Why is this Little Known ASX Company Attracting Attention from Veteran Stock Pickers?

Published 24-FEB-2016 09:46 A.M.

|

17 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Not all coal is the same. There is ‘good’ coal and ‘bad’ coal. And those working with ‘good’ coal are working with a premium product.

When we talk about good coal and bad coal, we are referring to the huge difference between ‘thermal coal’ and ‘coking coal’.

Thermal coal is used in power stations to create energy in a relatively inefficient, but low cost way.

It’s understandable that this aspect of coal production is hitting the buffers given the alternatives available.

But coking coal is used to make steel.

Coking coal is used as part of metallurgical processes that remain coal-dependent – regardless of renewable energy proponents.

Coking coal prices have fallen, but by a noticeably smaller margin compared to thermal coal and they are likely to bounce higher when steelmaking makes its comeback.

There are suggestions this could happen as early as next year...

As economic activity picks up again, so too will steel production and demand for coking coal – the most premium-priced type of coal there is.

One ASX listed company we’ve been looking into that is already in production could potentially defy the sceptics and make a sturdy return on its coal ambitions.

It could do so by having secured an overlooked high grade coking coal asset located in an existing producing area close to a hotspot of future demand...

...and focusing only on the premium metallurgical side of coal, rather than the downbeat energy side.

Put simply its product quality meets the demands of buyers and as such this company expects steel mills based in Asia to offtake later down the track.

Nippon Steel & Sumitomo, JFE Holdings and Kobelco are all in the mix having previously performed test work on the same coal seams.

This stock has been unfairly punished given the current climate, with a current market cap of less than $3 million – and that may be cause for consideration amongst investors on this fact alone, but this company is not merely a company with exploration assets only and a tiny market cap. .

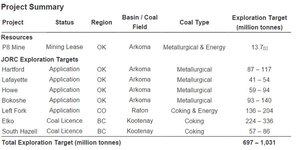

It’s already in production at one of its assets based in the US – with now another 257Mt JORC asset added to its books in Canada – the largest Coal JORC Resource of any ASX-listed company operating in that region.

Keep in mind, however, this is still a junior player in the market and caution is advised if considering this stock for your portfolio.

Preliminary indications suggest this company has access to 257Mt inferred tonnes of high grade coking coal that continue to fetch around US$80 per tonne in global markets, despite the global slowdown.

Commodities go through cycles, seeing peaks and troughs just like any other market or economy.

The coal industry is no different, but considering there’s currently a shortage of crystal balls, anyone interested in a cyclical commodities play could do worse than picking a company with superior Project economics compared to its peers, a low market valuation and that is still relatively unknown.

There is no such thing as a ‘dead commodity’, but sudden changes in supply and demand for coal has led to many investors throwing the baby out with the bathwater, declaring coal as yesterday’s news.

The fact is that coal (and all other commodities) should eventually see a resurgence which makes looking for ground-floor bargains a worthy enterprise during the current market malaise.

Speaking of investors, this company has one further ace in its hole.

Just who is the influential veteran stock picker who has been steadily accumulating this stock over the past six months?

Read on and you can find out.

The good news is that we’ve been alerted to a company that is likely to lead from the front when coal prices march out of the doldrums, and it is this peer superiority that piqued our interest in this stock.

Introducing:

Coal remains the largest and most widespread fossil fuel resource providing 23% of the world’s energy.

This proportion is gradually falling when it comes to energy generation, but when it comes to steel production:

Coal is forecast to be used for the foreseeable future as there are no substitutes for what it does as part of steel production.

Rapidly industrialising nations such as China and India have reduced their coal consumption and steelmaking due to waning economic activity, but where thermal coal has a good chance of being gazumped by more efficient energy alternatives, steelmaking should see a resurgence once the big industrial nations get back on track in terms of economic growth.

It’s this line of thinking that has Pacific American Coal’s (ASX:PAK) management looking to the future for PAK’s prospects in the coal industry.

PAK is a counter-cyclical coal producer that’s on the front foot when it comes to coal production.

Coal prices may be at their lowest levels in years, but what defines a good stock is not necessarily the underlying price of its commodity.

Rather, it’s the project economics that often differentiates between a resources company hitting the highs as opposed to hitting the buffers.

Far from being scared off by the turmoil in commodity markets, PAK acquired a top-notch coal asset in British Columbia, Canada last year and has since updated its JORC Resource to the tune of 257.5Mt.

This means that PAK now has the largest Coal JORC Resource of any ASX-listed company operating in Canada, pipping its band of competitors in all aspects in terms of Project economics and commercial viability.

But it’s market cap remains below $3 million.

Let’s take a look at exactly what PAK has under its belt...

Emerging coking coal company with a world class resource

PAK’s flagship project “Elko” – was secured last year.

Here is the project site mapped out:

Being the resourceful explorers they are, PAK snuck in and took advantage of historical exploration data already done on site, conducted the necessary geological surveys and modelling, to now find itself in a strong position to advance the project all the way through to production.

According to the historical data, and PAK’s own analysis, the Elko project has known high quality coking seams across the site which bodes well for PAK’s finished product; not to mention negotiating future offtake agreements.

Here are the highlights of PAK’s Elko project:

![]()

With all the commercially important aspects in the bag, PAK is on course to become a boutique coking coal producer, ready to supply the next wave of industrial development across Asia.

If we move onto looking at what kind of prices PAK’s product can expect to fetch, here’s KPMG’s forecast:

KPMG analysts see coking coal prices trending higher from around US$105/tonne up to US$135/tonne by 2020.

Thermal coal is oversupplied and outmatched by alternatives, but coking coal is likely to see strong demand alongside steelmaking activity.

Here’s an illustration of how coking coal is used to make steel:

In order to make steel, large amounts of coking coal, iron ore and limestone must be used as part of a sophisticated process that’s unlikely to change anytime soon.

But how does PAK stack up against the competition?

As we said earlier, it’s not necessarily the price of coal that determines the success of a coal company.

Much more important is the company’s mettle compared to its peers – both in project quality and geography. It’s PAK’s mettle in comparison to its neighbours that improves the chances of PAK smelting its way to commercial access.

PAK’s commercial success is a forecast only and as speculative investment, caution should be applied.

Now let’s take a detailed look at how PAK’s projects and operations compare to its peers...

Mapped out below is the Crowsnest Coalfield where PAK’s flagship Elko asset is based.

Overall, PAK has six separate coal licences, all adjacent to Tier 1 operations.

As a company, PAK has an exploration target of 1031 million tonnes spread across Canada and the US – with one already in production.

From a project size point of view, PAK has managed to lay claim to one of the largest portfolios in the region, second only to Teck in terms of resource size. PAK’s total resource at Crowsnest is estimated at 343Mt.

In terms of size, PAK has enough to warrant attention from large, major producers and small enough to progress and develop without losing focus.

But when it comes to product quality, it seems the southern tip of Crowsnest has some rather alluring geological features that have propelled PAK’s coal to the top of the pecking order in British Columbia.

One man’s coal is another man’s treasure

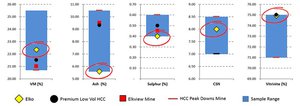

Shown below, is a comparison of coal quality between PAK’s Elko project (illustrated as yellow diamond) and other comparable samples from the Elkview Mine (red square) in the north of Crowsnest, the Peak Downs mine in Queensland (red dash) and a standard sample of Premium Low Vol coal (black circle), accepted as a high quality coking coal across the industry.

Of the five categories used by coal buyers to determine quality, PAK’s Elko project reigns supreme in each.

Let’s go through each one to see what it means and how it affects PAK’s chances of finding an offtake when production begins.

Volatility matters

In coal, volatile matter (VM) refers to substances, other than moisture, that are given off as gas and vapour during combustion.

This is usually a mixture of short and long-chain hydrocarbons/aromatic hydrocarbons and some sulphur. Volatile matter of coal is determined by heating the coal to 950°C under carefully controlled conditions and measuring the weight loss, excluding weight of moisture driven off at 105°C.

For coking coal, the lower the VM the better. And as you can see, PAK’s coking coal weighs in at just above 22%, placing it right in the low-mid vol range and in line with its neighbouring peers and industry averages.

Here’s a rough guide to how volatile matter content applies to coal type and quality. Low volatile matter is generally suitable for coking coal used in steel making, while higher volatile matter content finds its way into the thermal markets.

Ash

Ash content of coal is the non-combustible residue left after coal is burnt. It represents the bulk mineral matter after carbon, oxygen, sulphur and water is removed during combustion.

Analysis is fairly straight forward, with the coal thoroughly burnt and the ash material expressed as a percentage of the original weight. Low ash content indicates a high quality coal deposit that will ultimately need less processing time, energy and expense.

PAK’s Elko coal weighs in at an industry-spanking 5.5% – a great feature likely to help PAK’s commercial chances.

A sample of PAK’s Elko coal – carbon rich, contaminant poor means it’s suitable for coking

Sulphur

Coal deposits naturally have a particular level of sulphur content held within them. Sulphur is a contaminant with toxic effects when the mined coal is burnt or processed. Therefore, the lower the sulphur content in your deposit, the better.

When benchmarked against premium coking coals, PAK’s Elko coal has one of the lowest sulphur contents than any of its peers at 0.4%.

Yet another feature that ensures lower processing time with less effort required to get the final product for sale.

Crucible Swelling Number (CSN) also known as Free Swelling Index (FSI)

The simplest test to evaluate whether a coal is suitable for production of coke is the free swelling index test. This involves heating a small sample of coal in a standardised crucible to around 800°C.

After heating for a specified time, or until all volatiles are driven off, a small coke button remains in the crucible. The cross sectional profile of this coke button compared to a set of standardised profiles determines the Free Swelling Index.

PAK’s Elko coal is towards the top-end of the FSI indicating a high quality coking coal that will produce high quality coke to be used in steel production.

Vitrinite

Vitrinite is one of the primary components of coal and by measuring its content, allows geologists to determine how carbon-rich a coal deposit is.

The vitrinite held within the coal deposit is used as a measure of a coal’s suitability for coking.

The higher the vitrinite content, the more likely it is that carbon density will be higher, therefore commanding higher sale prices. For coking coal, it is essential for carbon content to be high, and PAK’s Elko coal scores 75%, right at the top-end of the scale for determining how its coal deposit will be used.

The Verdict

As you can see, PAK’s Elko coal outperforms its peers in several categories that are key to obtaining a premium sale price. It’s also worth mentioning that when large mature producers come looking for good assets to re-stock their portfolios, they will more likely than not, try to cherry pick the highest quality projects that are closest to market.

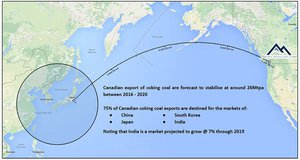

Here too, PAK has sneaked in with a premium location with established export infrastructure for direct export to Asia:

PAK’s Elko coal compares favourably with benchmark coals from around the world including Peak Downs, and PAK has all the elements needed to get its premium product to market.

And there’s one final piece of the puzzle to ensure PAK’s product meets the demands of buyers...

...extensive testing by six steel mills based in Asia that are likely to offtake later down the track.

Nippon Steel & Sumitomo, JFE Holdings and Kobelco are just three mills that conducted extensive testing of Elko’s coal to conclude that it meets their end-user requirements.

In other words, when assessing all the location, quality and project economics together, PAK has the entire chain covered from paddock to plate.

The only thing remaining now is for PAK to progress its Elko project as quickly as possible in order to:

- Attract an offtake partner

- Attract a larger coal producer to consider a joint-venture agreement

- And hopefully raise its market valuation!

The good news is that at least one of those targets is likely to be met because of the superior project economics PAK is blessed with – as long as PAK can adequately progress its exploration over the next few years.

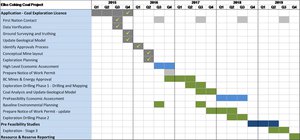

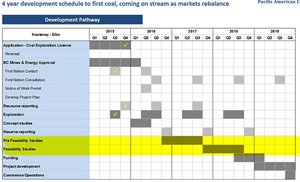

Here’s the estimated timetable PAK is working towards:

PAK is committed to getting into the Pre-Feasibility stage by the end of this year which means investors could already see significant revaluation of its share price as the market wakes up to this sleeping gem of a resource held by PAK.

So far, PAK has spent around $250,000 to date on concept studies and exploration. It will require a further $400,000 to complete its concept study including the formulation of its mine layout, initial works and other field studies.

For Pre-Feasibility at the end of this year, PAK will likely require a further $4MN according to its estimates and $5MN to complete the Feasibility Study in 2017.

If successful, PAK has the potential to deliver juicy returns in a respectable period of time.

However, as resources investors know, investing in a mining company often takes time for fruit to be borne, so seek professional advice if considering PAK for your portfolio.

For PAK, attracting investment down the track could be fairly straightforward because of those attractive project economics as we’ve explained.

One other factor which helps to substantiate PAK’s chances is rather human however...

Following the money

As with all the stocks we write about and bring you, we always like to see the human side.

Are there any key management figures? Can they tip the balance in favour of a successful venture?

These are the types of questions we ask when considering a stock.

In the case of PAK, one particular investor has attracted our attention.

Warwick Grigor is a veteran stock picker and has gradually raised his holding in PAK over the past 6 months, and now owns 8.16% of the company.

For those of you who have never heard of Warwick Grigor, he is a highly respected and experienced mining analyst, with an intimate knowledge of the industry.

Mr. Grigor has won awards and accolades such as being named ‘The Best Mining Analyst in Australia’ for three consecutive years by the Register of Australian Mining and ‘Best Gold Analyst in Australia’ by the Australian Financial Review .

And he likes to put his money where his mouth is too.

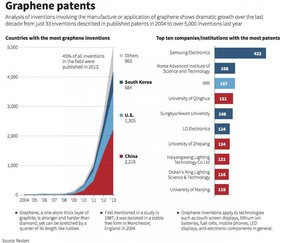

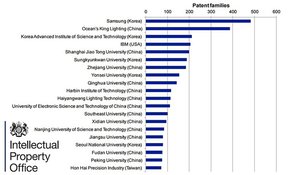

According to our research Mr. Grigor has a range of investments with coal and graphene as the most high profile.

Whenever smart money starts moving, it’s often advisable to pay attention.

With Mr. Grigor building a sizeable position in PAK, this adds weight to the theory that PAK is actually onto something and is looking to the next big thing. We think this, because only last week PAK recently announced in a letter to shareholders, that it would leverage its strong carbon based positon, with “Elko” as a foundation, and look for value adding opportunities in the world of high tech carbon based products.

As a large and active shareholder, Warwick Grigors’ knowledge and expertise in this carbon technology space has been welcomed by the highly experienced PAK board. The board is made up of veteran merchant banker and resource specialist Geoff Hill as Chairman, finance expert Simon Bird, and highly regarded coal marketing man Paul Chappell.

The Board and everyone involved with PAK has achieved a great deal to date. Its directors have done an outstanding job in a tough market driving the company to reach its goals and managing the cash. Shareholders have shown their appreciation of this and have been understanding and supportive as the company continues to move forward notwithstanding unprecedented and difficult market conditions.

Coking coal from a global perspective

If we look at the macro side of things, it seems Australia is well placed for the next cycle of coal market activity.

Coking coal is dominated solely by Australia, the source for around 60% of global trade.

According to Morgan Stanley, Australian producers are tightening their grip on the coking coal niche due to a range of factors including a weaker Aussie dollar.

Morgan Stanley analysts think that hard coking coal contract prices bottomed last year at an average of $90 a tonne and will start to rise towards $95 this year.

Swiss investment bank UBS expects the average price to bottom in 2016 at $91 a tonne and rise to $104 in 2017.

The coal industry is currently separating the wheat from the chaff.

In other words, the explorers/producers with the worst project economics are sizing down and closing down, while companies with strong project economics are adjusting operations and biding their time.

AngloAmerican’s chief Mark Cutifani predicted continuation of coal’s correction back in 2014 saying that prices will not recover until “enough supply has fallen out of the beleaguered sector to drive a price recovery”.

Survival of the fittest

As the inefficient players slowly leave the market, the removal of supply will help prices recover as well as ensuring that only the most efficient operators remain.

PAK intends to take a place at this ‘table of the fittest’ in 3-5 years’ time when it hopes to enter production.

That may sound like an eternity given today’s speculative, yield-focused economic times but in fact, there are plenty of catalysts between now and 2020 that could see PAK’s $2.7MN market cap and $0.04 share price revalued.

Here at The Next Mining Boom , we think there’s a fairly strong chance of a seasoned, mature resources company eventually realising PAK’s inherent value and swooping in for a JV deal or an outright takeover when coal prices begin to pick up again.

It’s what mature producers tend to do: view junior exploration companies as Project incubators, to be sifted and plucked for the most prospective, commercially viable projects to boost their own portfolios.

If you dare to defy the commodity naysayers that see coal as yesterday’s news, PAK packs a punch by offering a ground floor entry into one of the strongest coal Projects around; focusing on carbon-rich coking coal that commands premium sale prices and is used in functions likely to remain dependent on coal (metallurgy) for decades into the future.

As PAK detaches from US thermal coal market, one can expect its search for value adding technology to provide impetus in the short term while its long term value is underpinned by its “ELKO“ Canadian coking coal project .

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.