WRM Trading at Discount to Valuation

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Professional and novice investors alike know that buying undervalued company shares is a pretty handy way to make money in the stock market.

So when multiple independent research groups identify White Rock Minerals (ASX:WRM) as a small-cap bargain, taking notice could pay off.

WRM is a mineral explorer and developer with two major 100%-owned projects on the go.

Its flagship project is the Mt Carrington gold-silver project in northern NSW, which is currently undergoing an optimisation study and PFS.

Its second project is the newly acquired Red Mountain zinc-dominated volcanogenic massive sulphide (VMS) exploration project in Alaska. It’s an advanced VMS project, rich in high-grade zinc and silver deposits, which has already been identified as being of global significance, and with a further 30 look alike exploration targets for follow-up.

Earlier this year WRM announced a high-grade 2012-JORC Mineral Resource Estimate at the Red Mountain Project, with some 9.1 million tonnes grading 12.9% zinc equivalent, this within a global Resource Estimate of 16.7 million tonnes at 8.9% zinc equivalent.

This resource estimate prompted Independent Investment Research (IIR) to publish a report on the company’s Red Mountain Project.

Specifically, IIR determined that the project’s value was not being reflected in the company’s share price. It valued the project at between A$30 million and A$66 million, which corresponds to 6 cents per share. That compares to the minute A$1.2 million that WRM paid for the project in mid-2016.

It should be noted here that broker projections and price targets are only estimates and may not be met and share trading patterns should not be used as the basis for an investment as they may or may not be replicated. Those considering this stock should seek independent financial advice.

IIR’s analysis was detailed in out last update on WRM on July 12 — ‘ Is WRM’s Zinc-Silver Project Pushing it Towards Revaluation? ’

That report from IIR has now been followed up by a research report from stock broking firm DJ Carmichael. Its analysis covers both WRM’s Red Mountain Project in Alaska, plus its flagship Mt Carrington Project in NSW.

While WRM is flying under the radar at just 1.3 cents per share, DJ Carmichael has noted that there is significant value in the Red Mountain Project that is not reflected in the share price, having valued that project alone at 6 cents.

The broker has also valued Mt Carrington at 1.9 cents per share and has an overall valuation on the company of 8 cents per share, including a 12-month target price of $0.04.

It seems it may be just a matter of time before the market starts to catch on to the potential on offer from WRM.

Here’s all the latest...

White Rock Minerals’ (ASX:WRM) two projects — Red Mountain and Mt Carrington — are each highly prospective, yet still underappreciated by the market. A fact that has now been backed up by two independent research groups.

This podcast features Matt Gill talking in depth about the two projects and the opportunity to be part of a growing gold, silver and zinc company.

Here you can see the Mt Carrington Project (left) along with Red Mountain (right):

Red Mountain polymetallic VMS Project in Alaska

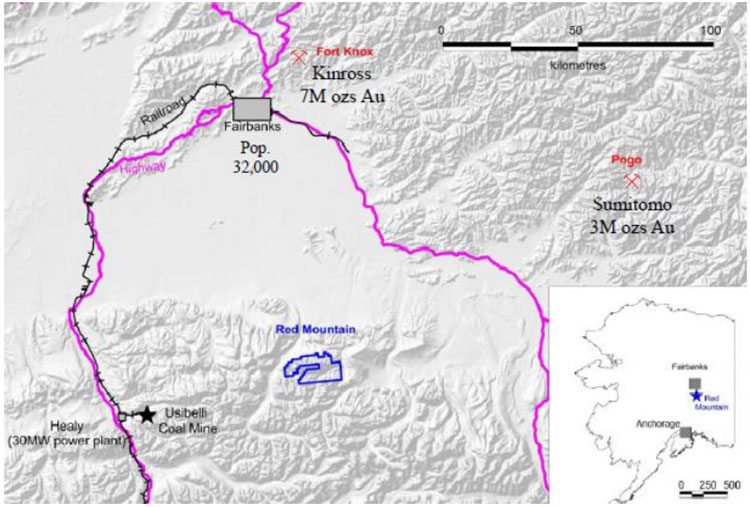

Located 100 kilometres south of Fairbanks in Alaska is WRM’s recently acquired Red Mountain VMS Project.

WRM holds 143 square kilometres of highly prospective ground in the Bonnifield Mining District with 224 mining claims that has seen no modern exploration. Since acquiring the original tenement package WRM has significantly added to it.

The VMS mineralisation in the Bonnifield District is located in the western extension of the Yukon Tanana terrane. The district includes more than a dozen VMS prospects and several gold-quartz vein prospects which are largely under-explored.

It is known to be prospective for zinc, lead, silver, gold, copper and uranium, but low metal prices in the 1990s forced explorers to abandon the field and shelve projects.

WRM’s tenement package covers 30 look-a-like exploration targets in addition to the existing Dry Creek and West Tundra Flats deposits that were identified via conductive geophysics and geochemistry.

The project is in the top quartile of undeveloped high-grade VMS deposits globally. It has one of the highest-grade VMS zinc-silver-lead-gold deposits out of its peers, and has 30 undrilled VMS targets still to be tested.

In April this year, WRM released it maiden JORC 2012 Mineral Resource Estimate at the Red Mountain Project.

Total inferred mineral resource of 16.7 million tonnes grading 8.9% zinc equivalent, containing a high grade resource of 9.1Mt grading 12.9% Zi-Eq. It has impressive base and precious metal content with 678,000t zinc, 286,000t lead, 53.5 million ounces of silver, and 352,000 ounces gold. This maiden resource immediately placed the Red Mountain Project in the top quartile of VMS projects globally and one the highest-grade projects of any company on the ASX.

Here is a summary of the company’s maiden resource announcement as reported by Finfeed.com (Finfeed is a related entity of S3 Consortium Pty Ltd as defined in Section 9 of the Corporations Act 2001):

This maiden resource places Red Mountain on a par with projects such as Red River Resources’ (ASX:RVR) Thalanga Project in QLD and Heron Resource’s (ASX:HRR) Woodlawn Project in NSW, both of which are currently going into production.

This resource placed the Red Mountain Project in the top quartile of VMS deposits globally and highlighted it as being one of the highest grade projects of any ASX-listed company.

While the mineral resource placed Red Mountain in the top quartile of undeveloped high grade volcanogenic massive sulphide VMS (zinc, silver, lead, gold, copper) deposits globally, this could be just the tip of the iceberg at Red Mountain as the mineral resource encompasses only a small portion of the total tenement holding.

VMS deposits tend to occur in clusters so it could be expected that the resource base could very well grow beyond its current 16.7Mt once it begins exploration on the look-a-like VMS targets in the tenement package.

Mt Carrington gold-silver project in NSW

The Mt Carrington gold-silver project located 230 kilometres south of Brisbane in northern NSW is WRM’s flagship project.

It has extensive mining infrastructure in place and drill ready exploration targets have been identified to expand the mine and extend the mine life.

Mineralisation is typically hosted by sheeted to stockwork-style quartz veining, breccia fill and minor massive silicified zones with phyllic to silicic alteration.

The majority of the mineralisation is associated with a 20km wide circular feature of low magnetic intensity called the Drake Quiet Zone, which has been interpreted as a large-scale caldera structure.

Mineral resources at Mt Carrington are contained within 8 separate deposits which are either gold or silver dominant. All are currently JORC 2004 but an upgrade to JORC 2012 resource standard is being undertaken as part of the on-going PFS / DFS. There are no ore reserves at this point in time, but it is expected there will be on completion of a successful PFS.

There are four gold deposits, totalling 3.81Mt at 1.3g/t Au and 2.9g/t Ag and four silver deposits totalling 8.95Mt at 51g/t Ag and 0.1g/t Au.

Combined, the resources total 338,000oz gold and 23.4Moz of silver.

WRM is now optimising the current Scoping Study in order to derive a PFS which will help determine the overall scale of a development at Mt Carrington.

There are several areas that could be optimised as part of the DFS. These include

- Pit sequencing and staging.

- Pit wall slope design in fresh material.

- Reduction in mining dilution.

- Fleet optimisation.

- Waste haulage optimisation.

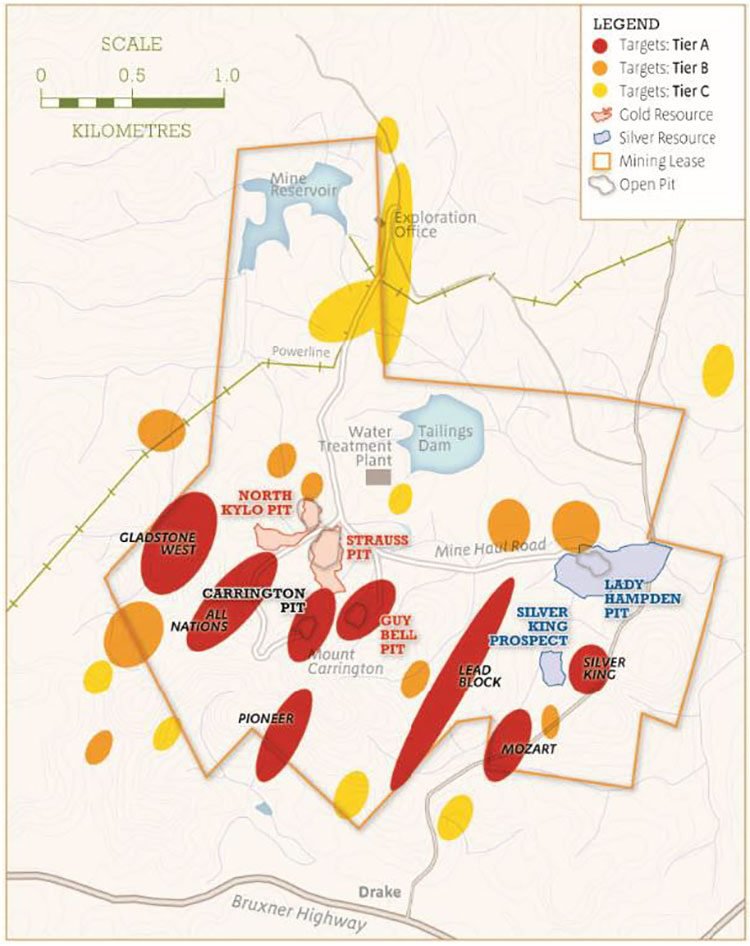

Mapped out below are near-mine and regional targets at Mt Carrington, for gold-silver that complement the existing resource base, and for intrusive-related copper-gold porphyry systems:

With these two highly prospective projects on its books, a rerating of WRM could be a just matter of time.

At the same time, it’s worth noting that this is an early stage play and investors should seek professional financial advice if considering this company for their portfolio.

And it’s not just our opinion that WRM is undervalued, trading at just 1.3 cents per share with an $11.3 million market cap...

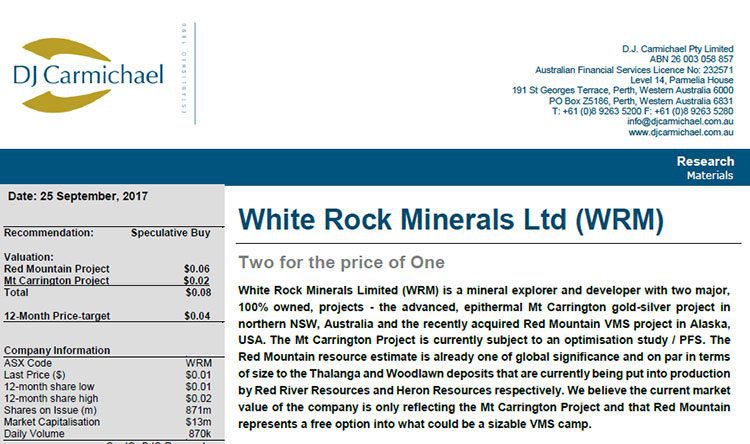

DJ Carmichael: WRM is a ‘Speculative Buy’

On September 25, WRM released a valuation report from stock broking firm DJ Carmichael...

DJ Carmichael has individually determined valuations for both the Red Mountain and Mt Carrington projects...

It valued Red Mountain at $52.9 million, equating to 6 cents per share.

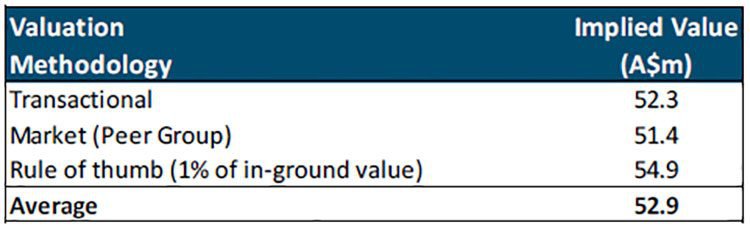

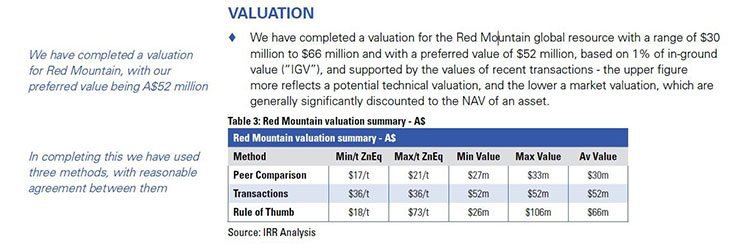

To arrive at this average valuation the broker used a combination of three valuation methods. These were an analysis of recent M&A transactions, a market peer group analysis, and a ‘rule of thumb’ check of 1% of in-ground value:

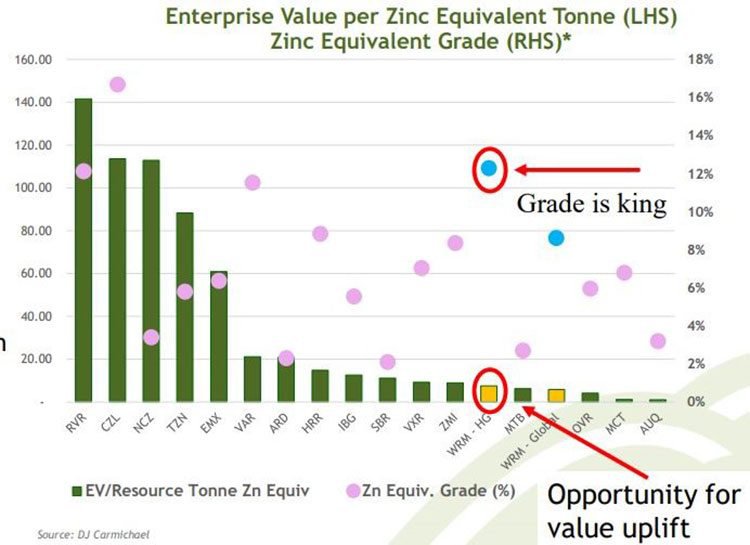

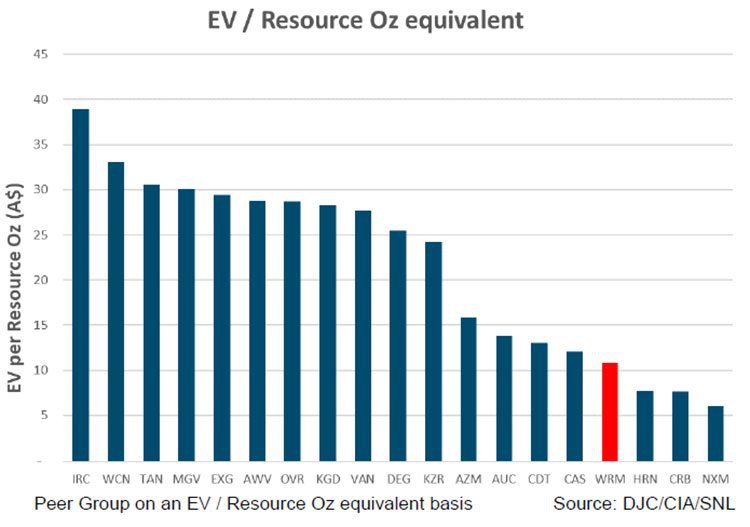

Taking a closer look at the peer group analysis, the Enterprise Value (EV) of the Red Mountain Project was found to be very low when compared to its peers, that’s despite its grade being close to the best in class:

This suggests there is significant potential for future recognition by the market of the Red Mountain project’s value.

In determining a valuation for the Mt Carrington project, the broker used two valuation methodologies — recent M&A transactional analysis of Australian-based gold deposits and a peer group analysis based on enterprise value (EV) per resource ounce gold equivalent.

The transaction based valuation arrived at a $17.2 million figure for Mt Carrington, based on an average gold price of $26.70 per oz.

The peer group comparison on EV/Resource Oz equivalent valued the project at $17.4 million. The broker found that each of the comparative projects to Mt Carrington have greater valuations, suggesting that WRM is undervalued. That’s even when (the already mentioned) considerable valued of the Red Mountain project is ignored.

These two valuation methods resulted in an average valuation of $17.3 million for the Mt Carrington Project, or 1.9 cents per share.

Keep in mind that the current WRM share price is just 1.3 cents. The market is clearly not yet assigning any value to Red Mountain, and even the Mt Carrington valuation of 1.9 cents per share exceeded the current WRM share price.

DJ Carmichael expect some recognition of the value of the Red Mountain Project to begin to occur in the coming 12 months...

For this reason is has a 4 cent per share 12-month price target on the stock, compared to an overall valuation for WRM of 8 cents per share.

More detailed explanation of how these valuations were calculated can be found in the DJ Carmichael report .

It should be noted that broker projections and price targets are only estimates and may not be met. Those considering this stock should seek independent financial advice.

Here is an article from Finfeed.com outlining the major points of the company’s projects and an explanation of how it arrived at its valuation:

Independent Investment Research highlights Red Mountain’s worth

DJ Carmichael’s analysis follows an earlier report from Independent Investment Research (IIR), a research house operating in the US and Australia. Click here for the full report:

IIR, a research house operating in Australia and the US, published a report on the company in July after the release of WRM’s initial Mineral Resource Estimate at Red Mountain.

WRM’s strategic acquisition of Red Mountain last year for just A$1.2 million lifted the company’s valuation and positioning among its peers.

IIR’s valuation of the Red Mountain project comes in well above what the company paid for it, at $30 to $66 million. Like DJ Carmichael’s Red Mountain valuation, that translates to a value of 6 cents per share (with a range from $0.034/share to $0.076/share), compared to the current share price of 1.3 cents.

Note that this valuation is just for WRM’s Red Mountain asset, not the entire company. It doesn’t take into account WRM’s 338,000 ounces of gold and 23 million ounces of silver at Mt Carrington, which offers excellent exposure to the Aussie dollar gold price, plus silver and zinc upside.

Here is summary of the IIR’s valuation:

IIR’s valuation of the project implies an approximate four-fold premium to the company’s current share price, even before any value from its Mt Carrington gold and silver asset is accounted for.

Again, it should be noted that broker projections and price targets are only estimates and may not be met. Those considering this stock should seek independent financial advice.

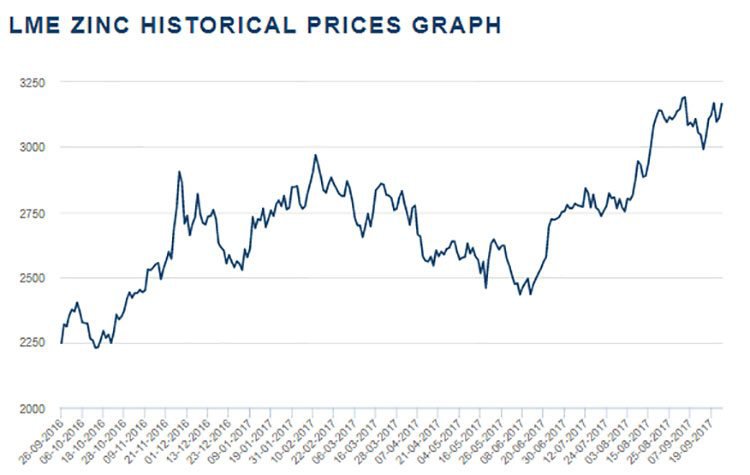

Soaring zinc prices bestowed to WRM

A key positive driver for WRM is the soaring price of zinc, in conjunction with declining forecasted mine production.

Zinc was the best performing base metal in 2016, and as the following chart demonstrates, it continues to perform well into 2017:

This outperformance is due to the fact that investment in exploration and development over the last few years had been held back due to historically low zinc prices forcing the closure of several operating zinc mines.

As demand for zinc grew in line with industrial growth, particularly in China, warehouse stocks have fallen and prices have risen. Demand is expected to continue rising over coming years, placing pressure on global stocks and further supporting the zinc price. There are signs that there will be a global supply deficit through to 2020.

However at the same time, we should point out that commodity prices can also fluctuate down, so caution should be applied to any investment decision and not be based on historical spot prices alone.

Red Mountain offering free upside potential

Red Mountain’s significant value and resources do not seem to be fully captured in WRM’s current share price and enterprise value... this has now been backed up by two independent research groups.

Both groups value the Red Mountain project at $52 million, or the equivalent of 6 cents per share. They see last year’s Red Mountain acquisition having not been recognised whatsoever by investors.

On top of that, DJ Carmichael value the Mt Carrington Project at $17.3 million, or 1.9 cents per share. The broker has also valued the whole company at 8 cents per share, with a 4 cent per share 12-month price target.

At the current share price of 1.3 cents per share, the company appears significantly undervalued, even when compared to each of the two projects individually.

DJ Carmichael’s and IRR’s valuations appears to be supported by HSBC (with a 15.5% interest in WRM), Citicorp (with a 7.9% interest) and several other major shareholders, which have already identified the value of the project and jumped in.

Supported by rising zinc prices, now could be a good time for new investors to take note — before the market picks up on the value on offer.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.