PWN Strike a Deal: Set to Drill 5 BN Tonne Potash Exploration Target

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Potash West (ASX:PWN) has facilitated a corporate manoeuvre which will enable its South Harz project in Germany funded for drilling, allowing the company to turn its full attention to the Dandaragan Trough Project in WA.

The South Harz project is very large, to say the least – it’s a 4 to 5 billion tonne potash exploration target, with grades of 7.2% to 25% K 2 O.

There is well-documented previous production from PWN’s South Harz project, and even more on neighbouring properties.

In fact, prior to 1993, 100 million tonnes of potash were mined next door to PWN’s German project, which amounts in over $20 billion in value assuming the market price of potash today...

Understandably, PWN is itching to start drilling on this project, which will hopefully take it on a rapid pathway to a JORC compliant resource.

By partially ceding ownership of the project (PWN will likely own 28% once this recently announced transaction is complete) and backing it into a separate ASX listed vehicle, the company can allow funding for the drilling and ongoing exploration here.

PWN remain on course to follow in the footsteps of Highfield Resources (ASX:HFR), a company with a much more advanced potash project in Spain – Highfield started out as a tiny ASX shell, and after steady project development on their potash projects, is currently capped at over $400M...

PWN has potential to follow a similar growth path, currently capped at under $10M – however success is no guarantee here, PWN remains a speculative stock.

Let’s find out more:

Potash West (ASX:PWN) essentially has four strings to its bow:

- A major share in the South Harz project in Germany, which will be vended into another ASX listed company of which PWN will retain a significant stake – we will get to the details shortly;

- The company is closing in on the definition of a phosphate ore project in the Dandaragan Trough in Western Australia, where the company is looking to produce in excess of 250 million tonnes;

- The company is looking to commercialise novel, patented, processing IP, dubbed the “K-Max” which could be a more efficient way to extract potassium from glauconite;

- Finally, this “K-Max” technology also extends to IP relating to lithium production – this is the “L-Max” technology, which PWN holds a 25% stake in.

In addition to the value of PWN’s phosphate and potash projects, both the K-Max and L-Max technologies can hopefully generate solid royalties for the company over time, as they both assist in the processing of fundamental resources for the globe moving forward – potash and lithium.

What PWN’s Davenport deal means for investors

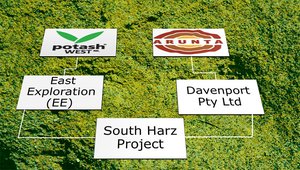

PWN’s corporate manoeuvre relating to the South Harz project is a little complicated, so let us break it down for you:

- PWN currently own 55% of a company called East Exploration (EE), with the rest of EE held privately.

- EE is the current owner of the South Harz potash project

- 100% of EE will now be sold to Davenport Pty Ltd, a wholly owned subsidiary of Arunta Resources (ASX:AJR)

- Davenport Pty Ltd will be listing on the ASX, subject to raising $4M

- This cash will be applied to drilling the South Harz project

- PWN and Davenport shareholders will have a priority entitlement in the capital raising

- PWN will own 28% of Davenport, post capital raising, subject to the amount raised.

The deal with Davenport allows PWN to keep some skin in the game without taking its eye off the ball.

PWN signed a binding term sheet agreeing to cede its entire 55% stake in East Exploration (EE) to Davenport Pty Ltd, a subsidiary of Arunta Resources (ASX:AJR).

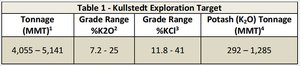

The South Harz Project in central Germany, comprises of two exploration licenses – Kullstedt and Grafentonna. Funds raised will be used to drill exploration targets within the Kullstedt license in the Sotuh Harz project which has an estimated potash exploration target of 4,055-5,141 million metric tons. Target grade ranges from 7.2%-25%.

At the time of the release of our first article on PWN, ‘ ASX Explorer Launches into $172BN Global Fertilizer Industry ’, PWN was earmarking a drilling campaign to begin the process of defining a JORC resource.

However one question mark was the funding – and now this strategic move has taken place, PWN could rapidly attain a maiden JORC resource at South Harz via a joint-venture.

All in all, the deal allows PWN to retain exposure on its German interests without having to throw additional time, effort and expense at exploration.

The Deal in Detail

Full terms of the deal are included in this ASX announcement from Arunta Resources.

In summary, as part of the deal:

- EE will be paid $250,000 as a non-refundable option and exclusivity fee

- EE receives 36,458,333 fully paid ordinary shares in Davenport at 20c per share

- Upon Davenport completing its IPO, PWN will receive 19,250,000 shares which equates to approximately 28% of Davenport

- EE will receive two tranches of 33,854,167 performance shares to be converted to ordinary shares upon reaching pre-set performance milestones

The first tranche of 33M shares will be issued if Davenport confirms its maiden Inferred JORC Resource within the next 4 years. However, this condition is also dependent on the grade and size of the resource:

- 250 million tonnes of Potash at or above 11.0% potassium oxide (K 2 O) by content, or

- 150 million tonnes of Potash at or above 12.0% K 2 O by content, or

- 100 million tonnes of Potash at or above 13% K 2 O by content, or

- 75 million tonnes of Potash at or above 15% K 2 O by content, or

- 50 million tonnes of Potash at or above 18% K 2 O by content;

The second tranche of 33M shares will be issued if Davenport completes all required mining approvals and utility contracts required to construct and operate a mine.

The deal still requires shareholder approvals from PWN, EE and Arunta but it is widely expected these will be mere formalities.

The South Harz project in greater detail

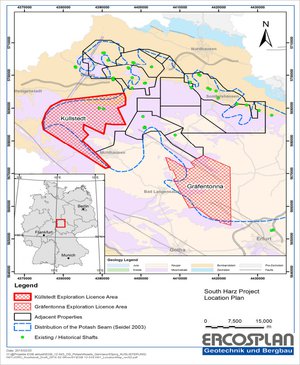

The South Harz project is split into two licenses with a combined area of 457km 2 in the heart of the world’s fifth-largest potash producing country – Germany.

A world class infrastructure network exists throughout the region and is being utilised by current potash producers such as K+S, to move finished products to key markets in Europe and offshore.

Potash grades seen so far by EE and PWN vary between 10%-18% K 2 O across the project.

The two licenses Kullstedt and Grafentonna comprise the greater South Harz project:

Given the strong previous drilling results on the project, and high potash production amounts in the surrounding region, PWN is looking to drive this project to production as soon as possible – and that begins with the upcoming drilling.

PWN’s West Australian phosphate and potash play

PWN also have a 100% owned fertiliser project located in the Dandaragan Trough in Western Australia. PWN is targeting production of 250 million tonnes of phosphate ore here:

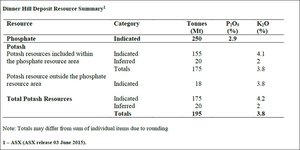

PWN’s main focus in the Dandaragan Trough is the Dinner Hills site, where the company is looking to produce more than 250 million tonnes of phosphate ore.

The Dinner Hill resource summary is as follows:

And that doesn’t even include an exploration target of 1.2 to 1.8 billion tonnes...

Yet more potash and phosphate potential to this company’s name.

Additional Value from Patented Technology

PWN’s value-add is not just in its project site(s) but also its technology.

Currently, PWN fully owns the intellectual property rights to the ‘K-Max’ process – an efficient way of producing potash from glauconite. The same tech is also being used to produce lithium carbonate from hard rock micas.

PWN has managed to secure a 25% stake in the IP which means prospective royalty payments further down the line once the K-Max and L-Max technologies are commercialised by its partners.

This is a blue sky tech play which could revolutionise the way potash and lithium are produced globally – and PWN shareholders could be the main benefactors.

At the same time, this technology is in its early stages, and there is no guarantee PWN will be able to commercialise it.

There’s Big Money in Phosphate and Potash

One of the most attractive aspects behind phosphate and potash fertilisers as a commodity is their longevity.

Primarily used in the manufacture of fertiliser products, they are key ingredients which ensure harvest yields are maximised while soil quality is maintained.

Fertilisers have a big future ahead with population growth and an expanding middle class in emerging markets such as China and India increasing the need for food in these key markets, and therefore fertiliser.

Fertiliser products are ripe to fill the gap between food demand and supply. Already, around 30% of all food produced globally is dependent on fertiliser.

The overall amount of food produced globally is much more likely to rise rather than fall – unless we see a sharp decline in the world’s population or the world consumes less food.

Both are very unlikely scenarios which means PWN’s operational environment and target market are likely to be resilient.

In a recent example of how hot the potash industry is right now, Canadian giant Potash Corp (TSE:POT) offered US$8.5BN in an attempted takeover of K+S (XETRA:SDF), a smaller rival based in Germany.

The takeover was rejected on the basis that “Potash Corp’s offer is too low”, according to a K+S statement. This was despite the €41 ($A62) per share offer which equates to a 40% premium.

According to K+S estimates, the company is worth in excess of €60 per share. S+K has reported stellar Q2 earnings last week with an operating profit of €179M – a 14% year-on-year increase.

The saga between Potash Corp and K+S continues with a new bid possibly in the offing. This case underlines two things:

- The potash market is growing strongly

- Low-cost market participants with large resources stand to attract buyout or joint-venture offers

At this early stage of its development, PWN is making a compelling case as a long-term investment with leverage to global population growth, greater food/water consumption and dwindling arable land.

However, caution should be applied when considering PWN for an investment, as it is a speculative stock.

We will be following this story closely...

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.