WMN Primed for Graphite Revenue After Completing Takeover Deal?

Published 23-DEC-2015 09:49 A.M.

|

13 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

What do you get if you add the following?

- 8Mt JORC resource of flake graphite at 12.7% Total Graphitic Carbon (TGC)

- 10,000+ hectares of exploration ground

- Low-cost production

- Provisional 50,000/t per year Letter of Intent received

- Intended production close to major end-user markets of South Korea, Japan and Taiwan

- $30MN market cap

Together, the result is a highly prospective opportunity to back the growth of one of the most exciting commodities in recent times: graphite (and its derivative, graphene), in a surging region of the globe – Asia.

Here at The Next Mining Boom , such a combination of factors perks our ears and raises our antennae because graphite demand is steadily increasing on the back of growing demand for lithium-ion batteries.

Graphite explorers that find themselves well-positioned now, are likely to be the first to receive the more lucrative offtake deals and takeover offers if and when graphite becomes part of the furniture in global commodities markets.

It’s still early days in terms of everything being made from graphite, and still some way off from graphene making its way into everyday mass consumables...

...but when a company has an 8Mt JORC Resource in the bag, a provisional offtake already secured and a relatively cheap cost of production – it means production isn’t too far away and it can start generating those all-important revenues.

Western Mining Network (ASX:WMN) is one such company.

It’s fair to say that this stock did not have the best second half of 2015 with funding issues hampering its development. However with a $6M funding arrangement recently locked in, the expectations are looking strong heading into 2016.

Conducting its own exploration (which is progressing rather nicely), WMN went out on a limb and bought out an existing Indonesian company earlier this year, with a JORC Resource already defined.

That deal has just been completed with the transaction formalised as of this week.

WMN has all its i’s dotted, t’s crossed and boxes checked so all that essentially remains is to move some of that graphite into world markets for sale. The next key milestone will be for a Scoping Study to be completed by Q2, 2016.

WMN’s graphite grades are some of the highest TGC seen anywhere in the world – the kind of graphite that fetches anywhere between US$1000 – US$10,000 per tonne.

With 8 million tonnes and a 10 year mining license to play with, a rough calculation suggests WMN could be sitting on billions of dollars of graphite potential over the coming decade.

However, while that may seem promising, WMN have a lot of hoops to jump through before production can begin, and the company’s success is no guarantee – so caution should be applied if considering as an investment.

Other prospective locations in Kalimantan, as well the company’s original location in Sulawesi could potentially add further meat to its overall Resource.

With the resources downturn playing whack-a-mole with commodities such as iron ore, oil and gold in the recent past, it may be a good time to have a look at a commodity that’s all about being part of the future.

Updating you on:

Western Mining Network (ASX:WMN) has diligently assembled a game plan to become a robust, full-spectrum graphite company that not only discovers graphite and sends it for sale, but also, produces high-end finished products via processing, which can then be sold directly to battery manufacturers for a larger profit margin.

The aim of the game is to be a vertically integrated graphite player – to capture the entire supply chain from ‘paddock to plate’ in other words.

We first brought you WMN in our initial article, Graphite Godfather’s Asian Power Play , where we had a detailed look at this intriguing graphite explorer with some lofty government connections.

We then followed up with an update in July with our article, 8 Million Tonnes of Flake Graphite Just Acquired by WMN where we outlined WMN’s JORC resource acquisition and likely effect on the company.

Since that time, WMN has had some issues securing finance, however now that a $6M placement has been confirmed , we would expect to see a lot more news flow out of WMN in the coming months.

With the acquisition complete and paperwork finalised, WMN will be moving quickly in the New Year to finalise a Scoping Study on its projects, which is expected to be complete by Q2, 2016.

WMN’s locations are perfectly positioned in a low-cost area of production, close to its end-user market...

WMN’s low-cost of production in Indonesia means it can produce and process graphite on the very door step of end-users.

The Letter of Intent signed with a South Korean buyer could allow WMN to sell at least 50,000 tonnes per year. Being based in South East Asia means WMN is well positioned to serve this industrially strong part of the globe.

Take a look at WMN’s project locations, mapped out right here:

Now, let’s zoom in to take a closer look at WMN’s portfolio of graphite assets.

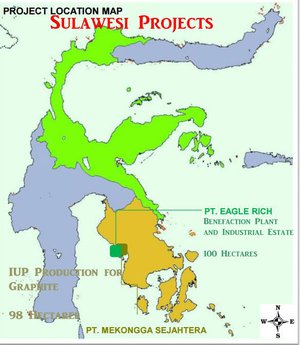

First off, WMN has a highly-prospective project on the island of Sulawesi – shown below:

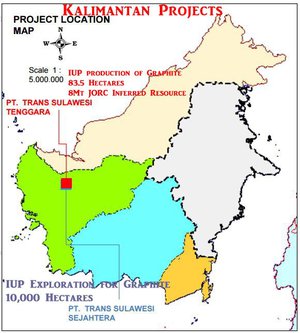

Secondly, WMN is now also operating on the island of Kalimantan, where it has access to two projects – one of which has already been JORC assessed to have an inferred 8Mt graphite resource, the other having an additional 10,000 Ha of exploration ground specifically identified as prospective for graphite.

WMN wants to monetise this ‘JORC’ed’ project as soon as possible but also has a neighbouring 10,000 hectare asset right next door.

Further down the track, this could be ripe for further exploration and a resource boost.

WMN’s brimming acquisition

As we mentioned earlier, WMN recently finalised its acquisition of the Grafindo Nusantara project in an all-share deal.

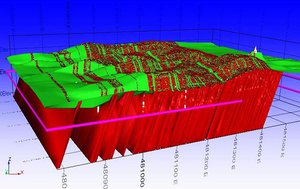

And if we look at the geology below the ground as modeled by geologists, it becomes pretty obvious why WMN pulled the trigger on this particular project.

Not only is this prospect brimming with graphite lodes as shown above (delineated in red), but also makes for an ideal second location for graphite production for the Company.

By acquiring this asset, WMN is able to fold it straight into its ongoing Scoping Study and can already start focusing on the bigger picture for this junior, pre-production explorer.

Let’s take a look WMN’s strategy and what’s it all about...

Graphite can be used in a very broad range of high margin, high value added applications.

However, WMN aims to be much more than just a producer of raw graphite.

By its own admission, WMN is working towards becoming an “integrated carbon company with a vertical business model”.

This effectively means WMN is on course to become both a producer and manufacturer of graphite-based products therefore able to extract a higher margin from its sales.

The goal is to use its assortment of graphite resources to produce a range of semi-finished and finished graphite products in cooperation with technology partners based in South Korea.

Leveraging local & regional connections

WMN’s focus on downstream production makes it a potential favourite of the Indonesian government, which is pushing to encourage resource sector companies to process onshore and maximise value added for commodity products within Indonesia.

Whilst other foreign listed companies complain, WMN, with its strong local shareholder base, is pushing to take advantage of this new policy to push for government support for the future development of its business.

Through the Letter of Intent and in order to secure its future once in production, Dongsung Highchem Co Ltd has committed to taking 50,000 tonnes of graphite per year from WMN’s Tamboli project.

With high-quality graphite selling for between US$1000 to $10,000 per tonne, WMN is on course to generate between US$50MN to US$500MN per year as long as the deal sticks and production starts flowing.

At the same time, there is no guarantee that the deal will stick, as it’s only a Letter of Intent at this stage. So caution should be applied if considering WMN as an investment and it’s always good to seek professional advice if considering this stock for your portfolio.

If you build it, they will come

With an offtake provisionally agreed, WMN is pushing hard to get beneficiation plants built as a follow on to the Scoping Studies currently ongoing and expected to conclude over the next few months.

We also understand that if lab tests and customer dialogues go sufficiently well, WMN may aim to skip an intermediate mini-plant stage and move straight to finance and build at least one full sized plant.

Not only is this a potential price catalyst for next year, the fact that WMN is already earmarking construction of production facilities indicates a graphite explorer ready for the production stage.

The conservative first step in the process will be the development of mini-plants in both Sulawesi and Kalimantan to produce metallurgical grade and electrical grade graphite.

These smaller scale mini plants are being planned to use full industrial processes and are set to produce five tonnes of metallurgical grade and electrical grade graphite per day.

The selling prices of the different grades of metallurgical and electrical graphite produced will vary widely, ranging from less than US$1000/tonne up to US$10,000/tonne. WMN management is of course aiming to successfully produce the higher priced, higher margin products such as large and jumbo flake graphite.

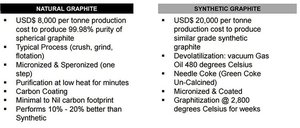

The production of lowest grade metallurgical grade products only require the application of more conventional beneficiation techniques including crushing, milling, agitation, flotation etc. whereas the higher value electrical grade graphite products will require more advanced graphitisation and crystallisation techniques – as currently used in the latter processing stages of the production of synthetic graphite.

The initial production of those more advanced products will be contracted out through WMN’s technology partners in South Korea or elsewhere.

Here’s a reminder of how natural graphite compares to its synthetic variant – remember it’s the natural graphite that WMN are looking to commercialise...

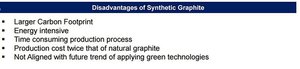

WMN has access to natural graphite, which is expected to dominate its more expensive, synthetic variant given the following disadvantages currently seen for synthetic:

If you’re of the opinion that green technologies will trump their carbon-emitting counterparts over the coming generations, you’d be in agreement with at least 200 countries that recently signed up to the Paris climate agreement, agreeing to reduce carbon emissions down to almost zero over the next 70-100 years.

This is yet another indicator that going green will pay off for investors over the coming decades – and WMN’s natural graphite fits that story to a tee.

WMN currently well-funded after $6M placement

As all resources investors know, funding is a huge bugbear for junior explorers. Especially at the current time with a commodities downturn still playing out.

The good news is that WMN has successfully confirmed $6 million in a recent placement, and snagged a new cornerstone investor – Lanstead Capital LP.

Lanstead Capital is a UK-based specialist investment firm, holding stakes in a number of companies listed on the LSE, AIM, TSX and ASX exchanges. Their decision to take a stake in WMN is a positive signal that institutional backers like this stock.

Following completion of the placement, Lanstead will hold 33 million ordinary shares in WMN, which represents 16.68% of WMN’s enlarged issued share capital.

Meanwhile WMN have drawn down $900,000 so far. Full details of the arrangement with Lanstead can be read here .

Now well-funded, ‘JORCed’ and with an offtake provisionally pencilled in, WMN expects to generate operating revenue within the next 12 months based on the operation of one or more of its proposed mini-plants.

The $6MN funding facility will also be used to push WMN’s current Scoping Study over the line and fund the construction of WMN’s pilot plant as part of its graphite project in Indonesia.

Graphite in Wonderland

WMN looks to have all it needs to pursue a vibrant and ambitious graphite strategy in Asia, but what’s the market WMN is delving into?

This aspect is probably the most exciting for WMN.

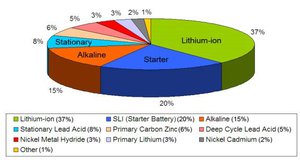

Graphite is on course to enter a growth-spurt backed by an insatiable demand for lithium-ion batteries.

Pretty much every electronic device these days requires a high-tech lithium battery which is largely comprised of graphite.

Here’s a chart of what kind of batteries are currently dominating. Notice the dominance on lithium-ion batteries...this dominance is expected to grow because of its technical superiority to all other types.

High profile battery manufacturers such as Tesla have already confirmed that lithium-ion will be the likely technology that is adopted by the market as a whole, which means graphite is likely to see stable demand over the coming years.

But don’t just take our word for it... check out these press clippings from prominent sources:

Taking stock of all the factors suggest WMN is well positioned for a bright graphite future

WMN’s business strategy is coming together nicely with its first revenues expected within 12 months.

A JORC resource has already been bagged courtesy of a tidy acquisition that fits perfectly into WMN’s existing tenement package in Indonesia.

WMN is currently finalising its Scoping Study and hoping to get the first of two mini-plants built as a priority – which also has been taken care of through institutional funding that has left WMN well-funded.

If we then throw in WMN’s provisional offtake deal, broader South Korean partnerships and its un-matched connections with local and national level government in its home market, the company is on course not only to become a low-cost producer of high-quality graphite, but also become a vertically integrated producer capturing the entire supply chain.

Of course this is all speculative and there is no guarantee that WMN will succeed – there are quite a few hoops to jump through still for this little company.

As we first mentioned at the start of the article, all these positive factors combine to give WMN a great chance of raising its lowly $30MN market cap and potentially establish a dominant production-stage supplier in the heart of Asia by the end of next year.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.