ASX Cobalt Explorer Begins Canadian Drill Campaign

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

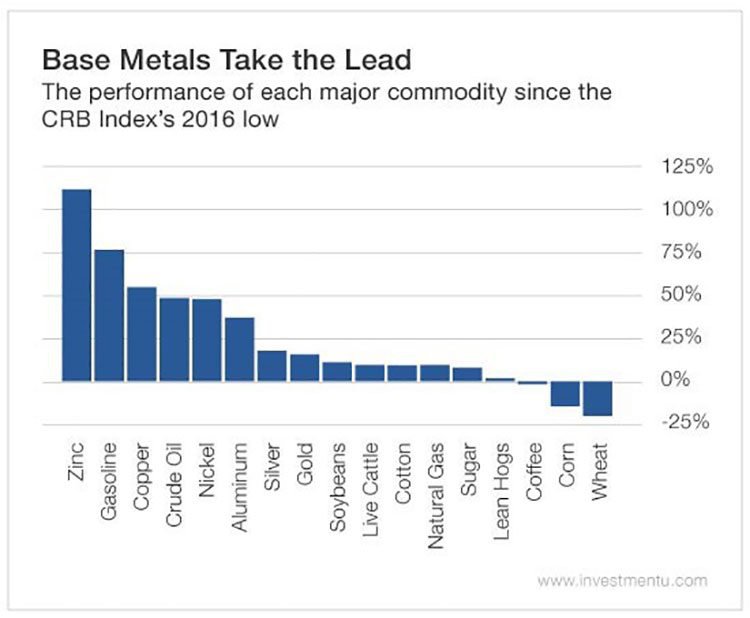

When it comes to metals, there is huge potential given current market conditions. Base metals are seeing renewed demand, along with rising prices.

The question is how can investors capitalise on the changing landscape?

One Perth-based company has assembled a blend of prospective base metal assets, including cobalt, nickel and copper, in Canada — a region with many commercial possibilities.

This company now has four distinct prospects with around US$20 million of historical data on hand and most recently took possession of additional cobalt ground at its Mulligan Cobalt Project.

Most notably, it has a 100% interest in two Belleterre Angliers Greenstone Belt (BAG) hosted polymetallic projects: Midrim and LaForce; and is now the largest regional land holder (118km 2 ) in an area that includes the historical Belletere gold mine (1.1 Moz) and Lorraine Copper/Nickel mine which produced 14.28Mlb copper and 6.34Mlb nickel).

Numerous copper-nickel polymetallic deposits have been identified in the greater BAG region, with two known occurrences sitting within the company’s claims.

Over $350 billion worth of metal has been extracted from the Abitibi Greenstone belt through the production of over 200Moz gold and 450MT copper zinc ore.

Today’s company is hoping to repeat history.

Although, this is an early stage play and anything can happen at this stage, so investors should seek professional financial advice if considering this stock for their portfolio.

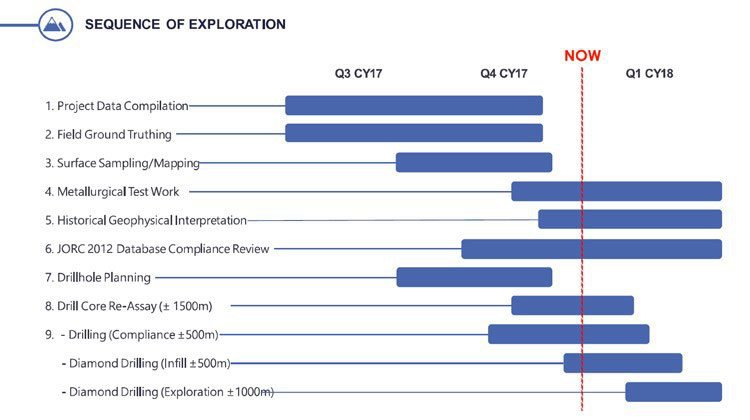

Based on the timing of its ‘sequence of exploration’ it could be on a momentum building springboard:

Source: Meteoric Resources

As you can see by the table above, the company has a lot of work in the pipeline to be finished by the end of the first quarter of 2018.

If all goes to plan, this $31 million-capped explorer could have an avalanche of newsworthy updates due over the coming months, especially if it can raise the $4.34 million it intends to raise in its current capital raising. Funds will go towards further progress at its Midrim Cu-Ni-Co-PGE property as well as funding further exploration including geophysical surveys over the two cobalt properties.

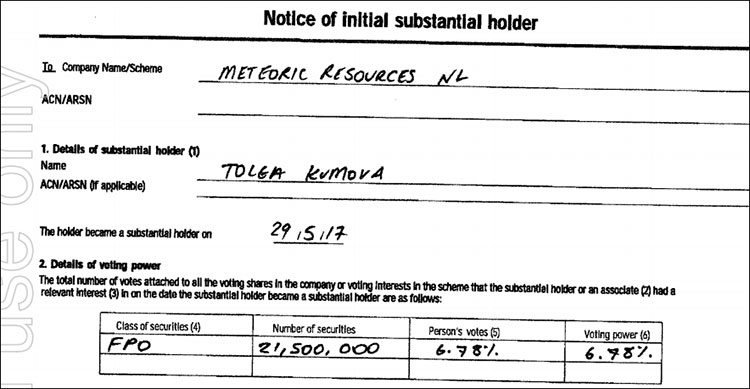

With so much activity and newsflow in the pipeline, this could be an opportunity for early investors to get on board, and join the likes of mining magnate Tolga Kumova to this company’s shareholder list.

Introducing...

To capture maximum value from the recharged metals market, Meteoric Resources (ASX:MEI) has obtained a spectrum of prospects in Canada — a strategic location that puts it right at the heart of the growing energy revolution.

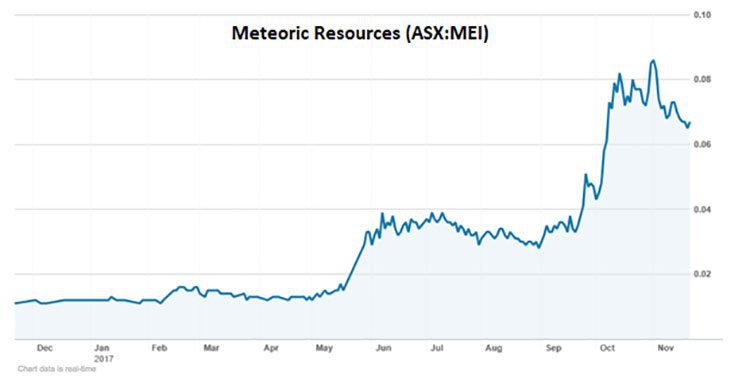

Australian Financial Review Young Rich Lister Tolga Kumova emerged with a 6.78% stake in MEI back in May, and since that time the share price has never really looked back.

In the MEI mix is a newly acquired polymetallic project which already includes historical survey data and almost 50 kilometres of drill-core potential and a pair of cobalt prospects.

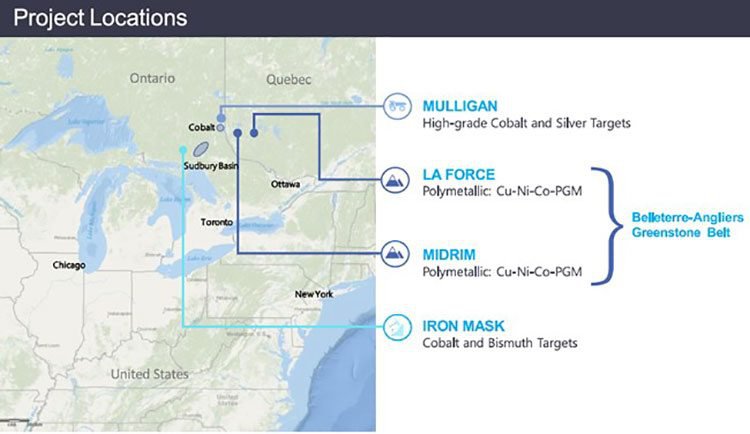

Here are the projects mapped out:

Source: Meteoric Resources

These newly acquired projects give MEI timely exposure to the ongoing energy-storage boom that’s pushing commodities like lithium, graphite and cobalt to new highs. Whilst the market is continuing its upward trend, MEI is also ascending on the back of exploration progress, new project acquisitions and a macroeconomic environment that’s conducive for higher commodity prices:

The past performance of this product is not and should not be taken as an indication of future performance. Caution should be exercised in assessing past performance. This product, like all other financial products, is subject to market forces and unpredictable events that may adversely affect future performance.

MEI wants in on the action

Right off the bat, MEI wants exposure to as many active metals projects as possible. It wants to be more than a bread-’n-butter copper/nickel miner, so is widening its horizons to include new-energy metals such as cobalt.

Cobalt is one of a trifecta of metals that is essential for any lithium-ion battery. For lithium-ion batteries to be used ubiquitously as a standardised power source for electronics, the total supply of cobalt, graphite and lithium will have to rise significantly.

This is what many prospective explorers are banking on; and the good news is that global markets aren’t letting them down. Take a look at how polymetallic metals have performed since the low-point of 2016:

Of course commodity prices do fluctuate and caution should be applied to any investment decision here. Seek professional financial advice before choosing to invest.

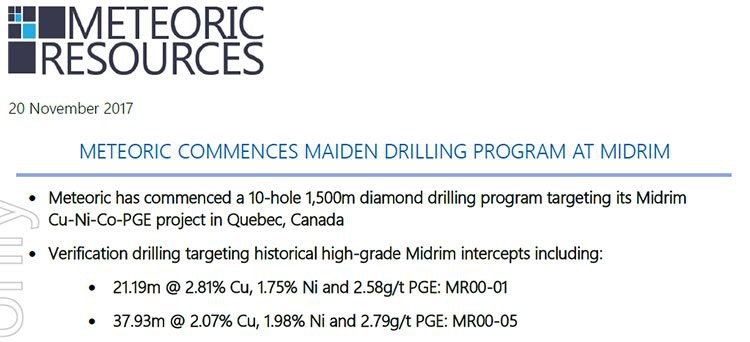

On the back of this, MEI has moved steadfastly into its maiden drilling program at its Midrim Project. MEI has identified 19 untested targets at Midrim and is committed to drill-testing the entire lot as soon as possible.

Source: Meteoric Resources

MEI’s maiden drill program will consist of ten holes cored with a diamond drill rig for a combined 1500m of drilling.

In addition, three historical drill holes with a total length of 797m will be utilised for supplementary electromagnetic surveying. One key incentive for MEI, is the fact that its exploration area is known to contain mineralisation of up to eight metres thick within the target horizon.

If MEI can prove up more Resources to be included in its Inferred and Measured categories, it would be a huge boon for this still micro-capped explorer, worth around A$30 million and priced at 6.5 cents per share.

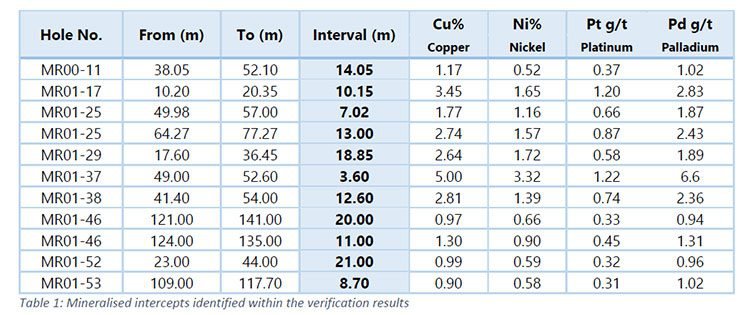

Here are MEI’s most recent batch of drill-holes. It shows that MEI has access to several different metals (and at reasonably high grade too):

With MEI’s polymetallic progress clearly on track and going according to schedule, its other metals focus has the perfect opportunity to shine.

We are talking here about MEI’s foray into cobalt exploration. Just recently, MEI announced its intentions to supply the world’s rapidly-growing energy-storage sector by venturing into some rather well-placed cobalt prospects in Canada.

MEI has commenced a cobalt focused exploration program to be accelerated following an in-country visit. It will also look at target generation for future drilling programs.

Considering MEI is going headlong into simultaneous polymetallic and cobalt exploration, let’s comb through its entire project portfolio, to see what chances it has of making good on its ambitions (and whether we can inference some valuation-boosting catalysts further down the track)...

MEI’s prospects are all based in Canada — two polymetallic projects (Midrim & La Force) and two cobalt projects (Mulligan & Iron Mask)

Mulligan (Cobalt) Project

This project is located on the border of Quebec and Ontario, with historical production averaging 10% cobalt. Previous production runs have sampled grades up to 19% cobalt and 56.7g/t gold.

Samples done by the Canadian Department of Mines, showed a peak result of 12.6% cobalt, 29.75 g/t gold, 39.7 g/t silver and 1.03% nickel.

MEI has reported visible sulphides directly from the areas where historical production had occurred in the past and estimates Mulligan to have at least eight parallel cobalt-rich polymetallic veins suitable for further exploration.

The company has just announced it has staked additional ground prospective for cobalt approximately five kilometres east of the Mulligan Cobalt project, situated in Ontario’s Cobalt Embayment, renowned for its historic production in excess of 50 million pounds cobalt and 720 million ounces silver.

This new ground will form the Mulligan East Cobalt project, consisting of 90 claims totalling 1371 hectares or 13.7 square kilometres; situated 50 kilometres north of the historic cobalt mining centre of Cobalt and approximately five kilometres east of the existing Mulligan claims.

MEI will target high-grade silver-cobalt vein-style mineralisation similar to the mineralisation present within the prolific Cobalt.

Iron Mask (Cobalt) Project

Iron Mask spans 1,408 hectares with MEI currently possessing eight claims over its tenements. The Basin from where MEI intends to obtain its cobalt ore has had historical production exceeding US$120 billion of nickel, copper and Platinum Group Metals (PGM). Previously-taken samples show chip samples peaking at 11.3% cobalt and 6.19% nickel while bulk samples averaging 15% cobalt and 279g/t silver.

As it stands, MEI has identified several geophysical targets from the historical data already available which show magnetic highs relating to copper-cobalt mineralisation and magnetic lows relating to zinc mineralisation. These are intriguing findings at this early stage and means MEI will be actively exploring this area in some detail over the coming weeks and months.

Midrim (Polymetallic) Project

If cobalt offers MEI a shot at the new-age energy-storage niche, then its polymetallic assets offer it reliable earnings on the back of bellwether commodities that will be required regardless of any energy tidal shifts.

Copper, nickel, zinc (among many other base metals) have remained resilient in terms of supply and demand conditions affecting prices, in recent years. Although prices were quick to fall around 2014-2015; they have now largely stabilised and are bouncing back.

MEI’s Midrim Project covers around 118 square kilometres of highly prospective land and already has two drill-tested EM targets to focus on. Furthermore, MEI has 32,000m of historical drilling available at its disposal conducted within the ‘Baby Segment’ of Midrim and is planning to kickstart a full maiden drilling program this month.

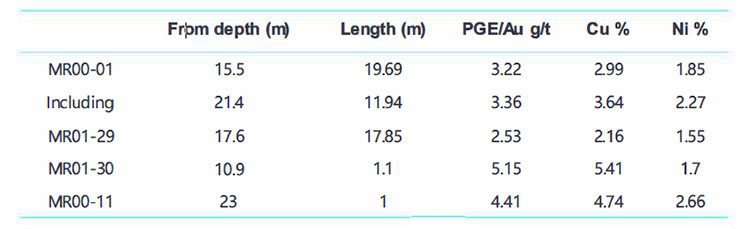

Significant drilling intercepts from the Midrim deposit include:

La Force (Polymetallic) Project

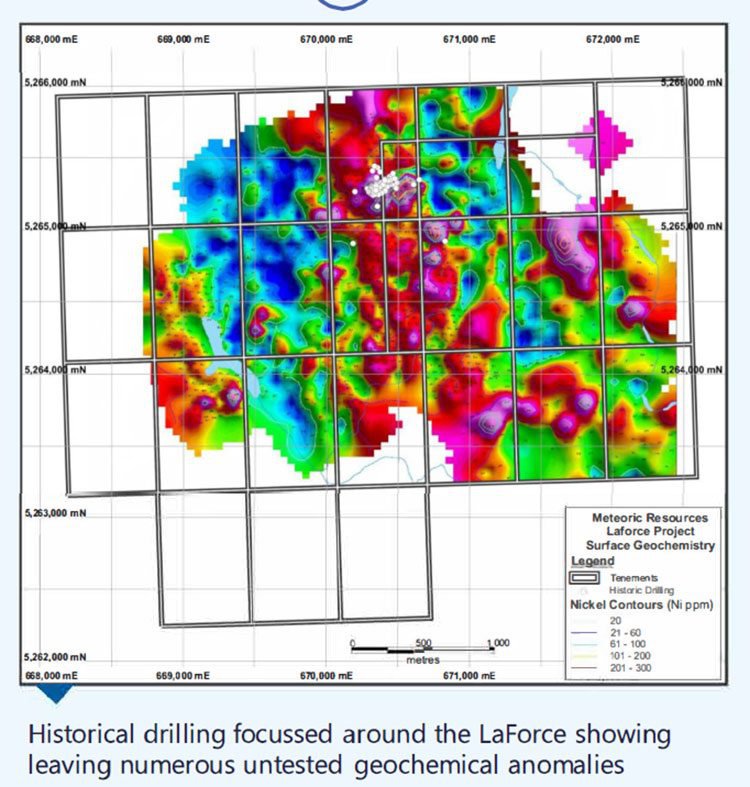

La Force has more than AU$3.Sm in historical drilling value already under its hood. This data will be assayed and figured into MEI’s overarching Resource in Canada. For now, MEI has 14,600m of historical drilling with 3500m of stored core yet to be assayed and more than 20 identified copper-nickel-cobalt-polymetallic targets along a 4.6 kilometres strike length.

Just look at the electro-magnetic survey showing anomalies littering La Force:

Evidence of an energy renaissance

The emergence of high-tech industries related to power storage has most definitely put the cat amongst the pigeons in the world of commodities.

Dozens of companies are scampering into the field to discover supplies of the elements expected to reshape modern manufacturing and industry. However, it’s the small-caps such as MEI that could potentially deliver the most outstanding returns.

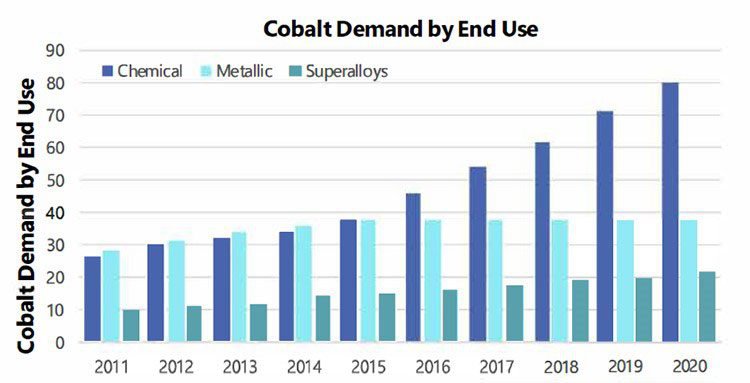

Commodities such as cobalt, lithium and graphite stand to benefit most from the ramp-up in lithium-ion battery use.

Electric-vehicles (EVs), which are expected to dominate car sales in globally over the coming decade, have had the larger impact on cobalt demand. Some countries such as France, have vowed to ban combustion engines in favour of EV’s before 2020. Other countries such as the US and China are rapidly growing their EV industries, creating a boon for soon-to-be new-energy metals producers such as MEI.

Take a look at the latest market offering from Tesla — a full-size lorry able to carry goods (clearly, Tesla is not content with only producing cars):

This new battery-powered lorry can travel up to 500 miles before needing a recharge and can carry a jaw-dropping maximum load of 80,000 pounds (36,000kg). What’s even more staggering is that this lorry can accelerate faster than sports coupe which just underlines the level of technological progress made possible by innovative technology such as lithium batteries.

The staggering thing behind the emerging EV industry is the improvement upon the current status-quo. Such dramatic improvements in efficiency are likely to ensure the long-term success of EVs, and therefore, ensure the long-term viability of commodities such as cobalt, lithium and graphite.

MEI is on course to become a part of this emerging industry, and can expect to enjoy superb margins as one of the first-movers in cobalt exploration.

The Cobalt Industry

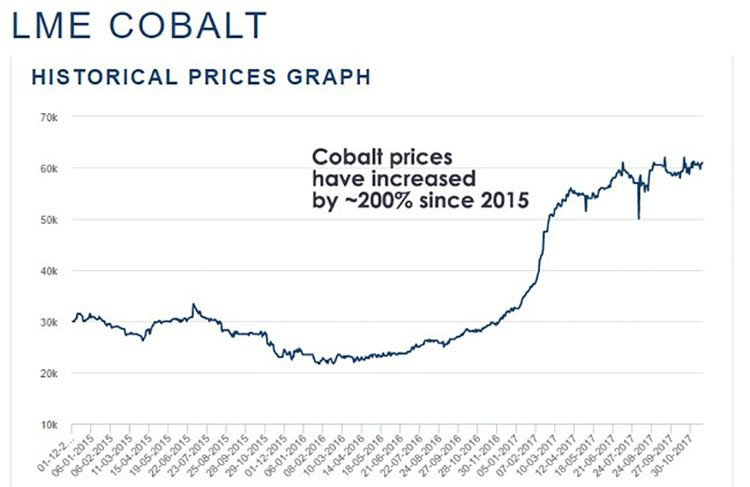

Cobalt prices have risen sharply in 2017, increasing from US$15/lb at the start of the year to over US$24/lb in March. That increase could be indicative of a demand imbalance that MEI could help fulfil at some stage over the next one to two years.

Cobalt also stands to gain from other key end-use applications such as high-performance alloys, tool materials, and catalysts.

On the supply side, the high concentration of cobalt production in the Democratic Republic of Congo (DRC) is a growing cause for concern due to the growing political instability in the region and human rights issue in the country’s mining industry.

But battery-producers are beginning to demand key battery ingredients such as cobalt, lithium and graphite to be from environmentally sustainable sources, and located close to the point of sale.

Its Canadian cobalt prospects combined with its polymetallic assets, indicate MEI could become an intrinsically important player over the coming years.

Walking slowly but surely towards metals market commercialisation

Metals markets are doing what they’ve always done — ebb and flow in response to changing demand preferences and supply conditions.

Which is why we’ve made it our mission to scour every nook and cranny of the metals landscape, to see if we can lay our eyes on something alluring for our readers.

In today’s case, MEI is collating together a rather good case to become a viable metals supplier over the coming 1-2 years.

With its bread-and-butter polymetallic projects providing the low-risk portion of its portfolio, MEI has also pencilled in a cobalt foray, at just the right time (as Tesla looks to ramp up production and head into competition with its Chinese peers).

Here at The Next Mining Boom, we’re strongly supportive of the ongoing terraforming going on in the energy commodities space. Lithium, cobalt, graphite and other metals such as zinc (not forgetting steel) are ushering in an entirely new way of generating, storing and distributing Energy.

For MEI, the operating synergies made possible by having its entire project-list located in Canada could be a key factor in seeing MEI keeping its operating and capital expenditure costs down. However, the most attractive part of MEI’s business plan is its real-time transformation from small-cap minnow to mid-cap spearhead, on course to move into the world’s next energy renaissance, fuelled by cobalt.

However, MEI remains a speculative stock and investors should seek professional financial advice if considering this stock for their portfolio.

Multiple exploration activities are due for completion across MEI’s Projects over the coming weeks and months which sets up likely price catalysts (as long as MEI manages to deliver the results market analysts are anticipating).

Commodities such as coal and oil are gradually being gazumped from the forefront of energy production, storage and distribution and being replaced by tomorrow’s crop of commodities that not only offer society a brighter, more productive future, but also some juicy returns for investors.

Take a look at how cobalt prices have reflected the various supply-demand shenanigans in cobalt over the past few years:

Everyone agrees that the electric-vehicle revolution has arrived but beyond that there is no consensus as to how fast it might evolve. If we take a leaf out of lithium’s book, cobalt has the legs to reach higher highs, and therefore, welcome a heap of aspirational cobalt suppliers to market — including the early-moving MEI, priced at a moreish $0.067 per share and worth A$30 million by market capitalisation.

If you’re looking for a ground-floor entry into tomorrow’s energy renaissance fuelled by new-age metals and efficient energy use — the polymetallic cobalt-wielding MEI could be the way to go.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.