ASX Explorer Launches into $172BN Global Fertilizer Industry

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Developing countries like China and India are undergoing extreme demographic changes at unprecedented rates...

Billions of people are living longer, getting richer, and eating more energy intensive food – like meat.

In the coming decades, the population of Earth will hit 9 billion.

The big question on the lips of governments, corporations and investors alike is...

How can we feed 9 billion people from rapidly shrinking arable land?

Food and water security are paramount for all, yet they are facing a potential crisis – and that presents an opportunity for astute investors.

The $172BN fertiliser industry could be the silver bullet that slays the food shortage vampire...

Now to make fertiliser, you need to mix nitrogen, phosphates and potash.

And via their large potash and phosphate resource base, we have just identified an ASX listed company seeking to tackle global food shortages head-on.

It owns one of the world’s largest glauconite (a source of potash) deposits in Western Australia.

Within this glauconite is a large resource of phosphate nodules, from which the company is poised to generate $60M/year EBITDA over a +20-year mine life.

It’s also holds a significant stake in German potash exploration licenses, with 4.5 BILLION tonnes of potential potash.

That’s a lot of fertilizer.

In the background, it’s also working on cutting edge potash processing technology, which could drastically improve its operating margins. If successful, this technology could be sold to other potash projects around the world...

The sheer size of this company’s projects mean that much bigger JV partners could start to become very interested in the near term.

However right now, this company remains very much under the radar, capped at less than $10M.

What really piqued our interest in this story initial was that the exploration project in Germany has many similarities with the early days of Highfield Resources – a company with an advanced potash project in Spain.

Highfield Resources was a humble ASX listed shell, but after steady progress with its potash projects, the company is now capped at over half a billion dollars ...

The potential to reap serious rewards from potash is clear – can this ASX listed explorer follow a similar path to Highfield?

Potash West (ASX:PWN) is a sub-$10M capped minerals explorer with long-term ambitions to profit from potash.

Fresh off the back of a $1.8M oversubscribed capital raise , PWN holds significant stakes in four specific assets which could provide significant value-add over the next 3-6 months:

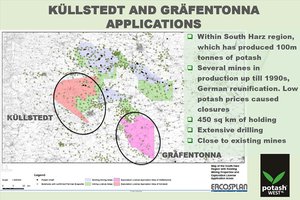

- An Exploration program in Germany where PWN owns 55% of East Exploration Pty Ltd (EE). EE owns 450 sq. km of exploration licences in the renowned South Harz region. If successful with it’s next drilling programme, PWN will own a stake of an inferred resource totalling 200 million tonnes with an exploration target of 4-5 billion tonnes. This project has sanguine similarities to Highfield – but more on that later.

- PWN’s second project is located in the Dandaragan Trough in Western Australia and aimed at producing potash, phosphates and other minerals. The jewel in the crown is the Dinner Hill site from which PWN hopes to produce in excess of 250 million tonnes of phosphate ore.

- A third project is PWN’s blue sky tech play that could disrupt the way potash is produced globally. PWN own 100% of the IP of this patented technology. This technology is dubbed “K-Max”, and should allow PWN to produce potash from glauconite at Dinner Hill. If this more efficient way of extracting potassium is unleashed over the next 5 years it could be a true money-spinner...

This IP has also enabled PWN to get involved in a new technology to extract lithium from micas, leading us to PWN’s final asset.

- Taking its patented K-Max technology a step further, PWN has a 25% stake in the IP relating to Lithium production. Lithium is a metal with demand growth predicted in excess of 10% per annum, driven by the dynamics of electric vehicles and lightweight batteries.

PWN’s exposure to the Lithium market could potentially add significant revenue over the coming years given growing use of battery powered devices and vehicles.

In essence, PWN is working on several routes to market via its own proprietary activities as well as forward thinking tie-ups with household names in the minerals and fertiliser industry.

Even with all of the above, PWN still has a market cap of less than $10M... it may be only a matter of time to the market wakes up to this company’s potential.

Arrowhead analysts Samarth Agrawal and Kanniga Rajamanickham recently placed a fair share value on PWN of $0.21/share , based only on the West Australian assets – that’s over 300% from PWN’s current share price:

Do remember that we only use analyst reports as an isolated tool when we make an investment – it’s not the only thing we go on.

What is Potash and What Does it Do?

Potash is a generic name for various salts that contain potassium (K) in water soluble form. It is a key ingredient of fertiliser and is one of three non-substitutable major elements in fertilisers in addition to nitrogen and phosphorous.

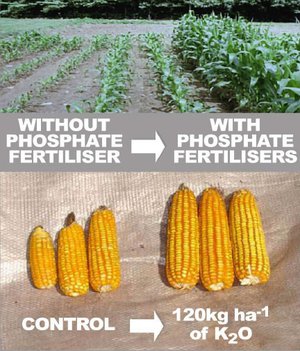

Here’s the ‘before’ and ‘after’ shot, for both phosphates and potash:

The potash market is like no other – only five companies control over 80% of global output.

And seeing as these cartelists want to maintain a stable high price, they regulate the amount of potash being sent to market to avoid oversupply.

It’s a high margin product, and from our investigations, we understand that these bigger producers are likely to limit the price to $400/tonne over the long term.

When PWN have exploration targets of over 4 billion tonnes of potash in Germany, that’s a lot of potential revenue for a company currently capped at less than $10M...

Potash allows farmers to achieve larger crop yields when correctly blended with other elements in fertilisers. Without fertilisers, crop yields are diminishing because of crop degradation reducing the quality of soil on a global scale.

Also, the availability of arable farmland land is gradually falling worldwide in tandem with a rapidly growing global population – making food security a hot topic.

With food and water security becoming a core issue, PWN is well situated to become a major contributor to the fertiliser market at a time of heightened demand.

The company’s first step is to supply phosphates and potash fertilizer into the agricultural sectors of Asia and Europe

At this early stage of the company’s development, it could be a good time to look at PWN as a solid long-term investment focusing on food and water supply as major themes for decades ahead.

Can PWN emulate Highfield’s success?

One company PWN could potentially emulate in terms of development and market value is Highfield Resources (ASX:HFR).

Highfield listed on the ASX in late 2011 and soon after going public, bought a brownfields potash asset in Northern Spain.

Over the past three years, Highfield Resources’ share price has risen from 18c per share and a $15 million market cap, to over $1.47 per share and a market cap of just under $500 million:

The past performance of this product is not and should not be taken as an indication of future performance. Caution should be exercised in assessing past performance. This product, like all other financial products, is subject to market forces and unpredictable events that may adversely affect future performance.

Over this period, Highfield Resources was able to prove an Inferred resource, drilled and confirmed an Indicated resource and eventually announced results of a feasibility study which showed proven deposits in its tenements.

Highfield recently featured in the Australian Financial Review’s Smart Investor, with the magazine highlighting Foster’s forecast production earnings for Highfield at US$42m pa in 2017 and $US214.5 pa in 2019...

Based on potential forward earnings from its potash projects in Spain, Highfield’s NPV valuation is over $2 billion ...

Here is where it gets interesting for PWN investors...

PWN currently owns 55% of the South Harz project, and drilling will start on the Kullstedt exploration licence soon. Because there is substantial previous drilling on the licence it is likely that limited drilling to twin existing holes will allow a rapid definition of a JORC compliant inferred resource.

When the exploration target has been evaluated at 4-5 billion tonnes, there is a strong potential value add for PWN on this imminent drill campaign.

Can PWN via its significant holding in the South Harz project, repeat Highfield’s success?

When looking at PWN and Highfield Resources side by side, a feeling of déjà vu inevitably surfaces due to the similar market and similar commercial strategies being employed by the two respective explorers.

Only PWN is capped at under $10M, and Highfield is now capped at over half a billion...

Oliver Asks for More

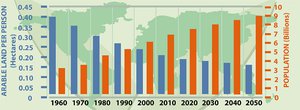

The global population is rising at an annual rate of 50-100 million people which means that by 2050, the planet Earth will have in excess of 9 billion people living on it – and almost certainly all of them will want to eat.

In tandem, the amount of arable land available for farming is rapidly shrinking from 0.35 pp per hectare in the 1970’s to 0.15 pp per hectare in 2020 .

More people means less space to farm and more has to be produced from a smaller amount of land.

Potentially, this is a crisis in the making which fertiliser producers and developers like PWN are trying to solve

Fertilisers allow farmers to grow more crops from the same amount of land. The use of fertilisers has proliferated to such an extent that today, over a third of the world’s total food supply can be directly attributed to the use of fertilisers.

That’s not all.

Not only is the population expanding at an unsustainable rate, but the type of food people are eating is changing too.

It is a societal tendency for people to spend a greater amount of money on meat and livestock as their standard of living rises – this makes sense.

Most of the world’s population growth is coming from developing countries such as China, India, Africa and South America. As people in developing countries get richer, they would rather eat more wholesome food including meat rather than sticking to plain Jane grains and greens.

This trend has a downside for farmers though.

Producing meat is roughly 4-10 times more land intensive than producing grains such as wheat or barley. This means that as China and India become more developed and richer on average, their citizens are likely to spend an increasing amount of their incomes on meat and therefore put even more pressure on dwindling arable land.

How quickly developing countries emulate their Western peers into falling in love with meat is unclear but when they do, it will be a bonanza for fertiliser sales in those regions.

And for PWN – once it can move into projects into production...

Every year the nutrient content of the soil used to grow our food (and clothing) is diminishing. To achieve the same quantity and quality of produce, farmers are having to use more and more fertiliser.

The world will need a consistently higher production rate of fertilisers (with higher potency) over the next 30 years.

The most populous countries in the world, China and India are currently seeing double-digit growth rates and a breath-taking surge in the amount of middle-class consumers. This trend is putting pressure on the global food supply and helping to raise food and commodity prices globally.

All in all, this is positive news for PWN’s ambitions to become a major contributor to the fertiliser market.

The South Harz assets

As we mentioned earlier, PWN owns a stake in two active exploration licences in the South Harz region of Germany, with some interesting similarities to Highfield Resources.

In partnership with world renowned German potash consultant Ercosplan, PWN intend to achieve a JORC compliant Inferred Resource of 200 million tonnes from an exploration target of 4-5 billion tonnes, within the coming months.

The central German region is renowned for its mineral deposits and given its 100-year history of mineral production, there has already been extensive drilling in the Kullstedt region already. This is a positive aspect for PWN because it helps the company to pick the best location for basing operations.

The local consultants Ercosplan made an announcement regarding proven potash deposits at Kullstedt back in March, but this news was not picked up by the Aussie market – this could mean a significant price correction if and when PWN have the resources JORC evaluated.

At this stage, PWN anticipates drilling approvals to be confirmed in October 2015 so drilling can start before the end of 2015 or early in 2016.

Dandaragan Trough

The second core project PWN is pursuing is the Dandaragan Trough in Western Australia.

The Dandaragan Trough holds a globally significant deposit of greensand, containing both rock phosphate and glauconite (which contains potassium).

All of these minerals are in high demand as agricultural fertilisers, and PWN’s plan is to both mine and produce products, including potash, to service this global market.

The green outline shows the borders of a sedimentary basin called the Dandaragan Trough and the red outline shows PWN tenements. It’s clear that the majority of the Dandaragan Trough is under PWN control!

PWN is leveraging the area’s solid infrastructure to reduce production costs and reduce market delivery times.

Railway connects are solid to two ports, including connections to the three largest fertilizer plants in WA. There is a supply of gas, there are quality roads, and high voltage power capacity. Sparse vegetation and freehold land classification are also factors that make the Dandaragan region a very cheap and efficient place for PWN to extract glauconite and produce potash.

Dinner Hill – The Jewel in the Crown

One of PWN’s biggest prospects is the exploration being done at Dinner Hill in the Dandaragan Trough.

Dinner Hill is a prime location because the phosphate is closer to the surface and easier to obtain compared to other locations.

Currently, Dinner Hill contains an indicated phosphate resource of 250 million tonnes with an exploration target of 1-1.5 billion tonnes. These numbers give PWN significant scope and upside within its current portfolio of exploration licenses in Western Australia.

Something We Made Earlier

An advantage for PWN is its close ties to other companies in the Minerals and Fertiliser industry.

By leveraging decades of technical expertise from within its own ranks and other individuals within the Fertiliser industry, PWN is on track to obtain a commercially viable project either via its own operations in Australia or as part of a pooled entity combining other companies in Germany.

Probably the most important business relationship PWN currently has is close co-operation with Strategic Metallurgy, headed by PWN Non-Exec Director Gary Johnson. Mr Johnson’s expertise has been key to securing all-important technological patents that are pivotal to PWN’s long-term success.

Strategic Metallurgy has developed a unique way of treating glauconite extracted from the Dandaragan trough to eventually produce Potassium Sulphate (Potash), called the K-Max process.

PWN owns 100% of the intellectual property rights of this technology, and the PWN and Strategic Metallurgy are dove-tailing on similar tech development related to other minerals such as lithium.

You’re no doubt aware that lithium has double digit demand growth predicted, based on lithium-ion batteries.

PWN has 25% of a novel treatment of lithium micas, which could offer significant advantages in lithium production costs. This is the same technology Cobre Montana (ASX:CXB) are commercialising now – you can read about this technology is further detail here: ASX Company to Dominate Global Lithium Market?

This stake in lithium technology provides a bit of extra upside in PWN leveraged to a metal tied to the growth of electric car batteries, amongst other futuristic uses.

But let’s get back to potash...

PWN’s long-term plan is to develop and build a fully operational potash production plant that utilises the cutting-edge K-Max technology developed by Strategic Metallurgy.

Now, applying new processing technology can be risky and usually means longer feasibility studies and higher expenses.

So instead of biting off more than it can chew on day one, PWN is taking a balanced approach.

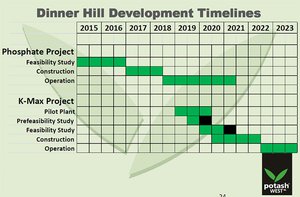

PWN intends to utilise revenue generated from its application of existing technology to produce phosphate fertiliser, which can fund the development of a state of the art $590 million production plant before 2021.

For the technically minded out there, PWN will be exploiting the phosphate horizon, to concentrate the phosphate nodules and produce single superphosphate.

The traditional process is proven to be commercially viable and cash flow generated from these operations will go directly into development work on PWN’s K-Max process.

Quality Over Quantity

If there’s one thing that could trump all the other factors it could be this one...

PWN will be producing a relatively Premium grade of Potash called SOP (sulphate of potash).

Most of the Potash produced globally is actually MOP (potassium chloride) and priced at approximately $320 per tonne. This variety of potash typically accounts for 80% of total global production and makes up 75% of total sales.

The bulk of the remainder is SOP potash, which PWN specialises in.

SOP typically fetches a 40% premium on its MOP counterpart, however is currently being sold at almost double the price (approximately $600 per tonne).

Very interestingly, SOP variety potash suffered almost no price volatility over the past few years amidst potash cartel wars on-going in Europe and North America that saw MOP potash prices plummet from above $400 per tonne down to $300.

The reason for the volatility was Urakali’s announcement that it would leave the Belarusian Potash Company cartel and promising to spike production independently. However SOP potash prices remained stable throughout.

PWN has been able to achieve a potassium extraction rate of more than 95% using a leaching technique fairly uncommon in other potash production. This bodes very well for the company’s short-term cash flow potential as well as its long-term value.

Phosphate Plant & Scoping Study

As part of its interim plan to commence production as soon as possible, PWN wants to use its favourable location and proprietary processing technique to pick up other minerals and take them to market for additional revenue alongside ongoing core operations.

PWN is planning to manufacture ‘single superphosphate’ (SSP) from the phosphate nodules at Dinner Hill. PWN estimates that it could produce 30% P 2 0 5 grade after grinding and processing. After mixing with sulphuric acid, the final product SSP would have a grade of 18% P 2 0 5 .

The stage 1 phosphate production planned by PWN has low capital expenditure requirements and low technical risk. This would start the positive cash flow, allowing further development work for stage 2 to be self-funded.

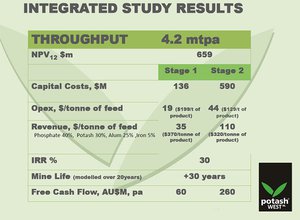

Stage 1 can generate strong cash flows, which underscores the potential of the Scoping Study conducted by PWN, shown below:

According to estimates, PWN could produce SSP at $200 per tonne and achieve a sale price of $370 per tonne which would generate around $60 million in annual free cash flow.

The initial capital cost of launching phosphate production is $136 million and likely to yield 400,000 tonnes per year with over 75% going for export.

Once this is up and going, PWN will look to progress with Stage 2 and utilise their improved processing technology, which would lead to $260M free cash flow...

Potash and Beyond

Food security is becoming a major social, economic and political issue on all continents, and provides a significant opportunity for the astute investor.

The technical experts behind PWN have fashioned an intriguing commercial plan to not only explore large scale proven deposits across the globe but also to radically improve the efficiency (and output) with which glauconite is processed into phosphates and potassium to make fertiliser products.

It has consciously established projects in areas of low sovereign risk and high quality infrastructure, where there is strong regional and local demand for fertilisers.

What PWN is trying to achieve is a microcosm of the broader food security issue globally. In the same vein that farmers must do more with less in order to remain competitive, so PWN is keen to produce better quality potash, and more of it.

Stay tuned to The Next Mining Boom for updates on how PWN is progressing over the coming months – it’s a stock that’s definitely worth watching.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.