First Assays for BEM as it Unleashes Maiden Graphite Resource

Published 24-AUG-2018 10:16 A.M.

|

14 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

This product is classified as ‘very high risk’ in nature due to its location and geopolitical situation of the region. Next Mining Boom advises that extra caution should be taken when deciding whether to engage in this product, however if you are not sure whether it is suitable for you we suggest you seek independent financial advice.

ASX graphite junior, BlackEarth Minerals NL (ASX:BEM), isn’t a company that likes to mess around.

This nimble small cap, which came onto our radar just a month ago, has been making strong headway in firming up its high-grade graphite assets in Madagascar — a locale that’s been a graphite producer for over a century and is renowned for its high-quality flakes.

Just seven months since listing on the ASX, BEM has turned out a sizeable maiden JORC compliant Resource estimation for its Razafy graphite prospect in southern Madagascar, stylishly delivering on a major milestone.

The Resource, which the company unveiled in mid-August, is a pivotal step in BEM’s strategy to fast-track development of its Maniry Graphite Project.

The Razafy Resource sits at 11.2 million tonnes at 7.1% total graphitic carbon (TGC) for 795,200 tonnes of contained graphite, the majority of which has been classified in the ‘Indicated’ category... an estimate that might swell substantially if BEM can prove up its recently announced exploration targets.

BEM’s Resource estimate is the culmination of the graphite explorer’s 74-hole, 5371 metre diamond drilling program at the Razafy deposit, which was done and dusted earlier this year.

This Resource will form the backbone of the Maniry Project scoping study, which has just kicked off this week. BEM expects to have the study completed by the end of this year with a feasibility study expected to follow commencing early 2019.

Intriguingly, the Maniry Project sits just 65 kilometres south from one of the largest known and highest quality flake graphite deposits in the world — NextSource Materials’ (TSX:NEXT) Molo Graphite Project, which is looking to produce premium graphite concentrate that may represent up to 3% of the annual global market.

What’s more, the grade of the graphite at BEM’s project is higher than that of Molo.

Meanwhile, BEM’s second graphite project in Madagascar, Ianapera, sits along strike from Molo — preliminary exploration will kick off there in the December 2018 quarter, although Maniry remains BEM’s central focus.

Alongside this hub of bustling activity, a detailed metallurgical test plan program will also be completed in October/November 2018, paving the way to begin marketing of graphite concentrates produced from a bulk sample generated from core at the Razafy graphite prospect drilling campaign.

BEM now also has an exploration target for the Maniry Project of 260-380 million tonnes at 6-8% TGC — something that aptly illustrates the high-level potential of the project.

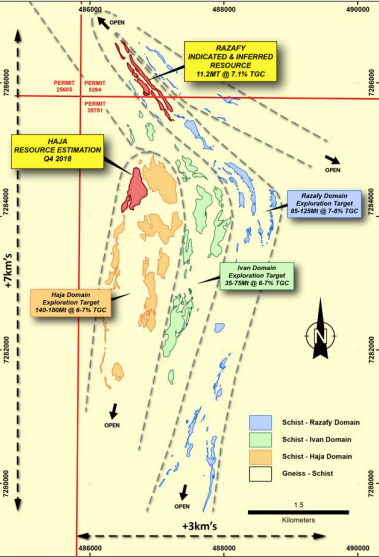

The project has been broken down into three regional domains of graphite mineralisation: the Razafy Domain, the Ivan Domain, and the Haja Domain.

BEM sees a particularly sizeable opportunity here to grow its graphite Resources through prioritised exploration of the high-grade Razafy Domain.

Of course, it is still early stages in the pursuit of this opportunity and investors should seek professional financial advice if considering this stock for their portfolio.

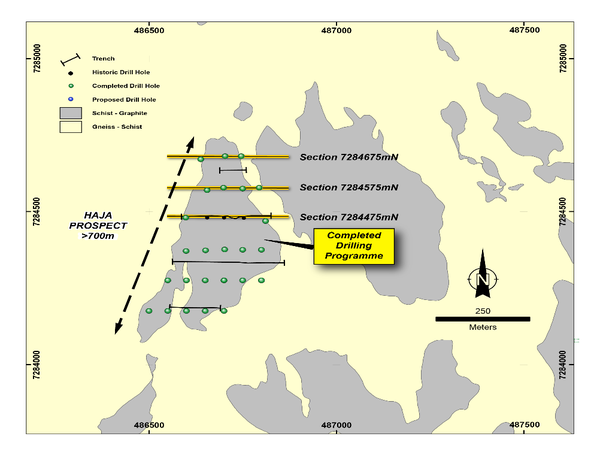

On top of that, Resource definition drilling at the Haja prospect is now complete, with 26 diamond holes drilled for 2,026 metres — more crystal-clear evidence of BEM’s flair for expedient work.

The first results have just been announced, with a maiden Resource estimation for Haja expected to be unveiled in the fourth quarter.

In short, all of this activity translates into a jam-packed schedule for the quick-footed BEM, with a lot to look forward to in the months to come.

And it scarcely could have picked a better time to do just that.

Graphite, which plays a central role in the ongoing electric vehicle (EV) boom, is a commodity that’s in high demand. Alongside lithium, cobalt, nickel and copper, graphite is one of the new tech metals that leverage the rapidly accelerating use of lithium-ion batteries in electric cars and energy storage.

Rapid growth in demand for graphite in lithium-ion batteries is predicted to underpin graphite demand growth of 5% to 7% per year between 2017 and 2027.

This can only bode positively for BEM, which is making powerful strides in its ‘fast-track to cashflow’ strategy.

Up to its eyeballs in newsflow, and with plenty more yet to come, this graphite explorer is clearly on a mission in Madagascar.

BEM is currently valued by the market at a tiny $11.6 million. Yet considering all it’s accomplished in such a short time, and what it has planned next, it shouldn’t be long before forward-focused investors cotton on to this supercharged graphite small-cap.

Checking in with all the latest from:

It became clear to us early on that BlackEarth Minerals (ASX:BEM) is a ‘right commodity, right place, right time’ kind of story.

We first introduced you to this rapidly expanding graphite play last month with the article, ‘Opportunities Abound for Graphite Junior Amongst Heavyweight Graphite Producers’. In that piece, we took an in-depth look at BEM’s graphite assets in amply mineralised Madagascar — its flagship Maniry Graphite Project, which will be the primary focus of today’s article, as well as the Ianapera Graphite Project to Maniry’s north.

This is where BEM has set its sights:

It’s worth noting that Madagascar itself makes for an ideal setting for BEM’s sharply focused graphite hunt. Political stability, coupled with a rich history and reputation for mining high-value graphite with access to suitable ports, makes Madagascar as a highly rated mining jurisdiction.

The country already has a well-supported mining industry that’s host to a cluster of major established graphite producers, including the likes of US$143 billion-capped French Total SA (EPA:FP), $67 billion Rio Tinto (ASX:RIO), and C$333 million Sherritt International (TSX:S).

BEM is hoping for some similar success — and given the rapid progress it’s been making since its ASX debut in January, it has every chance of doing just that.

With that in mind, let’s take a look now at some of the most recent news on BEM’s radar...

Scoping things out at Maniry

Just this week, BEM revealed it has appointed BatteryLimits to kick off scoping work on the Maniry Graphite Project.

Finfeed.com reported on the news on the day of the announcement:

BEM expects to finish the scoping study by the end of year — a major milestone and potential share price catalyst. This, in turn, will be a pre-cursor to a feasibility study in 2019.

BatteryLimits has plenty of graphite credibility points, having conducted metallurgical testwork, scoping studies, pre-feasibility and full feasibility studies on graphite projects in Tanzania, Mozambique and Australia.

It’s owned by BEM Chairman, Phil Hearse — one of Australia’s most respected mining professionals with some 40 years under his belt in diverse and challenging projects around the world, including multiple graphite studies in Australia and East Africa.

Hearse’s expansive resources career has taken him from operational and technical support roles at Broken Hill, Bougainville Copper, Queensland Nickel, and Gove Alumina to senior executive and managerial positions...

With Hearse’s wide-reaching connections expected to deliver more in the way of value for shareholders, this appointment builds further on BEM’s tightly honed strategy to develop its Maniry Project at lightning-fast speed.

Speaking of which...

You’ve got to be JORCing! BEM releases maiden Razafy Resource

In what serves as a pivotal step in its fast-track development strategy, BEM has released its maiden mineral Resource estimation for the Razafy graphite prospect at the Maniry Project...

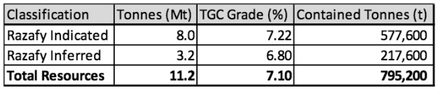

The Resource sits in at 11.2 million tonnes at 7.1% total graphitic carbon (TGC) for 795,200 tonnes of contained graphite at a 6% cut off grade.

The majority of the Resource falls into the ‘Indicated’ category, and has been broken down as follows:

- Razafy Indicated Resource: 8.0Mt at 7.22% TGC

- Razafy Inferred Resource: 3.2Mt at 6.80% TGC

A summary of the maiden Resource:

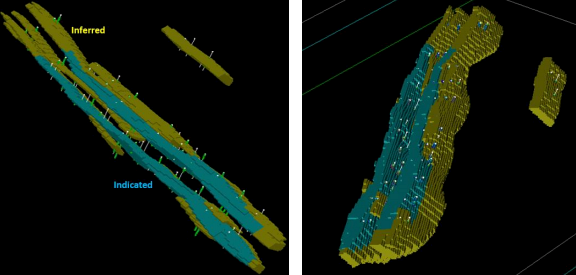

The graphitic mineralisation is currently open along strike in both directions and also down dip. The Resource is based on 2396 samples averaging 1.8m in length, and comes out of BEM’s 74-hole, 5371 metre diamond drilling program at Razafy, which was completed earlier this year and will form the foundation of ongoing scoping study work, which has been progressing in parallel with the Resource estimation process.

Below, you can see the Razafy Resource block models – Inferred and Indicated:

All in all, this high-grade graphite Resource with favourable mineralogy makes for a major milestone for the quick-moving BME — a graphite explorer that’s delivered its maiden Resource within seven short months of listing on the ASX...

There’s also sizeable opportunity here for BEM to grow its graphite Resources through exploration of the high-grade Razafy Domain, which is currently a priority exploration target (more on that in a moment). BEM will begin its next phase of exploration in the fourth quarter, with the aim to delineate further high-grade graphite within the Razafy Domain.

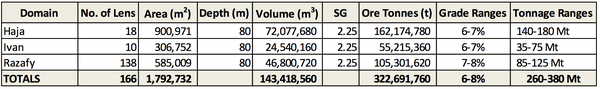

Meanwhile, alongside its impressive maiden Resource, BEM has also established non-JORC exploration targets for the Maniry Project...

Heading for a bullseye: BEM locks in Maniry exploration targets

BEM recognises the Razafy Resource as part of a much larger mineralised graphite system that has been defined by extensive and detailed programs of exploration, including geological mapping, rock chip sampling, trenching, drilling and airborne geophysical surveys (magnetics and VTEM).

BEM has now utilised these extensive, quality datasets to indicate the potential to significantly increase the mineral Resource in this area with additional drilling and associated activities.

Following this assessment, the Maniry Project now has an exploration target of 260-380 million tonnes at 6-8% TGC — something that amply demonstrates the project’s significant potential.

Of course it is just potential at this stage and investors should maintain a cautious approach to any investment decision made with regard to this stock.

As we mentioned earlier, the Maniry Project has now been broken down into three regional domains of graphite mineralisation — the Razafy Domain, the Ivan Domain, and the Haja Domain:

The Razafy Domain is a large-scale fold on the north and eastern margins of the Maniry area. This domain is characterised by multiple high-grade lenses such as the recently defined Razafy and Razafy East Lenses.

The exploration target for this domain, including the Razafy lens, is 85-125Mt at 7-8% TGC. Exploration in the fourth quarter will centre this domain in an attempt to delineate further high-grade mineralisation proximal to the Razafy Deposit.

The Ivan Domain, on the other hand, is located centrally at Maniry. The domain is characterised by large-scale, outcropping graphitic schists containing localised folding which appears to have provided localised areas of high-grade mineralisation within the broader lens. The exploration target for Ivan is 35-75Mt at 6-7% TGC.

Finally, the Haja domain is characterised by a large-scale fold of the graphitic schist on the western side of the Maniry Project. This contains the Haja lens in the interpreted fold nose position — theoretically, a position for higher grade mineralisation. The exploration target for this domain, including the Haja lens, is 140-180Mt at 6-7% TGC.

Exploration targets for the Maniry graphite domains and supporting assumptions:

Encouragingly, previous drilling at the Haja prospect identified extensive thicknesses of graphite mineralisation, including intersections of 70 metres at 5.3% TGC.

The Haja prospect has been systematically drill tested. The 2000 metre drilling program has seen 23 of the 25 planned drill holes completed. And now the latest results are in.

Assay results from the first five holes demonstrate that the Haja ore body is thick and consistent with zones of high grade graphite. These results have shown mineralisation is open along strike to the north and open down dip to the east.

The results have highlighted some unexpected zones of higher grade mineralisation (e.g. MNDD085 - 8.7m @ 10.4% TGC & MNDD086 - 19.5m @ 8.1% TGC) As further assays are received, it is anticipated that a continuous zone of high grade mineralisation will be identified within Haja.

The highlights include:

- 81.8m @ 6.1% TGC (Inc. 19.5m @ 8.1% TGC)

- 29.4m @ 7.3% TGC (Inc. 8.7m @ 10.4% TGC)

- 44.4m @ 6.3% TGC

The remaining assays from the program are expected to be received in the next four to six weeks, with a maiden JORC-compliant Resource estimation for the Haja graphite prospect expected to be released to the market in the fourth quarter.

You can read more about the results in the following Finfeed.com article:

Note: The Exploration Targets reported herein are not JORC compliant Mineral Resources. The potential quantity and grade of the Exploration Targets are conceptual in nature, there has been insufficient exploration to determine a Mineral Resource and there is no certainty that further exploration work will result in the determination of a Mineral Resource.

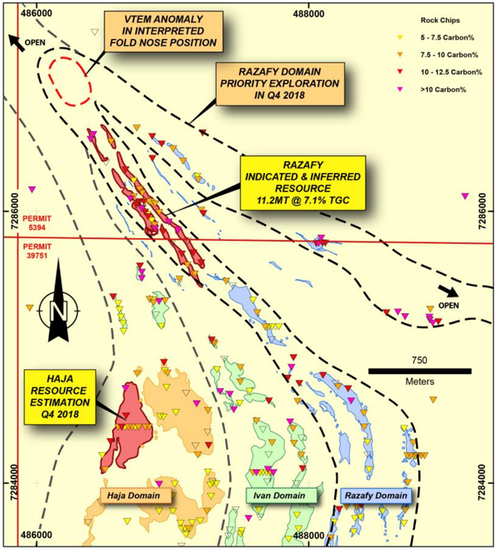

Exploration potential the cherry on top

Following on from its encouraging maiden Razafy Resource and large-scale exploration target, BEM has recognised the potential to consolidate the Maniry Project into a significant ‘camp’ of graphite mineralisation.

As we’ve noted, the Razafy domain has been identified as a priority area for further exploration in the short term, as it represents the highest potential to host higher-grade accumulations of graphite mineralisation.

Areas of immediate focus include:

- Immediate extensions along strike from the defined Razafy Resource. Mapping and rock chip sampling will be used to define potential areas for the next phase of drilling.

- VTEM data, which was collected by the former project owner Malagasy Minerals Ltd in 2008 for nickel-copper sulphide exploration, in conjunction with mapping and rock chipping to identify a large-scale fold that will provide the focus of a combined mapping, rock chipping and trenching program in the fourth quarter.

Exploration potential at the Razafy domain:

Particularly interesting here is a large, prevalent VTEM anomaly, which is located in an interpreted fold nose position.

For those of you who don’t have PhDs in geology, fold noses are well-known structural positions for high-grade graphite mineralisation.

A good example of this is the aforementioned Molo graphite deposit — a Resource that plans to produce just over 17,000 tonnes of premium graphite concentrate a year, representing up to 3% of the global market.

As we may have mentioned, Molo sits 65 kilometres north of the Maniry Project and just ten kilometres away from the Ianapera Project.

A short word on graphite’s ascent

As we explored in our last update, demand for graphite is primarily driven by the steel market and Chinese industrialisation. Consumption slowed down during the 2010-2017 period, as Chinese steel output growth slowed.

However, rapid growth in demand for natural flake graphite and synthetic graphite in the lithium-ion battery industry is now forecast to underpin total graphite demand growth of 5–7% between 2017 and 2027.

Market forecaster, Roskill, says that graphite demand is about to experience rapid growth and price escalation — something that bodes very nicely indeed for an aspiring graphite miner like BEM...

Graphite has been earmarked as a critical mineral in the United States and the European Union, as the lithium-ion battery rally continues to mount.

Looking at the US and China in tandem is an interesting exercise, following the US imposed 10% tariff on flake and synthetic graphite out of China.

However it is a fluctuating commodity with regards to price and investors should seek professional financial advice with regard to any stock playing in the graphite sector.

Not only is this a further threat to the relationship between the two nations, but it will also create an advantage for other graphite sources, including those from North America and Africa — especially as the auto industry continues to increase consumption, and as the rising demand from the building materials market grows, given graphite’s ability to act as a fire retardant.

Roskill predicts that electric and hybrid cars could account for 69% of all motor vehicle sales by 2027.

On top of that, graphite use in batteries could be five to 10 times higher than the current level by 2027, depending on the uptake of lithium-ion batteries in EVs and other applications.

In short, now seems to be an ideal time to be chasing high-grade graphite in abundantly mineralised Madagascar. And BEM is certainly moving quickly to meet this rapidly building graphite demand...

All the right ingredients for a blue sky graphite play

Considering its laundry list of achievements since listing on the ASX at the beginning of the year, BEM is delivering on its ‘fast-track to cashflow’ strategy in spades. It’s rapidly whirled through ambitious timelines, barely breaking a sweat.

And there’s a lot more to look forward to in the months to come for this ASX micro-cap.

BEM expects to have its Maniry scoping study completed by the end of this year, with a feasibility study to follow in 2019. On top of that, BEM is looking to release a JORC-compliant Resource for Haja in the fourth quarter. Any of these upcoming activities could well serve as share price catalysts.

With consistent newsflow and timely delivery of key milestones, BEM seems to have all the right elements in place for a strategic graphite play. And here at The Next Mining Boom, we can’t wait to see what it does next.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.