The Largest Australian Graphite Resource? It Belongs to AXE

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

When we first introduced you to Archer Exploration (ASX:AXE), we told you about a market listed graphite play with the biggest JORC-compliant graphite resource in the country.

AXE has its foot on a resource of 8.55 million tonnes @ 9% graphite content for 770,800 tonnes of contained graphite – the biggest resource in Australia.

But not all of AXE’s graphite was created equal, with three key projects each having different properties and different commercialisation paths.

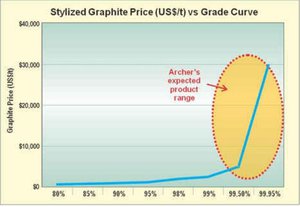

Currently capped at around $7M, AXE is aiming to produce 10,000 tonnes of 99%-plus battery-grade graphite for the market as early as next year.

AXE is currently in talks with potential offtake partners about striking a deal, and has even gone as far as sending samples to cashed-up overseas investors to run the rule over (or the microscope).

At the moment, high quality graphite can go for up to $30,000 per tonne on the open market, with AXE aiming to produce with cash costs of $1700/t.

You can start to imagine some of the margins AXE could generate if it gets absolutely everything right...

At the same time, the price of graphite can fluctuate dramatically, so there is no guarantee AXE will be able to sell its own product at these prices.

Much more realistically, AXE is aiming to get its first project over the line, and diversify its product line.

It’s also just tripled the prospectivity of its flagship project...

It’s time we took a closer look:

In this article we’ll run you through the game plan for Archer Exploration (ASX:AXE) and its Australian graphite assets, and also take a look at some recent developments which could just alter the game plan altogether.

AXE’s main game

The main game for AXE is its graphite projects in the Eyre Peninsula of South Australia, with three key deposits making up what we like to call the Axe Trinity.

However, the keen-eyed among you may notice there are a number of targets yet to be drilled – the blue dots on this map...

Those untested targets represent an upside in resource size for AXE – there could be much more graphite sitting there...

The plan for AXE is to mine graphite here and send it to a 10,000 tonne per year graphite processing facility based at Sugarloaf Hill.

It wants to be able to process high purity, battery-grade graphite at more than 98.5%, and become a boutique, high grade graphite producer.

At the moment AXE is looking for mining approval for 1.65 million tonnes of graphite ore from its projects, with the Sugarloaf processing facility to essentially become a central hub for a spoke-and-wheel operation.

AXE wants to mine at several points surrounding Sugarloaf, and then truck in the ore to the processing centre.

The final mining application is thought to be with the South Australian government, and AXE expects to have all mining applications ticked off in the first and second quarters of the 2016 calendar year – which is just around the corner now.

The fact that AXE has got a timeline sorted out which it is confident in presenting to shareholders is a sign of confidence.

At the same time, there is no guarantee that this application will be granted and timelines adhered too – so caution should be taken when considering AXE as an investment.

AXE has its plan sorted out, but to fulfil its dreams it needs a resource.

Three key prospects (at this stage) will fill the processing centre while a fourth prospect has a different market altogether...

AXE’s Prospects

Campoona

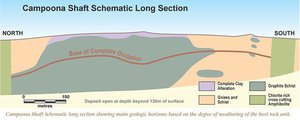

Campoona is the star of the show for AXE, and the centre of its plans for a 10,000 tonne per year processing centre at Sugarloaf, which will take ore from the Campoona Shaft area.

The plan at this stage is to mine for 14 years from Campoona Shaft, but this could have already changed. More on that later...

Campoona Shaft itself is an old graphite mine which has in effect been rediscovered by AXE, and has been worked to the point where it’s underpinning its mining hopes.

As you can see from the schematic above, the main schist at Campoona Shaft remains open which means there could yet be more graphite action below.

The plan is to keep an open pit to about 100m to keep costs down, but the potential is there to deepen into the future if need be.

Back in May, AXE took a sample of graphite to the Australian scientific body CSIRO to see how it performed against on-market synthetic graphite.

The results were glowing , with CSIRO finding that AXE’s graphite from Campoona Shaft met the criteria for use in current generation lithium-ion batteries – a huge boon for AXE.

It meant that even at this early stage and with a lot of kinks in the processing to still work out, that AXE’s graphite was commercially ready to go.

Just imagine what a couple more years of testing and refining will do to its product...

Crucially, it also found that it compared well to synthetic graphite.

Synthetic graphite is used in 32% of all lithium-ion batteries because its purity is above 99.5%, but it also tends to be pretty expensive because of all the processing which goes into it.

So if AXE’s more natural graphite can already compete with synthetic graphite, then it has an opportunity to grab market share by undercutting producers of synthetic graphite while maintaining margins.

The CSIRO will further test AXE’s graphite in the coming weeks, after suggestions that the graphite could perform even better with a hair of tweaking to sample size and uniformity.

The Campoona Shaft project also has great access to vital infrastructure including water and power. AXE recently confirmed that the mining and processing project at Campoona could effectively be powered by an existing powerline from a water treatment facility 4.75km away from the site.

Central Campoona

After the development of the Campoona Shaft, AXE’s plan is to prove up the nearby Central Campoona resource.

Luckily, AXE recently announced that tests on graphite dug up from Central Campoona deposit was consistent with that of graphite from the Campoona Shaft.

This was a significant milestone.

It effectively means that AXE should be able to produce graphite from Central Campoona using exactly the same methods used to produce at Campoona Shaft.

AXE doesn’t have to alter its flow sheet at all and it basically can either extend the mine life or boost output from the 10,000t processing centre.

AXE has remained tight-lipped on whether it will seek a variation in mining approval from the South Australian government on the back of the revelation, but it is undoubtedly running the numbers and trying to figure out the best way it can use the additional resource.

Remember, the original plan centred solely around the Campoona Shaft deposit. You can see below the kind of impact the Central Campoona could have...

Above is the JORC-compliant resource for both Central Campoona and Campoona Shaft.

The 520,000 tonne indicated and inferred resource at Central Campoona makes up 23% of the combined 2.17Mt resource for both projects.

This essentially means its flagship project got a 23% boost.

It’s also bagged another potential contributor to an expanded production line up....

Wilco South

Wilco South could be AXE’s largest graphite deposit, but with only 20% of targets at the prospect drilled, AXE is focusing on its other projects instead of advancing Wilco South for now.

This project has a JORC resource of 6.83Mt @ 8.8% graphite (with a 5% cut-off) and a potential mine life of about 20 years.

It makes up a large chunk of AXE’s overall JORC resource, so the fact it is going ahead with a processing centre based on a fraction of its JORC resource speaks to the longer-term potential AXE is looking at.

In fact, AXE says the Wilco South deposit is essentially open to both the north and the south.

It told shareholders in its annual report:

“It is reasonable to expect that additional drilling at Wilco South will increase the graphite inventory”

So AXE has gone about proving up a sizeable graphite deposit in the Eyre Peninsula of South Australia, and with approvals on the Campoona Shaft Mine expected in the first half of next year, AXE is timing its run onto the market pretty well...

Graphite set to skyrocket in the coming years?

Regular readers of The Next Mining Boom would know that we tend to write about the graphite and graphene sector a lot.

It’s one of the hottest sectors around at the moment, with a forward demand profile which simply can’t be ignored.

One of the most exciting uses for graphene at the moment is in the lithium-ion battery space, with synthetic graphite currently used in 32% of all lithium-ion batteries.

The number of lithium-ion batteries is expected to skyrocket over the next few years:

The above is a graphic we’ve used before to demonstrate the growth of the lithium-ion market going forward, and it’s one we like as it shows the step-change coming.

Lithium-ion batteries are being used to power things like electric cars and solar battery storage.

It’s why the market is so excited by developments such as Tesla’s so-called ‘gigafactory’, being built in the middle of the Nevada desert.

Tesla is planning on manufacturing 500,000 cars per year in the later half of this decade, but to do that it needs lithium-ion batteries to power the cars.

The project is so big, it will consume the current worldwide production lithium-ion batteries.

All of it.

Suffice to say providers of raw materials such as lithium or in AXE’s case, graphite, are pretty excited by the demand profile.

But this isn’t some sort of pipe dream – it’s actually happening.

The picture above is from the Gigafactory site in November last year.

Tesla itself has started tying up deals with miners for raw materials, the latest being a deal with Bancora Minerals and Rare Earth Minerals for the supply of lithium hydroxide .

It’s a preview of the sort of deals big industrial users such as Tesla could do with suppliers into the future, and while it’s folly to suggest that AXE is going to get a call from Elon Musk any time soon, those deals could create supply imbalances closer to home.

That’s where the potential is for AXE.

Tesla is far from the only industrial giant playing around with graphite, with Samsung recently announcing that it was experimenting with graphene as a way to improve battery life .

You can imagine the sort of supply it would need if it decides to roll out full scale.

New uses for graphite and graphene are being thought up all the time, as the chart below demonstrates.

This chart from the UK patents office shows the number of patents lodged worldwide pertaining to graphite and graphene.

When people say ‘they’re thinking up new ways to use graphene all the time’ – this is exactly what they mean.

The possibilities are endless, and AXE also has a line on another massive growth industry...

Sugarloaf – sweet diversification

Aside from being the site of AXE’s processing centre, Sugarloaf also has its own graphite resource – but with a twist.

Originally, the plan was to prove up Sugarloaf as another graphite resource to feed the processing centre, but once AXE got samples back to the lab there was a snag.

Testing by AXE and the University of Adelaide found that the graphene was essentially immature and did not form crystalline graphite – the kind of graphite ripe for processing.

But it wasn’t all bad news.

Testing confirmed elements such as potassium, phosphorous, magnesium, iron, copper, zinc, manganese, boron, and calcium.

These weren’t present in large enough quantities to mine themselves, but combined AXE thought it could make a pretty good fertiliser.

The elements are all nutrients required for plant growth.

At the start of September the University of Adelaide confirmed via a 30-day trial that plant growth is “significantly” boosted when raw graphite from Sugarloaf was used as a soil conditioner.

It essentially means that AXE has just opened up a whole new revenue stream.

Managing director Gerard Anderson spelled out the possibilities.

“This has the potential to be a second commercially viable graphite product in addition to our high quality, battery grade graphite that we have found at the company’s neighbouring Campoona, Campoona Centra, and Larcoma projects,” he said.

“Tests to date are showing that the manufacture of a saleable Sugarloaf product should be fairly simple, involving mining, crushing and bagging. No further processing is required.”

While it has a fair way to go until it’s firmed up a viable product and is ready to ship to market, but it will be selling into a market which is keen to boost production.

The above chart is from Deloitte Access Economics, and spells out some of the future economic opportunities Australia has through to 2033.

As you can see on the top right of the image, agribusiness is right in the sweet spot.

It’s almost top of the pile for global opportunity, and is leading the way for Australian advantage.

In short, the agribusiness sector is growing and it needs fertiliser to help it grow.

It was named as one of the five ‘next waves’ for the Australian economy as it starts to transition away from the mining construction boom.

Its report “Positioning for Prosperity? Catching the next Wave” outlined the possibilities.

It wrote:

Key drivers of global demand are lifting, including population growth in key markets. Global food demand will rise alongside the world’s population, which is expected to grow by 60 million people a year over the next 20 years.

Many of these new citizens will be in India and Africa. Viewed another way, the world’s population will rise by the size of India today. But that is just the increase in baseload demand. Income growth in key markets will be much more important still. As incomes rise in emerging economies, so too does kilojoule intake and, more importantly, a switch to protein takes place.

The latter will power a dietary shift from grains and cereals towards meat, dairy, fruit and vegetables. That means a swing to more intensive land use. Simply put, the world is on the cusp of a leap in demand for higher-value food products.

Feeding into this market will require more intensive plant growth either as direct wheat growth or to grow feedstock for increasing livestock exports.

Enter AXE.

It’s simply too early to know how large a role AXE can play in catching the wave, but the economics are there to underpin a pretty handy little money spinner for AXE should it be able to prove its product viable.

Mad about magnesite

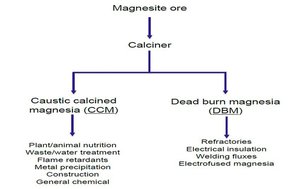

Meanwhile, AXE has quietly gone about trying to extract value from its longer term plays.

One of those is its magnesite project at Leigh Creek, location north north-west of its graphite projects.

At the moment it’s sitting dormant, but it also happens to be the largest of its type in the world, representing another value add for AXE.

The only issue is that AXE is currently working to prove up its graphite plays, meaning it doesn’t necessarily have the resources to advance the project by itself.

However, it’s potentially bringing on a partner which could see both parties benefit.

At the end of September, AXE announced that it had inked a heads of agreement with Leigh Creek Energy, which has an in-situ gasification project on the go right next door to AXE’s magnesite tenement.

One of the possible development pathways for AXE’s magnesite project would be a caustic calcined magnesia plant.

That would require a large and constant energy source.

Enter Leigh Creek Energy.

While it’s still a longer-term play, the fact AXE is exploring energy options at this stage means that it’s still very much on the menu for AXE and could be factored into longer term growth plans.

By the same token however, there’s no absolute guarantee that this longer-term play will eventuate for AXE so take it as a possible rather than a probable development. It’s always recommended that investors seek professional advice before investing.

The Final Word

The economics and longer-term play for both graphite and agriculture make for pretty good reading if you’re invested in a company such as AXE.

AXE has a plan to shorter-term commercialisation well in progress and has plenty of targets lined up for further expansion down the road.

AXE also has plenty more drilling to keep it occupied should it want to prove up an even bigger resource.

It is also diversified into a sector which could actually outpace that of graphene, suggesting a longer-term play could be in the works.

For now, AXE is getting all of its ducks in a row...

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.