Electric Cars Need This: ASX Junior’s Billion Tonne Potential

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Tesla’s electric car sales are up 55% from last year...

With a current market cap of $26BN USD, Tesla is widely tipped to be the first company to take electric cars to the masses.

Rumours abound that software giant Apple, after revolutionising home computers, phones and watches, wants to make electric cars also.

Richard Branson has hinted that his mega corporation Virgin may also have a crack at electric cars – they are sending people to space after all.

Traditional car makers are not going quietly though.

German auto maker BMW has a successful electric car on the market, along with a hybrid coupe.

Rival German Mercedes is also planning a suite of electric vehicles.

The race for electric car dominance is in full swing and hotly contested.

Whichever company can put an electric car in the most garages across the world stands to generate billions of dollars in revenue for decades to come...

The one thing in common with all these cars is that they’re powered by a rechargeable lithium-ion battery.

Lithium is fast becoming the power source of the future – today.

The rise of the electric car has led to soaring demand for portable power gained from rechargeable lithium-ion batteries.

The market for rechargeable batteries is predicted to double by 2016 to over $22BN , with lithium as the key ingredient.

Add this to the demand generated by renewable energy storage systems – lithium batteries are required to store solar and wind energy – and it’s clear that lithium is a strategic metal for the future.

The next company to bring a big lithium resource into production should find plenty of customers lining up to take its product.

At The Next Mining Boom we’ve been alerted to an ASX-listed junior capped at just $4.2M that’s got its hands on a huge lithium resource on industrial Germany’s doorstep.

When we say ‘huge’, we really mean it – The company’s inferred resource stands at half a billion tonnes...

The exploration target is another half a billion tonnes...

In terms of volume this deposit is in the Top 4 hard rock lithium deposits in the world, and may one day grow to be the largest in the world with some additional drilling.

But having the largest deposit in the world is useless if the costs to extract are too high.

Again this is where this little company may have an edge.

They have struck up a relationship with a strategic partner that uses a process that could dramatically drops their extraction costs.

We will know specifics on this in just days – when the company releases their Scoping Study results.

This imminent catalyst could be the cause of a re-rate for this company:

European Metal Holdings Ltd (ASX:EMH) is currently developing the Cinovec Project in the Czech Republic – a low cost nation with a low corporate tax rate.

100% owned by EMH, the Cinovec Project houses a top 4 hard rock lithium resource by volume, plus quantities of tin, tungsten and potash that aren’t to be ignored.

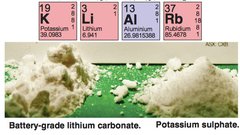

EMH has just confirmed that 99.56% pure lithium carbonate has been precipitated from a sample of Cinovec ore. Current indications are that EMH’s process is low cost – with the production of battery grade lithium carbonate at a cost equivalent to brine deposits.

The latest estimated operating cost is less than $2,000 per tonne of lithium carbonate produced (after sulphate of potash credit).

When sales from tin and tungsten are taken into consideration, the total cost of lithium carbonate production by EMH has the potential to be substantially less than for brine deposits.

EMH’s Cinovec Project is located right on the border with industrial power house Germany – BMW, Mercedes you may be familiar with – they all have factories here, and are ramping up electric car development.

There is also lithium producer Rockwood nearby – recently the subject of a $6.BN takeover offer by Albemarle. Headquartered in Frankfurt, with a production site in Langelsheim, they are gearing up for an increased demand in batteries for electric vehicles – perhaps they might be interested in some of EMH’s lithium at the Cinovec Project?

The Czech Republic is a member state of the European Union, so it has strong economic ties to this exclusive economic region and EMH will have few hurdles to jump when it comes time to produce and sell lithium.

EMH’s Top 4 hard rock lithium resource by volume

We have looked into some of the other companies with large hard rock lithium resources – and noticed a rather large disconnect between EMH’s market cap and the rest.

This chart compares hard rock lithium deposits across the globe – the blue column is EMH’s, with a potential total resource that could end up head and shoulders above the rest:

EMH is currently capped at just $4.2M.

Western lithium is listed on the TSX – and has a market cap of over $60M...

Bacanora Minerals is listed on the TSX and AIM and has a market cap of over $135M – it’s not shown on the above chart but it has a resource of just 160 million tonnes .

Talison lithium was taken over by an industrial Chinese group for $815M back in 2012...

Yet EMH may have a bigger lithium resource than them all.

For this reason we see a lot of potential upside in EMH, as it steers its Cinovec Project toward production.

EMH recently signed a Memorandum of Understanding (MoU) with Cobre Montana, an ASX listed company that may lead to improved extraction of lithium – reducing extraction costs compared to traditional methods.

From here on in, the big question is how much will it cost EMH to extract the lithium? Current estimated operating costs are $2,000 per tonne of lithium carbonate produced . After tin and tungsten credits, operating costs are anticipated to reduce further – potentially in the lowest quartile operating costs.

A Scoping Study for Cinovec’s mining and processing operation is set to be completed in the coming days and could paint an even clearer picture of future – a catalyst for a re-rate if there ever was one.

After that, EMH will launch a Pre-Feasibility Study (PFS) that will see more drills turning to finalise the resource sizes at Cinovec and come up with a mining plan.

There are scores of catalysts in the pipeline on the way – and EMH’s tiny market cap of just $4.2M could be the ground floor starting point for the company to potentially become a global strategic metals player.

In this article, The Next Mining Boom will run you through all the elements of the ambitions and strategies, and bring them together to show you why we have made a long-term investment right now.

Let’s start with the metal that could catapult EMH onto the world stage...

Our Track Record

Regular readers of our sites will be familiar with our long-standing interest in high potential stocks.

Did you see our Next Tech Stock article on Ziptel (ASX:ZIP) $1.7 Trillion Telco Market: ASX Tech Company Weeks Away From Global App Launch ?

ZIP has been up as high as 200% since we released this article:

Source: Etrade Australia

The past performance of this product is not and should not be taken as an indication of future performance. Caution should be exercised in assessing past performance. This product, like all other financial products, is subject to market forces and unpredictable events that may adversely affect future performance.

lithium – the metal of tomorrow, today

lithium (Li) is the lightest metal on the periodic table and has such low density you can actually cut it with a knife!

Boeing is using lithium in its new generation of light passenger planes, lithium salts are used to treat a range psychiatric conditions, and defence companies are incorporating it into new designs.

But lithium’s reactive power is the main game – for the markets and for EMH.

Watch what happens when you put lithium in to water:

There is so much reactive potential in lithium that the world’s first nuclear fusion reaction was based on the transmutation of Li to Tritium.

And this reactive power has led lithium to become the main ingredient for modern rechargeable electric batteries used primarily in two industries – automotive and renewable energy storage.

The rise of the electric car and renewable energy storage systems like those necessary for solar panels worldwide has led to soaring demand for lithium that EMH is determined to satisfy with its Czech Republic play.

The market for rechargeable batteries is predicted to double by 2016 to over $22BN , and companies like EMH, which are intent on producing it, are clearing moving into a growing sector.

Global production of Li is at 600,000 tonnes a year right now and trending ever upward:

China has mandated that 30% of its cars should be electric – which could place a lot more strain on global lithium supplies.

The ever increasing demand means more lithium mines are needed to keep up – just like what EMH’s are planning at the Cinovec project.

If EMH can bring its Cinovec lithium mine into production in the heart of Europe, it could be poised to be the next big supplier of this valuable substance to the continent’s high tech industries – and to the rest of the world.

Batteries – EMH’s future power

To give you an idea of the potential, now and in the future, let’s dig a bit deeper into the world of rechargeable batteries.

While that may not sound too sexy, this may change your mind:

That’s the Tesla Model S , a fully electric car that can accelerate from 0 to 100kmph in just over three seconds, and a vehicle that has more than 500km in the engine from a single charge from its lithium-ion batteries.

Tesla is the world’s leading manufacturer of purely electric cars and has strong global sales driving its expansion.

Tesla’s success is paving the way for other auto makers to create their own electric cars – either hybrids like Toyota’s Prius, or full battery power models like BMW’s i3.

There are now close to three quarters of a million electric cars on the world’s roads, and the numbers are rising all the time:

And each and every one of those cars, no matter what company makes them, has a rechargeable lithium-ion battery turning the wheels – full of the stuff EMH is planning on digging out of the ground in the Czech Republic.

Part of the drive in this future growth of lithium demand will be the Tesla Gigafactory – an enormous lithium-ion battery production facility being built in Nevada.

The Tesla Gigafactory will be the first of its kind in the world and could be the first of many facilities across the USA and the globe. This could turn into a production line for a new era of electric vehicles all using lithium-ion batteries.

Tesla has even announced a plan to make lithium-ion batteries for electric homes , a vision of the future that could come around sooner than we think.

The blue sky here is that electric cars will become the dominant mode of transport in the coming years, potentially causing lithium to become a major part of the transport fuel chain... with the consequent long term surge in lithium prices.

Again, that’s blue sky – but there is more than enough growth and demand for lithium through the expanding market for batteries for EMH to capitalise on right now.

And EMH’s focus on developing a globally significant lithium resource in the Czech Republic could also bring it an added competitive edge...

Our Track Record

Did you see our Next Small Cap article on Rumble Resources (ASX:RTR) So You Think Sirius Is Big? $5M ASX Explorer Drilling in Weeks ?

RTR has been up as high as 88% since we first released our article:

Source: Etrade Australia

The past performance of this product is not and should not be taken as an indication of future performance. Caution should be exercised in assessing past performance. This product, like all other financial products, is subject to market forces and unpredictable events that may adversely affect future performance.

Czech mate – EMH’s Cinovec project

There has been historic mining at EMH’s Cinovec Tin-Tungsten-lithium Project in the Czech Republic going back 600 years to the 14 th century.

Back in those days, people were looking for tin at the site – a metal still in demand these days and still present in the ground there – but in modern times lithium is the name of the game.

EMH’s inferred lithium resource currently stand at over half a billion tonnes:

The image below is a section view of the resources at EMH’s Cinovec Project – and as you can see there is plenty of lithium in the ground waiting to be dug up:

It’s shallow – just over 500m at its deepest – so extraction should be relatively simple and cheap – and there’s ample scope for more exploration.

If more lithium is found there in future drilling, EMH could have a billion tonne deposit in its hands...

There’s been over 80,000m of historical drilling to date under the Communist Regime – so that potential billion tonne resource is backed up by strong geologic evidence.

Tin tonnage gives Cinovec a boost

And it’s not just lithium EMH can dig up at Cinovec.

There are also significant quantities of tin, tungsten and potash that it can dig up and sell too.

All strategic commodities, all with a seemingly bright future.

Tungsten is a steel hardener – every gram EMH find could be sold to local steel mills and it’s defined as a critical metal in the EU.

And potash is used as a fertilizer in agriculture – and its price is tied to global food demand...

Tin is a key ingredient in cars – the German automotive industry will no doubt be interested in EMH’s tin. Plus tin is increasingly being used in high tech industries including batteries, solar and nano-technology.

General consensus on the tin price scenario is for high demand in the coming years:

A good thing for EMH – their inferred tin resource stands at 30.1 million tonnes at 0.37%:

The tin can be extracted using simple tried and tested gravity technology prior to the lithium extraction – two bangs for one buck...

EMH has a working estimate of 80% tin recovery at Cinovec – and with tin forecast to sell for up to $25,000 a tonne in the next few years, its 114.4kt of tin (30.1 MT @ 0.37% Sn) could be a solid revenue earner for EMH in the coming years as demand for the metal rises.

The Scoping Study underway right now at Cinovec will determine an estimate for how much it will cost to produce Tin there.

Novel processing step to reduce production costs for EMH?

EMH has just signed a non-binding Heads of Agreement with Cobre Montana, to record the intentions of both parties prior to drafting a formal Joint Venture agreement.

The JV covers the production of lithium carbonate and associated by products through processing tails from treatment to recover tin and tungsten.

Cobre Montana Ltd are trialing proprietary low temperature leach to recover lithium and are working with EMH to potentially utilize this process at Cinovec. Cobre Montana, through its alliance with Strategic Metallurgy, has the ability to use its licensing rights, and know how, to extract lithium from the micas that occur within the mineralised zones at EMH’s Cinovec.

The technology provides a low power process for lithium carbonate production – with added benefits of recovering the high value sulphate of potash as a by-product.

Cobre Montana is undertaking test work over the next 6 months that will culminate in the presentation of a commercial development proposal for EMH.

For those interested in Cobre’s process, you can check out this presentation which goes into far greater detail.

Essentially, the process involves low-temperature leaching.

Lithium is usually extracted using super-heated roasters and can be very costly to set up and run.

But the Cinovec lithium Project has lithium contained within zinnwaldite, a mica that could lends itself very well to extraction technology using low temperature leaching and froth flotation – a kind of combination of the methods used to extract lithium from brine and hard rocks – done in a cheaper way.

Eventually EMH could set up a processing facility in the Czech Republic to extract lithium from the material it mines at Cinovec.

The low temperature leaching process could be cheaper and faster than the traditional method of high temperature roasting.

Combine that with the soaring demand for lithium, the cheaper price of doing business in the Czech Republic, the strategic location of the Cinovec Project on the doorstep of Western Europe, and the size of the resource at hand, and EMH is well positioned to potentially become a leading global producer of lithium.

EMH powers ahead

EMH is working to complete a Scoping Study for an underground bulk mining operation at Cinovec and it’s rapidly checking off the items on its to-do list:

News of EMH’s Scoping Study is expected in the coming days...

Then EMH will move swiftly on to a Pre-Feasibility Study that will see more drilling undertaken to firm up the resources and help finalise its plans for a mining operation.

We will be looking ahead to more drilling at Cinovec to expand the size of its resource.

EMH has already significantly boosted the lithium extraction potential through test work from its strategic partner Cobre Montana, which bodes well for the Pre-Feasibility Study coming next where cost projections for production could be announced.

Cobre Montana is due to present a commercial proposal to incorporate the technology directly into EMH’s Cinovec project in the coming months.

All these elements could be catalysts for a rise in EMH’s current $4.2M market cap and at The Next Mining Boom we’ll be keeping an eye on developments there.

Remember, EMH could potentially be sitting on the world’s biggest hard rock lithium resource...

EMH has a globally significant lithium resource in its hands with tin, tungsten and potash present in bulk as well.

Lithium is in great demand as the rise of electric cars fuels a growing industry for lithium-Ion batteries – the very thing EMH’s lithium is perfect for.

The Cinovec Project is strategically located near Europe’s high tech industrial heart and could service both the continental and North American markets for lithium.

The Czech Republic is stable, cheap and generous with its tax system – perfect for $4.2M EMH as it seeks to set up a world beating resource.

And EMH has access to an advanced extraction process that could allow it to dig up and sell lithium quickly and cheaply.

We don’t think it will be long before more wake up to EMH’s potential, which is why we’re in at the bottom floor and looking skyward.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.