Cashed Up NSL Now on the Inside Track for Positive Cashflow

Published 10-MAR-2016 10:46 A.M.

|

12 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

The only foreign iron ore miner in India is NSL Consolidated (ASX:NSL).

That’s a big deal for this company when you consider that India is one of the fastest growing countries on the planet, with a population in excess of 1.3 billion people.

With industrialisation moving at breakneck speed courtesy of Indian PM Narendra Modi’s reforms, India is already building dozens of new cities, factories and infrastructure to cater for its vast population.

It’s highly likely that India’s modernisation will need large amounts of raw materials such as iron ore, coal, oil and steel over the coming years (and decades).

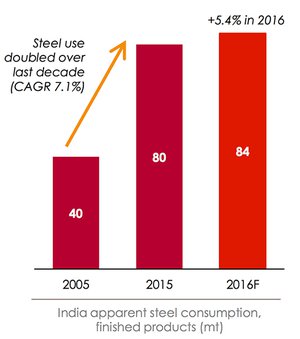

India’s steel industry in particular, is expected to triple in size over the next 10 years (having already doubled in the last 5 years).

NSL is already in production – currently selling low-grade iron ore directly to end-users.

NSL has offtakes secured with multibillion dollar steel manufacturers and is able to produce at costs that are significantly below current market prices.

The signs are that it will offload anything and everything it unearths at an attractive price given the demand for iron ore in Andhra Pradesh – India’s fastest growing province, and home to NSL’s operations.

The company also expects to see its high-grade Phase 2 plant kick-off in a few months’ time – supplying premium priced iron ore directly to Indian steel mills.

So even if a global iron ore malaise continues, NSL is insulated from this due to operating within a domestic Indian market.

The company should remain viable due to its superior project economics, and the local pent-up demand for steel and iron ore.

It is certainly acting like it has a long term future.

NSL recently secured commitments from its top 20 shareholders, investment funds and high net worth investors, raising $3.2M before costs.

The encouraging news was that this was $1.2M oversubscribed.

NSL board and management increased their stake in the company – so this extra skin in the game is a solid sign from external investors that the leaders of this company are convinced it’s going in the right direction.

However there is still a lot of work for NSL to do and professional advice should be sought if considering this investment for your portfolio.

In January, NSL signed an MoU (Memorandum of Understanding) directly with the Government of Andhra Pradesh (GoAP), agreeing a bilateral relationship covering mining, beneficiation and palletisation of low grade iron ores in the state.

A month later, and the MoU puts GoAP in the final phase of granting land to NSL close to its existing stockyard operations. The MoU has also played a part in NSL receiving swift approval for a connection to the state power grid .

The land will enable NSL to expand its Phase Two wet beneficiation plant in the near future.

If we look further afield, the added impact of Chinese growth and rapid industrialisation has created an economic beast some people are calling ‘ Chindia ’.

When taken together, China and India account for over 2.5 billion people and standout as the two most prolific economies fighting for supremacy on the global stage.

NSL could be producing high grade iron ore in India with equipment built in China. The final product could also end up being exported back to China following the latest proposals to build an economic highway between the two countries.

NSL is tapping into a new global economic hotspot at just the right time and expects to be producing 200,000 tonnes of iron ore in 2016 and 8 million tonnes annually before 2020.

That’s a big call and a big opportunity – and with NSL capped at a tiddly A$8.5MN and priced at around 1c a share, this could be a ground-floor entry of impressive proportions.

Checking in on:

NSL Consolidated (ASX:NSL)’s prime focus is on iron ore in India.

In fact, it’s the only foreign iron ore miner currently operating in the country.

Before we get into the nitty-gritty of how NSL has a great shot at making its business work, it’s important to remember that they are not merely a junior explorer.

This $8.5MN-capped minnow already produces low-grade iron ore and has direct end-user agreements where it can offload all it produces for a reasonable price.

Now the time has come for NSL to step up a gear and move into the high-grade iron ore game, where the rewards are potentially much larger.

NSL’s Phase 2 wet beneficiation plant is on schedule to come online within the coming months allowing the company to move into high grade production of iron ore, which commands higher prices and allows NSL to generate better margins.

If that wasn’t tasty enough...

...NSL already has not one, but two offtake agreements with steel producers less than 100km away.

For small-cap investors, there is vast potential in this stock and it is still priced at the bargain-basement level of around 1c per share.

However, like all small mining companies, there is simply no guarantee the stock price will go up. Caution is always recommended if considering an investment in NSL.

Let’s take a look at what NSL is really made of, and see whether it has a chance of living up to its potential.

On location

NSL’s operations are based in India’s fastest growing province – Andhra Pradesh – mapped out below:

The Government of Andhra Pradesh (GoAP) is on track for an average 14% growth each year for the next 15 years.

To help with the cause, a sprawling 113 sq. km. industrial park is currently being built less than 30km from NSL’s operations...

And that industrial park is bound to need a fair bit of iron ore, especially if it’s going to be making steel products.

The Orvakallu Mega Industrial Hub will soon have four airports constructed as part of a wholesale infrastructure build out across the province.

The hub has the full support of GoAP and was a key factor behind NSL’s cornerstone MoU signed with GoAP last year.

This government needs iron ore – and NSL has it.

This is an important deal for NSL because close co-operation with the local authorities can spring up some outstanding benefits such as prompt land acquisition, adequate infrastructure development and attractive operating incentives.

One benefit has already become evident: NSL is now connected to the power grid .

The approval for a 33kV grid power connection gives NSL access to an industrial specific power grid for all operations at its stockyard, which includes the Phase 2 wet beneficiation plant. Approval was granted within six days of application, validating NSL’s stance in the Indian iron ore industry.

Being the only ASX-listed iron ore miner in India provides scope for NSL to not only be a first mover here, but also to take its operations to the next level and help Andrah Pradesh develop a diligent mining policy based on best practise and modern technology.

Taking the inside track can mean less distance to travel to the finish line, as track-and-field athletes would confirm.

Here’s what NSL’s MoU announcement says:

NSL could see 8 million tonnes of iron ore production as a result of Andrah Pradesh’s growing pains... but what does Andrah Pradesh get in return?

To get its iron ore industry chugging, the Indian government recently lowered export tariffs thereby liberating producers to not only sell their product in India, but also, in other global markets such as China.

Starting from fiscal year 2016-17, export duty on iron ore fines with Fe content below 58% will be reduced from 10% to zero while export duty on iron ore lumps with Fe content below 58% will fall from 30% to zero.

The export duty cut is part of an ongoing industrial renaissance in India that is being led by PM Modi. The underlying goal is to modernise the country and lift hundreds of millions of people into better living standards, using improved infrastructure.

Here’s a quick summary of where these 20-40 new cities will be built:

When we look closer, it would seem China and India are becoming quite the Batman and Robin of global geo-politics and economics.

Chindia the behemoth

The term ‘Chindia’ was first coined by long-serving Indian Member of Parliament Jairam Ramesh – who himself hails from Andrah Pradesh.

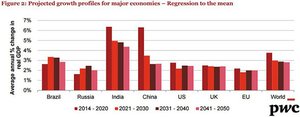

Along with Russia and Brazil, China and India represent the BRIC countries which currently have the highest potential for growth in the next 50 years.

From a purely macro perspective, India is the world’s fastest growing major economy growing at 7.5% last year, industrialising faster than any other country with the possible exception of China.

Drilling down into the iron ore market, India became the third largest producer of steel in the world in January 2015, leaving behind US as the fourth largest producer.

Bucking the global trend of a consistent decline in steel production, India is the only country among major steel producing countries such as China, Japan, South Korea and the US, which recorded a positive trend in steel production and consumption in 2015.

So if there is one place that would be considered fairly desirable to have a strong foothold in domestic iron pre production, it’s India. Good thing NSL have been working in the country for quite a few years now.

China has also been able to weather the economic turmoil of recent years, maintaining growth rates of around 6% while its major G20 counterparts such as the US, UK, Japan and Europe continually flounder at GDP growth rates of around 0%-2%.

Here’s an infographic showing the rise of ‘Chindia’ in broad strokes:

And here’s a snapshot of where PricewaterhouseCoopers (PwC) thinks the BRIC’s are capable of:

China and India are the clear standout leaders and are expected to lead global growth, trade and infrastructural investment that will ultimately require lots of iron ore and steel to accomplish.

If you want to know more about India’s ‘Act East Policy’ that aims to re-focus India’s future prosperity on Eastern trading routes, as opposed to Western, take a look at this report published by the Lowy Institute.

Refocusing on NSL

With the operating background, its location and future market demand all taken care of, that leaves NSL (and potential investors) with one very important consideration – what about cost and long-term viability?

In this respect, NSL is well placed.

For one, NSL already has offtake agreements in place, for both its low grade (already in production) and high grade ore (going into production in Q3 2016).

NSL signed offtakes with JSW Steel and BMM Ispat, which means all its product could be sold directly to end-users.

And second, NSL has relatively superior production costs compared to less efficient local miners.

Let’s take a deeper look at NSL’s Phase 1 (low grade ore) production costs...

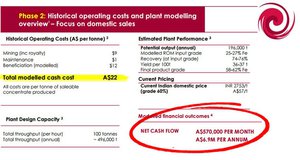

NSL is able to produce low-grade iron ore at around A$23 (US$16) per tonne while the current market price is around A$55 (US$40).

This could potentially help NSL to generate $333,000 per month and A$4MN in cash flow.

These are speculative figures and should not be taken as definite, locked in numbers, so proceed with caution when considering these figures as part of your overall research into investing in this company.

Once the Phase 2 wet plant has been commissioned, set for later this year, NSL may be able to produce iron ore ‘fines’ – a premium iron ore – for A$22 per tonne.

By operating a ‘wet beneficiation’ process, NSL can produce a 58-62% Fe product at around 200,000 tonnes per year.

Here’s a photograph of NSL’s Phase 2 equipment – not long to go now before it is shipped from China.

NSL is confident its Phase 2 plant will go cash flow positive by the end of this year , generating A$570,000 per month and A$6.9MN per year in cash flow for NSL.

NSL doesn’t want to operate on the margin where it struggles to remain competitive while praying for a high iron ore price. That’s a job for the large miners such as Rio Tinto and BHP in high cost locations like Australia.

For NSL it is quite the opposite.

NSL has found a great location from which to generate both low and high grade iron ore that captures a high profit margin.

Ultimately, NSL is a low-cost producer completely unperturbed by falling global iron ore prices that currently stand at US$40 (A$60) per tonne.

That leaves plenty of profit margin for NSL, especially as the domestic Indian markets move to an entirely different beat, and NSL is therefore able to remain viable despite the market’s broader market anemia.

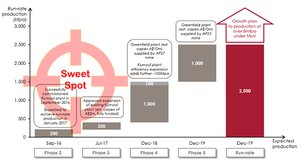

The 5 year plan

NSL’s goal is to reach a production rate of 8 million tonnes per annum over the next 5 years.

The underlying strategy is to make staged investments with cash flow drip-feeding further investment and exploration.

NSL is looking to produce and sell both low and high grade iron ore in India.

India continues to lead global industrialisation and as part of that trend, its consumption of iron ore and steel is continuing to grow despite the falls in global iron ore prices over the past few years.

In fact, the current low-price environment provides India a window of opportunity to stockpile as many raw materials as possible with a view of maximising their value further down the track when prices recover.

This would explain why domestic producers have been suffering under the weight of export duties. The Indian government doesn’t want all its domestically produced resources going abroad – especially at low prices.

With the tide now changing under the weight of falling prices, an efficient foreign explorer stands a much higher chance of doing well in India because not only will its produce be used by Indian steel mills, but now it can also export to other high consumption regions such as China.

NSL and catalysts

NSL is now in a position to upscale its production both in terms of quality and quantity over the coming 6 months.

With two centrepiece offtake agreements already signed with multibillion dollar steel manufacturers, the future is looking commercially bright for NSL – with its 1c share price on a course for a very possible revaluation later this year.

On the production side, NSL has managed to conjure up a very competitive cost profile which allows it to stay competitive and commercially viable despite a falling iron price.

But possibly most important of all, is that NSL is the only ASX-listed iron ore miner in India and has close ties with the local Andrah Pradesh power structure which will provide intangible benefits as well as tangible.

Becoming a significant iron ore producer in the heartland of Asia and servicing the Chindian market of the future, means that NSL is in the right place at the right time, leveraged to the continual sprawl of the world’s two largest and most economically vibrant countries.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.