Cash is Flowing As MNM Starts Trial Gold Mining

Published 29-NOV-2017 09:42 A.M.

|

11 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Mantle Mining (ASX:MNM) is set to resuscitate the golden past of the East Victorian goldfields.

Last year MNM acquired the Morning Star and Rose of Denmark mines at Woods Point Goldfield, which, by all accounts, was a well-engineered bargain. The district boasts six million ounces of historical high-grade gold production and signs point to significant upside potential at the project.

MNM has since completed an underground diamond drill programme testing a geological model not pursued by the mine’s previous owners. The drill programme kicked off in June on the northern limits of the Morning Star adit at the prospective Stacpoole zone.

The programme returned some encouraging results in May and September and confirmed a sizeable block of mineralisation at the Stacpoole zone which can be sampled and trial-mined.

The gold reef was intersected with quartz vein thicknesses of between 200mm and 700mm. A total of 592 metres was drilled at 15 locations with 26 holes. In Phase 2 of drilling, MNM were also able to confirm the extension of Stacpoole’s gold zone to the south.

A strike distance of ~200 metres of the Stacpoole zone has now been drilled, which represents the southern half of the zone — being the most accessible area, either by shaft or by conventional decline.

This followed MNM identifying a substantial quantity of very high grade gold intercepts of up to 17,608 grams per tonne gold in May at the project’s Kenny zone.

High-grade intercepts were noted over a 150 x 50 metre zone, including 38.6 grams per tonne gold at 1.5 metres. That’s in an area that has seen no mining and only limited underground sampling in the past.

These findings will help MNM identify priority targets at Kenny’s Reef; a vital step at this stage.

Although, MNM remain an early stage play here and investors should seek professional financial advice if considering this stock for their portfolio.

In other news, earlier this month the company sold two non-core leases for $400,000 — the Granite Castle and Charters Towers projects in QLD. The proceeds should come in handy in terms of strengthening the balance sheet, and allowing MNM to invest further in developing Morning Star.

The company has received further interest from potential buyers for other non-core assets, which could further boost cash reserves down the track.

Also this month, MNM informed the market that major shareholder InCoR Holdings Plc has raised its shareholding in the company to 9.96%.

InCoR is a venture capital company in the resource sector, with particular expertise in base and precious metals mining and mining technologies. With offices in London and Geneva, it has an interest in multiple international companies and projects, and boasts a highly experienced selection of mining executives among its ranks.

Funding has been flowing in quite comfortably for the company this year.

MNM has a ready resource, an as-new processing plant and a healthy balance sheet.

Considering the nature of the Australian gold projects the company has on the boil, MNM could be on the verge of a growth spurt as it looks to increase its market cap above the current $13 million .

Hold on to your hats as we update you on:

There’s no denying the multiple signs pointing to significant upside potential as Mantle Mining Corporation (ASX:MNM) closes in on its ultimate Eureka moment. Time will tell if MNM has what it takes to add to Victoria’s rich gold production history.

Gold zone extended as Stacpoole validates its place in MNM’s portfolio

The main aim for MNM is progressing its #1 priority — the Morning Star gold mine. Central to the plan has been the rehabilitation of the mine adit as well as a diamond drilling campaign at the highly prospective Stacpoole zone.

Management can tick both off the list, and the results are looking the goods. In August, the company announced a new gold reef structure at the mine’s Stacpoole zone.

The zone was identified as an attractive opportunity early on in MNM’s exploration activities, with near surface mineralisation close to the existing adit. It was thus pegged as a low-cost prospect.

With both Phase 1 and 2 of the recent Stacpoole diamond drilling now complete, a total of 592 metres has been drilled at 15 locations with 26 holes.

Importantly, drilling at the southern extension confirmed the Stacpoole zone extends further south than previous modelling — big news for MNM and its shareholders.

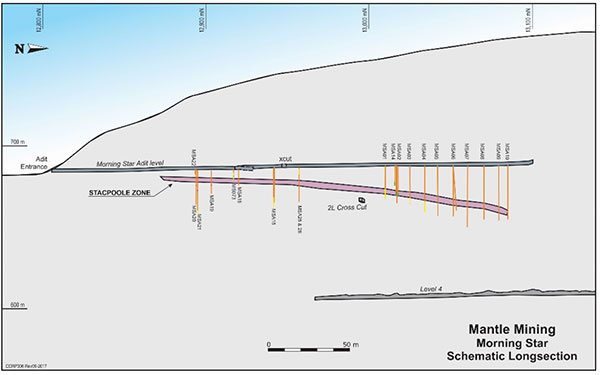

The Stacpoole zone sits immediately below the historically rich Age of Progress zone, which itself sits approximately 5 metres below the Morning Star adit floor.

This Long Section shows the Stacpoole zone in relation to the adit and 2 level:

Source: Mantle Mining

The underground drilling programme set out to make real inroads in identifying future targets, confirm the dyke offset of the zone, confirm gold zone extension to the south, and hone in on an area that was suitable for sampling and trial mining.

Drill holes intersected the reef with quartz thicknesses between 200mm and 700mm.

Below is an example of a reef that sits 5 to 8 metres above the Stacpoole zone, which is below the creek level and consequently was not easily accessed by previous miners.

Source: Mantle Mining

This campaign was important because it gives consistent indication of gold grades and lets the company determine the position and degree of development of the Stacpoole zone.

This is of particular interest since drilling in the broader district is known to significantly underestimate gold grades.

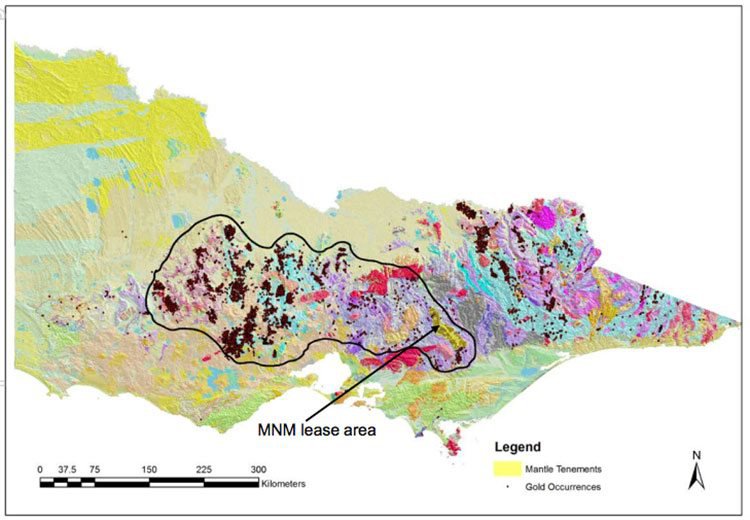

At this point we want to remind you of the kind of positioning MNM has won for itself, in what is a historically gold-rich area. Below shows the company’s lease area, and where gold has been encountered in the past:

Source: Mantle Mining

Results for the zone up to this point indicate that it is positioned significantly below the Age of Progress reef, and therefore could be a lot closer to the adit entrance than first thought. This means that there could be less adit rehabilitation required, meaning time and cost savings, among other benefits.

Trial mining may not be far off, and consequently this Morning Star could soon be shining for MNM.

The processing plant and administration/accommodation hub is ready and waiting to be used:

Source: Mantle Mining

New funding for future development

There’s nothing like a bit of breathing room on a small cap’s balance sheet. MNM has had a few doses of this in recent times.

In August it announced incoming funds to the sum of $2.5 million.

MNM raised $1 million under a convertible loan facility, while an additional $1.5 million in funding was made available under a loan note facility with $500,000 of those funds immediately available.

Not only does this injection of cash facilitate the completion of the Morning Star Gold NL acquisition, it also provides capital for the next phase of the mine’s development... as well as providing scope to look into further opportunities in the highly prospective Eastern Victorian goldfields (with historic production of 6 million ounces of gold).

Whatever comes of this is speculative at this stage, so investors should take a cautious approach to any investment decision made with regard to this company.

Here’s a summary of the capital raising published on Finfeed.com following the announcement:

(Finfeed is a related entity of S3 Consortium Pty Ltd as defined in Section 9 of the Corporations Act 2001)

The company added to its incoming funds this month through the sale of two non-core leases for $400,000 — the Granite Castle and Charters Towers projects in QLD — with the funds earmarked to facilitate further investment in Morning Star.

It’s also fielding interest from potential buyers for further non-core assets, should it see fit to sell them off. The move is consistent with the overall strategy to focus its full attention on the opportunities presented not only by Morning Star but its other projects in the eastern Victorian gold fields.

As we alluded to earlier, the company has already identified near term production targets at Morning Star. Its October update informed the market it would be concurrently exploring the option of a conventional decline at Morning Star in the interests of cost efficiencies over the long term.

So far, this has involved recommissioning the shaft and winder, applying for the appropriate permits, and preparing for the upcoming trial mining. Following that, the company can then decide if it will commit to the conventional decline.

If that possibility eventuates, it would add one more tick in the ‘pros’ column for this promising project.

Considering the advanced nature and inherent potential of all of MNM’s projects, as well as the advantage of already having a processing plant, it’s not a stretch to ask whether the company is currently undervalued.

This month’s decision from InCoR Holdings to increase its substantial holding in MNM certainly supports this idea. It now has a 9.96% interest in the burgeoning gold play.

This is particularly pertinent news considering InCoR has the team and experience to pick and choose the most promising metals projects and companies to invest in. Several high-level mining executives sit on its board, so no doubt a company like MNM was put through a rigorous review process before InCoR chose to take a 9.66% stake in it.

Morning Star – analysis beyond Stacpoole

Mid-year the company released encouraging news regarding the high-grade Kenny zone at the Morning Star gold mine. Having completed a structural reinterpretation and historical review of the Kenny zone, MNM ascertained that it is distinguished by the substantial quantity of very high grade gold intercepts, featuring drill results of up to 17,608 grams per tonne gold.

That intercept was at a narrow width, however high-grade intercepts occur over a recognisable zone of about 150m x 50m in areas where no mining or only very limited underground sampling has been undertaken. Some of the larger widths included 1.5 metres grading 38.6 grams per tonne.

What’s also promising is the fact that the Kenny zone is already accessible from existing underground mine development, making it an attractive option to pursue in the near-term and bumping it up the priority list.

Progress continues at Rose of Denmark

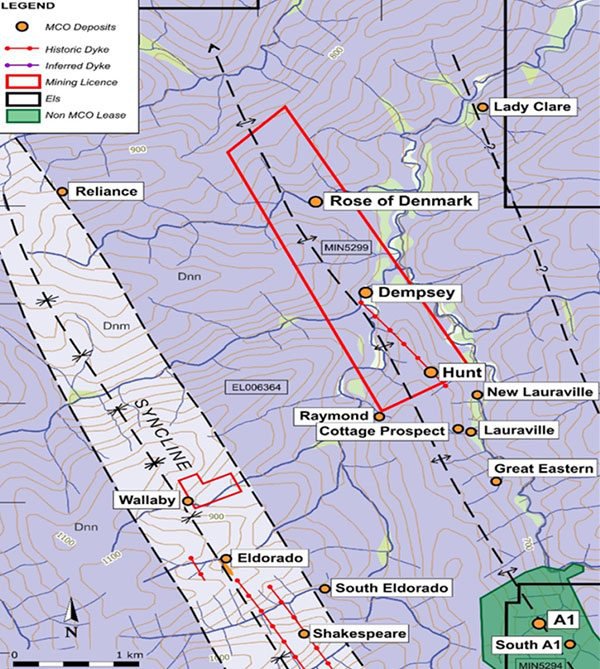

While Morning Star is the bones to this company’s business plan, its Rose of Denmark mine, just 12 kilometres away, is drawing increasing interest as development gets going. A definitional drilling proposal has been sent to MNM’s JV partner on the project, and could commence in the near term — with multiple clear gold targets in mind.

Interestingly, in the company’s October update, it outlined the potential for mechanical mining at the project — in similar fashion to what is happening at Centennial Mining’s nearby A1 Gold Mine.

Consider the proximity and geological similarity of the Rose of Denmark mine to the A1 mine:

The development is newsworthy because of the obvious advantages of mechanised mining.

Not only is it considered safer, cheaper, more time efficient, and easily updated to include new innovations... it can also enhance the quality of the mining work. It is win-win, but not all deposits and mines are amenable to mechanised mining. But for mines that are, there’s a far greater chance they will end up making their owner rich...

This is of course speculative and investors should seek professional financial advice if considering this stock for their portfolio.

Whether mechanised mining will be possible at the site will be determined in the all-important next round of drilling at Rose of Denmark.

Gearing up to a possible revaluation?

MNM’s Morning Star mine has a historical production of 830,000 ounces of gold at 26.5 gold per tonne and has many unexploited high grade zones.

Essentially, the company holds almost all the ground in a district with six million ounces of historical high grade gold production.

With the current gold price sitting at circa A$1700 an ounce, the timing couldn’t be better for this Australian small cap working to establish itself as a major gold play.

With the skilful use of modern day applications and techniques that were unavailable to previous explorers of the area, MNM may just be in a bit of a sweet spot, and on the precipice of delivering immense value to its shareholders.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.