Could this Emerging Stock Deliver a Major European Coking Coal Hub?

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Investing in resource stocks needn’t be taxing.

A good way to sort the wheat from the chaff in small-cap resource stocks is to simply stick to the nitty-gritty fundamentals. It doesn’t need to be more difficult than that.

Yes, it is advisable to scour the inter-webs for the most pertinent information regarding various commodities plays. But the simple answer is usually the correct one.

Which brings us to the fundamentals of coking coal; essential for steel making, and a major contributor to global industrialisation.

Coking coal prices soared last year, boosted by China calling a day on many of its own coal mines along with a swathe of supply disruptions worldwide that have spurred shortage concerns.

The spot price for premium coking coal more than doubled in 2016, and despite a brief respite, could be galvanising for a renewed demand cycle spurred on by very new-age technologies.

Bread-and-butter infrastructure construction is also stepping up a gear in several powerhouse nations around the world.

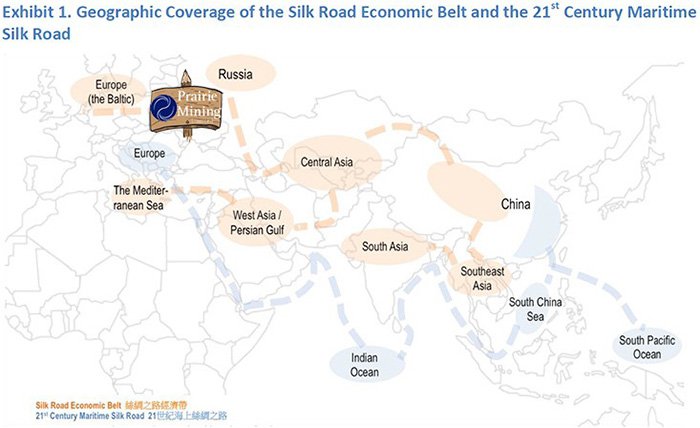

China, the US, Russia, India, UAE, Brazil — these are just a handful of countries that have announced gargantuan infrastructure programmes to build stacks of affordable housing, reams of commercial opportunities and ultimately, usher in a higher standard of living for its citizens. This includes work on an inter-continental Silk Road that will connect 65 countries spanning across Asia, Europe, Africa and Oceania.

These projects require coal and may offer an explanation as to why coking coal prices are seeing such huge leaps, as steel-building comes back to the table with hasty aplomb.

One listed (LSE, ASX and WSE) company we’ve come across has the potential to make a sturdy return on its coal ambitions...

It holds two high-quality coking coal assets at different stages of development.

Preliminary indications suggest this company has access to 1,000Mt of coking coal spread across two distinctly opportunistic projects.

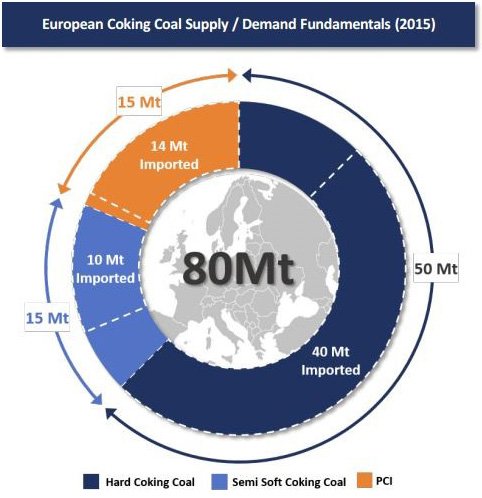

The projects are located in Poland, on the doorstep of a hotspot of European demand which has resulted in the continent importing 80% of its coking coal from Russia, Australia and the US.

It’s focused on the premium, metallurgical/coking type of coal.

This company also has its paperwork in complete order with a Pre-Feasibility Study (PFS) already done and a Bankable Feasibility Study (BFS) in progress at one project, while having a Scoping Study en route to hit the wires any day now.

One project has already been confirmed to have robust project fundamentals including producing over 6Mt a year of semi soft coking coal and thermal coal at an average cash operating cost of US$24.96 per tonne — that would be the lowest cash cost for coal delivered into Europe, period.

However, it should be noted that with all operations of this type, success is no guarantee. You should consider your own personal circumstances before investing, and seek professional financial advice.

With potential brimming, plenty of catalysts on the horizon, a strategic partner in CD Capital ready to invest up to $83 million, commodities back in the limelight and a string of resource stocks fumbling for the ignition keys to their hay-bailers, we think now could be a good time to get acquainted with the coking coal growth story.

It is a story that’s being overlooked on the surface, but one that has immense value down below...

Introducing:

LSE:PDZ

WSE: PDZ

Here at The Next Mining Boom , we don’t like to beat around the bush.

The coal industry had been struggling for years, with falling prices putting coal explorers and producers to the sword.

Waning demand for energy, growth in renewables and a focus on emissions have been a bane for coal operators for the past seven years.

However, coking coal’s importance is coming to greater attention.

Coking coal is used to make steel and used as part of metallurgical processes that remain coal-dependent – regardless of climate change warriors and renewable energy proponents.

Steel production tailed off in 2015 alongside slowing global economic growth, specifically in China and the US. But this effect is now gradually subsiding as steel-making moves into its next phase of rising cyclical demand.

This is putting a strong bid into coking coal prices, and resurrecting what were previously dormant projects exploring for coking coal.

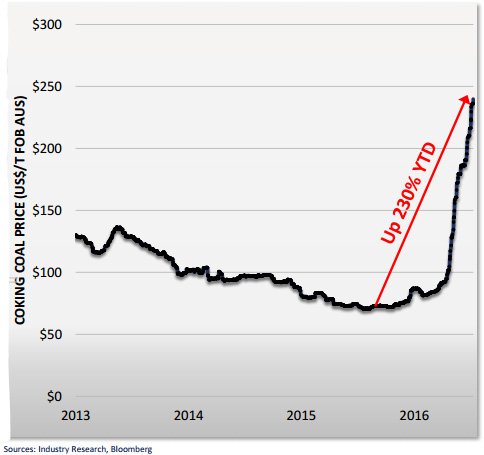

Here is the hard coking coal price from 2013 to early this year (although it should be noted that the price has come down and currently sits at approximately $160):

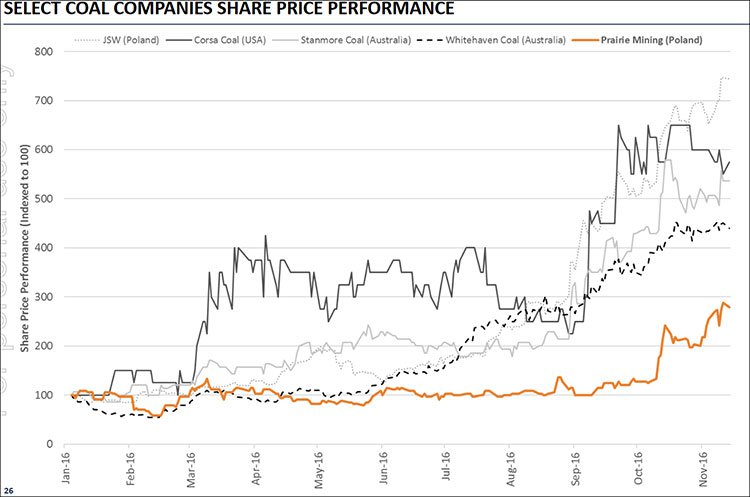

Meanwhile, here’s how PDZ’s share price has performed over the past year (marked in orange below), against a number of other coal stocks – as you can see – whilst PDZ has done pretty well...

... There looks to be a fair bit more upside still to come in PDZ as it progresses with the development of its projects.

PDZ shares have risen from around $0.095 AUD per share in February 2016, to as high as $0.51 AUD per share last month. That’s a gain of more than 430% in less than a year, and it has to do with PDZ’s acquisition of its Debiensko Project and its strategic co-operation agreement with China Coal for its Jan Karski mine.

The past performance of this product is not and should not be taken as an indication of future performance. Caution should be exercised in assessing past performance. This product, like all other financial products, is subject to market forces and unpredictable events that may adversely affect future performance.

PDZ still has some catching up to do, and appears to have plenty of upside as it heads toward production...

China’s continued tampering with its domestic markets has meant a wavering supply of coking coal — a boon for coking coal companies like PDZ that are waiting to capitalise on supply gaps and feed existing demand in Europe.

One absolutely pivotal caveat to understand, is that while PDZ may produce some thermal coal at Jan Karski, PDZ is predominantly focused on the uber-premium coking coal variant, which remains the key piece of the puzzle in steel-making.

Even the new-age lithium-powered Tesla cars require over half a tonne of coking coal to manufacture the required steel.

So as lithium investors pile into lithium stocks, they may be forgetting that any energy-storage/electric-car/new-age revolution will require a lot of steel, and by extension, coking coal.

Following a sustained correction over the past few years, coking coal is rediscovering its lustre.

Considering there’s currently a shortage of crystal balls out there, anyone interested in a cyclical commodities play could do worse than picking PDZ, as it heads toward production.

The company has comparatively superior project economics to its peers, a low market valuation and having been overlooked by exasperated investors oversaturated with negative news flow from the coal sector, it still remains relatively unknown.

Here is another of the Next Mining Boom’s European “near term” production resource stocks – PDZ to perform similarly?

The Next Mining Boom is closely looking at near term resource production stocks on the European continent – as the companies edge toward production and are well funded, there appears to be upside along the way.

The most recent example is Berkeley Energia (LSE | ASX: BKY) – since we first wrote about BKY in the article ASX Stock Set for Spanish Bull Run with Uranium Production , the stock has been up over 50%:

The past performance of this product is not and should not be taken as an indication of future performance. Caution should be exercised in assessing past performance. This product, like all other financial products, is subject to market forces and unpredictable events that may adversely affect future performance.

We are hoping that PDZ performs just as favourably over the months to come as it firms up its coking coal production plans in the heart of Europe.

So let’s take a look at what’s buried under this Prairie

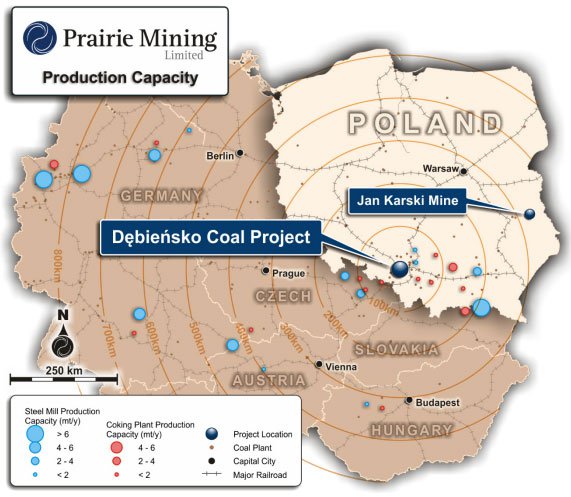

Prairie Mining (ASX | LSE | WSE: PDZ) is a multi-project coal developer focused on developing two prime projects in Poland — the Jan Karski Mine and the Debiensko Hard Coking Coal Project, seen here:

Combined, the projects provide PDZ with a unique angle into the coal sector, and PDZ expects to concentrate on producing coking coal as its prime resource, from its basket of assets in Poland.

Here is a similar map, overlaid with possible delivery points, including steel mills and end-user markets. As you can see, PDZ is casting its commercial rod in exactly the right place, especially when it comes to infrastructure. Its recent Infrastructure Study confirms existing high quality and site connected rail, road, power and water infrastructure at Debiensko that could support an accelerated development timeline with very low capital intensity.

Jan Karski Mine

As mentioned earlier Jan Karski has already been confirmed to have robust project fundamentals including producing over 6Mt a year of semi soft coking coal and thermal coal at an average cash operating cost of US$24.96 per tonne — that would be the lowest cash cost for coal delivered into Europe, period.

Yet, how much of the market PDZ would be able to attract remains to be seen and as such investors considering this stock for their portfolio, should seek professional financial advice.

Our small-cap antennae have honed in on PDZ, on track to produce the lowest-cost coal in Europe.

The Jan Karski Mine is a large scale premium quality coal project with a current JORC Resource Estimate of 728Mt spread across four coal exploration concessions.

Around this time last year, PDZ announced the results of a Pre-Feasibility Study (PFS) for Jan Karski. Here are the juicy details that help to raise hopes of eventual economic viability and production:

Here is that location map again — take a look at the countries in close proximity — PDZ will be ready to deliver its coking coal into these markets in the coming years.

Since the publication of its PFS, PDZ has moved onto obtaining more certainty in its operations at Jan Karksi, which brings us onto PDZ’s cornerstone deal with China’s largest coal mine developer China Coal.

China Coal is a $10 billion goliath (China’s second largest coal miner) that builds more coal mines than the rest of the world’s coal developers combined.

China Coal has built more than 300 major shafts around the world, including shaft sinking at Vedanta’s Sindesar Khurd Lead-Zinc Mine in India .

PDZ has signed a provisional agreement with China Coal that will see the two companies complete a BFS at Jan Karski by mid-2017, in order to entice a consortium of Chinese banks to fund the project further into infrastructure construction and eventually, coking coal sales.

Jan Karski represents a unique opportunity for PDZ, considering the grades and Resource quantities seen from exploration to date.

PDZ will be able to leverage China Coal’s immense technical expertise, financing capabilities and relationships with Chinese Banks, as part of China’s ground-breaking Silk Road Project.

With the cogs of global geo-politics turning every which way but loose, we think PDZ’s Polish positioning couldn’t be more timely or opportune:

PDZ is in the position to service a small part of Europe’s need to import 80mt of coking coal per year. That is where PDZ will find a market and where there could be no shortage of buyers.

For a truly in-depth look into coal and all the likely impacts on other sectors and industries, here is a thorough discussion, hosted by the Center for Strategic & International Studies (CSIS), with the International Energy Agency’s (IEA) Senior Energy Analyst, Carlos Fernandez Alvarez.

Not forgetting PDZ’s other prime Polish Project — Debiensko

Debiensko is PDZ’s 100% hard coking coal project in addition to Jan Karski in Poland.

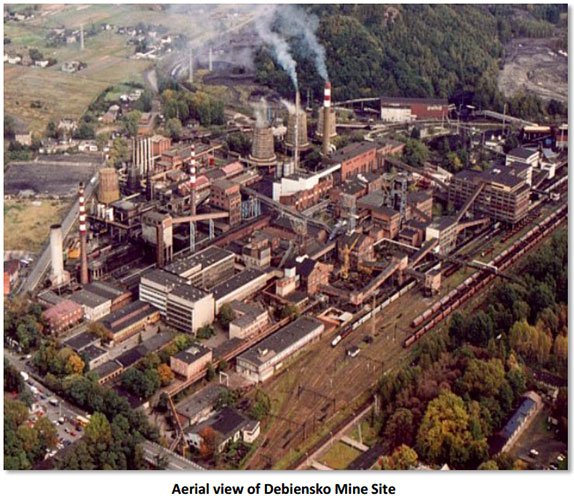

It’s a high-quality coking coal project with a 50-year mining concession already granted with all environmental permitting hurdles vaulted. Debiensko is brownfield mine, previously in production up until the year 2000, and situated next to two operating mines in the same geological setting that PDZ is reviving.

Being a brownfields site, it reduces the Project’s environmental compliance burden over time and means it is ‘Mine Ready’ today.

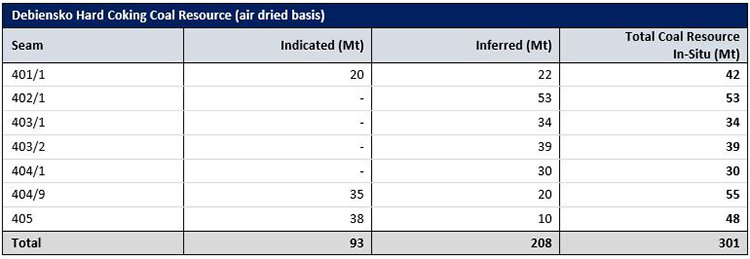

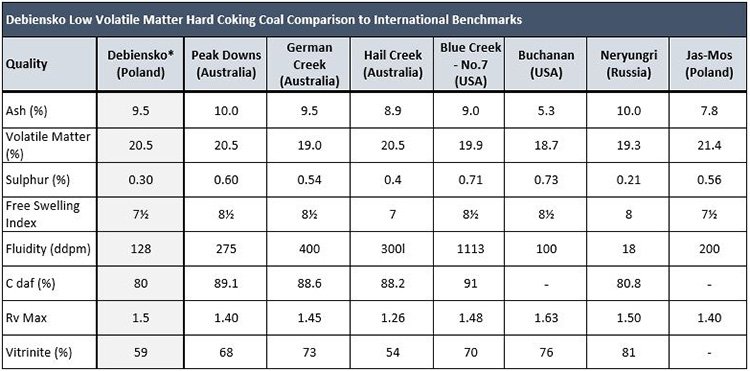

PDZ will seek to develop a plan to re-start mining at Debiensko based on a maiden JORC coal resource estimate of 301Mt of coking coal released in early February – including premium hard coking coal of similar to the prime quality coal produced by BHP and Glencore in Queensland or Teck Resources in North America.

Debiensko is currently undergoing extensive work and analysis given its relatively recent acquisition.

Here is a look at its plan moving forward:

Having all this ready for action will certainly help:

And here’s an aerial view showing extensive infrastructure and ‘ready-to-rock’ status:

Following detailed technical due diligence, PDZ is confident that a revised development approach is achievable that would allow for the early mining of profitable coal seams, whilst minimising upfront capital costs.

Here is Debiensko’s current Coal Resource Estimate

For a company of PDZ’s size, a 301Mt maiden JORC Resource, plus the 750Mt estimated at Jan Karski, is a superb start.

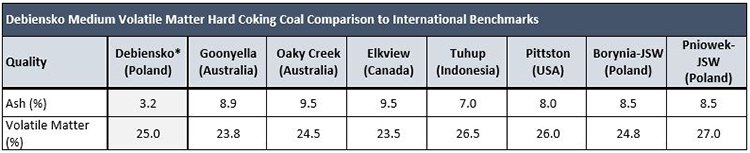

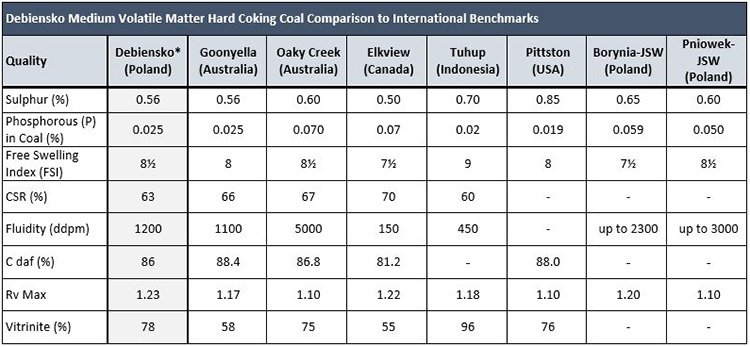

Furthermore, if we compare the coking coal qualities of leading coal producers, here again PDZ is throwing its hat into the ring — and what a hat it is turning out to be.

Take a look at the quality estimates of PDZ’s coal from Debiensko, compared with other coal mines around the world.

With both Debiensko and Jan Karski now firmly set on concerted development paths, we think PDZ could be set for a revaluation, as long as development goes to plan.

Let’s have a look at the prize PDZ is ultimately playing for

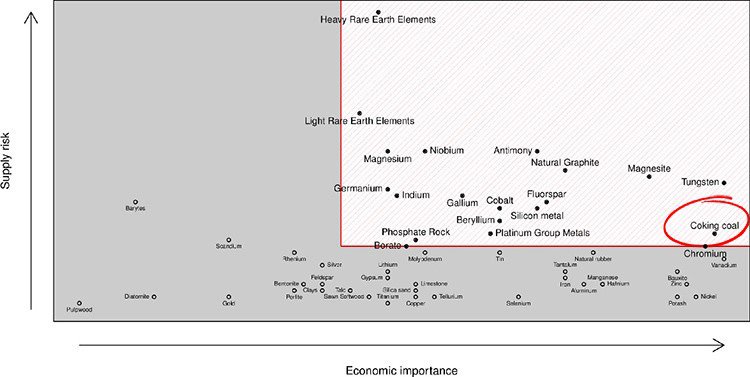

Overlooked in recent years as an investment opportunity, coking coal is a hugely critical mineral for major industry, and Europe as a continent.

According to the EU Commission, coking coal is a critical raw material which (as is always the case with empire-builders) means it is worthy of protectionism and keeping European coking coal supply firmly in the hands of Europeans.

Geo-political competition is heating up between the likes of China, the US, Europe and Russia. So grabbing a stake in PDZ as an emerging coking coal producer in Poland, positioned between Russia and the EU, with access to China’s Silk Road, and with significant bulk to boot — could be prove to be a very wise decision over the coming decade.

Primary evidence of a resurgence in coal

If you thought your commute to work was bad, spare a prayer for Mongolian truck drivers in the business of delivering coal to and from China.

up coal supply lines.

This type of anecdotal evidence may not be conclusive proof that an industrial renaissance is back on the table, but it does indicate that China, in particular, is building up steam on the industrialisation and manufacturing fronts.

For the full video, click here .

With so much commodities real-estate available to small-cap investors, should they consider this Little House on the Prairie?

There is no such thing as a ‘dead commodity’, but sudden changes in supply and demand for coal has led to many investors throwing the baby out with the bathwater, declaring coal as yesterday’s news.

The fact is that coal (and all other commodities) will eventually see a resurgence based on cycles, which makes looking for ground-floor bargains prudent – while they’re still on offer.

The good news is that in PDZ, we may have found an ideal vehicle in which to obtain exposure to coking coal.

PDZ is valued at a shade over $77.4 million AUD and £47.7 million, and yet, stands at an advanced stage of exploration with a genuine possibility of claiming to be Europe’s lowest cost coking coal producer.

We will know more when PDZ publishes its long-awaited Scoping Study for Debiensko in the coming days and its BFS for Jan Karski later this year — both of which could prove to be significant price catalysts for PDZ.

After a sustained decline over more than four years, coal prices have rebounded strongly in 2016. Steam coal spot-prices increased significantly, from around US$45 per tonne in January 2016 to above US$90 per tonne by November.

For coking coal the increase was even sharper, quadrupling from US$77 per tonne in January up to over US$300 per tonne by November 2016.

Yet commodity prices do fluctuate both ways, and caution should be applied to any investment decision here and not be based on spot prices or predictions alone. Seek professional financial advice before choosing to invest.

Supply discipline, high cost mine closures and reduction capital expenditures have retired some output from the market also.

However, rather than a big change in the international supply/demand balance, the main driver of the rise has been China’s policy changes cutting its coal output, which has pushed domestic prices up, resulting in higher prices elsewhere.

In PDZ, we think we have found yet another strong small-cap mining candidate packing some very attractive assets and with everything it needs now in hand, to punch above its current AU$77.4 million market cap (GBP 47.7 million).

PDZ’s location in Europe and Europe’s requirement for steel suggests to us that this little house on the prairie has the foundations to become a property worthy of any mature miner or existing coal producer out there.

PDZ is a company with fine blend of superficial allure and below-the-surface substance, yet to be discovered and commercialised to its full extent. But with coking coal making a swift comeback, PDZ could surprise market analysts in coming months.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.