WRM’s Path to Gold Production Continues: DFS Now Underway

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

A ‘Game-changer for White Rock’ is what White Rock Minerals (ASX:WRM) management dubbed the company’s $4.9M capital raising late last year.

The funds allow $11.6M-capped WRM to advance a Scoping Study at its Mt Carrington gold-silver project in northern NSW. The study involves completion of a Definitive Feasibility Study (DFS) and obtaining its Environmental Impact Assessment (EIS) for Mt Carrington.

Completion of these two caveats will unlock a financing package of $19M offered by private resources investment fund, Cartesian Royalty Holdings. From there, WRM will be well on its pathway to production at its cornerstone asset, which is forecast to provide strong financial returns over its initial seven-year mine life.

With funding for construction secured and a highly skilled team assembled to deliver its DFS and EIS, WRM could soon reap the rewards of its hard work.

Having brooded over its cornerstone Mt. Carrington Project since 2010, and ploughing time and effort incubating it towards production, WRM is now determined to see its commercial plans hatch into reality.

And all the required pieces are falling into place. The key terms for a fully funded construction financing package is agreed. The project has low capital costs – requiring less than $30M to get going (this including the DFS and EIS costs). The project already has approximately $20M worth of infrastructure in place, reducing development risk, timeframe and capital cost.

That’s for a project with a net present value – based on an initial mining review in October 2016 – of $60M, with an internal rate of return of more than 100%, and expected free cash flow of around $100M. Put another way, over AU$100M is expected to be generated in free cash flow from the initial 7 years of operation.

A carryover from the project’s potential upside to the share price is yet to be seen, but with gold prices hammering out a base around US$1,200/oz. (A$1,600/oz.), silver prices around A$22/oz. and commodity markets gradually healing their wounds on the back of cyclical demand, now could be time to back a well-funded bargain-basement gold company with a clear path to production.

The 100% WRM-owned Mt Carrington project has a 338,000 oz. gold + 23.4m oz. silver resource, and is on the cusp of kick-starting construction of its processing plant.

However it is an early stage of this company’s development and if considering this stock for your portfolio you should take all public information into account and seek professional financial advice.

If WRM stays the course and sees its ambitions realised, it could become a viable gold junior progressing towards mid-tier producer status.

In recent years, several Aussie gold juniors have talked the talk and walked the walk — nurturing their gold-price-sensitive projects and recording enviable share price gains in the process.

Could WRM play the part of ‘El Dorado’ and join them?

Read on to find out...

After several years of Asian region procrastination and waning global demand, metals prices in particular have started to crawl out of their doldrums. The commodities landscape hasn’t looked this good since 2011.

Precious metals such as gold, silver and platinum have been strong over the past year or so, delivering outstanding financial performance for a host of Aussie gold juniors (in exploration mode) and gold mid-caps (in production mode).

White Rock Minerals (ASX:WRM) is leveraged to both gold and silver. Even minor rises in the metals’ prices can deliver big rewards to the company’s cash flow. Using the $1600/oz. as a base level gold price, a $100/oz. rise would translate to an additional $6 million in free cash flow over the mine’s life. In the case of silver, a $1/oz. price rise would increase free cash flow by $6 million over the life of the mine.

These numbers make a compelling investment case as they are, yet WRM could boost them even further after further optimisation as they progress through to DFS level of study and analysis.

The past performance of this product is not and should not be taken as an indication of future performance. Caution should be exercised in assessing past performance. This product, like all other financial products, is subject to market forces and unpredictable events that may adversely affect future performance.

A pick up in other industrial-use commodities have proven to be barometers for broader economic activity and industrial demand.

Check out this handy little table showing commodities with most love for investors:

One of our other recent gold picks, here at The Next Mining Boom , is Blackham Resources (ASX: BLK) — a gold junior hastily progressing towards gold production in Australia. BLK is currently up by over 100% since the start of 2016.

The past performance of this product is not and should not be taken as an indication of future performance. Caution should be exercised in assessing past performance. This product, like all other financial products, is subject to market forces and unpredictable events that may adversely affect future performance.

WRM has a great chance to emulate BLK’s performance, having JORC Resources and funding secured – the exact steps BLK took last year which helped raise its own valuation.

With that in mind, let’s see how WRM is prepping for its golden debut

Two elements are crucial to WRM’s future: completing a Definitive Feasibility Study (DFS) and an Environmental Impact Statement (EIS) at the Mt. Carrington gold and silver development asset, WRM’s primary focus.

To do so, WRM raised approximately $1.65MM via a Placement to professional investors, followed immediately by an Entitlement Offer to existing shareholders and placing some short fall – this raising a further $3.2M.

This should see it through to the completion of the DFS.

A Phase 2 capital injection of the Popeye variety

WRM’s goldilocks expansion plans have caught the eye of Cartesian Royalty Holdings, a private equity investment fund.

Cartesian Royalty is ready to release US$19M of development cash for WRM to plough into developing Mt. Carrington — pending the DFS results coming in as expected, and obtaining the necessary approvals.

We’ve scoured the analyst research, and overlaid it with the macro view that gold is back, to conclude that there’s a good chance the DFS will give WRM the economic green-light to build its infrastructure.

This is speculation on our part at this stage, so investors should not only look at the information within this article, but all publicly available information before making an investment decision.

Progressing the next stage of WRM’s development requires a plentiful supply of cash and financier Cartesian Royalty Holdings, is locked-and-loaded ready to pull the trigger on its capital line to WRM.

Key infrastructure is already in place to support future mining. This saving is worth approximately $20 million to WRM.

Mt Carrington site infrastructure includes:

- granted mining leases covering 850Ha,

- a 1.5Mt tailings storage facility with capacity for expansion,

- a 750ML freshwater dam,

- a site exploration and mine administration office,

- a water treatment plant with 0.8ML/day output capacity,

- connection to the NSW State high voltage power grid which traverses directly through the Mining Leases, plus

- existing haul roads for the gold and silver deposits and previous processing plant foundations.

That is all going to save WRM a heap of cash, and allow it to move into production much quicker than if this was a greenfields site.

An upfront capital cost of AU$14.5M has been estimated for a proposed 0.8Mtpa floatation and CIL processing plant at Mt. Carrington, and a further $6.1M designated for additional site infrastructure and pre-mining minutiae.

For a quick recap of the location, here is where Mt Carrington sits in New South Wales, Australia, south of Brisbane:

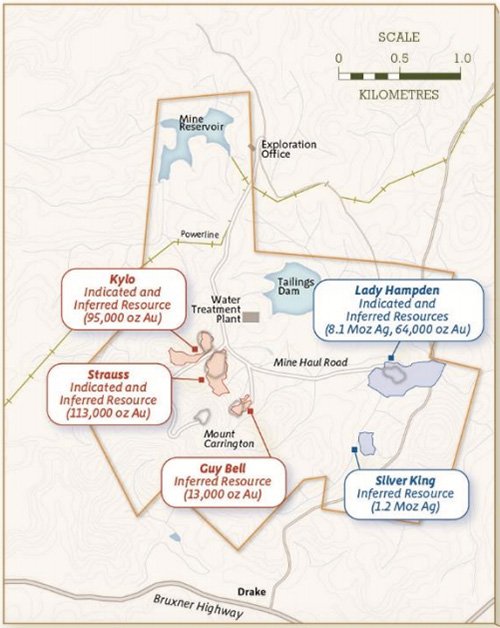

There is a possibility WRM will expand its existing 338,00oz gold Resource and 23.4 million oz. silver Resource, as part of the final DFS completion process .

The chart below illustrates the latest information on WRM’s progress towards proving up more gold and silver mineralisation to be added to its JORC Resource.

Here is a summary of WRM’s Mt. Carrington Project as per WRM’s Scoping Study:

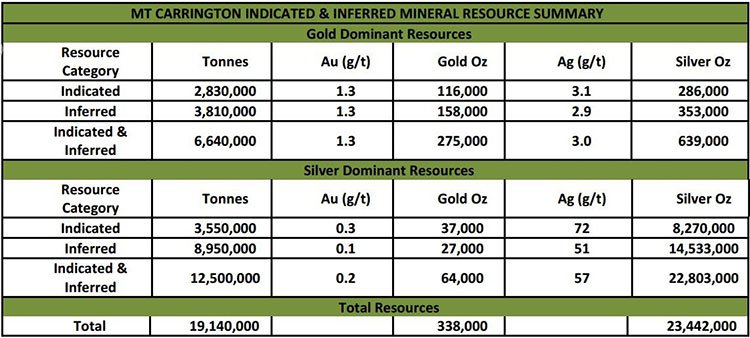

And here is WRM’s official JORC Resource table:

With all that in mind, let’s take a look at what WRM is planning to do with its endowment at Mt. Carrington:

WRM’s Scoping Study update in March 2016, and now the upcoming DFS, help stretch WRM’s upside at Mt. Carrington. Plus soft gold market activity and plenty of spare capacity could push development costs lower still.

The Australian dollar gold price seems to have found a floor, which inherently helps WRM to keep its project economically viable.

Coupled with WRM’s silver resource, this could be the next addition to Australia’s precious metals production line.

WRM inches towards gold production as gold turns around for its renaissance

WRM has been working on its Mt. Carrington Project for several years, collating pain-staking exploration data and mapping out tenements in NSW.

With the DFS now underway, WRM is on the cusp of activating over US$19M in further development funding from Cartesian Royalty Holdings, WRM’s cornerstone funding partner.

Furthermore, WRM will have access to over AU$100M in free cash over the initial (estimated) 7 year mine life at Mt. Carrington, which may be further extended following WRM’s DFS results and ongoing exploration activity.

All in all, WRM makes a compelling case as it looks to bloom from scrawny junior explorer to butch mid-tier producer. The big macro catalyst helping WRM is the strength of gold and silver priced in Australian dollars.

However at the same time, we should point out that commodity prices can also fluctuate down, so caution should be applied to any investment decision and not be based on historical spot prices alone.

The fact that WRM will be selling gold and silver in Aussie dollars, potentially as soon as 2019, is neatly conducive and very synchronistic with WRM’s gold and silver mining project.

WRM’s commercial plans are significantly aided by the prospect of early gold sales. This means WRM can realistically expect to pay back the initial capital expense on mining Mt. Carrington within 12 months.

The approximate $100M of free cash generated would underwrite further exploration on WRM’s tenements, where at least six drill-ready targets have so far been identified. This could also extend Mt. Carrington’s longevity, if the upcoming DFS doesn’t.

When all is said and done, we see WRM as a strong candidate to join the growing list of opportunistic and gold-savvy Aussie gold explorers metamorphosing into gold producers right before our very eyes. Several factors have elegantly dovetailed together for WRM in order for Mt. Carrington to have been incubated into its current pre-hatch state.

With the final few hurdles now in sight, WRM is sitting on a golden market opportunity to hatch into a gold and silver producer pouring over 30,000 ounces onto global markets each year.

That’s the kind of small-cap investment opportunity we like to retrieve for our small-cap-investing brethren — small, tightly-run precious metals bloodhounds that are right where they need to be, at the right time.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.