Is CXX the World’s Next Niobium Producer?

Published 02-JUN-2016 10:00 A.M.

|

17 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

The Next Mining Boom presents this information for the use of readers in their decision to engage with this product. Please be aware that this is a very high risk product. We stress that this article should only be used as one part of this decision making process. You need to fully inform yourself of all factors and information relating to this product before engaging with it.

It looks like there is soon to be a new entrant in the tightly held Niobium market...

In the case of Cradle Resources (ASX:CXX), a junior niobium ‘producer in the making’; its intentions are squarely focused on piercing a market where only a few players have previously dared to tread, and in which CBMM, a US$13BN Goliath has most of the Niobium market share (85%).

CXX’s entry into the market will be boosted by the recent appointment of Ian Middlemas and Robert Behets to the Board as non-executive directors.

The pair were part of the founding team that developed Mantra Resources , a Tanzanian uranium company acquired by ROSATOM, Russia’s nuclear holding company, for $AU1.16BN.

CXX is hoping the pair has similar success with their Tanzanian niobium venture – not necessarily as an acquisition target, but as a company that can build up a strong asset base, capable of producing its commodity to its fullest potential and that may become an acquisition target based on its operational strengths.

However, before we go too far, it should be noted that for political and social reasons, this is a very high risk stock. Getting mining projects up and running in countries such as Tanzania is no simple feat, and there may be challenges ahead.

With CXX’s Definitive Feasibility Study (DFS) now published, Mr Middlemas and Mr Behets will focus on the company’s finance and marketing objectives, with the overall goal to see CXX’s Panda Hill Niobium Project into construction and positive cash flow.

Financially the pair are working from a powerful base.

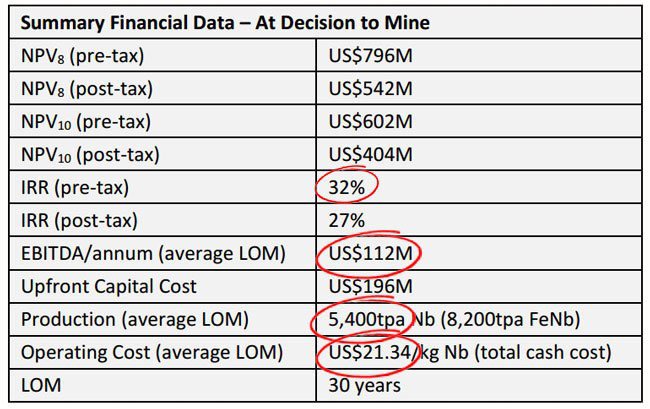

Following the publication of a stellar Definitive Feasibility Study (DFS) that outlines CXX’s Panda Hill Project generating an NPV 8 (after tax) of US$542M, with a pre-tax IRR of 32% and nominal payback period of only 4.75 years, CXX is now firmly on track to realise its production goals.

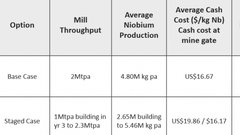

Along with its project partner, private equity backed Tremont Investments limited (who shares the project with CXX on a 50/50 basis), CXX is gunning for an initial target of 1.3mtpa for the plant throughput or the ROM (run of mine) production, ramping up to 2.6 mtpa after four years – and this production ramp up will be funded by project cash flow.

CXX is aiming to start off with lower production (6% of the world market) and then ramp up production after it has built a customer base.

Given average life of mine operating costs for the process are estimated at US$21.24/kg Nb, and niobium prices have remained stable at around the $40/kg mark for the past few years, CXX’s project should move into profitability relatively quickly, and should stay that way for many years.

With its DFS indicating a solid green light for long term profitable niobium production, CXX is now working overtime to get approvals to build its project infrastructure, and is seeking offtake and debt financing partners on the back of the compelling DFS results.

This is where Mr Middlemas and Mr Behets can shine – doing the deals that matter to CXX’s future in the niobium market.

Now could be a good time to put your feelers into this Cradle.

Refocusing on:

Cradle Resources (ASX:CXX) has been gradually putting together its case for niobium production at Panda Hill in Tanzania since 2014.

We first alerted our readers to this stock in January 2014 in our article, “ Rare Ingredient in ‘Super Steel’ – Tiny ASX Explorer has Just Found Enough to Become the 4th Largest Global Supplier ”.

At the time, CXX was pulling the trigger on a Scoping Study and in the middle of compiling its Pre-feasibility Study (PFS). In February this year, we again alerted our readers to CXX as strong exploration results set the stage for CXX to announce a bumper DFS.

As you can see there has been plenty of business activity that could help CXX raise its valuation. In fact, since we last wrote about this stock , it has been up as high as 90%:

The past performance of this product is not and should not be taken as an indication of future performance. Caution should be exercised in assessing past performance. This product, like all other financial products, is subject to market forces and unpredictable events that may adversely affect future performance.

We may have been bringing you the CXX and Niobium story for quite some time, but it appears lately CXX has been getting even wider coverage – here is the latest from Bloomberg on CXX :

This global coverage should put CXX in the spotlight as it focuses on the next stage of securing the company’s growth.

The CXX ‘Mantra’

When your DFS has you pointing in the right direction, you want a management team in place that can see you through to production, whilst ensuring that operations not only remain stable, but hopefully lift the company to new heights.

The appointment of Mr Ian Middlemas and geologist Mr Robert Behets to the Board is designed to help CXX achieve that goal.

Mr Middlemas has a 10% stake in CXX, so he has put his money where his mouth is and will use his extensive skills and experience in corporate finance, project funding and marketing to hopefully create further value for CXX shareholders.

Along with Mr Behets, who has over 25 years’ experience, much of it in Tanzania, Mr Middlemas was part of the founding team that developed Mantra Resources.

Mantra’s flagship Mkuju River Project in southern Tanzania confirmed the presence of multiple thick, high grade zones of sandstone-hosted uranium mineralisation at shallow depths.

It was so successful it attracted the attention of Rosatom Corp., Russia’s nuclear holding company, which agreed to buy Mantra for A$1.16BN.

With these guys at the helm, CXX is hoping to gain similar traction and growth.

Its appointment of Misters Middlemas and Behets is to add technical, commercial and managerial skills, as well as Tanzanian operational experience.

Meanwhile the London-based James Kelly will move from non-executive director to executive director and will play a bigger role in CXX’s financing strategies.

Mr. Kelly is a former Xtrata, Glencore and JP Morgan executive with extensive resources experience and knowhow, thereby adding confidence that CXX’s flagship asset will be progressed diligently and on schedule.

Operations, most notably finance and marketing, will be a major focus over the next six months, particularly with the DFS giving out such good numbers for the Panda Hill project.

The Tanzanian play

CXX has its mitts on an economically viable high-grade niobium project located in one of the most low-cost areas in the world.

Before we go too far, let’s have a look at what niobium actually is.

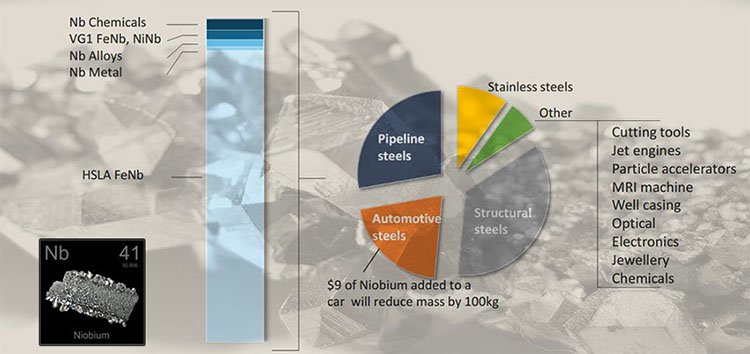

Niobium has been dubbed a ‘space age’ metal, due to its uses in high tech, futuristic products such as space shuttles and jet engines, and lighter, modern car bodies.

The base market demand for Niobium is driven by its use in making high strength, lighter, low alloy steel – In fact, 90% of Niobium is produced for this purpose.

The demand for Niobium has steadily increased since 2000, and is forecast to grow at around 3% p.a .

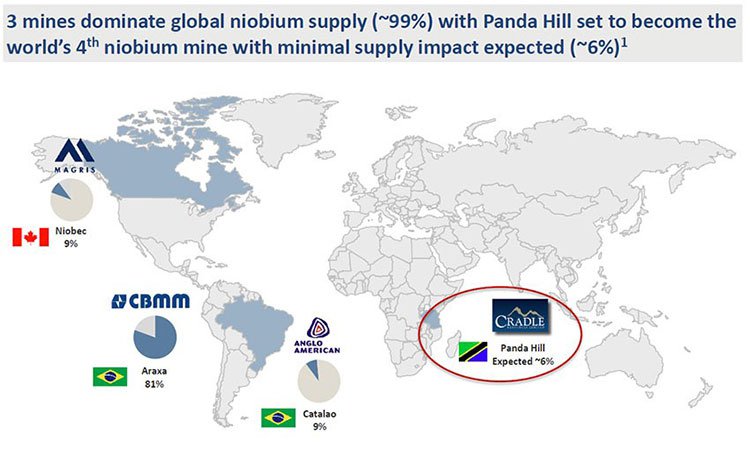

With so few producers on the market, but with so many futuristic uses for Niobium, any newcomer with an acquirable asset such as Panda Hill, could well be the subject of a large takeover one day.

Just look at what happened recently with Anglo American selling its niobium/phosphate business, most notably the Catalão mine, in Brazil for US$1.5BN to China Molybdenum.

Anglo American was the second niobium deal completed recently after the Niobec mine in Canada was divested by IAMGOLD Corp. to a consortium led by Magris Resources for US$500MN...

There is always a chance that unsuccessful bidders in the Anglo American sale may come knocking on CXX’s door offering attractive bids for Panda Hill – however for now it appears that CXX are more driven by getting the project into production and generating free cash flow, rather than dressing up Panda Hill for a quick sale.

In any case, the pent up demand to secure a stake in the niobium market may see CXX secure project financing sooner than you think.

CXX has managed to conjure up some superb economics at its Panda Hill Project including a 30+ year mine life, and highly positive financial returns, for a little known metal with unwavering demand. Let’s find out a little more about what is at Panda Hill.

Recapping the Cradle

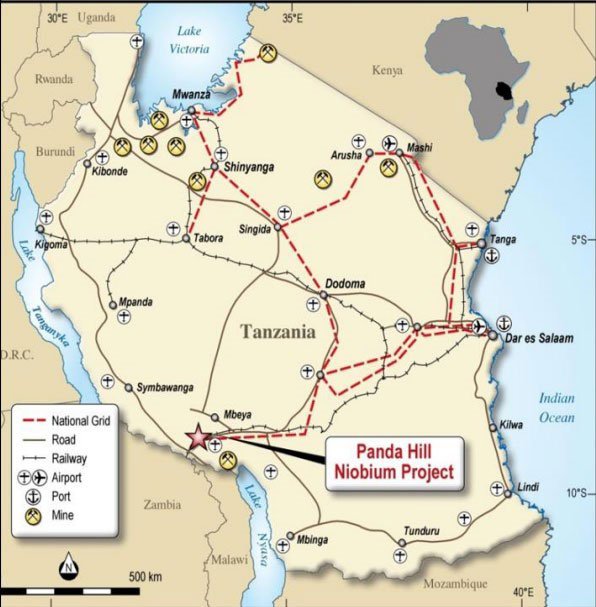

Mapped out below is CXX’s Panda Hill Project location, in Tanzania:

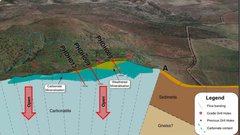

Panda Hill is set to be an open-pit mine with shallow mining and straightforward processing planned. With a strip ratio of 1.5:1, costs can be kept low, especially upfront mine costs.

Today CXX has a high grade resource backed by a DFS that supports economic production

Let’s take a detailed look through CXX’s recent DFS, and bear in mind when reading the figures that CXX is progressing Panda Hill on a 50/50 JV deal with Tremont Investments.

For starters, here’s that summary of all the key financial metrics again:

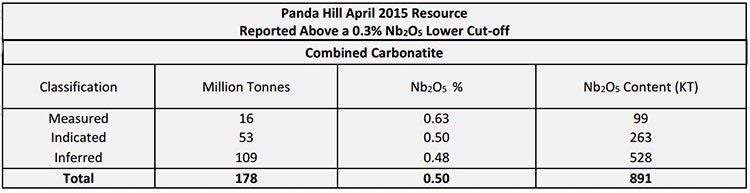

And here are the all-important Resource figures, split into Measured, Indicated and Inferred categories:

As you can see, CXX has its hands on a financially robust 5400tpa project (average LOM) with an extended mine life of 30 years and 178Mt Resource. This will likely be expanded over time as and when CXX’s current resources start to dwindle with early indications suggesting 200Mt-400Mt is possible as an early Exploration Target .

The Internal Rate of Return (IRR) is a healthy 32% pre-tax while the Project’s EBITDA is US$112MN (A$152MN) which means CXX has a strong chance of making a profit on Panda Hill.

Here are the highlights of the project:

Pre-tax NPV:

US$796MN

IRR:

32%

EBITDA:

US$112MN

Capex:

US$196MN with 4.5 year payback period

Production quantity:

5400tpa

Operational cost:

US$21.34/kg

Mine life:

30 years

Given current information, CXX is on track to become the world’s next niobium producer in less than 2 years’ time and could record healthy operating margins from the outset.

Just as a quick side note, do remember that niobium is a highly specialised metal for which pricing is set directly between buyers and sellers without a centralised exchange.

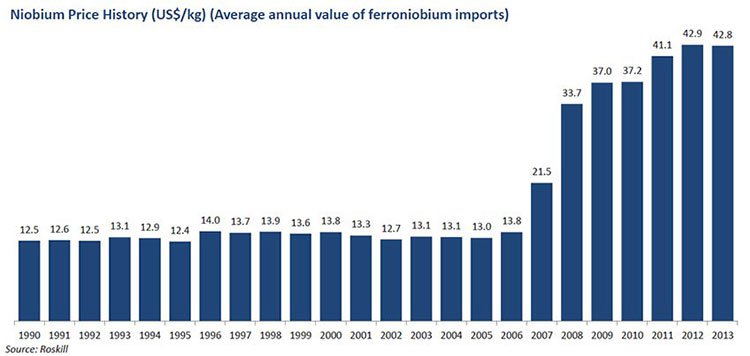

Here is what niobium prices have been doing according to resource analyst specialist Roskill:

Although these are not the most up to date figures, one aspect is incredibly interesting.

In 2007 and 2008, despite the global economy facing severe problems caused by the GFC and commodities prices falling across the board (not helped by a stronger US dollar), niobium prices started their ascent from around $20/kg to reach a high of $43/kg in 2012.

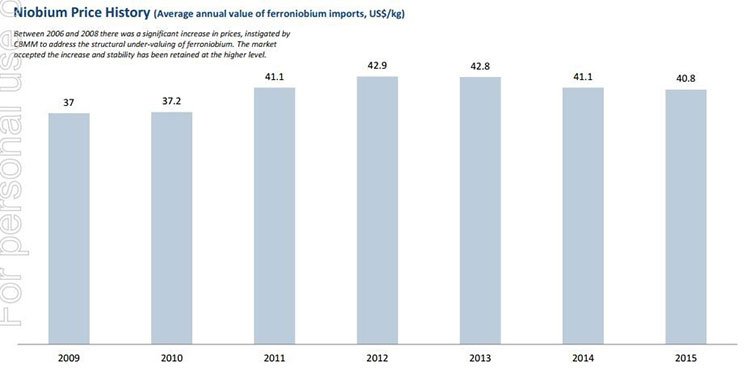

Here’s the most up to date table indicating how stable niobium prices have remained:

CXX’s cost-structure is neatly below the industry average, with strong margins likely

Today, estimates vary but the general consensus is that niobium sells for around $30-$40/kg depending on the amount being sold and the exact final grade.

For CXX, its DFS forecasts a market price of US$38.92/kg... as a starting price in 2018, with the price likely to increase up over life of the mine.

CXX’s all-inclusive operating cost is just US$21.34/kg.

Based on the DFS numbers, CXX’s profit margin could potentially be around US$16/kg or 56% and CXX is targeting to produce 1.3Mtpa for ROM production...

...and then ramp up to producing 2.6Mtpa in Year 5.

Remember however, that these numbers are speculative and should not be the sole factor in your investment decision. Seek professional advice if considering this stock for your portfolio.

According to the DFS, Year 5 is when the margins will receive a significant livener...

Considering the improved project design and all the latest exploration data included in the DFS, CXX is planning to boost its NPV and EBITDA by a handsome margin in Year 5 of the project.

The DFS calculates that CXX should be able to boost its pre-tax NPV 8 by 77% up to US$1.4BN and EBITDA by 8% to $121MN in Year 5...

...and yet, CXX remains capped at A$45MN...

In our view, calling that an oversight is an understatement.

Commodities markets remain subdued in general with most investors staying apprehensive given the drying up of the Australian commodities boom.

However, there is a strong possibility that stocks like CXX are being overlooked because of the broader industry sentiment and anxiety.

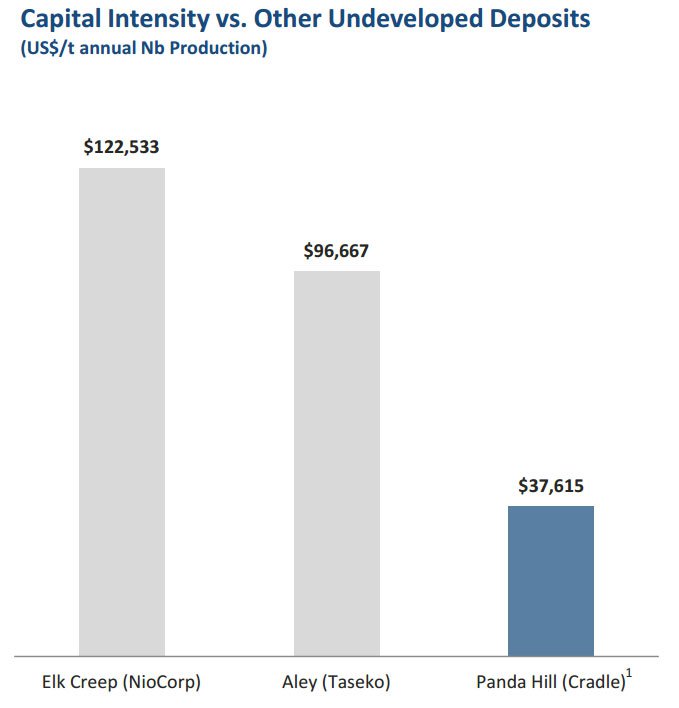

Running a peer comparison underlines how competitive Panda Hill is on cost

Here’s how CXX’s Panda Hill Project stacks up to other undeveloped niobium projects out there, in terms of capital intensity.

As you can see, Panda Hill is significantly less capital intensive than both NioCorp’s Elk Creep project and Taseko’s Aley projects to get off the ground.

CXX, with its joint venture partner, will need to spend $196MN to build its plant and other infrastructure but expectations are that it will be able to repay the entire amount in less than 5 years.

What do the analysts think?

As part of our stock-vetting process, we always like to see what analysts have to say.

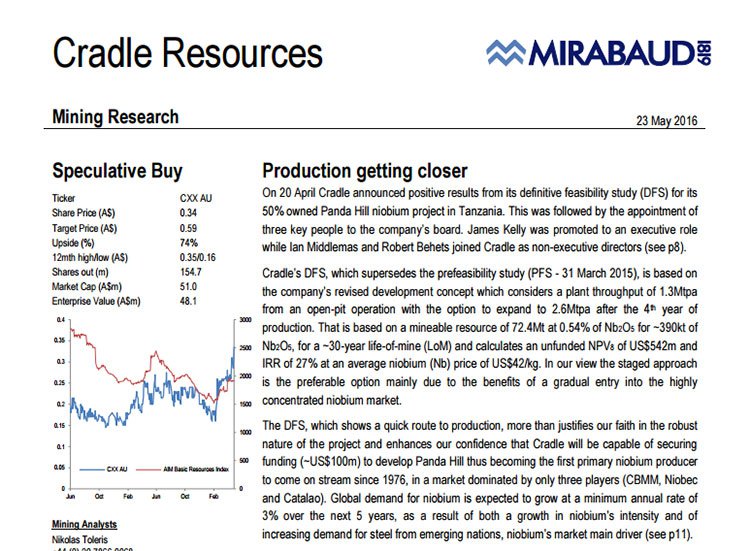

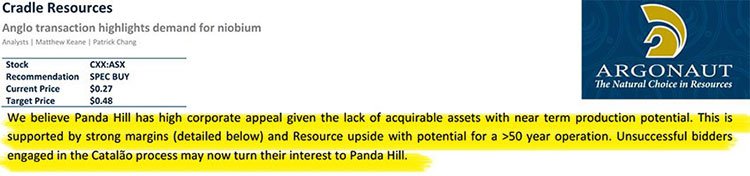

Mirabaud and Argonaut have been tracking CXX, and updated their calls in response to the DFS published in late April.

Click on the image to read Mirabaud’s Nikolas Toleris full report:

Mirabuad’s revised valuation of $0.59/share (from $0.56/share) is over 95% more than CXX’s current share price.

At the same time, there is no guarantee that CXX will go up in value based on this analyst report alone – always consider a range of factors before making an investment, including your own personal circumstances.

Matthew Kean and Patrick Chang from Argonaut see CXX as a “spec buy” and targeting A$0.48 by the end of the year – 60% above its current trading:

Again, analysts caution make up only one part of an overall investment decision, so apply caution and seek professional advice for further information about this stock.

Taking two steps back, to go three steps forward

CXX is pursuing low-cost niobium production in order to break into this tightly held boutique metals market.

With a superb DFS now in tow, its ambitions to break into the market, starting as a low cost producer, are looking good.

As we mentioned earlier, rather different from the standardised metals such as aluminium, iron and copper, Niobium is a key component of high strength, low alloy steel production and other specialist uses given its unique properties.

This gives the niobium a significant advantage over other metals from an economic fundamentals perspective.

If you need a quick refresher course on what niobium is, and what it does, make a cuppa and watch this video:

Although steel production has slowed globally and other metals markets have suffered from falling demand, the market for niobium has kept its ground rather well. Prices have remained stable over the past 10 years while demand is rising year-on-year.

Here’s what niobium looks like and what it’s used for:

Today, 10% of all newly manufactured steel has niobium in it – and that’s expected to grow because of the advantages niobium delivers for end-users.

So despite all the commodities fear-mongering out there, CXX has now acquired a strong DFS for a commodity that’s resisting the market turmoil and is forecast to grow as much as 3% in the long term.

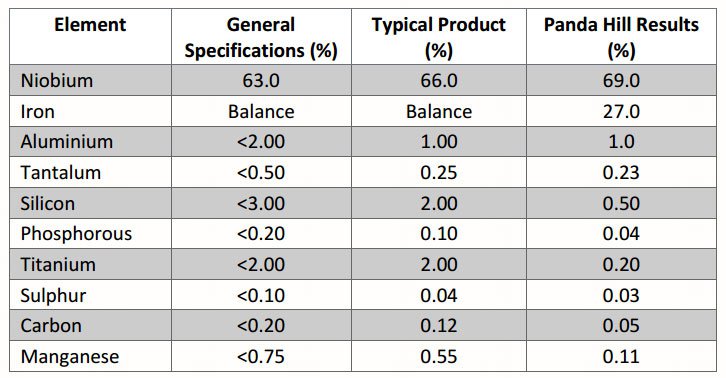

Here’s a photo of Panda Hills final product, recently tested at the ANSTO facility in Sydney.

These ferro-niobium buttons can be sold directly to steel mills as long as they meet the required grade. Tests done on Panda Hill’s ore shows it bears high-grade niobium with low impurities which puts CXX in a stronger position when negotiating offtakes.

Currently, there are only three producing Niobium mines in the world producing around 90,000 tonnes a year with a total value of US$2.2 billion.

The niobium market has been kept tighter than an Olympic weightlifter’s Lycra on competition day...

Brazil is currently the world’s largest producer of niobium, generating a whopping 85% of global capacity. So when it comes to niobium competition, the epicentre is Brazil.

Brazil has two of the largest niobium deposits in the world, the Araxá and the Catalão deposits. The Araxá mine is operated by CBMM while the Catalão mine is operated by Anglo American.

The current world leader in niobium production, by a country mile, is CBMM owned by the Moreira Salles family, one of Brazil’s wealthiest dynasties.

CBMM is privately owned and makes around US$600MN in annual profit. It has an estimated market value of around US$13 billion based on the sale of a 30% stake in its Araxa asset, to a group of Asian steelmakers for US$3.9BN in 2011.

And if you were wondering what this family looks like, here they all are:

When we compare the two companies side-by-side, it’s clearly a case of David & Goliath.

CBMM is worth around $13BN and makes around $600MN profit per year.

CXX on the other hand, is only valued at around A$45MN, but has a 50% stake in a project with an EBITDA of $112MN and a DFS outlining an NPV 8 (after tax) of US$542M – CXX is gunning to enter the field as a boutique producer, and even with this status, it would likely command a much larger market cap than today’s levels.

Small companies have to start somewhere and CXX seems to be in the right place at the right time and, in fact, has a good relationship with the BFG (Brazilian friendly giant).

However this is only the start of their journey and therefore requires a cautious approach when considering this stock for your portfolio.

The wider niobium industry is thriving

As we highlighted earlier, recently the niobium market saw a changing of the guard as Anglo American sold its niobium asset in Brazil for US$1.5BN to China Molybdenum as part of a massive restructuring mission led by CEO Mark Cutifani. Anglo’s Boa Vista mine and metallurgical plant was generating US$163 million of EBITDA in 2015.

Without speculating too much, China’s industrial powerhouse companies are seemingly cherry picking some great assets out there across several commodity types and geographies. It may have something to do with China’s intentions to compete on the world stage and to improve its terms of trade.

The move to acquire Anglo’s niobium assets yet again underlines that niobium has inherent value and could be a prelude for a huge demand ramp-up once broad economic activity picks up again globally.

Anglo’s sale also indicates that CXX is unlikely to have trouble in finding an offtake partner and ensuring it can offload all its product.

CXX wants to shoehorn itself into this tightly-held market, to produce around 6% of the world’s supply when it goes into production in around 2 years’ time

From the Cradle to the Bank

Once the world economy rebounds and starts chugging along, steel production is likely to follow suit with specialised boutique resources such as niobium, coking coal, zirconium and tantalum having a strong chance of seeing a spurt in demand.

Commodities and their demand/supply are very cyclical by nature so while global demand continues to wane today, in 2-3 years’ time when CXX is expected to go market, this could all be different.

The bottom line is that CXX has secured an economically viable project that can earn strong margins even in today’s downbeat commodities environment .

It has also put a strong operational team in place, including highly experienced Tanzanian operators Mr Ian Middlemas and Mr Robert Behets, who will dedicate the next six months to shoring up finances and improving operations in an effort to repeat the success they had with Mantra Resources.

CXX’s resource is sufficiently large to obtain ample institutional funding, to kick-off operations and would be able to provide early returns given the straightforward type of mining being planned.

Looking further out, CXX is targeting a bulky 200Mt-400Mt exploration target which will be summarily added to its overall Resource later down the track.

CXX is ready for today and primed for tomorrow – and that’s exactly what we like to see from our stocks here at The Next Mining Boom .

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.