MKG’s Outstanding Assays Allows it to Focus on the Big Gold Picture

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Mako Gold (ASX:MKG), the Australian junior explorer with the $964 million capped Perseus Mining (ASX:PRU) in its corner, has been hard at work over the past few months.

There has been little rest for managing director Peter Ledwidge and crew as they have continued to add to Mako’s highlights reel.

One particular highlight was the 26% increase in the company’s share price following the release of assay results from the first 16 holes drilled from the company’s drilling program at its Napié Project in Côte d’Ivoire, which is now complete.

Such was the impact of its news, that by the end of July the stock was up 40% from where it sat the previous month.

The release of its most recent quarterly report, for the period ending 30 June, focused on several key milestones including outstanding drill results.

Of particular note was Mako’s ability to quickly increase its interest on its Farm-in Joint Venture Agreement with Occidental Gold SARL (OG), a subsidiary of Perseus Mining Ltd (ASX:PRU) for the 224 square kilometre Napié Permit.

Mako now has a controlling 51% interest in the Napié project after reaching its first milestone and has its sights set on earning up to 75% of the project on completion of a Definitive Feasibility Study (DFS).

Also of interest is major ASX listed gold producer Resolute Mining’s (ASX:RSG) 19.9% stake in Mako and Peter and Ann Ledwidge’s stake of nearly 10%.

This points to a tightly held company, with the backing of two major mining outfits in Resolute and Perseus.

The quarterly did indeed read as a highlights reel, however the news hasn’t stopped there.

Just last week, the company announced that it has lodged two applications for exploration permits with the Ministry of Mines in Côte d’Ivoire covering a total area of 296 square kilometres.

These two new permits would more than double the company’s footprint in Côte d’Ivoire to 520 square kilometres.

The permit applications were strategically selected by Mako to cover significant greenstone-granite contact as these contacts present excellent targets for shear-hosted orogenic gold deposits, and if granted, would further strengthen Mako’s investment case.

The final piece of news in its current flurry of activity came last Friday, 9 August, when Mako released the final assays from its 4,141-metre reverse circulation (RC) drill program.

The assays from eight holes at the Tchaga Prospect returned narrow gold intercepts with the best individual result of 1-metre up to 7.55 g/t gold.

Overall results for the entire program have been excellent.

Now, with results in hand, Mako will turn its attention to a follow up drill program after the wet season, predicted to end in November.

With all that in mind, let’s look at its recent activity in more detail and further outline the investment case.

Market Capitalisation: $6.58 million

Share Price: 0.086 cents (as at 12 August)

Here’s why I like MKG:

A quick recap of the ground MKG holds

Mako Gold (ASX:MKG) has been rapidly advancing the Napié Project in the Côte d'Ivoire region of West Africa in a joint venture with Perseus Mining subsidiary, Occidental Gold.

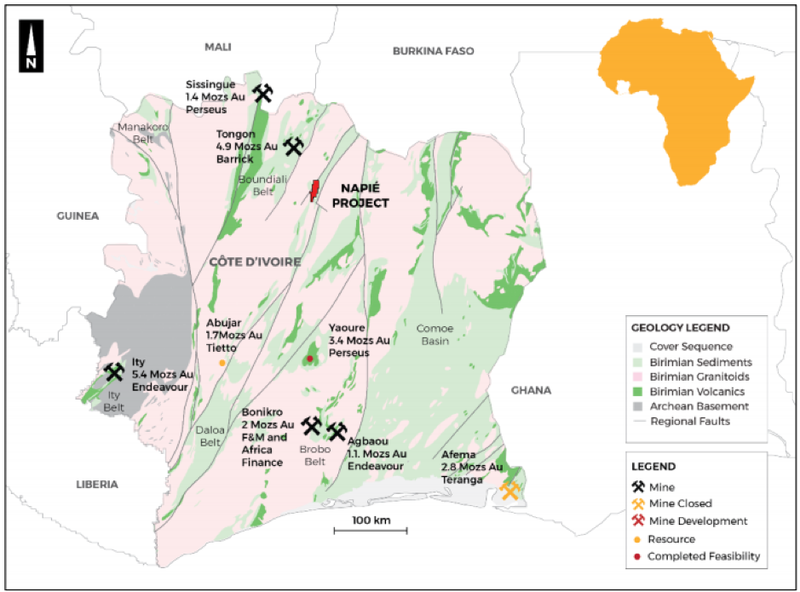

To date, Côte d'Ivoire has produced just 20Moz of gold resources, however this underexplored region is said to be ripe for future gold discoveries.

Certainly, the $31 billion capped Barrick Gold’s 4.9 million ounce Tongon project lying to the north-east and Perseus Mining’s (ASX:PRU) 3.4 million ounce Yaoure project situated to the south, would attest to the potential here.

You can read about their influence in the region in our previous article: ASX Micro Cap Hunting for Multi-Million Oz. African Gold Resources.

The following map identifies Mako’s Napié Project in relation its billion dollar capped neighbours:

The following Hot Copper video filmed at the recent Diggers and Dealers mining conference outlines the JV with Perseus, as well as MKG's relationship with the $1.75 billion capped Resolute Mining, which holds 20% of the company.

No doubt, the potential of the Napié project has attracted the attention of these mining giants. However, it is hard to overlook the experience that managing director Peter Ledwidge and his geologist wife Anne bring to the table.

The pair was part of the team behind Orbis Gold which made three gold discoveries in Burkina Faso, one of which (Natougou Gold Project / Boungou Mine) has been progressed through to production as a world class mine for the $1.3 billion capped Semafo Inc. (TSX:SMF).

Following the Orbis takeover by Canadian-based miner Semafo, the Ledwidges founded Mako, named for Peter’s passion for sharks. They brought with them experienced former members of the Orbis team, which helped to identify two highly prospective projects in West Africa – the Napié in Côte d’Ivoire and the Niou Project in Burkina Faso. The latter project has seen Mako recently define a greenfield gold discovery, which we will cover in brief shortly.

It is the team’s experience that has helped rapidly progress the Napié project and the latest results, combined with existing assays from the current drilling program, all point to a great deal of upside to come.

Outstanding assays lead to extension of strike length

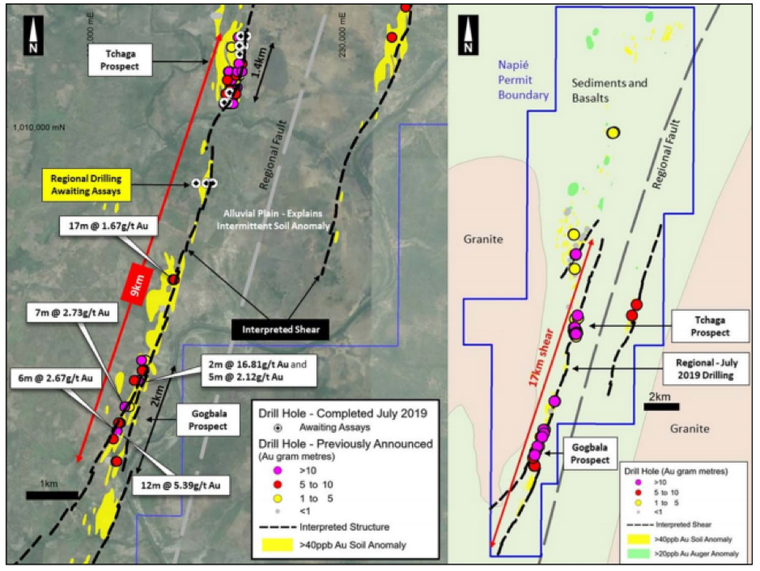

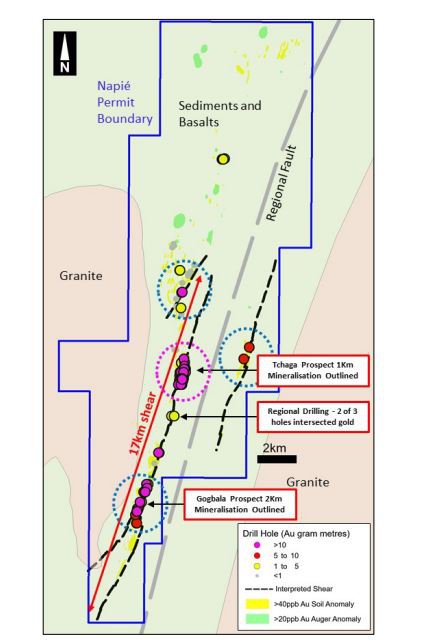

Twenty-four reverse circulation (RC) drill holes were completed for a total of approximately 3,670 metres on the Tchaga Prospect at Mako’s Napié project.

In addition, three RC holes were completed on the regional trend for a total of 480 metres drilled to test mineralisation between the Tchaga and Gogbala Prospects.

The purpose of the regional drilling was to test the interpreted shear in an undrilled area between the gold mineralised Tchaga and Gogbala prospects.

Mako suspects that gold mineralisation intersected at the Tchaga Prospect and the Gogbala Prospect, are part of the same system and both lie along the recently interpreted 17 kilometre-long shear zone.

Hole locations from the regional drilling program and select previous drill results that are shown below tend to support these conclusions.

Gold intersections from the Gogbala prospect have featured promising widths and high grades, including 12 metres at 5.4 g/t gold, 17 metres at 1.7 g/t gold and 2 metres at 16.8 g/t gold.

The latest results confirm this has been a highly successful drilling campaign. So successful that Perseus is happy to let Mako continue to do the heavy lifting.

Perseus group exploration manager Doug Jones said, “Perseus recognises the potential demonstrated by results from Mako’s exploration at Napié to date, but has decided its primary focus must remain on its core assets whilst retaining exposure to the exploration up-side at Napié.

“We believe the project is in good hands and look forward to continuing positive news flow as Mako advances its programs over the coming months.”

The release of assays late last week from the final eleven holes of the 27 hole program, came just days after Mako lodged two applications for exploration permits with the Ministry of Mines in Cote d’Ivoire that would more than double the company’s footprint in the region to 520 square kilometres.

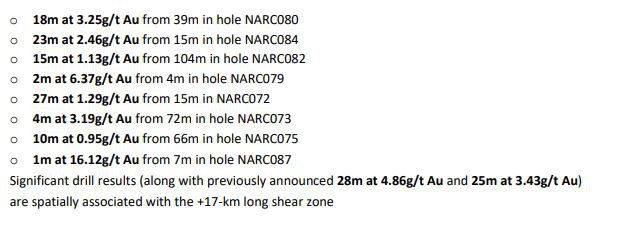

The majority of results were received from the remaining eight holes of the Tchaga Prospect and show narrow gold intercepts which display a best individual result of 1m assays up to 7.55g/t Au (NARC095).

Select results from the July campaign can be seen below.

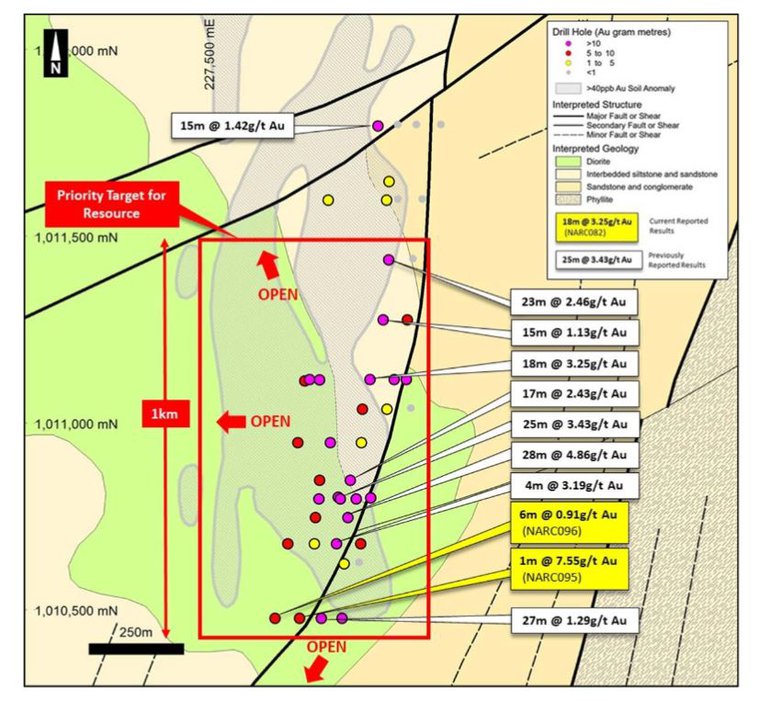

During the July drilling campaign, Mako extended the gold mineralised zone to 1km strike length on the Tchaga Prospect. The findings enabled Mako to clearly identify an area of focus in its endeavour to outline a JORC compliant gold resource with further drilling.

The final three assays were delivered from RC drill holes along one drill fence between the Tchaga and Gogbala prospects.

Two of the three drill holes intersected gold, with best intercepts of 1m at 1.48g/t Au (NARC099) and 1m at 1.27g/t Au (NARC098). While no significant width of gold mineralisation was intersected, these drill holes confirm that there is gold mineralisation along this section of the 17km-long shear.

The results suggest that this area could be a target for future exploration and confirm that the shear zone hosts gold mineralisation two kilometres southwest of the Tchaga Prospect.

Here are several highlights from the July drilling campaign:

Further drilling

Following the end of the wet season in November, Mako will begin a follow up drill program, with several targets already identified.

The company’s focus will be on the Tchaga Prospect, particularly the 1km strike zone as seen in Figure 2 above and outlined by the red rectangle.

Infill drilling between sections as well as extending the strike-length and width of mineralisation in the directions marked as “Open” (see Figure 2) will be Mako’s main focus during the next round of drilling.

“We are thrilled to have outlined 1km of strike length of gold mineralisation in our latest drilling campaign,” Mako Peter Ledwidge said.

“We are focusing on the big picture and feel confident that Mako can move quickly towards a resource on the Tchaga Prospect. To this end, we hope to be drilling again on the Tchaga Prospect shortly after the end of the wet season.”

Whilst, Napié has been the company’s main focus, Mako’s program in Burkina Faso is also moving ahead.

Diamond in the rough

Burkina Faso represents an attractive investment destination.

The country has strong government support for mining, a modern mining code (2014) and gold resources of over 50 million ounces. Ten new gold mines have been constructed in the last 12 years.

This is a supportive, mining friendly jurisdiction and Mako is looking to capitalise.

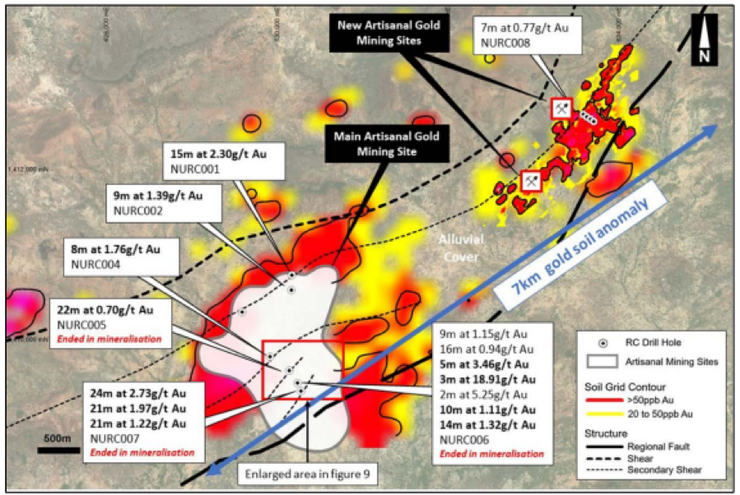

Drilling at Mako’s Niou Project in Burkina Faso is likely to commence towards the end of the year.

With a geological mapping program complete, drilling will follow up on assay results delineated from the maiden drilling gold discovery in January 2019. This program included 15 metres at 2.3 g/t gold, 24 metres at 2.7 g/t gold and 3 metres at 18.9 g/t gold.

The planned reverse circulation (RC) and/or diamond drilling (DD) program will target extensions from the best gold intersections in NURC005, NURC006 and NURC007 from the recent maiden drilling program.

Target extensions can be seen below. The red rectangle highlights the priority planned drilling area.

It should be noted that shear zones such as these commonly host economic gold deposits in Birimian greenstone belts.

Mako’s Burkina Faso interests have been put on hold ever so slightly, as the company wanted to make the most out of its work at Napié before the wet season kicked in.

Rest assured, Mako still has its sights on making the most of its Niou Project, with work to begin at the end of the wet season, which is typically in October/November — which is only a few months away.

Gold hits six-year high

The July drilling program saw shares in Mako surge 20%, but promising exploration results were just part of the equation.

Also working in the company’s favour has been the steady rise of the gold price.

Late last week, gold surged through the psychological US$1500 per ounce mark and after hitting US$1520 per ounce session, was trading in the vicinity of US$1510 per ounce.

The last time the gold price passed US$1500 in an upward trend was in April 2011 when it peaked at about US$1570 per ounce and then retraced to just under US$1500 per ounce in May/June.

However, as you can see on the chart where the line dips just below US$1500 per ounce in 2011, it was followed by a surge that saw the gold price hit an all-time high of more than US$1900 per ounce.

Whether we are in for a rally of this proportion remains to be seen, but one thing is for sure, the gold sector is looking very attractive.

That’s good news for Mako.

As it looks to extend its footprint and capitalise on recent results, the gold price is the icing on the cake for a company that already has the backing of major miners, as well as a management team that has tasted success at the highest levels.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.