ASX Junior Kick Starts Mine amid Iron Ore Revival

Published 06-JUN-2019 10:26 A.M.

|

14 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Iron ore is back.

Soaring past the US$100 a tonne level, the crucial steelmaking commodity is priced at five-year highs placing our major resource stocks back in the spotlight.

Since the start of the calendar year, Fortescue (ASX:FMG) has more than doubled its share price, while diversified miners Rio Tinto (ASX:RIO) and BHP are up 33% and 16%, respectively.

During that time, iron ore prices have jumped 50%, rising from just over $70 a tonne to above $110 a tonne last week.

This rally follows the Brumadinho tailings dam tragedy in January, where a dam failed at Vale’s Córrego do Feijão iron ore mine in Brazil, releasing a flow of mining waste that hit the mine’s administrative area killing more than 200 people.

In response, Vale, the world's biggest iron ore producer, stopped production at its mines in the area, which had been producing about 93 million tonnes of iron ore each year. Months on and it is still unclear whether iron ore production will resume at some of those mines.

But it’s not just the Brumadinho dam tragedy that’s responsible for the higher iron price.

In China, iron ore consumption continues to rise — the country now imports about a billion tonnes every year — yet its stockpiles are at their lowest level in more than two years and are still falling.

Clearly there’s plenty of demand to meet and supply to be filled, hence the run on the share price of Fortescue and other majors.

However, when it comes to the smaller end of the market, unfortunately, there are very few juniors that offer iron ore exposure. That’s just one of the reasons I like the ASX small cap that I have for you today.

The company owns a previously producing iron ore asset in Tasmania, which was placed into care and maintenance when the iron ore price sank, but it is now seeking to again produce a direct shipping ore (DSO) product given the turnaround in the price of iron ore. The project has proven resources, reserves in the ground, and offers significant exploration upside.

We haven’t seen iron ore prices at this level since 2014, which coincidently, is when today’s ASX junior ceased operations at its Tasmanian iron ore project. Given the weakening iron ore market back then, the company made the strategic decision to put the project on ice until the economics improved.

So long as the iron ore price remains where it is or continues to be stronger for longer, today’s company could emerge as a near term producer, supplying much needed iron ore to China.

Introducing,

Market Capitalisation: $3.65 million

Share Price: 0.6 cents

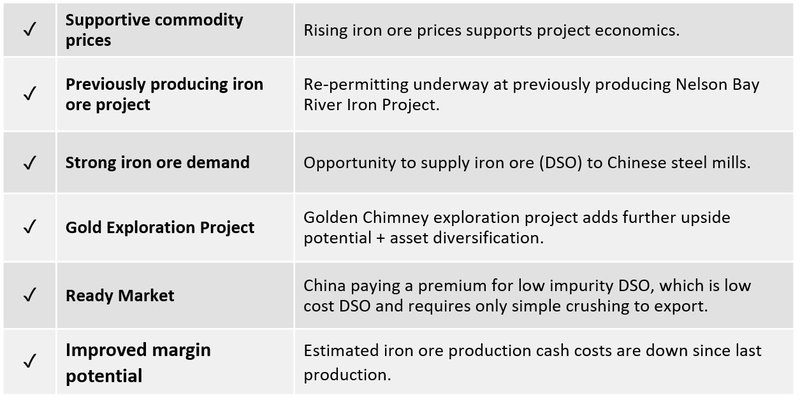

What I like about Shree:

Iron ore is making a comeback

In light of a change in dynamics in the iron ore market, Shree Minerals (ASX:SHH) has started re-permitting activities for the development of a DSO operation at its Nelson Bay River Iron Project in north-west Tasmania .

Shree’s ambitions in Tasmania are supported by improvements in the iron ore price, which is back above US$100/t due to recent supply disruptions, a lift in demand for DSO specifically, and improving sentiment in the sector.

January’s Brazilian tailings dam disaster saw 93 million tonnes of iron ore supply lost, or about 6% of the market’s supply.

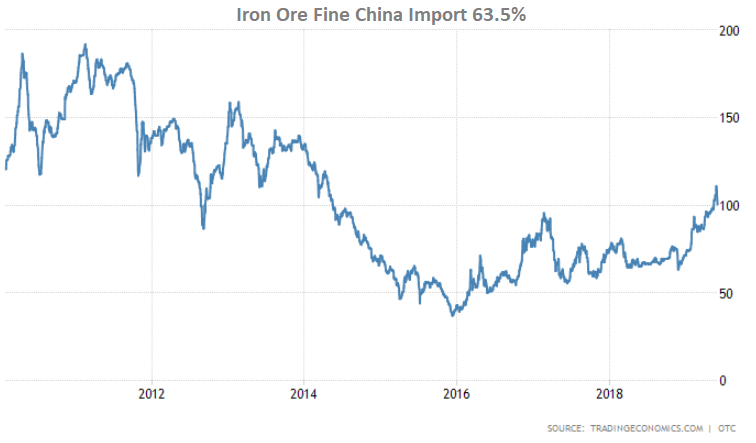

In response to the disaster and the shutdown of Vale’s mines in the region, the iron ore price jumped from about US$75 a tonne to above US$90 before continuing to rise above US$100. This all came after the iron ore (fine China import) price hit a record low of US$37 in December of 2015.

Encouragingly, at least for SHH and its shareholders, the consensus analyst view is that it may take years to normalise iron ore supply back to the levels produced before these disruptions occurred.

Plus, any near-term supply response is expected to be limited, particularly with little latent capacity left at major Australian iron ore exporting ports and railways.

Credit Suisse, for one, is tipping iron ore to fetch stronger prices in coming years. Unexpectedly, the bank now expects Chinese steel output to rise 1.8% in 2019, while it had originally forecast a 2% fall.

Citibank also expects a continued strong iron ore price, saying “A combination of supply disruptions in Brazil, robust Chinese steel demand and improved profitability levels at Chinese steel mills will keep iron ore prices elevated this year, according to Citibank’s Commodity Analyst team”.

Yet, it hasn’t just been supply disruptions that caused the recent rally in the ore price. This supply shock from Vale’s lost production came right as the market experienced a jump in demand for steel from China.

After last year's slowdown, the country is hoping to stimulate its economy which is pushing steel prices higher. In fact, Chinese steel production has hit new record highs, meaning that the steel mills can and will continue to pay more for iron ore, given that 98% of the mined iron ore is used to make steel.

Additionally, China’s recent crackdown on pollution has led for greater demand and a further lift in premiums paid for material with lower impurities, like low alumina (as per the Nelson Bay River ore produced previously), as Chinese authorities continue emphasis on environment control.

For Australian exporters the story gets even better, as AUD iron ore prices have further improved due to the weakening of the AUD to below US$0.70, from its US$0.95 levels when the Nelson Bay project was last operating in 2014.

It’s interesting to compare SHH’s performance over the past ten years or so to that of the iron ore price.

As you can see below, SHH’s share price has seen little action since it fell off in 2014. This drop came right as the company decided to suspend operations at the Nelson Bay River Project due to weak iron ore prices. Iron ore prices declined by so much — eventually hitting a record low of US$37/tonne in 2015 — that it had become uneconomical to operate the mine.

As you can see in the iron ore price chart below, Shree Minerals’ share price is highly correlated with the iron ore price.

Here’s the commodity’s price movements dating back to 2010:

Both see a period of sharp decline from 2014, yet the major difference between the two charts is that iron one has already begun its recovery — it recently got back to five year highs and above US$100/tonne.

Assuming that Shree continues progressing the project back towards production of DSO, I expect its share price to follow the iron ore price higher. That idea is supported by the recent spike in volume in SHH, as is also seen on the share price chart above.

Nelson Bay River Iron Project

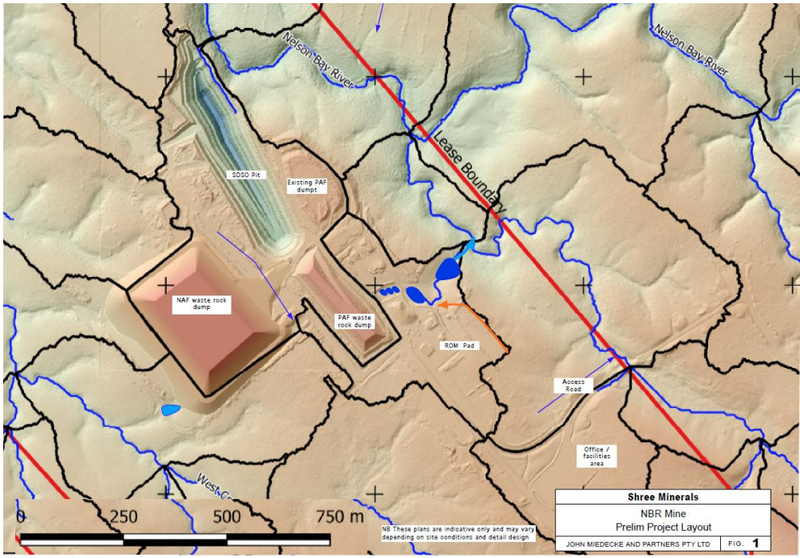

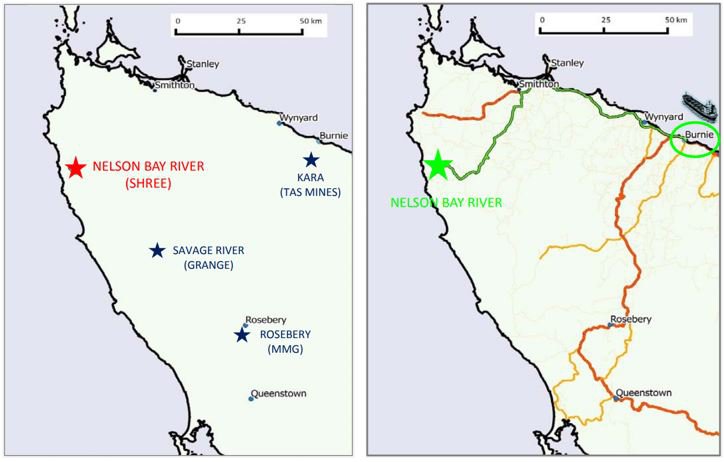

Shree’s wholly owned Nelson Bay River Iron Project, including Mining Lease 3M/2011, is located on the north-west coast of Tasmania — an area in need of stimulus and economic development.

The project was the first greenfield mine in the region in many years, creating economic benefits for the region. The economic activity generated by the project to date has been over approximately $27 million with substantial employment. For the brief period the mine operated, over 50 people were directly employed to work there.

The project produced its first DSO in November 2013, after a two year delay in the environmental approval process.

That delay pushed the project out to the bottom of the commodity price cycle, so that its start-up coincided with a marked decline in iron ore prices by nearly 50%. This made the project uneconomic and left SHH to make the strategic decision in June 2014 to place the mine in care and maintenance.

At that time, the excavation of the south DSO (SDSO) pit was only about 25% complete, suggesting there remains plenty of opportunity.

Additionally, in its 2017 annual report, Shree reported estimated that C1 cash costs (US$/DMT CFR North China) had reduced to approximately US$54 for its iron ore products (fines and lump). This is well down from the US$88 as seen at year end June 2014 and US$63 at year end June 2015 and would have a positive impact on margins once the mine is back up and running.

High DSO resource expansion potential

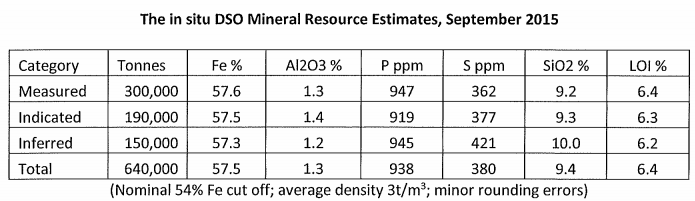

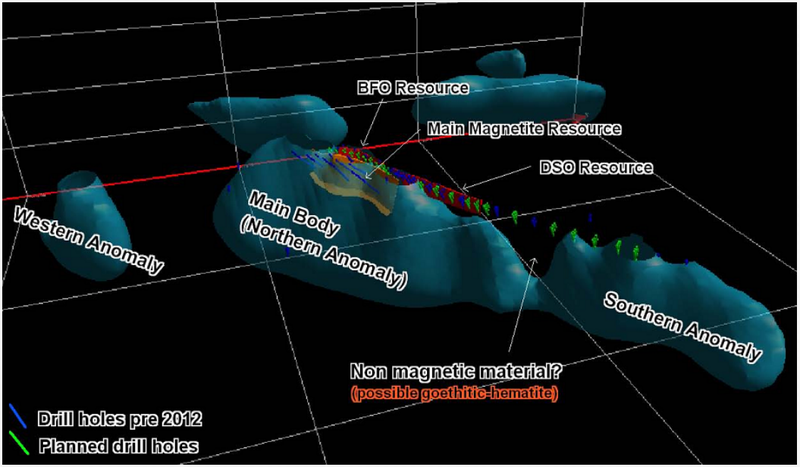

The project has a JORC NBR has a JORC-compliant global iron Resource of 11.3Mt, including goethitic-hematite Resource of 1.4Mt and magnetite Resource of 7.8Mt.

The DSO Resource and reserve estimate is below, while SHH also has a beneficiable low-grade resource (BFO) and a magnetite resource, but these are not the immediate focus.

Shree’s present mine development strategy includes mining the DSO first followed by BFO material, and then the Magnetite Resource.

Following the recent improvement in iron ore prices, Shree has been actively pursuing re-permitting activities as part of the development process of the DSO project.

High grade hematite ore, better known as direct shipping ore, is low cost to produce because once mined the ores go through a relatively simple crushing and screening process before being exported for use in steel making. The DSO requires no major processing beyond crushing and screening after which it is simply trucked to the port and shipped.

This current global resource is based on limited drilling of less than one kilometre at the north end of a four kilometre aeromagnetic anomaly. Encouragingly, 3D aeromagnetic inversion studies indicate continuation at depth and along strike. Further DSO potential has been identified in the central zone.

SHH developed the south DSO pit in 2013 and production commenced in November of that year, with the first shipment made in January 2014. The operation was developed as an all contract mining, processing and haulage operation with local contractors in the region. The iron ore shipments totalled 181,000 tonnes historically.

The Nelson Bay River product (DSO lump and fines) had been very well received and in demand by customers who appreciate its low impurities.

Here is the planned mine development on site. The main features are the SDSO pit and waste dumps. Other elements are the mine water treatment dams, ROM stockpile area and the facilities area.

Well positioned

The project is situated within an established mineral province in the region. It’s located not far from the $300 million capped Grange Resources’ (ASX:GRR) Savage River iron ore mine, MMG Ltd’s Rosebery base metals operations, and Tasmania Mines’ Kara (DMM and fines) operation.

Shree was the first company to conceptualise and discover DSO iron ore resources in Tasmania, paving the way for other similar discoveries and investments in the region, including Venture Minerals (ASX:VMS), whose Riley and Livingstone DSO deposits are not far from Nelson Bay River.

The company is leveraging existing export infrastructure, including using existing roads to Port Burnie export facilities. It also has diesel power generation on site. Existing development at the project and regional infrastructure is particularly important in this region. Given the typography in Tasmania you have to follow existing roads and it’s hard to move around.

Development Approvals for Mine

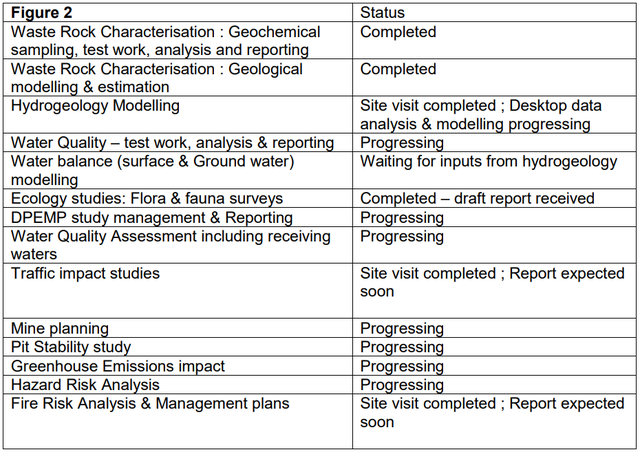

Since deciding to actively pursue re-permitting activities as part of the development process of the DSO project at Nelson Bay River, Shree is completing a draft development proposal and environmental management plan (DPEMP) for the DSO operations.

Shree has initiated requisite technical studies and engaged independent consultants and contractors who are very well regarded and respected in the industry to carry out these studies.

These studies are now either complete or near complete and Shree hopes to soon complete the draft DPEMP, which will be submitted to the state Environmental Protection Authority (EPA).

Some of the detailed technical studies completed and still progressing include the following:

Golden Chimney Project

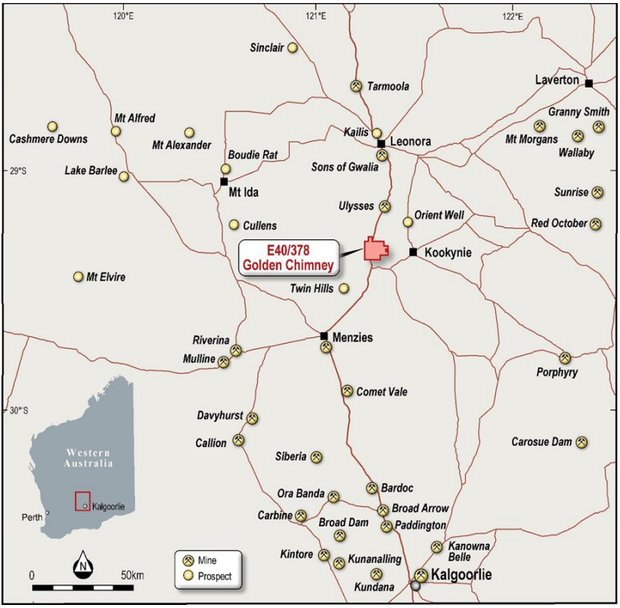

As mentioned, iron ore and the Nelson Bay River Project is not the only play of SHH’s. In early March, Shree executed an option to acquire an early stage gold exploration project — the Golden Chimney Exploration License (E40/378) — from Carmichael Prospecting Company Pty Ltd.

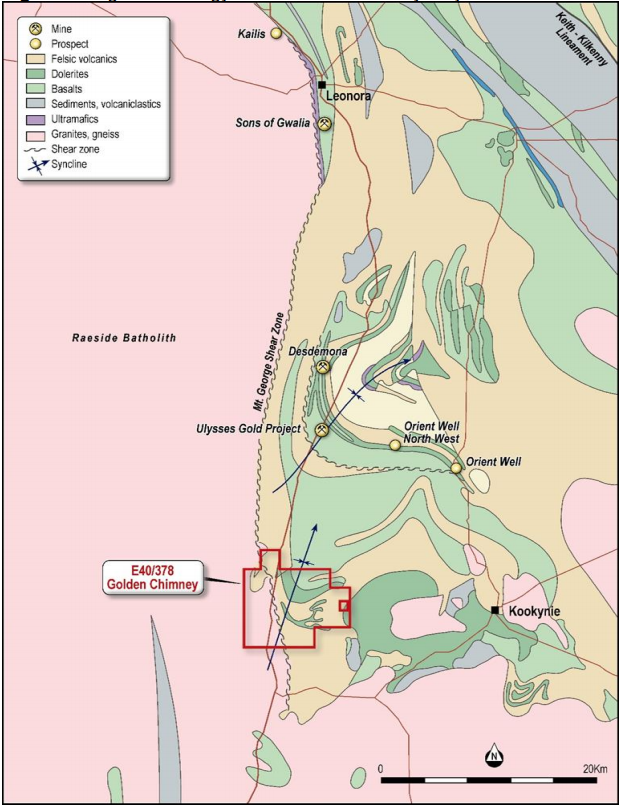

Located in the Eastern Goldfields of WA, approximately 180 kilometres north of Kalgoorlie and 40 kilometres south of Lenora, the Golden Chimney Project provides exploration potential and asset diversification to Shree.

Western Australian gold has been a strong sector and the Leonora province has re-emerged as a historic gold region.

The project is located in a proven mining region — just 13 kilometres south of the historic Ulysses gold mine, 40 kilometres south of the Thunderbox (Kallis) gold mine, and 60 kilometres south-west of the Murrin South Nickel Cobalt Mine.

The world class deposit, the Sons of Gwalia Gold mine, also occurs within this geological terrain. Other significant and economic nearby deposits include King of the Hills mine, Tower Hill, and the Trump gold mines.

The company is busy executing its exploration strategy to determine the prospectivity of its gold assets.

The tenure is largely covered by alluvium, quaternary drainage and laterite and the EL offers a moderate amount of visible outcrop across the tenement.

A major north-south trending structure, named the Mt George Structural Lineament, transects the exploration license and displays a high level of deformation as a shear zone of up to several kilometres wide.

Previous geological activities suggested that additional geophysical and geochemical work is required to further test the mineralised potential of the prospects.

Positive initial exploration initiatives will provide a greater level of certainty to follow up the prospects with a targeted drilling program. Recent success at the Ulysses project, which is in a similar structural corridor to Golden Chimney, should increase the prospectivity of this area.

Exploration underway

Following the exercise of its option, SHH immediately commenced exploration activities. This included a review of historical data, including historical drilling, soil and rock chip geochemistry, the analysis of aeromagnetic images as well as 3D interpretation of historical RC drilling at the Golden Chimney prospect.

Previous exploration has included stream sediment sampling, soil sampling and RC drilling with the focus being on two prospects called Golden Chimney and Golden Chimney West.

A look over the historical exploration at the Golden Chimney Prospect suggests that the strong and robust anomaly defining the mineralisation is open to the north east and along the strike of the hosting magnetic dolerite.

Field geochemical exploration program

SHH has completed an auger soil sampling program at the prospect, aiming to confirm and refine historical soil anomalies and identify new anomalies of the Golden Chimney style.

The program was completed for 1040 sieved soils, collected on a 200m x 100m grid. Auger holes were drilled to depths of 0.3m to 1.0m and soil samples were collected below the level of any surface depletion and dilution. The preferred sample horizon was either a carbonate rich layer, which is often present in the Leonora area, or a soil colour change representing a change in redox soil conditions.

Shree submitted the samples to a geochemical laboratory for analysis and expect results later this month. They will be assayed for a range of elements including gold, copper, lead, zinc, arsenic, bismuth, nickel, cobalt, tungsten, rubidium and lithium.

Shree intends to define a number of drill targets from this program and will continue its exploration at Golden Chimney over the coming months.

A final word

With the iron ore price on the rise, now could be a perfect time to leverage off its move.

And while there are very few juniors where you can find iron ore exposure, Shree Minerals has everything that it needs already in place, meaning it can deliver a quick response to the improving market.

With a previously operational mine and existing JORC resource, plus plenty of tenure still to explore, I’d expect a quick response from investors once the opportunity at hand becomes more widely recognised.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.