ASX explorer potentially sitting on a billion dollars of this rare wonder metal…

Published 17-FEB-2014 12:52 P.M.

|

5 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Since we first uncovered Cradle Resources (ASX:CXX), the news flow has not let up.

The Next Mining Boom first brought you the CXX story in our original report Rare Ingredient in “Super Steel” – Tiny ASX Explorer has Just Found Enough to Become the 4th Largest Global Supplier . This report details all the facts on CXX and the Niobium investment proposition.

Since the report was released, CXX has risen as high as 50%.

The past performance of this product is not and should not be taken as an indication of future performance. Caution should be exercised in assessing past performance. This product, like all other financial products, is subject to market forces and unpredictable events that may adversely affect future performance.

CXX are now moving fast developing and defining their highly prospective Niobium resource .

Niobium is a rare wonder metal that makes steel stronger AND lighter. Needless to say this mysterious metal is in high demand as a commodity to watch.

The Niobium market is a closed shop – just three major producers reap continual profits from the world’s demand of this very useful metal.

CXX are aiming to disrupt this market by producing their own Niobium and taking a profitable slice of the market.

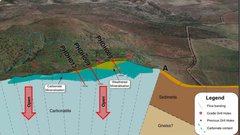

CXX currently own 50% of the Panda Hill Project in Tanzania – with management control. They also have the option to buy the rest of the Project before 2017.

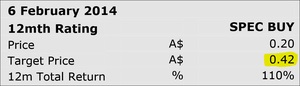

In less than a month since our first report, we have been bombarded with high impact, positive news flow, on an almost weekly basis – the chief piece of news is the positive Scoping Study results . Following the release of the Scoping Study, Paterson’s Analyst Simon Tonkin has outlined a target 100% gain from the current CXX share price :

Although this price prediction was made by a professional who analyses stocks all day, we should mention that it of course is no guarantee that this price target will be met.

Scoping Study Results

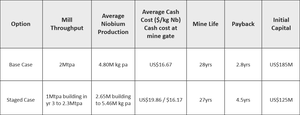

In late January 2014, the CXX’s Scoping Study results for the Panda Hill Project were released, one further step completed on the pathway to Niobium production. Details of the Base case and Staged case are as follows:

In summary, the independent Scoping Study concluded that CXX have on their hands:

- Low upfront capital costs for base case – US $185 M – 19% lower than CXX’s original estimates;

- Attractive Staged option available – this would see production ramping up from 1 Mtpa to 2.3 Mtpa, reducing upfront capital costs to US $125 M – but still maintain similar economics over the life of the mine;

- Substantial cash flow can be generated at current Niobium prices – Niobium fetches about US $40/kg on the market, and CXX are looking at cash costs of only US $16.67/kg – that’s an impressive 58% below the Niobium selling price ;

- Payback less than three years for the base case , and 4.5 years for the Staged Case – not a lot when the life of the mine in both scenarios is over 25 years;

- Open cut mine – with a relatively shallow strip ratio of only 0.37 to 1 – this means it’s easier and cheaper to dig up;

- Potential remains to improve economics further – In the following months, optimisation will be undertaken on the mine, particularly in relation to mine scheduling and reagent use.

In addition to the Scoping Study, CXX are still eyeing off potential for expanding the resource size – through further exploration activities within the project.

Our Track Record

Regular readers of our sites will be familiar with our long-standing interest in reporting on high potential stocks that we uncover. To note just a few:

- Our latest portfolio addition – ASX:CXO, has been up almost 100% since we called it in the report BHP Circling... Micro Cap Neighbour to Drill Mammoth Targets

- Since we uncovered ASX:SEG, its share price has risen 100% since we called it in the report Sirius went from 5c to $5... New Upstart Explorer Has More Land, More Drilling Targets

- After our report on ASX:SWE The last junior oil explorer operating in this exciting region with this same JV partner went up 800% in a matter of months – the share price has been up to 150% since we call it

- Following our coverage on ASX:TRF – This junior stock will rebound hard in a broad commodity rally – TRF has risen as high as 110%

- And who could forget our tip of the deacade, TSX:AOI, which has since a rise as high as 600% (!) since we called it in the report East African Oil – Hot Tip of the Decade!

The past performance of these products are not and should not be taken as an indication of future performance. Caution should be exercised in assessing past performance. These products, like all other financial products, are subject to market forces and unpredictable events that may adversely affect future performance.

Niobium Grade – Positive Results

It’s worth highlighting the recent metallurgy testing undertaken on the weathered material at Panda Hill.

The maximum potential niobium recovery at a 55% Nb2O5 grade is between 75% and 82% – compared to the fresh ore average of 88%. Existing Nb producers – there are only 3 of them – recover about 50 to 60% overall – so CXX’s results are in line with the big producers .

![]()

What’s Next for CXX?

Over the course of 2014, CXX will continue along the path to becoming the fourth major player in the Niobium industry. The year will see them move to ‘ Definitive Feasibility Study ’ mode (DFS), and will give regular updates along the way.

One thing that will be necessary during this time is an equity raising.

CXX have spent the last couple of weeks in Africa at the Indaba mining conference – and some serious networking was undertaken. It now appears likely that the whole equity raising will be undertaken by London based funds specialising in emerging resource projects.

These funds are likely to be strategic cornerstone investors and ‘sticky money’. F

ollowing this raise, The Next Mining Boom sees potential for significant price appreciation – as CXX starts ticking all the boxes on the path to becoming a Niobium producer. To stay updated with all the CXX updates as they come to hand, like CXX on Facebook or follow them on Twitter .

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.