LKE Now Drilling At Kachi Lithium Brine Project

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Lake Resources’ (ASX:LKE) Kachi Lithium Brine Project is just one of the company’s several assets in South America’s enviable ‘Lithium Triangle’ — a region in northern Argentina and Chile that is the source of half the world’s lithium.

Its projects can be found among those belonging to the world’s biggest lithium producer, the US$11.8 billion-capped Albemarle (NYSE:ALB) and the world’s second biggest, the US$15 billion Sociedad Quimica y Minera de Chile.

Not to mention, the ASX-listed Orocobre (A$1.2 billion million) sits right next door as does the C$1.1 billion capped Lithium Americas (LAC.TSX).

As a would-be lithium producer, those are the best neighbours you could ask for, especially as the company begins an expansive exploration program.

LKE recentlyinformed the market that it had commenced drilling at its highly prospective Kachi lithium brine project in the Catamarca Province, Argentina.

The highly anticipated drill programme has kicked off with diamond drilling over the lithium-bearing salt lake at the project, covering an initial 1000 metres, with the capacity to expand depending on interim assay results. All signed approvals have been received, cash has been raised (LKE has raised $1.66 million in an unsecured note offer), and now... it’s go time for this lithium hopeful.

News is now expected to flow from the company’s boardroom as it begins its exploration in earnest. The market can expect more drilling, more assays and all being equal more money for the company and investors...

However, it should be noted that this is an early stage play and investors should seek professional financial advice if looking at LKE for their portfolio.

With drilling happening right now and assay results due for release in the coming weeks, it seems like an ideal moment to delve right in with:

Lake Resources (ASX:LKE) announced to market in September that it had signed a Letter of Intent with the Argentine Government, State of Catamarca (CAMYEN entity).

The agreement will see LKE’s Kachi project accelerated, along with a select few energy and mining projects in the province, to ensure development is both successful and appropriate for the region.

The agreement will ensure LKE receives active assistance in getting the project through various permitting stages on the way to production, including environmental and community support, as well as the provision of services. The agreement shows that the project is considered one of real significance in the Lithium Triangle.

There’s nothing like cooperation from government to get a mining small cap over the line in a place like South America — so we’re chalking that up as another piece of exceptionally good news.

After some time on the sidelines, the popularity surrounding LKE is now starting to pay off...

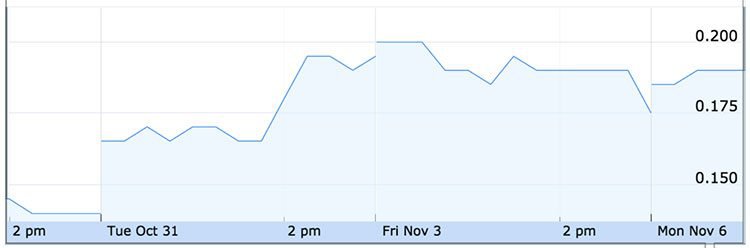

Here is what LKE’s share price has done since we last wrote about them in May:

That’s an increase of 280%. In early November, it spiked at $0.25, which represented a 344% increase on the price since the day we last wrote about LKE.

The past performance of this product is not and should not be taken as an indication of future performance. Caution should be exercised in assessing past performance. This product, like all other financial products, is subject to market forces and unpredictable events that may adversely affect future performance.

So let’s start with the latest, and most newsworthy, announcement from the company — the commencement of its much-anticipated drilling campaign at Kachi and examine why the company is now piquing investor interest.

Drillbits spinning at Kachi lithium brine project

LKE got the ball rolling last week by getting the drill-bit spinning, kicking off the planned 1000 metre diamond drilling campaign over the lithium-bearing salt lake at the Kachi project — a site covering 50,000 Ha of mining leases 100% owned by LKE’s Argentine subsidiary, Morena del Valle Minerals SA.

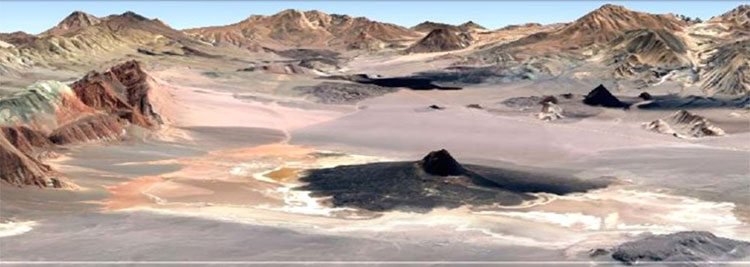

Here’s a look at the first drill hole platform:

That is a hard salt lake for as far as the eye can see.

Having received all signed approvals from regulators for the maiden programme, and with the claim of support from the local community, LKE was not going to waste any time on ticking off this important milestone.

The first set of assay results should be due out in the next few weeks to months.

Although, at the same time, it is difficult to determine what those results may be and any determination is speculative at this stage, so investors should take a cautious approach to their investment decision in this stock.

What we do know is that these interim results will determine whether the drilling will be extended beyond the initial 1000 metres planned.

Drill rig at the Kachi project

Prior surface sampling at Kachi has revealed positive lithium results including over 200 mg/L lithium recorded from near-surface auger brine sampling, as well as 204 mg/L lithium and up to 322 mg/L.

The promising early indicators are stacking up, and no doubt the company has high hopes of expanding on these with the current campaign...

Kachi is located in one of Argentina’s most prospective lithium regions.

Landscape photo of the Kachi Project location in Catamarca Province, Argentina.

In recent times the region has attracted interest from several lithium plays. In fact we’ve seen significant corporate transactions of late in leases adjacent to the Kachi project, involving companies such as SQM, Orocobre and Lithium Americas...

LKE certainly seem to be in the right place.

Cashed up for campaign success

Earlier this month LKE announced the news it had raised $1.66 million via an unsecured note offer.

Unsurprisingly, the news acted as a further share price catalyst for the A$44.5 million capped company... spiking the price ~140%:

The past performance of this product is not and should not be taken as an indication of future performance. Caution should be exercised in assessing past performance. This product, like all other financial products, is subject to market forces and unpredictable events that may adversely affect future performance.

The oversubscribed support comes at an opportune time for LKE as it ramps up its exploration efforts and allows drilling to advance at the Kachi project.

The funds were raised via commitments for 1,665,000 unsecured notes to sophisticated and professional investors, with the initial intention to raise $1.5 million, and extra demand causing the offer to be upsized. The increased capacity for resources and time now available to go towards exploration will put LKE in a good position to demonstrate the potential of the project.

Considering the Notes are debt securities and are otherwise not convertible into ordinary shares, LKE will not be seeking shareholder approval and the debt security acts to avoid dilution of shareholders.

Just on that point, there are 31.25 million unlisted options at 5c which expire on 4 April 2018. These are deeply in the money and are expected to be converted for $1.56M in Jan/Feb/Mar which would pay for any debt securities

Further to this, there are 19.35 million listed options at 10c which expire in Aug 2018 which are also deeply in the money ($1.93M).

With that in mind, the company could organise a similar facility to bring forward the benefit of when the option holders convert their in-the-money options.

If the company can find success with this round of drilling, and prove its got hold a high-value lithium brine asset at Kachi, the next step will be to compile results into a Scoping Study and define a Maiden Resource.

New director boosts technical expertise

In July, LKE boosted the technical expertise of their team with the appointment of Dr Nick Lindsay as non-executive director.

With a degree in geology, a PhD in Metallurgy and Materials Engineering, as well as an MBA, Lindsay also brings over a quarter of a decade of experience working in Argentina, Chile and Peru. And, eminently useful for LKE with its current ventures, he also speaks fluent Spanish.

Lindsay has facilitated the listing of companies like Laguna Resources, from inception through to acquisition. Currently he serves in the role of CEO of Manuka Resources Ltd — an unlisted company looking to become the latest Australian silver producer.

His experience also includes a former position as President – Chilean Operations, for Kingsgate Consolidated Ltd, and his current membership with the AusIMM and the AIG.

Lithium macro factors = good timing for LKE?

We all know lithium has been one hot metal in the last few years — and by now, we all know that’s due to the rapidly growing need for lithium-ion batteries in electric vehicles and renewable energy storage.

Accordingly, there’s been plenty of noise in the media about lithium, and plenty of investors wanting to jump on board.

Of course commodity prices do fluctuate and caution should be applied to any investment decision here and not be based on spot prices alone. Seek professional financial advice before choosing to invest.

What’s interesting is the fact that not too many people have considered the widening gap between supply and demand.

Bloomberg touched on the topic a few months ago...

That article quotes the CEO of Santiago-based lithium consulting firm SignumBOX saying the world needs a new project entering the market every year to satisfy growing demand.

Even then, it’s unsure whether that would be enough to stop what is an arguably tight market from heading into deficit, with an accompanying hike in the metal’s price...

If you’re launching yourself into the business of producing lithium, this kind of supply deficit is a good thing.

Perhaps it’s time to start paying close attention when you’ve got automakers striking deals with lithium producers — like the deal Great Wall has struck with Pilbara Minerals in WA...

Great Wall will take a $28 million interest in Pilbara as part of an off-take ‘tie-up’ to support a proposed expansion of PLS’s flagship A$234 million lithium project.

The general consensus is that this is the first direct investment in a lithium supplier by an auto group. The agreement will see Great Wall take between 75,000 tonnes and 150,000 tonnes of spodumene concentrate from Pilbara Minerals.

It’s a smart move by the automaker, as they no doubt predict a tightening of global lithium supply as demand for lithium-ion batteries increases into the future.

This augers well for a small cap like LKE that can take the lithium bull by the horns and prove up a resource that could have substantial market impact.

Summing up...

With drilling underway, and close to 1 million in the bank ($930,000 at last report end of September) — which doesn’t yet include the $1.6 million due to come in shortly from its capital raise earlier this month —LKE is looking like it can move forward at a solid pace.

All the good work the company has done this year is set to drive it expediently through the next few weeks and months, during which it intends to gather some potentially excellent results from the current drilling campaign.

Once it has those, there’s no stopping it from compiling a Scoping Study, and then defining a Maiden JORC estimate for the Kachi project... and then, the sky is the limit. There is every chance LKE are about to gain even more momentum, which could well end up in a serious uptick in its share price...

This small cap explorer has one of the largest portfolios of landholdings in Argentina with four different projects – an amount substantially larger than a number of its major active peers in the region. Despite this, its market cap still sits under the A$50 million mark.

However, with drilling results from the first project still to come, LKE is now giving itself the best chance of success and is on the verge on unlocking the immense potential value of the first of four lithium projects.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.