Fully Funded BLK on Clear Path to Gold Production

Published 24-SEP-2015 10:16 A.M.

|

11 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

The last time The Next Mining Boom wrote about Blackham Resources (ASX:BLK), we liked what we saw.

With a lot of gold companies, especially the smaller ones, the gold resource is only one part of the equation.

Quite rightly, smaller companies spend several years poking around trying to prove up a resource.

Good intersections, bonanza grades, and promising technical work get the market excited – but why?

Long term investors don’t buy gold stocks because the companies involved find gold – they get involved because at the end of the day the company will be selling this gold.

Share price movement on a particularly good assay is essentially a bet on whether or not the company’s gold will be sold at some point in time and eventually start generating cash for shareholders.

There’s nothing wrong with that of course, and represents an early entry point for investors, in a potentially rewarding project down the track.

However, BLK is different.

BLK has a market cap of $31 million and a share price of 16c (at the time of writing).

It has had several extremely promising exploration results in recent times, with high grade hits and resource extensions the order of the day.

It told investors during its latest such announcement that previous modelling on one of the project’s key extensions had appeared to be conservatively modelled in the past on the back of key assay results.

But here’s the thing: it could be producing as soon as the second quarter next year.

At the same time, BLK is a speculative stock, and there are risks involved in investing in small cap miners like BLK.

Thanks to a canny deal struck by BLK management – who opportunistically picked up the company’s assets from a distressed seller – it has its hands on a great gold resource and a previously-mothballed gold plant which simply needs a bit of TLC in order to start producing 100,000 ounces of gold per year...

Better yet, the company is fully funded to production.

BLK has all the promise of an early-stage gold stock with the near-term production capability of an established player

BLK is shaping as the best of both worlds, and it happens to have some of the more active acquirers of gold projects nearby...

Re-introducing:

We first wrote about Blackham Resources (ASX:BLK) back in May in the article ASX Junior to Unleash 100koz pa Gold Machine: Funding Now Secured , on the back of the $38.5M funding deal the company landed, which is enough to cover them all the way to production.

In this article we will update you on all the latest activity happening with this emerging gold producer.

But first, let’s see what a few others have been recently saying about BLK.

A number of analysts have been running the ruler over BLK, including Mining Analyst Adam Kiley from The Sophisticated Investor :

Mr Kiley values BLK at 40 cents a share – that’s 150% more than BLK’s current trading levels. At the same time – this is based on a number of assumptions, and there is no guarantee BLK will hit these kinds of highs.

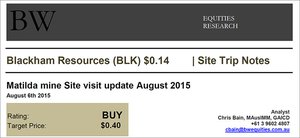

BW Equities analyst Chris Bain also recently confirmed a BLK target price of 40 cents a share following a site visit to the Matilda Gold Project – that’s a second analyst predicting a 150% gain from today’s level:

Like all analysts though – these are just educated guesses based on some assumptions – reports like these aren’t the only thing we go by when making an investment.

State One Stockbroking recently released a report on BLK – listing a target price of A$0.36 – that’s a 125% gain from today’s level:

Once again, just to be clear, there is no guarantee this share price will eventuate for BLK – and investors should seek professional advice before investing in this stock.

BLK does have other things on its plate, but the real focus is BLK’s major resource play – the Matilda Gold Project:

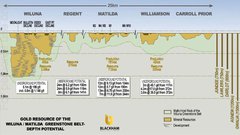

The Matilda Gold Project in the Northern Yilgarn region of Western Australia is surrounded by a regional endowment of 40 million ounces of gold, and BLK’s 780km2 of highly prospective ground gives it plenty of room to grow.

Essentially Matilda is a cluster of high-grade gold resources arranged around the Wiluna Gold Plant.

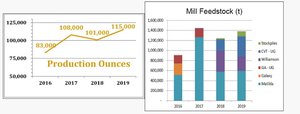

The big idea is to progressively bring each of the resources online, reactivate the Wiluna Gold Plant, and get first production of high-grade gold by Q2 of 2016.

The $150 million Wiluna Gold Plant is owned by BLK and currently in care and maintenance, but when it’s back in operation, it will process the ores mined by BLK for immediate sale using a low risk, free milling process – crush, grind, gravity, and CIL:

Currently, the entire Matilda Gold Project has a measured, indicated, and inferred resource of 44 million tonnes of ore at a grade of 3.3% gold – that’s 4.7 million ounces of gold .

The first stage of production will be soft oxide and free milling, using the existing resources at the Matilda Mine, with additional gold ores coming from the high grade reefs like Golden Age, Galaxy and Caledonia.

Matilda – getting the party started

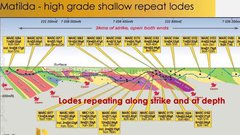

The first resource BLK will bring into production is the Matilda Mine, which has JORC inferred, indicated and measured resources of 12.5Mt @ 1.8g/t for 712,000oz.

It will send the gold to the Wiluna Plant – set to produce 100,000/oz. of gold per year.

Back in July, the resource estimate for Matilda received a 40% boost from the positive results of a drilling program to 7,260,000t @ 1.8g/t for 424,000oz Au. Drilling work is ongoing and Matilda could see yet more upgrades in size.

BLK’s plan is to reactivate the open cut mine, dig deeper, and define new zones of mineralisation to target through exploration to keep the Wiluna Plant churning out gold.

It recently told the market that as a result of further drilling at Matilda, it had firmed up a new high-grade lode and extended mineralization at existing pits.

Earlier this month it further firmed up its view of Matilda with another round of drilling identifying a number of extensions that could “expand and add further confidence to the free milling, open pit inventory” .

This included adding further confidence to the base of a crucial pit, with hits such as 14.5m @ 6.74g/t from 163m confirmed the pit as a source of free-milling high-grade gold to get the Matilda up and going.

Mine economics

At the moment BLK is working towards a Definitive Feasibility Study, drilling away to bring other resources into the indicated category – hence the regular drilling results flowing into the market right now.

But even before it has a DFS in the bag, BLK has done some modelling of cash costs which caused us to do somewhat of a double-take.

It has estimated that once things are up and running, that it will have cash costs between A$1000 per ounce produced and A$1,100/oz.

The current gold price is roughly $1,600/oz. (at the time of writing), meaning it has a margin of between $500 and $600/oz. However caution should be applied here – the price of gold does fluctuate, and could be different when BLK enters production.

Remember that the plant is scheduled to produce 100,000/oz. per year...

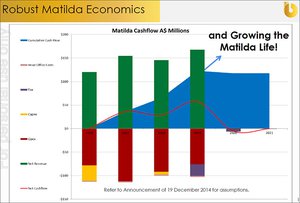

BLK has estimated free cash flow at $162 million (using a A$1,500/oz gold price) over the initial four years of the Matilda Gold Project’s 10 year initial mining and processing life.

With a small capex of just $25 million the project produces some very strong cash flow.

That rapid early cash flow should result in a payback on capital expenditure within just nine months .

Best of all, BLK’s Matilda Gold Project is fully funded to production – the company has secured a $38.5 million funding package from Orion Mine Finance, a mining-focused investment business managing over $2 billion of funds.

Under the terms of the deal, BLK gets a $2.5M private placement, a $6M initial loan, and a further $30M once the DFS has been completed.

This is a true turnkey operation – BLK can mine and process its own ore into high purity gold using the Wiluna Gold Plant, prior to refining into LME grade 99.99% gold bars at the Perth Mint.

And for BLK, it now looks as though even more gold will be stacked up by the Matilda Gold Project for imminent processing...

Galaxy and Golden Age

While Matilda will provide the initial free-milling ore to get the Wiluna Gold Plant up and running, the broader project has been envisioned as a staged development, with other mines such as Galaxy, Golden Age, and Williamson coming on stream later in the process.

Recent drilling has focused on the Galaxy and Golden Age deposits.

Golden Age Bonanza Grades

Initial assay results at Golden Age bought up a bonanza grade hit of 5.1m @ 198 g/tonne .

The rest of the assay results confirmed the high grade nature of the Golden Age Reef and that the system was still open.

The hits included:

* 2.2m @ 18.9 g/t including 0.8m @ 42.1 g/t .

* 0.9m @ 24.8g/t

* 3m @ 9.18 g/t

* 0.7m @ 16.2 g/t

BLK Managing Director Bryan Dixon said the latest set of results demonstrated BLK now has more gold on its hands than it previously thought .

“The drilling at Golden Age has confirmed our understanding that this deposit has significantly further high-grade potential, that remains open, and has previously been conservatively modelled,” he said.

That’s right. Conservatively modelled.

The higher grade Golden Age ore will be blended with Matilda open pit ore to increase the head-grade of the mill feed.

Galaxy – Impressive grade ore near surface

Galaxy has also been producing some high grade results.

At the moment, BLK is at the Pre-Feasibility phase on the Galaxy Mine, but as it is just 13km away from the Wiluna Gold Plant, it’s shaping up as a valuable source of feedstock as the plant starts to ramp up production.

At the end of August, BLK released the latest drilling results at Galaxy .

It had drilled four holes at the pit shell area in order to give it confidence that it was on the right track.

Suffice to say, hits including 2.5m @12.84g/t from 80m, 3.6m @ 6.39g/t from 35.1m and 7.5m @3.14 g/t from 7.8m did just that.

The results effectively firmed up BLK’s theory that the high-grade Galaxy deposit starts from the surface – meaning more cost-effective mining.

What’s more, BLK said these results combined with previous drilling meant that “high grade shoots are stacked, flatter lying and have greater strike extensions than previously modelled”.

In other words, it has more gold on its hands at Galaxy than previous thought.

A further drilling program is currently in the works at Galaxy, which is being designed as a testing program of an eastern extension – meaning there could be more for investors to chew on in the not-too-distant future.

It’s these kinds of updates from gold miners which get the market looking closely at a stock, but in the case of BLK there is a train of thought that it could being examined by ‘acquisition hungry’ players in the area...

Is BLK a takeover target?

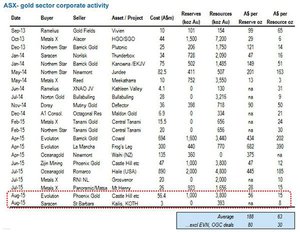

That’s certainly the thought from State One Stockbroking, which recently took a look at the corporate M&A activity in the region and came up with a compelling series of numbers...

It ran the rule over gold transactions in the past two years to try and get a baseline on what the gold sector was looking like.

It came up with an average transaction price of $46 per ounce resource on the projects acquired in the past two years.

Remember that BLK’s project has a potential total resource of 44 million tonnes of ore at a grade of 3.3% gold , meaning a potential 4.7 million ounces of gold .

With a market cap of $31.8 million and a resource of 4.7 million ounces of gold, BLK has an implied value of $6.38/oz.

Compared to the average transaction price of $46/oz., BLK starts to look like an absolute bargain. For potential buyers, a cut-price potential acquisition and for investors, plenty of upside.

At the same time, there is no guarantee of any offer ever eventuating for BLK, and this should not be taken as a sign its share price will rise.

Geography may also play a helping hand for BLK...

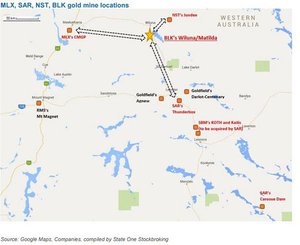

State One’s report said that the most active acquisition players in the north of WA were Metals X (ASX:MLX), Saracen Minerals (ASX: SAR) and Northern Star (ASX:NST).

Just have a look at the map below...

It looks like BLK’s project is in the middle of three hungry sharks, and with BLK firming up both resource and project economics by the day, The Next Mining Boom may not be the only ones taking a closer look at BLK.

The Final Word

BLK is doing everything right at the moment.

But it’s still a speculative stock and caution should be applied before investing.

BLK is drilling in order to firm up its resource at its flagship Matilda Gold Project, and has near-term production on the menu.

Normally gold companies either have regular releases of promising drilling information going onto the market OR near-term production it’s getting ready for.

Rarely does a company have both.

Better yet, BLK is fully funded to production.

Thanks to BLK’s strategy of picking up a quality asset from a distressed owner and giving it the once over, it has managed to build a near-term proposition not normally associated with a company of its size.

Meanwhile, it continues to drill, with each fresh set of assay results having the potential to up its resource size further still as it heads to a Definitive Feasibility Study.

Given the region it’s in, The Next Mining Boom may not be the only ones noticing BLK at the moment...

But either way BLK has a clear path forward toward commercialisation and cashflow. It should pay back the capital costs associated with the project within nine months .

Not too many small ASX-listed companies can say that with any certainty.

With drilling results continuing to firm up and extend the resource at Matilda, investors have both a long-term production plan to looks forward to and shorter-term drill hits to maintain interest.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.