Is WRM’s Zinc-Silver Project Pushing it Towards Revaluation?

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

The last time we caught up with White Rock Minerals (ASX:WRM), the company had been busy setting itself up for multi-layered success.

It had recently announced a promising JORC Mineral Resource Estimate at its highly prospective Red Mountain Project in Alaska — about 100 kilometres from Fairbanks — an advanced VMS project rich in high-grade zinc and silver deposits.

However, we aren’t the only ones who have taken notice of what’s going on at Red Mountain.

Independent Investment Research (IIR) — a research house operating in Australia and the US — this week published a report about WRM following the company’s recently released initial Mineral Resource Estimate at Red Mountain.

According to IIR, WRM’s valuation and positioning among its peers has been fundamentally impacted by its strategic acquisition of Red Mountain which it completed mid-2016... at the bargain price of A$1.2 million in scrip.

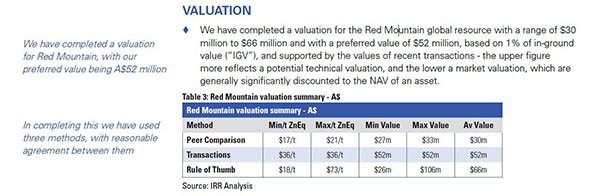

How much is WRM worth in real terms, right now?

IIR values WRM at A$30 to $66 million, just for Red Mountain alone.

That translates to a value of $0.06 per share (with a range from $0.034/share to $0.076/share).

It should be noted here, however, that broker projections and price targets are only estimates and may not be met. This is a speculative stock and those considering this stock should seek independent financial advice before making any investment decision.

IIR’s valuation doesn’t yet take into consideration WRM’s 338,000 ounces of gold and 23 million ounces of silver at its cornerstone asset, the Mt Carrington epithermal gold-silver project in NSW, which offers excellent exposure to the AUD gold price, with additional silver and zinc upside.

Perhaps what is most eye-catching about WRM is how it is compared to its peers and competitors.

The comparisons demonstrate a discord between the current market capitalisation of WRM relative to its peers, with the company’s superior resource size and zinc equivalent grade somehow not yet captured in the company’s enterprise value.

Which, it probably goes without saying, points to some serious room for upside.

IIR’s valuation isn’t subjective: it comes down to facts and figures... and it looks like this $13 million-capped explorer could be set to fly much higher than its current position.

Catching up with:

White Rock Minerals’ (ASX:WRM) Red Mountain project is now in the top quartile of undeveloped high-grade VMS deposits globally. It has one of the highest-grade VMS zinc – silver – lead – gold deposits out of its peers, with 30 lookalike targets still to be tested. It has a JORC compliant Resource, with some 9.1 million tonnes grading 12.9% ZnEq.

Yet WRM’s market-cap is still just $13 million.

The recent report by independent investment firm IIR following WRM’s recently released Mineral Resource Estimate for its Red Mountain Project indicates there could be a great deal of upside on the horizon.

The following article gives you a look at the maiden resource in more detail.

The highlights of this were the total inferred mineral resource of 16.7 million tonnes grading 8.9% zinc equivalent for 1.5 million tonnes of contained zinc equivalent at a 1% zinc cut off for Dry Creek, the 3% zinc cut off for West Tundra Flats and 0.5% copper cut-off for the Dry Creek copper zone. These results highlight the fact that Red Mountain is a quality base and precious metal asset. It should also be noted that mineralisation commences at surface and is open down dip.

The Mineral Resource places the Red Mountain project in the top quartile of undeveloped high grade volcanogenic massive sulphide VMS (zinc, silver, lead, gold, copper) deposits globally.

So with that in mind, let’s dismantle the report in a little more depth.

Raring report could lead to a revaluation

With the release of IIR’s report on WRM’s Red Mountain project, we can see the demand for this stock potentially heading north. The report was also released while the company’s shares were trading at the bargain price of just 1.5 cents.

A switched on investor could actually see how this might represent a potential blue sky buying opportunity.

Here is summary of the research house’s valuation:

We want to remind you that its current market-cap is just $13 million.

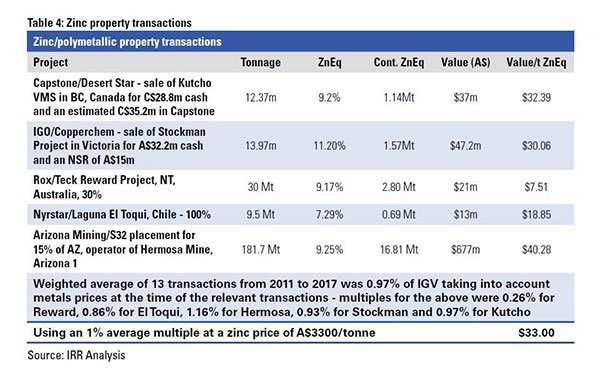

Here’s a look at zinc/polymetallic property transactions which could be in a comparable range to Red Mountain:

IIR’s valuation of the project implies an approximate four-fold premium to the company’s current share price, even before you account for any value from its Mt Carrington gold and silver asset...

Again it should be noted that broker’s estimates may not eventuate.

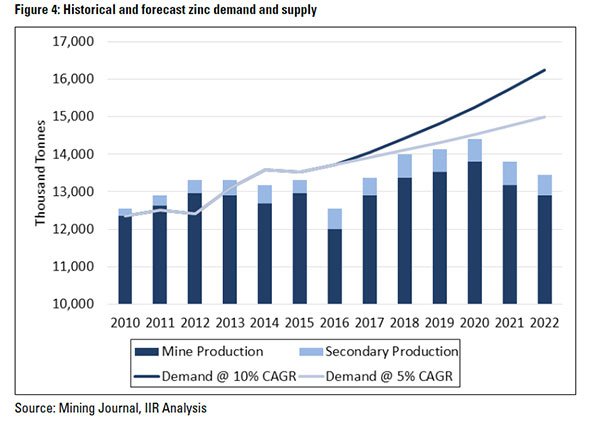

The zinc price is only ~5% shy of last year’s high of ~US1.30/pound — its highest price since 2007. With IIR predicting zinc supply to peak in 2020 and to then fall, WRM looks to be perfectly timing the Red Mountain project to supply hungry markets...

Of course commodity prices do fluctuate and caution should be applied to any investment decision here. Seek professional financial advice before choosing to invest.

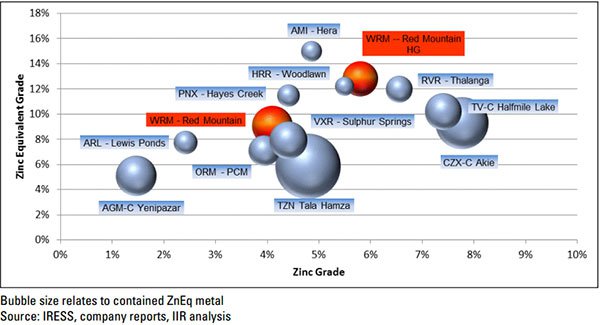

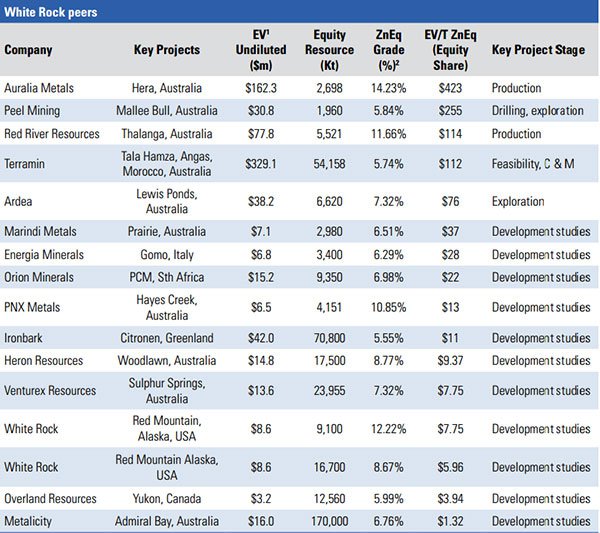

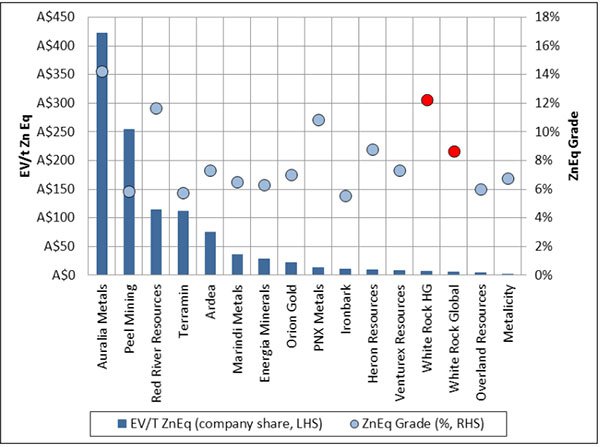

WRM’s Red Mountain Project is actually ahead of most of its competition, being in an advanced development stage. For an even sharper comparison, the table below considers only those ASX or TSX-listed companies with un developed zinc projects:

Of particular note, is how well Red Mountain’s high-grade resource compares to its peers on zinc grade and zinc equivalent grade.

Why the focus on Red Mountain?

Red Mountain’s significant value and Resources do not seem to be fully captured in WRM’s current enterprise value.

It’s not that Mt Carrington is not worthy of having its unlocked value equally advertised — it’s an advanced gold and silver asset expected to generate free cash flow of more than $100 million over its initial seven-year mine life when up and running.

It has more to do with the fact that the value of the savvy acquisition of Red Mountain last year hasn’t been fully realised in the eyes of investors...

As such, WRM’s current market-cap and enterprise value could very well be short of the mark.

IRR’s valuation appears to be supported by HSBC (with a 15.5% interest in WRM), Citicorp (with a 7.9% interest) and several other major shareholders, which have already identified the value that the IIR report reveals.

As we mentioned earlier, management acquired Red Mountain for $1.2 million in scrip — a good deal on which the company’s valuation could easily pivot... if investors pay attention.

Peer comparisons indicate the extent of current discount

Together, the table and graph below give an idea of the superior grades and size of the Resource at the Red Mountain project, while putting into focus the comparatively low current enterprise value relative to its peers:

Macro matters

A key positive driver for WRM is the soaring price of zinc, in conjunction with declining forecasted mine production.

Zinc prices are estimated to remain strong well into the foreseeable future, with longer-term prices maxing out to US$2,400/t.

Zinc was the best performing base metal in 2016, and as the following chart demonstrates, it continues to perform well:

If you’re not convinced yet, this article by mining.com sums up the current zinc sentiment:

As you can see there’s a lot to play for here for WRM and it is doing its best to make sure it has every chance of hitting the right notes at just the right time.

Meanwhile, at Mt Carrington...

We haven’t forgotten WRM’s cornerstone project in all this — the Mt Carrington gold-silver play in NSW, which has extensive mining infrastructure already in place.

Right now, the company is working towards completing a Definitive Feasibility Study (DFS).

In late May, WRM released assay results for two drill holes completed in April at the project. The drilling was done at the Lady Hampden deposit to obtain fresh rock samples for metallurgical test work, which is underway for each of the main deposits at Mt Carrington (Lady Hampden, Strauss, Kylo and White Rock).

Two highlights of the results were:

- 11m @ 4.21g/t Au & 86g/t Ag from 58m (LHDM002)

- 19m @ 1.5g/t Au & 255g/t Ag from 119m (LHDM002)

The findings were in line with the company’s expectations, supporting the idea of wide zones of mineralisation at the site.

If you enjoy the nitty gritty details: the sample intervals intersected provided representative mineralisation as well as high grade and low grade variability samples from within the current pit design, to be used to optimise the ‘processing flow sheet,’ including the comminution and flotation circuits.

As we said, this is all in aid of completing a DFS, which will inform the company of the geology of the Resource to JORC 2012 standard, and lock down a design for the mine and plant that will need to be built. That is, the plant required once the mine is up and running and generating a predicted free cash flow of more than $100 million over its initial seven-year mine life.

This figure is speculative, so investors should take a cautious approach to any investment decision they make and seek professional financial advice if considering this stock for their portfolio.

Not only does this give WRM and its shareholders a boost in confidence, it also gives some information about timelines and progress. The company also stated it plans to release a Probable Reserve Statement to JORC 2012 standard during the third quarter of this year.

With an established 2004 JORC compliant mineral Resource Estimate of 338,000 ounces of gold and 23.4 million ounces of silver, even at this early stage the project is valued at circa $20 million...

Shifting gears to the future

There are a couple of key points that boost WRM’s prospects in the near and long term at its Alaskan Red Mountain project.

Factors like:

- The sheer size and grade of the contained Resource,

- The open mineralisation at outcrops; positive metallurgy results,

- Potential upside due to the fact that Red Mountain has had very minimal exploration using modern tools and techniques,

- The mining-friendly location of Alaska,

- The timing around a turbo-charged zinc market, and

- Top-tier personnel in the management team... to round it out.

When you add in its Mt Carrington play in NSW, there are more than enough opportunities for news flow and the potential for a serious price inflection point — or three.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.