Production-bound IMA Shows Glowing Progress

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

The crystals found in zircon deposits around Western Australia indicate mineral sands are the oldest minerals on Earth, dated at around 4.4 billion years.

In fact WA is the most zircon-rich region on earth.

This mineral seems to be as old as time itself. And it has been used for a range of applications since man and mineral first encountered each other.

Zircon’s properties allow it to be made into completely different forms with different applications, ranging from gem stones one would wear as jewellery, all the way through to glazing for ceramic tiles.

Zircon is also used to manufacture catalytic converters, ceramic pigments, glass and foundry sand, not to mention tubbing and cladding in nuclear power stations, a hugely opportunistic niche market in the coming decade especially as China ramps up its nuclear power stations.

Image Resources (ASX:IMA) has identified these trends and readied itself to take advantage.

IMA is an ASX-listed zircon explorer with a Defined resource, a chunky offtake deal underway, and production for sale into global markets about to commence next year...

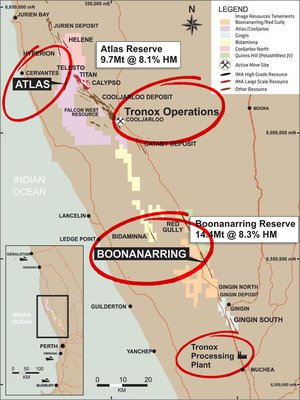

IMA’s projects are smack bang in the middle of two existing zircon powerhouses, Tronox and Iluka, in the Perth Basin in Western Australia.

The Company’s core goal is to beef up its Bankable Feasible Study in order to carve out a significant market share from under Iluka and Tronox.

Further to this, IMA will be supplying its zircon into a $4BN annual market expected to grow by 35-50% by 2020, and is aiming to produce around 40,000-60,000 tonnes per year to generate $72M in annual revenue.

Now, these figures are speculative and will likely vary from reality, so don’t solely use them as the case for making an investment in this stock.

This $14M market capped company is currently drilling at a rate of knots and is on the verge of finalising a corporate transaction with a key Chinese resource fund that will give it a wet plant worth around $20M.

Once the deal is finalised IMA will be greenlit to go into production as soon as possible.

Refocusing on:

Operating from Western Australia, Image Resources (ASX:IMA) is located in the most zircon-rich region on earth.

Australia currently accounts for almost 40% of total global production because of the country’s zircon-rich geology and strong infrastructure to support high-end operations.

Not only that, IMA has also discovered Heavy Mineral (HM) composites that show remarkable and atypical high levels of titanium mineral Leucoxene. This is primarily used as feed stock for the production of titanium dioxide pigment, with a small percentage also used in titanium metal and fluxes for welding rods and wires (more on this later).

IMA’s Operational Summary

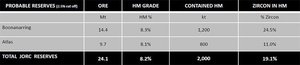

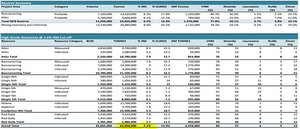

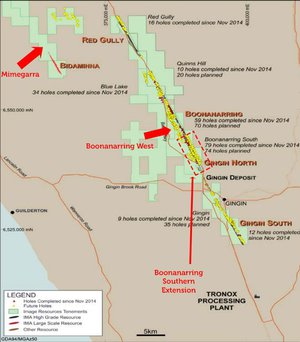

IMA’s Atlas reserve holds probable reserves of 9.7Mt @ 8.1% HM while Boonanarring holds 14.4Mt @ 8.3% HM. Both sit either side of Tronox’s operations – you can see exactly where on the map further down the page.

Combined, IMA has access to over 24Mt of Ore with grades of 8.2% HM.

IMA is aiming to produce around 40,000-60,000 tonnes per year from a 3-4Mtpa operation. That equates to approximately $72M in annual revenue. This assumes a sale price of US$1200/tonne and a production rate of 60,000tpa – which are only assumptions, and a lot can change between now and IMA selling into markets, so caution is advised if considering an investment.

Table showing IMA’s total resource potential

If we include reserves that have not yet received JORC approval, IMA’s total reserves stand at 63Mt at 7.1% HM spread across 6 distinct resources.

IMA has been working hard to finalise all of its exploration work and commercial agreements – with a view of going into production next year.

Its Bankable Feasibility Study (BFS) is just months away from completion and attractive production margins are already on the horizon.

Attaining a BFS is all about doing the leg work and drilling lots of holes in order to substantiate what’s really under the ground.

IMA is doing that at a rate of knots with over 140 drill holes scheduled to be completed and added to the BFS.

We first covered IMA back in early August in an article titled Upstart ASX Explorer Sandwiched Between Billion Dollar Giants: Takeover on the Menu?

We then updated you in September in our article, IMA Threatens Zircon Oligopoly in Western Australia .

Now, IMA stands on the verge of finalising its proposed corporate transaction with a key Chinese resource fund and offtake partner.

Once approved, the deal will give the green light for IMA to get into production as soon as possible.

IMA and Co.

Currently capped at just $13M, IMA is unlikely to gate-crash the oligopolistic zircon niche all by itself.

Iluka and Tronox currently account for over 80% of global production with both companies operating existing mines in Western Australia. These guys are big and they want to keep it that way.

Why is this important for IMA?

Well, IMA just happens to have landed on its feet by securing prime ground right in between Tronox’s operational site and its processing plant. Take a look on the map below:

This is incredibly significant because IMA’s positioning threatens the current oligopoly in the zircon market and effectively makes IMA a disruptive competitor and possibly a takeover target for Iluka and Tronox.

IMA and the Wizard of OZC

A key aspect of IMA’s path to production was a recent deal (still to be finalised) with Murray Zircon (MZ) and Chinese-based OZC.

The overarching deal not only contains an offtake element that guarantees IMA’s product will get to market, but also includes a whole host of operational and logistical benefits summarised below:

- IMA will acquire a wet plant worth around $20M including MZ’s ancillary equipment to be used in future operations (pictured below);

- OZC will purchase 90% of all zircon produced by IMA via a non-binding off-take agreement;

- OZC to provide IMA with US$8M in working capital;

- IMA will receive a conditional loan of $4M from MZ which isn’t repayable if IMA doesn’t get into production within the next 3 years;

- MZ’s key personnel will contribute their knowledge and expertise on IMA’s projects going forward;

- MZ will receive a 42% stake in IMA which could rise to 47% if all project financing is completed and mining begins within 2 years, and;

- IMA will receive an option to purchase MZ’s dry mineral separation plant.

With OZC and MZ in its corner, IMA wants to produce around 7% of the world’s zircon output from its Boonanarring project in Western Australia, with 90% directly offloaded to OZC.

The proposed transaction between MZ, OZC and IMA was recently approved by Australia’s Foreign Investment Review Board (FIRB). FIRB approval was a key permitting milestone that now sets the stage for IMA to finalise the deal and fast-track to production next year after completing its BFS.

The global market for Zircon is forecast to grow at a CAGR of 7% between 2015-2020.

In 2014, the global market for zircon was worth around US$4BN.

When looking at likely demand drivers, several key trends will potentially have an influence on the amount of zircon sold each year.

The major sources of new zircon demand are catalytic converters, ceramics and nuclear cladding which are all expected to bloom in the coming years.

One other factor, is stronger environmental emissions standards in developing countries which are gradually catching up to the levels seen in developed countries.

As more people in China and India become wealthier and break into the middle class, they are likely to drive cars which are fitted with catalytic converters as standard.

The largest markets for automotive catalytic converters are North America, Europe, and Japan, but demand in the rest of the world is expected to increase due to expanding environmental regulation that will soon include more countries as part of global climate change discussions between the world’s top policymakers.

The Chinese wealth effect is so vast given the 1BN+ population that even a higher propensity to spend on zircon coated ceramic tiles is expected to boost zircon demand as China continues its rapid socio-economic development.

The largest zircon producer, Iluka, even published a detailed study into this potential catalyst last year:

As a general rule the better the glaze on a tile, or other ceramic products such as bathroom fittings, the higher the zircon content.

The key findings of that analysis was that the “zircon loading” on Chinese ceramics was rising as house owners and property developers demanded higher quality fittings.

With all that being said, there is one other factor that trumps them all...

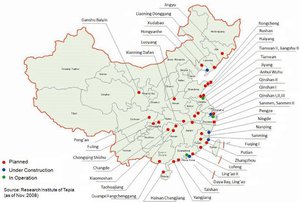

The sharp increase in nuclear power station construction already set in stone by the Chinese government for the forthcoming decade.

Here’s a summary of just how big China’s nuclear energy ambitions are:

China is on course to build over 30 new nuclear power stations in the next 10 years.

That’s an average of three fully operational nuclear power plants each year, for ten years.

Even Egyptian pyramid builders would be impressed with that kind of rate of construction.

China’s installed capacity of 13GW for nuclear power in 2013 has increased to 20GW in 2014 and is well on track to hit its 2020 target of 58GW.

That’s a 446% increase in just 7 years...

China’s rapid industrialisation phase has made eye-watering figures seem like a routine event.

And none of that is possible without an ample supply of high quality zircon, which IMA and its Chinese offtake partner OZC are only too happy to fill.

Zircon relatively sheltered from the commodity storm

Every commodity-focused business is sure to keep an eye on the underlying price of its commodity.

Whereas iron ore, coal, oil and grains prices have seen extreme declines in the past five years, zircon has been leading a relatively sheltered existence.

Zircon is not publicly traded as a homogenised commodity because its form and applications are too varied for a standardised unit price to be defined. Therefore, all pricing is negotiated directly between the producer and end-user.

This type of market dynamic helps to keep prices stable despite the understandable demand/supply shocks that sometimes affect global commodity markets.

Take a look at this chart showing Iluka’s sale prices over the past six years. Bear in mind that Iluka is the world’s biggest zircon manufacturer accounting for the majority of world sales.

The average per tonne price for zircon has remained fairly stable around the US$1100 mark despite falling as low as $815 in 2009 and rising above $2000 in 2012. From the above, Iluka’s average zircon sale price since 2009 is $1307 per tonne.

Iluka is busy exploring for new sources of zircon as any mature miner would.

In the past quarter alone, Iluka drilled 115 holes for 1881 metres and continues to operate in Western Australia as a prime location. Heavy mineral mineralisation of around 5% was reported by Iluka.

Two more tenements in the bag

Much like Iluka, IMA isn’t waiting around either.

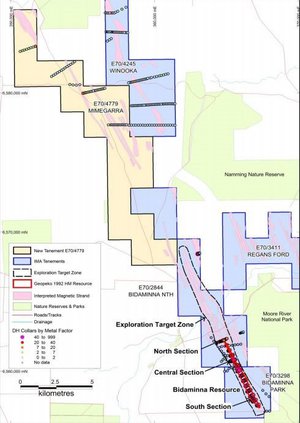

Mapped out below are IMA’s tenements shaded in green. IMA’s brand new Bidaminna Resource to the north-west is a new addition to IMA’s portfolio with extensions also achieved at its Boonanarring resource, to the west and south. Mimegarra is a brand new tenement 56km 2 in size recently acquired.

In total, IMA’s entire tenement portfolio is around 1,200 sq. km.

Let’s take a look at IMA’s new arsenal in more detail

The added tenement (Mimegarra) as well as extensions to Boonanarring are very significant because every tonne added to IMA’s total resource now could help IMA to reach a higher valuation further down the track.

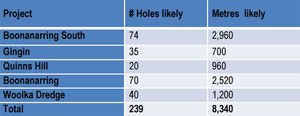

Unsurprisingly, IMA is therefore determined to drill 200+ holes over the coming months as indicated in the table below:

Table showing IMA’s planned drilling schedule

Further drilling is planned to generate as many samples as possible for evaluation. Remember that IMA’s core goal is to beef up its BFS in order to carve out a significant market share from under Iluka and Tronox.

Boonanarring West

Ongoing technical work on previous drilling and magnetic surveying has highlighted a 9km stretch to the west of Boonanarring.

IMA has moved quickly to designate this new discovery as a new tenement that warrants further exploration. Botanical surveys and a 70-hole drilling programme have been earmarked as a priority for 2016.

Infill ground magnetic studies will help IMA to clarify the viability of this new discovery but the great news is that it’s close enough to the existing Boonanarring reserve to be included in IMA’s BFS and therefore should see IMA extend the mine life at Boonanarring from 7 to 10 years.

Boonanarring South

To the south of Boonanarring, IMA has discovered a new area of mineralisation which warrants infill and extension drilling. 74 air core holes over a 6.4km distance are planned as a priority for 2016.

The existing Boonanarring reserve is elongated and stretches for over 9km. A 6km extension effectively expands the exploration ground at Boonanarring by over 50% which again bodes well for IMA’s BFS.

The blue sky hope is that both the western and southern extensions expand the existing 21Mt resource by several multiples although that is just an aspiration at this stage.

The drilling programmes at Boonanarring West and South are specifically intended to help IMA establish a 10 year mine for the reserve.

Bidaminna Project

Ground magnetics shows that the mineralisation around Bidaminna is more extensive than previously thought .

Composites taken over three sections across the length of the Bidaminna Resource, shows extraordinary and atypically elevated levels of leucoxene content with contained HM.

That’s good for the bottom line.

Whilst commodity pricing for Leucoxene isn’t readily available, it has been reported by MZI Resources to be US$352/tonne for L70 Leucoxene (65-85% TiO 2 , whilst the L88 Leucoxene (85-95% TiO 2 came in at US$1,166/tonne.

Given the Bidaminna Project has much higher Leucoxene products, IMA could reasonably expect high prices. Meanwhile the lower value limenite products currently fetch between US$100 to US$150.

Now, like all commodities, we should be clear that prices can vary on limenite products – so don’t treat the above numbers as gospel.

In detail, the HM suite is dominated by the more valuable high Titanium minerals – High Titanium Leucoxene (7%-24% of the HM), Low Titanium Leucoxene (15%-47% HM) and Altered Limenite (13%-37%HM).

The Bidaminna resource is estimated to be 44Mt @ 3% HM stretching 5.3km.

Along with this discovery, more land has been pegged to cover the northern and southern expansion of this deposit. In total that’s approximately 98km 2 that will be covered by three new tenement applications, along with 276km 2 in the Bidaminna region and 1022km 2 in the North Perth Basin.

According to IMA, the current exploration target is 11.2km in length ranging from 600 to 1300m in width.

This new target may contain 100-110Mt with 3-5.8Mt contained HM.

Of course, it’s still early days but this prospect has got IMA so excited that it pulled the trigger on securing a brand new tenement called Mimegarra totalling 56 sq.km.

Bidaminna location map showing the location of South, Central and Northern section locations.

Imagining the zircon potential for IMA

With China turning to nuclear energy to solve its energy crisis...

...while Chinese consumers favour reassuringly expensive zircon-coated ceramic tiles for their lush new bathroom renovations....

...and driving gas guzzling new cars...

...future zircon demand is expected to be robust.

In IMA’s case, zircon is leveraged to China’s industrial development just as much as it is to consumer spending habits. Zircon is a niche mineral that is starting to garner widespread application as well as seeing more intense industrial use.

Zircon prices have shown resilience amidst the tough global commodity landscape which is another factor that bodes well for this plucky production-bound explorer.

The $13M-capped IMA is on course to enter this market with a bang once all the formals are agreed.

Here at The Next Mining Boom , we’ll most definitely be keeping an eye on how this image develops.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.