Tiny Miner’s First Sales Days Away: Stockpiles Waiting to Be Processed, Delivering Instant Cash Flow

Published 14-AUG-2014 08:19 A.M.

|

28 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

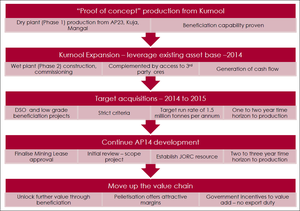

Brazil’s Vale has tried and failed. The Australian giant, BHP, saw its hopes fall flat. Rio Tinto is still battling red tape. The majors have struggled, but one tiny $5M capped company is succeeding in a place where so many have failed. We’re talking about India – the eighth largest economy in the world – which has the world’s third largest steel making industry and a seemingly insatiable domestic demand for iron ore. The iron ore market in India is much more attractive than current global markets. Forget about global seaborne prices – the domestic Indian iron ore market is completely different. India’s domestic iron industry is huge, and getting bigger by the year. Now recent government crackdowns on illegal mining have reduced output and squeezed prices – the price of local iron ore jumped 9% alone in June... Yet whilst there have been many attempts, no foreign owned companies own and operate iron ore assets in India. Until now. At The Next Mining Boom we’ve been alerted to an ASX-listed junior explorer that’s managed to get its hands on a brace of Indian iron ore mining and processing projects and it’s just pushed the start button to get production underway. The first sales are imminent – we are talking a couple of weeks here. This company is expecting to generate $200k/month free cash in a few weeks’ time, after that the path to growth is clear – in quick succession the next milestone is $530k/month... All in all, this company is expecting free cash flow of over $6M/year... Remember this company is capped at just $5M and therefore appears seriously undervalued. Once the cash starts flowing, the company is planning to ramp up its production levels and widen its exploration efforts. Untapped potential revolves around this company’s 38Mt to 95Mt iron ore exploration targets at 20% to 55% Fe. The key to its success is to go after low grade iron ore – the stuff most Indian miners utterly ignore – and use beneficiation technology to turn it into a high grade product that can be sold to the highest bidder. Beneficiation technology is common in Australia and Brazil – but practically unheard of and unused in India. This company is unlocking a niche of largely ignored wealth in the domestic Indian iron ore market – and it’s doing it all with local support won through five and a half years of blood, sweat and sheer hard work. This is a company doing what no one else does in India – and we’ve taken a long term position in its ambitious plans to unlock the low grade iron ore potential of the subcontinent. But it’s not only the long term – this company is on the cusp of some serious cash flow in just a few weeks – which should fatten their bank account nicely... We’re happy to share our latest investment with you:

NSL Consolidated Limited (ASX: NSL) is a $5M junior mining explorer with a focus on India’s untapped low grade iron ore sector. We’ve just invested with NSL right at the moment its plans appear to be coming together. NSL has spent millions of dollars, and spent five and a half years in India getting its projects ready for production. Plus the domestic demand for iron ore in India continues relentlessly. Yes India does has a reputation as being a hard place to do business – but NSL have learnt a few lessons over the last few years, have gone through all the approval hoops, and are now on the cusp of production and selling into the huge Indian domestic iron ore market. It’s just hit the ‘start button’ at its main iron ore mining lease. Positive cash flow is imminent – remember the first sales of iron ore are just weeks away. NSL has a tight capital structure with the board and management owning 25% of the company. The Top 40 shareholders own 56%. NSL is a company whose people believe in the project and have put their money where their mouths are. NSL is leveraged for growth and ripe for a run. NSL is about to unlock their profit making machine, they are forecasting $530k / month and $6.6M/yr net cash flow – and it’s all about to happen now:

Just to repeat, NSL is THE ONLY foreign company to own and operate iron ore assets in India – giant majors like Vale, BHP, Rio Tinto – all tried and failed. But NSL has carved out an iron ore project about to start generating cash – we should be seeing the benefits of this very soon. It holds three mining leases in Andhra Pradesh all centred around a dry beneficiation plant which takes low grade iron ore and processes it to grades of up to 55% Fe – this type of grade is in very high demand in the domestic Indian steel industry. NSL has just restarted this plant.

And it’s easy to see why... In India, the local mining companies only go after 50% or higher Fe grades. Anything of lower grade they ignore. That’s right they can’t be bothered with it. But the Indian companies don’t seem to use beneficiation technology. Beneficiation technology uses techniques like crushing and milling to improve the concentration of the ore and remove impurities. The end product is high grade fine ore powders. By using beneficiation technology, NSL can swoop in, tap into the huge feed-stocks of low grade iron ore at its mines and process it to a saleable, profitable, higher grade level. NSL will be implementing this technology in India. There are 200,000 tonnes of feedstock just sitting at NSL’s AP23 mine ready to go. Here is, just waiting to be turned into high grade iron ore and cash for NSL:

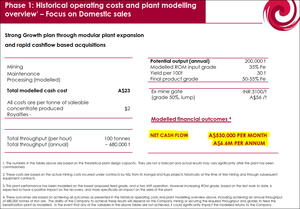

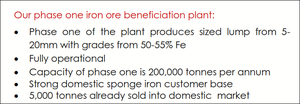

The plan is to transport it to NSL’s nearby beneficiation plant that’s just been turned back on, process it and sell it. NSL is on track to generate free cash of $200,000/month, moving up to $530,000/month in their Phase 1. Using this immediate cash flow, NSL can bring their wet beneficiation plant online too, delivering higher grades (58 to 62% Fe), charging more for their product and doubling their production rate . All the while, they can use these funds to explore and mine more iron ore at its three mining leases and keep feeding the beneficiation beast! Here is a sneak preview of NSL’s Phase 1 beneficiation plant – ready to start benefiting NSL investors’ wallets:

There are even more juicy iron ore infrastructure pictures below – just keep reading. To get production online NSL has just raised $1.16M through an equity raising and has also entered into an agreement for a standby finance facility of up to $2.5M which can be drawn down anytime over 12 months as a financial back stop. However if they don’t need any of this $2.5M, they don’t need to use the facility. For a time, the plant’s operations were suspended, yet as we write NSL are bringing back contractors and workers, turning on the power and getting things done. Best of all, NSL has local support with government ministers giving their full backing to the project. NSL has an Indian team – geologists, finance, operations – all of whom are on site at the beneficiation plant right now working under an Australian plant manager. We have recently chosen to make an investment in NSL. We see short term catalysts in the near term production but will be holding for the long term. We take our positions in our stocks for at least 12 months – for more information please see our Financial Services Guide and Disclosure Policy . Here is our purchase contract for NSL:

Are you an NSL investor and want to spread the word?

Get the message out there – make sure everyone knows about NSL and share this article by clicking the buttons below: [sd_share_article title=”Tiny Miner’s First Sales Days Away: Stockpiles Waiting to Be Processed, Delivering Instant Cash Flow”] In this article, The Next Mining Boom is going to run you through:

- Why India’s economy is worth investing in

- How India’s iron ore sector works

- What NSL’s plans are for mining and beneficiation

- How NSL can double its production once the first phase gets underway

The name of the game for NSL is near term cash flow through domestic sales of iron ore processed from its existing stockpiles. Once that’s underway, it starts mining the blue sky with exploration of its mining leases and production ramp ups. NSL is starting off small but it has grand plans for expansion. We’re expecting NSL to complete its first iron ore sales very soon so we’d better get cracking!

Incredible India

So why mine iron ore in India? After all, the big magnet for iron ore is Western Australia where the really big red earth deposits are. But if you want to mine iron ore down under then you have to spend a lot of money. When it comes to mining it, you have to spend even more in infrastructure and paying your FIFO work force. Atlas Iron has just released its June results and they show the big WA miner is expecting to move between 12.2 and 12.8M tonnes in the next 12 months with an all-in cash cost of between $68 and $73 a tonne. Australia is a high volume iron ore producer but also has high costs considering the global price for iron ore hovers just above the $100 mark at the moment. But in India, it’s an entirely different ball game. For starters, the iron ore price there does not reflect the global shipping price. It’s set locally, in a cash and carry type system. Prices rose 9% in June – it moves to different dynamics than global prices. Domestic 50% grade Fe sells for around $56/tonne at the moment – fairly decent when you consider NSL’s cost to produce is $28/tonne. The big reason for the excellent profit margin – aside from the favourable local iron ore price – is that it’s cheaper to operate a mine in India than in Australia. Now, it’s not simply because wages are lower in India or that it’s underdeveloped. Far from it. India’s GDP is around US$1.3 trillion at the moment and it’s rated as the world’s eighth largest economy. However in Purchasing Parity terms , which recognises India’s low cost base and the fact that you can get more for less, the GDP notionally rises to three times this amount (US$3.8 trillion), which places it on a similar size to Japan. By the end of 2013, India became the third largest economy in the world – after the USA and China – in Purchasing Parity terms. India is the “I” in the BRIC nation acronym and, along with China, is considered one of the future bright lights of Asia’s economic map. NSL has seen the opportunities India presents and grasped them firmly. India’s economy is growing by at least 6% a year and is widely predicted to keep growing over the next decade. Its manufacturing industries are huge and the newly elected national government has just announced a plan to kick them into overdrive. The Indian people are going to get richer – GDP per capita is expected to grow four times over. They are going to need a lot more steel – and therefore a lot more iron ore which NSL can provide. There are risks involved in operating in India, however it is a democracy that’s relatively politically stable. It has a huge population of 1.2BN with a working-age pool that’s expected to grow by 240M people in the next 20 years. English is widely spoken, higher education is prized and there is a strong entrepreneurial culture. India’s iron ore industry is very large but its fragmented – about 80 small scale operations are supplying demand, in total they pump out about 150 Mt a year of iron ore. BHP, Vale and Rio Tinto have been trying for years to get an iron ore project in India off the ground. Like NSL, they too have seen all of the positives we’ve just covered about India, but unlike NSL they are yet to succeed in getting the green light for their plans. India presents a growing high potential economy for NSL who have really inserted themselves in the market place and are now on the cusp of positive cash flow. India’s educated and hard-working work force and political stability encourages long term investment and long term projects. And everything there is cheaper.

Our Track Record:

Did you see the Next Small Cap article on Segue Resources (ASX:SEG) ? SEG has been up as high as 200% since we first released our article:

Source: Etrade Australia

The past performance of this product is not and should not be taken as an indication of future performance. Caution should be exercised in assessing past performance. This product, like all other financial products, is subject to market forces and unpredictable events that may adversely affect future performance.

Indian Iron Ore takeaway

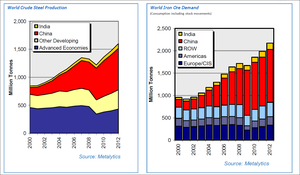

Ok, so now we know India’s economic potential. NSL is positioning themselves well to be involved in such a dynamic country. But let’s drill down into India’s iron ore industry. After all, India is the world’s third largest steel producer and as we all know iron ore is what feeds that particular beast. India produced 81.2M tonnes in 2013 – that figure coming off a yearly growth rate of 5.1%. A couple of graphs below show how India fits into the world economy – lots of market share for India to enter:

With so much production demand you’d figure its domestic iron ore market is going full steam ahead? Well, India’s iron ore industry is having a bit of a strange time at the moment. And it’s giving NSL a great opportunity to take advantage. India actually imports huge amounts of iron ore at the moment despite having massive native reserves of this valuable substance. Up to 15M tonnes of foreign iron ore – most of it from Australia – will enter India in the 2014 financial year. The big reason for that is a government crack-down on illegal mining throughout India. This move by the national government actually cut iron ore production by a quarter over the past four years and in the last fiscal year output was down to 152M tonnes – enough to drop India from third to tenth on the global iron ore production scale. The state of Goa has a two year ban on illegal mining and Karnataka’s ban was only lifted one year ago. India wants a more regulated mining industry and is taking the pain of lower production now so it can have world class standards later. This is having the effect of squeezing the Indian iron ore market and driving up local prices for the stuff that’s available.

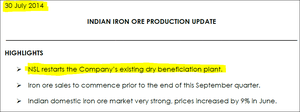

So you have a weird situation in India right now where there’s high demand for iron ore, high prices being paid but production isn’t really able to take advantage – great for NSL as it brings its legal and approved projects on stream! At the same time as all the mining regulation is happening, the newly elected national government is trying to revive India’s manufacturing industries and a rise in demand for iron ore is widely predicted. In response, the national iron ore miner NMDC has announced it’s planning to ramp up its domestic operations by two thirds in five years to over 50M tonnes to bridge the gap between future demand and present production. NSL is bringing its huge iron ore projects on stream at a key moment for India’s iron ore industry. There is huge demand for its product, big prices being paid for legally mined iron ore, and a vast gap to fill from production that’s fallen away under the government’s illegal mining ban. As NSL will be mining legally, they will be taking full advantage of the gap in domestic production that’s been created. And when we say big prices are being paid for iron ore in India, we mean it. India’s iron ore prices are not connected to the global seaborne price. Oh no. They are set every month by NMDC – and in June it announced that it’s raising domestic iron ore prices by 9%.

![]()

Right on time for NSL don’t you think? India’s domestic iron ore market is cash and carry and uses a spot price. Indian steel mills are desperate for iron ore – they are churning out steel as fast as they can to meet demand domestically and from next door neighbours, China – and the rest of the world. The Indian economy’s demand for steel is currently 80 Mt/year and expected to keep growing. It will likely benefit hugely from the new government’s structural reforms and industrial overhauls. The forecast is for consistent growth:

There are billions of people to lift out of poverty in India – plus millions of cities to be bought up to 21 st century standards – this is going to require a lot of steel and hence a lot of iron ore. Ernst & Young gets in on the action for Indian steel too, saying the national government’s efforts to remove barriers to foreign investors like NSL is starting to pay off. This is a time of great change and opportunity for India’s iron ore sector and at The Next Mining Boom we think NSL is timing its run toward production at just the right time. Demand is high, prices are up and both look like staying that way. But it’s not just the state of the market that attracts us to NSL’s Indian iron ore play...

Three iron ore projects; one iron-clad goal

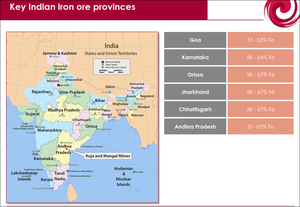

NSL has three distinct opportunities in India – mine iron ore, process it and sell it. Let’s take a look at the first – mining it. In India, all the focus is on high grade iron ore – no one is looking at the still very profitable low grade stuff – except NSL which has snapped up three mining leases – AP23, Kuja and Mangal.

India is not like Western Australia where you have a big exploration spend and it takes many years, decades sometimes, of bureaucratic hurdles just to get a mining lease. India has much smaller leases that NSL can get into production and operation relatively quickly – now that it has learnt all the hard lessons. NSL has spent the last five and a half years getting all of its ducks in a row in India and in that time has amassed invaluable intellectual property – remember they are the only foreign company to own and operate in India. It’s a nimble mining nation – if you know your way around the approvals processes... That’s five and a half years of lessons on mining approvals (30 to 40 alone for the type of operation it’s pursuing!), bureaucracy, contractor selection, mine start up, port agreements etc. But it’s paid off – and NSL has secured three low grade iron ore mining leases that have the potential to yield high grade profits...

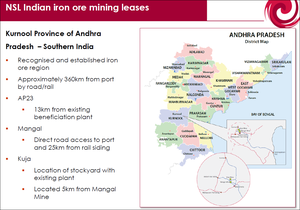

AP23 is the main mine NSL is focussing on, at least in this initial phase of development and production. It’s the yellow pin to the west in the map above. The mine is just 13km away from the beneficiation plant at Kurnool and will be the first of the three plays to be tapped by NSL.

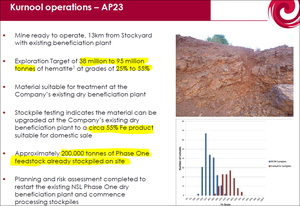

The AP23 mine has an Exploration Target of 38M to 95M tonnes of hematite at grades of 25% to 55%. So not only do NSL have stockpiles of iron ore, they also have the upside of big exploration targets. Test mining was conducted in 2013 and up to 200,000 tonnes of valuable material was stockpiled on site. Stockpile testing indicates the material can be upgraded at NSL’s dry beneficiation plant to a circa 55% Fe product suitable for domestic sale. This 200,000 tonnes of stockpile can deliver 60,000 tonnes of saleable iron ore – that’s almost $3.5M worth of income just sitting there waiting to be exploited. This is great – a pile of valuable, in demand material that will inject immediate cash flow into NSL once everything gets underway. And remember, it’s just the start at AP23. Once cash gets flowing then exploration will begin in earnest so NSL can keep unlocking new revenue streams. They don’t plan on stopping at current stockpiles... after five and half years getting into and understanding the market, once they start making cash we don’t see them stopping. The next mining lease under NSL’s control is Kuja which immediately adjacent to NSL’s stockyard facilities where the dry beneficiation plant is.

NSL says the mine at Kuja is ready to operate – in fact the company has already done some mining there with drilling, independent assessment, geophysical interpretation and trial mining all completed. This work has led NSL to revise its mining plan for Kuja increasing its viability to 331,297 tonnes per annum over the five year period of validity... Last but not least is Mangal – another NSL mine that’s 100% ready to go. Previous mining activity undertaken by NSL at Mangal includes drilling, independent geological assessment, geophysical interpretation and, of course, mining. The mining plans estimate a yield of 500,000 tonnes per annum over the five year period of validity. Mangal itself is just 5km from NSL’s stockyard and has a 2.5km long site access road already constructed. In fact here is the Mangal site now:

NSL has been busy for five and a half years getting these three iron ore mining leases ready to go and setting up the stockyard with its beneficiation plants. In just weeks it is about to start making cash – we believe we have invested in NSL at the right time. NSL have already taken approximately 8,000 tonnes of iron to port to sheet plots – export ready for when the global iron ore market turns. But export is only part of the game. The big idea for NSL is to sell its products locally – and the ball is rolling...

Our Track Record:

Did you see the Next Oil Rush article on Real Energy (ASX:RLE) ? RLE has been up as high as 40% since we first released our article:

Source: Etrade Australia

The past performance of this product is not and should not be taken as an indication of future performance. Caution should be exercised in assessing past performance. This product, like all other financial products, is subject to market forces and unpredictable events that may adversely affect future performance.

Push the production button

The key to everything is NSL’s Phase One dry Beneficiation plant at Kurnool which has just been turned back on. Beneficiation may sound like a religious rite but it’s actually the process by which iron is extracted from ore. The beneficiation plant’s advanced technology is what will make NSL more than just an iron ore miner. The ability to mine iron ore is one thing. But the ability to process it, in India, for the huge Indian domestic iron ore market – that gives NSL a huge advantage. The lower grade iron ore NSL is targeting is a niche; an untapped resource that’s overlooked by other Indian miners in favour of high grade stuff. But by introducing beneficiation, NSL changes the game. It can mine low grade iron ore, process it and sell it domestically at grades of up to 55% Fe... not bad at all! NSL’s dry beneficiation plant is located at the company’s stockyard in the Kurnool district of Andhra Pradesh, India. Just have a look at these pictures:

As you can see the dry beneficiation plant is ready to go. All of the infrastructure is in place and only needs someone to press the on button. In fact, NSL has just done that. On site at Kurnool there is a buzz of activity. Contractors are starting the engines of earthmoving equipment and bringing them inside the gates along with a new labour force, spare parts and all the other logistics NSL will need to support the ramp up. And when the plant is ready to start processing it will have an enormous stockpile of feedstock to chew on – 200,000 tonnes to be precise.

A pile of low grade feedstock is just sitting there at AP23 and came from the extensive trial mining that took place there in 2013. The next step, happening right now, is to move all of that feedstock from AP23 to the waiting beneficiation plant and start processing and making money. The target is to create 55% Fe product suitable for domestic sale. And NSL has forecast it can produce 200,000 tonnes a year, delivering $6.6M/year net cash flow:

Fairly impressive for a company currently capped at just $5M... The milestone of first month of sales is just weeks away – we’re waiting on the edge of our seats for this event. Remember, 200,000 tonnes of feedstock is just sitting there waiting to be processed! The yield is set to be 30% so we reckon on an immediate saleable tonnage of 60,000 tonnes. By running this dry beneficiation plant NSL becomes a vertically integrated company – it mines its own iron ore, processes and sells it. Every step of the process is controlled by NSL. No one else is doing this in India. Like we said before, Phase One is just the start. The warm up act. The next step for NSL is to ramp up production in a move it has cleverly dubbed “Phase 2”.

Phase 2 – Wet processing

Once NSL is generating solid cash flow from its Phase 1 operations – remember this is just weeks away – it will look to expand the operations. And when we say expand, we really mean it. NSL is looking to commission a wet beneficiation plant and when it comes on stream it will essentially double the company’s iron ore output, and produce higher grade iron ore:

The way it works is that waste from the Phase 1 dry plant goes to the wet plant for further processing. NSL figures on final product grades of between 58-62% Fe. The plant itself has been fabricated in China and needs to be shipped to India and put in place. To do that, NSL reckons it needs at least another $2.4M to cover transportation, installation and commissioning costs. This outlay may be covered by the imminent cash flow from Phase 1. A very neat plan. Once Phase 2 wet processing is online it will have the potential to add an extra 200,000 tonnes per annum in sales – and an extra $7.5M net cash flow to NSL’s bottom line. That would make an annual net cash flow of $13.5M – once again, we need to remind you that NSL is currently capped at just $5M. Wet plant work is routine in Australia, China and Brazil... and now it’s coming to India via NSL. With Phase 1 and 2 in mind, you can begin to see NSL’s clever play. India has huge reserves of iron ore and a big domestic market for the stuff. But in India, anything below 50% is considered a waste product. But NSL sees it as gold dust. By introducing dry and wet beneficiation technology NSL can unlock the enormous potential of India’s low grade iron ore deposits; mine them and process them and sell them for the same price that the higher grade stuff gets. Yes, it takes a little more effort. But NSL is doing it right. It has local support, advanced technology and infrastructure all in place and a solid supply of feedstock. We like the short term upside with NSL and its imminent cash flow plans, but we have also invested in NSL for the long term and are betting on the company carving out a potentially very profitable niche in a dynamic market. We’re betting that we’re not the only ones taking notice...

Wanted: JV Partner

NSL is focussed on bringing its iron ore mines and wet and dry beneficiation facilities on stream and into cash flow as soon as possible. The plan to do it is sound. Use the stockpiles from AP23 and run them through the dry plant for quick sales. Then use the cash to bring the wet plant online and ramp everything up to support the higher rate of production. But a JV partner could accelerate that beyond NSL’s capacity right now. Ideally, NSL would look to add a Joint Venture (JV) partner to speed up getting the Phase 2 infrastructure online – it could add extra cash without diluting shareholders. NSL pulled out of a previous JV partner relationship which was a $12.5M deal to take 40%. Unfortunately this partner was waiting on money from the government which wasn’t forthcoming and NSL wanted to crack on by itself. NSL has not ruled out another JV – we don’t know anything more just yet but watch this space. In the meantime, NSL has been raising funds so it can fulfil all of its ambitions with or without a JV partner...

NSL cashed up to restart

NSL is bringing these mines online as well as a series of processing facilities – all with the aim of immediate sales and cash flow. To do that, it’s just raised $1.16M in an equity raising for the placement of 116,000,000 fully paid shares at an issue price of 1 cent per share, raising $1.16M before costs of the offer. Encouragingly most of the shares were bought by NSL’s top 40 shareholders and the board and management.

Plus they have recently secured additional finance of up to $2.5M via a credit facility:

Using this cash as a buffer, NSL will get things started in India, get those immediate sales and cash flow and then expand everything – mines and beneficiation plants – the lot. But it’s not just iron ore NSL has its eyes on producing in India.

Our Track Record:

If you are new to our site, you may not have seen our Next Oil Rush Tip of the Decade – which called Africa Oil Corp (TSX:AOI) – AOI has been up over 600% since we called it!

The past performance of this product is not and should not be taken as an indication of future performance. Caution should be exercised in assessing past performance. This product, like all other financial products, is subject to market forces and unpredictable events that may adversely affect future performance.

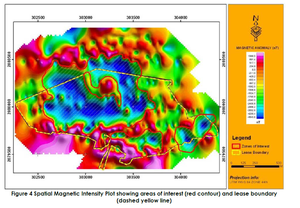

Magnetite play points the way

NSL has a new play in India called the AP14 Magnetite Project and, typical of NSL’s style, its development is already very advanced.

AP14 lies in a province called Karimnagar which is 200km North-East of the city of Hyderabad. NSL’s management team have been meeting top bureaucrats from the state of Telangana and approval has been won to go ahead and find all of that magnetite. Very recently NSL company representatives met with the a team of powerful government officials: Honourable Chief Minister, Government of Telangana, Sri K Chandrasekhar Rao, the Chief Secretary Government of Telangana, Principal Secretary to the Chief Minister, Government of Telangana and the Special Principal Secretary for Industry and Commerce, Government of Telangana.

NSL says the Chief Minister and his team of advisors were well aware of the company’s AP14 project and he gave his personal assurances to provide all support required. NSL says Rao welcomed the company’s investment in the state’s mining industry which in the past has not been strategically developed. Plus NSL seemed to have got a fair bit of media coverage too! Now it’s not too hard to see why the locals and NSL are keen to get AP14 on stream as quickly as possible. The project has an Exploration Target that’s just been upgraded to between 134M and 377M tonnes of magnetite at grades between 20% and 50%.

But the Direct Ship Ore (DSO) Exploration Target for AP14 is between 5 and 10M tonnes of magnetite. DSO deposits need very little beneficiation and the grades NSL will be targeting at AP14 are between 55% and 65% magnetite so when that comes on stream it’ll be a nice earner. NSL says early indications are that the resource at AP14 is a Banded Magnetite Quartzite style mineralisation with spot samples ranging from 39.72% Fe up to 69.23% Fe. When the time comes to dig it all up NSL is spoiled for infrastructure choice. There are two ports that can be used for export – Vizag and Krishnapatna – plus any mining facilities it builds at AP14 can be powered with coal from the nearby Singareni coal mines and power stations. There’s a railway siding within 30km linked by sealed roads and domestic power within 5km of the site. Water wise there is a perennial water source nearby that can be tapped for any magnetite processing needs. Just take a look at the view from the top of AP14 – see all that water in the background?

So all the ingredients are there, just waiting to be combined by NSL. A big magnetite resource with good grades, high quality infrastructure, willing locals and a company keen to get it all into production as fast as possible. It should take between two and three years for NSL to get a magnetite mine into production at AP14. Before that, it will be concentrating on exploring AP14’s magnetite resources, firming them up and developing plans for drilling and then mining. The usual process we’re all familiar with new mining projects. The other projects are the main focus, but we like that NSL is developing AP14’s magnetite iron ore project as well. It gives the company a little bit of extra upside and creates a much stronger local position than if it just focussed on one product. We’ll be keeping a close eye on the magnetite play NSL is developing – it’s a good thing to have up its sleeve.

Blood, sweat and tears – now getting in gear

NSL has done the hard yards over five and a half years of pain. Now the payoff is about to come. We believe we have invested in NSL at the right time. NSL has all the intellectual property of operating iron ore in India – this is something no other company has – plus three mining leases and a dry beneficiation plant back in play and a wet plant on the way. All of these plans will be unlocked by the first sales of NSL’s iron ore product from the beneficiation plant which has just been brought back online. We expect to see cash flow very soon – the company says first sales will come in September.

Above and beyond the immediate cash flow we expect to see NSL expand the exploration and then mining programmes at its three mining leases near the plant and see their existing feedstock and then resources move through the beneficiation process. Phase 2 is the wet processing plant and this represents another huge catalyst for NSL’s growth. The plan is to use the cash flow from Phase 1, dry beneficiation, and get the wet plant delivered from China and commissioned. This will double NSL’s capacity. This is the catalyst we will be keeping the closest eye on. The immediate cash flow from Phase 1 is great but Phase 2 is the company making one. Things are going to move pretty fast for NSL in the coming months and we think we’re investing with this company as a long term hold at just the right time. Five and a half years is all boiling down right now – the start of production. NSL is a company that is doing what no other company is doing – it owns and is operates an iron ore play in India going after the underdeveloped low grade stocks the country has in abundance. The use of beneficiation technology is unlocking a significant niche in the market and we think NSL’s plans should bring good returns. NSL appears ripe for a run and all the major catalysts for growth are coming right now as production gets underway and then ramps up along with, fingers crossed, the share price.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.