First Mover LIT to Feed Insatiable Lithium Demand?

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Lithium Australia (ASX:LIT) has certainly moved along since the last time we checked in on this tech play/miner.

In the last few months, LIT has developed its very own proprietary leaching technology – reducing the need to license from a third party, and has become more involved in upstream exploration, picking up new projects and bringing back promising numbers from others.

Regular readers would have accompanied the company’s progress through our regular Next Mining Boom updates. In fact, LIT has been up over 330% since August 2015 alone – we first covered the company under its previous incarnation Cobre Montana, in the article ASX Company to Dominate Global Lithium Market?

The past performance of this product is not and should not be taken as an indication of future performance. Caution should be exercised in assessing past performance. This product, like all other financial products, is subject to market forces and unpredictable events that may adversely affect future performance.

This junior with growing ambitions is not just another company trying to develop some far-flung project with all of its eggs in one basket.

LIT has quickly and quietly been taking positions in upstream projects under the noses of more established miners by focusing on a lower-quality resource, but applying tech to bring it up to snuff.

However, before we go too far, remember, that this is still a junior stock and caution must be applied to any investment decision.

Traditionally, LIT has focused on lithium micas, but its recent Mexican adventure has it focusing on clays as well.

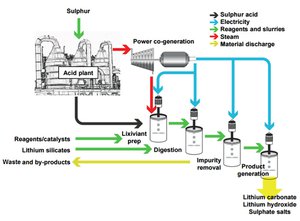

However, that could pale into insignificance with LIT’s recent announcement that it may have found lithium’s ‘holy grail’ – it has managed to apply low-energy processing technologies to recover lithium from the more conventional hard-rock source, spodumene.

This is all done in solution, and removes the dollar-burning roasting step used by existing operators.

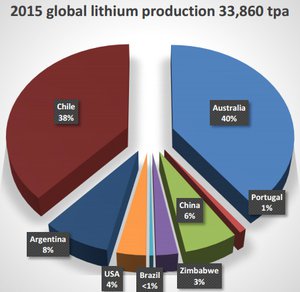

The significance of this achievement should not be underestimated, as 40% of the world’s lithium comes from one mine which produces a spodumene concentrate, but downstream processing relies on energy intensive (and very expensive) roasting to recover the mineral.

Not so with LIT’s new process which can take spodumene to lithium chemicals without roasting.

Potentially this can save the mainstream lithium producers hundreds of millions of dollars every year.

But can the majors get access to the technology? LIT remains tight lipped as to its ultimate intentions in this space.

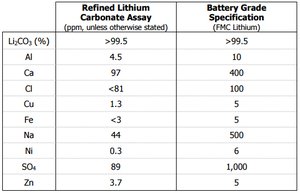

The company has big expectations for 2016, which include continuous production of lithium hydroxide, and pilot testing its new tech.

LIT is also taking exploratory matters into its own hands and has confirmed it will conduct a 35 hole drilling programme in Ravenswood, Western Australia, just a few kilometres from a lithium mine...

This company moves quickly, so it’s about time we re-introduced:

The new tech

As promising as the L-Max method licensed from Lepidico was, it was just that.

Licensed.

For a company as innovative as Lithium Australia (ASX:LIT), having your ground breaking tech in effect within the purview of a third party isn’t a great way to go about things.

So, quietly, in the lab, LIT has focused on developing its very own process which it unleashed towards the end of February.

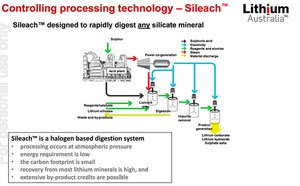

Say hello to the ‘Sileach Process’ – which is now patent pending.

The game-changing aspect of the process – which sets it apart in the market is that it can potentially leach spodumene , micas , jadarite , and clays.

These are all types of lithium ore – some more traditional and others previously ignored.

What LIT is promising to do here is to unlock the whole chain .

It can process anything – and therefore LIT doesn’t have to confine itself to a particular kind of project.

It is very early days though and all we have to go on is LIT’s word at this stage – but independent testing has reportedly achieved lithium extraction from an alpha spodumene of up to 92% in a grand total of four hours .

Like L-Max before it, the new process requires no roasting of the ores before leaching – which is by far the most expensive part of the whole process.

Imagine the kind of power and heat you need to roast tonnes and tonnes of ore before you can leach it.

If you’ve ever left the heater on at home when you went to work – you’ll know what that can do to your energy bill.

Imagine that on an industrial scale .

Now you know why producers, if the grade wasn’t good enough, were more prone to throwing micas on the scrap heap rather than producing them.

While it’s very early days, LIT Managing Director Adrian Griffin is talking a big game here.

“The Sileach TM process is potentially to the lithium industry what froth floatation is to the base metals industry,” he said when announcing the new process.

Now, you don’t need to know the particulars of froth floatation – but what you need to know is that it changed the game for base metals.

LIT gives the example of mining at Broken Hill during the early 1900s.

It was often the case that three out of every four tonnes was simply thrown on the scrapheap because the lead couldn’t be separated from the zinc.

If only there was a way to do that. Enter froth floatation.

Now, LIT is hoping for a similar breakthrough.

“Hard rock lithium faces a similar dilemma with energy intensive processes dictating what can and can’t be economically processed,” Griffin said.

“Only high-grade spodumene concentrates are viable under such conditions. The low-grade materials, be they spodumene or mica, have, in the past, been destined for the waste dumps.

“The Sileach process can change that by producing a cost-effective means of processing lower grade, or hitherto difficult to treat materials.”

LIT is talking a big game here, but what it’s doing in the upstream demonstrates that at least it believes in the process and the value chain it can unlock.

Viva Mexico!

Those of you who have been following the LIT story with us would be familiar with the company’s move into Mexico – if not, you can refresh yourself in this article Tesla Strike Lithium Deal: To Source From Ground Directly Next to LIT?

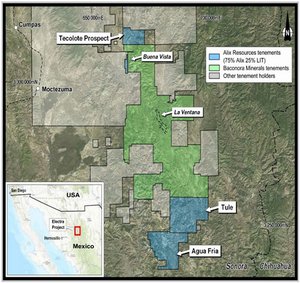

Back in November LIT struck a MoU agreement with ALiX Resources to apply its tech to lithium clays within its Sonora project, but last month it managed to turn the MOU into a fully-fledged joint venture.

Those of you following the lithium story closely would be familiar with the name ‘Sonora’.

It’s the project at the centre of a massive deal struck in recent times between the project proponents and electric car behemoth Tesla.

Both Rare Earth Minerals and Bacanora Minerals signed a conditional supply deal with Tesla to supply lithium hydroxide from the project to Tesla’s gigafactory to the north in Nevada.

It was widely read as the starting gun on end lithium ion battery manufacturers starting to deal with raw material suppliers such as REM and Baconora (and LIT).

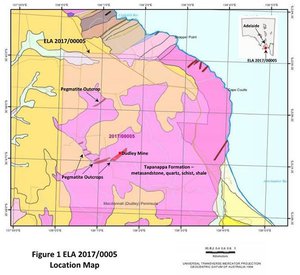

You’ll notice from the map above that the resource at Bacanora’s deposit is thought to run through to ALiX’s property.

The reason LIT was brought into the equation was that it is now seen as somewhat of a world leader in applying its tech to bring low grade material up to snuff.

ALiX’s deposit is thought to contain a low-grade clay lithium deposit.

Remember that LIT has experience in bringing low-grade micas up to a saleable grade, but not necessarily clays...

If LIT is able to bring ALiX’s clay to an end-product grade, it opens up a raft of upstream opportunities.

You can imagine resources companies the world over, sitting on low-grade clays, simply frustrated that the pricing support isn’t there to mine the clays.

Enter the canny Australian company which has solved the riddle, effectively taking low-value clay to a high value product...

LIT has been working towards something here – and Sonora project is key to it all.

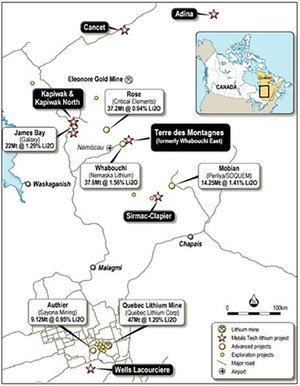

As you can see on the right, the Sonora project is shaping as one of the world’s largest.

Now, the projects to the right – the big boys – have a few things in common.

The chief among them is that they’re clay and mica deposits.

Given LIT’s new processing process, LIT could turn both into high-value lithium hydroxide.

The message here is clear – if LIT is successful in Mexico, then there’s absolutely no reason why it can’t unlock the potential of other projects in that wheelhouse.

Just imagine all the gargantuan projects which are on the backburner because processing micas and clay is considered uneconomic...

Enter KCA

Key to LIT’s clay dreams will be a partnership with Nevada-based lithium specialist Kappes Cassiday & Associates (KCA).

While LIT works on the conversion of the clay to a higher-value proposition, KCA will be working on the scoping study to bring the whole thing together.

Having the ability to bring the clay up to grade is one thing, but doing it in the most cost-effective process possible is another.

Having that scoping work under the belt from a well-respected Nevada-based consultancy smacks of another game altogether for us...

While Tesla has done a conditional deal at Sonora, it’s merely a conditional deal and does not cover all the lithium hydroxide Tesla will need.

Founder Elon Musk has also been pretty vocal about this only being the start of the deals, saying the Sonora deal is not set in stone and in any case, Tesla will need more.

Enter LIT which is now putting together a game plan to be able to supply both lithium carbonate and lithium hydroxide at an end price which may be cheaper than the likes of REM and Bacanora can provide.

Having a scoping study behind the work may convince Tesla that LIT’s plan isn’t all bluster.

And with its MoU with ALiX progressing to farm-in and JV stage, this gives LIT up to 65% of the product.

That’s no bluster at all.

The good news for LIT is that being involved in a project which supplied one of the largest company’s in the world puts you in the headlights, and perhaps the shop window...

However at the same time, this is speculation on our part – there is no guarantee of success for LIT here – this is a speculative stock, and it’s always a good idea to seek professional advice before choosing to invest.

Over to Europe

We speculated earlier that LIT could become a travelling solution for miners with low-grade micas or clays, but we get the feeling that LIT is actually playing a much larger game here, and that is challenging all of the accepted wisdom in the processing of lithium ore.

If it were simply a tech company, then it wouldn’t have taken so many upstream positions.

However, it has direct and indirect interests in projects on three continents .

Aside from the Mexican project, it has the aforementioned non-binding MoU with European Metals Holdings (ASX:EMH) over the Cinovec project in the Czech Republic.

We first wrote about EMH back in April 2015 in the article Electric Cars Need This: ASX Junior’s Billion Tonne Potential – which has a pile of information on Cinovec. Incidentally, EMH has also performed well since we first covered off on them, with its share price as high as 250% since our first article:

The past performance of this product is not and should not be taken as an indication of future performance. Caution should be exercised in assessing past performance. This product, like all other financial products, is subject to market forces and unpredictable events that may adversely affect future performance.

Back in May EMH put out a conceptual scoping study covering off on the project – you read about that in more detail in this article Tesla Reveal the Powerwall as EMH Reveal Low Cost Lithium Production Plans .

At that stage, the conceptual yearly revenue was put at $US223 million ($A322.8 million) on the back of yearly costs of $125 million.

Not bad at all...

But LIT said by adding the potential to produce hydroxide to the mix meant that revenue could effectively double.

While there was no breakdown of any additional costs associated with the process, one simply doesn’t turn down a doubling of revenues.

What’s interesting about this particular project is what happens when taking into account the new Sileach process.

The rocks from which all previous estimates flowed was zinnwaldite (a type of mica) – but lithium could occur in other silicates which before now were unrecoverable.

The aforementioned Scoping Study estimated that the overall lithium recovery for the project was about 70%. But with Sileach in the mix?

LIT hasn’t put a number on it, but it has put words to it.

“LIT believes that the Sileach process can substantially improve this, potentially adding to the revenue stream.”

Watch this space...

And back to Australia

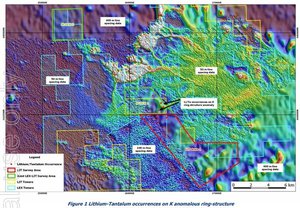

Pilgangoora Li-Tantalum project

All the way up in the Pilbara, LIT has joined forces with Pilbara Minerals (ASX:PLS) to take a look at the lithium micas at the Pilgangoora project.

PLS has had a cracking run over the past year or so on the back of the realisation by the market of the magnitude of this lithium project – now capped at $300 million, with a share price up over 900% since March 2015:

The past performance of this product is not and should not be taken as an indication of future performance. Caution should be exercised in assessing past performance. This product, like all other financial products, is subject to market forces and unpredictable events that may adversely affect future performance.

Most of the resource there is a more conventional spodumene mineralisation.

There is some lithium mica as part of this, but it’s showing similarities to the Mexican project, meaning that if LIT is able to crack the Sonora riddle it could subsequently open up another option in Australia.

The project has indicated and inferred resources of 80.2 million tonnes @ 1.26% lithium oxide ore – so a shade above a million tonnes of lithium oxide.

Better yet, the history books show that most of the lithium micas could be in areas not yet drilled, which is where LIT will come in...

LIT recently managed to bag a year-long extension on the agreement with PLS to evaluate the lithium production potential of the project.

The extension was made largely because of the promising exploration leads to date, including the delineation of a 6.5km mapped pegmatite system at the project.

Meanwhile, the pair has also found a new zone, dubbed the “Triple Creek Zone” – which has been identified as a major target for further evaluation.

Crucially, this has not been included in the resources estimate – meaning there could be further upside here.

Equally, it could turn out to be nothing so don’t heart-and-soul price this in just yet. It’s worth keeping an eye on though.

The new Pilangoora project

Meanwhile, LIT has doubled-down in the Pilbara lithium hot spot region with the company entering an MoU with Venus Metals (ASX:VMC) to explore the lithium potential of VMC’s own Pilangoora project.

Maybe VMS was hearing good things from PLS over a few quiet ones in the rough and ready Pier Hotel...

As you can see, they’re virtually next door.

The partnership on a broad level will be to determine if there’s enough lithium material there to justify a local lithium processing centre.

Given LIT is working on two Pilangoora projects now, we can foresee some sort of regional processing arrangement – but that’s just blatant speculation on our part.

LIT will be working on a plan to generate revenue from both micas and more traditional spodumene rock.

While VMC is retaining 100% of the project and LIT is paying for at least one year for exploration on the permit, the play here is strategic.

Imagine being able to go to both VMC and PLS with a plan for both of them to make money from material which would have been considered a waste before.

Imagine if LIT had the process for making said money locked down.

Now, can’t you see some kind of cooperative agreement or LIT being able to play the two companies off each other to secure the best deal?

We can – but again we’re given to rampant speculation.

In any case, it’s something to be on the lookout for here.

The reason why PLS and VMC are now interested in the lithium hydroxide potential of their permits is pretty simple – the lithium market is shaping up very nicely indeed.

Coolgardie

Back in Australia, this eastern Goldfields project is one of six on the menu in WA, with four sitting on the Yilgarn Block.

The lithium micas from this project have actually fed the L-Max trials LIT has done so successfully in the past, meaning that LIT has rolled gold proof that the project can fly.

Doing the testing with random micas is one thing, but demonstrating commercial viability with the actual source rock you’re hoping to use is a whole other ball-game.

At Coolgardie, it has an 80% stake in an area shared with Focus Minerals (ASX:FML), focusing on pegmatites 15km from the WA outback town.

Ravensthorpe

LIT recently defined two key areas for first drilling at the southern portion of its Ravensthorpe tenements, and will be firing up the drill bit in the coming months.

LIT’s main focus will be the Horseshoe #1 and Horseshoe #2 pegmatites and its exploration target is a minimum grade of 1% Li 2 O with a size range of 525,000t to 1,281,000t and grade range of 0.8%-1.2%.

This is a maiden drill program of up to 35 drill-holes that have been scheduled once all approvals have been confirmed.

Importantly, LIT’s exploration drilling here will be undertaken just kilometres from Galaxy-General Mining’s commissioning Mt Cattlin lithium mine.

Drilling is expected to commence in October.

Ravensthorpe, traditionally, has been a nickel town thanks to the like of BHP.

However, by opening up a position near General Mining’s Mt Cattlin lithium project, LIT is aiming to change this perception.

This isn’t the main game for LIT, but rather a demonstration of its ambitions — and if recent results are anything to go by, then ambition may be starting to make way for reality.

Maiden results at the project in effect firmed up the presence of at least seven pegmatites within the project area.

Assay results based on rock-chip sampling, 19 samples all told, ranged from 1.26% lithium oxide to 4.23%Li 2 O.

The mean was 2.96%Li 2 O.

At the moment results from the fieldwork are still ongoing, but after the initial results proved so promising, LIT Managing Director Adrian Griffin was left dumbfounded.

“It is surprising that such prospective pegmatites have had such little recent evaluation,” he said.

“The area has the potential to add significant quantities of lithium mica to our inventory and become an integral part of our plan to establish a processing facility for lithium micas in Western Australia using ground-breaking, low-energy processing technologies to recover lithium as carbonate or hydroxide for the battery industry.”

So there is certainly potential for this little project to jump up the priority list on the back of a successful drilling campaign.

Greenbushes

Greenbushes, meanwhile, has the potential to be anything .

It’s within walking distance of the world’s largest lithium mine, operated by Talison Lithium.

Talison produces 38% of the world’s lithium.

LIT’s project covers a 50km structural trend which at this early stage is showing signs of being similar to Talison’s mine.

Talk about auspicious...

Seabrook

At Lake Seabrook, it’s in a joint venture with Tungsten Mining (ASX:TGN), with LIT taking the lion’s share of the venture.

Last year it was awarded a new exploration license in the area, effectively doubling the size of the project’s footprint.

The joint venture is hoping to feed that material through LIT’s new process to make that waste market-viable lithium carbonate.

The market

Lithium is being seen as one of the hotter commodities moving forward for one simple reason: lithium-ion batteries.

While there are other metals involved in the production of the batteries, lithium is one of the key ingredients thanks to its ability to keep cool, and its lightness.

Both of those properties are crucial in batteries.

Here is what lithium is currently being used for.

![]()

We’ve all heard about its use in car batteries, but it is not just the next generation of cars which are expected to fuel the boom...

...that’s just a part of it.

And not just in the US either.

The below chart demonstrates that while Tesla’s gigafactory is a large proportion of the demand drivers, it’s just one part of the whole.

As you can see, China makes up the rest.

Despite the well-publicised downturn in manufacturing in China, it still remains the world’s heartbeat in this regard.

So while the factories in China may very well be aimed at an international market, there are signs that domestic demand for products containing lithium-ion batteries is picking up.

According to a recent report from International Business Times , Chinese consumers bought three times as many electric cars last year than they did in 2014.

In fact, one of the more startling revelations from the report was that Chinese consumers snapped up 114,000 units in the first ten months of the year.

Tesla has been notoriously reticent to say too much about its sales, but it has projected 52,000 sales for the year.

While China’s figures are split between a few manufacturers, everybody knows Elon Musk and Tesla.

China, however, is perhaps better placed than western nations to be the driver of the lithium-ion battery boom.

That gives you the sort of insight needed to see that China could become one of the dominant players in the market, and it already controls a heck of a lot of lithium supply.

We’re not suggesting that LIT will sell into the Chinese market, but it demonstrates the enormous growth potential worldwide.

While everybody is talking Tesla in Europe and the US, China is emerging as a force.

What does this mean for raw materials providers?

It means western car manufacturers are going to be absolutely desperate to get their supply of raw materials sorted before China moves lock, stock into the upstream and locks it down – thereby crippling the production capability of those other nations.

Long story short, it’s a great time to be a raw material producer.

The Final Word

LIT is starting to show glimpses of the massive play it is putting together here.

If further testing of its patented (well, under patent application) Sileach TM process comes off as the early work indicates it will, then LIT could well and truly be off to the races.

However at the same time, this tech is still in the early stages of being proven commercially – so its recommended investors apply caution and consider a range of other factors (not just our thoughts alone), before choosing to invest in this stock.

Before, LIT used the L-Max method – which focused only on micas.

But the Sileach process promises to be able to process all low-quality lithium ore – potentially opening up a whole new chain of products for LIT to work with.

Meanwhile, its upstream moves have seen it become more and more involved in promising projects where there is an abundance of low-grade ore.

If LIT can demonstrate value across the chain, combined with the upstream position it’s been building ...well LIT could turn into anything.

LIT has the potential to absolutely disrupt the upstream segment of an industry which itself is disrupting the whole energy game.

We’ve said it before – LIT isn’t a miner. It’s a tech play.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.