Understanding it all… in 3D

Disclosure: S3 Consortium Pty Ltd (the Company) and Associated Entities own 2,161,544 GAL and the Company’s staff own 14,000 shares at the time of publishing this article. The Company has been engaged by GAL to share our commentary on the progress of our Investment in GAL over time.

It’s much easier for us to see it now.

Galileo Mining (ASX:GAL) made a significant discovery of PGEs (palladium, platinum, gold, copper, nickel, rhodium) in May.

Since then, the discovery keeps getting larger ... and GAL is yet to find the true extent of the discovery, meaning it could get much bigger still.

There is a lot going on here, and it’s easier to visualise in 3D using some custom made, colourful 3D blobs, which we will try today.

In recent weeks, GAL may have also just found two entirely new mineralised systems, AND hit massive sulphides, including significant amounts of high grade cobalt.

Massive sulphides are generally a host rock for easy to process, high grade mineralisation...

Plus, the 5km to the north of the discovery hole — which GAL’s target generation model suggests is the most prospective — is yet to be explored for more new mineralised systems.

We also know that when there are multiple mineralised systems, they usually originate from a “source” — a hidden, big fat high grade deposit.

Given GAL is currently finding all sorts of new mineral systems, it would be exceptionally interesting if they could find that source, but that is a topic for another day.

Given the importance of our GAL Investment in our overall Portfolio, we called on some help to generate 3D models of the mineralised body at its Callisto discovery which we will share today.

Note that these 3D models are just an interpretation of the publicly released data and assumptions have been made in their creation with no input from the company. They are for illustrative purposes only and should not be relied upon for making investment decisions.

GAL’s initial discovery sent GAL’s share price from 20c to as high as $1.95.

If it can keep expanding this discovery, while also finding new systems north along the prospective 5km of strike, this might only be the beginning of a larger share price run.

There’s been a lot of new information released by GAL in the five months since the discovery was made.

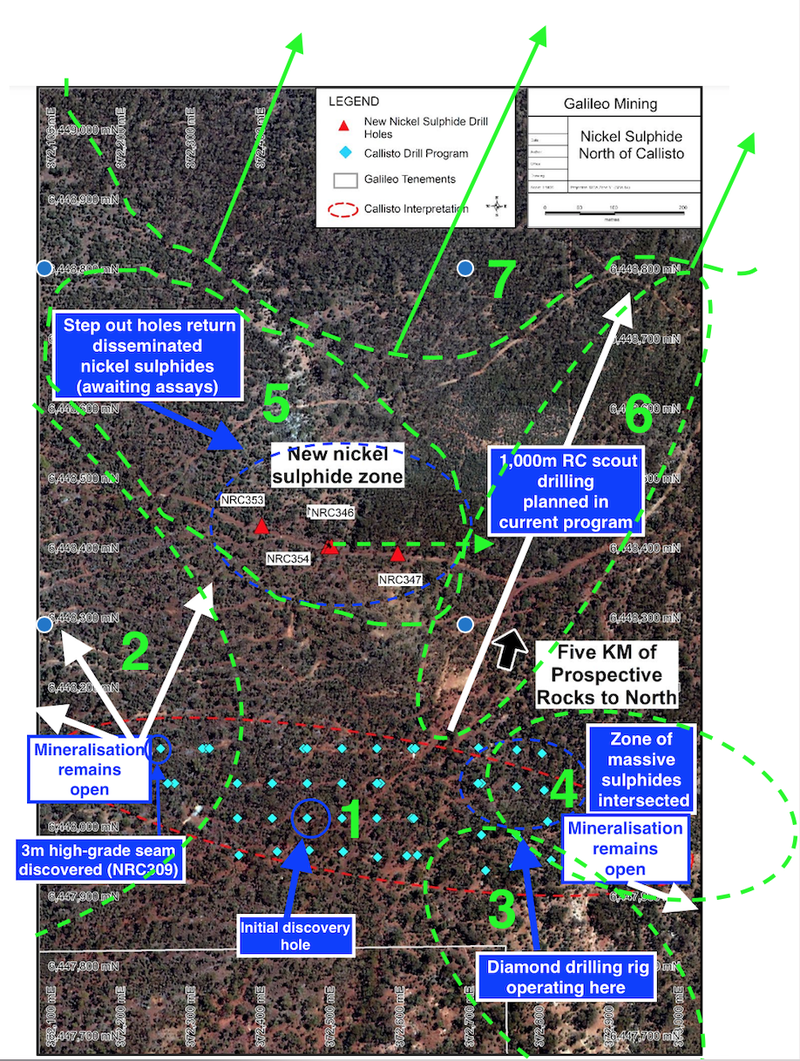

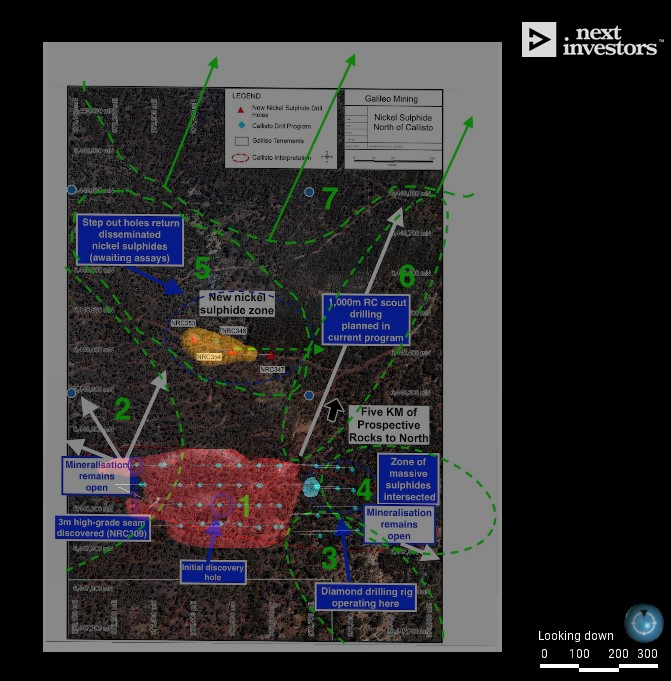

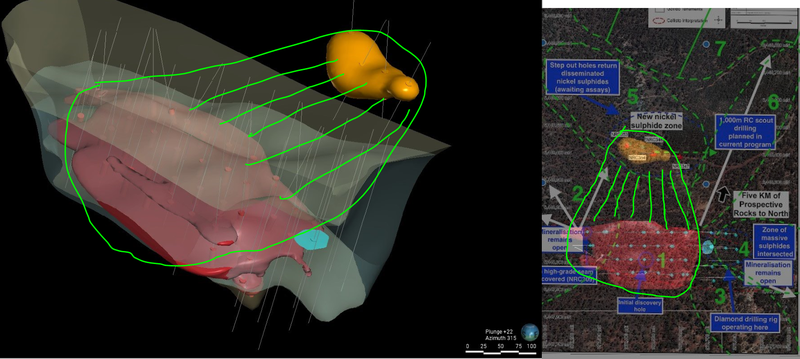

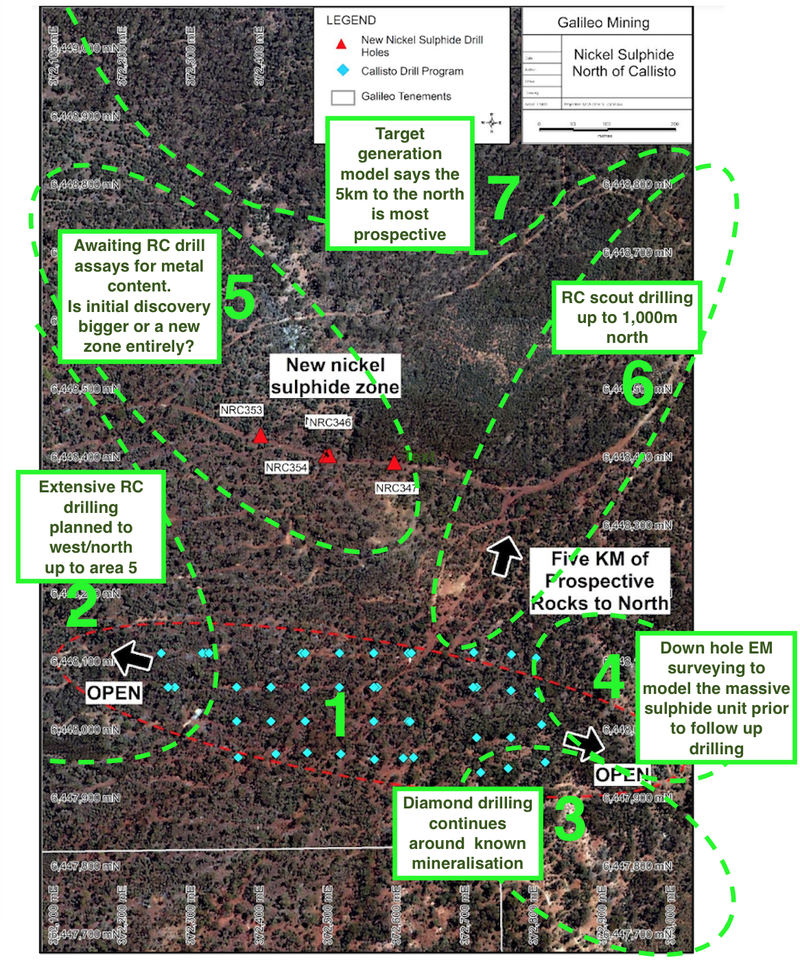

Today we provide a quick summary into the significance of each of the moving parts in the increasingly interesting GAL story, with a 3D visual of what it might look like, including:

- Initial discovery - Drilling continues to find out just how big it is.

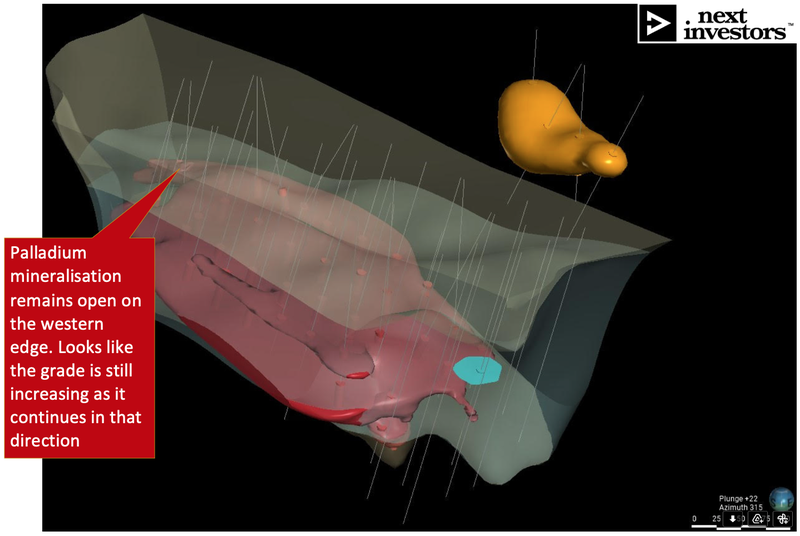

- Drilling to the west-northwest - Mineralisation remains open to west-northwest; appears to show increasing PGE grades in that direction.

- Drilling to the east-southeast - Mineralisation also remains open to east-southeast.

- Massive sulphides found, downhole EM ongoing - Massive sulphides are easy to process host rocks where higher grade mineralisation is often found, similar to IGO’s Nova nickel discovery. Downhole EM and more results coming.

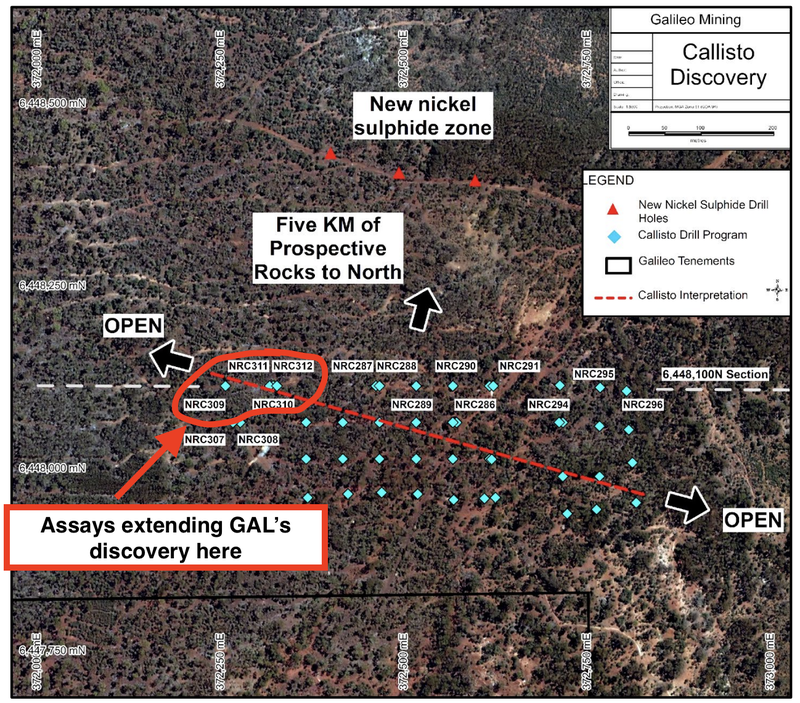

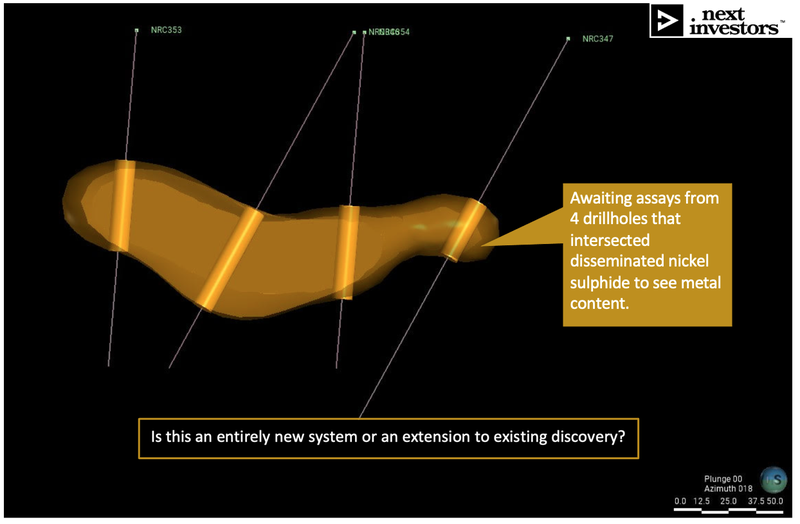

- Drilling to the north - New nickel sulphide zone found 400m north; GAL still to determine whether it is an extension of the initial discovery or an entirely new system.

- Step-out drilling - Up to 1,000m of scout drilling planned to the north in the current drill program, and now with approvals in place to drill out ~3.5km of strike to the north.

- Potential extension of over 5km - A total of 5km of prospective strike to explore (this map shows only around 1⁄5 of the potential at Callisto)

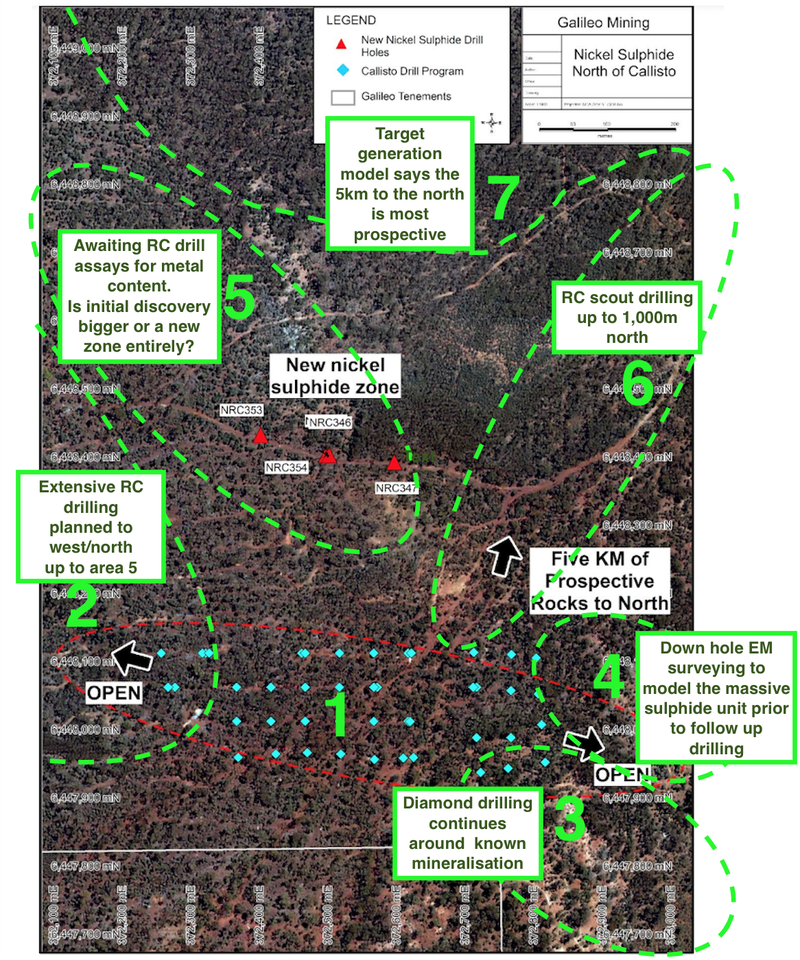

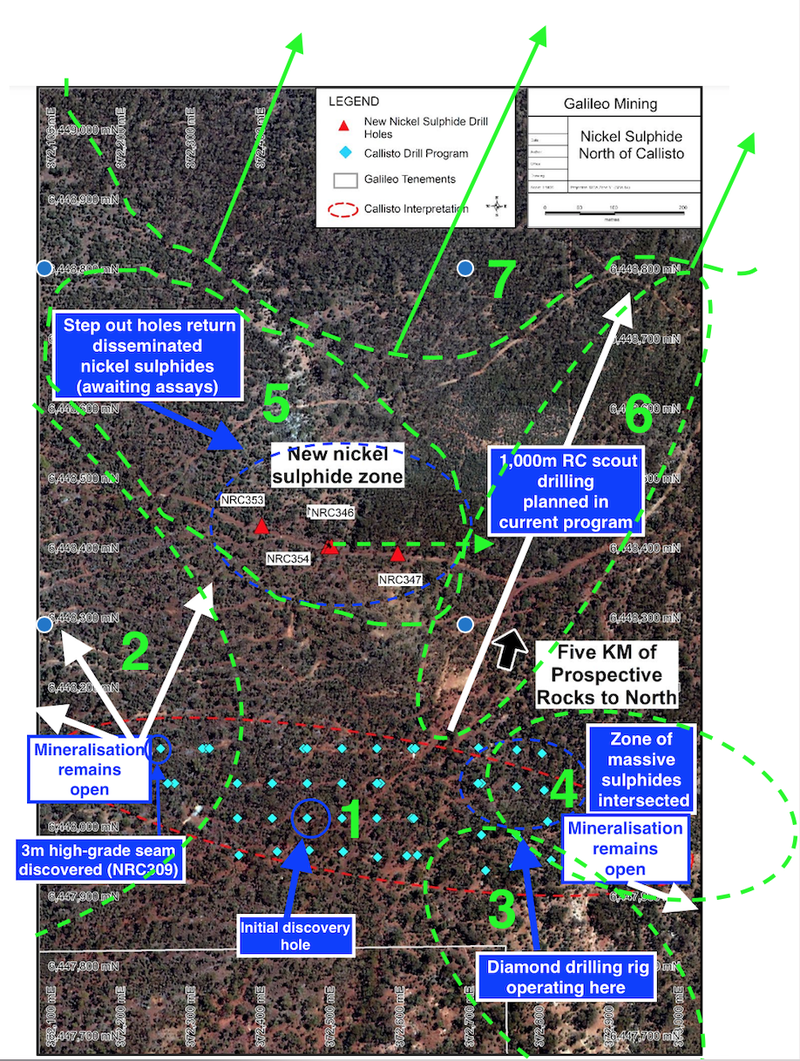

It’s a lot to follow. We find the easiest way to understand each of these areas is by looking at them on a map, with the corresponding areas marked 1-7.

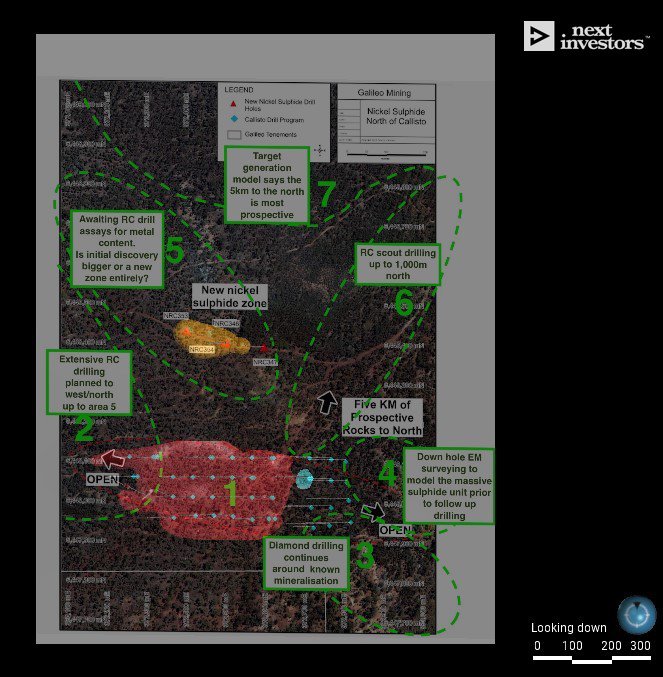

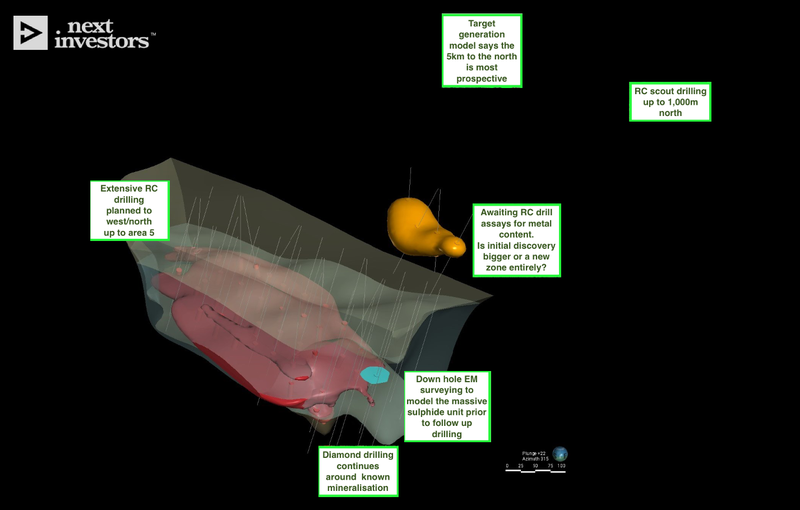

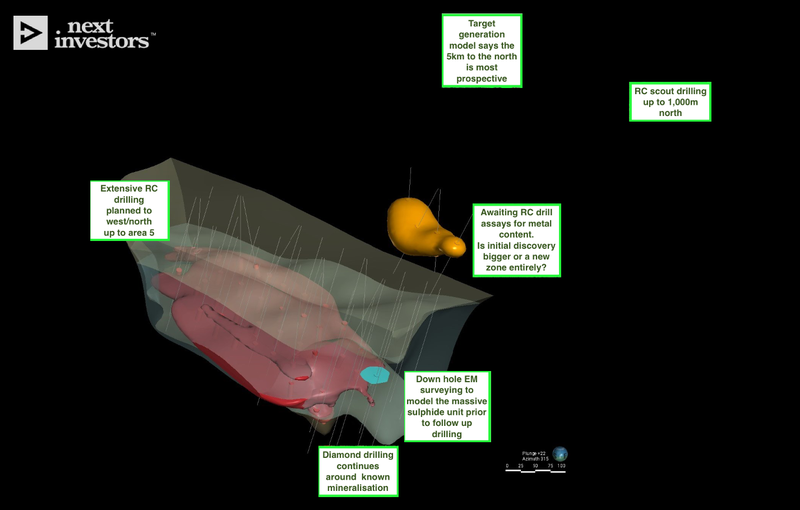

With so much happening and with GAL making up a large % of our overall Portfolio, we thought it important to visualise GAL’s discovery in 3D, as it’s getting harder to understand on just a 2D map (above) without being able to also visualise what is under the ground.

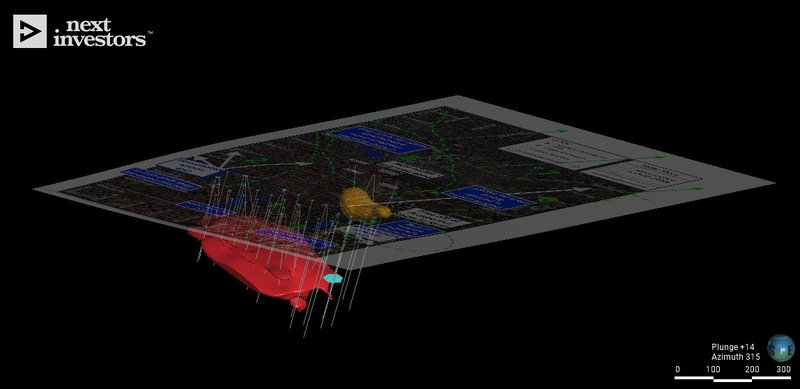

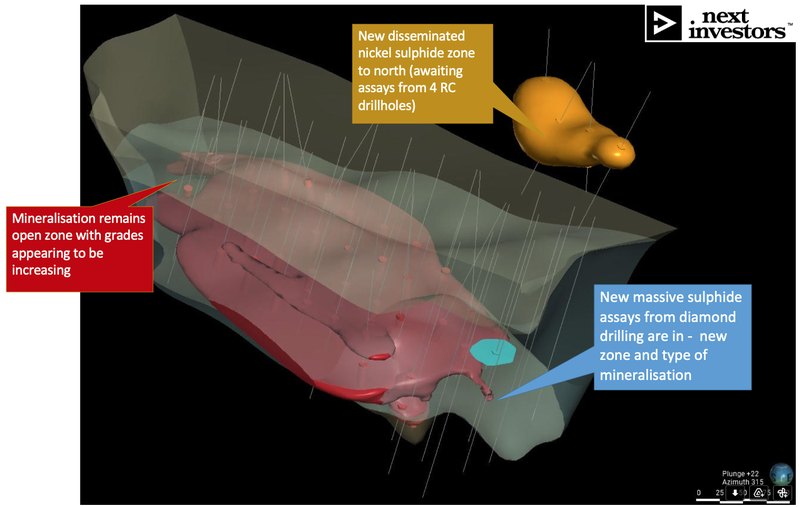

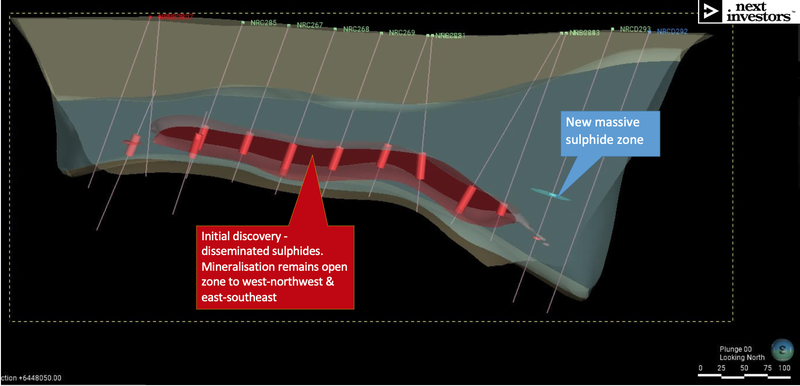

We reached out to a contact with some geological modelling skills, who was able to take the drill data from all the past GAL announcements and model what each ore body looks like under the ground, here’s what came out:

Disclaimer: these 3D models are just an interpretation of the publicly released results and several assumptions have been made. The models are for illustrative purposes only and to help explain the upcoming drilling. Investors should not rely on these illustrative models in making any investment decisions.

How are these 3D models done?

Detailed data for each drillhole is included in the appendices of all ASX exploration announcements, and with time and effort can be pulled into a 3D model.

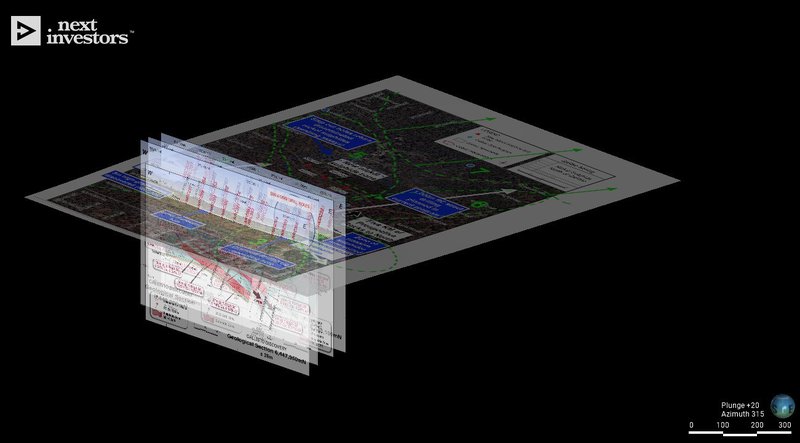

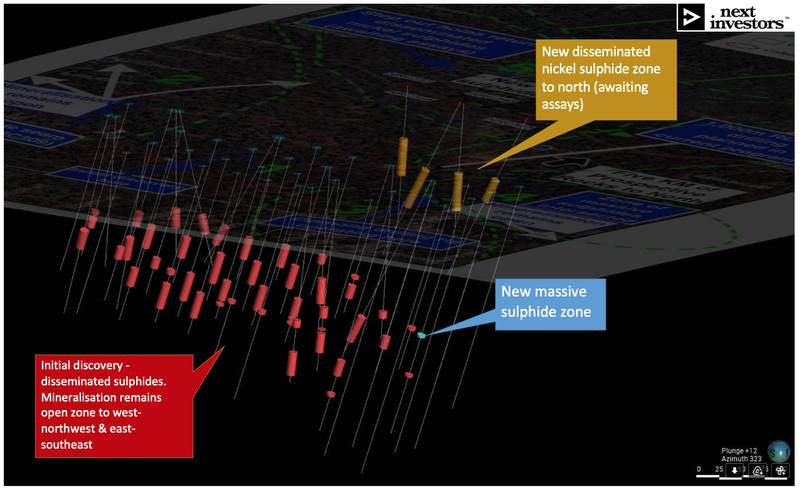

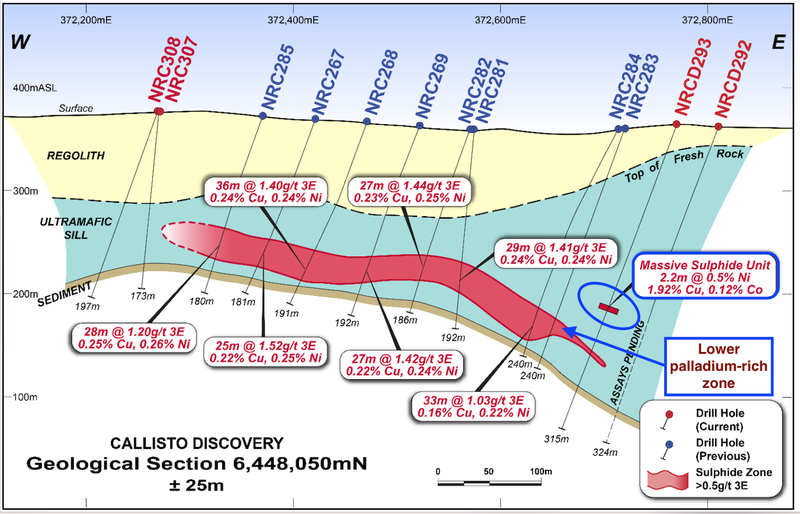

For GAL, the first step was laying out visual sulphide images (the red 2D worms) from past announcements:

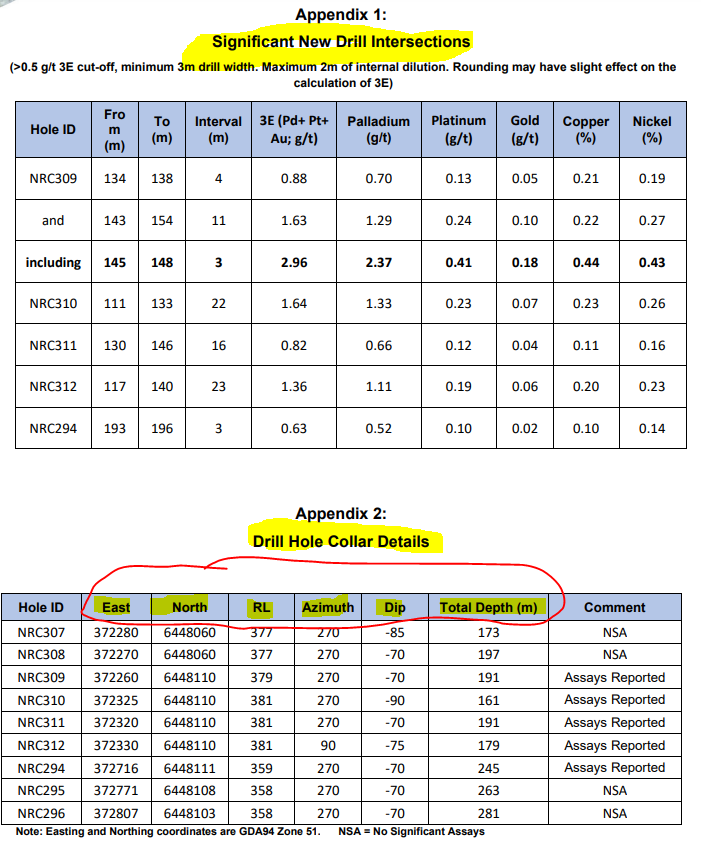

Then if you scroll to back of any exploration drill results announcements, in the appendix you will find the intercepts + location + orientation of each drillhole, for example:

Entering the data into a 3D modelling system (and making some assumptions), we get the following visual representation of each drillhole and intercept. Each drillhole starts at surface level and the significant assay intercepts are shown by the cylinders:

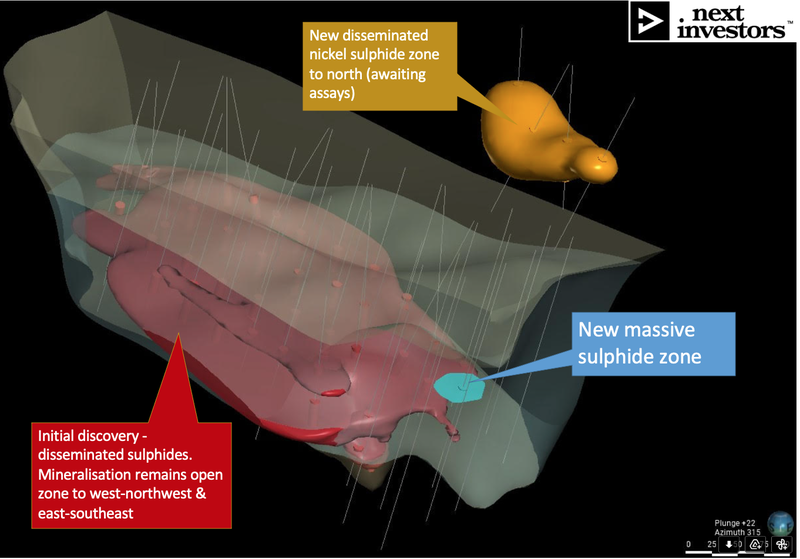

Taking the overlay of the visual sulphides representation from the 2D images in the announcements helps inform some assumptions to fill out the 3D shapes below:

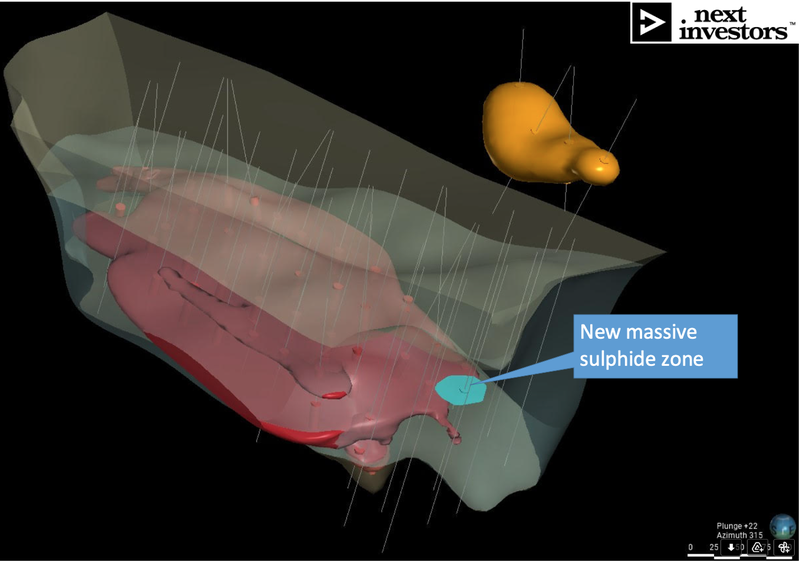

- Red = The first discovery and the extensional drilling (visual sulphide zones + significant assays).

- Light blue = The new massive sulphide zone found, pending downhole EM and more drilling/assays.

- Yellow = The newly intersected nickel sulphide zone to the north which may be an extension to GAL’s existing discovery, or a whole new discovery on its own (no grades or cut off yet, so we don’t know much about what this may turn out to be yet).

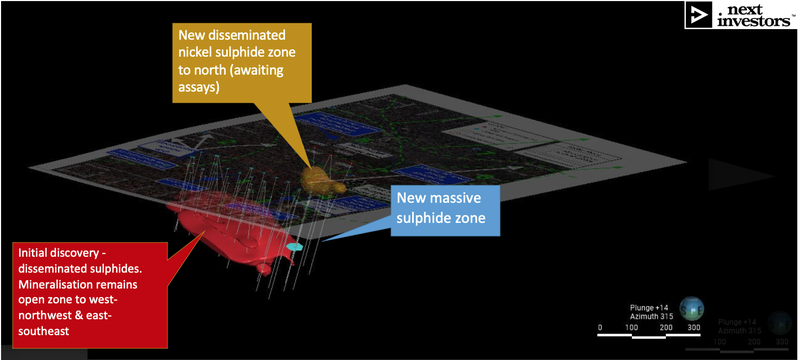

And here is what it looks like overlaid on our image from earlier in the email, showing each of the 7 areas we are watching for progress on:

And then we can move back to a 2D style view where we can focus on what’s happened in each of the 7 areas of activity:

As you can see, the yellow section (area 5) sits to the north of the initial discovery (area 1) and sits a lot closer to the surface. Importantly, it sits along the ~5km of prospective strike GAL has to the north of its discovery, which GAL’s models show to be the most prospective.

As for the massive sulphide section of GAL’s discovery, this starts to appear in the light blue section west of the discovery, where GAL’s project seems to be dipping down at depth.

We hope that as the company drills to the north, the yellow section grows (or joins together with the red section) AND the blue section extends and more blue sections are discovered.

In a short summary, here is what we are watching for next in each of the 7 sections:

Now with the overlay:

And on the 3D model...

When GAL announced its Callisto discovery hole we said there were two ways for it to increase the value of its new discovery:

- It discovers zones of higher grade mineralisation. ✅ OR

- It drills in different directions and down to new depths, testing for extensions and continuity of mineralisation of its discovery. ✅

Less than six months later, GAL can tick the box for each pathway — it has discovered new zones of high grade mineralisation and it is still to find the extents and the overall size and geometry of the mineralised zone that hosts the discovery.

And with almost 300 square kilometres of prospective ground at its Norseman project in WA, we think more upside remains.

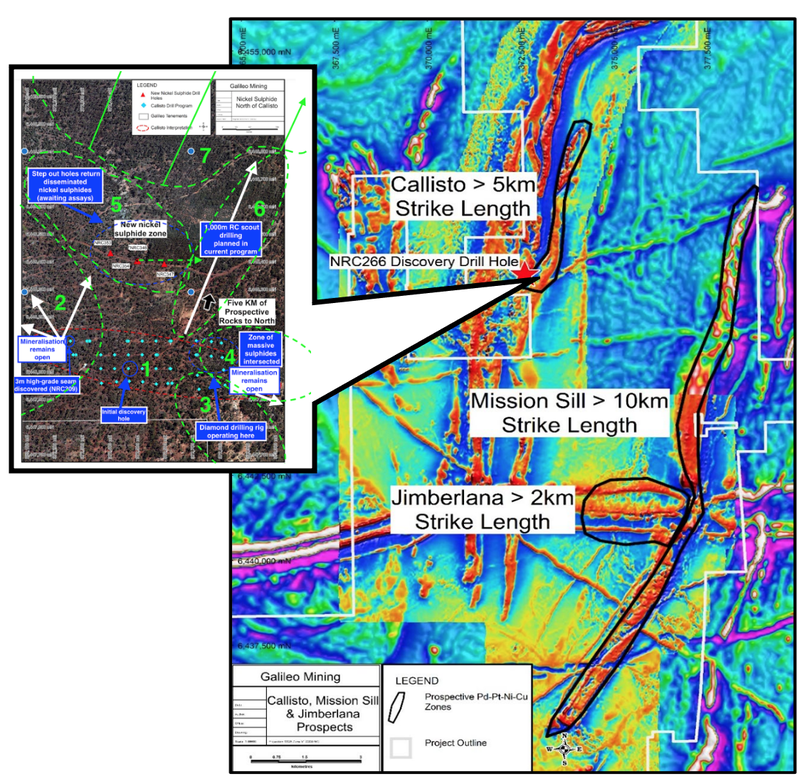

Along with Callisto, there are a further two prospects at Norseman with another 12km of strike that require follow up drilling.

Just at Callisto, GAL has over 5km of prospective strike length, almost all of which remains undrilled.

GAL now has two rigs on the ground — a reverse circulation (RC) rig doing around 5,000 metres per month and a diamond drilling rig doing around 2,000 metres per month.

GAL has a lot more drilling planned in the months ahead, leaving more chances of finding new mineralised zones, and hopefully the source of the mineralisation.

The potential that GAL has here seems to have been recognised by Mark Creasy who has been buying up GAL shares on market and now holds 27.4% of shares on issue.

Creasy most recently tipped in $2.85M between September 20-27th at an average price of $1.19.

This followed his $7M investment in the July placement at $1.20, after buying $2.35M worth of shares on market throughout June.

We recently named six of our Investments that are in the race to be our top performer for 2022.

At this stage, GAL is leading the pack to record the best return of 2022 of any Investment in our Portfolios — its discovery in May sent its share price from 20c to as high as $1.95.

If GAL continues delivering results and making new discoveries, it has an excellent chance of extending its gains and holding onto that top spot.

We note GAL’s managing director Brad Underwood has 2.5 million performance shares owed to him if the GAL share price can hit $3.60 (as a 5 day VWAP). As long term investors in GAL we would like to see him unlock these shares at this share price.

Having raised over $20M in July, we expect that GAL has a decent amount of cash remaining to drill a lot more holes by the end of the year (we’ll know more once the September quarterly results are out in the coming days).

This takes us to our “Big Bet’ for GAL:

Our Big Bet

“GAL increases the size/scale of its Norseman PGE discovery to a stage where the project/company is acquired by major shareholder IGO Ltd (or another major miner) for over $1BN.”

NOTE: our “Big Bet” is what we HOPE the ultimate success scenario looks like for this particular Investment over the long term (3+ years). There is a lot of work to be done, many risks involved - just some of which we list in our GAL Investment memo. Success will require a significant amount of luck. There is no guarantee that our Big Bet will ever come true.

We have updated our internal GAL “Progress Tracker” document to reflect the recent news.

Click here to see our Progress Tracker

Recent GAL news

This month, GAL made three meaningful announcements regarding its exploration program at Callisto:

- New nickel sulphides discovered (yellow on image below) - Step-out drilling 400m north of its discovery hit nickel sulphides, revealing either a whole new discovery or an extension to GAL’s existing discovery (we covered this news HERE);

- Massive sulphides assays (blue) - Assay results from the diamond drilling in August that intersected massive sulphides, east of the initial discovery hole. These showed an entirely different zone and type of mineralisation (above the palladium-rich disseminated sulphide zone) that has similarities to the Nova nickel-copper-cobalt mine; and

- Shallow mineralisation to the west of the initial discovery (red) - The western most drilling to date hit nickel sulphide mineralisation that remains open and appears to show increasing grades in that direction.

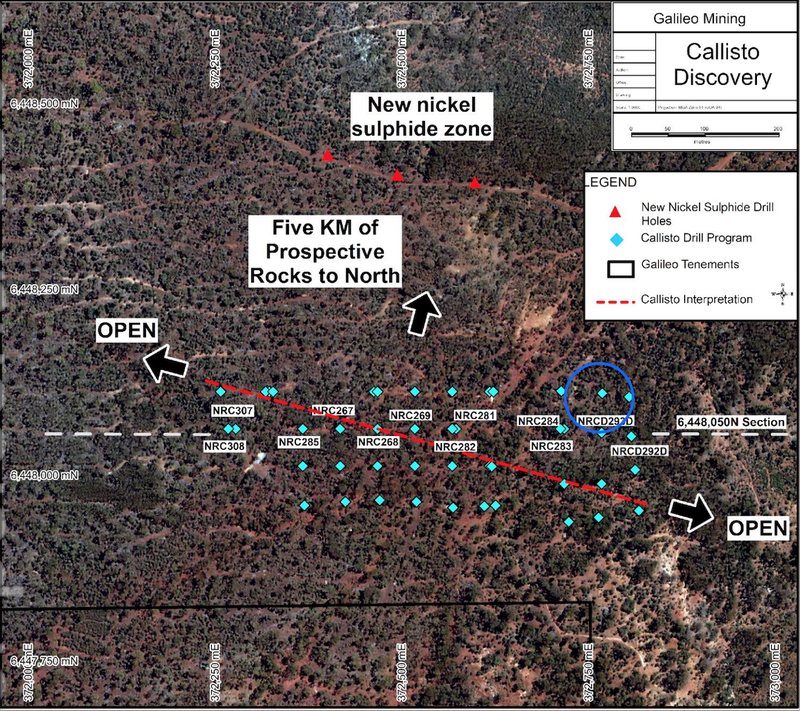

Keep in mind that the map above shows only a tiny slice of the Callisto area (approximately 1km), and as we have already pointed out a few times - GAL has 5,000 metres of prospective strike here (see prospective zones marked in black on below map).

So while having already made a significant discovery, GAL has really only scratched the surface here at Callisto:

... and then there’s a further 12km of prospective strike across GAL’s two other prospects at the Norseman Project — the Jimberlana Prospect and Mission Sill Prospect.

New massive sulphide target zone - see image area 4

Around five weeks ago GAL hit ‘massive sulphides’ east of its discovery hole while testing for extensions to its PGE discovery.

Massive sulphides are typically the host rock for easy to process, high grade mineralisation, which can add a lot of value to a deposit.

Last week we got the first batch of assay results from these massive sulphides which returned nickel-copper-cobalt mineralisation revealing a new style of magmatic nickel-copper-cobalt with potential for high-grade zones.

This new zone of mineralisation is above and would have a separate magmatic source to the lower palladium rich zones which hosted the initial discovery.

Assays included an interval of 2.2 metres of sulphides, grading 0.50% nickel, 1.92% copper, 0.12% cobalt, 0.10 g/t palladium from 189.8m.

Within that interval was 1.2 metres of massive sulphides.

The values of the base metals contained in that massive sulphide zone are much greater than previously seen, with nickel grades of 0.77%; much higher values of copper, at 2.48%; and for the first time GAL saw significant amounts of cobalt (0.18%); while the amount of palladium was lower than in previous holes, at 0.14 g/t.

Because of the enrichment of cobalt, the nature of the massive sulphide, and the relative values of PGEs (palladium, platinum and gold) between the two zones, this can be interpreted as a separate and distinct zone of mineralisation (shown in blue):

So we know that this massive sulphide is separate from the lower palladium rich zone (red) 40-50 metres away. That means there is potential for more of both styles of mineralisation and GAL will continue to explore for those.

We like that there are a number of different types of mineralisation in and around Callisto.

Importantly, this style of massive sulphide nickel-copper-cobalt in ultramafic rocks is similar to magmatic sulphide deposits such as IGO Ltd’s Nova nickel-copper-cobalt mine in the nearby Fraser Range.

The 2012 Nova nickel discovery was acquired by IGO (GAL’s second biggest shareholder) in a deal worth $1.8BN. GAL’s biggest shareholder (and also major IGO shareholder), Mark Creasy, who has been busy buying GAL shares on market in recent months, was also involved in the Nova discovery.

So as well as ongoing work on the lower palladium rich zone, GAL will follow up on the results from this massive sulphide target.

GAL plans on doing downhole EM surveying, which involves running a probe down the hole looking for more mineralisation around that massive sulphide unit.

We expect this will provide even more additional drill targets for follow up.

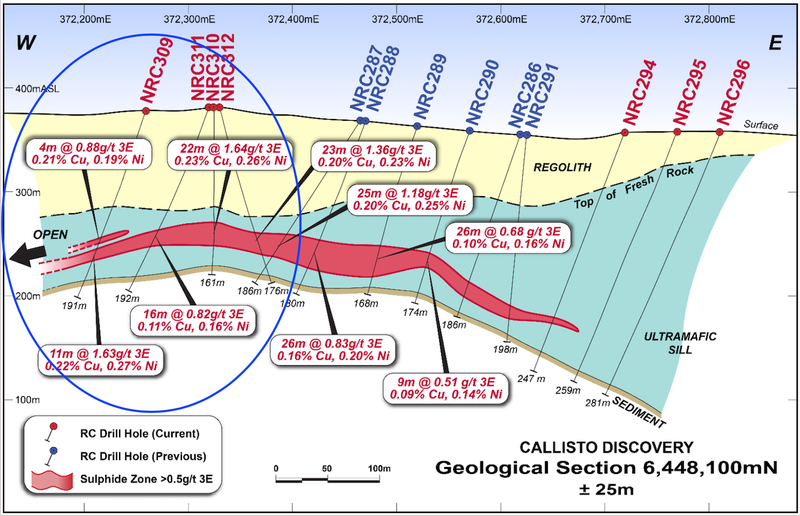

High grade assays continue west - see image area 2

GAL has also extended the known mineralised zone of its discovery to the west/north-west, with assays confirming PGEs in the western most drilling done to date.

The mineralisation remains completely open to the west-northwest where GAL has discovered a 3m high-grade seam in drillhole NRC309.

Importantly, GAL is still hitting palladium mineralisation on the western edge and it looks like the grade is still increasing as it continues in that direction.

The mineralisation looks like it has a plunge to it, moving from the west-northwest to the east-southeast.

While GAL doesn’t know what it will find to the west or further to the north-west — it’s still a big unknown open space — there is real potential based on the results to date, particularly as GAL is starting to see some higher grade seams within the overall zone of mineralisation.

So as GAL continues drilling and learning about the mineralisation that it has on its hands, it does know that it is very widespread and contains high grade seams.

GAL continues to drill at both ends looking to follow the mineralisation, and plans to keep drilling to find the extents and the overall size and geometry of the zone.

New nickel sulphide zone to the north - see image area 5

As we wrote about two weeks ago, step out drilling 400m north of the Callisto discovery hole hit nickel sulphide mineralisation.

We are awaiting assays from the four drillholes to see the metal grades, which should arrive in around four weeks time.

We don’t know what the relationship is between this new zone and the initial Callisto discovery 400m to the south, but it is significant that sulphides have been identified at such a small distance away from that discovery hole.

New zones of mineralisation such as this demonstrate the opportunity for growth, through a combination of drilling out the known metal-rich sulphide zones, and the potential for new discoveries in the five kilometres of prospective ground GAL holds to the north of its discovery.

So far, these early drill results supported GAL’s target generation model that suggested that the five kilometres north of Callisto are the most prospective. We’ll know more once the assays are in, but we expect that these step out holes will mean one of two things:

1 The original discovery is suddenly way bigger - assuming that the ore body extends all the way from the original discovery to the northern scout drill holes, and assays come back positive.

2. GAL has found an entirely new mineral system - this new potential discovery may NOT be connected to the original discovery to the south, meaning an entire new system has been discovered, with a further 5km of highly prospective ground to the north.

What’s next?

GAL currently has two rigs on the ground — a RC rig and a diamond drilling rig - the images below show where GAL is going to focus its drilling on.

RC Drilling to test for extensions to its discovery 🔄

GAL is doing RC drilling to the north, east, and west of its initial discovery.

GAL has so far undertaken scout RC drilling up to 500 metres north of Callisto.

So far, the sulphides intercepted to the north suggest the discovery could continue northwards OR that GAL has another separate ore body here.

Ultimately, assays will better reveal what GAL has on its hands.

In the current program GAL plans to extend this scout drilling on existing tracks up to one kilometre north, with holes every 100m.

It also plans to drill to the west and north of its initial discovery all the way up towards the newly discovered area to the north (image area 5).

We also note that GAL recently announced that it has approvals in place that allow for it to systematically drill out ~3.5km of strike to the north.

As a result, we will be watching to see if GAL continues to intercept sulphides here to the north, and in all directions.

Diamond drilling to the east testing mineralisation at depth 🔄

GAL is also drilling to the east-southeast of its discovery, testing for mineralisation at depth.

This is the same area where GAL recently hit massive-sulphides.

The massive sulphides are particularly important because they are generally a host rock for higher grade, easier to process mineralisation.

These assay results also confirmed an entirely different zone of mineralisation that has similarities to the Nova nickel-copper-cobalt mine (image area 3).

GAL has already confirmed that downhole EM surveys are being run to try and plan out the best places to drill as it continues drilling in this direction.

We hope the deeper diamond drillholes continue to hit more of the same type of geology.

Key risks

Click on the image below to see the key risks to GAL in detail.

Our 2022 GAL Investment Memo

Below is our August 2022 Investment Memo for GAL, where you can find a short, high level summary of our reasons for Investing.

The ultimate purpose of the memo is to record our current thinking as a benchmark to assess the company's performance against our expectations for the following 12 months.

In our GAL Investment Memo, you’ll find:

- Key objectives for GAL for the coming year (starting from August 2022)

- Why we are Invested in GAL

- The key risks to our Investment thesis

- Our Investment plan

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.