ASX Explorer in Pole Position as Electric Cars Spark Graphite Rush

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

You used it every day back in primary school to draw and write with. But right now, this substance is helping to write the future of the human race as a key ingredient in the batteries powering the global electric car revolution. The Next Mining Boom has recently invested in an ASX listed company who is sitting on a resource with the highest grade of this substance in Australia. The substance also helps to run your laptop, your smart phone and your computer tablet... A one atom thick layer of this substance has an entirely futuristic set of applications – due to its incredible strength...

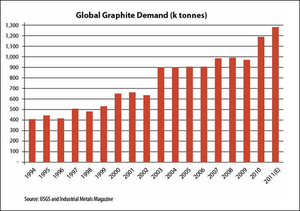

That’s right, we are talking about graphite. China, the world’s largest producer of graphite, has revealed its stocks are running low. Combine that with:

- the increasing demand for graphite from battery manufacturers;

- plus the accelerating growth of battery powered electric cars;

- plus the cutting edge applications being developed in science labs around the world with graphene – the one atom thick layer of graphite...

And you have a tidal wave of positive graphite sentiment that can’t be ignored. The Next Mining Boom has just made a long term investment in one junior explorer with a promising inferred graphite resource in Western Australia. Lately graphite has been helping to line the pockets of other well positioned companies and quick witted investors:

- Syrah Resources share price has jumped from 15c to near $5.50, as it confirmed a resource of 382Mt of this stuff in Mozambique – it’s now capped at over $850M – recent share price surges have been due to news that Glencore may have sparked a $2 billion takeover race ;

- Triton Minerals has gone from 6c to 50c in the last few months with just 60% ownership of a 100 Mt resource, next door to Syrah – now the company is worth $130M;

- Lamboo Resources is also getting in on the action due to its Australian project, climbing from 7c up to an astonishing 93c in the last 8 months on the back of just a 7Mt resource, now valued at $120M.

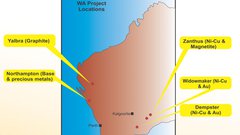

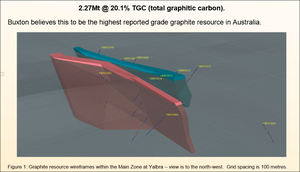

The past performance of these products is not and should not be taken as an indication of future performance. Caution should be exercised in assessing past performance. These products, like all other financial products, are subject to market forces and unpredictable events that may adversely affect future performance. But these companies have likely already had their big runs – certainly the dynamic early stage growth that we are interested in at The Next Mining Boom is long gone. The company we have invested in is hoping to follow in the footsteps of these ASX listed graphite wonder stories – and it’s capped at just $16M, with plenty of blue sky to run into. This company holds the highest grade graphite resource in Australia – 20.1% total graphitic carbon. At 2.27 Mt, its resource size currently at first glance appears to be small – but this is enough for an 8-12 year mine life and some valuable early cash flow. Plus the resource is open along strike, the company is applying for tenements down strike, and drilling results are being processed right now in the lab.... So the truth is, no one knows just how big their high grade graphite resource might be... but we should know a whole lot more when samples come back from the lab in just weeks . The other question mark over this company is the metallurgy – jumbo flakes of graphite sell for around $1,600 /tonne right now, while the amorphous stuff goes for $500/tonne ... we don’t yet know the nature of this company’s graphite – but we should know a little more when those sample results are back in the coming weeks. It’s not only graphite that this company has in its arsenal – housed in this company’s $16M market cap comes another high potential project, in one of Australia’s hottest nickel post codes... When it comes to nickel in Australia, there is only one place to be – the Fraser Range. Yes, not only does this company have a graphite play, it also has a massive land holding right next door to Sirius, a company that saw its share price go through the roof when it discovered two big nickel deposits. The past performance of this product is not and should not be taken as an indication of future performance. Caution should be exercised in assessing past performance. This product, like all other financial products, is subject to market forces and unpredictable events that may adversely affect future performance. As the nickel price continues to climb in recent months, this company’s maiden Fraser Range drilling program identified a highly prospective 1km strike length, which has now set the scene for a follow up drill program hunting massive nickel sulphides... It can count on the support of a wealthy Chinese investor, who controls 15.9% on the company and last tipped in $2.3M, at a premium to the current share price. One well respected broking firm’s Analyst has rated this company a “Speculative Buy”. We like not only the multiple near term catalysts on the horizon, but also see long term potential – so we have decided to make a long term investment in BUX. With graphite AND Fraser Range nickel plays, if this company was a boxer it would have a knockout punch in both fists... Let’s bring it onto the ring shall we, our latest investment:

Buxton Resources (ASX:BUX) is capped at a measly $16M right now – despite having two projects uniquely placed with potential to blow up its share price if they present the markets with some juicy numbers. BUX has a tight capital structure, with top 20 shareholders owning 60% of the company. Add to this the relatively small amount of shares on issue and BUX appears to be highly leveraged to success. With $2M on hand at the end of March 2014, even following recent exploration this company should have a decent bank balance right now. But given BUX are still an exploration company, at some stage in the future they will likely need to raise more capital to continue to develop their projects.

Are you a BUX investor and want to spread the word?

Get the message out there – make sure everyone knows about BUX and share this article by clicking the buttons below: [sd_share_article title=”ASX Explorer in Pole Position as Electric Cars Spark Graphite Rush”] Newer readers should know that we invest in stocks we write about like BUX as a long term hold – for more information check out our Financial Services Guide and Disclosure Policy . Number one on our radar is BUX’s Yalbra Graphite Project in the mid-west region of Western Australia. A maiden drilling program there has identified a 2.27Mt inferred resource of graphite. OK, that’s not much, but remember, it’s an initial size... and it’s still enough for an 8 -12 year mine life and some healthy early cash flow. The head turner is the purity grade of BUX’s graphite – 20.1% – with some drill intercepts returning figures higher than 30%!

![]()

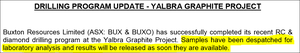

Graphite is a hot commodity right now, tied to the rise of electric cars that use Lithium-Ion batteries that rely heavily on graphite to work. More on that later. BUX’s WA graphite resource is the highest grade graphite in Australia right now and as far as we can see the key things holding it back at the moment are its resource size and further metallurgical results. But BUX isn’t sitting on its hands. Oh no. BUX has just completed a large scale Reverse Circulation (RC) and diamond drilling program at Yalbra and drill results are imminent.

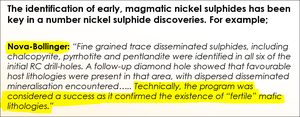

These sample results should further prove up what BUX are sitting on, honing in on % purity and graphite quantity. Metallurgy results should be a major catalyst for BUX – if these results are any similar to its higher valued peers then we could see BUX re-rated... As if that wasn’t enough, BUX has another WA mining project, this time down south in the Fraser Range near the port city of Esperance. The Fraser Range is THE place to be for Aussie mineral exploration right now... Regular readers of the Next Mining Boom and the Next Small Cap will know why we love the Fraser Range so much, but if you are new in these parts then we have two words for you – Sirius Resources – a company that went from 5c to $5 almost overnight after it found two huge nickel resources in the Frasers called Nova-Bollinger.

The past performance of this product is not and should not be taken as an indication of future performance. Caution should be exercised in assessing past performance. This product, like all other financial products, is subject to market forces and unpredictable events that may adversely affect future performance. The Nova-Bollinger discoveries sparked the much discussed great nickel rush in the Fraser Range and made instant fortunes for the investors who got in on the ground floor. But Sirius has made its big discoveries – we are interested in the next big finds – hence why we are investing in BUX. BUX are not alone, there are a whole host of companies exploring the Fraser Range, we have covered two in particular, Segue Resources (ASX:SEG) , and Mining Projects Group (ASX:MPJ) . Segue Resources has been up as high as 100% since we first released our article:

Source: Etrade Australia

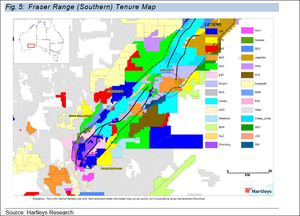

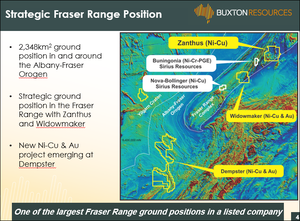

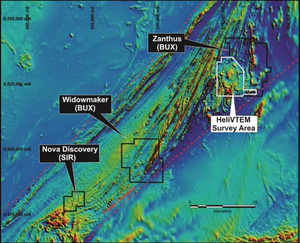

The past performance of this product is not and should not be taken as an indication of future performance. Caution should be exercised in assessing past performance. This product, like all other financial products, is subject to market forces and unpredictable events that may adversely affect future performance. BUX has one of the largest ground positions in the Fraser Range belt with two main projects – Zanthus and Widowmaker covering 592km2 together. Here is a rough guide to who sits where in the Fraser Range, BUX’s Zanthus project is circled in pink:

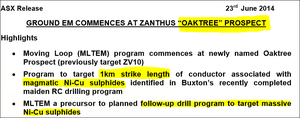

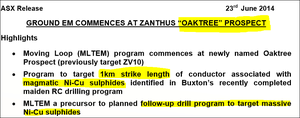

Nestled within the Zanthus project, it’s got a new target dubbed the Oaktree Prospect where a fresh round of ground EM surveying is underway :

All of BUX’s projects including Oaktree are in the same strike zone as Sirius’ Nova-Bollinger discoveries with Zanthus 60km away and Widowmaker 22km away. So there you have it. One company, two in demand materials, and two projects with loads of imminent catalysts that could see it follow in the footsteps of its much higher valued peers. But assets and chances aside, another compelling reason for us that brought about our investment in BUX is its leadership team and the connections between them. Graphite is a growth material for China which until quite recently produced and exported the bulk of it. But times have changed and stocks in the East are running low, opening up new opportunities for graphite producers to sell to China. Good news for BUX, as the Chairman of BUX lives in China and has worked there for most of his career. One of BUX’s Directors is also a Corporate and Financial manager of the company’s major shareholders – NBH – a powerful and influential foreign investment fund. Plus, another director of BUX built a sterling reputation at BHP as the go to man for nickel projects, heading up exploration programs in North and South America with consummate skill. It’s not just us who are bullish on BUX, Analyst Mike Millikan from Hartleys also likes what he has seen, allocating a ‘Speculative Buy’:

Looks good, but just remember, analysts arent perfect – they can get things wrong – we always approach these analyst predictions with caution.

In this article The Next Mining Boom is going to run you through why we have made an investment in BUX:

- What graphite is and why it’s so in demand

- What BUX’s graphite play is all about

- BUX’s China connections and cashed up position

- BUX’s Fraser Range nickel play

- All the imminent catalysts driving the buzz on BUX’s potential.

Let’s get started...

The great global graphite grab

Graphite means ‘writing stone’ in Ancient Greek and for a very long time in human history that’s what people did with it – write and draw and doodle with Graphite. But in modern times we have found scores of uses for it, some humble and some so ambitious they boggle the mind. All the new graphite fuss is playing right into the hands of BUX. Graphite is a very stable form of carbon, a superfine version of coal that can absorb tremendous amounts of heat so you will see it almost every day coating brake pads. It’s why the wheels rims of your new Audi get so black between washes. Tap the brakes and graphite slows your momentum.

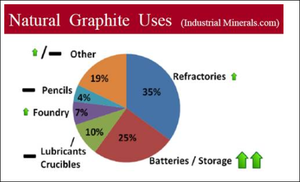

Graphite is also used in pencils, to make lubricants, to line foundry facings and steel making. All of these materials provide a constant demand on the world’s supply of graphite and are the industry’s regular cash cow. The Royal Geological Society has listed graphite as a strategic mineral – basically because it’s extremely useful, yet hard to get your hands on. But forget pencils. What’s getting the markets hot and sweaty right now is graphite’s use in electric car batteries.

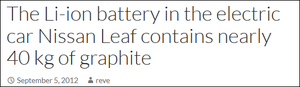

Lithium-Ion batteries contain loads of graphite – there are 10 times more graphite in these batteries than lithium) and are used in electric cars, an industry that’s growing leaps and bounds as more people buy cars like the Toyota Prius and American cities like St Paul embrace charging stations to allow them to recharge. The Lithium-Ion batteries used in a Nissan Leaf have over 40kg of graphite!

Car manufacturers are falling over themselves to do a Bob Dylan and go electric. Mercedes-Benz, BMW, and many others are all plugging in to Lithium-Ion batteries that use graphite. The International Energy Agency reckons there could be 20M electric cars on the road by 2020. That’s a lot of graphite to sell! A few batteries here and there is all well and good, but now let’s look at something truly space age and with the potential to truly boost the demand for graphite once and for all – a gigafactory.

A gigafactory is a fancy name for a large battery making plant. US electric car manufacturer Tesla is planning to build one – no word yet on where or when – but CEO Elon Musk reckons the global auto industry will need 200 such plants by the year 2040.

Musk says the gigafactory will cost $5BN to build and produce enough batteries for half a million electric cars by 2020. Panasonic is the factory partner – making batteries for its sophisticated line of consumer electronics that use similar tech to Tesla’s power plants. Sounds like a lot of graphite demand to me... maybe BUX can one day help out with a high grade Aussie resource? In what could be a globally significant tipping point, Tesla has also announced it will not contest ANY of its patents . This throws open the doors to new manufacturers who can now use Tesla’s technology for free – this could finally lead to the creation of a global electric car industry that could one day overtake and destroy its internal combustion rival.

They may need more batteries than they thought... All of these batteries will use graphite in some shape or form. All of them. Electric cars and consumer electronics represent a tangible outlet for the world’s supply of graphite. For years China has held sway over graphite but its stocks are running out!

All of these growing waves of demand for graphite has caused a surge in graphite exploration companies – we think BUX will next, that’s why we have in them.

Hi tech graphene – atomic sized graphite

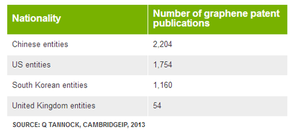

Then there is graphene – a super strong substance made from graphite that is 200 times stronger than steel. Basically, graphene is a sheet of graphite one atom thick. In 2010 two scientists won the Nobel prize for their work on graphene and a few years later some Irish scientists discovered how to make graphene using a kitchen blender, some lead pencils and washing up liquid! The graphene phenomenon has sparked a global race to sew up the rights to just about every application for it you can think of from electronics to plane wings, car bodies and military equipment.

Graphene is still very much a future application for graphite – but nevertheless there is a scramble for companies to unearth suitable graphite that can make graphene.

Graphite supply side dynamics

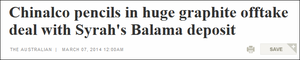

Some commentators have raised concern that Syrah, capped at $700M, with a mammoth 382 Mt resource, might fill the entire supply side of graphite, leaving all competitors in the dust. But recently China’s Chinalco, the third biggest aluminium producer in the world, has signed an agreement to take up to 100,000 tonnes of Syrah’s future output, putting it to use in yet another new end market – aluminium anodes.

If Chinalco find graphite to be better than other products for aluminium anode application, the world will need even more graphite:

All in all, the future market for graphite looks very bright – let’s now take a closer look at BUX’s competitors on the ASX...

How BUX stacks up against the rest

We have been suitably impressed by the performance of graphite stocks lately. Syrah Resources has gone from 15c to $5.50 as it proved up a 382 Mt graphite resource in Mozambique – it’s now capped at $850M, thanks in part to recent news of a $2BN takeover race started by Glencore:

Source: Google Finance

The past performance of this product is not and should not be taken as an indication of future performance. Caution should be exercised in assessing past performance. This product, like all other financial products, is subject to market forces and unpredictable events that may adversely affect future performance. Triton Minerals, next door to Syrah in Mozambique, has gone from 6c to 50c in the last few months with its 100 Mt resource, now the company is worth $130M, and they only own 60% of their project:

Source: Google Finance

The past performance of this product is not and should not be taken as an indication of future performance. Caution should be exercised in assessing past performance. This product, like all other financial products, is subject to market forces and unpredictable events that may adversely affect future performance. Lamboo Resources is also getting in on the action due to its Australian project, climbing from 7c up to an astonishing 93c on the back of just a 7Mt resource, now it’s valued at $120M:

Source: Google Finance

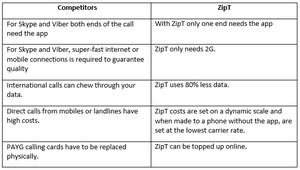

The past performance of this product is not and should not be taken as an indication of future performance. Caution should be exercised in assessing past performance. This product, like all other financial products, is subject to market forces and unpredictable events that may adversely affect future performance. BUX is in its rookie season in the graphite game and is still looking up to the established players like the guys above. But as far as we’re concerned BUX is playing a blinder, entering the field with a strong suite of assets up its sleeve. Who knows, in a few days or a few weeks we could have a set of figures in hand from BUX’s latest round of exploration drilling and BUX may be heading in a similar growth trajectory. But for now, let’s drill down into the details of this comparison table to see how BUX fares:

OK, so BUX has 85-100% ownership of its Yalbra graphite project in Australia which has a pre-upgrade JORC resource size of 2.27Mt with a JORC resource grade of 20.1% TGC (Total Graphitic Carbon), giving it a market cap of $16M. The only unknown is the metallurgical properties of the resource. That will come with time and drilling. The next few weeks should further define what BUX are sitting on. Right across the board, BUX compares quite well with four established ASX listed graphite competitors; Talga Resources, Lamboo Resources, Triton Minerals and Uranex Minerals. BUX is the minnow of all of them, capped at just $16M – that’s with the Fraser Range nickel play added in. Back to graphite, the only category BUX suffers in is JORC resource size. Its 2.27Mt prospect is dwarfed by the 103Mt resource controlled by Triton Minerals. The other three are all bigger too. Talga has 7.6Mt, Lamboo has 7.1Mt and Uranex has an exploration target between 55Mt and 101Mt. But, bear in mind that BUX’s 2.27Mt is a pre-upgrade figure, and it’s still enough for an 8-12 year mine life. At this early stage, it’s a guesstimate – the tip of the spear of what could be in the ground. Plus BUX are applying for licenses in the direction of strike. So when a full scale exploration program gets underway, that 2.27 Mt figure could start to creep up to those more established graphite projects. The category where BUX truly shines is JORC resource grade – 20.1% TGC. The Yalbra resource is the highest grade in Australia. The only graphite source with a higher grade in the above table is the Nunasvaara project owned by Talga – 24.4% TGC. Impressive grades, and they are targeting some hi-tech graphene applications, but the graphite there is amorphous – BUX are chasing flakes. BUX has flake graphite in the ground, the good stuff – We just don’t know how much flake graphite yet. If BUX can confirm a 2Mt plus resource of high quality flake graphite with high grades then we would be suitably impressed... The second category that BUX’s excels is in its country of operation – Australia. Yalbra is in Western Australia where the mining industry is the be all and end all. From the forests of the South-West to the arid deserts of the North-West just about every possible mineral that can be dug up and sold is being dug up and sold. Almost the whole state of Western Australia is geared to mining – it makes 90% of its income from the industry. The risk BUX encounters operating a graphite mine in Western Australia is minimal. The work force is first rate, the infrastructure is modern and plentiful and the government is stable and effective. Compare that to Triton and Uranex who operate in Mozambique and Tanzania respectively. The risks of operating in Africa are higher than Australia. Infrastructure can sometimes not be as good, the political winds can change direction very suddenly and much time and effort needs to be invested in developing the work force. Best of all, BUX’s market cap is low, just $16M compared to the $120M market cap Lamboo has with a 7.1Mt flake graphite resource of just 5% TGC (Total Graphitic Carbon) grade. Lamboo has already seen tremendous market growth. It bears repeating. BUX is valued at $16M with a 2.27Mt graphite resource with a grade of 20.1% TGC. We think BUX is severely undervalued on the ASX and its low market cap means investors have the chance of seeing their support grow in value as BUX realises its potential. There are many graphite miners further down the road than BUX, but at The Next Mining Boom we reckon none of them have as much potential for investors, either due to already realised value or a lesser quality graphite project. Throw in the Fraser Range nickel project as well!

Our Track Record:

Did you see The Next Small Cap article on Navarre Minerals (ASX:NML)? NML has traded as high as 100% since:

Chart Source: Etrade.com.au

The past performance of this product is not and should not be taken as an indication of future performance. Caution should be exercised in assessing past performance. This product, like all other financial products, is subject to market forces and unpredictable events that may adversely affect future performance.

BUX’s highest grade graphite resource in Australia

BUX’s Yalbra Graphite Project is rated as having the highest grade resource of graphite in Australia. The company’s maiden drilling program in 2013 intersected numerous zones of high grade graphite, giving it an inferred JORC resource of 2.27Mt at 20.1% TGC (Total Graphitic Carbon).

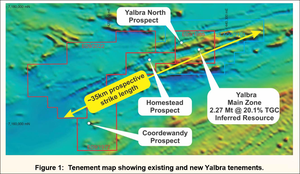

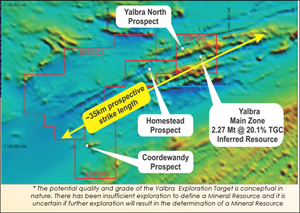

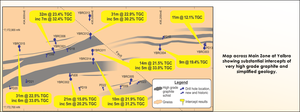

That’s just for starters though. On the map, Yalbra is in the mid-west region of Western Australia 280km east of the coastal town of Carnarvon. This is farming and mining land, hot and dry and full of unexplored ancient formations that make geologists go weak at the knees. BUX controls tenements in the area with 85-100% ownership. There are two main areas BUX is concentrating on – Yalbra Main Zone where you’ll find the 2.27Mt inferred resource at 20.1% TGC and Yalbra North where a new discovery is waiting to be explored further:

What caught our eye was that BUX is quietly expanding its ground holding down strike from the Yalbra Main Zone – it’s just applied for an exploration license of 93 km 2 to the east – along the strike from the Main Zone. Several prospects in this additional land have graphite mineralisation identified at surface:

![]()

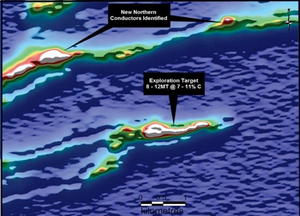

So the current 2.27Mt inferred resource may start to expand too... BUX currently has over 566km 2 of tenements with 35km of strike length – quite a large playing field – full of prospective graphite targets. As well as the 2.27 Mt inferred resource, there are a number of exploration targets and glowing electromagnetic-magnetic (EM) conductors that have attracted BUX:

BUX just completed a 1,750m combined Reverse Circulation (RC) and diamond drilling program at Yalbra to probe deeper into the graphite targets it developed during drilling in 2013:

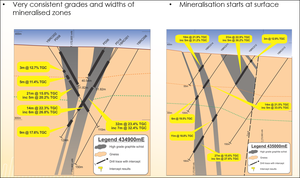

The aim of this drilling is to expand the 2.27Mt resource to enable a Scoping Study to take place and conduct metallurgical testing to determine what kind of graphite BUX has in the ground. The next few weeks should see a flurry of news as the drilling results come back – all steps toward knowing whether BUX has a real deal graphite project or not. Resource size is important of course, but in the graphite game the grade and metallurgical properties are what really count. The higher the grade and the bigger the flakes the more money you can charge for the product. We’ll dig into the types of graphite in the next section but for now, just know that purity and size count for a lot. BUX has finished both RC and diamond drilling and sent the samples for laboratory analysis – it says results will be released as soon as they come to hand. It is an understatement to say we’re waiting on the edge of our seats at The Next Mining Boom for those drill results. If the existing drill information and the performance of other ASX listed graphite stocks is anything to go by, we could be in for some high times indeed. BUX has previously done a lot of exploration drilling at Yalbra Main to get an idea of what’s in the ground – what it found was impressive. During November 2013, the Company completed a 15 hole RC drilling program for 1,689m at Yalbra. These were the best results:

Source: Buxton Resources

Over 30% TGC is almost unheard of and the fact that most of the best drill holes have at least some graphite of that purity is a great result. Examination of these samples has found that significant medium and coarse graphite flakes are present – just the stuff you want – and very high grade material intersects in most of the drill holes. Mineralisation starts at the surface and continues all the way down. Open in all directions. We like this as it tells us there is potential resource upside... BUX says it’s a consistent resource with a high grade core. Have a look at this:

Source: Buxton Resources

You guessed it, the grey stuff is the high grade graphite. This is just one area of BUX’s graphite tenements in Western Australia. There’s another target in the Yalbra North zone and the two new tenements, Coordewandy and Gum Creek Graphite are part of the same strike zone. BUX has a 2.27Mt resource (pre-upgrade) at 20.1% TGC at Yalbra Main so far. Hopefully a nice juicy resource upgrade can follow from these drill results, but another crucial thing is the metallurgy of BUX’s Yalbra project. All will be revealed shortly, once the laboratory testing is completed on the fresh Yalbra samples just dug up during the RC and diamond drilling program. What they find will determine everything, because not all graphite is equal.

Graphite’s different guises

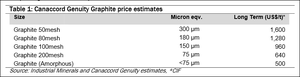

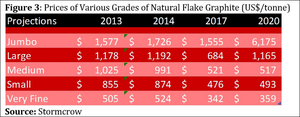

Basically, there are two types of graphite – graphite flakes and amorphous graphite. Geological attributes aside, jumbo flakes are the most lucrative, with an estimated sale price of $1,600 /tonne while amorphous is cheaper selling for $500/tonne.

Jumbo flakes are the best to dig up and there are forecasts that they will sell for $6k / tonne in the coming years due to rising demand from the steel and auto industries:

You can see above the price of amorphourous graphite is predicted to fall away, whilst the jumbo flake sizes are predicted to rise in price. That’s why BUX are focussed on hunting the best quality graphite they can find – they may be able to pick up some graphite of lower grade and quality – its just a matter of how much they want to find and at what quality. But they’d rather focus on the lucrative large / jumbo flake size market. Graphite flakes are just that, big plate like particles with hexagonal edges if they are unbroken and irregular or angular edges if they are. If you find flakes, they are easier to dig up, easier to process and are more likely to have a higher purity. Amorphous graphite is made up of very, very fine flakes and often has higher impurities that cause it to have a lower sale value. So jumbo flakes are the name of the game and BUX has found flake graphite at its Yalbra project in Western Australia. The big question hanging over BUX right now is what percentage of big coarse flakes do they have? When BUX can confirm its graphite flake type – fingers crossed its jumbo and lots of it – then we will really understand this company’s true potential. Bring on those drill results! BUX is currently capped at $16M with a 2.27Mt flake graphite resource in the bag so far. It has just completed a second, even deeper and more sophisticated round of exploration to explore its graphite potential and we’re hoping this undervalued company can have a similar upwards trajectory as the other graphite explorers. Until then, we can only wait and take quiet pride in the fact that even though BUX is just beginning its graphite journey it already stacks up very nicely against many other more established players...

Our Track Record:

Did you see The Next Oil Rush article on Real Energy (ASX:RLE)? RLE has traded as high as 40% since:

Chart Source: Etrade.com.au

The past performance of this product is not and should not be taken as an indication of future performance. Caution should be exercised in assessing past performance. This product, like all other financial products, is subject to market forces and unpredictable events that may adversely affect future performance.

BUX’s China connections

China is the world’s biggest producer of flake graphite, providing over 70% of the world’s supply. But it’s fast becoming a big importer too. China has in the past placed embargoes on graphite and flooded the market. But now it’s revealed its stocks are dwindling. Excellent news for BUX who can readily step in with a 2.27Mt resource rated at 20.1% TGC – the second highest grade in the world – and which could soon be upgraded when we know the results of its latest round of exploration drilling! Even better, BUX has studiously developed close business ties to some of the most powerful and influential people in China, so when the time comes to sell graphite they will get to the front of the line. BUX’s major shareholder is National Business Holdings; a Chinese company that can provide strong financial backing for BUX’s ambitions if needed. BUX calls its relationship with NBH a “strategic partnership”:

It began in September of 2012 when NBH helped BUX with a $2.1M strategic capital raise taking a 15% placement of shares in the company worth $1.5M – this was effectively at 35c when BUX was trading at 17c. NBH repeated that in March of 2013 with a $2.3M capital raise, which was undertaken at a share price of $0.46... much more than BUX’s current share price. We are glad we have made our recent investment at a lower price than the two big NBH capital injections... The $2.3M capital raise included a further uptake of BUX shares and support from a Hong Kong resources fund, a private equity firm, and institutional and sophisticated investors. NBH can turn on the money tap for BUX – it’s done it twice and we dare say it will do it again – so investors can see that BUX has solid financial backing from one of China’s elite investment groups. This Chinese connection will be invaluable when the time comes for BUX to find buyers and strike deals for any confirmed graphite resources it has out at its Yalbra Graphite Project. But BUX doesn’t have to travel all the way to China to connect with the world’s second largest economy. Just look in the board room.

![]()

Non-Executive Chairman Seamus Cornelius has been living and working as a corporate lawyer in China for 17 years. He has been based in Shanghai and Beijing since 1993. Cornelius has 21 years of corporate experience in both legal and commercial negotiations and is considered a specialist in cross border investments focussed on energy and resources – like graphite. He is BUX’s man in China, the leader with the local knowledge and connections. He has advised large international companies on their investments in China and advised Chinese state owned entities on their investments in natural resource projects outside of China including in Australia. OK, so that’s the top of the table sorted. How do the rest of BUX’s leadership team get on with China? Non-Executive Director Xiangzhou Liu has spent over 16 years working in senior finance roles with financial institutions and investment companies in China and the United States.

![]()

Oh, and right now, Liu is the Deputy General Manager of National Business Holding Co. Ltd, BUX’s major shareholder... He is directly responsible for managing NBH’s corporate and financial strategies – a good bloke to have around! Liu has also worked as the Deputy Manager of International Trade for China Bank of Communications, a major Chinese financial institution. BUX’s connections with China run deep. Its major shareholder NBH is a powerful Chinese investment group. Its Non-Executive Chairman has lived there for years and one of its Non-Executive Directors has a senior role at NBH. NBH has twice helped BUX raise millions of dollars, the last time at a premium to the current share price, so it can continue to develop its mining assets including the Yalbra Graphite Project. When the time comes to dig deeper, BUX should have strong financial backing. When the time comes for BUX to sell its graphite, we’re betting NBH will have customers set up and ready to sign on the dotted line.

Nickel in the Fraser Range – BUX’s other hand

BUX isn’t just concentrating on graphite. It’s also a major player in the nickel rush underway right now in Western Australia’s Fraser Ranges. Essentially in the $16M BUX there is the upside potential of both graphite one of the hottest commodities right now, and the Fraser Range – the hottest exploration postcode in Australia... Unless you’ve been living under a rock you’ll know the incredible story of the rise and rise of Sirius Resources – a company that went from 5c to $5 almost overnight after it found two huge nickel resources in the Frasers called Nova-Bollinger. The Nova-Bollinger discoveries sparked the great nickel rush in the Fraser Range and made instant fortunes for the investors who got in on the ground floor.

The past performance of this product is not and should not be taken as an indication of future performance. Caution should be exercised in assessing past performance. This product, like all other financial products, is subject to market forces and unpredictable events that may adversely affect future performance. Now, prospecting is a mix of science and luck and there are no guarantees in this business. But a big reason The Next Mining Boom has invested with BUX is that we reckon it has a chance of repeating Sirius’ success in the Fraser Range. Sirius’ big Nova discovery is a magmatic nickel sulphide deposit that is part of a geological structure known as an “eye” due to the circular magnetic reading it shows on surveys. The other deposit, Bollinger, is a dominantly flat lying body to the east. The key thing here is geology – the age of the rocks, the degree of metamorphism and deformation, the ratio of copper and cobalt to nickel and the association of mafic intrusive rock. If all of these things are present you will very likely get a big nickel sulphide resource like Nova-Bollinger. Now, consider this. BUX has one of the largest ground positions in the Fraser Range belt with two main projects – Zanthus (Ni-Cu and Magnetite) and Widowmaker (Ni-Cu and Au) – covering 592km2 together.

Both projects are on the same strike as Sirius’ Nova-Bollinger discoveries with Zanthus 60km away and Widowmaker 22km away. Within the Zanthus Project it’s just uncovered the “Oaktree Prospect” – a new target where a fresh round of ground EM surveying is underway – more on that in the next section. BUX is operating in the exact same area as Sirius and both the Zanthus and Widowmaker projects have shown through early drilling and surveys to have similar geological features as Nova-Bollinger. We will know more when BUX drills. But the early results are a good indication of what could be confirmed soon. An airborne VTEM survey at Widowmaker identified seven priority targets for an aggressive exploration program. Out at Zanthus, gravity data has shown signs of an “eye” just like the one that gave away Nova’s existence. Plus, the EM survey underway at Oaktree could turn up something big too. Before we go any further, we need to dig down into the geology a bit more so you’ll be able to understand why we’re so interested in BUX’s nickel in the Fraser Range.

Our Track Record:

Did you see The Next Oil Rush article

on Tangiers Petroleum (ASX:TPT)? TPT has traded as high as 80% since:

The past performance of this product is not and should not be taken as an indication of future performance. Caution should be exercised in assessing past performance. This product, like all other financial products, is subject to market forces and unpredictable events that may adversely affect future performance.

BUX’s nickel niche

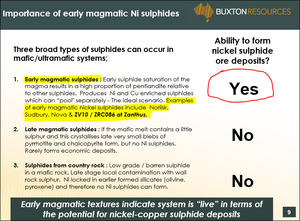

BUX’s nickel prospects there have what’s known as ‘ magmatic’ nickel sulphides within ‘ ultramafic’ rock. Ask your local geologist – Those two things together are the holy grail of nickel exploration. Magmatic means a molten substance beneath or within the earth’s crust from which igneous rock is formed – also known as ultramafic rocks. The Fraser Range was formed millions of years ago by volcanic activity and the thing that helps forms nickel – sulphides – settled there in three different ways, forming three different types of nickel deposits.

Only one forms a nickel sulphide deposit – early magmatic sulphides. This type of sulphide deposit forms early in the volcanic cycle, producing pools of nickel and copper. This is ideal – and is what makes up the Nova deposit, the resource discovery that sent Sirius’ share price into the stratosphere. The other two types you can find are low concentrate deposits. Late magmatic sulphides have a small proportion of sulphides but no concentrated nickel sulphides. It’s rare to get an economic deposit from these, it’s kind of like skimming a pool for leaves. Sulphides from country rock are the lowest grade, forming the latest so any nickel is either contaminated by other materials or locked inside silicates. No nickel sulphides can form and if you get one of these it’s a big fat zero. In August of 2013 BUX conducted a HeliVTEM survey over its E28/1959 tenement, a form of electromagnetic surveying done by helicopter. What they found was a number of gravity anomalies, major structures and geochemical anomalies that led to 18 EM targets that were drilled in the first exploration program.

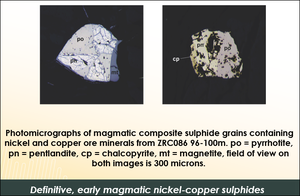

The early indications from initial exploration and testing are that BUX has early magmatic sulphides. The point is that the right sort of geological system exists within BUX’s Fraser Range tenements for nickel deposits to form – and it’s very, very similar to the Nova complex discovered by Sirius just down the strike length road. BUX’s drill results so far have confirmed layered mafic-ultramafic intrusive bodies and this is compelling evidence that something big and hopefully nickel shaped is lurking beneath the surface of the Zanthus prospect. Only deeper drilling will reveal what is really there and how big it is. If you want more evidence of nickel, the proportion of pentlandite in the rocks also indicates early magmatic sulphides. Just check this out:

Chock a block with pentlandite. You get this sort of thing in a Proterozoic orogen – a place where millions of years ago the earth’s crust bunched together and formed mountains – like the Fraser Range. So far, drill results to date have been encouraging rather than outstanding. But Sirius’ first up results at Nova didn’t set the world on fire either. At Sirius’s Nova deposit, initial drill results were pretty ordinary in terms of grade (like 0.1% nickel) – but the point was that it was the right environment for the presence of the important stuff. Nickel sulphide deposits.

As long as the geology is right and demonstrates the right environment for some big early magmatic nickel sulphides, the results have a good chance of improving. Like Sirius in the early stages, BUX has also identified what it’s calling a “fertile” project at Zanthus that has the potential for discovery of an economic resource of Ni-Cu mineralisation.

BUX’s Nickel Priority #1: Oaktree

Ground EM surveys are underway now at Oaktree – BUX’s newly uncovered high potential nickel lead:

Oaktree was formerly known as target ZV10 and was uncovered during BUX’s maiden drilling program at Zanthus. That work identified preserved magmatic nickel-copper sulphides, indicating an ultramafic deposit. The current EM program is targeting a 1km strike length of conductor associated magmatic Ni-Cu sulphides – homing in on the evidence taken from the maiden drilling. Once the EM program is finished BUX will have a raft of defined drill targets that it can dig into with an expanded exploration program. BUX has done a lot of the spade work – proving up good leads for a large nickel sulphide deposit at Zanthus – one of two prospective nickel tenements under its control. With nickel trending onwards and upwards, we are hoping that BUX can uncover something promising on the next drilling campaign...

Our Track Record:

If you are new to our site, you may not have seen our Next Oil Rush Tip of the Decade – which called Africa Oil Corp (TSX:AOI) at around CAD$1.8 . AOI has been as high as CAD$11.25 since – that’s over 600%!

The past performance of this product is not and should not be taken as an indication of future performance. Caution should be exercised in assessing past performance. This product, like all other financial products, is subject to market forces and unpredictable events that may adversely affect future performance.

BHP’s go-to guy for nickel is on board with BUX

BUX’s board boasts a couple of experienced Chinese heads, with its Non-Executive Chairman living there and a Non-Executive Director who is also sets the strategic course for BUX’s biggest investor. But not only that, when it comes to nickel, the BUX team also has it covered. Let us introduce you to BUX’s nickel knight – Non Executive Director Stuart Fogarty:

![]()

His last job was as BHP’s Senior Exploration Manager for both North and South America. Before that he was WA Exploration Manager for BHP. Before that he was in nickel exploration in WA, beginning his career at Kambalda Nickel. Basically he’s BHP’s go to guy for nickel... and now he is a Director at BUX. The rush for nickel in the Fraser Range is accelerating and competition is fierce. BUX has the biggest land holding with some of the best prospects going. But if it’s going to succeed it needs a steady hand on the tiller. We look at Fogarty’s CV and see a man who knows what he’s doing. We can bang on and on about BUX’s resource assets, but the assets that really count are the people running the show. You don’t become the Senior Manager of BHP’s North and South America exploration program with a head full of rocks. You get that job because you know how to take a prospect into production. BUX’s board are experts in their fields. They have the connections, the experience and the ambition to make BUX’s resource double play – graphite and nickel – the next big thing in Australian mining. The Next Mining Boom is investing with BUX because it has high quality assets being developed by high quality people.

OK, so what’s next for BUX?

Right now BUX is waiting for the lab results of samples taken from its Yalbra Main graphite prospect during an RC and diamond drilling program. BUX says the results will be released as soon as they come to hand – it could be just days or weeks away. There is no guarantee BUX’s latest round of drilling at Yalbra will turn up a golden ticket for the company. But BUX has already proven a 2.27Mt resource at 20.1% grade – the highest quality graphite resource in Australia. Remember some BUX grades have even reached as higher than 30%. And 2.27 Mt is enough for a mine life of 8 – 12 years. So we’re happy to take our chance in BUX’s graphite grab and have invested in the company as a long term play. Drilling results are imminent – any day now – and we’re glad we’ve got our ringside seats. It’s a similar story at its Fraser Range nickel project where BUX has a new round of ground EM surveys going on at its Oaktree Prospect, part of its Zanthus nickel project. This is a precursor to a more detailed drilling program, so the aim here is to find some fat juicy nickel targets and then go after them with a full scale drilling program later. Even after this quarter’s exploration work, BUX should be cashed up with more than $2M in the bank as of March 2014, a phone a friend relationship with NBH (one of China’s most powerful foreign investment bodies) and a leadership team with deep expertise, ties and experience in nickel and graphite. BUX is in a really sweet spot right now, doing the crucial spade work like drilling and surveying as its market cap is low ($16M) and its share price is undervalued. But once all of its catalysts start rolling in, the bargain basement price we have snapped up BUX for now may be long gone. Price jumps aside though, BUX is more than a quick buck operator. It has identified two markets – graphite and nickel – that it can create niches in and turn good profits for a long time. That’s why The Next Mining Boom is backing BUX for the long term.

Are you a BUX investor and want to spread the word?

Get the message out there – make sure everyone knows about BUX and share this article by clicking the buttons below: [sd_share_article title=”ASX Explorer in Pole Position as Electric Cars Spark Graphite Rush”]

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.