however, is lagging behind.

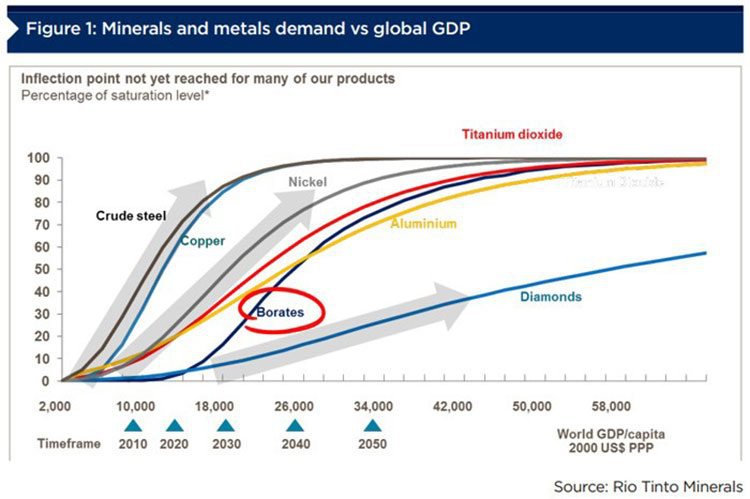

Alongside growing demand for metals such as copper, nickel, steel and aluminium, borates are seeing demand growth thanks to their complimentary properties and industry applications.

Today, two companies produce 75% of the world’s borates supply (Rio Tinto and Eti), making this market an effective duopoly dominated by the two majors. This state of affairs has kept prices supressed, while fresh supplies to world markets have been non-existent.

Maybe that’s why Rio Tinto recently bagged itself a huge lithium-boron resource in Serbia?

When the big players make bold moves it’s time to pay attention...

ABR is barking up exactly the right tree, and positioning itself as a rarefied supplier of a mass-consumed product in the years to come.

Here are the market themes borates address:

Agriculture, energy efficiency, and urbanisation are some of the most topical and early-stage market sectors that promise swathes of spare capacity for ABR to expand into, and reap rewards for its shareholders.

Drilling in progress at the Fort Cady Project

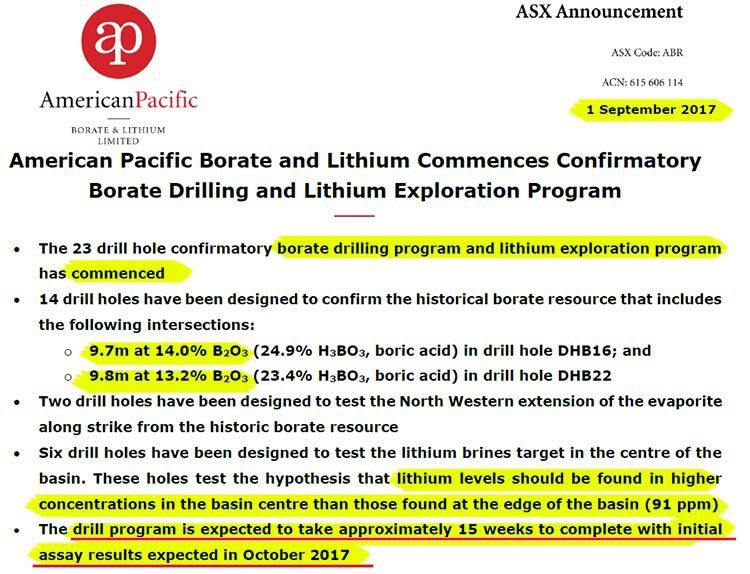

Having only listed on the ASX in July this year, ABR is in no mood to dilly-dally.

The company has launched into confirmatory borate drilling and has initiated lithium exploration immediately:

The key point to note for investors is that potentially imminent catalysts are in sight, and could hand ABR a leg-up in the peer comparison stakes.

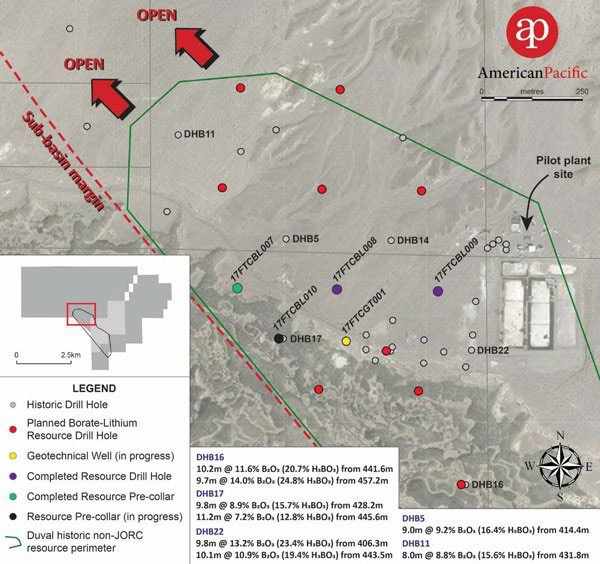

Here is the latest state of play on ABR’s drilling at Fort Cady:

The purple dots represent completed drill holes, while the red dots indicate what ABR is going to drill.

The ore body ABR is hunting for seems to be held at around 400m below the surface which keeps mining cost low. Additionally, Fort Cady remains open at strike to the north-west, leaving the door for further Resource upgrades.

ABR’s funding position is adding to the good cheer at Fort Cady

Funding is often a major concern to junior explorers. On this note, ABR is fortunate to have nabbed an institutional care package. That comes in the form of a strong line of capital, plus some veteran project developers that have previously worked for Highfield Resources (taking that company from $4 million to over $500 million in market capitalisation between 2011 and 2016).

Anthony Hall was Managing Director at Highfield Resources, steering the potash developer to becoming a mid-cap company in less than five years. Other notable management figures include Stephen Hunt, who has previously taken two ASX-listed entities from exploration to production in the past.

Last but not least, ABR have brought in a former Rio Tinto project manager with 45 years’ experience, Jerry Aitken, as a Strategic Advisor. His expertise could prove to be a catalyst for ABR’s geological progress...and hopefully its share price.

Overall, ABR’s management team has almost 200 years’ experience between them, which is just the way we like it, here at The Next Mining Boom . Abundant industry knowledge and project expertise is a crucial element and may explain why ABR’s ASX-listing came in oversubscribed.

However it is an early stage of this company’s development and if considering this stock for your portfolio you should take all public information into account and seek professional financial advice.

One other noteworthy point about ABR’s boardroom is the institutional figureheads backing the venture.

Jeremy Bond’s Terra Capital has emerged as a major shareholder in ABR. For those of you who’ve never heard of Jeremy Bond... his grandfather, Alan Bond, was a prolific resource stocks investor specialising in small-cap stocks.

On the Highfield listing, Jeremy Bond reportedly scooped a sizeable windfall by backing Highfield at around 30 cents and selling out at the peak of $2, two years later.

Today, some of the same institutional names have come together to progress Fort Cady via ABR... and we think they stand a superb chance of achieving their commercial ambitions.

If ABR can emulate anything close to this kind of performance, it would be a great boon for ABR shareholders.

Sowing the seeds of commercial success

Dozens of companies have set off with lithium-exploration shovels, racing to secure supplies of the silvery white metal, which is used to make the types of batteries that power billions of smartphones, laptops and, increasingly, electric cars.

The lithium market is dominated by four producers: Sociedad Química y Minera de Chile (SQM), Albemarle, FMC and China’s Tianqi Lithium. On top of that, there are at least 28 listed companies in Australia and Canada developing lithium projects.

The lowest-cost production of lithium is through the evaporation of brines beneath the deserts in Chile, Argentina and Bolivia, but those countries have failed to substantially increase output.

As a result, China has begun to source the chemical from within hard rock in Australia and elsewhere, a more expensive and energy-intensive process that requires additional processing.

ABR wants to integrate itself into the actively developing borates and lithium industries simultaneously. Below are the reasons why we expect it to achieve such a target.

Capex – capital expenditure is expected to be minimal given the type of mining ABR wants to do, and the historical data already available. ABR has a head-start in Nevada with over US$50 million already spent on technical studies and preliminary exploration. Now it needs to pick up the baton and complete the remaining work. ABR has over $14 million in cash on hand and is unlikely to go back to the market for more funding anytime soon.

Margin – considering the rapid development of both borates and lithium as two up-and-coming resource markets, we think ABR could be in line for substantial profit margins once it gets into production. Both lithium and borate prices have been climbing on the back of additional demand, while supplies have been slow to come online. This means that ABR is walking into markets that are only beginning to realise their potential, and could therefore achieve strong commercial results on the back of its first-mover status in this market space.

Technicals – the Fort Cady Project has been on the cusp of extensive development for three decades. Several parties have come and almost made the decision to mine. However, lacklustre prices and speciality market demand were insufficient to get Fort Cady into production. That has changed in recent years, with borates and lithium now sprawling into consumer markets. This effectively means Fort Cady has been previously overlooked, but is now ready to be seen.

Flexibility – ABR has a plentiful array of options with which to progress Fort Cady. The geology is conducive to various types of mining, which ABR will review in due course after the publication of its Scoping Study and feasibility assessments. However, even at this early stage, ABR is confident it can secure a strong borates resource and with the additional option of siphoning off battery-grade lithium as part of a separate lithium operation.

Is it California Dreamin’ for ABR?

ABR is a bit of an early bloomer. Having listed in July, this stock is already showing promise in the form of a rising share price, a tightly held share register and just 170 million shares on issue.

With a share price of 32 cents per share, ABR is now up 40% since its listing in July. That’s a nice gain for early investors, but certainly has for further gains.

Global Geoscience (ASX:GSC) is probably ABR’s closest competitor and peer, and stands out as ABR’s prime emulation target over the coming 12 months. If GSC’s rise of 244% over the past twelve months is anything to go by, then there could be plenty of short-term upside for ABR shareholders.

Another of ABR’s peers, A$1.2 billion-capped Pilbara Minerals (ASX:PLS), has also had a nice run this this year, rising 65% over the past 12 months.

Past performance is not necessarily indicative of future results. As part of the due diligence process, clients must consider all factors over and above the past performance of the product. Clients should not engage with a product solely on it past performance.

What all of these lithium explorers have going for them, is the fact that lithium has started to make its demand footprint known through higher prices and supply fears.

ABR just happens to be in the same boat, only worth much less at A$54 million, compared to GSC at A$300million and PLS at A$1.2 billion. The potential for ABR is therefore clear: if it proves up either a significant JORC-verified borates or lithium Resource, we may well see it primed for a considerable rerate.

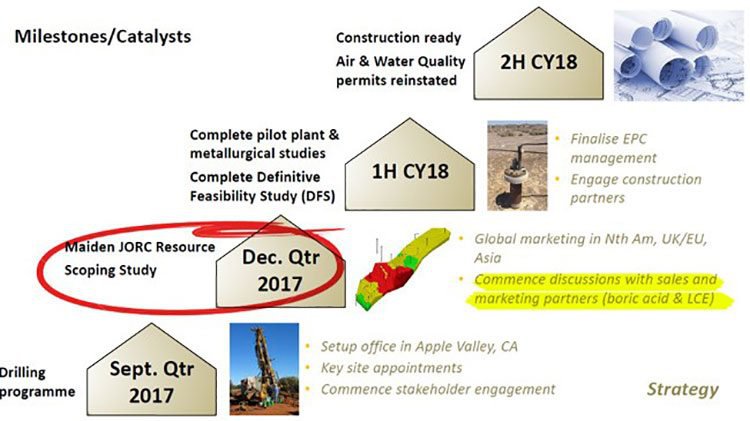

So, as catalysts are already appearing on the horizon in the form of drill-testing, assay results, a Scoping Study and a maiden JORC Resource potentially available by the end of the year... that seems like a lot of value for a modest price.

We think this could be the perfect vehicle for small-cap resource investors to beef up their portfolios before every Tom, Dick and Harry catches onto the dual-pronged ‘energy-storage-revolution’ and ‘modern technology’ market themes, currently charging through global markets like a bull in china shop.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.