GPR Accelerate Gold Production Plan with New Multi-Million Ounce Acquisition

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

The Next Mining Boom presents this information for the use of readers in their decision to engage with this product. Please be aware that this is a very high risk product. We stress that this article should only be used as one part of this decision making process. You need to fully inform yourself of all factors and information relating to this product before engaging with it.

Savvy investors have a keen eye for small-cap players with large-cap future potential — and there’s no better place to find such opportunities than the junior gold sector right now.

One junior of interest is Geopacific Resources (ASX:GPR), who we have been tracking since early 2015 as it ventured into Cambodia in an effort to establish the country’s first ever metals mine.

What has piqued our interest further since we last checked in on GPR, is that this enthused explorer has gone out and added an entirely new asset onto its books — an advanced asset in PNG that will likely go into production prior to the Cambodian Kou Sa Project.

The asset is the Woodlark Island Gold Project.

Woodlark is one of the last multi-million ounce, fully permitted, unmined gold projects in the world.

Make no mistake, this is not an exploration project, it is a development project and at Woodlark GPR just needs to convert existing resources into reserves.

Woodlark is part of a joint venture (75/25 in GPR’s favour) deal with ASX-listed company Kula Gold (ASX:KGD) which was listed by Credit Suisse as one of its “top stock picks for the brave”.

Woodlark could well add considerable value to GPR’s portfolio in the near term. The company expects this acquisition to fast track its production ambitions, as it moves towards production with a modest outlay for what could be considerable rewards. Looking at the figures the deal means GPR is paying $11/resource oz. for the gold at Woodlark. That is a good deal.

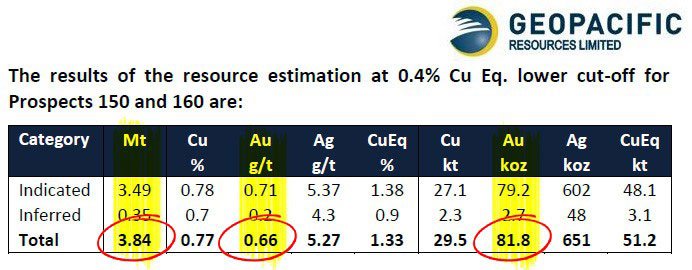

Meanwhile steady progress is being made at Kou Sa. A recently published JORC resource estimate of around 3.84Mt at 0.66g/t gold for 81,800oz and 29,500t of copper at 0.77% as an initial estimate from Prospects 150 and 160 at its Kou Sa Project in Cambodia serves as a prelude to its highly-awaited Scoping Study due later this year.

Finally, with the gold price so strong right now, GPR’s Nabila project in Fiji has been brought back to prominence. Faddy’s Prospect at this project also holds the prospect of near-term cash-flow for GPR, with the potential to process ore at Lion One Limited’s proposed Tuvatu Plant.

Before we go too far, it should be noted that for political and social reasons, this is a very high risk stock. Getting mining projects up and running in countries such as PNG is no simple feat, and there may be challenges ahead.

Holding these three plays together at GPR is Mr Ron Heeks, the man who found the coal that allowed Sebuku to list on the Singapore Stock Exchange with a float of more than $400M.

Mr Heeks and the entire GPR team have decades of experience in getting projects off the ground in under developed countries such as China, Indonesia, Mongolia and West Africa.

Clearly these are strong projects in strong hands and there are plenty of catalysts on the horizon as GPR resumes its push towards becoming an established gold producer by the end of 2016.

With all that and more, we update you on:

GPR is eyeing up production at its newly acquired asset in PNG, as well as progressing its Kou Sa Project in Cambodia as far as possible towards production.

While the Kou Sa Project has up until this point been the flagship project for GPR and still holds significant potential, its Woodlark Project in PNG is in an advanced stage and provides an opportunity to add significant advance stage resources to the company’s portfolio with the aim to generate revenues as early as possible.

Let us go through GPR’s asset portfolio and mission plan, to see whether this bravely ardent gold explorer has the minerals to prosper.

GPR has pulled the trigger on acquiring a new asset in Papua New Guinea (PNG) — The Woodlark Island Gold Project

Being a successful gold mining company has a lot to do with smart acquisitions, made at the right time.

Many strongly performing ASX gold companies have picked up discounted assets and diligently moved them into higher multiples of value over the past few years....

...and that’s exactly what GPR intends to do with Woodlark.

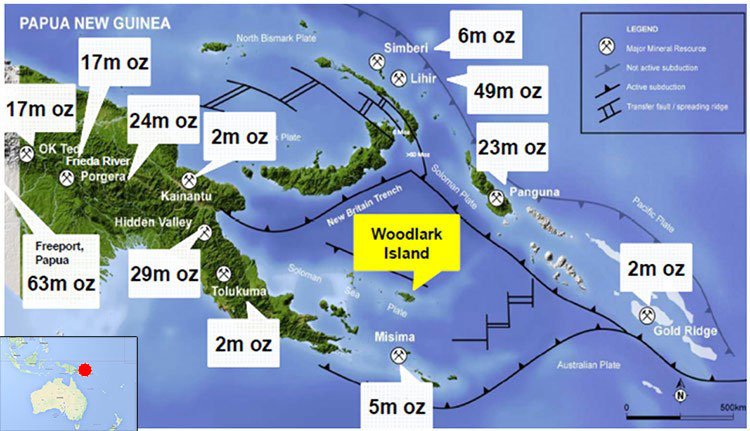

Here it is in all its glory, mapped out amongst a sea of multi-million ounce gold projects that Papua New Guinea is endowed with:

As you can see, Woodlark is located smack bang in the middle of a dozen existing Resources ranging from 2 million ounces, as high as 63 million ounces.

This next map shows the blue sky potential for Woodlark beyond the near term production plan, with more than 15 exploration targets already identified.

Aeromagnetics with current resource areas and epithermal gold exploration targets.

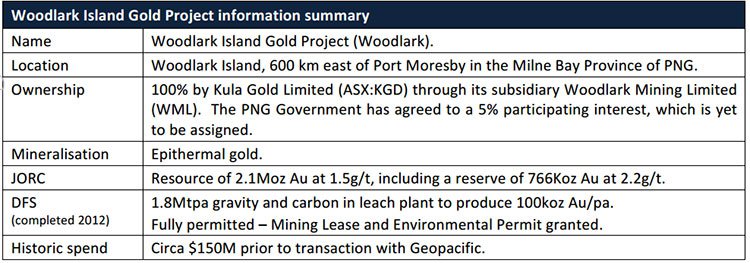

Woodlark itself, already has a gold resource definition of 2.1 million ounces and a Reserve of 766,000oz.

Here is a quick summary table of the main features of Woodlark Island:

GPR is taking on Woodlark as part of a JV deal with ASX-listed Kula Gold (ASX:KGD) on a 75/25 split in GPR’s favour – with a opportunity to move up to 80% if they finance KGD’s share of development costs.

GPR will need to commit up to $18.65MN, but this funding commitment is to be spread over three tranches , thereby reducing the pressure on GPR, and leaving room for buying into more of the project if required.

There is no guarantee that the opportunity for alternative buyers will last as long though, as GPR has built incentive targets into the deal that could see them getting the project even more cheaply and moving to production more quickly.

Essentially, the nature of the deal means GPR is paying $11/resource oz. for the gold at Woodlark and the project is permitted to go straight into production when GPR choose – an important point which means Woodlark is ready to build. What GPR want to do now is convert existing resources into reserves.

There are no vendor payments required, and all funds will be used to advance the project to production, with GPR making the decision to move into Tranche 2 before December this year.

Given Woodlark is a development project with a defined 2 million ounce resource and full permitting, it’s likely to catapult GPR into the gold production stakes much sooner than previously thought.

It’s worth reiterating – Woodlark is one of the last multi-million ounce, unmined gold projects in the world that does not require any further permitting or legacy dispute issues – and it’s now set to be in GPR’s capable hands.

That’s a game-changer.

In its own right, Woodlark could be a strong asset for years to come. But when added to its other South East Asian assets, GPR is making a strong case to become the next enviable gold producer listed on the ASX. How far to the finish at Woodlark?

GPR has the control here – the company is the sole manager and sole funder of the project during the earn-in period.

We have seen that the successful track record of the team at GPR has attracted the support of significant resource funds in the past at its Cambodian project, so hopefully there should be no problem funding Woodlark into production.

However at the same time, there is no absolute guarantee that this will be funded. Like all speculative mining stocks, apply caution to any investment decision.

For GPR to start mining they must first rebase some of the CAPEX and OPEX estimates for the project and move existing, inferred and indicated resources into proven and probable categories.

Considering that the costs were done at the height of the mining boom, GPR has an ‘edge’ it can use to its advantage — by updating a rather outdated Definitive Feasibility Study (DFS) done way back in 2012.

There is now more data, more expertise and fresh operators to move Woodlark along.

Given the GPR’s team has previously worked on over ten mines in six countries with similar project caveats, we think Woodlark is a great acquisition that could well firm up GPR’s valuation, especially if the spot gold price continues to rise.

In fact, in many ways, the trajectory GPR are looking to take at Woodlark could be compared to Dacian Gold’s (ASX:DCN) path.

Dacian’s market cap currently sits at $459.9M, a long way from GPR’s $34.3M, however GPR is confident that similarities between the two projects could see GPR start to bridge the valuation gap.

Like Dacian, GPR has an experienced team with a track record of developing and funding projects into production – which is likely why Kula approached GPR to reinvigorate the Woodlark project.

While Dacian’s resource is slightly larger, the average grade is similar.

GPR’s point of difference however, is in time frame and cost to get to production, and the fact it will not face the issues encountered by Dacian – such as moving tailings pits and working around/dewatering a pit from previous mining.

Dacian has taken a few years to prove up its resource in Australia, but GPR gets its by completing the work already done by Kula, before the project stalled due to macro-economic factors.

What Kula did achieve over previous years was the all-important permitting work, which has been very useful to GPR because it significantly shortens its time horizon to production.

GPR’s plan is to rapidly increase the gold reserves to 1.2Moz – and by that time it will essentially be build-ready.

In essence this plan for Woodlark is very similar to Dacian was able to achieve, and thus deliver its $460M valuation.

For example, like Dacian, GPR will schedule production so that the high-grade is processed first to reduce the payback period, leaving low grade to the end when the costs are very low.

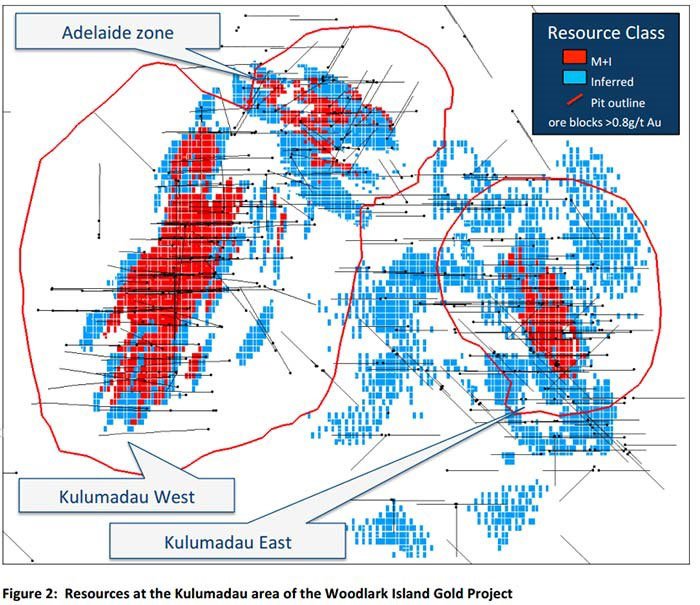

In the chart below, you can see GPR’s Measured and Indicated Resources shown in red, and Inferred resources shown in blue.

GPR will be working as quickly as possible to collate and convert existing resources.

Currently, GPR estimates it can convert ~500,000 gold ounces from resource to reserve categories over the coming months.

And then there is the exploration potential on top of its all, so it’s not hard to see Woodlark growing into a 5 million ounce goldfield, just like the others that dot the region.

The main goal is to prove up a reserve base of 1.2 million ounces of gold as an initial first step, and then develop Woodlark into production.

When early-stage speculative plays make it onto the investment banking radar — it could be a time to sit up and take notice

In further good news related to GPR’s latest acquisition, earlier this year, The Sydney Morning Herald published an opinion piece citing Kula Gold as one of “top stocks for the brave” owing to the potential of the Woodlark project.

It’s a big call by Credit Suisse, but one that investors are sure to take note of, especially when they see it in the context of the overall GPR play – remember GPR is now earning into 75% of the very asset that got Credit Suisse interested in Kula Gold...

Kou Sa Project

Although Woodlark has become GPR’s main focus to early production, the Kou Sa Project in Cambodia is also on a highly prospective path to becoming a long-term gold producer.

GPR has been working on Kou Sa for quite a while, and it’s partly because Cambodia is a rather virgin territory with significant unexplored resource potential. The Cambodian Government wants to tap the value of Cambodia’s geology and crystallise some of the mineral value previously overlooked.

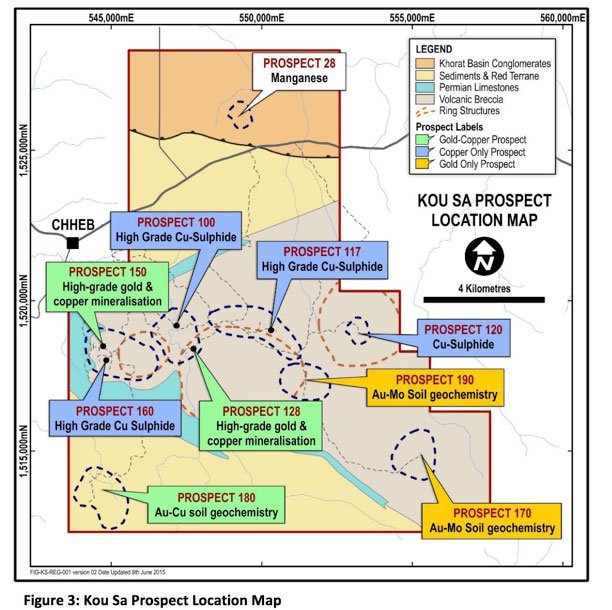

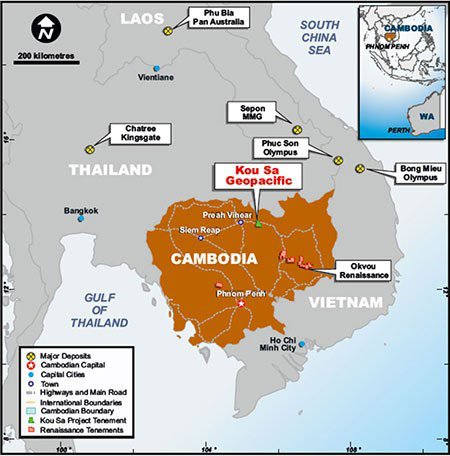

Here is the Kou Sa Project in a regional context:

The Kou Sa project is a joint venture between GPR, which has an 85% stake and the Royal Group, a Cambodian conglomerate with the local connections and know-how to assist GPR along the way.

The entire Kou Sa deal structure was recently renegotiated (in GPR’s favour) — with cash payments now deferred until the completion of two production milestones.

This tweak allows GPR to focus on exploration by de-risking the funding uncertainty until at least the production stage (by which time GPR will hopefully have Woodlark up and running as a production asset).

Drilling deeper

Looking deeper into Kou Sa, GPR has recently published JORC resource estimates which are being summarily added into a comprehensive Scoping Study expected later this year.

In the meantime, GPR has a provisional exploration estimate. Later this year, that estimate will hopefully transform into firmly penned resource targets. It’s also worth noting the new epithermal gold discovery at Prospect 190 (P190), which holds much promise for the company.

Here are the latest resource estimates from Kou Sa:

GPR has identified around 3.84Mt at 0.66g/t for 81,800oz gold and 29,500t of copper at 0.77% as an initial estimate from Prospects 150 and 160 alone.

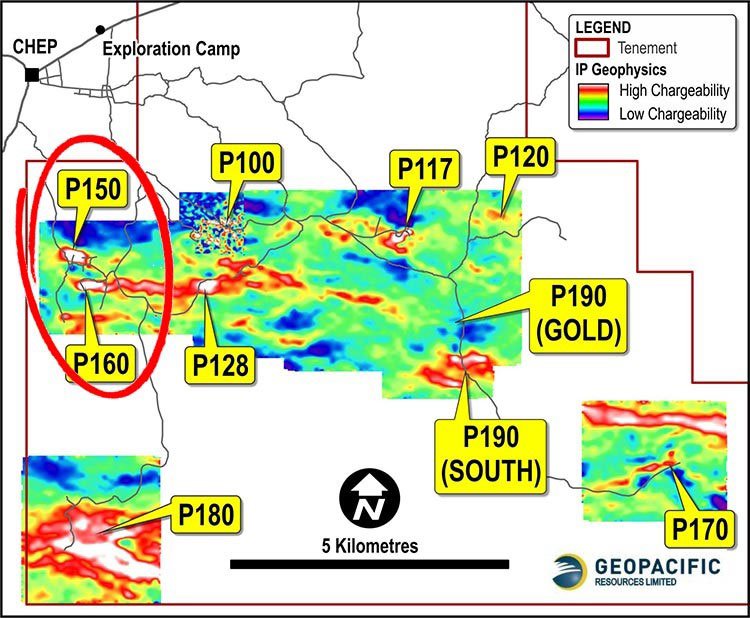

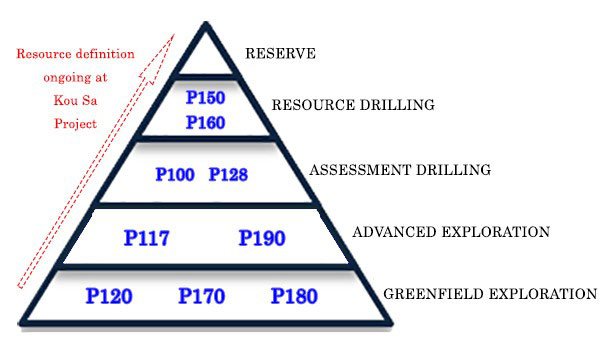

GPR also has several more high Prospects at Kou Sa, which will serve to expand production over the years to come, as can be seen from the map below:

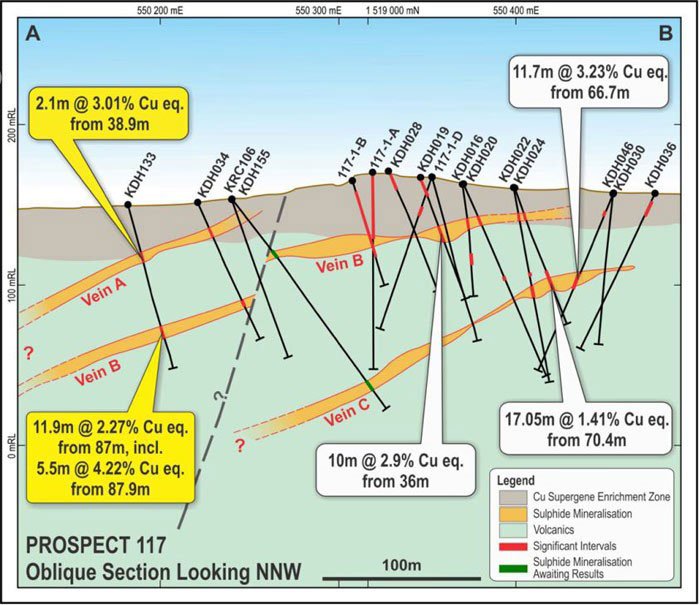

In addition to P150 and P160 (circled in red), GPR is also conducting exploratory drilling at Prospects P100, P117, P128 and P190, labelled above.

GPR is also progressing its 4 other prospects which will be summarily added to its Scoping Study and a revised JORC Resource for the entire Kou Sa Project.

The two standout features of Kou Sa, are its shallow mineralisation and high-grade ore that is expected to perform well in processing.

GPR is being smart about where and how it fills its boots with gold. The first target is the high-grade, shallow mineralisation that litters Kou Sa.

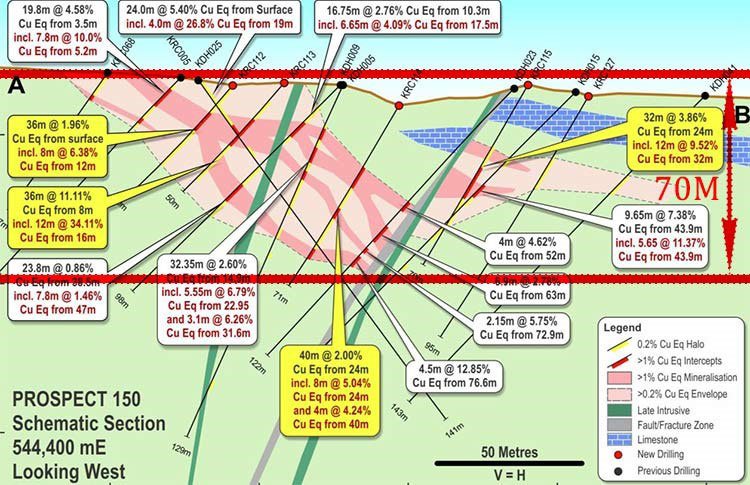

Take a look at this schematic section of Prospect 150:

GPR expects to wade into gold production at depths less than 70 metres.

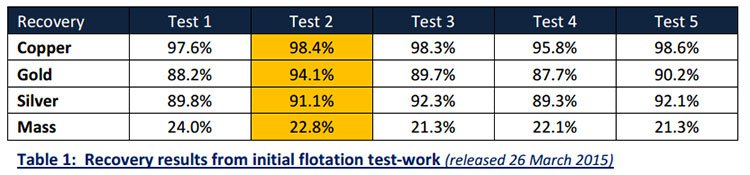

When looking at GPR’s recovery rates, the gold portion of its mined ore scores an average recovery rate of 89% across five flotation tests done earlier this year:

What these tests show is that GPR is working with a high-grade gold project that has a strong chance of long-term commercial viability.

Therefore, GPR has the prospective ground, the cash to drill and some very positive early results.

Summarising all GPR’s prospects at the Kou Sa Project, and their current status:

The timing of GPR’s gear-change could also lend a hand, as gold prices continue to march north since the start of 2016.

The past performance of this product is not and should not be taken as an indication of future performance. Caution should be exercised in assessing past performance. This product, like all other financial products, is subject to market forces and unpredictable events that may adversely affect future performance.

Gold priced in US dollars has risen around 30% since January 1 st 2016, while in Australian dollars, spot gold is up 41%, at the time of writing.

The macroeconomic environment is a key factor for any gold explorer, especially one at GPR’s development stage where its ongoing Kou Sa Scoping Study will attempt to factor in gold prices, exchange rates and other project economic caveats that have the power to make or break GPR’s chances.

If Kou Sa proves economically viable as part of its Scoping Study, it could be another path to revaluation on top of what is expected from its Woodlark PNG near term production play.

Not forgetting Fiji

With so much to look forward to with GPR, one could be forgiven for entirely forgetting GPR’s other, less-well-known SE Asian asset — in Fiji.

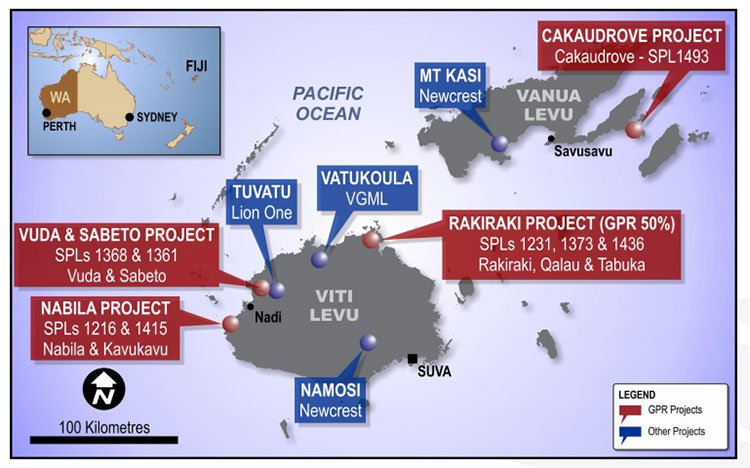

In Fiji, GPR has 4 projects which have the potential of gold production in the near-term via toll milling. Additional long-term development of stand-alone mine could also expand the rate of production significantly.

Here are GPR’s Fiji assets mapped out:

Fiji represents yet another potential value-add piece of the gold puzzle of GPR. To what extent will require time and more exploration progress, but by the same token, raises the chances of strong price catalysts over the coming months.

The man behind the curtain

Pulling the strings for GPR and its march towards production and near term revenues is Ron Heeks. Heeks spoke to Finfeed about the Kou Sa project and its team back in November 2015.

Here’s part of that interview:

“The team at GPR has significant experience with successfully taking projects from exploration into production in emerging economies. This experience means that the team understand the importance making an early start in working with local authorities to establish what the relevant business and infrastructure frameworks will be and how they will affect GPR.”

It perfectly describes what has been happening in Kou Sa since GPR entered Cambodia in 2013.

In fact the board and senior management team have built ten mines in six countries, most of which were in physically or socio-economically challenging jurisdictions including China, Indonesia, Mongolia and West Africa.

As for Mr Heeks among other roles, he was the Technical Manager of Straits Asia responsible for the restart of the Mount Muro gold mine, including two new gold discoveries, developing them into viable deposits and then starting mining operations.

He was also responsible for re-evaluating the exploration strategy at the Sebuku coal operation and subsequently enabling an increase of resources and reserves to over 300 million tonnes. This is the company that became the first mining company listed on Singapore Stock Exchange, with a float of more than $400M.

During this time Mr Heeks managed more than 1000 employees, exploration programs with ten helicopter-supported drilling rigs and mining operations covering five open-cut pits and two commodities.

As you can see, he has vast experience and that goes well with managing three projects for GPR in three different countries.

Kick-starting into a gold gear

As we stated earlier, the current state of the overall ‘gold market’ has been steadily improving since the start of this year.

Several ASX-listed gold miners have defied the commodity naysayers and severe market turbulence, by acquiring projects at value or improving their own internal production efficiency to make their operations economic.

With the price of gold has started to climb and it’s taking gold miners with it.

At the same, the price of gold can fluctuate, and shouldn’t be the only basis for an investment – seek professional advice if considering this stock for your portfolio.

GPR has set its market play in SE Asia, a low-cost operating area with a blank canvas as an added bonus in Cambodia.

The recent acquisition of Woodlark bolsters GPR’s commercial chances with production cash flow now expected to trickle in by the end of the year.

Last but not least, GPR also has a Fijian hand to play with four high-grade projects on its books, located in and around proven resources (just like in PNG and Cambodia by the way).

All in all, GPR assembled a neat path to gold production that has been significantly hastened via a smart acquisition and gold’s reversion back to its long-term upward trend.

With these factors falling into alignment, this SE Asian gold starlet with near term production presents an interesting opportunity, just as gold prices come back into focus.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.