Can Drill-ready Lithium Brine ASX Junior Step Out of $15.8BN Albemarle’s Shadow?

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Nevada is at the very epicentre of the current lithium-ion battery commercialisation-boom.

The lithium boom was sparked by the breakthrough in efficient energy storage solutions, which are now being used in devices ranging from wristwatches to electric cars.

One tightly held ASX-listed junior seems to be well-briefed with regards to the growing opportunity in lithium (specifically in Nevada) and last year secured three highly prospective lithium projects in the region.

The main highlight for this company is that its tenements are known to be located above favourable brine chemistry, which indicates a very competitive production cost (and greatly depleted capex) over time.

Put simply, this company stands out from others because deriving lithium compounds from brine sources is cheaper than from mineral sources.

Nevada is known for its favourable brine chemistry and given its centrality to the likes of Tesla, could one day be a major source of supply for car manufacturers and electronics giants.

Nevada also boasts a stable working environment, with top line infrastructure and support from service companies including drillers, hydrologists, chemical engineers and surveyors.

As such, today’s company has made a strategic move to set up operations in the area with a long-term objective to prove commercial grades and quantities of lithium bearing brines.

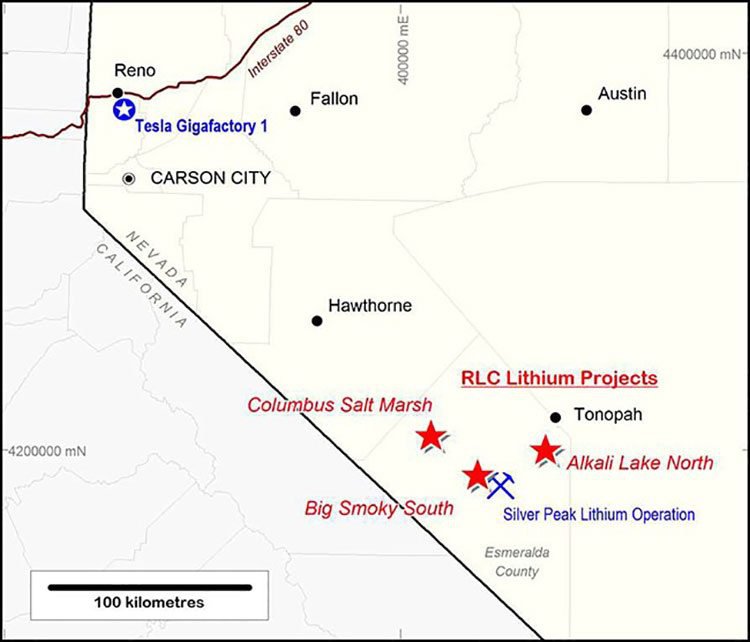

Notably, its flagship project, the Big Smoky South project, is only 10km from the $15.8 billion capped Albemarle’s Silver Peak, while its Columbus Salt Marsh project is less than 50km from Silver Peak.

That’s some good ground to be on, given the success of the NYSE listed neighbouring giant.

Of course, today’s company is at a much earlier stage than Albemarle and there is a lot of work to be done on its projects, so interested investors should seek professional financial advice if considering this stock for their portfolio.

The company, which is currently raising $3.5 million, believes its three project areas could be capable of providing sufficient brine to produce between 5000 tonnes and 10,000 tonnes lithium carbonate (for a total of 15,000 tonnes per annum lithium carbonate) annually.

Should results fall its way, the company expects to take about three years to get into production.

For now, it will concentrate on substantial drilling programmes to assess its assets, conduct environmental base line studies, develop production well fields, determine the best process route and then build a production facility.

Suffice to say there is a storm front of news to come.

If successful, its lithium endowment in Nevada will allow this company to springboard onto the rapidly developing energy-storage market which includes supplying the raw materials for producers of electric cars and lithium-battery-laden devices.

This company wants to capitalise on the current hive of activity in Nevada, by acquiring some easy-access lithium brine projects and moving onto technical work almost immediately. This company’s directness gives us reason to believe it is now in prime position to establish a long-term mining operation, in a region that is primed for activity.

Without further ado, we present:

Reedy Lagoon (ASX:RLC) is an ASX-listed lithium junior with a solid array of lithium projects in Nevada, USA.

Nevada is the scene of one of the biggest energy shifts in history; energy storage courtesy of lithium-ion batteries is the likely bridge between abundant energy and its availability.

A shift towards a cleaner and more efficient use of energy is being accompanied by one commodity in particular –lithium – which is experiencing significant increases in demand.

Electric vehicles (EVs) use almost 5,000 times the lithium of a smartphone and with vehicles such as the Tesla Model 3 and the Chevrolet Bolt going into mass production, there is considerable upside regarding lithium’s future prospects.

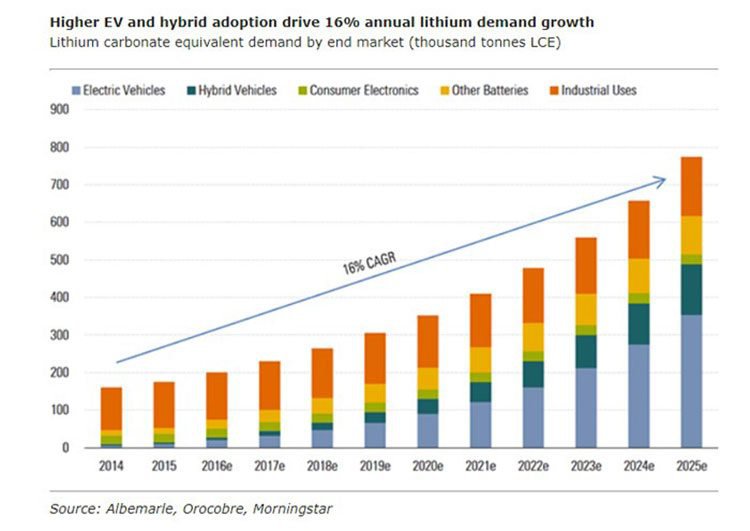

Lithium demand is surging and expected to continue on its development path. Analysts at MorningStar, estimate lithium demand will rise at double-digit rates from the current 175,000 tonnes in 2015 to 775,000 tonnes by 2025 — an increase they say would be the fastest of any significant commodity over the past century.

Alongside such rampant growth rates, the average price of lithium has jumped threefold since 2014 and was up 60% over the course of 2016.

It should be noted here that commodity prices do fluctuate and caution should be applied to any investment decision here and not be based on spot prices alone. Seek professional financial advice before choosing to invest.

Electric vehicles, phones and laptops all need one thing: lithium batteries. And the world’s foremost battery manufacturers are scrambling to secure lucrative futures in an industry set to be a blockbuster over the next decade, similar to how gasoline has developed since the advent of the car.

Enter Reedy Lagoon

RLC has three project areas located in Nevada, USA. Each one is capable of providing sufficient brine to produce around 5,000t of lithium carbonate each.

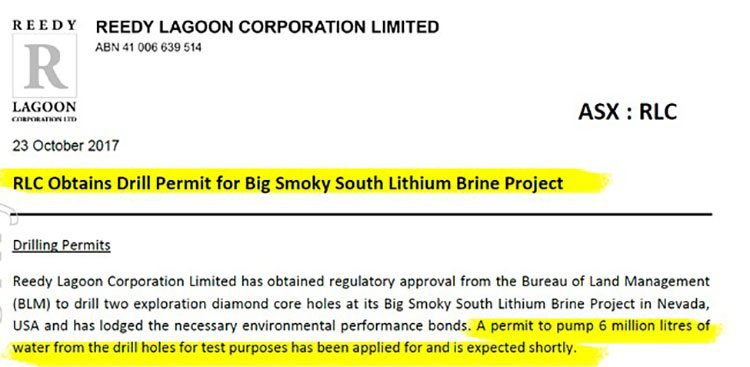

To help push forward its aims in Nevada, RLC has just announced a capital raising to raise $3.5 million at 2.5 cents with the offer closing on December 1 and funds going towards operations at its three projects, in particular Big Smoky for which it has just received drill permits.

RLC is targeting 15,000t of annual production at its projects within the next 1-2 years as its sets off on a path to revaluation.

RLC’s projects are all brine-based which creates several possibilities with regards to project economics.

The projects are:

- Big Smoky Valley – 148 claims, 2960 acres;

- Columbus Salt Marsh – 81 claims, 1620 acres

- Alkali Lake – 128 claims, 2560 acres

Here’s a look at where its projects sit in the big scheme of things...

Battery grade lithium compounds such as lithium carbonate and lithium hydroxide are the target commodity for all lithium miners; but the reality is that there is more than one way to skin a cat.

High-grade lithium can be extracted from a range of host hard rocks including spodumene, as being done by various Aussie explorers in Western Australia. However, to make things really interesting for lithium-market value-hunters, is that lithium can be obtained from alternative (and more cost-effective) host settings such as underground naturally-occurring salty water reservoirs known as lithium brines.

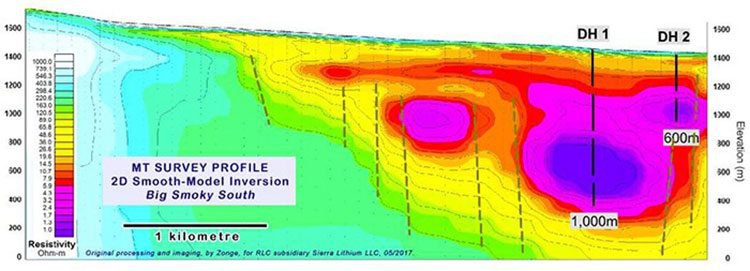

The salt in the water acts as an electrical conductor, the size of which can be measured by above ground geophysical surveys that measure the amount of electrical resistance that a reservoir has.

Deriving lithium compounds from brine sources tends to be cheaper than from mineral sources such as spodumene, however, they tend to take a little longer to bring to market but with the cushion of having longer-lasting mine life.

If RLC can define a lithium Resource in Nevada, it could mean a sustainable, commercially-viable mining operation will eventually be put together that is around for much longer than several of its peers.

Let’s take a look at RLC’s chances in Nevada

RLC’s three projects in Nevada are illustrated below:

Combined, RLC’s lithium projects have an exploration Target of between 750,000 tonnes and 1,000,000 tonnes of LCE at a grade of between 90mg/L and 120mg/L.

To turn this potential into reality, RLC is embarking on a campaign of explorative drilling as its foremost priority:

The Big Smoky Lithium Project is probably RLC’s flagship and could see significant progress within the short-term.

Let’s take a look at RLC’s upcoming drilling in more detail

As we’ve mentioned, RLC has three distinct projects in its pipeline, with one in particular likely to bring early price catalysts.

Having been issued with a drilling permit last month, RLC is now planning to drill two holes at Big Smoky South – the deeper drill hole planned is shown targeting the 400 metre wide zone of resistivity less than 1 ohm-m between 600 metres and 1,000 metres depth (shown in blue).

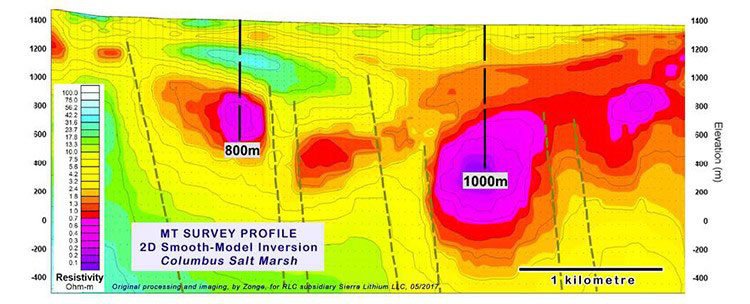

The other high priority prospect for RLC is the Columbus Marsh Project:

Here too, RLC has drill permits for two holes as shown in the magneto-telluric survey profile above. The deeper drill hole planned is shown targeting the upper 400 metres of the large zone of resistivity less than 1 ohm-m between 600 metres and 1,600 metres depth (shown coloured blue, purple and red in illustration above).

RLC’s Strategy

RLC’s strategy is to make headway in lithium mining, by focusing on cheaper productions costs.

Lithium brines can be processed at around half the cost burden endured by the hard rock miners because it doesn’t need to be mined, crushed or roasted. It is simply pumped to the surface and converted directly into high-grade lithium products, made available to end-user buyers such as battery manufacturers.

Since Tesla’s Elon Musk announced that it would build its gigantic lithium-ion battery gigafactory in Nevada, junior mining companies have been flocking to Nevada like to try their hand at developing lithium projects. Tesla’s gigafactory is now under construction, and the spectre of insatiable EV car production is already visible as evidenced by strong EV sales globally and Tesla’s pre-sale sell-outs of all its cars.

The State of Play in Nevada

If we look around RLC’s local vicinity, it’s clear that Nevada has become the world’s epicentre for all thing lithium-related. The largest local brine project is the Silver Peak Lithium Brine Project owned by NYSE-listed chemical giant Albemarle.

Albemarle produces around 6,000 metric tonnes of lithium carbonate each year from its Silver Lake project. However, it uses large swathes of land purely for ‘evaporation ponds’ which tend to tie up development time and expenses. There are also environmental complications to having large evaporation ponds in operation.

RLC intends to avoid the rigmarole of evaporation ponds, and wants to go straight from extraction to processing directly, thereby shortening processing time significantly.

RLC believes it can process lithium-bearing brine directly on-site and create high-grade lithium products via a more efficient method of brine processing. Furthermore, RLC intends to return a portion of the brine it processes back into aquifers in order to mitigate any environmental impacts and reduce ongoing expenditures.

RLC’s nearest project, the Big Smoky South project is only 10km from Silver Peak while its Columbus Salt Marsh project is less than 50km from Silver Peak. RLC’s ground is therefore highly likely to contain lithium if going by ‘nearology’ alone.

Processing towards a lithium future in Nevada

Most of the world’s lithium is currently produced in Australia, Chile and Argentina, but more recently, there’s been a noticeable lithium rush in Nevada.

Joining this lithium gold-rush is RLC — a company that remains capped at only $9.8 million, but with a hatful of alluring projects at the heart of the lithium action.

RLC is adamant it has identified large underground salt brines or “conductors” at all three of its project areas, which is now about to be drill-tested over the coming weeks and months.

The news has attracted market attention. Check out RLC’s recent share-price action:

The past performance of this product is not and should not be taken as an indication of future performance. Caution should be exercised in assessing past performance. This product, like all other financial products, is subject to market forces and unpredictable events that may adversely affect future performance.

As you can see, RLC is beginning to attract market interest as its share price gradually moves higher after its flurry of announcements in recent weeks. Could the upcoming drill-programme have anything to do with it?

Either way, RLC is planning on conducting several drill-holes over the coming weeks, which will ultimately be used to help it define its Resource in Nevada. The million-dollar question is exactly how much lithium is locked within the brines underneath RLC’s land...

...and it’s a question RLC will be answering over the coming weeks and months.

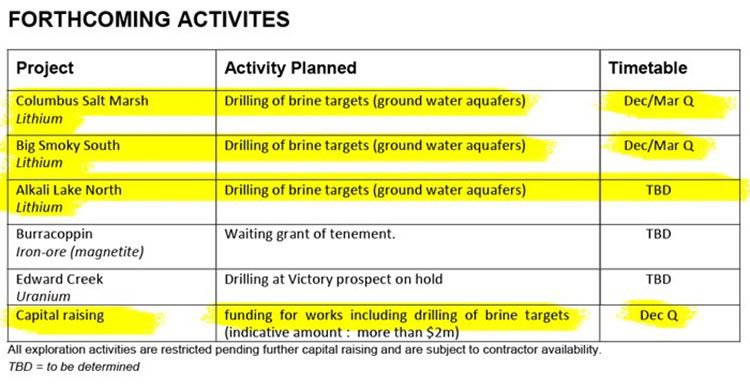

Here’s a look at the coming timeline of activity.

Ultimate goal for RLC

The global demand for Lithium has created a modern-day gold rush of sorts – and it’s only the beginning.

Tesla’s gigafactory being just a 250km stone’s throw away from RLC, means RLC is unlikely to have a problem offloading any (and all) of its production in Nevada.

RLC’s objective is to prove up commercial grades and quantities of lithium bearing brines on its projects and build annual production of at least 15,000 tonnes of lithium per annum.

The number is speculative at this stage and investors should seek professional financial advice for further information if considering this stock for their portfolio.

If RLC is successful in this task, it will likely mean a substantial revaluation from current levels. For now, RLC has locked in three Lithium brines projects within about 30km of each other that are right on the doorstep of America’s only producing Lithium brines mine, the Silver Peak mine in the Clayton Valley. Moving forward however, RLC plans on expanding its Nevada footprint through robust exploration and a business model focused on cost-effective brine extraction and processing.

Unlike its largest peer (the Silver Peak mine) RLC isn’t planning to build acres of evaporation ponds that take between 18 and 24 months to produce lithium, as well as adding significant capex and permitting obstacles. This is a key factor that could ensure operational supremacy.

With a market cap of just $9.8 million, RLC is perfectly-positioned to make good progress in Nevada, and raise its market valuation on the back of a lithium market expansion.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.