GPR Targeting 1.2 Million Ounces in SE Asian Elephant Country

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

The Next Mining Boom presents this information for the use of readers in their decision to engage with this product. Please be aware that this is a very high risk product. We stress that this article should only be used as one part of this decision making process. You need to fully inform yourself of all factors and information relating to this product before engaging with it.

In the not-so-distant future, Southeast Asia could emerge as one of the most important regions in the global metals industry.

So far, the entire region has seen sparse exploration without a ‘mining industry,’ as such, to speak of.

That’s about to change courtesy of Geopacific Resources (ASX:GPR) — an Aussie gold explorer that isn’t afraid to take a chance on the promising region.

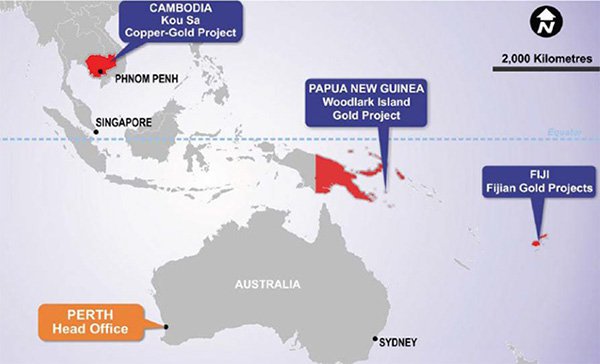

It turns out that Cambodia, Papua New Guinea, Fiji and the surrounding islands, sit on top of high grade metals mineralisation including copper/gold that was previously unattainable due to political and economic factors.

All that has changed over the past 25 years, with Southeast Asian countries now routinely ranking amongst the global leaders in growth and development.

With the combination of strong economic growth plus improved commodity exports, Southeast Asia could very well win out to become tomorrow’s commodities savannah all developers want to tap.

At the same time, given GPR is operating in PNG, this is a very high risk stock for political and social reasons. Getting mining projects up and running in countries such as PNG is no simple feat, and there may be challenges ahead.

GPR already has a strong foothold in the region with its high-potential Woodlark Project, including the Kulumadau and Busai deposits, where excellent assay results have just been recorded.

The latest news from this international gold explorer is that it has found more wide intersections of high-grade, near surface gold mineralisation with visible gold from the Kulumadau deposit at its Woodlark Gold Project in PNG.

These recent assay results give GPR the potential to upgrade Woodlark’s Resource inventory and deliver the plan to increase Reserves to 1.2 million ounces.

Results from further infill drilling delivered 21m @3.27 g/t gold at Kulumadau.

GPR’s operational space contains some significant geological features, pointing to a future hot-spot for mining all sorts of commodities...

And hopefully some rich commodity pickings for us and our readers, here at The Next Mining Boom .

The prime gold producing regions are fast becoming those with lower cost of production and better economics to support gold exploration and mining...

...and GPR presents as a junior explorer with the right numbers, a strong geographical position and a clear path to development.

Updating you on:

Geopacific Resources (ASX:GPR) is operating off the beaten track of gold exploration.

Let’s take a run through GPR’s operational space and background economics to see if it could grow into one of only a handful of producers in this promising region. GPR has three areas of focus: Kou Sa in Cambodia, Woodlark Island in PNG and a smattering of gold projects in Fiji.

We’ve written about GPR’s Cambodian potential several times over the past year and for some background, check out our previous articles:

- ‘GPR Accelerate Gold Production Plan with New Multi-Million Ounce Acquisition’ —July 2016

- ‘GPR: The Copper-Gold Explorer with an Ace up its Sleeve’ — November 2015

- GPR Looking to Prove Up Cambodia’s ‘Garden of Eden’ — September 2015

- ‘Fully-Funded ASX Explorer Following in Sandfire’s Footsteps’ — July 2015

GPR’s Kou Sa Project is coming along nicely with recent exploration uncovering a new gold anomaly. But more on that later.

The current focus is on the potential of Woodlark.

GPR recently agreed to acquire up to 80% of the undeveloped Woodlark Island Gold Project in PNG.

Here’s Managing Director Ron Heeks discussing Woodlark and why he believes GPR is on the path to production at Woodlark...

Woodlark currently hosts a 2.1Moz resource at 1.5g/t including 0.77Moz reserve at 2.2g/t, and has spent US$150 million on exploration and study work over recent years.

The acquisition, which involved an 80% earn-in joint venture with Kula Gold (ASX: KGD), paves the way for GPR to open its wings as a fully-fledged gold developer on the verge of a gold pour.

We always thought Kou Sa was unlikely to be GPR’s only market arrow given its broader Southeast Asian intentions.

Yet to see the company push forward into PNG at such an opportunistic time, inspires confidence in its overall strategy and goal to dominate the Asia/Pacific region from this early stage.

That means it won’t have to play catch up further down the track as the mid-cap developers plough in and cherry-pick the best projects.

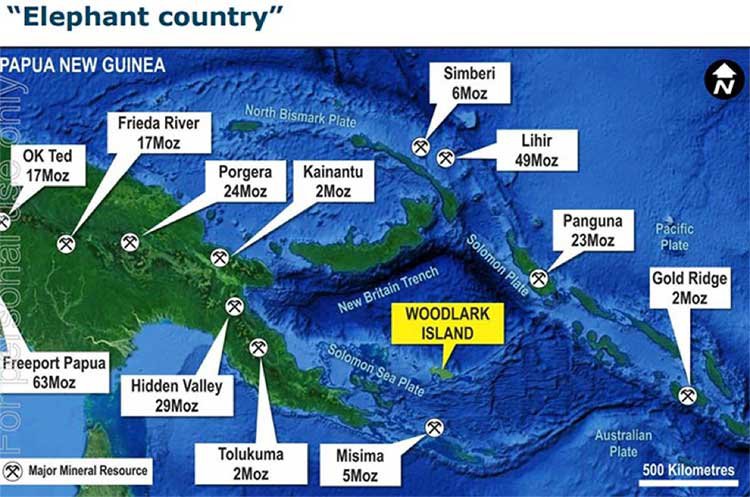

The region GPR has parachuted into is otherwise known as “Elephant Country”:

GPR’s locale boasts no less than 240Moz of known Resources, and with Woodlark Island now in the bag, GPR could potentially join this rank-and-file of gold bugs in the Pacific Ocean’s southeast.

Just a few weeks after the Woodlark transaction was finalised, GPR re-started “aggressive exploration”, to enable an updated reserve and rebased feasibility study to be completed in mid-2017, just a few months away now.

We’ll most definitely have our calendars marked for that date as it could prove to be an early catalyst for the company.

The big prize for GPR is to achieve its target of developing a project capable of delivering 150,000oz. per year over 10 years, in exchange for around $150 million in costs.

However, like all speculative mining stocks this is some time away and investors should apply caution to any investment decision.

An ounce of gold currently sells for around US$1,200 (AU$1,600), while GPR is also benefiting from the comparatively bargain-basement exploration costs in Southeast Asia. This means that GPR has some very workable numbers — and significant exploratory upside potential.

Here again is GPR’s Ron Heeks speaking at the RIU Explorer’s Conference this year.

Asia loves annual double-digit percentage lifts — and so do we.

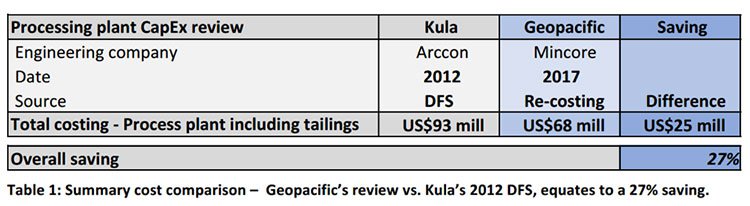

Virgin territories are not for the squeamish, but GPR’s efficient progress to date, including a 27% cut to costs, suggests Woodlark and PNG in general could be a glimmering new addition to global gold flows.

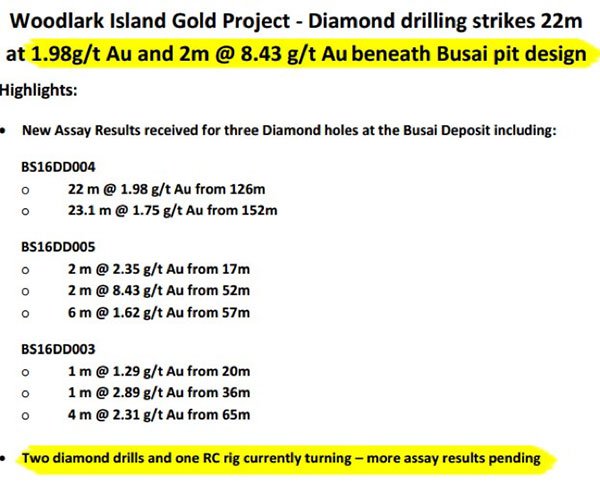

Here are recent assay results delivered by GPR in February:

Further results delivered in mid-March look like this:

And this:

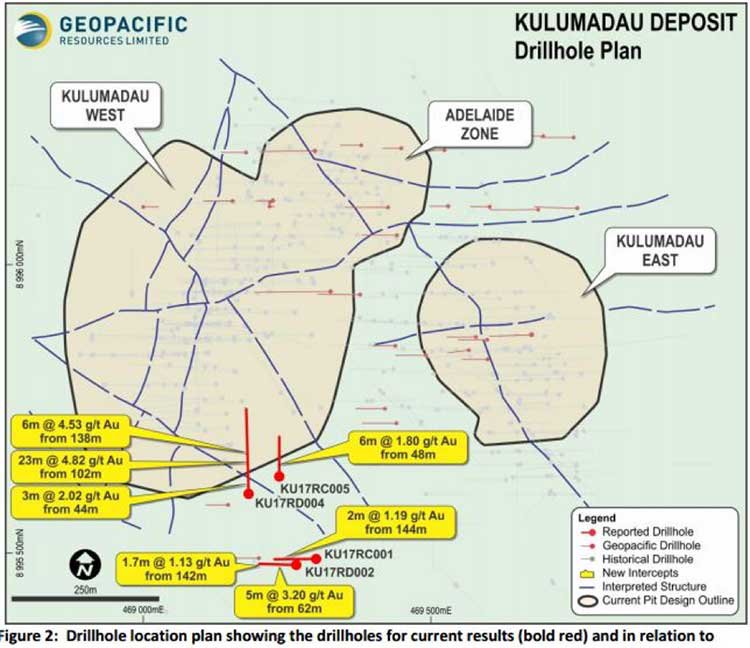

The following map indicates the positioning of the holes being assayed and why GPR believes it can increase its Reserve inventory.

With more drilling to come and GPR’s JV deal based on progressive exploration achievements, there’s a strong likelihood GPR is working up commercially-viable production at Woodlark.

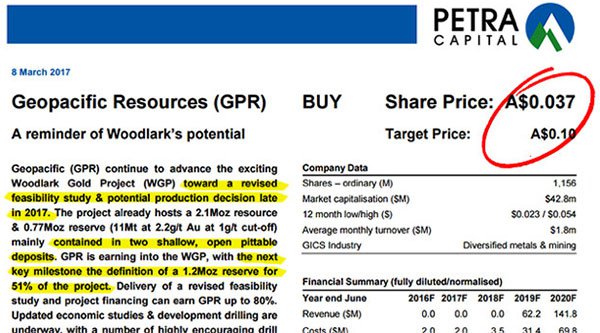

Let’s take a look at what analysts are saying about GPR’s chances in SE Asia:

Analysts from Petra Capital are targeting a share price of $0.10 per share, which represents a 167% return should GPR make good on its progress, in both exploration and associated mine design, processing efficiency and so on. At the same that price target is no guarantee to come to fruition – so invest with caution and not just on a price target alone.

And here’s the Sophisticated Investor’s, Adam Kiley’s analysis of GPR and its associated risks and potential rewards:

Once again, it is worth reiterating that that analysts don’t have a crystal ball, and make a number of assumptions when compiling their valuations – so don’t assume everything will turn out as planned.

It’s still early days but already, several indicators suggest GPR has a chance of romancing the stone out of this virgin gold region.

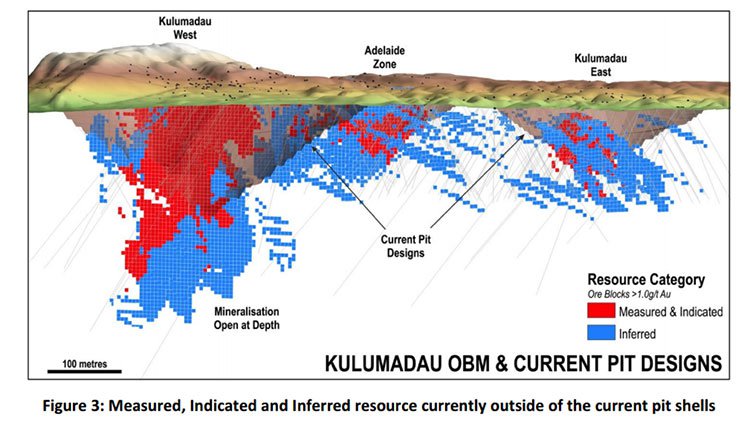

For the more technically-minded, here are GPR’s technical estimates

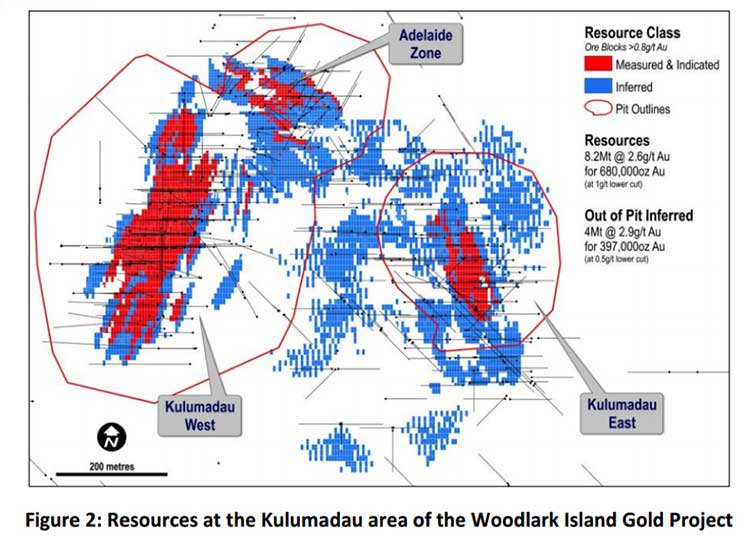

Resourceful GPR is already bagging Measured & Indicated Resources and summarily adding them to its growing batch of minable gold below the Kulumadau West prospect.

Now from a birds-eye view, here are the pit outlines GPR is already pencilling in around Kulumadau West, Adelaide Zone and Kulumadau East.

With a $8 million exploration spend, GPR could potentially add more minable ounces to its JORC Resource at Woodlark, and importantly, secure that 80% stake to ensure maximal cashflow when gold starts pouring.

In summation, GPR is on course to end up with a 150,000oz per year gold mining operation, likely to span at least 10 years, from which it will scoop 80% cashflow.

Considering the huge 200 million-plus revenue potential Woodlark has already, spending $8 million on developing (and possibly expanding) a known gold-bearing Project seems like a bright idea.

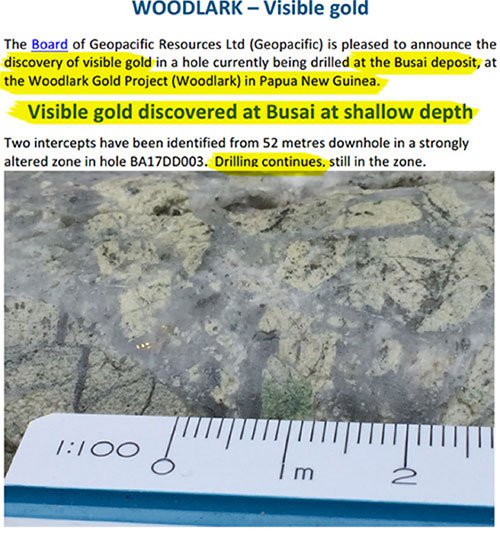

Going deeper for shallow gold

If there’s one thing that raises hopes of major gold sales at a later date...

...it’s finding visible gold outcroppings and gold mineralisation at less than 100m depth.

This goes back to the huge wealth of potential at GPR’s disposal, made possible by spearheading exploration in a relatively unexplored region.

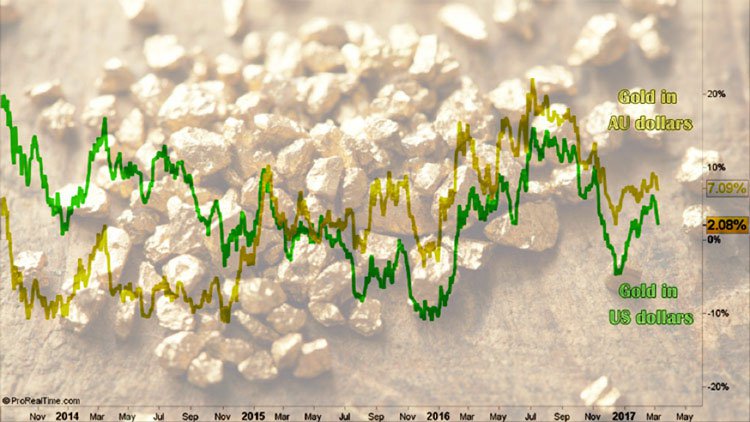

Gold prices are stable and trending

Gold prices have been on a reassuringly stable platform since 2014 — refusing to find new heights above US$1,370/oz., and maintaining a strong floor above US$1,000/oz.

In fact, since 2013 the US gold price has risen by just 2%, and the Aussie gold price by 7%.

GPR’s low-cost production, combined with four years of steady gold prices, within the US$1,000-US$1,400 range, all add up for GPR.

At the same, the price of gold can fluctuate, and shouldn’t be the only basis for an investment – seek professional advice if considering this stock for your portfolio.

Recapping Cambodia

In acknowledgement of the changing dynamics, GPR moved into Cambodia in 2013, securing 153km 2 of exploration ground.

The pace of GPR’s Cambodian adventure at Kou Sa has slowed, but it still has excellent long term potential.

To improve its Terms of Trade, Cambodia is moving quickly to develop a mining exports industry. With the assistance of foreign companies such as GPR, Cambodia wants to realise the mining potential within its borders.

GPR is leading the way by helping Cambodian authorities develop best practise mining legislation and has been fortunate enough to expedite its exploration on the back of strong geophysics.

Supported by institutional resource funds and with $23 million committed, GPR is moving full steam ahead to achieve its goals of defining a JORC resource, moving onto a scoping study and eventually producing over 150,000t of copper equivalent per year.

Tertiary factors

GPR’s leader and the man responsible for its navigation is Ron Heeks who you heard from earlier — a gold market veteran who has managed over ten mines in six different countries.

His speciality is nurturing and expanding relatively small prospects into large Projects. His industry experience is second to none and comes readily available with demonstrable results relating to Resource definition, JV negotiation, M&A, prospect selection and capital expenditure.

Mr. Heeks has managed reams of large portfolios in his 30-plus year career, so seeing him with the reigns at GPR is reassuring.

Both his geological and capital management skills are being rigorously tested given GPR’s SE Asian operational space, but this only serves to further substantiate the opportunity GPR has.

As long as its development path remains smooth, GPR could end up with one of the largest gold Resources in the region, whilst maintaining a low cost base compared to its peers.

Building an allotment in the Garden of Eden

GPR is one of those companies that has indomitable ambition. An ambition to participate in the development of one of the world’s remaining commodity hotspots, containing ample quantities and grades of many different commodities.

While many other gold bugs have been seen scampering into the safe-havens of Western Australian gold and gold deposits with extensive historical drilling (in the hope of scoring solid deposits with a low-risk of failure presumably)...

...other explorers such as GPR are taking a different route to its first gold pour.

SE Asia offers a potentially enormous level of both grade and quantity of metals mineralisation in the region.

Furthermore, GPR’s future development is largely de-risked because of the work it has put in already.

GPR has been working at the sharp end of helping Cambodian authorities introduce the country’s first meaningful Mining legislation and raise up a metals industry to support the country’s immense growth rate.

Now with the 1.2Moz Woodlark Project acquired, GPR has effectively taken a shortcut to its first batch of gold.

Woodlark is one of the last multi-million ounce, fully permitted, unmined gold projects in the world.

GPR is now on course to earn-in to about 80% of Woodlark and will likely see production continue for around 10 years (assuming no further mine expansions).

GPR is riding a wave of metals resurgence towards commercialising its dream of developing a previously untapped territory, and therefore reaping the above average returns such undertakings can offer.

With actual results now proving the grades GPR was confident of tapping, it may be good time to make some extra space for GPR in our Next Mining Boom small-cap portfolio.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.