Drilling Results in Days: Billionaire Backer Hunting Mammoth IOCG Deposits with Tiny Explorer

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

IOCG. These four letters stand for Iron-Oxide-Copper-Gold and add up to create some of the biggest mineral resources of precious metals on the planet. Nestled in the Gawler Craton in South Australia sits the prefect breeding ground for these enormous resources, which can hold vast quantities of gold, copper, silver and uranium. Notable recent discoveries are:

- Olympic Dam’s expansion in 1997/98 – BHP’s mine is so big it could go pumping out minerals for another 200 years;

- Prominent Hill in 2000/01 – at full capacity this will pump out 100,000 tonnes of copper and over 100,000 oz of gold a year;

- Carrapateena in 2005/06 – the ground on this deposit sold for $300M to Oz Minerals. Now it’s valued by Oz at over $1 billion.

The combined total of these discoveries alone amounts to over $420 Billion of copper. This doesn’t count the hundreds of billions of dollars that Olympic Dam is already worth. Owing to the fertile IOCG breeding ground of South Australia, this region may host more mammoth deposits – but to find them you need high tech exploration artillery – as they are likely hidden deep under cover... We have recently invested in a tiny $12M exploration company that is on a mission to uncover Australia’s next monster IOCG deposit using high tech exploration tools. This emerging company is not operating alone – it’s aided by one man with a very deep back pocket: Robert Friedland. Robert Friedland, a $1.1BN net worth mining entrepreneur, has rewritten the rule book on how to explore for minerals and make buckets of money doing it. Friedland’s big scalp discoveries include Voisey’s Bay Nickel in Canada – he sold this for $3.1BN in 1996, and the Oyou Tolgoi Copper Gold Project in Mongolia – which is currently worth $8BN. Friedland indirectly controls High Power Exploration – who after an extensive due diligence and screening of over 1,000 projects worldwide has chosen to partner with our latest investment. Having Friedland in this company’s corner is a sign that a man who has been ahead of so many curves is seeing what others can’t see. We are now on the brink of this company’s drilling results – we expect these to land in just days... Is this company one step closer to uncovering Australia’s next mammoth IOCG deposit?

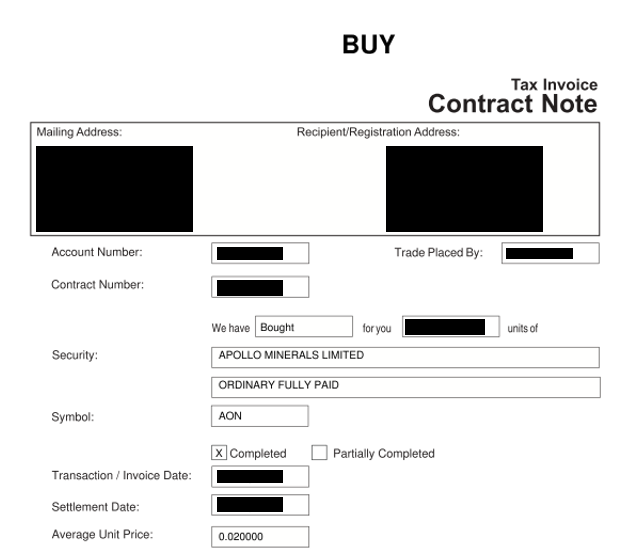

Apollo Minerals (ASX:AON) is a junior base, precious metals and iron ore explorer with a market cap of around $12M. Fresh off the back of a $2.2M capital raise from institutional and sophisticated and investors, which was done at a premium to the current share price, they have just completed a drilling campaign – and the results are due any day now. Previously, Friedland’s High Power Exploration invested $1M and have acquired a 10% stake in AON at 2c a share – which is around current market prices. The AON team also boasts Chris Anderson, the key geophysicist involved in the Carrapateena discovery – he is looking to build on his already impressive track record of IOCG discoveries in South Australia with AON. The Carrapateena discovery cost about $500k to drill – it was sold for $300M cash – now it’s valued by Oz Minerals at $1.14BN. Back in 1974, when Olympic Dam was discovered, it was thought to be the only major IOCG deposit around. Now there are three... Prominent Hill was found in 2001, Carrapateena in 2005, and now we are in 2014 – can AON make the next discovery? Surely there must be more IOCG deposits lurking below – the only way to find out is by drilling and using new technology to look beneath the sand in the South Australian outback. That is exactly the path AON are going down – and in just days they will be releasing more drilling results. When big IOCG discoveries are made – the markets take notice. A little company called Minotaur discovered Prominent Hill in 2001 – shareholders who held pre-discovery rode a 2,190% portfolio growth – the company was eventually taken over by Oxiana – now Oz Minerals. Keep reading for more details on how this happened. The past performance of this product is not and should not be taken as an indication of future performance. Caution should be exercised in assessing past performance. This product, like all other financial products, is subject to market forces and unpredictable events that may adversely affect future performance. We have recently made an investment in AON, and will be following their progress over the coming months. For our newer readers, it’s important to note that we invest in every stock we write about as a long term hold – we take our positions in our stocks for at least 6 to 12 months – for more information please see our Financial Services Guide and Disclosure Policy .

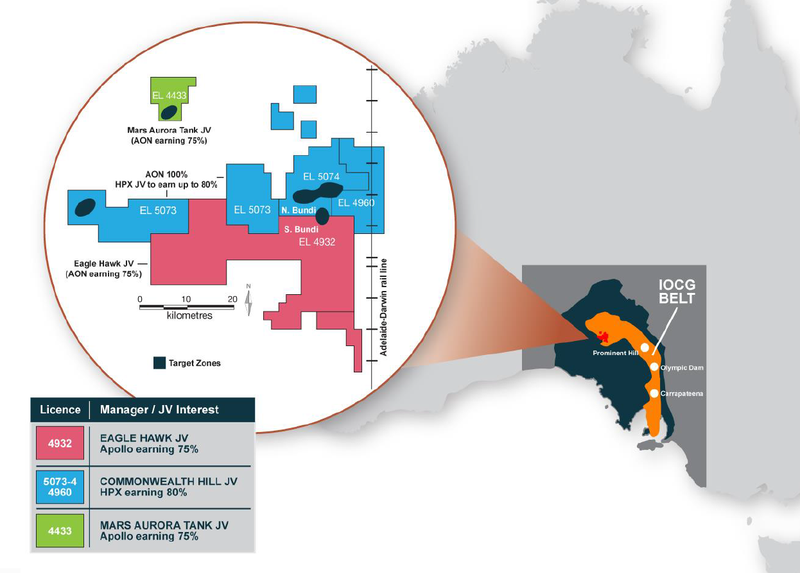

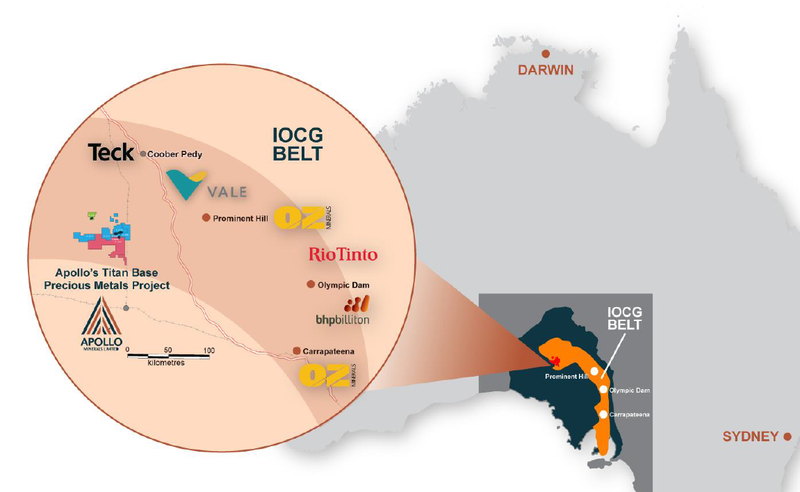

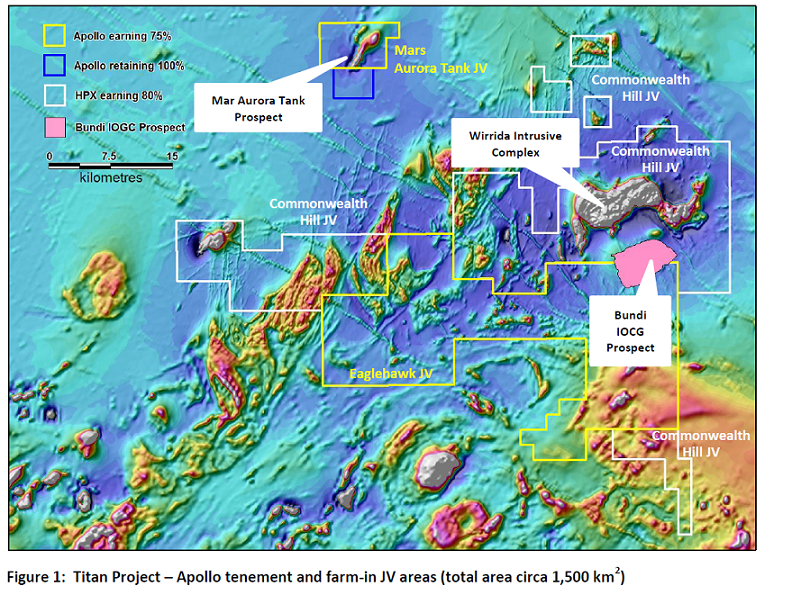

AON has three tenements under its control that are highly prospective for IOCG deposits. It’s called the The Titan Base-Precious Metals Project in the world class Gawler Craton in South Australia. Inside the Gawler Craton sits an IOCG belt – it’s there you’ll find those big multi-billion dollar IOCG mines like Olympic Dam and Prominent Hill. AON are exploring this region using high tech exploration techniques, and have just completed a drilling campaign, with results due in days. AON’s project consists of 1,500 km2 of ground, as shown in this map:

Rather than front up all the exploration cash themselves, AON have cleverly entered into JVs with other companies, to share the exploration costs. In simple terms, AON have three tenement types, as shown on the map above:

- The blue areas are the Commonwealth Hill JV: AON is being free carried by High Power Exploration (backed by billionaire mining entrepreneur Robert Friedland), who are chipping in up to $3.4M of exploration costs for 80% – this means AON are getting their exploration funded without having to raise capital further – a handy position to be in;

- The pink areas are the Eagle Hawk JV: AON is earning into 75% by funding up to $1.7M in exploration (a company called Mincor own the other portion);

- The green areas are the Mars Aurora Tank JV: AON need to spend another $750k to earn a 75% share (a company called Marmota own the other portion).

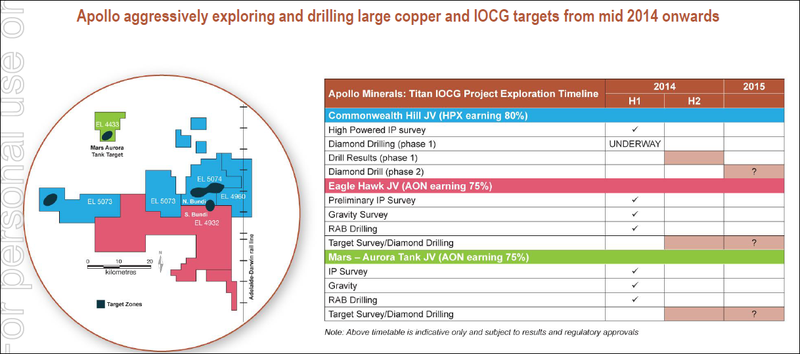

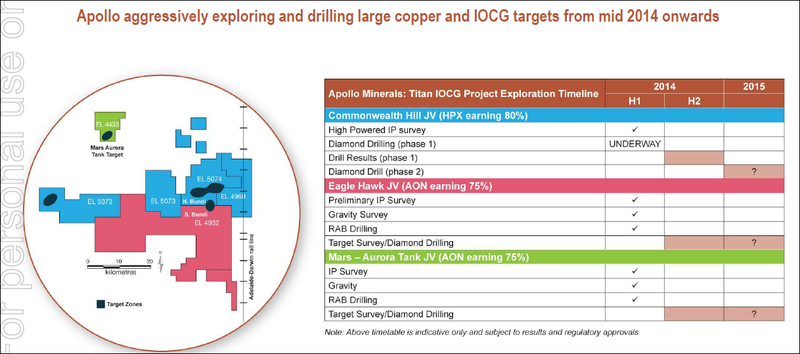

On each of these JV project sites AON has identified strong geophysical anomalies and the right sort of geological formations. Right now we are waiting for the drilling results which are due any day now on the Commonwealth Hill JV – that’s the blue area above. We are also looking out for drilling due to start soon at the Eagle Hawk JV (the pink area above). Here is the plan for AON’s big quarter of catalysts across their projects – activity is planned across all their tenements:

Within the JV areas sit a number of eye catching targets – prime suspects for potential IOCG deposits:

Zooming into the blue Commonwealth Hill JV area, sits a target called Bundi – this is the target that AON has just drilled . Any day now drilling results will be released. It’s also got drilling planned for the Aurora Tank target in the coming weeks. Recent survey results showed its targets are on par with Prominent Hill, the nearby mammoth IOCG resource being exploited by OZ Minerals, the $1.2BN mining giant. Drilling here by Minotaur Gold and others intersected gold of up to 2 g/t so the question is not if there is mineralised ore – but how much and at what grade? Geophysics results are also on the way soon from the Eaglehawk JV where it seems other IOCG targets are lurking. One of Australia’s most experienced analyst’s Simon Tonkin at Patersons is rating AON as a “ Speculative Buy ”:

We don’t soley rely on analyst reports when making investment decisions, they are just one tool, however it’s good to see Tonkin is backing AON also. Ultimately AON is taking strides to uncovering IOCG resources that have the potential to still be in production when your grandchildren start having children. That’s the size and extent of IOCG resources. Time is precious though so, in this article we’re going to take you through everything there is to do with AON and its plans including:

- AON’s links to the Prominent Hill IOCG discovery

- What is an IOCG and why it gets geologists so hot and bothered

- Who are the billionaire backers in AON’s corner

- What the Titan project is made up of

- Why each of AON’s IOCG targets hold so much potential

- What catalysts are coming now and in the future for AON and its JV partners

Are you an AON investor and want to spread the word?

Get the message out there – make sure everyone knows about AON and share this article by clicking the buttons below: [sd_share_article title=”Drilling Results in Days: Billionaire Backer Hunting Mammoth IOCG Deposits with Tiny Explorer “]

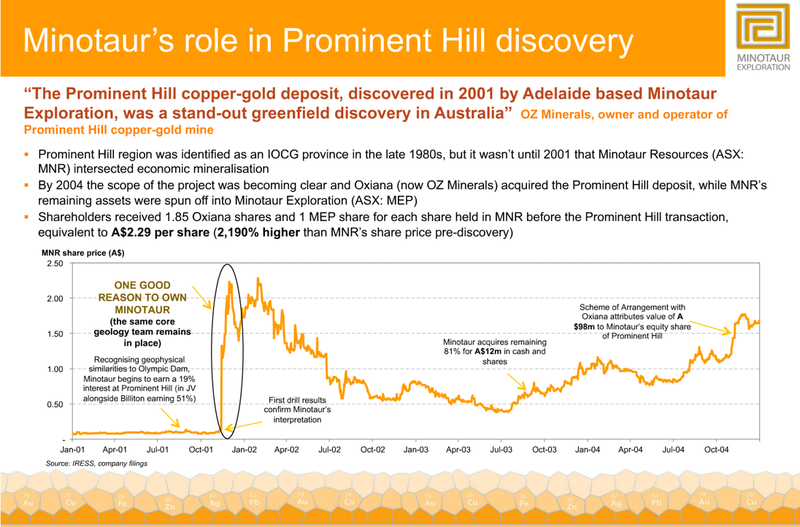

AON links to Minotaur – responsible for the Prominent Hill discovery

To comprehend the outcome if AON can discover a massive IOCG deposit, let’s look a company called Minotaur for a moment. Minotaur started out as a small exploration company, just like AON. In 2001, they managed to hit the mammoth Prominent Hill IOCG discovery. It’s a long history of takeovers and acquisitions, but the main takeaway is in the image below. Shareholders of the original Minotaur Resources who held from pre Prominent Hill IOCG discovery days to the Oz Minerals takeover found themselves riding a 2,190% portfolio growth :

The past performance of this product is not and should not be taken as an indication of future performance. Caution should be exercised in assessing past performance. This product, like all other financial products, is subject to market forces and unpredictable events that may adversely affect future performance. The Minotaur story doesn’t end there – we did some digging and found out that before Minotaur Resources, the company was called Minotaur Gold. Minotaur Gold once held the Prominent Hill assets AND Commonwealth Hill – which is now AON’s ground. So AON are actually conducting their work on unfinished Minotaur ground. As mentioned above, this ground was never drilled deeper than 100m or so for copper and gold. Minotaur weren’t looking for IOCG targets at Commonwealth Hill, and they didn’t have modern technology to uncover anything – so they gave it up.

Now AON have scoured Commonwealth Hill with the latest technology, and are about to release drill results chasing big IOCG targets...

Just like Minotaur were pre-discovery, AON are currently trading at ridiculously low levels right now – imagine if AON can hit the next Prominent Hill deposit?

Opening up the IOCG belt

In a nutshell, AON is hunting IOCG deposits in an area of the Gawler Craton in South Australia known as “ the IOCG belt .” Billionaire backer Friedland’s High Power Exploration has partnered with AON and is chasing a mammoth discovery in one part of AON’s sprawling land package. If you have just joined the mining investment game, Iron-Oxide-Copper-Gold or IOCG deposits are massive concentrations of copper, gold and uranium ores hosted within iron oxide. They range in size (so far) from 10M tonnes to 4,000M tonnes.

They are colossal – and extremely valuable. Find an IOCG deposit and you can set up a mine that will be in production for decades or even longer. IOCG deposits are found across the world with lots of them in Chile, Brazil and Southern Peru. But the really big ones are found in South Australia – exactly where AON is trying to find the next one. AON are employing high technology to do this – and with drilling results out in days we should know if they are closer to finding a new one. The main IOCG province in South Australia is the Gawler Craton in a part dubbed “The IOCG Belt”. 4 of out of the world’s Top 10 IOCG deposits are found here. The Gawler Craton is roughly 440,000km2 of land and on its eastern boundary is where you find all the IOCG action:

It’s within this IOCG belt that you’ll find three main IOCG mines: Olympic Dam which is owned and operated by BHP Billiton and holds the world’s 4 th largest copper deposit and the world’s largest known single deposit of uranium. Needless to say, it’s worth hundreds of billions of dollars to BHP. Here it is all that sprawling infrastructure:

Olympic Dam has been in production since 1988 and doesn’t even look like slowing down – BHP reckons another 200 years of mining still to be undertaken there.

The site has a huge underground mine and an integrated metallurgical processing facility. It’s a one stop shop that mines vast quantities of metals and ore and processes it all for sale. Olympic Dam earnt BHP a revenue over $1 billion in 2013-14. Something the size of Olympic Dam is AON’s goal – define a mammoth resource which can be mined for decades...we would be very happy as early AON investors if this happened. We are looking forward to their drilling results which hopefully point towards something big. Then there is Prominent Hill – a copper, silver and gold mine operated by OZ Minerals. In 2014 alone production was forecast to be up to 90,000 tonnes of copper, and 140,000 ounces of gold – that’s in just one year...

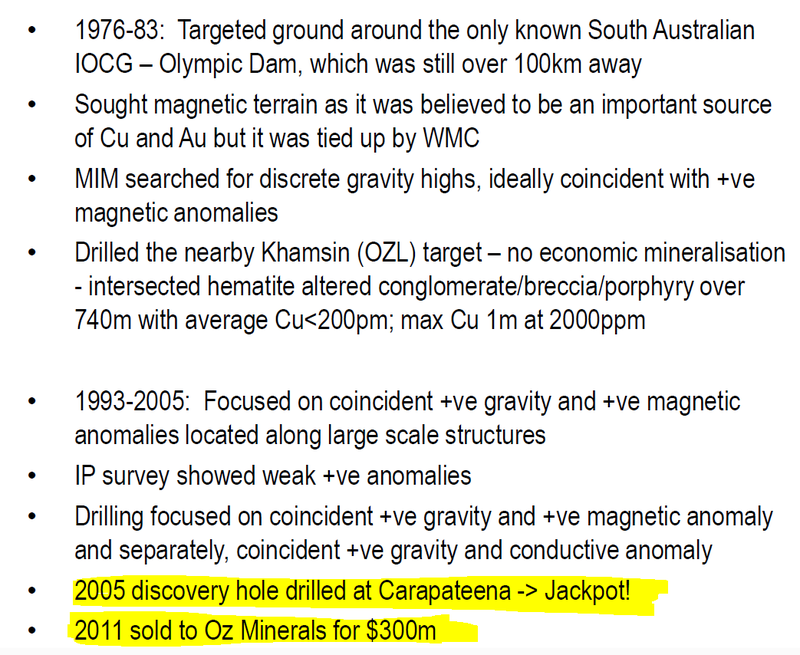

This is the same Prominent Hill that Minotaur discovered back in 2002... Carrapateena is also owned and operated by OZ Minerals and lies to the south of Olympic Dam. Its sprawling IOCG deposit was discovered in 2005 and OZ acquired the project in 2011. Since then it’s been developing plans to mine the area and recently valued it at over $1 billion. Finding another massive, multi-billion dollar IOCG deposit like Olympic Dam, Prominent Hill and Carrapateena is AON’s ultimate goal. AON has 1500km2 of land in the IOCG belt ripe for exploration and has a score of very promising IOCG targets and plays. AON want to add the next IOCG deposit to this list. The discovery of Carrapateena points the way forward for the company:

The main point to make about the Carrapateena discovery is that it took 14 years of geophysical surveys, drilling and a little bit of sheer blind luck to find it. But AON is determined to find IOCG deposits much faster. IOCG deposits are usually cone shaped and a mix of shallow deposits and very, very deep resources. Finding one is a challenge and you need a crack team of geologists, geophysicists and engineers to be on the ball. The next generation of ore bodies will be deep – and for that, the latest technology and new innovations are required to discover new mines. Lucky for us, AON has an elite mining exploration group handling all of that...

Our Track Record:

Did you see the Next Small Cap article on Segue Resources (ASX:SEG) ? SEG has been up as high as 200% since we first released our article:

Source: Etrade Australia

The past performance of this product is not and should not be taken as an indication of future performance. Caution should be exercised in assessing past performance. This product, like all other financial products, is subject to market forces and unpredictable events that may adversely affect future performance.

The mining dream team

AON’s massive IOCG targets in South Australia’s highly prospective Gawler Craton are very promising but... Targets are one thing – finding them and exploiting them is quite another. The quickest way (and the usual way) to hunt down undeveloped resources is to get some help – a farm-out programme or a JV partner that can accelerate your efforts. Well, AON has gone one better...it’s formed a strategic alliance with one of the world’s elite exploration companies – High Power Exploration Inc (HPX) .

High Power Exploration is the A-Team of mining exploration – a collection of very successful, effective and highly driven people who are using advanced technology to find valuable resources around the world. High Power Exploration is a privately-owned company indirectly controlled by Robert Friedland – a mining industry legend whose personal fortune comes in at over a billion dollars. We’ll go into detail about Friedland in a little while, but for now let’s just say having Robert Friedland in AON’s corner is a massive tick for the company and its plans to unlock wealth in the remote outback of South Australia. All the details of the strategic alliance deal between AON and High Power can be read here :

The summary is that High Power Exploration took up $1M worth of equity in AON (at a premium to today’s price) and have the option to investing a further $4.8 M to earn an 80% interest in the Commonwealth Hill JV. They obviously liked what they saw to take up such a big stake. Good news for AON – they have secured big dollars and a high powered partner who can help accelerate its IOCG projects. And now in just days, drilling results will be released on AON and High Power Exploration’s ground. Let’s have a look at the people AON is now in business with. Now, in terms of day to day operations, High Power is led by CEO Mark Gibson who used to work at Anglo American before joining up in 2011 and taking the company from a cash shell to its present status as a major mining developer. In fact, if you look at the leaders list High Power is a crew of people who have all held very high ranking exploration jobs at some of the world’s biggest mining companies.

The Chief Geophysicist Barry de Wet held the same role with BHP Billiton and Ivanhoe Mines (owned by Freidland) while Chief Operating Officer Marcus Birch was GM at Clarity Minerals. The man who really catches our investing eye is Eric Finlayson – whose title is Senior Adviser-Business Development. Finlayson’s track record is impressive – 24 years with mega-miner Rio Tinto including five years as Head of Exploration. What really makes Finlayson tick is the use of advanced technology to find new deposits of minerals. In this in-depth interview posted on the High Power website Finlayson explains that while high-grade surface deposits have been the mainstay of the mining industry for decades they are becoming more difficult to find in well-explored areas. Also, he notes that grades from these deposits are steadily declining. Good to hear this guy is on AON’s team!

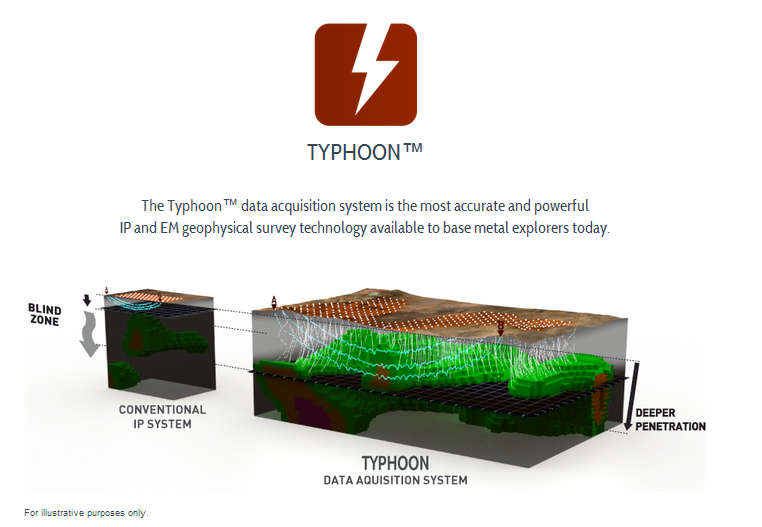

Finlayson’s answer to the challenge is to go deep . Explore and exploit resources that are below cover. AON is going after IOCG deposits in the world class backyard of South Australia which by their very nature have large portions below cover and deep underground. Finding them is challenging work – so you can see why a strategic alliance with High Power is valuable. High Power can target deep deposits through a technological process it calls Typhoon.

Using a combination of Induced Polarisation (IP) and Electromagnetic surveying (EM) Typhoon technology delivers a focussed signal that penetrates deep into the ground and returns information that’s crunched by advanced software to give a big picture of what lies beneath. It’s all hidden in this otherwise unassuming truck:

The Typhoon system is all in one. Unlike conventional systems that use multiple bits of gear, Typhoon is all contained within one truck. So High Power can do a deeper IP and EM survey much faster and process the information quicker. In fact, High Power Exploration has already delivered the goods for AON with a 140km2 high powered induced polarisation (IP) ‘Typhoon’ survey over the Bundi North and Wirrida Intrusive Complex Prospects. There is still some data to released, but even so, 10 major targets have been identified to date:

AON has taken those targets to conduct a 1,000m reverse circulation (RC) and diamond core (DC) drill program at Commonwealth Hill:

We should find out any day now the results of this campaign... The drilling programme was designed to confirm the source of a number of strong chargeability anomalies at depth within, and along the margins of these prospects. It took 14 years to discover the Carrapateena IOCG deposit using conventional techniques. By speeding up the discovery process with the latest technology, how long will it take to find the next one? At The Next Mining Boom this strategic alliance is a simple equation:

Funding + technology + excellent people = a great shot at success.

AON is going after IOCG deposits – mammoth resources that could result in the establishment of the next Olympic Dam. Having High Power Exploration on board is a sign that the ground holds a lot of potential. Plus, the primary backer of High Power Exploration is a man who doesn’t throw darts at a board when deciding on an investment...he is the dart!

Our Track Record:

Did you see the Next Oil Rush article on Rey Resources (ASX:REY) ? REY has been up as high as 75% since we first released our article:

Source: Google Finance

The past performance of this product is not and should not be taken as an indication of future performance. Caution should be exercised in assessing past performance. This product, like all other financial products, is subject to market forces and unpredictable events that may adversely affect future performance.

A billionaire backer from central casting

If you’ve been around the mining and exploration game for a while then the name Robert Friedland should be familiar. If not, you’re in for a treat.

Just to repeat, Friedland has indirect control of High Power Exploration, the major JV backer of AON’s South Australian IOCG mining play. 63 year old Friedlan d’s net worth is estimated at $1.1BN. He’s an entrepreneur in every sense of the word. In fact, we’re surprised Hollywood hasn’t yet made a film about his life. It was at Reed College, Oregon where he was studying towards a degree in political science that he met the young Steve Jobs – yes, that Steve Jobs. The story goes that Friedland also ran a spiritual retreat at an apple orchard and when he struck up a friendship with Jobs it was that laid back place that gave Apple the company’s name! Fast forward a few years and Freidland became a global investor in high-risk mining operations from Canada to Africa to Asia. His first major discovery was a large nickel deposit in Canada’s Voisey Bay which he sold to Canadian miner Inco for $3.1BN in 1996.

The big step up for Friedland came when he founded Ivanhoe Mines Ltd. It was in this company that he discovered one of the world’s, if not the world’s biggest copper gold mine Oyou Tolgoi – which once was worth over $15 BN, now worth $8 BN. Friedland then set up Ivanplat, an African focused platinum and copper company which recently changed its name to Friedland’s previous venture, Ivanhoe Mines. This company is now worth $3BN. Ivanhoe Mines has been discovering, investing in and exploiting massive resource projects around the world. Most of them are high risk ventures that no one else wanted to touch with a 10 foot pole. He opened mines in Burma, Mongolia, Africa – places where the price of business was low but the risks we at The Next Mining Boom are usually wary of – politics, infrastructure quality, security – are par for the course. But Friedland and his crew at Ivanhoe made them work. Here is where the dots begin to connect for AON, High Power Exploration and Freidland. Freidland has made a name and fortune for himself by taking on high risk ventures that gave huge rewards or by doing things differently. His indirect control of High Power Exploration matches that vision perfectly. High Power Exploration specialises in going after ore bodies once thought unattainable or put in the too hard basket. It explores deep and drills deep. Cover is not an excuse. They will find a way. Of course AON could have done things the conventional way. Take a long time exploring the usual way, then drilling the usual way and then, eventually, bringing in JV partners. But that would take years and cost a lot more money. Instead of that, AON has from the very start sought out the best and brightest to help. Friedland’s magnetic personality has plucked score of big projects from out of the blue sky and put them on the bottom line. High Power Exploration is revolutionising the way resources are explored for – and uncovering things people never dreamed of. And now they are sharing that with our latest investment, AON.

Over many years of investing at The Next Mining Boom we’ve learned that people – rather than assets – are a big decider when it comes to success or failure. The right attitude, skills, connections and drive play a huge factor in whether a project with the right assets gets sold for the right price or gets developed to its full potential. With superstars like Friedland and the team at High Power Exploration backing AON we’re confident the right people are taking on the IOCG challenge in South Australia.

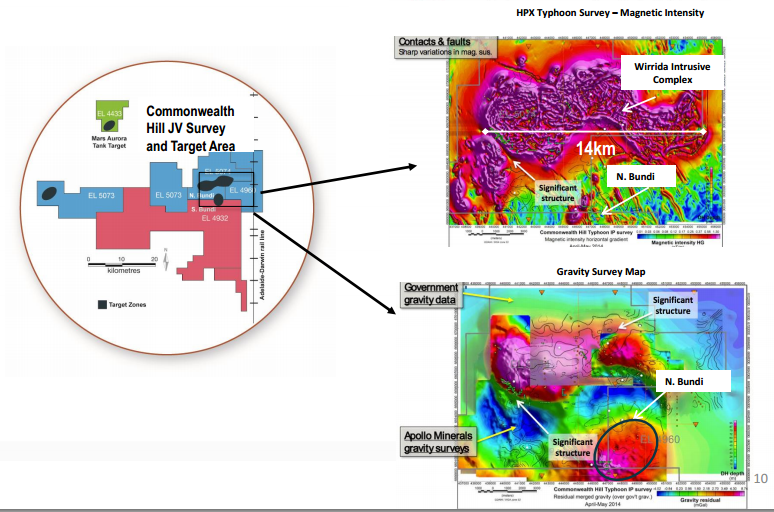

AON’s Commonwealth game

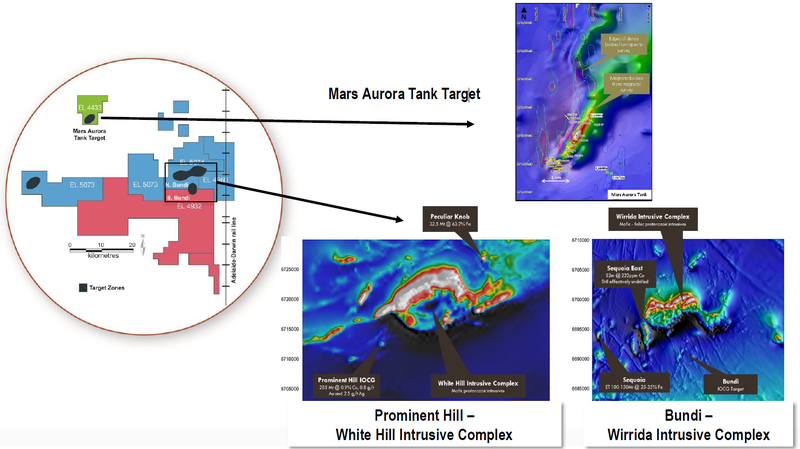

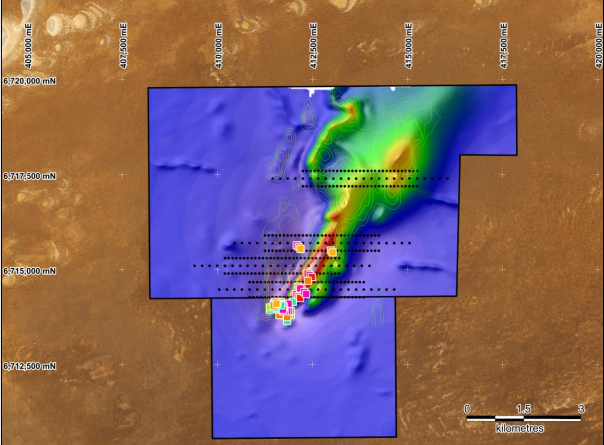

AON’s Commonwealth Hill JV is the one we’re really focussed on at The Next Mining Boom. Working with High Power Exploration, AON has identified two big targets – The Wirrida Intrusive Complex and the Bundi North target. As you can see here the targets are indicating something potentially massive:

Exploration drilling is underway right now at both targets following an extensive survey of the area by High Power. The 140km2 high powered Typhoon induced polarisation survey identified a number of co-incident dense, chargeable targets which may represent significant sulphide bodies. AON says they have the potential to host IOCG style mineralisation as seen at the Prominent Hill and Carrapateena IOCG sites.

That drilling campaign has ended and we are days away from the results. The exploration programme used reverse circulation (RC) and diamond core (DC) drilling and covered over 2,000m of drilling on a number of IOCG targets including the Wirrida, Bundi North and Mars Aurora Tank Prospects. The prospective drill targets identified and confirmed by the ‘Typhoon’ survey over the Bundi North and Wirrida Intrusive Complex Prospects are being targeted as well as a bunch of others. Assay results should be released very soon. Now, surveying and drilling aside, we’re going to give you an idea of what AON potentially has in the ground at Commonwealth Hill...

Our Track Record:

Did you see the Next Oil Rush article on Austin Exploration (ASX:AKK) ? AKK has been up as high as 70% since we first released our article:

Source: Etrade Australia

The past performance of this product is not and should not be taken as an indication of future performance. Caution should be exercised in assessing past performance. This product, like all other financial products, is subject to market forces and unpredictable events that may adversely affect future performance.

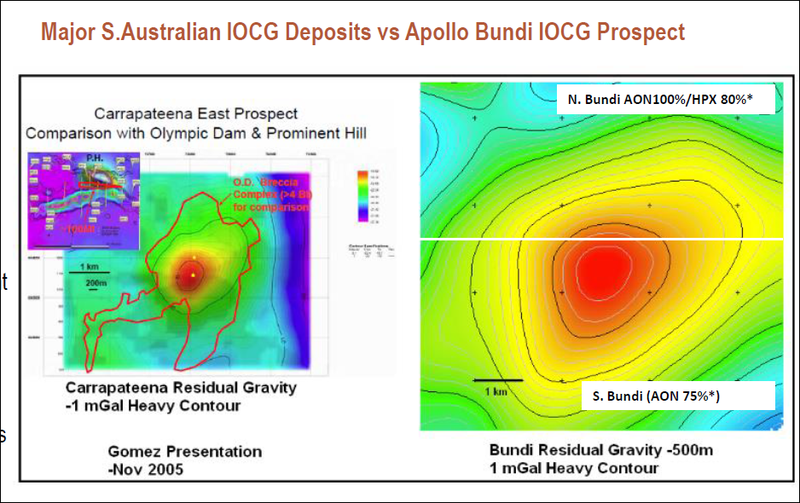

AON’s big red dot

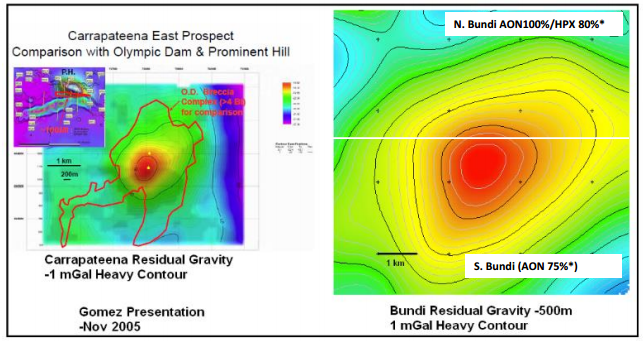

The Bundi target is another where AON is aiming to hit the motherlode. In the image below, the big red bullseye on the left is Carrapateena, the massive IOCG resource being developed by Oz Minerals – they bought Carrapateena for $300M and it’s now valued at over $1BN. It’s a pretty impressive target, approximately 500m wide... But have a look at the big red bullseye on the right. It’s AON’s Bundi target, and it’s over 1 km wide:

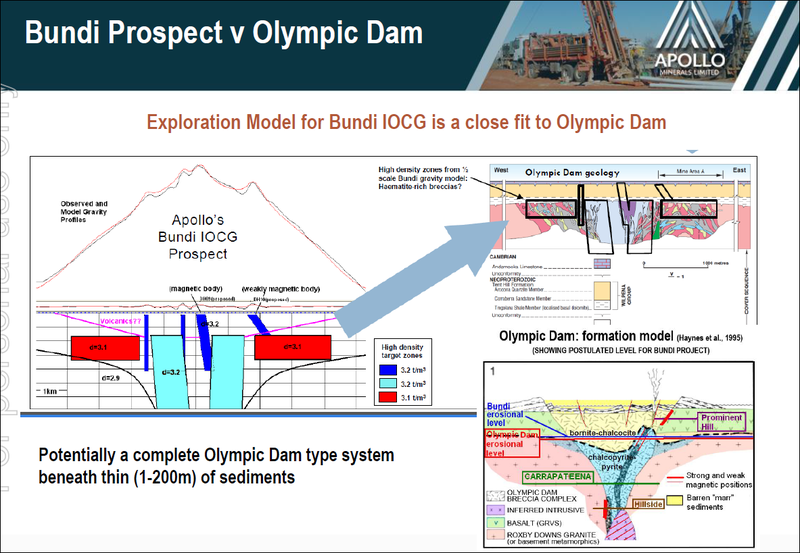

AON’s Bundi gravity footprint is larger than Carrapateena and larger than Prominent Hill. It’s on par with Olympic Dam. Remember – AON’s geophysicist is Chris Anderson, the key geophysicist involved in the Carrapateena discovery – it cost $500k in drilling to discover – now it’s valued by Oz Minerals at $1.14BN. Some of the drilling recently completed with High Power Exploration hit the North Bundi area – we expect assay results in days. When it comes to exploration the Bundi target is very similar to Olympic Dam. Have a look at this cross-section of the play:

As you can see AON’s Bundi target is wide and shallow at the top and then tapers to a deep shaft in the middle – just like Olympic Dam. Its erosion level is similar to Olympic Dam as well so that long producing and high value mine offers a good comparison. Remember, AON’s Bundi target is part of what’s called the IOCG belt and these things tend to lump in clusters.

AON should be delivering assay results from its drilling programme any day now. Those results may results could lead to more clues in the hunt for Australia’s next massive IOCG deposit. AON has done the hard yards in securing a raft of high quality tenements covering a huge chunk of some of Australia’s richest mining ground. The neighbouring areas are pumping out precious metals and iron ore from huge IOCG deposits developed over many years. We have invested in AON to potentially get involved in the next one. Currently sitting at just a $12M market cap, the share price is at a discount to recent capital raisings – a big hint that AON is undervalued. At The Next Mining Boom we’ve come in as long term investors right at the moment it seems all the big catalysts are about to land. And it’s not just the Bundi and Wirrida targets we’re waiting for results from. AON has also launched an ambitious gravity survey programme covering Eaglehawk and Mars Aurora as well. On AON’s Eaglehawk tenements, a gravity survey has been completed at the southern area of the Bundi target and its surrounding terrain. The survey is primarily targeting a possible southern extension to the Bundi anomaly and will also evaluate areas south of Bundi which have not previously been covered by Apollo and are also in highly prospective IOCG terrain.

Results from the Eaglehawk surveys should be coming through soon and given the strong readings that AON has been getting from the Bundi target we may well see another new IOCG play revealed very soon. But over AON’s Mars Aurora Tank prospect, things are really heating up...

Nothing stops a tank

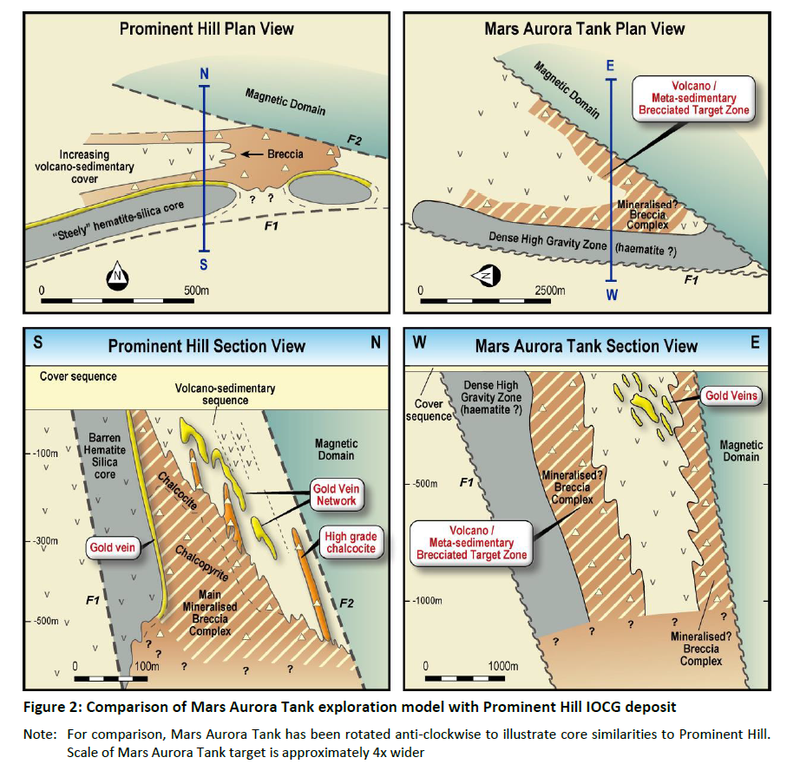

AON has identified a ‘Prominent Hill’ style target at its Mars Aurora tenements which it’s earning a 75% stake in through a JV with Marmota.

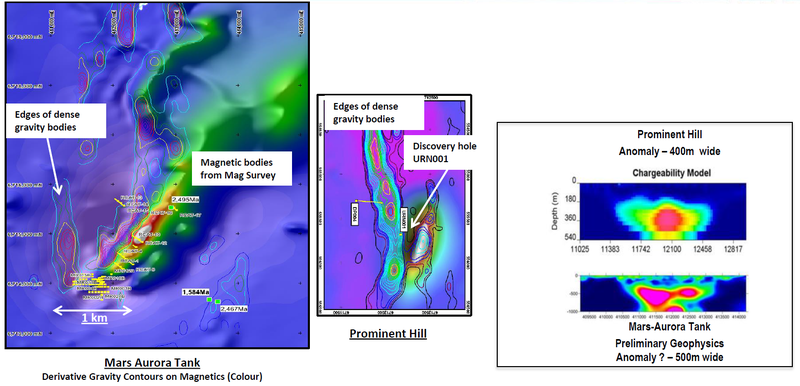

Now, just to jog your memory, Prominent Hill is one of the massive IOCG deposits that give the IOCG belt in South Australia its name. Finding an IOCG target that even just barely resembles Prominent Hill is worth checking out – now we aren’t geologists, but we’ve gotta say, the resemblance on AON’s ground is uncanny:

The target AON has developed out at Mars Aurora Tank was formed through the processing of anomalous geochemistry gathered through a drilling programme completed at the tenement earlier this year .

AON conducted IP and gravity surveys on the central zone of the Mars Aurora prospect to test for near surface copper and gold shows and to form a picture of deeper resources. The results show the area is comparable to the nearby Prominent Hill IOCG resource and that possible IOCG mineralisation exists at Mars Aurora. The geology now shows that the area can potentially host an IOCG system.

There has been some historic drilling at the site and small quantities of gold, silver, iron and copper were found. But AON is aiming deeper and for bigger IOCG or gold deposits. Now that AON’s initial exploration drilling has taken place and a target has been found, the challenge is to put all of this knowledge together, select deeper drilling targets and push the envelope until an IOCG resource is confirmed. Drilling at Mars Aurora Tank is likely to be announced very soon. In resource investing timing is crucial. You want to get in when the catalysts are coming to a head and our investment at The Next Mining Boom in AON has come at a time when lots of the threads are coming together. Deep drilling at Mars Aurora tank is about to kick off. Survey results from Eaglehawk are coming soon , and you guessed it, the drilling of Eagle Hawk targets is next on the list. And above all of this, the Commonwealth Hill JV is kicking off with work being done by High Power Exploration. AON are basically free carried on this work. AON has secured some of the most promising tenements in the world for IOCG deposits and has the backing of Robert Freidland, one of the world’s heavy hitters for mining exploration plus a team with a track record of major IOCG discoveries in South Australia. AON has brought High Power Exploration, Friedland’s indirectly controlled mining technology firm, to fast forward the process of finding an IOCG deposit and hopefully one day digging it up.

Our Track Record:

If you are new to our site, you may not have seen our Next Oil Rush Tip of the Decade – which called Africa Oil Corp (TSX:AOI) – AOI has been up over 600% since we called it!

The past performance of this product is not and should not be taken as an indication of future performance. Caution should be exercised in assessing past performance. This product, like all other financial products, is subject to market forces and unpredictable events that may adversely affect future performance.

What’s next for AON?

We are in some crucial, potentially company making moments for AON. It’s got multiple high impact drilling and exploration programmes underway or recently completed in South Australia’s Gawler Craton and results will be published steadily over the coming months. The big ones we’re waiting for are at Bundi. Results should land any day now... That’s the big red eye on the magnetic survey charts, much, much bigger than Prominent Hill magnetics. If AON can release some big drill results then watch out for a re-rate... Drilling results are also due from Eaglehawk and Mars Aurora Tank so in a few weeks we could see AON further define their multiple IOCG prospects. The rough timetable for AON runs like this:

So drill results are due across the board – the next few weeks could get very interesting. The long term success of neighbouring IOCG deposits like Olympic Dam, Prominent Hill and Carrapateena show the possibility of making billions dollars over many, many years of mining from just one resource. At The Next Mining Boom we are investing with AON for the long term. We think this company has carved out a big chance to discover a mammoth IOCG deposit in a prime breeding ground, South Australia’s Gawler Craton. It has billionaire backers in Robert Freidland and the specialist technology explorer High Power Exploration. It has JV support in all three of its tenements and exploration, surveying and data processing is going full pelt. Discovering just one IOCG deposit would transform AON and its paltry $12M market cap. It has more than one chance of making that happen and in the next few weeks we could see a steady stream of announcements that could utterly change the mining landscape in Australia. Another Olympic Dam? Another Prominent Hill? Another Carrapateena? Only time will tell and AON has wound the clock very tightly indeed.

Are you an AON investor and want to spread the word?

Get the message out there – make sure everyone knows about AON and share this article by clicking the buttons below: [sd_share_article title=”Drilling Results in Days: Billionaire Backer Hunting Mammoth IOCG Deposits with Tiny Explorer “]

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.